Yes, You Should Buy a House Right Now

Mortgage rates and home prices are high. You should still buy a house right now.

Mortgage rates and home prices are high. You should still buy a house right now.

You can't time the housing market.

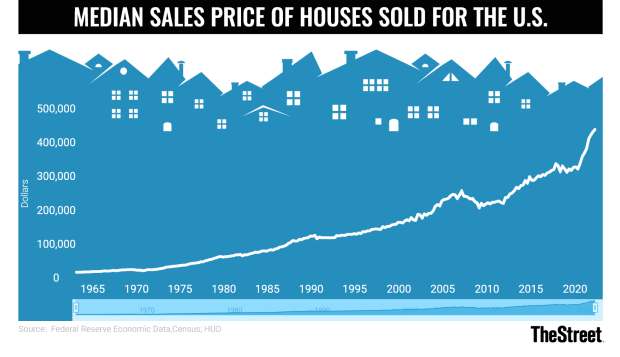

That statement, on the surface, seems like it's wrong, but over 50 years of sales data suggest broadly that the right time to buy a house is always now. Housing prices, of course, vary by market, but on a national level, they have climbed steadily since the 1960s, according to data from the St. Louis branch of the Federal Reserve.

Mortgage rates, which have basically doubled from 2.9% a year ago to 5.89% as of Sept. 8, are a factor, but waiting for rates to drop is a dangerous game. If mortgage rates do fall, more people are likely to end up back in the housing market. That will push prices higher.

Housing is in most cases, not an optional purchase. Unless you have someone willing to give you a place to live free of charge, your choice is renting or buying a home, and as housing prices climb rental rates generally move in the same direction.

"Median rent in the top 50 metropolitan markets hit a record $1,849 in May, up 15.5% from a year earlier, according to Realtor.com, a real estate services firm. It was the 15th straight month of record rent," TheStreet's Dan Weil wrote in July.

Put simply, if you need a place to live, and expect to stay put for at least a few years, buying makes more sense than renting.

TheStreet

Housing Prices Go Up

As you can see on the chart above, housing prices move steadily higher. Yes, there are periods where they dip and individual markets may vary but the right time to buy a house has historically generally always been "now."

Mortgage rates are a factor, but they are also relative. The current rate hike has slowed, if not stopped, rising prices in many markets. If we see lower rates, even a few years from now, that would be a catalyst for prices to rise again.

It's important to understand the impact of mortgage interest rates on your potential payment. If you borrow $300,000, here's what you would pay per month at a variety of interest rates

- 3%: $1,265

- 4%: $1,432

- 5%: $1,610

- 6%: $1,700

- 7%: $1,996

That's a $435 per month difference between where rates were a year ago and where they are now (more or less). The added cost certainly factors into how much you can spend on a house, but it generally does not mean you should not buy a house.

A Personal Look at Buying a House

During the pandemic, my wife and I sold our downtown condo, used the proceeds to buy a resort condo/rental property, and moved into a rental. When we moved to the rental -- a move forced by needing to stay on my son's bus route for his last year-and-a-half of high school -- we were paying $2,495 a month for a 2,600 s.f. 4-bedroom townhouse in a community with a nice pool and a gym.

That number was around what our costs were in the condo we owned previously, but we weren't building equity or gaining any appreciation. In year two, our rent went up to $2,700 a month and that's when we began looking for a home.

Ultimately, we decided we could not afford what we wanted (a 3-bedroom, single-family home) in the South Florida area where we lived, so we began looking about 40 minutes north. Ultimately, we found a home in a nice community with similar amenities to what we were leaving and bought a 3-bedroom, 1,600 s.f. single-family home for $315,000, putting 20% down.

And while we downsized a bit, we had never needed as much space as we had in the rental, so having a yard, a garage, and a nice screened-in lanai seemed like a fair trade-off. We got in before interest rates spiked our mortgage is at roughly 4% making our monthly payments, which includes about $400 in homeowners association fees as well as our insurance and tax escrows about $2,1,00 a month.

That's $600 a month less than we were paying to not own a home (and $1,900 a month less than what our previous landlord got from the next tenants). If we had waited a few months and paid 6% interest our payment would have gone up $330 per month (and our cost to buy would have been higher as prices keep climbing).

So, now, instead of renting where costs would almost certainly rise on a year-to-year basis we're building equity in a property in a community where prices are likely to climb. We, of course, face added costs like repairs and improvements (we redid the entire house), but we own our home and that gives us an asset that should build our wealth over time.

federal reserve pandemic mortgage rates real estate housing market interest rates

International

Censorship And The Digital Public Square

Censorship And The Digital Public Square

Authored by Adeline Von Drehle via RealClear Wire,

“We don’t want no censorship, we don’t…

Authored by Adeline Von Drehle via RealClear Wire,

“We don’t want no censorship, we don’t need no censorship!” Kevin Nathaniel’s voice boomed from the podium in front of the Supreme Court as he, frontman of the Spirit Drummers, led the crowd in a series of sing-songy, reggae-inspired chants. His audience was small but excitable. Some wore Kennedy ’24 beanies and “Ivermectin saves lives” T-shirts. Others showed off signs reading “Fauci is the tyrant the founding fathers warned us about,” and “Freedom of speech includes views you don’t like,” and “Media literacy = censorship,” as they bopped along to the bongo drums.

Inside, the Supreme Court was gearing up to hear the oral arguments of Murthy v. Missouri, in which Missouri and Louisiana, as well as several individuals, claim that federal officials violated the First Amendment in their efforts to combat misinformation on social media. The parties contend that the Biden administration effectively coerced platforms into silencing the voices of American citizens, particularly those on the right who posted about the COVID-19 lab leak theory, pandemic lockdowns, vaccine side effects, election fraud, and the Hunter Biden laptop story. The plaintiffs have called it a “sprawling Censorship Enterprise.”

People live with different facts than their neighbors. One reason for this is social media algorithms, which use engagement features such as “like” buttons to feed users more of the content they seem to be interested in. Such a system can result in one person’s feed looking completely alien to another person. That we live in parallel universes is not news, but the dilemma it poses raises crucial questions about the responsibility of social media companies to track what is on their platforms and whether the government even has the right – or the responsibility – to counter what it deems misinformation, and when a line has been crossed into unconstitutional censorship.

Plaintiffs in Murthy v. Missouri claim the line was crossed, and then crossed a few hundred more times. The suit names federal officials including President Joe Biden, former White House Press Secretary Jen Psaki, Anthony Fauci, Surgeon General Vivek Murthy, and others – as well as federal agencies such as the Department of Health and Human Services and the Centers for Disease Control and Prevention.

While the lawsuit ostensibly sets out to detail the many ways the federal government violated Americans’ First Amendment rights, it also spent a great deal of its time explaining why the information the mainstream has labeled “misinformation” is actually the truth.

The Missouri and Louisiana attorneys general cite studies, journal articles, and news stories to bolster their assertions about mail-in voter fraud and about the inefficacy of masking, quarantining, and COVID-19 vaccines. “Yesterday’s ‘misinformation’ often becomes today’s viable theory and tomorrow’s established fact,” they wrote in their legal brief.

The plaintiffs go on to the meat of their complaint, which is about 50 pages of what they hope will be viewed as convincing evidence of a well-oiled censorship machine.

In one example, they present transcripts of Jen Psaki linking encouragement for social media companies to “stop amplifying untrustworthy content … especially related to COVID-19, vaccinations, and elections” with comments about anti-trust regulation and privacy protections, insinuating that the federal government would impose undesirable regulations on social media companies if they do not increase censorship of right-wing messaging.

The suit also states that Dr. Fauci “coordinated with social-media firms to police and suppress speech regarding COVID-19 on social media,” particularly about the lab-leak theory – which contends that COVID-19 originated in a lab in Wuhan, China – because Fauci himself signed off on funding the gain-of-function research that may have created the virus. Instead, Fauci and other officials at the National Institutes of Health pushed the narrative that COVID was a zoonotic virus that jumped to humans in a Wuhan seafood market.

Whether these examples and many others constitute threats or nefarious coercion is what the high court is now weighing. A federal district court judge issued a preliminary injunction that prevents much of the federal government from collaborating with various groups about what should and should not be allowed on social media. The Fifth U.S. Circuit Court of Appeals kept it in place, saying the evidence showed the existence of “a coordinated campaign” of unprecedented “magnitude orchestrated by federal officials that jeopardized a fundamental aspect of American life.”

The injunction rang alarm bells as it specifically banned communication between the federal government and the Election Integrity Partnership, which was instrumental in debunking false claims about the 2020 election. The Supreme Court stayed the injunction, suggesting it was less convinced than the lower courts by initial evidence.

One private individual suing alongside the states is Dr. Aaron Kheriaty, who was fired from his job at a University of California school for refusing a COVID-19 vaccine. Author of “The New Abnormal: The Rise of the Biomedical Security State,” Kheriaty describes government censorship as a “leviathan,” a Hobbesian term to describe an entity with utter control over its subjects.

“It’s an interconnected network of public and supposedly private entities that is basically working 24/7 to flag and pressure the social media companies into doing its bidding with censorship,” said Kheriaty. “If these social media companies are not complying, the government can turn the screws and turn up the temperature and basically force them into compliance.”

Some conspiracy theories turn out to be true. But this would be a big one.

It is undeniable that conservative and right-wing voices were censored on social media, mostly beginning in and around March 2020, just as the plaintiffs argue in their suit. Platforms such as Facebook, X (formerly Twitter), and YouTube all made concerted efforts to either outright remove dissenting posts about the COVID-19 pandemic and the 2020 presidential election, or at least to diminish the reach of such posts.

Litigating whether such measures are unconstitutional raises a host of questions, starting with whether platforms such as X or Facebook are solely private sector companies or whether in a highly digital age they have become the de facto public square where censorship is more proscribed. This is not merely an academic concern. The First Amendment protects, in the Supreme Court’s words, a “robust sphere of individual liberty” that allows private actors to make their own decisions about what speech they wish to associate with. Social media companies have been considered private actors under the law and are permitted to moderate user speech and content as they see fit under Section 230 of the Communications Decency Act.

But with social media platforms acting as the present-day town square, it’s no surprise that so many Americans think it unjust that they could be censored for their views. “Modern society is so thoroughly dependent upon social media for communication, news, commerce, education, and entertainment that any restriction of access to it can easily feel like a matter of constitutional significance,” writes legal scholar Mary Anne Franks.

The Murthy v. Missouri suit argues that Section 230 “directly contributed to the rise of a small number of extremely powerful social-media platforms, who have now turned into a ‘censorship cartel.’” In this part of the suit, the case transforms itself into an argument for the overturning of Section 230, which multiple states are considering.

The lawsuit cites numerous examples of censorship that occurred before the Biden administration took office, and claims it was indeed threats from the Biden campaign which coerced social media companies to overly censor. It will be difficult to prove abridgment of free speech on these points, as only a government – not a campaign – is legally bound by the First Amendment.

The plaintiffs cite, “perhaps most notoriously,” the example of the Hunter Biden laptop story. The New York Post ran a story on Oct. 14, 2020, about the computer of then-presidential nominee Joe Biden’s son and the proof it held of corrupt business dealings, but the Post’s Twitter account was blocked until after the election. In fact, no one could share the story (even via Twitter direct message) because, as the Wall Street Journal Editorial Board put it, “nearly all of the media at the time ignored the story or ‘fact-checked’ as false.” The plaintiffs argue the story was censored because social media companies were “parroting the Biden campaign’s false line,” and so treated the story as “disinformation.”

Similar arguments are made about censorship of speech that raised concerns about the security of voting by mail – that the Biden campaign coerced social media companies into censoring such speech because it did not align with their personal interests. Such posts about election fraud spiraled into a narrative that the election was stolen and contributed to the violent Jan. 6 riot at the U.S. Capitol.

In 1783, George Washington warned that if ‘the Freedom of Speech may be taken away,’ then ‘dumb and silent we may be led, like sheep, to the Slaughter.’ Citing this quote, the plaintiffs in Murthy v. Missouri began their quest to unveil the censorship leviathan.

Whether the courts find their evidence compelling enough to reapply the injunction on much of the federal government is the question of the case. The plaintiffs argue that the government has no role at all, insisting that labeling “disfavored speech ‘misinformation’ or ‘disinformation’ does not strip it of First Amendment protection. Some false statements are inevitable if there is to be an open and vigorous expression of views.”

Kheriaty echoed the sentiment. “The constitution is very clear that the government’s role is not to distinguish between true and false information or true and false speech,” he said. “The government’s only role is to distinguish between legal and illegal speech.”

Danger is invited in when people are not exposed to a multitude of viewpoints, they say. Perhaps we are all victims of the certain censorship that comes from our personalized social media feeds, in which we are fed only information we want to hear. Each side thinks the other is brainwashed. This has led to real-world harm, and surely will again in the future. Whose job is it to save us from ourselves?

Uncategorized

Retirement Crisis Faces Government And Corporate Pensions

It is long past the time that we face the fact that "Social Security" is facing a retirement crisis. In June 2022, we touched on this issue, discussing…

It is long past the time that we face the fact that “Social Security” is facing a retirement crisis. In June 2022, we touched on this issue, discussing the stark realities confronting Social Security.

“The program’s payouts have exceeded revenue since 2010, but the recent past is nowhere near as grim as the future. According to the latest annual report by Social Security’s trustees, the gap between promised benefits and future payroll tax revenue has reached a staggering $59.8 trillion. That gap is $6.8 trillion larger than it was just one year earlier. The biggest driver of that move wasn’t Covid-19, but rather a lowering of expected fertility over the coming decades.” – Stark Realities

Note the last sentence.

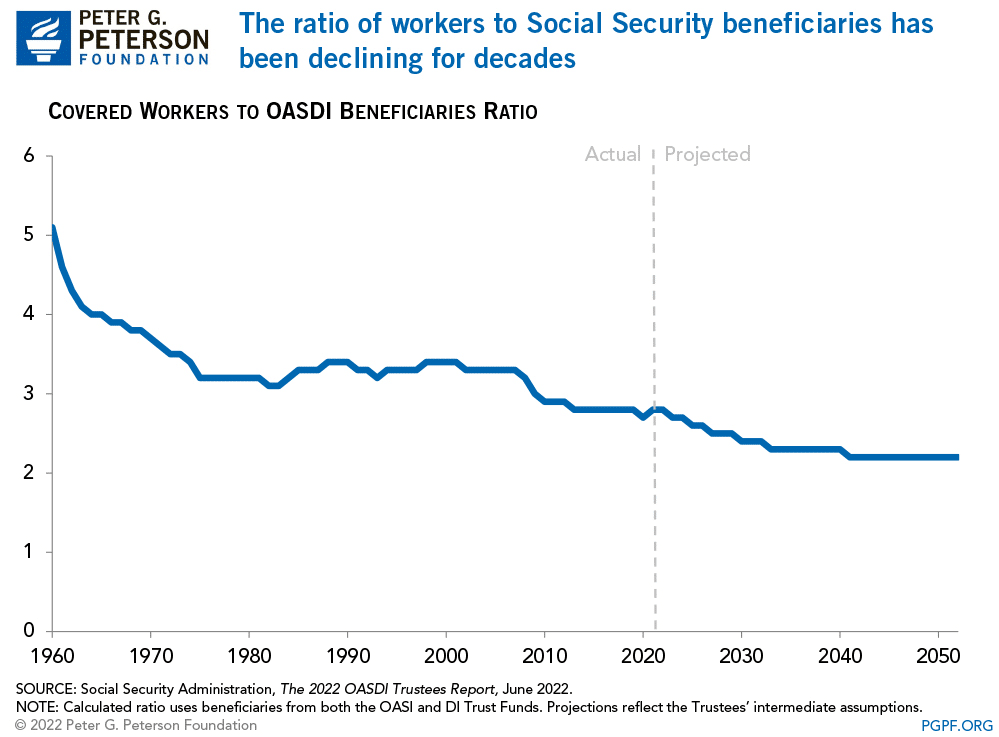

When President Roosevelt first enacted social security in 1935, the intention was to serve as a safety net for older adults. However, at that time, life expectancy was roughly 60 years. Therefore, the expectation was that participants would not be drawing on social security for very long on an actuarial basis. Furthermore, according to the Social Security Administration, roughly 42 workers contributed to the funding pool for each welfare recipient in 1940.

Of course, given that politicians like to use government coffers to buy votes, additional amendments were added to Social Security to expand participation in the program. This included adding domestic labor in 1950 and widows and orphans in 1956. They lowered the retirement age to 62 in 1961 and increased benefits in 1972. Then politicians added more beneficiaries, from disabled people to immigrants, farmers, railroad workers, firefighters, ministers, federal, state, and local government employees, etc.

While politicians and voters continued adding more beneficiaries to the welfare program, workers steadily declined. Today, there are barely 2-workers for each beneficiary. As noted by the Peter G. Peterson Foundation:

“Social Security has been a cornerstone of economic security for almost 90 years, but the program is on unsound footing. Social Security’s combined trust funds are projected to be depleted by 2035 — just 13 years from now. A major contributor to the unsustainability of the current Social Security program is that the number of workers contributing to the program is growing more slowly than the number of beneficiaries receiving monthly payments. In 1960, there were 5.1 workers per beneficiary; that ratio has dropped to 2.8 today.”

As we will discuss, the collision of demographics and math is coming to the welfare system.

A Massive Shortfall

The new Financial Report of the United States Government (February 2024) estimates that the financial position of Social Security and Medicare are underfunded by roughly $175 Trillion. Treasury Secretary Janet Yellin signed the report, but the chart below details the problem.

The obvious problem is that the welfare system’s liabilities massively outweigh taxpayers’ ability to fund it. To put this into context, as of Q4-2023, the GDP of the United States was just $22.6 trillion. In that same period, total federal revenues were roughly $4.8 trillion. In other words, if we applied 100% of all federal revenues to Social Security and Medicare, it would take 36.5 years to fill the gap. Of course, that is assuming that nothing changes.

However, therein lies the actuarial problem.

All pension plans, whether corporate or governmental, rely on certain assumptions to plan for future obligations. Corporate pensions, for example, rely on certain portfolio return assumptions to fund planned employee retirements. Most pension plans assume that portfolios will return 7% a year. However, a vast difference exists between “average returns” and “compound returns” as shown.

Social Security, Medicare, and corporate pension plans face a retirement crisis. A shortfall arises if contributions and returns don’t meet expectations or demand increases on the plans.

For example, given real-world return assumptions, pension funds SHOULD lower their return estimates to roughly 3-4% to potentially meet future obligations and maintain some solvency. However, they can’t make such reforms because “plan participants” won’t let them. Why? Because:

- It would require a 30-40% increase in contributions by plan participants they can not afford.

- Given many plan participants will retire LONG before 2060, there isn’t enough time to solve the issues and;

- Any bear market will further impede the pension plan’s ability to meet future obligations without cutting future benefits.

Social Security and Medicare face the same intractable problem. While there is ample warning from the Trustees that there are funding shortfalls to the plans, politicians refuse to make the needed changes and instead keep adding more participants to the rolls.

However, all current actuarial forecasts depend on a steady and predictable pace of age and retirement. But that is not what is currently happening.

A Retirement Crisis In The Making

The single biggest threat that faces all pension plans is demographics. That single issue can not be fixed as it takes roughly 25 years to grow a taxpayer. So, even if we passed laws today that required all women of birthing age to have a minimum of 4 children over the next 5 years, we would not see any impact for nearly 30 years. However, the problem is running in reverse as fertility rates continue to decline.

Interestingly, researchers from the Center For Sexual Health at Indiana University put forth some hypotheses behind the decline in sexual activity:

- Less alcohol consumption (not spending time in bars/restaurants)

- More time on social media and playing video games

- Lower wages lead to lower rates of romantic relationships

- Non-heterosexual identities

The apparent problem with less sex and non-heterosexual identities is fewer births.

No matter how you calculate the numbers, the problem remains the same. Too many obligations and a demographic crisis. As noted by official OECD estimates, the aging of the population relative to the working-age population has already crossed the “point of no return.”

To compound that situation, there has been a surge in retirees significantly higher than estimates. As noted above, actuarial tables depend on an expected rate of retirees drawing from the system. If that number exceeds those estimates, a funding shortfall increases to provide the required benefits.

The decline in economic prosperity discussed previously is caused by excessive debt and declining income growth due to productivity increases. Furthermore, the shift from manufacturing to a service-based society will continue to lead to reduced taxable incomes.

This employment problem is critical.

By 2025, each married couple will pay Social Security retirement benefits for one retiree and their own family’s expenses. Therefore, taxes must rise, and other government services must be cut.

Back in 1966, each employee shouldered $555 of social benefits. Today, each employee has to support more than $18,000 in benefits. The trend is unsustainable unless wages or employment increases dramatically, and based on current trends, such seems unlikely.

The entire social support framework faces an inevitable conclusion where wishful thinking will not change that outcome. The question is whether elected leaders will make needed changes now or later when they are forced upon us.

For now, we continue to “Whistle past the graveyard” of a retirement crisis.

The post Retirement Crisis Faces Government And Corporate Pensions appeared first on RIA.

gdp covid-19International

SNB Ends the Rate-Cut Drought

This makes it the first developed nation to cut interest rates after the COVID-19 pandemic, the fall of Credit Suisse, the onset of the war in Ukraine,…

This makes it the first developed nation to cut interest rates after the COVID-19 pandemic, the fall of Credit Suisse, the onset of the war in Ukraine, and persistent inflation pressures.

Switzerland’s central bank explained its decision by stating that local inflation will probably remain below 2% for the foreseeable future. Despite this announcement and a drop in inflation, economists believe that the Bank of England (BOE) will not alter its current interest rates.

Norges Bank, the Norwegian central bank, and the US Federal Reserve kept their countries’ respective interest rates unchanged. The latter is, however, expecting three rate cuts in 2024.

Don’t miss out the latest news, subscribe to LeapRate’s newsletter

CNBC said that a Reuters poll predicted that the SNB would keep rates at 1.75%. According to this report, Swiss inflation fell to 1.2%, which is below the 2% benchmark, signalling an economy ready for rate cuts.

The SNB expects further annual inflation decreases and predicts average inflation of 1.4% for 2024, 1.2% for 2025, and 1.1% for 2026 should the policy rate remain steady at 1.5% for the entire period.

CNBC cited analysts from Capital Economics, who commented:

We think inflation will come in even lower than the new SNB forecasts imply and remain around the current level of 1.2% before falling to below 1.0% next year. Accordingly, we forecast the SNB to cut rates at the September and December meetings taking the policy rate to 1%, where we think it will remain throughout 2025 and 2026.

The post SNB Ends the Rate-Cut Drought appeared first on LeapRate.

federal reserve pandemic covid-19 interest rates ukraine-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges