International

Yen Blues

Overview: Benchmark 10-year bonds yields in the US and Europe are at new highs for the year. The US yield is approaching 2.90%, while European rates…

Overview: Benchmark 10-year bonds yields in the US and Europe are at new highs for the year. The US yield is approaching 2.90%, while European rates are mostly 5-8 bp higher. The 10-year UK Gilt yield is up nine basis points to push near 1.98%. The higher yields are seeing the yen's losing streak extend, and the greenback has jumped 1% to around JPY128.45 The dollar is trading lower against the other major currencies but the Swiss franc. The dollar-bloc currencies and Scandis lead the move. Emerging market currencies are mixed. Of note central European currencies are mostly higher (the Polish zloty is the chief exception) and Asia Pacific currencies and the South African rand are softer. Most of the large Asia Pacific equity markets, but China and Hong Kong rose. Europe's Stoxx 600 is off around 1.4%, giving back nearly twice the gains recorded in the last two sessions. US futures have reversed their earlier gains. Gold was turned back from $2000 yesterday and is consolidating around $1975. June WTI is also consolidating (~$105-$108). US natgas is snapping a five-day advance, while Europe's benchmark is up around 6.5% after falling 8.4% yesterday. Iron ore is off 2.6% to extend yesterday's 2.2% fall. Copper is lower for the first time in five sessions. July wheat has come back offered after rising five times in the past six.

Asia Pacific

The yen is falling for the 13th session today and has a six-week losing streak coming into this week. Most recognize that the driving force is the divergence of monetary policy and interest rates. Indeed, the trend follower and momentum traders, as captured in the non-commercial (speculative) futures traders have their largest net short yen position in four years (Commitment of Traders report through April 12). Some, like the historian Adam Tooze, wonder if the yen's weakness will reduce Japan's demand for Treasuries. The dollar has been rising for some time. Leaving aside the panic in 2020 as the pandemic broke, the dollar bottomed against the yen on January 5, 2021, and bottomed against the euro the following day.

The US Treasury's portfolio flow report (TIC), released before the weekend shows Japanese investors were net purchasers of US Treasuries for the past three years, boosting their holdings by about $264 bln. There were net sellers in the previous four years (2015-2018) of a little the more than $190 bln. The data that was released last week showed that Japanese holdings increased by $3.2 bln in February to $1.306 trillion, which is near the record highs set last year. Yet, while they apparently were buying Treasuries in February, according to Japan's Ministry of Finance weekly data, Japanese investors sold around JPY2.3 trillion (~$19 bln) of foreign bonds. Note that Japanese life insurers, with around $3 trillion of assets are expected to announce this fiscal year's investment strategy later this month. US Treasuries are an important way that the weakness of the yen can be avoided.

What about other investors? Amid a historic sell-off in bonds, foreign investors have bought a record amount of US securities over the six months through February (average $126 bln a month), according to the TIC data. Finally, consider that the Federal Reserve acts as a custodian for foreign central banks. The Treasury and Agency holdings in custody ended last year around $3.41 trillion. As of April 13, they stood near $3.46 trillion, a $50 bln increase in 3 1/2 months, during which time the US 10-year yield rose by about 130 bp and the 2-year yield rose slightly more than 170 bp. Yes, someone has been selling US bonds, but it does not look like it was Japan or central banks. Foreign investors have been significant buyers of US assets through February.

Japanese Finance Minister Suzuki’s rhetoric stepped up a little. He warned about the "rapidly weakening" yen and noted that its weakness generated "strong demerits" for the economy. Ahead of his trip to the G7 and G20 meetings, he confirmed being in contact with the US. The market is unpersuaded. The dollar is making new highs in Europe near JPY128.45. The 13th session advance means that dollar has not fallen once this month against the yen. Today is the first session since late March, though, that the dollar is above its upper Bollinger Band (two standard deviations above the 20-day moving average). It is found near JPY127.90 today. The JPY130 level remains the next big target. The Australian dollar held yesterday's low slightly above $0.7340 and returned to $0.7400. It needs to move above yesterday's highs (~$0.7415) to boost confidence a low is in place. The Aussie has fallen in the last four sessions, and eight of the past nine. The US dollar is trading around CNY6.38, the upper end of its range going back to last December. The PBOC announced nearly two dozen measures aimed at households and small businesses to ease some economic pressures, mostly encouraging lending that may be be worth around CNY1 trillion (~$155 bln). Note too that the PBOC's transfer of CNY600 bln profits to the government (used for tax rebates and transfers to local governments) may be the rough equivalent of another 25 bp cut in reserve requirements. Although Chinese officials have been restrained on exchange rate, we suspect pressure is building for a weaker yuan. That said, for the second consecutive session, the PBOC set the dollar's reference rate slightly lower than expected (CNY6.3720 vs. CNY6.3730).

Europe

Russia's offensive in Donbas appears to have begun in earnest. This may signal a new phase in the war. Europe seems to be moving toward embargoing Russian oil. It may first move to ban oil via Russian ships on the Baltic and Black Sea. It may be phased in over a few months. This will not satisfy some of the critics and will take some time it to bite. However, Russia is thought to have little storage capacity and already reports suggest refining capacity is limited.

UK Prime Minister Johnson is expected to offer an apology to Parliament later today. It will be his first appearance in Parliament since the London police fined him (and Chancellor Sunak) for his birthday party during Covid restrictions in 2020. The war in Ukraine seemed to off the PM a new lifeline as he appeared to have been facing a backbench rebellion before the invasion. The parliament session could be brutal, and the opposition is pushing for a formal censure and parliamentary investigation. The key to Johnson's political future may be the local elections on May 5, the same day the BOE meets. The swaps market has about a 33% chance that the central bank hikes by 50 bp.

The euro tested the $1.0760 area, holding a couple hundredth of a cent above last week's two-year low. Although the single currency has frayed support at $1.08, it did not close below it until yesterday. It has managed to resurface it to reach almost $1.0815 in early European trading, where it met fresh sellers. There is a 1.2 bln euro option struck at $1.08 that expires today. The euro has fallen for the past three sessions. Meanwhile, the latest polls for this weekend's run-off election in France shows a widening lead for Macron. An average of polls (calculated by Bloomberg) shows a little more than an eight-percentage point gap, after Macon had an almost 5 percentage point lead in the first round. Sterling dipped below $1.30, but also held last week's low (~$1.2975) and is trying to snap a three-day drop. Like the euro, sterling’s session highs were recorded in early European turnover. It reached $1.3040, which may be the peak. Yesterday's high was closer to $1.3065. There are a set of options for GBP470 mln at $1.30 that expire today.

America

St. Louis Fed President Bullard is using his version of the Taylor Rule to press his hawkish arguments. The Taylor Rule relates inflation and GDP relative to neutrality to a certain target for the overnight rate. Bullard, the leading hawk, argues that the Fed funds target ought to be around 3.5% by the end of the year. Even if the Fed were to hike by 50 bp at each of the remaining six meetings the effective rate will be just below there. He said yesterday that while it is not his base case, a 75 bp hike may be needed at some point. The December Fed funds futures implies a 2.50% yield at year end. The swaps market seen the Fed funds peaking around 3% next year.

The surge in US interest rates warns that the interest-rate sectors should be among the first to feel the sting. Many see the housing market as a likely candidate. March housing starts and permits will be reported today. A 1.6% decline in starts, the median forecast in Bloomberg's survey would be the second in three months, and put starts lower on the year. Still, around 1.74 mln, starts will remain at historically high levels. The same is generally true of permits. A decline in March permits would be the second consecutive decline but anything above 1.8 mln must be considered strong. More pressure is likely to be seen tomorrow with the weekly mortgage applications, which likely fell for the sixth consecutive week (through April 15) and existing home sales. Existing home sales are expected to have fallen for the third month in the past four. They may have slipped below a 6 mln unit annual pace for the first time since last August. Lastly, Chicago Fed President Evans speaks at the Economic Club of New York at lunch today. He is often perceived to be a dove, but even the doves at the Fed seem open to a 50 bp hike next month. Evans does not have a vote on the FOMC this year.

Canada reports March housing starts and existing home sales today. Both are expected to have held up better than in the US. However, there is scope for disappointment. After declining by slightly more than a quarter in December-January, Canadian housing start rose by almost 8% in February. Existing home sales have risen since last September, which followed a five-month slide. Canada also reports its February portfolio flows. These are not the economic data points that typically move the foreign exchange market. Tomorrow's March CPI report is a different matter. Price pressures are accelerating, and the market has a 90% of a 50 bp hike discounted for the next central bank meeting on June 1.

The Canadian dollar is consolidating. The greenback remains within last Thursday's range (~CAD1.2520-CAD1.2640). It is in 20-30-tick range on either side of CAD1.2600 today. There is a $625 mln option at CAD1.2625 that expires today. The Canadian dollar has weakened for the past three sessions and five of the past six. It seems the best directional cues are still coming from equities. Mexico's economic calendar is light today and the US dollar is finding support this month in the MXN19.72-MXN19.75 area. The greenback posted an outside down day yesterday (trading on both sides of last Friday's range and settling below its low. Follow-through selling today took it to MXN19.7625 before bouncing back. It toyed with the MXN20.00 level last week but filed to close above it.

Disclaimer

bonds us treasuries pandemic equities monetary policy fomc fed federal reserve us treasury home sales housing market currencies us dollar canadian dollar euro yuan gdp interest rates gold oil mexico japan hong kong canada european europe uk france russia ukraine chinaInternational

“Extreme Events”: US Cancer Deaths Spiked In 2021 And 2022 In “Large Excess Over Trend”

"Extreme Events": US Cancer Deaths Spiked In 2021 And 2022 In "Large Excess Over Trend"

Cancer deaths in the United States spiked in 2021…

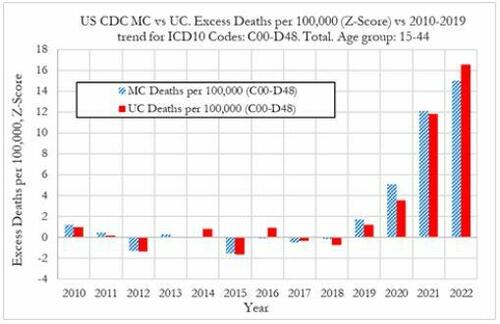

Cancer deaths in the United States spiked in 2021 and 2022 among 15-44 year-olds "in large excess over trend," marking jumps of 5.6% and 7.9% respectively vs. a rise of 1.7% in 2020, according to a new preprint study from deep-dive research firm, Phinance Technologies.

Extreme Events

The report, which relies on data from the CDC, paints a troubling picture.

"We show a rise in excess mortality from neoplasms reported as underlying cause of death, which started in 2020 (1.7%) and accelerated substantially in 2021 (5.6%) and 2022 (7.9%). The increase in excess mortality in both 2021 (Z-score of 11.8) and 2022 (Z-score of 16.5) are highly statistically significant (extreme events)," according to the authors.

That said, co-author, David Wiseman, PhD (who has 86 publications to his name), leaves the cause an open question - suggesting it could either be a "novel phenomenon," Covid-19, or the Covid-19 vaccine.

Cancer deaths in US in 2021 & 2022 in large excess over trend for 15-44 year-olds as extreme events. A novel phenomenon? C19? lockdowns? C19 vaccines? Honored to participate in this work. #CDC where are you? @DowdEdwardhttps://t.co/iUV5oQiWCW pic.twitter.com/uytzaIvvor

— David Wiseman PhD, MRPharmS (@AdhesionsOrg) March 12, 2024

"The results indicate that from 2021 a novel phenomenon leading to increased neoplasm deaths appears to be present in individuals aged 15 to 44 in the US," reads the report.

The authors suggest that the cause may be the result of "an unexpected rise in the incidence of rapidly growing fatal cancers," and/or "a reduction in survival in existing cancer cases."

They also address the possibility that "access to utilization of cancer screening and treatment" may be a factor - the notion that pandemic-era lockdowns resulted in fewer visits to the doctor. Also noted is that "Cancers tend to be slowly-developing diseases with remarkably stable death rates and only small variations over time," which makes "any temporal association between a possible explanatory factor (such as COVID-19, the novel COVID-19 vaccines, or other factor(s)) difficult to establish."

That said, a ZeroHedge review of the CDC data reveals that it does not provide information on duration of illness prior to death - so while it's not mentioned in the preprint, it can't rule out so-called 'turbo cancers' - reportedly rapidly developing cancers, the existence of which has been largely anecdotal (and widely refuted by the usual suspects).

While the Phinance report is extremely careful not to draw conclusions, researcher "Ethical Skeptic" kicked the barn door open in a Thursday post on X - showing a strong correlation between "cancer incidence & mortality" coinciding with the rollout of the Covid mRNA vaccine.

The argument is over.

— Ethical Skeptic ☀ (@EthicalSkeptic) March 14, 2024

The Covid mRNA Vaxx has cause a sizeable 2021 inflection, and now novel-trend elevation in terms of both cancer incidence & mortality.

Now you know who the liars were all along.

????Incidence = 14.8% excess

????UCoD Mortality = 5.3% excess (lags Incidence) pic.twitter.com/uwN9GMrHl1

Phinance principal Ed Dowd commented on the post, noting that "Cancer is suddenly an accelerating growth industry!"

????Indeed it is…Cancer is suddenly an accelerating growth industry! @EthicalSkeptic provides a chart below showing US Cancer treatment in constant dollars with a current growth rate of 14.8% (6.3% New CAGR) versus long term trend of 1.78% CAGR or $33.8 billion in excess cancer… https://t.co/RIn4R2YZZ7

— Edward Dowd (@DowdEdward) March 14, 2024

Continued:

As a former portfolio manager of of a $14 billion Large Cap Growth Equity portfolio I can definitively say Cancer treatments and the Disabilities have become growth industries that both have inflection points coincidental to the mRNA vaccine rollouts in 2021.

— Edward Dowd (@DowdEdward) March 14, 2024

Chart 1 from… pic.twitter.com/TCt4X1plnM

Bottom line - hard data is showing alarming trends, which the CDC and other agencies have a requirement to explore and answer truthfully - and people are asking #WhereIsTheCDC.

We aren't holding our breath.

Experts are sounding the alarm on a spike in cancer diagnosis worldwide. It is still a mystery. @DowdEdward from Phinance Technologies has also been sounding the alarm for months.

— dr.ir. Carla Peeters (@CarlaPeeters3) March 15, 2024

We are facing a dramatic degradation of the human immune system https://t.co/CPnwP3Oj9G

Wiseman, meanwhile, points out that Pfizer and several other companies are making "significant investments in cancer drugs, post COVID."

Pfizer among several companies making significant investments in cancer drugs, post COVID. @DowdEdward @Kevin_McKernan @JesslovesMJK @niki_kyrylenko https://t.co/nefEZYLW1o https://t.co/r505Sbbcq4

— David Wiseman PhD, MRPharmS (@AdhesionsOrg) March 15, 2024

Phinance

We've featured several of Phinance's self-funded deep dives into pandemic data that nobody else is doing. If you'd like to support them, click here.

List of our projects following disturbing tends in deaths, disabilities and absences.

— Edward Dowd (@DowdEdward) March 16, 2024

Link to projects at bottom.

✅ V-Damage Project

✅ Excess Mortality Project

✅ US Disabilities Project

✅ US BLS Absence rates Project

✅ US Cause of Death Project

✅ UK Cause of Death…

Government

Gen Z, The Most Pessimistic Generation In History, May Decide The Election

Gen Z, The Most Pessimistic Generation In History, May Decide The Election

Authored by Mike Shedlock via MishTalk.com,

Young adults are more…

Authored by Mike Shedlock via MishTalk.com,

Young adults are more skeptical of government and pessimistic about the future than any living generation before them.

This is with reason, and it’s likely to decide the election.

Rough Years and the Most Pessimism Ever

The Wall Street Journal has an interesting article on The Rough Years That Turned Gen Z Into America’s Most Disillusioned Voters.

Young adults in Generation Z—those born in 1997 or after—have emerged from the pandemic feeling more disillusioned than any living generation before them, according to long-running surveys and interviews with dozens of young people around the country. They worry they’ll never make enough money to attain the security previous generations have achieved, citing their delayed launch into adulthood, an impenetrable housing market and loads of student debt.

And they’re fed up with policymakers from both parties.

Washington is moving closer to passing legislation that would ban or force the sale of TikTok, a platform beloved by millions of young people in the U.S. Several young people interviewed by The Wall Street Journal said they spend hours each day on the app and use it as their main source of news.

“It’s funny how they quickly pass this bill about this TikTok situation. What about schools that are getting shot up? We’re not going to pass a bill about that?” Gaddie asked. “No, we’re going to worry about TikTok and that just shows you where their head is…. I feel like they don’t really care about what’s going on with humanity.”

Gen Z’s widespread gloominess is manifesting in unparalleled skepticism of Washington and a feeling of despair that leaders of either party can help. Young Americans’ entire political memories are subsumed by intense partisanship and warnings about the looming end of everything from U.S. democracy to the planet. When the darkest days of the pandemic started to end, inflation reached 40-year highs. The right to an abortion was overturned. Wars in Ukraine and the Middle East raged.

Dissatisfaction is pushing some young voters to third-party candidates in this year’s presidential race and causing others to consider staying home on Election Day or leaving the top of the ticket blank. While young people typically vote at lower rates, a small number of Gen Z voters could make the difference in the election, which four years ago was decided by tens of thousands of votes in several swing states.

Roughly 41 million Gen Z Americans—ages 18 to 27—will be eligible to vote this year, according to Tufts University.

Gen Z is among the most liberal segments of the electorate, according to surveys, but recent polling shows them favoring Biden by only a slim margin. Some are unmoved by those who warn that a vote against Biden is effectively a vote for Trump, arguing that isn’t enough to earn their support.

Confidence

When asked if they had confidence in a range of public institutions, Gen Z’s faith in them was generally below that of the older cohorts at the same point in their lives.

One-third of Gen Z Americans described themselves as conservative, according to NORC’s 2022 General Social Survey. That is a larger share identifying as conservative than when millennials, Gen X and baby boomers took the survey when they were the same age, though some of the differences were small and within the survey’s margin of error.

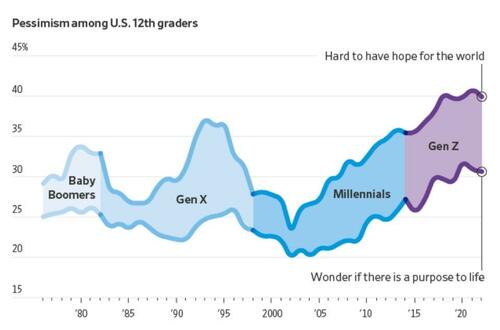

More young people now say they find it hard to have hope for the world than at any time since at least 1976, according to a University of Michigan survey that has tracked public sentiment among 12th-graders for nearly five decades. Young people today are less optimistic than any generation in decades that they’ll get a professional job or surpass the success of their parents, the long-running survey has found. They increasingly believe the system is stacked against them and support major changes to the way the country operates.

Gen Z future Outcome

“It’s the starkest difference I’ve documented in 20 years of doing this research,” said Twenge, the author of the book “Generations.” The pandemic, she said, amplified trends among Gen Z that have existed for years: chronic isolation, a lack of social interaction and a propensity to spend large amounts of time online.

A 2020 study found past epidemics have left a lasting impression on young people around the world, creating a lack of confidence in political institutions and their leaders. The study, which analyzed decades of Gallup World polling from dozens of countries, found the decline in trust among young people typically persists for two decades.

Young people are more likely than older voters to have a pessimistic view of the economy and disapprove of Biden’s handling of inflation, according to the recent Journal poll. Among people under 30, Biden leads Trump by 3 percentage points, 35% to 32%, with 14% undecided and the remaining shares going to third-party candidates, including 10% to independent Robert F. Kennedy Jr.

Economic Reality

Gen Z may be the first generation in US history that is not better off than their parents.

Many have given up on the idea they will ever be able to afford a home.

The economy is allegedly booming (I disagree). Regardless, stress over debt is high with younger millennials and zoomers.

This has been a constant theme of mine for many months.

Credit Card and Auto Delinquencies Soar

Credit card debt surged to a record high in the fourth quarter. Even more troubling is a steep climb in 90 day or longer delinquencies.

Record High Credit Card Debt

Credit card debt rose to a new record high of $1.13 trillion, up $50 billion in the quarter. Even more troubling is the surge in serious delinquencies, defined as 90 days or more past due.

For nearly all age groups, serious delinquencies are the highest since 2011.

Auto Loan Delinquencies

Serious delinquencies on auto loans have jumped from under 3 percent in mid-2021 to to 5 percent at the end of 2023 for age group 18-29.Age group 30-39 is also troubling. Serious delinquencies for age groups 18-29 and 30-39 are at the highest levels since 2010.

For further discussion please see Credit Card and Auto Delinquencies Soar, Especially Age Group 18 to 39

Generational Homeownership Rates

Home ownership rates courtesy of Apartment List

The above chart is from the Apartment List’s 2023 Millennial Homeownership Report

Those struggling with rent are more likely to be Millennials and Zoomers than Generation X, Baby Boomers, or members of the Silent Generation.

The same age groups struggling with credit card and auto delinquencies.

On Average Everything is Great

Average it up, and things look pretty good. This is why we have seen countless stories attempting to explain why people should be happy.

Krugman Blames Partisanship

With the recent rise in consumer sentiment, time to revisit this excellent Briefing Book paper. On reflection, I'd do it a bit differently; same basic conclusion, but I think partisan asymmetry explains even more of the remaining low numbers 1/ https://t.co/4lqm7X4472

— Paul Krugman (@paulkrugman) February 17, 2024

OK, there is a fair amount of partisanship in the polls.

However, Biden isn’t struggling from partisanship alone. If that was the reason, Biden would not be polling so miserably with Democrats in general, blacks, and younger voters.

OK, there is a fair amount of partisanship in the polls.

However, Biden isn’t struggling from partisanship alone. If that was the reason, Biden would not be polling so miserably with Democrats in general, blacks, and younger voters.

This allegedly booming economy left behind the renters and everyone under the age of 40 struggling to make ends meet.

Many Are Addicted to “Buy Now, Pay Later” Plans

Buy Now Pay Later, BNPL, plans are increasingly popular. It’s another sign of consumer credit stress.

For discussion, please see Many Are Addicted to “Buy Now, Pay Later” Plans, It’s a Big Trap

The study did not break things down by home owners vs renters, but I strongly suspect most of the BNPL use is by renters.

What About Jobs?

Another seemingly strong jobs headline falls apart on closer scrutiny. The massive divergence between jobs and employment continued into February.

Nonfarm payrolls and employment levels from the BLS, chart by Mish.

Payrolls vs Employment Gains Since March 2023

-

Nonfarm Payrolls: 2,602,000

-

Employment Level: +144,000

-

Full Time Employment: -284,000

For more details of the weakening labor markets, please see Jobs Up 275,000 Employment Down 184,000

CPI Hot Again

CPI Data from the BLS, chart by Mish.

For discussion of the CPI inflation data for February, please see CPI Hot Again, Rent Up at Least 0.4 Percent for 30 Straight Months

Also note the Producer Price Index (PPI) Much Hotter Than Expected in February

Major Economic Cracks

There are economic cracks in spending, cracks in employment, and cracks in delinquencies.

But there are no cracks in the CPI. It’s coming down much slower than expected. And the PPI appears to have bottomed.

Add it up: Inflation + Recession = Stagflation.

Election Impact

In 2020, younger voters turned out in the biggest wave in history. And they voted for Biden.

Younger voters are not as likely to vote in 2024, and they are less likely to vote for Biden.

Millions of voters will not vote for either Trump or Biden. Net, this will impact Biden more. The base will not decide the election, but the Trump base is far more energized than the Biden base.

If Biden signs a TikTok ban, that alone could tip the election.

If No Labels ever gets its act together, I suspect it will siphon more votes from Biden than Trump. But many will just sit it out.

“We’re just kind of over it,” Noemi Peña, 20, a Tucson, Ariz., resident who works in a juice bar, said of her generation’s attitude toward politics. “We don’t even want to hear about it anymore.” Peña said she might not vote because she thinks it won’t change anything and “there’s just gonna be more fighting.” Biden won Arizona in 2020 by just over 10,000 votes.

The Journal noted nearly one-third of voters under 30 have an unfavorable view of both Biden and Trump, a higher number than all older voters. Sixty-three percent of young voters think neither party adequately represents them.

Young voters in 2020 were energized to vote against Trump. Now they have thrown in the towel.

And Biden telling everyone how great the economy is only rubs salt in the wound.

International

Copper Soars, Iron Ore Tumbles As Goldman Says “Copper’s Time Is Now”

Copper Soars, Iron Ore Tumbles As Goldman Says "Copper’s Time Is Now"

After languishing for the past two years in a tight range despite recurring…

After languishing for the past two years in a tight range despite recurring speculation about declining global supply, copper has finally broken out, surging to the highest price in the past year, just shy of $9,000 a ton as supply cuts hit the market; At the same time the price of the world's "other" most important mined commodity has diverged, as iron ore has tumbled amid growing demand headwinds out of China's comatose housing sector where not even ghost cities are being built any more.

Copper surged almost 5% this week, ending a months-long spell of inertia, as investors focused on risks to supply at various global mines and smelters. As Bloomberg adds, traders also warmed to the idea that the worst of a global downturn is in the past, particularly for metals like copper that are increasingly used in electric vehicles and renewables.

Yet the commodity crash of recent years is hardly over, as signs of the headwinds in traditional industrial sectors are still all too obvious in the iron ore market, where futures fell below $100 a ton for the first time in seven months on Friday as investors bet that China’s years-long property crisis will run through 2024, keeping a lid on demand.

Indeed, while the mood surrounding copper has turned almost euphoric, sentiment on iron ore has soured since the conclusion of the latest National People’s Congress in Beijing, where the CCP set a 5% goal for economic growth, but offered few new measures that would boost infrastructure or other construction-intensive sectors.

As a result, the main steelmaking ingredient has shed more than 30% since early January as hopes of a meaningful revival in construction activity faded. Loss-making steel mills are buying less ore, and stockpiles are piling up at Chinese ports. The latest drop will embolden those who believe that the effects of President Xi Jinping’s property crackdown still have significant room to run, and that last year’s rally in iron ore may have been a false dawn.

Meanwhile, as Bloomberg notes, on Friday there were fresh signs that weakness in China’s industrial economy is hitting the copper market too, with stockpiles tracked by the Shanghai Futures Exchange surging to the highest level since the early days of the pandemic. The hope is that headwinds in traditional industrial areas will be offset by an ongoing surge in usage in electric vehicles and renewables.

And while industrial conditions in Europe and the US also look soft, there’s growing optimism about copper usage in India, where rising investment has helped fuel blowout growth rates of more than 8% — making it the fastest-growing major economy.

In any case, with the demand side of the equation still questionable, the main catalyst behind copper’s powerful rally is an unexpected tightening in global mine supplies, driven mainly by last year’s closure of a giant mine in Panama (discussed here), but there are also growing worries about output in Zambia, which is facing an El Niño-induced power crisis.

On Wednesday, copper prices jumped on huge volumes after smelters in China held a crisis meeting on how to cope with a sharp drop in processing fees following disruptions to supplies of mined ore. The group stopped short of coordinated production cuts, but pledged to re-arrange maintenance work, reduce runs and delay the startup of new projects. In the coming weeks investors will be watching Shanghai exchange inventories closely to gauge both the strength of demand and the extent of any capacity curtailments.

“The increase in SHFE stockpiles has been bigger than we’d anticipated, but we expect to see them coming down over the next few weeks,” Colin Hamilton, managing director for commodities research at BMO Capital Markets, said by phone. “If the pace of the inventory builds doesn’t start to slow, investors will start to question whether smelters are actually cutting and whether the impact of weak construction activity is starting to weigh more heavily on the market.”

* * *

Few have been as happy with the recent surge in copper prices as Goldman's commodity team, where copper has long been a preferred trade (even if it may have cost the former team head Jeff Currie his job due to his unbridled enthusiasm for copper in the past two years which saw many hedge fund clients suffer major losses).

As Goldman's Nicholas Snowdon writes in a note titled "Copper's time is now" (available to pro subscribers in the usual place)...

... there has been a "turn in the industrial cycle." Specifically according to the Goldman analyst, after a prolonged downturn, "incremental evidence now points to a bottoming out in the industrial cycle, with the global manufacturing PMI in expansion for the first time since September 2022." As a result, Goldman now expects copper to rise to $10,000/t by year-end and then $12,000/t by end of Q1-25.’

Here are the details:

Previous inflexions in global manufacturing cycles have been associated with subsequent sustained industrial metals upside, with copper and aluminium rising on average 25% and 9% over the next 12 months. Whilst seasonal surpluses have so far limited a tightening alignment at a micro level, we expect deficit inflexions to play out from quarter end, particularly for metals with severe supply binds. Supplemented by the influence of anticipated Fed easing ahead in a non-recessionary growth setting, another historically positive performance factor for metals, this should support further upside ahead with copper the headline act in this regard.

Goldman then turns to what it calls China's "green policy put":

Much of the recent focus on the “Two Sessions” event centred on the lack of significant broad stimulus, and in particular the limited property support. In our view it would be wrong – just as in 2022 and 2023 – to assume that this will result in weak onshore metals demand. Beijing’s emphasis on rapid growth in the metals intensive green economy, as an offset to property declines, continues to act as a policy put for green metals demand. After last year’s strong trends, evidence year-to-date is again supportive with aluminium and copper apparent demand rising 17% and 12% y/y respectively. Moreover, the potential for a ‘cash for clunkers’ initiative could provide meaningful right tail risk to that healthy demand base case. Yet there are also clear metal losers in this divergent policy setting, with ongoing pressure on property related steel demand generating recent sharp iron ore downside.

Meanwhile, Snowdon believes that the driver behind Goldman's long-running bullish view on copper - a global supply shock - continues:

Copper’s supply shock progresses. The metal with most significant upside potential is copper, in our view. The supply shock which began with aggressive concentrate destocking and then sharp mine supply downgrades last year, has now advanced to an increasing bind on metal production, as reflected in this week's China smelter supply rationing signal. With continued positive momentum in China's copper demand, a healthy refined import trend should generate a substantial ex-China refined deficit this year. With LME stocks having halved from Q4 peak, China’s imminent seasonal demand inflection should accelerate a path into extreme tightness by H2. Structural supply underinvestment, best reflected in peak mine supply we expect next year, implies that demand destruction will need to be the persistent solver on scarcity, an effect requiring substantially higher pricing than current, in our view. In this context, we maintain our view that the copper price will surge into next year (GSe 2025 $15,000/t average), expecting copper to rise to $10,000/t by year-end and then $12,000/t by end of Q1-25’

Another reason why Goldman is doubling down on its bullish copper outlook: gold.

The sharp rally in gold price since the beginning of March has ended the period of consolidation that had been present since late December. Whilst the initial catalyst for the break higher came from a (gold) supportive turn in US data and real rates, the move has been significantly amplified by short term systematic buying, which suggests less sticky upside. In this context, we expect gold to consolidate for now, with our economists near term view on rates and the dollar suggesting limited near-term catalysts for further upside momentum. Yet, a substantive retracement lower will also likely be limited by resilience in physical buying channels. Nonetheless, in the midterm we continue to hold a constructive view on gold underpinned by persistent strength in EM demand as well as eventual Fed easing, which should crucially reactivate the largely for now dormant ETF buying channel. In this context, we increase our average gold price forecast for 2024 from $2,090/toz to $2,180/toz, targeting a move to $2,300/toz by year-end.

Much more in the full Goldman note available to pro subs.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Spread & Containment4 days ago

Spread & Containment4 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex