International

Why Helium Could Be The Hottest Commodity Play Of 2022

Helium is already 100x more expensive than natural gas—even with skyrocketing oil and gas prices. And the helium land rush is on in full force. It’s made easier by the fact that the bulk of helium comes from natural gas fields, and what investors.

Helium is already 100x more expensive than natural gas—even with skyrocketing oil and gas prices.

And the helium land rush is on in full force.

It’s made easier by the fact that the bulk of helium comes from natural gas fields, and what investors should be paying attention to now is the largest conventional gas field in the United States.

This is where we could find the biggest potential beneficiary of a helium shortage that will dictate the future of everything from supercomputing and space travel to MRIs and medical research across the board.

Helium plays in general are strong bets because we no longer have a federal reserve of helium—as of this year—and we’re looking at an extremely tight supply picture coupled with fast-growing high-tech demand.

But Total Helium (TSX.V:TOH) is the furthest along and its advantages are clear …

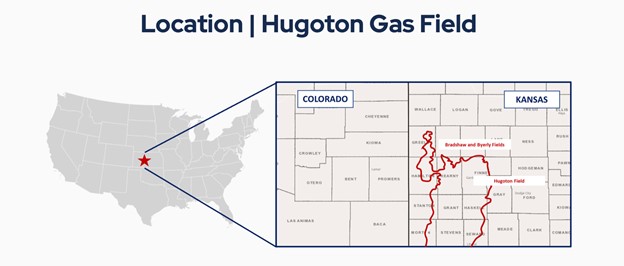

It has a helium play in the biggest conventional natural gas field in the United States, Hugoton, in the Kansas-Oklahoma panhandle.

The company reports it already has a deal with a member of the helium oligopoly—Linde (NYSE:LIN), one of the biggest downstream companies in the sector.

And it’s got superb sponsorship: Behind Total Helium is Craig Steinke, the founder of Reconnaissance Africa, the bold junior explorer taking on the giant Kavango Basin in Namibia and Botswana, with an estimated potential of 120 billion boe.

Here are 5 reasons we plan to keep a very close eye on Total Helium (TSX.V:TOH) right now:

#1 The Biggest Helium Play in North America

Discovered in 1922, the Hugoton natural gas field isn’t just the largest in the United States—it’s reportedly the largest conventional gas play in all of North America.

It has a potential 75 trillion cubic feet of recoverable natural gas.

And it’s not only the historical center of conventional natural gas production—it's a helium behemoth that’s already produced approximately 300 BCF of helium.

Now, Total Helium is expanding this massive field, armed with new technology and a market that will be starving for more helium supplies.

So far, Total Helium has approximately 86,000 acres of leases on hand at Hugoton—about 46,000 in leases and about 40,000 in farmout agreements with Scout Energy, one of the largest producers in the basin.

And the leasing campaign is still ongoing. The end game here is said to be a 1.65 million-acre extension.

And Total Helium’s extension area is said to have proven concentrations of helium:

Total Helium (TSX.V:TOH) is targeting 70 billion cubic feet of helium here, along with 8.5 trillion cubic feet of produced gas, enriched with liquids.

They estimate that the average well they drill could be able to produce over 27,000 Mcf of helium.

At today’s natural gas and helium prices, we think this is a play that’s hard to beat, and there’s even more upside here when we consider the methane potential …

So why hasn’t Hugoton been on the mainstream radar in recent years?

In the previous century, this was a monster gas producer for the United States. But a lack of technology kept us from realizing its full, continued potential. And then the shale boom hit. The advent of fracking—even though exorbitantly expensive and environmentally questionable—took all attention away from the technology to recover Hugoton’s remaining gas riches.

A key issue was water.

While the rest of the world was distracted by unconventional oil and gas, Steinke—a long-time wildcatter—found a different niche: proven reservoirs with high water concentrations. This is what Hugoton is. And without the right technology, it can be just as challenging as fracking.

But that technology now exists, and while the world has remained distracted … Steinke has not.

Steinke and his team are experienced in this kind of reservoir. Now, in Hugoton, they have a significant injection zone for the additional volumes of water that get produced. Hugoton was a problem earlier on because no one had the right technology to be able to handle the water. Total Helium does. Water disposal is an important part of the economic equation here.

This is a natural gas, methane, and helium play, and with the right water disposal system, which is said to have been already secured, it should be easy to get at.

Geological storage studies have already been completed and engineering studies are underway.

Everything appears to be lined up for this play and the critical infrastructure is in place, with a massive pipeline network.

#2 Soaring Gas Prices as First Wells Are Spudded

Total Helium (TSX.V:TOH) started drilling its first well, Boltz 35B, on November 14th. The process includes installing a 3-phase power for operating a submersible pump, building a pipeline connection to sell produced gases, and establishing disposal lines for connecting the well to the existing salt-water disposal well.

In December, they intend to start testing, completion, and production at Boltz 35B.

This one is moving fast, and the news flow from now through the end of the year could be extremely defining for this exciting new stock.

All the more so when the company’s projected return on investment for a single well is 877%.

* RPS Competent Person Report –P50 Case

Total Helium says it will also be keeping costs down by paying their farmout partner, Scout Energy, 15 cents per barrel for disposal, which is a very nominal fee—even when you have agreed to sell Linde 10,000 Mcf of helium per month at $212 per Mcf—the discounted price until Linde recoups its investment. Anything beyond that 10,000 Mcf will could go at market price for up to $500 per Mcf. And even at $212/Mcf, it’s profitable.

And we think there is plenty of additional upside here, as well.

Total Helium’s total prospect area is approximately 1.65 million acres, representing a 19x growth opportunity.

There’s even more upside in the potential to competitively bid up excess helium, which is selling for anywhere between $300/Mcf to $600/Mcf. That excess helium alone has a potential for a 1.8x growth scenario for Total Helium.

Finally, the company’s helium storage JV with Linde has ongoing revenue potential.

#3 Total Helium Has Critical Partnership & Sponsorship

A partnership with a huge multinational industrial gas company makes this opportunity a rare one for a junior player.

Linde (NYSE:LIN) is a $160-billion-market-cap major that provides atmospheric gases to customers in multiple trillion-dollar industries, from petroleum refining, aerospace, electronics, and healthcare to manufacturing, food and beverage, chemicals and water treatment industries.

This isn’t just any partnership deal. Total Helium (TSX.V:TOH) and Linde have a JV deal that may see them create the only alternative helium storage facility to the U.S. federal helium reserve in the entire world. The U.S. federal helium is planned to be auctioned off to private investors.

This partnership deal also looks like an ideal setup for generating cash flow for Total Helium. The company has already received $950,000 in the form of an upfront payment from Linde. And they’re set to receive another $950,000 as they spud their first wells.

They also have a $360,000 consulting contract with Linde for establishing underground helium storage facilities, with 50/50% ownership deal.

So far, Total Helium has generated over $2.2 million in current and upcoming cash flows from its partnership with Linde.

The deal with Linde isn’t the only thing that sets Total Helium apart. This is a level of sponsorship we don’t often see in a small-cap play like this.

The man behind Total Helium, Craig Steinke, is also behind the most exciting oil play we’ve seen in a decade, at least—Recon Africa’s Kavango Basin with an estimated potential of up to 120 billion boe. Steinke is great at making moves on huge hidden, or forgotten gems and swooping in to acquire big plays that are usually reserved for supergiants.

Now, Steinke is aiming to do something similar with Total Helium (TSX.V:TOH), as the bit hits the ground in North America’s largest conventional natural gas field.

Except that now, it’s about a basket of high-priced gases, including helium and methane …

#4 North America is Desperate for Home-Grown Helium

Helium is extremely lightweight, non-reactive, and can liquify at extremely low temperatures. It’s also completely non-renewable. In other words, there is nothing that can replace it.

The Bureau of Land Management (BLM) first jumped on helium in WWI, feeding technology that sent helium balloons to bomb our adversaries. Since then, helium has been considered a strategic gas held in a federal reserve. During the Cold War, helium was used for cooling the tips of missiles.

Now, helium is a key to our supercomputing power. A key to big data. Our hard drives are now “helium drives”. Fiber-optic telecommunications might be impossible without helium. So may medical research, and even MRIs. A NASA space shuttle requires 1 million cubic feet of helium just during the launch countdown.

Linde bought much of its past helium from the BLM, but now they have to look elsewhere. That search has taken them as far away as Russia and Qatar, but transporting helium that far is a risk because it is not bound to the earth by gravity and can leak away. Industrial Gas Companies have been paying a premium to Russia and Qatar for helium, so a sizable North American option is not only ideal—it’s vital.

#5 Bottom Line: Impressive ‘Helium Enhanced’ Economics

Natural gas is trading at just under $5 right now. And that’s about $2 more than the norm in recent years. Helium still blows it away at up to $500/Mcf.

And now that the BLM is out of business, North America could find itself facing a helium shortage.

One of the most innovative wildcatters on the natural resources scene has scooped up tens of thousands acres of leases for the largest natural gas field in North America, and a venue that serves as the epicenter of American helium.

Unique water disposal technology could make this one of the most profitable helium producers out there, which is exactly why they’ve attracted giant Linde as a JV partner with a helium offtake deal.

Both Total Helium (TSX.V:TOH) management and Linde have significant skin in this game which could provide a serious boost in investor confidence.

And they’ve just spudded their first well, with completion targeted for this December. We’re looking at a fast-moving play with world-class helium potential and a management team of world-renowned wildcatting fame. The clock is ticking on this one and it goes way beyond party balloons.

Other companies looking to capitalize on the alternative resource space:

Air Products & Chemicals (NYSE:APD) has been at the forefront of global hydrogen production for years. They recognize that this clean alternative fuel can help make an impactful dent in boosting our country's green energy initiatives as well as reducing carbon emissions across industries by decreasing reliance on fossil fuels like coal and petroleum products, etc., which Air Product’s own extensive experience with helping others achieve sustainability goals through chemical innovation will bring about even more progress than before

Air Products and Chemicals has well over 60 years of experience producing hydrogen, and more than two decades designing fueling stations. It’s SmartFuel stations have been deployed across the globe and support a number of different unique and interesting transportation applications. The fully-integrated stations include compression, storage and dispensing systems that have proven to be safe and reliable for its customers. Though Air Products has been around for some time, the $66 billion company has had a particularly strong year in 2021 thanks to the growing interest in Hydrogen applications.

Canada’s renewable energy push is gaining speed, as well. Boralex Inc. (TSX:BLX) is one of Canada’s premier renewable energy firms. It played a major role in kickstarting the country’s domestic renewable boom. The company’s main renewable energies are produced through wind, hydroelectric, thermal and solar sources and help power the homes of many people across Canada and other parts of the world, including the United States, France and the United Kingdom.

Maxar Technologies (TSX:MAXR) is one of the leading space companies on the planet, founded nearly 20 years ago. Maxar has a variety of services, including satellite development, space robotics, and earth observations. One of their most well-known products is the Canadarm2 robotic arm for the International Space Station (ISS). The ISS has been operational since 1998 with more than 100 missions to date. Maxar Technologies has had a history of partnering with NASA to maintain the ISS's systems as well as providing them with new technologies such as the Canadarm2 robotic arm. is a moon-bound tech stock to keep an eye on. While space firm specializes in satellite and communication technologies, it is also a manufacturer of infrastructure required for in-orbit satellite services, Earth observation and more.

More importantly, however, Maxar’s subsidiary, SSL, a designer and manufacturer of satellites used by government and commercial enterprises, has pioneered research in electric propulsion systems, lithium-ion power systems and the use of advanced composites on commercial satellites. These innovations are key because they allow satellites to spend more time in orbit, reducing costs and increasing efficiency.

As demand for energy continues to explode in a post-pandemic China, CNOOC Limited (TSX:CNU) will likely be one of the biggest winners in this boom. It’s the country’s most significant producer of offshore crude oil and natural gas and may well be one of the most controversial oil stocks for investors on the market. A label that has nothing to do with its operations, however.

Recently, U.S. regulators announced their intention to de-list Chinese companies from the New York Stock Exchange, going back on their announcement just a few days later. The sustained negative press surrounding Chinese companies, however, has put CNOOC in an uncomfortable position for investors. While many analysts see the company as significantly undervalued, it is still struggling to gain traction in U.S. markets. Though that could be changing as Biden works to ease tensions with China

Magna International (TSX:MG) is a really interesting and roundabout way to get in on the explosive commodity market without betting big on one of the new hot stocks tearing up among the millennials right now. More than a decade ago, Magna International was already making major moves in the battery market, investing over half a billion dollars in battery production while the market was still in its infancy. At the time, electric vehicles as we know them had barely hit the scene, with Tesla launching its premiere car just two years prior.

Magna’s massive investment in batteries, however, has paid off in a big way. Since its controversial bet of yesteryear, the company has seen its valuation soar by tens of billions of dollars, and it has solidified itself as one of the leaders in the increasingly competitive battery business.

Westport Fuel Systems (TSX:WRPT) isn’t necessarily a resource play, but it is an important company to watch as new fuels and new forms of energy take the spotlight. Especially as the world races to leave behind traditional gasoline and diesel-powered vehicles. That’s because, while it is a manufacturing play at heart, it offers a particularly unique way to gain exposure to the alternative fuels market. As a key manufacturer of the hardware needed to build natural gas and other alternative-fueled cars, Westport is definitely a company to watch in this scene.

Westport Fuel has been making major moves in the market over the past year, and its efforts are finally coming to fruition. Since May 2020, the company has seen its stock price rise by 322%, and with more potential deals like the one it has just sealed with Amazon to provide natural gas-powered trucks to its fleet, the stock has even more room to run in the coming years.

By. Tom Kool

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that helium prices continue to increase or remain at current levels; that helium will remain or grow in importance for future of many different technology applications; that Total Helium (the “Company”) will be able to successfully explore for and produce helium, methane and/or natural from its exploration properties and that the Company will be able to commercialize the production of any helium, methane and/or gas reserves found and recovered on its properties; that current technology, including the implementation of appropriate water disposal systems, will allow the Company to successfully explore and develop potential helium and/or gas reserves on the Company’s properties; that the Company will achieve its anticipated return on investment on drilled wells; that the Company will be able to minimize the costs incurred during the exploration and development process; that the Company will be able to store any recovered helium in its joint venture with Linde; that the Company and Lind will be able to develop the only alternative helium storage facility to the U.S. federal helium reserve in the entire world; that the U.S. federal helium will be auctioned off to private investors; that the Company will generate ongoing cash flow from its deal with Linde; and that management of the Company can leverage experience from other exploration projects to achieve success. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that helium prices may not increase in the future and may actually decrease for various reasons; that helium may be replaced with other resources such that its importance in technology applications may decrease in future; that the Company may fail to successfully explore for and produce helium, methane and/or natural from its exploration properties or that the Company is unable to commercialize the production of any helium, methane and/or gas reserves found or recovered on its properties; that current technology may be inadequate or cost prohibitive for the Company to successfully explore and develop potential helium and/or gas reserves on the Company’s properties; that the Company may not achieve a return on investment on drilled wells as anticipated or at all; that the Company’s exploration and development efforts, if any, may be more costly than anticipated; that the Company may be unable to leverage its joint venture with Linde for the storage of any helium it recovers and the Company and Linde may be unable to develop a helium storage facility as anticipated or at all; that the Company may fail to generate cash flow from its deal with Linde; and that management of the Company may be unable to leverage any of its experience from other exploration projects. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by Total Helium but may in the future be compensated to conduct investor awareness advertising and marketing for TSX.V:TOH. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct. Price targets that we have listed in this article are our opinions based on limited analysis, but we are not professional financial analysts so price targets are not to be relied on.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of Total Helium and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.

tsx stocks pandemic federal reserve small-cap treatment testing epicenter oil africa canada france russia chinaGovernment

Chinese migration to US is nothing new – but the reasons for recent surge at Southern border are

A gloomier economic outlook in China and tightening state control have combined with the influence of social media in encouraging migration.

The brief closure of the Darien Gap – a perilous 66-mile jungle journey linking South American and Central America – in February 2024 temporarily halted one of the Western Hemisphere’s busiest migration routes. It also highlighted its importance to a small but growing group of people that depend on that pass to make it to the U.S.: Chinese migrants.

While a record 2.5 million migrants were detained at the United States’ southwestern land border in 2023, only about 37,000 were from China.

I’m a scholar of migration and China. What I find most remarkable in these figures is the speed with which the number of Chinese migrants is growing. Nearly 10 times as many Chinese migrants crossed the southern border in 2023 as in 2022. In December 2023 alone, U.S. Border Patrol officials reported encounters with about 6,000 Chinese migrants, in contrast to the 900 they reported a year earlier in December 2022.

The dramatic uptick is the result of a confluence of factors that range from a slowing Chinese economy and tightening political control by President Xi Jinping to the easy access to online information on Chinese social media about how to make the trip.

Middle-class migrants

Journalists reporting from the border have generalized that Chinese migrants come largely from the self-employed middle class. They are not rich enough to use education or work opportunities as a means of entry, but they can afford to fly across the world.

According to a report from Reuters, in many cases those attempting to make the crossing are small-business owners who saw irreparable damage to their primary or sole source of income due to China’s “zero COVID” policies. The migrants are women, men and, in some cases, children accompanying parents from all over China.

Chinese nationals have long made the journey to the United States seeking economic opportunity or political freedom. Based on recent media interviews with migrants coming by way of South America and the U.S.’s southern border, the increase in numbers seems driven by two factors.

First, the most common path for immigration for Chinese nationals is through a student visa or H1-B visa for skilled workers. But travel restrictions during the early months of the pandemic temporarily stalled migration from China. Immigrant visas are out of reach for many Chinese nationals without family or vocation-based preferences, and tourist visas require a personal interview with a U.S. consulate to gauge the likelihood of the traveler returning to China.

Social media tutorials

Second, with the legal routes for immigration difficult to follow, social media accounts have outlined alternatives for Chinese who feel an urgent need to emigrate. Accounts on Douyin, the TikTok clone available in mainland China, document locations open for visa-free travel by Chinese passport holders. On TikTok itself, migrants could find information on where to cross the border, as well as information about transportation and smugglers, commonly known as “snakeheads,” who are experienced with bringing migrants on the journey north.

With virtual private networks, immigrants can also gather information from U.S. apps such as X, YouTube, Facebook and other sites that are otherwise blocked by Chinese censors.

Inspired by social media posts that both offer practical guides and celebrate the journey, thousands of Chinese migrants have been flying to Ecuador, which allows visa-free travel for Chinese citizens, and then making their way over land to the U.S.-Mexican border.

This journey involves trekking through the Darien Gap, which despite its notoriety as a dangerous crossing has become an increasingly common route for migrants from Venezuela, Colombia and all over the world.

In addition to information about crossing the Darien Gap, these social media posts highlight the best places to cross the border. This has led to a large share of Chinese asylum seekers following the same path to Mexico’s Baja California to cross the border near San Diego.

Chinese migration to US is nothing new

The rapid increase in numbers and the ease of accessing information via social media on their smartphones are new innovations. But there is a longer history of Chinese migration to the U.S. over the southern border – and at the hands of smugglers.

From 1882 to 1943, the United States banned all immigration by male Chinese laborers and most Chinese women. A combination of economic competition and racist concerns about Chinese culture and assimilability ensured that the Chinese would be the first ethnic group to enter the United States illegally.

With legal options for arrival eliminated, some Chinese migrants took advantage of the relative ease of movement between the U.S. and Mexico during those years. While some migrants adopted Mexican names and spoke enough Spanish to pass as migrant workers, others used borrowed identities or paperwork from Chinese people with a right of entry, like U.S.-born citizens. Similarly to what we are seeing today, it was middle- and working-class Chinese who more frequently turned to illegal means. Those with money and education were able to circumvent the law by arriving as students or members of the merchant class, both exceptions to the exclusion law.

Though these Chinese exclusion laws officially ended in 1943, restrictions on migration from Asia continued until Congress revised U.S. immigration law in the Hart-Celler Act in 1965. New priorities for immigrant visas that stressed vocational skills as well as family reunification, alongside then Chinese leader Deng Xiaoping’s policies of “reform and opening,” helped many Chinese migrants make their way legally to the U.S. in the 1980s and 1990s.

Even after the restrictive immigration laws ended, Chinese migrants without the education or family connections often needed for U.S. visas continued to take dangerous routes with the help of “snakeheads.”

One notorious incident occurred in 1993, when a ship called the Golden Venture ran aground near New York, resulting in the drowning deaths of 10 Chinese migrants and the arrest and conviction of the snakeheads attempting to smuggle hundreds of Chinese migrants into the United States.

Existing tensions

Though there is plenty of precedent for Chinese migrants arriving without documentation, Chinese asylum seekers have better odds of success than many of the other migrants making the dangerous journey north.

An estimated 55% of Chinese asylum seekers are successful in making their claims, often citing political oppression and lack of religious freedom in China as motivations. By contrast, only 29% of Venezuelans seeking asylum in the U.S. have their claim granted, and the number is even lower for Colombians, at 19%.

The new halt on the migratory highway from the south has affected thousands of new migrants seeking refuge in the U.S. But the mix of push factors from their home country and encouragement on social media means that Chinese migrants will continue to seek routes to America.

And with both migration and the perceived threat from China likely to be features of the upcoming U.S. election, there is a risk that increased Chinese migration could become politicized, leaning further into existing tensions between Washington and Beijing.

Meredith Oyen does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

congress pandemic deaths south america mexico chinaGovernment

Is the National Guard a solution to school violence?

School board members in one Massachusetts district have called for the National Guard to address student misbehavior. Does their request have merit? A…

Every now and then, an elected official will suggest bringing in the National Guard to deal with violence that seems out of control.

A city council member in Washington suggested doing so in 2023 to combat the city’s rising violence. So did a Pennsylvania representative concerned about violence in Philadelphia in 2022.

In February 2024, officials in Massachusetts requested the National Guard be deployed to a more unexpected location – to a high school.

Brockton High School has been struggling with student fights, drug use and disrespect toward staff. One school staffer said she was trampled by a crowd rushing to see a fight. Many teachers call in sick to work each day, leaving the school understaffed.

As a researcher who studies school discipline, I know Brockton’s situation is part of a national trend of principals and teachers who have been struggling to deal with perceived increases in student misbehavior since the pandemic.

A review of how the National Guard has been deployed to schools in the past shows the guard can provide service to schools in cases of exceptional need. Yet, doing so does not always end well.

How have schools used the National Guard before?

In 1957, the National Guard blocked nine Black students’ attempts to desegregate Central High School in Little Rock, Arkansas. While the governor claimed this was for safety, the National Guard effectively delayed desegregation of the school – as did the mobs of white individuals outside. Ironically, weeks later, the National Guard and the U.S. Army would enforce integration and the safety of the “Little Rock Nine” on orders from President Dwight Eisenhower.

One of the most tragic cases of the National Guard in an educational setting came in 1970 at Kent State University. The National Guard was brought to campus to respond to protests over American involvement in the Vietnam War. The guardsmen fatally shot four students.

In 2012, then-Sen. Barbara Boxer, a Democrat from California, proposed funding to use the National Guard to provide school security in the wake of the Sandy Hook school shooting. The bill was not passed.

More recently, the National Guard filled teacher shortages in New Mexico’s K-12 schools during the quarantines and sickness of the pandemic. While the idea did not catch on nationally, teachers and school personnel in New Mexico generally reported positive experiences.

Can the National Guard address school discipline?

The National Guard’s mission includes responding to domestic emergencies. Members of the guard are part-time service members who maintain civilian lives. Some are students themselves in colleges and universities. Does this mission and training position the National Guard to respond to incidents of student misbehavior and school violence?

On the one hand, New Mexico’s pandemic experience shows the National Guard could be a stopgap to staffing shortages in unusual circumstances. Similarly, the guards’ eventual role in ensuring student safety during school desegregation in Arkansas demonstrates their potential to address exceptional cases in schools, such as racially motivated mob violence. And, of course, many schools have had military personnel teaching and mentoring through Junior ROTC programs for years.

Those seeking to bring the National Guard to Brockton High School have made similar arguments. They note that staffing shortages have contributed to behavior problems.

One school board member stated: “I know that the first thought that comes to mind when you hear ‘National Guard’ is uniform and arms, and that’s not the case. They’re people like us. They’re educated. They’re trained, and we just need their assistance right now. … We need more staff to support our staff and help the students learn (and) have a safe environment.”

Yet, there are reasons to question whether calls for the National Guard are the best way to address school misconduct and behavior. First, the National Guard is a temporary measure that does little to address the underlying causes of student misbehavior and school violence.

Research has shown that students benefit from effective teaching, meaningful and sustained relationships with school personnel and positive school environments. Such educative and supportive environments have been linked to safer schools. National Guard members are not trained as educators or counselors and, as a temporary measure, would not remain in the school to establish durable relationships with students.

What is more, a military presence – particularly if uniformed or armed – may make students feel less welcome at school or escalate situations.

Schools have already seen an increase in militarization. For example, school police departments have gone so far as to acquire grenade launchers and mine-resistant armored vehicles.

Research has found that school police make students more likely to be suspended and to be arrested. Similarly, while a National Guard presence may address misbehavior temporarily, their presence could similarly result in students experiencing punitive or exclusionary responses to behavior.

Students deserve a solution other than the guard

School violence and disruptions are serious problems that can harm students. Unfortunately, schools and educators have increasingly viewed student misbehavior as a problem to be dealt with through suspensions and police involvement.

A number of people – from the NAACP to the local mayor and other members of the school board – have criticized Brockton’s request for the National Guard. Governor Maura Healey has said she will not deploy the guard to the school.

However, the case of Brockton High School points to real needs. Educators there, like in other schools nationally, are facing a tough situation and perceive a lack of support and resources.

Many schools need more teachers and staff. Students need access to mentors and counselors. With these resources, schools can better ensure educators are able to do their jobs without military intervention.

F. Chris Curran has received funding from the US Department of Justice, the Bureau of Justice Assistance, and the American Civil Liberties Union for work on school safety and discipline.

army governor pandemic mexicoInternational

Rand Paul Teases Senate GOP Leader Run – Musk Says “I Would Support”

Rand Paul Teases Senate GOP Leader Run – Musk Says "I Would Support"

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump…

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump into the race to become the next Senate GOP leader, and Elon Musk was quick to support the idea. Republicans must find a successor for periodically malfunctioning Mitch McConnell, who recently announced he'll step down in November, though intending to keep his Senate seat until his term ends in January 2027, when he'd be within weeks of turning 86.

So far, the announced field consists of two quintessential establishment types: John Cornyn of Texas and John Thune of South Dakota. While John Barrasso's name had been thrown around as one of "The Three Johns" considered top contenders, the Wyoming senator on Tuesday said he'll instead seek the number two slot as party whip.

Paul used X to tease his potential bid for the position which -- if the GOP takes back the upper chamber in November -- could graduate from Minority Leader to Majority Leader. He started by telling his 5.1 million followers he'd had lots of people asking him about his interest in running...

Thousands of people have been asking if I'd run for Senate leadership...

— Rand Paul (@RandPaul) March 8, 2024

...then followed up with a poll in which he predictably annihilated Cornyn and Thune, taking a 96% share as of Friday night, with the other two below 2% each.

????????️VOTE NOW ????️ ???? Who would you like to be the next Senate leader?

— Rand Paul (@RandPaul) March 8, 2024

Elon Musk was quick to back the idea of Paul as GOP leader, while daring Cornyn and Thune to follow Paul's lead by throwing their names out for consideration by the Twitter-verse X-verse.

I would support Rand Paul and suspect that other candidates will not actually run polls out of concern for the results, but let’s see if they will!

— Elon Musk (@elonmusk) March 8, 2024

Paul has been a stalwart opponent of security-state mass surveillance, foreign interventionism -- to include shoveling billions of dollars into the proxy war in Ukraine -- and out-of-control spending in general. He demonstrated the latter passion on the Senate floor this week as he ridiculed the latest kick-the-can spending package:

This bill is an insult to the American people. The earmarks are all the wasteful spending that you could ever hope to see, and it should be defeated. Read more: https://t.co/Jt8K5iucA4 pic.twitter.com/I5okd4QgDg

— Senator Rand Paul (@SenRandPaul) March 8, 2024

In February, Paul used Senate rules to force his colleagues into a grueling Super Bowl weekend of votes, as he worked to derail a $95 billion foreign aid bill. "I think we should stay here as long as it takes,” said Paul. “If it takes a week or a month, I’ll force them to stay here to discuss why they think the border of Ukraine is more important than the US border.”

Don't expect a Majority Leader Paul to ditch the filibuster -- he's been a hardy user of the legislative delay tactic. In 2013, he spoke for 13 hours to fight the nomination of John Brennan as CIA director. In 2015, he orated for 10-and-a-half-hours to oppose extension of the Patriot Act.

Among the general public, Paul is probably best known as Capitol Hill's chief tormentor of Dr. Anthony Fauci, who was director of the National Institute of Allergy and Infectious Disease during the Covid-19 pandemic. Paul says the evidence indicates the virus emerged from China's Wuhan Institute of Virology. He's accused Fauci and other members of the US government public health apparatus of evading questions about their funding of the Chinese lab's "gain of function" research, which takes natural viruses and morphs them into something more dangerous. Paul has pointedly said that Fauci committed perjury in congressional hearings and that he belongs in jail "without question."

Musk is neither the only nor the first noteworthy figure to back Paul for party leader. Just hours after McConnell announced his upcoming step-down from leadership, independent 2024 presidential candidate Robert F. Kennedy, Jr voiced his support:

Mitch McConnell, who has served in the Senate for almost 40 years, announced he'll step down this November.

— Robert F. Kennedy Jr (@RobertKennedyJr) February 28, 2024

Part of public service is about knowing when to usher in a new generation. It’s time to promote leaders in Washington, DC who won’t kowtow to the military contractors or…

In a testament to the extent to which the establishment recoils at the libertarian-minded Paul, mainstream media outlets -- which have been quick to report on other developments in the majority leader race -- pretended not to notice that Paul had signaled his interest in the job. More than 24 hours after Paul's test-the-waters tweet-fest began, not a single major outlet had brought it to the attention of their audience.

That may be his strongest endorsement yet.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex