Why Central Banks Are The Opioid Of Our Economy

The Fed has got the good stuff, and it might take an intervention to set our economy back on track.

The Fed has got the good stuff, and it might take an intervention to set our economy back on track.

Consequences of monetary policy will go beyond the stock market or the economy. It will shape everyone’s life throughout the 21st century, up to the very meaning of freedom and democracy.

Central bank policy is a fascinating subject and probably one of the most controversial discussions you can have on a trading floor. If you are a newcomer to this industry and you are looking for an icebreaker at the coffee machine on a Monday morning: Central banks are always a good pick. Everyone will have an opinion about it. Good or bad, very few people stay indifferent to central bank policies. It always amazes me how such topics can provide such radically opposite views. Even the most prominent actors on the stock market and the most brilliant minds of the planet can’t find a consensus on the impact of central bank actions. So, where lies the truth about central bank consequences?

Before we start, I don’t want to disappoint anyone: You will not find the holy truth here. You will only find the humble opinion of someone who has spent 10 hours of his day in front of his Bloomberg screen trying to assess the future impact of monetary policy on our daily life. This article will be a strong espresso shot of my personal opinion, research and conclusions I have gathered over the past five years when I was working as a portfolio manager for private clients. I will try to make the complex as simple as possible, and whether you have been in the industry for years or you have no prior background in finance and economy, I hope this article will challenge your perception and raise your interest on a subject that will shape everyone’s life in the 21st century.

“Quantitative Easing At Vitam Eternam”

When we talk about the modern time of central banks, we need to talk about quantitative easing, also called QE. You probably heard that term during the aftermath of the 2008 Global Financial Crisis, as it was the main tool used by central banks to relaunch our economy. It would be normal to still hear about it nowadays, as it is still active. And I know what you are thinking right now: “What? 12 years later? But the financial crisis is over now….” Yes. And that is part of the problem I am hoping to explain in this article. In simple terms: Quantitative easing is a transaction in which a central bank will purchase a given quantity of an asset, usually bonds, from governments or companies. The direct effect is to offer liquidity to the government or company, which in turn, might use this money to launch a program (for example for governments: Social welfare during the COVID-19 pandemic).You might be asking, “But Dustin…what does it have to do with me?” I’ll get there, I promise.

The mechanism behind QE is that it can reduce interest rates via asset purchases: Buying these government bonds will inevitably push the price of the bond higher and, therefore, the rates of the bond lower (you have to trust me on that). It will lower the cost for governments and companies raising funds in these markets and should, at least in theory, lead to higher spending in the economy.

When the European Central Bank (ECB) continually buys government bonds, it pushes interest rates lower, including indirectly affecting the one that you will negotiate with your commercial bank, to buy a house for example. This is also why we say that quantitative easing is supposed to “stimulate” the economy. By lowering interest rates, people will be incentivized to consume (e.g., buying a house). There is ongoing debate among financial experts on whether QE is equivalent to “printing money.”. Some would argue that it is not, that QE is merely an asset swap between central banks and a commercial bank and, in order to create new money in the system, commercial banks would need to create new loans. However, no one can contest the fact that central banks buy assets by creating central bank reserves. We will not go down the rabbit hole of discussing monetary base versus money supply. The central bank buys assets out of thin air. We will refer to that as “printing money” in this article.

Obviously, the central bank has unlimited power for printing money and, hypothetically, they could print as much money as they want. They could even indirectly give money to people. For example: France could issue any number of government bonds and redistribute the proceeds to the people, knowing perfectly that the central bank would buy these bonds. The problem with printing money (in any form) is that it has its own consequences. It is not free. I want you to stop here for a second, as this is probably one of the most important points of this article. Read it as many times as you need to: There is no free lunch in life.

The expression “free lunch” is used in finance to refer to something you get for free that you would usually have to work or pay for. It is not only a financial term, it also applies to your daily life in more ways than you realize. Take the example of Google, you think you use Google for free, but they actually monetize your personal information. You are the product, and your personal information is the implicit currency. You never get anything for free. Think about it. Everything has a hidden cost.

To go back to quantitative easing and liquidity injection, what does it have to do with free lunch? And what will be the hidden cost?

You might be thinking, “What’s the problem of a liquidity injection? If we can afford houses and we can consume more because credit is cheaper. What is wrong about that?” Well, the central bank still has to print money for that. It is like an “implicit” loan, not only for you, but for our entire society. Think of it like a collective loan. So, like any loan you take, we will have to pay back this liquidity at some point, one way or another. And there are many ways: Either we will have higher inflation, or our currency will be worth less, or we will have higher taxes. The more something is available, the less value it has. And it is the same with our money.

The problem is that the consequences I just mentioned have failed to materialize just yet (e.g., higher inflation or weakening of currency). And because the symptoms have not appeared, people think they won’t ever appear, so they think they can keep doing what they are doing without consequences. People advocate that we live in a new world environment, which is true. For example, technological revolution is naturally deflationary (you get more for less, e.g., Netflix) which can counterbalance the inflationary effect created by QE. This might be one of the reasons why inflation stays abnormally low while we keep printing money, but it doesn’t mean that everything is fine. For example, the use of acetaminophen might temper your fever for a moment but if the root of your problem is much deeper, the acetaminophen will only hide the real problem.

Part of the problem is that people only think about the first derivative (no inflation = no problem). However, we live in a very complex and multidimensional world where consequences are not always linear. We never wonder what are the second and third derivatives of our actions, which are mathematically speaking the most dangerous and powerful ones (example for the financial experts: consequences of gamma in options derivatives, butterfly effect, etc.).

Remember: Your actions have consequences and there is no such thing as a free lunch. Even if not obvious at first, consequences (especially second and third derivative ones) might appear later in the future in new and unknown forms. While it may not be immediately apparent, printing money will have consequences, and we should deal with quantitative easing in that manner.

“Like always, we perverted a good concept for Machiavelllic purposes.”

Like I said, the purpose of QE was to stimulate the economy during a downturn. During a recession, it is important to restimulate the economy. When you push interest rates lower, you tunnel fresh capital to firms, projects and investments. It helps to create jobs, and the more people have jobs, the more people consume, the easier they can afford to buy a house, and so on: It is a self-nourishing feedback loop. On that point, it does make a lot of sense to use such tools to stimulate the aggregate demand during difficult times.

QE is one of the strongest tools in the shed, and in times of crisis, you need all the help you can get. That’s why I am not here to blame central bankers in this kind of situation. Where would we be if they hadn’t intervened after the financial crisis? Or during the COVID-19 pandemic? Probably in a worse situation than now. While QE interventions are justified to ramp up the economy during certain times, it is really hard to rationalize the use of liquidity over a long period of time. The financial market is like any natural system. QE is the antibiotic administered to our economic immune system. And just like with real-life antibiotics, its repeated and improper use can lead to the growth of nasty, therapy-resistant bugs and, in the long term, hamper our natural ability to fight off disease. We have been feeding our economic body with antibiotics for the past 13 years, every day, for no particular reason. We have been making our economic immune system weaker and weaker, year after year.

We now use extreme measures on a regular basis. At some point your “extreme” measures are no more “extreme” if you keep using them on a daily basis. They essentially become the new normal. But what will happen the next time we have a rough patch? What firepower will be left if we’ve already used up all of our ammunition?

When you think about it, central bank interventions are completely “unnatural.” Life is cyclical, we are born, we live and we die. This is the cycle of life. The economy, too, is cyclical, there is a phase of recovery, a booming economy, a slowing economy and, from time to time, there is recession. Either caused by human actions (like 2008) or by economic cycles. Nowadays, we do everything in our power to make cycles generally longer. Not only on the financial market with QE but also with life longevity and biogenetic techniques, which, sure, on paper sounds exciting. In the particular case of the economy, the fact that we try at any cost to save and push cycles for extended periods of time has negative consequences for the entire ecosystem. Central bank intervention is prone to moral hazard, and negative interest rates keep zombie companies alive. Crises are painful but they tend to clean the economic environment from human excess (excess leverage, fraud, financial bubbles). In the new environment we live in, where we don’t allow the stock market to go down, we push people to take more risk. We create a very unnatural, fragile system.

We had many windows of opportunity during all this time to decrease our deficit and create a healthy debt environment but as always, when everything is working fine and the sun is shining, nobody really wants to change anything. Paradoxically, this is the exact moment when we need to do something. It is not in the middle of a storm or a crisis that we are going to get back on track with healthy habits.

Quantitative Easing At The Corporate Level

As part of the plan of quantitative easing, money was injected into big companies (remember the process of buying bonds?). The initial goal of this bond buying process was to diffuse this effect in the entire system. But then what happened? Nothing. The money got stuck at the corporate level, and it was not funneled down to the rest of the economy. And when you think about it, it just makes a lot of sense. Imagine you are on the board of a large company, the recession is over, the economy is booming and you have a lot of cash. On top of that money and even without asking, central banks show up to buy bonds on the market, push interest rates down and offer you cheap money on a gilded platter. Indeed companies have credit risk that influence the rate at which they can borrow money, but one component of the interest rate will be pushed lower by central banks. Therefore, your overall cost of financing will go down, ceteris paribus. This loan for large companies will have almost zero interest and even better, some large companies can even borrow at negative interest rates. Would you turn down that offer from central banks? Heck no. So you take this extra money, even if you don’t need it and, what do you do with it? You return it to your shareholders.

One very common method for this that has recently grown in popularity over time is “share buyback.” Imagine, you can now borrow money virtually for free and you can buy back your own shares and push your stock price higher. Isn’t it fantastic?

What is even more beautiful in this mechanism is that it will not only increase the wealth of your investors, but you will, on top of that, artificially make your stock more attractive for future buyers, as you will inflate your earning per share (or EPS, earnings will stay constant but your number of shares will decrease). EPS is very often used to select and buy stocks. In that case, you not only increase your stock price, but you make it even more attractive to future investors.

Another strong argument to push companies to do buybacks is tax incentive, as buyback goes untaxed as long as the shares are not later sold, while for example, dividends are taxed when they are issued. This is why, according to Howard Silverblatt, S&P companies have spent more on buybacks than on dividends every year since 2010.

To avoid misunderstandings, I am not “against” share buybacks, but I do think they should be regulated. If you are a large company like Apple, that makes an enormous amount of profit every year, and you lack R&D projects, then it makes a lot of sense to return some of this profit to investors. But what about if you are a company that generates no cash flow, but you are still able to do share buybacks because you can borrow money for free?

In some cases, we have even witnessed companies borrowing money to buy back their stocks while they had negative cash flow AND they were laying off people (e.g., Royal Caribbean borrowed to boost its liquidity to more than 3.6 billion, laid off workers in mid-March but has not suspended its remaining 600 million buyback program).

Really, don’t get me wrong, I am a capitalist, but what I just described is simply morally wrong. You are indirectly transferring money from the taxpayers to the shareholders. According to JPMorgan Chase, in both 2016 and 2017, the proportion of buybacks funded by corporate bonds reached 30%.

For your information, “share buybacks” were illegal by law in the U.S. before 1982, it was considered market manipulation. (“Are you kidding me? — Nope.”)

The second problem we have with that liquidity injection is that it is not really available to everyone. Larger companies have easier access, and they are the ones that actually need less of these injections, because they already have access to the primary market contrary to mid-size or small-size companies. If you are a small company, you don’t have access to the financial market (or at a very expensive price), therefore, when times are rough, you might get pressure from bigger businesses that have access to cheap money to buy you out. It also creates a dislocation of resources and an implicit bias that leads to consolidation in sectors and monopoly (e.g., Amazon).

Discrepancies Between The Financial Market and Fundamentals

So far, I have modestly talked about the impact of central banks on the financial market, but it has obviously had an enormous impact on market price. Besides the example I gave on stock buybacks, another impact is simply the discounted cash flow effect. The price of a stock is simply the actualization of their future cash flow at a certain interest rate. Like with bonds, the price of a stock goes up when interest rates go down, and the price goes down when interest goes up (all else equal).

When you lower interest rates, you mechanically push the price of stock higher. If you don’t believe in the theory of discrepancy between prices and fundamentals, take a look at a ratio invented by Warren Buffet, formed by dividing the Wilshire 5000 Total Market Index (the 5,000 biggest U.S. companies) over the GDP of the U.S. This ratio gives you an idea of what the price of the market in the U.S is compared to how the economy is actually doing. We have never seen such a discrepancy in human history.

Another example of a discrepancy: This is a photo from April 23, 2021, when, as you can see, ECB officials reported a possible 15% fall in GDP. At the same time, the highest number of jobless claims on record was reported in the U.S. Yet, looking beyond to the indices to the left, markets couldn’t care less.

Why the lack of correction? Was none of this news? It was, but in this new environment, bad news can be good news. If you have bad quarterly macroeconomic figures, it means more stimulus, which means lower interest rates, which means higher stock prices. Stocks go up and the economy goes down.

Another worrying phenomena that we see implied by central banks is what people called the “central bank put”: The fact that the central bank will be here forever, ready and willing to support the market. This moral hazard tends to push stock prices higher regardless of fundamentals. As a former fund manager on volatility, it was amazing to see how stocks could pop up during central bank meetings. A couple of words pronounced by an official would be enough to skyrocket stock prices. Below, you will find the plot to back my theory. It is the performance of the EURO STOXX 50 when you withdraw the three days of central bank meetings every quarter: the day before the meeting, the day of the meeting and the day after the meeting. Withdrawing only 12 days of trading over an entire year can completely erase the upside performance of the index. Astonishing. Why? Because you don’t compound on the best market days and most of the best market days were around central bank meetings. A study by JPMorgan shows that, over the last 20 years, if you miss the 10 best days you can reduce your annualized return by half.

How can we sanely explain that most of the performance on an index solely comes from a few comments made by central bank officials? Business is the same. Companies didn’t sell more or less goods. It has nothing to do with fundamentals. Nothing changed. It is just words. Just the reassuring confidence of central banks interventions. That is why, these days, we see such discrepancies between price and fundamentals. And remember this: Price and fundamentals are mean-reverting. The time window may vary, but at the end, they both converge to each other at some point. Do you believe we might have a 50% GDP increase in the next couple years? Then, you know which one will likely converge to the other one here.

The president of the reserve bank of Dallas, Robert Kaplan, had this to say about bond buying: “I worry that [bond buying has] some distorting impact on price discovery, that they encourage excessive risk-taking, and excessive risk-taking can create excesses and imbalances that can be difficult to deal with in the future.

Hooked On Liquidity

You may ask yourself: “Has anybody thought about pulling the plug?” In December 2018, the Federal Reserve moved in that direction by raising interest rates. There were instant reactions on the market: Markets tanked. This was the first warning to central bankers: “You gave it to us, you fed us that liquidity for so long, and you think you can just walk away like that? No way.” On that day, it was clear that markets are now dictating the rules, not central bankers. The monster got too big, and they were the ones feeding it. Nobody knows how to deal with the spoiled child (that they spoiled themselves). Nobody wants to be remembered as the central banker that created the “mother of the mother of the greatest depression.” The person who will finally recognize what is going on, and actually act on it, will have to bear the burden of bursting the bubble. This person will be accused of crashing the market, putting millions of people on unemployment.

In the long term, and whether we like it or not, we are all on the same boat here. You, me, Jerome Powell, Christine Lagarde. We are all, one way or another, tied to the financial market. The pensions of millions of American people are heavily invested in the stock market, the security of your employment is tied to the financial health of your company, which is also tied to how the economy is doing, which is tied to how the financial market is doing. Even your money, sitting in your bank account, is tied to the financial market. That could be worth nothing if, tomorrow, people lose faith in central banks.

“Not everything done in the name of good intentions will necessarily end up a good thing.” I am not here to put central bankers on trial. I acknowledge how challenging their job might be. Probably one of the highest responsibilities on Earth, and I respect that. Who am I to judge? I am just passionate about the market. I am also not here in any way to encourage conspiracy theories, those advocating that central bankers did so in order to enrich themselves and their friends in the private sector. I don’t think it was a Machiavellian or even orchestrated plan.

I do think that it was created for a good purpose (i.e., relaunching the economy). However, like most things in life and because of human nature, it got hijacked to serve personal interest. A similar example would be the creation of AI algorithms on social media, built to serve a particular purpose (in this case for marketing purposes), that end up serving another one (manipulating elections all over the world).

My purpose behind this article is more about raising awareness among people that are outside of the financial world. It is also, I hope, a wake-up call for everyone involved in our business, that our path, economically speaking, is unsustainable.

Because we act on our own interest, to gain a little bit more everyday in the short term, we will put in jeopardy everything over the long term. We need to change our mentality and for that it is important to know the truth. That it is OK to be wrong. It is OK to make mistakes. It is OK to not have the answer. It is OK to not know. However, what is not OK, is to keep doing the same things, over and over again, and hoping for different results. It was Einstein’s definition of madness.

Today, our monetary policy is still based on target inflation, because it was written into our academic textbooks 20 years ago. Everything has changed since then. Everything. We need to adapt to our times. No adaptation means no future. Even religions were able to adapt and modernize themselves, so why not central bankers?

I understand that they have been elected for a certain mandate and that they have to carry out what they have been elected for. But how can they base their monetary policies and actions that have such tremendous consequences on everyone’s lives on something they are not even able to calculate? See the graph below from the ECB.

As Daniel Kahneman said, “It is wrong to blame anyone for failing to forecast accurately in an unpredictable world. However, it seems fair to blame professionals for believing they can succeed in an impossible task.”

Maybe their mandates were wrong to begin with. I think it is time to rethink everything we’ve learned and think differently. We need to open the discussion. Like Christine Lagarde mentioned in one of her first speeches, we need to conduct a review of our own work — even if it means admitting we were wrong.

But people fail to acknowledge that keeping the systems afloat like we do is only making the bubble bigger and bigger, day after day. When we raise the ceiling of debt, year after year, we are only passing on the “hot potato’’ to the next generation. To our kids, and grandkids. But remember, someone will have to pay the bills at the end. It is in the collective interest to act on it now, sooner rather than later, but to do so you need to think about others first and it almost feels like an impossible task. A study made by Thomas Schelling in 1984 showed that many people fail to save for retirement because of a failure to identify with their future self. Therefore, they will trade immediate rewards for themselves against future benefit for an unknown “self.”

“If we now care little about ourselves in the further future, our future selves are like future generations. We can affect them for the worse, and, because they do not now exist, they cannot defend themselves. Like future generations, future selves have no vote, so their interests need to be specially protected” (Parfit, 1987).

So, if we cannot even identify with our future self to make the right decision, how are we supposed to do it for a perfect stranger?

This is the most challenging part. We need to sacrifice a little bit of comfort now for the sake of the community. If we are not able to change how we behave and how we invest, we are doomed to fail.

“Evolution can only happen if risk of extinction is present.” — Nassim Taleb

Quantitative easing was (is) the golden age of shareholders. By diverse mechanisms (low interest rate, share buyback), market price and shareholders’ wealth were pushed to record highs while the economy grew little in comparison. It created a massive and historical gap between the top percentile of wealthy people and the rest of the world.

Is the central bank responsible for the growing wealth inequality? There is clearly a correlation between these two, but do we have a causality? It is a subject of debate. However, it’s clear that quantitative easing had some impact in at least exacerbating this wealth gap. Wealth concentration is bad for the economy. If the government fails to counter it and monetary policy makes it worse, then who is going to protect the weakest ones? We, as humans, are judged on how we can protect the weakest ones. That is what makes us human.

Wealth inequality can create the type of polarization along the political spectrum that could hurt our democracy. It allows for the festering of resentment and reinforces some people’s ideas that there is a political elite, deep state, and so on. Rising populism is a phenomenon that we observe all over the globe (U.S., Italy, U.K., Brasil, Mexico) and that could potentially lead to social unrest or civil wars. Social unrest is the consequence of people’s distrust of their institutions (third derivatives), wealth inequality (second derivatives) and indirectly from quantitative easing (first derivatives).

We are currently trading the short term for the long term. If we are not able to correct this trajectory, the impact will not only be monetary (financial market crash) but could lead to social crisis, up to the point of losing our entire system.

“Compendiaria res improbitas, virtusque tarda.”

Wickedness takes the shorter road, virtue the longer.

The impact of quantitative easing goes way beyond the simple price of the stock market. It has consequences on everyone’s life, on our political system, up to the very meaning of freedom. Something that we take for granted. Probably because we are a spoiled generation that lived in the safest and most peaceful period in human history. It is probably because we never experienced such painful moments that we act this way. Something that Nassim Taleb refers to as “skin in the game.” When people are not held accountable or don’t suffer from the consequences of the mistakes they make. If we know our behavior will be the reason for our extinction, why do we keep behaving like that?

A study conducted by Edward Miller, CEO of Johns Hopkins Medicine, concluded that 90% of the people who suffered a heart attack and had coronary artery bypass surgery did not change their lifestyle afterward. Even though it would mean they might suffer from a second heart attack at some point in the future. Given the choice of changing behavior or facing potential life-threatening events, people would choose the second one. Most of us want to change but wanting to change and being able to change are two different things.

“Opioids And Economy”

Opioids are chemical substances that relieve pain. Opioids such as morphine are widely used in medicine. Would you say morphine is a bad substance? Not necessarily. It really depends on how we use it. If you use morphine to treat acute pain, it will probably be used for a good cause. On the contrary, if you talk about opioids in the case of drug addiction, it’s not going to be a good thing. But both of them, pain relief and drug addiction come from the same origin: opioids.

You may be wondering why I am talking about opioids in the context of central banks and quantitative easing.

Let’s have a look at the case of the opioid crisis in the U.S. If you are a construction worker or any technical worker, and you break your back while on duty, you might be administered some morphine at the hospital. Now let’s imagine that this construction worker is our economy, it went through a rough patch, the only healthy way to put our economy back on track was to inject him with some liquidity (morphine) so it can keep functioning. It would be a little sadistic to let our man go through this painful experience without offering something that can help alleviate his pain. In that case, we wouldn’t blame the doctor for this intervention.

However, the doctor has also some responsibility with the patient, by administering him the right and adequate dose of morphine. We need to make sure that the pain is under control. Smaller and smaller doses of morphine will be allowed to our fellow worker as time passes and his injuries start healing. Otherwise, if we kept giving him morphine, the likelihood of an addiction to opioids will increase. Once the underlying problem is solved and his backbone (our economy) is back on track, our patient can go back to work. There should be no need for the use of opioids at this point, or at least the bare minimum on an occasional basis. So, it is a very legitimate question to ask, why, in our economy’s case, did our doctor not stop the intervention? Why did our central bankers refuse to withdraw the stimulus to our economy?

We kept it because we were scared that its effects would be too temporary and go away too fast. Even worse, we increased our dose of liquidity: “Just in case it would be needed.” We kept feeding the patient opioids. An addiction can change a man. It can change his behavior: faking some illness to get more opioids. That is what happened in December 2018, we could have weaned the market off, but we were scared of the reaction. Today, our worker (economy) is a functional addict. His systems got used to it. The more we inject, the less effect it has on him, and the more he will ask for a stronger dose.

At some point, the doctor’s prescription will expire or the drug will fail to have an effect, and then what? He will have no other choice but to turn to harder drugs to satisfy his needs. At that point, what will be our economy’s equivalent of “harder drugs”? Is the ECB going to buy all the available sources of ETF on the EURO STOXX 50? And then buy the entire stock market?

The worker’s addiction will make him inevitably lose everything down the road, starting with his job, his family, probably up to his life.

Once our liquidity loses its stimulus effect, our market will experience this trajectory as well. Our economy is not yet down the street looking for its more potent fix, but I think it’s fair to say that, at that point, our economy has already lost its job.

Thank you for taking the time to read this article. You may ask: Why did I publish this article? From time to time, I re-read my stories and I try to rethink what I know or challenge some belief I had in the past that turned out to be dead wrong. Publishing on Medium is, to me, being accountable for my ideas. It is my humble form of having “some” skin in the game.

“If you do not take risks for your opinion, you are nothing.” — Nassim Taleb

This is a guest post by Dustin Lamblin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

bonds government bonds corporate bonds pandemic covid-19 stocks bitcoin btc etf euroGovernment

Four Years Ago This Week, Freedom Was Torched

Four Years Ago This Week, Freedom Was Torched

Authored by Jeffrey Tucker via The Brownstone Institute,

"Beware the Ides of March,” Shakespeare…

Authored by Jeffrey Tucker via The Brownstone Institute,

"Beware the Ides of March,” Shakespeare quotes the soothsayer’s warning Julius Caesar about what turned out to be an impending assassination on March 15. The death of American liberty happened around the same time four years ago, when the orders went out from all levels of government to close all indoor and outdoor venues where people gather.

It was not quite a law and it was never voted on by anyone. Seemingly out of nowhere, people who the public had largely ignored, the public health bureaucrats, all united to tell the executives in charge – mayors, governors, and the president – that the only way to deal with a respiratory virus was to scrap freedom and the Bill of Rights.

And they did, not only in the US but all over the world.

The forced closures in the US began on March 6 when the mayor of Austin, Texas, announced the shutdown of the technology and arts festival South by Southwest. Hundreds of thousands of contracts, of attendees and vendors, were instantly scrapped. The mayor said he was acting on the advice of his health experts and they in turn pointed to the CDC, which in turn pointed to the World Health Organization, which in turn pointed to member states and so on.

There was no record of Covid in Austin, Texas, that day but they were sure they were doing their part to stop the spread. It was the first deployment of the “Zero Covid” strategy that became, for a time, official US policy, just as in China.

It was never clear precisely who to blame or who would take responsibility, legal or otherwise.

This Friday evening press conference in Austin was just the beginning. By the next Thursday evening, the lockdown mania reached a full crescendo. Donald Trump went on nationwide television to announce that everything was under control but that he was stopping all travel in and out of US borders, from Europe, the UK, Australia, and New Zealand. American citizens would need to return by Monday or be stuck.

Americans abroad panicked while spending on tickets home and crowded into international airports with waits up to 8 hours standing shoulder to shoulder. It was the first clear sign: there would be no consistency in the deployment of these edicts.

There is no historical record of any American president ever issuing global travel restrictions like this without a declaration of war. Until then, and since the age of travel began, every American had taken it for granted that he could buy a ticket and board a plane. That was no longer possible. Very quickly it became even difficult to travel state to state, as most states eventually implemented a two-week quarantine rule.

The next day, Friday March 13, Broadway closed and New York City began to empty out as any residents who could went to summer homes or out of state.

On that day, the Trump administration declared the national emergency by invoking the Stafford Act which triggers new powers and resources to the Federal Emergency Management Administration.

In addition, the Department of Health and Human Services issued a classified document, only to be released to the public months later. The document initiated the lockdowns. It still does not exist on any government website.

The White House Coronavirus Response Task Force, led by the Vice President, will coordinate a whole-of-government approach, including governors, state and local officials, and members of Congress, to develop the best options for the safety, well-being, and health of the American people. HHS is the LFA [Lead Federal Agency] for coordinating the federal response to COVID-19.

Closures were guaranteed:

Recommend significantly limiting public gatherings and cancellation of almost all sporting events, performances, and public and private meetings that cannot be convened by phone. Consider school closures. Issue widespread ‘stay at home’ directives for public and private organizations, with nearly 100% telework for some, although critical public services and infrastructure may need to retain skeleton crews. Law enforcement could shift to focus more on crime prevention, as routine monitoring of storefronts could be important.

In this vision of turnkey totalitarian control of society, the vaccine was pre-approved: “Partner with pharmaceutical industry to produce anti-virals and vaccine.”

The National Security Council was put in charge of policy making. The CDC was just the marketing operation. That’s why it felt like martial law. Without using those words, that’s what was being declared. It even urged information management, with censorship strongly implied.

The timing here is fascinating. This document came out on a Friday. But according to every autobiographical account – from Mike Pence and Scott Gottlieb to Deborah Birx and Jared Kushner – the gathered team did not meet with Trump himself until the weekend of the 14th and 15th, Saturday and Sunday.

According to their account, this was his first real encounter with the urge that he lock down the whole country. He reluctantly agreed to 15 days to flatten the curve. He announced this on Monday the 16th with the famous line: “All public and private venues where people gather should be closed.”

This makes no sense. The decision had already been made and all enabling documents were already in circulation.

There are only two possibilities.

One: the Department of Homeland Security issued this March 13 HHS document without Trump’s knowledge or authority. That seems unlikely.

Two: Kushner, Birx, Pence, and Gottlieb are lying. They decided on a story and they are sticking to it.

Trump himself has never explained the timeline or precisely when he decided to greenlight the lockdowns. To this day, he avoids the issue beyond his constant claim that he doesn’t get enough credit for his handling of the pandemic.

With Nixon, the famous question was always what did he know and when did he know it? When it comes to Trump and insofar as concerns Covid lockdowns – unlike the fake allegations of collusion with Russia – we have no investigations. To this day, no one in the corporate media seems even slightly interested in why, how, or when human rights got abolished by bureaucratic edict.

As part of the lockdowns, the Cybersecurity and Infrastructure Security Agency, which was and is part of the Department of Homeland Security, as set up in 2018, broke the entire American labor force into essential and nonessential.

They also set up and enforced censorship protocols, which is why it seemed like so few objected. In addition, CISA was tasked with overseeing mail-in ballots.

Only 8 days into the 15, Trump announced that he wanted to open the country by Easter, which was on April 12. His announcement on March 24 was treated as outrageous and irresponsible by the national press but keep in mind: Easter would already take us beyond the initial two-week lockdown. What seemed to be an opening was an extension of closing.

This announcement by Trump encouraged Birx and Fauci to ask for an additional 30 days of lockdown, which Trump granted. Even on April 23, Trump told Georgia and Florida, which had made noises about reopening, that “It’s too soon.” He publicly fought with the governor of Georgia, who was first to open his state.

Before the 15 days was over, Congress passed and the president signed the 880-page CARES Act, which authorized the distribution of $2 trillion to states, businesses, and individuals, thus guaranteeing that lockdowns would continue for the duration.

There was never a stated exit plan beyond Birx’s public statements that she wanted zero cases of Covid in the country. That was never going to happen. It is very likely that the virus had already been circulating in the US and Canada from October 2019. A famous seroprevalence study by Jay Bhattacharya came out in May 2020 discerning that infections and immunity were already widespread in the California county they examined.

What that implied was two crucial points: there was zero hope for the Zero Covid mission and this pandemic would end as they all did, through endemicity via exposure, not from a vaccine as such. That was certainly not the message that was being broadcast from Washington. The growing sense at the time was that we all had to sit tight and just wait for the inoculation on which pharmaceutical companies were working.

By summer 2020, you recall what happened. A restless generation of kids fed up with this stay-at-home nonsense seized on the opportunity to protest racial injustice in the killing of George Floyd. Public health officials approved of these gatherings – unlike protests against lockdowns – on grounds that racism was a virus even more serious than Covid. Some of these protests got out of hand and became violent and destructive.

Meanwhile, substance abuse rage – the liquor and weed stores never closed – and immune systems were being degraded by lack of normal exposure, exactly as the Bakersfield doctors had predicted. Millions of small businesses had closed. The learning losses from school closures were mounting, as it turned out that Zoom school was near worthless.

It was about this time that Trump seemed to figure out – thanks to the wise council of Dr. Scott Atlas – that he had been played and started urging states to reopen. But it was strange: he seemed to be less in the position of being a president in charge and more of a public pundit, Tweeting out his wishes until his account was banned. He was unable to put the worms back in the can that he had approved opening.

By that time, and by all accounts, Trump was convinced that the whole effort was a mistake, that he had been trolled into wrecking the country he promised to make great. It was too late. Mail-in ballots had been widely approved, the country was in shambles, the media and public health bureaucrats were ruling the airwaves, and his final months of the campaign failed even to come to grips with the reality on the ground.

At the time, many people had predicted that once Biden took office and the vaccine was released, Covid would be declared to have been beaten. But that didn’t happen and mainly for one reason: resistance to the vaccine was more intense than anyone had predicted. The Biden administration attempted to impose mandates on the entire US workforce. Thanks to a Supreme Court ruling, that effort was thwarted but not before HR departments around the country had already implemented them.

As the months rolled on – and four major cities closed all public accommodations to the unvaccinated, who were being demonized for prolonging the pandemic – it became clear that the vaccine could not and would not stop infection or transmission, which means that this shot could not be classified as a public health benefit. Even as a private benefit, the evidence was mixed. Any protection it provided was short-lived and reports of vaccine injury began to mount. Even now, we cannot gain full clarity on the scale of the problem because essential data and documentation remains classified.

After four years, we find ourselves in a strange position. We still do not know precisely what unfolded in mid-March 2020: who made what decisions, when, and why. There has been no serious attempt at any high level to provide a clear accounting much less assign blame.

Not even Tucker Carlson, who reportedly played a crucial role in getting Trump to panic over the virus, will tell us the source of his own information or what his source told him. There have been a series of valuable hearings in the House and Senate but they have received little to no press attention, and none have focus on the lockdown orders themselves.

The prevailing attitude in public life is just to forget the whole thing. And yet we live now in a country very different from the one we inhabited five years ago. Our media is captured. Social media is widely censored in violation of the First Amendment, a problem being taken up by the Supreme Court this month with no certainty of the outcome. The administrative state that seized control has not given up power. Crime has been normalized. Art and music institutions are on the rocks. Public trust in all official institutions is at rock bottom. We don’t even know if we can trust the elections anymore.

In the early days of lockdown, Henry Kissinger warned that if the mitigation plan does not go well, the world will find itself set “on fire.” He died in 2023. Meanwhile, the world is indeed on fire. The essential struggle in every country on earth today concerns the battle between the authority and power of permanent administration apparatus of the state – the very one that took total control in lockdowns – and the enlightenment ideal of a government that is responsible to the will of the people and the moral demand for freedom and rights.

How this struggle turns out is the essential story of our times.

CODA: I’m embedding a copy of PanCAP Adapted, as annotated by Debbie Lerman. You might need to download the whole thing to see the annotations. If you can help with research, please do.

* * *

Jeffrey Tucker is the author of the excellent new book 'Life After Lock-Down'

Government

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A U.S. Centers for Disease Control (CDC) paper released Thursday found that thousands of young children have been taken to the emergency room over the past several years after taking the very common sleep-aid supplement melatonin.

The agency said that melatonin, which can come in gummies that are meant for adults, was implicated in about 7 percent of all emergency room visits for young children and infants “for unsupervised medication ingestions,” adding that many incidents were linked to the ingestion of gummy formulations that were flavored. Those incidents occurred between the years 2019 and 2022.

Melatonin is a hormone produced by the human body to regulate its sleep cycle. Supplements, which are sold in a number of different formulas, are generally taken before falling asleep and are popular among people suffering from insomnia, jet lag, chronic pain, or other problems.

The supplement isn’t regulated by the U.S. Food and Drug Administration and does not require child-resistant packaging. However, a number of supplement companies include caps or lids that are difficult for children to open.

The CDC report said that a significant number of melatonin-ingestion cases among young children were due to the children opening bottles that had not been properly closed or were within their reach. Thursday’s report, the agency said, “highlights the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight,” including melatonin.

The approximately 11,000 emergency department visits for unsupervised melatonin ingestions by infants and young children during 2019–2022 highlight the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight.

The CDC notes that melatonin use among Americans has increased five-fold over the past 25 years or so. That has coincided with a 530 percent increase in poison center calls for melatonin exposures to children between 2012 and 2021, it said, as well as a 420 percent increase in emergency visits for unsupervised melatonin ingestion by young children or infants between 2009 and 2020.

Some health officials advise that children under the age of 3 should avoid taking melatonin unless a doctor says otherwise. Side effects include drowsiness, headaches, agitation, dizziness, and bed wetting.

Other symptoms of too much melatonin include nausea, diarrhea, joint pain, anxiety, and irritability. The supplement can also impact blood pressure.

However, there is no established threshold for a melatonin overdose, officials have said. Most adult melatonin supplements contain a maximum of 10 milligrams of melatonin per serving, and some contain less.

Many people can tolerate even relatively large doses of melatonin without significant harm, officials say. But there is no antidote for an overdose. In cases of a child accidentally ingesting melatonin, doctors often ask a reliable adult to monitor them at home.

Dr. Cora Collette Breuner, with the Seattle Children’s Hospital at the University of Washington, told CNN that parents should speak with a doctor before giving their children the supplement.

“I also tell families, this is not something your child should take forever. Nobody knows what the long-term effects of taking this is on your child’s growth and development,” she told the outlet. “Taking away blue-light-emitting smartphones, tablets, laptops, and television at least two hours before bed will keep melatonin production humming along, as will reading or listening to bedtime stories in a softly lit room, taking a warm bath, or doing light stretches.”

In 2022, researchers found that in 2021, U.S. poison control centers received more than 52,000 calls about children consuming worrisome amounts of the dietary supplement. That’s a six-fold increase from about a decade earlier. Most such calls are about young children who accidentally got into bottles of melatonin, some of which come in the form of gummies for kids, the report said.

Dr. Karima Lelak, an emergency physician at Children’s Hospital of Michigan and the lead author of the study published in 2022 by the CDC, found that in about 83 percent of those calls, the children did not show any symptoms.

However, other children had vomiting, altered breathing, or other symptoms. Over the 10 years studied, more than 4,000 children were hospitalized, five were put on machines to help them breathe, and two children under the age of two died. Most of the hospitalized children were teenagers, and many of those ingestions were thought to be suicide attempts.

Those researchers also suggested that COVID-19 lockdowns and virtual learning forced more children to be at home all day, meaning there were more opportunities for kids to access melatonin. Also, those restrictions may have caused sleep-disrupting stress and anxiety, leading more families to consider melatonin, they suggested.

The Associated Press contributed to this report.

International

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

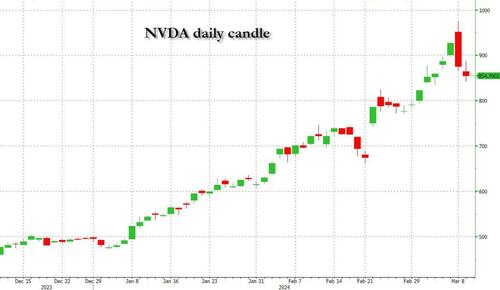

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International4 days ago

International4 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges