What to expect from the Miami Bitcoin 2021 conference

Miami is about to host thousands of attendees for the Bitcoin 2021 conference — here are some of the major appearances and talking points to watch for.

From Thursday through Saturday, a throng of crypto faithful will gather at the…

Miami is about to host thousands of attendees for the Bitcoin 2021 conference — here are some of the major appearances and talking points to watch for.

From Thursday through Saturday, a throng of crypto faithful will gather at the Mana Wynwood Convention Center in Miami for the Bitcoin 2021 conference.

Bitcoin 2021 perhaps holds even greater significance than usual, as participants can gather in a physical location after COVID-19 restrictions forced many other crypto conferences to go virtual.

This year’s conference boasts a stellar cast of members of Congress, celebrities, cryptographers, CEOs and other crypto proponents, with the total attendance anticipated to exceed 50,000 people.

Some of the personalities expected at the event include Miami Mayor Francis Suarez, Bitcoin (BTC) permabull and MicroStrategy CEO Michael Saylor, Twitter’s Jack Dorsey and the Winklevoss twins — Cameron and Tyler Winklevoss — among others.

Mayor Suarez recently revealed that he bought Bitcoin after the United States Senate passed its $1.9 trillion stimulus bill back in March.

Bitcoin 2021 will also see pro-crypto government officials like Wyoming Sen. Cynthia Lummis as well as former heads of U.S. financial watchdogs like Chris Giancarlo and Brian Brooks. Giancarlo is a former chairman of the U.S. Commodity Futures Trading Commission, while Brooks recently served as the acting comptroller of the currency.

Saylor, the Winklevoss twins and Anthony Pompliano will headline the two fireside chats on Friday, while Galaxy Digital’s Mike Novogratz, Paxos CEO Charles Cascarilla, Square Crypto’s Steve Lee and freelance journalist Aaron van Wirdum will appear in fireside chats on Saturday.

On topics related to scalability, Zap CEO Jack Mallers will talk about businesses utilizing the Lightning Network, while the MIT Bitcoin Project’s Jeremy Rubin will appear in a panel titled “Bitcoin is DeFi.”

With the recent criticisms of Bitcoin mining, it is perhaps unsurprising to see a few panels dedicated to the subject, with titles like “The Moral Case for Bitcoin” and “Bitcoin Mining Fixes Our Energy Problems.”

Other panels planned for the event will explore topics concerning on-chain analytics, proof of reserves and banking the unbanked.

Cointelegraph's editorial team will be on sight to provide the latest updates on the biggest events as well as to conduct interviews and even livestreams through YouTube and Twitter. Stay tuned!

bitcoin crypto btc covid-19 cryptoSpread & Containment

Five Below makes checkout changes shoppers may not like

The value retailer is discouraging theft at the checkout counter.

Huge retail chains like Walmart (WMT) , Target (TGT) , CVS (CVS) and others have faced a high amount of retail theft, or what they call inventory shrink, since 2020 and have been implementing measures to eliminate those costly losses.

Among the most common measures used by Walmart, Target and some others has been locking up popular items behind glass cases to prevent shoplifting. Customers shopping at these stores have encountered a lot of their favorite products, such as cosmetics, shampoo, over-the-counter drugs and even laundry detergent locked up in those cases.

Related: Target limits self-checkout, makes a change customers will love

Shoppers need to either push a button near the product to alert a worker to unlock the case or, in some situations, run around the store looking for a worker with the proper key to open the case. It's a very inconvenient problem for shoppers, and not all stores are consistent with their lockup policies.

For example, one Walmart store might lock up some of their instant coffee products, while another cross-town Walmart location, or even a Target competitor, doesn't lock up any coffee.

Retail stores have also implemented new self-checkout rules to discourage inventory shrink, but again, stores are inconsistent with their rules. Walmart stores have a 20 items or less rule for their self-checkout lanes to try to steer shoppers with more items to checkout clerks that might help reduce the occurrence of theft. But neither customers, nor workers seem to be observing that rule. Target on March 17 implemented a new 10 items or fewer rule in its self-checkout lanes, but we'll see if anyone enforces it.

These self-checkout requirements are also supposed to speed up the checkout process, but that only works if all the self-check registers are working and an adequate amount of checkout clerks are working registers as well.

The next step for retailers in addressing inventory shrink at self-checkout would be to eliminate self-check altogether.

Pat Greenhouse/The Boston Globe via Getty Images

Five Below cuts back on self-checkout lanes

After finishing the fourth quarter of 2023 with a "higher-than-planned shrink," or higher level of theft than expected in its stores, value retailer Five Below (FIVE) has implemented associate-assisted checkout in all of its stores for 2024, CEO Joel Anderson said on the company's earnings call on March 20.

"In addition, in our high-shrink stores, the primary option for checkout is more of the traditional, over-the-counter associate checkout," Anderson said. "We expect to have 75% of our transactions chain-wide assisted by an associate with a goal of 100% in our highest shrink, highest-risk stores to be fully transacted by an associate."

The retailer also checks receipts and adds guards

"Additionally, in those stores, we’re implementing further mitigation efforts, including receipt checking, additional store payroll and guards. We intend to measure progress as soon as Q2 when we perform a limited number of store counts," Anderson said.

Five Below tested several inventory shrink mitigation initiatives late in the third quarter and into the fourth quarter of 2023, which included product-related tests, front-end initiatives and guard programs, Anderson said in the earnings call. He said the most significant change the Philadelphia-based company made across most of the chain was to limit the number of self-checkout registers that were open, while positioning an associate upfront to further assist customers.

Anderson said he is confident the company's measures will help it over time, but the company has not included any financial impact for shrink reduction in its 2024 guidance. The company, however will aggressively pursue returning to pre-pandemic levels of shrink or offsetting the impact over the next few years, he said.

mitigation pandemicUncategorized

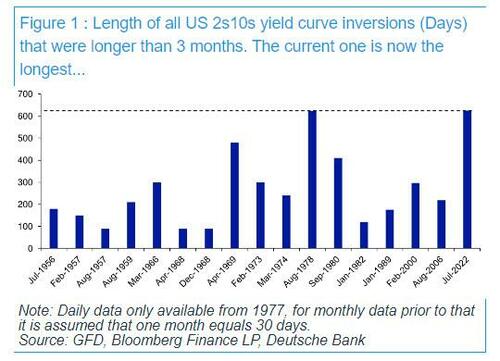

After 625 Days, The Longest Yield Curve Inversion In History

After 625 Days, The Longest Yield Curve Inversion In History

Today is a historic day, as last night – DB’s Jim Reid reminds us – we quietly…

Today is a historic day, as last night - DB's Jim Reid reminds us - we quietly passed the longest continuous US 2s10s inversion in history. After the 2s10s first inverted at the end of March 2022, it has now been continuously inverted for 625 days since July 5th 2022. That exceeds the 624 day inversion from August 1978, which previously held the record.

As regular readers are aware, an inverted yield curve has been the best predictor of a US downturn of any variable through history: the yield curve has always inverted before all of the last 10 US recessions, with a lag that is usually 12-18 months, but some cycles - certainly this one - take longer.... much longer.

In fact, the lack of a recession so far has prompted Red to ask - in his latest Chart of the Day note - if the inverted yield curve recession indicator has failed this cycle?

"Possibly", the DB strategist responds, "but in many ways the yield curve has already accurately predicted many of the drivers that would normally lead to a recession. However, these variables haven't then created recessionary conditions as they normally would have done." He explains:

It led, as it always does, the very sharp deterioration in bank lending standards, and led the declines in bank credit and money supply that are almost unique to this cycle. It was also at the heart of why we had some of the largest bank failures on record with SVB, Signature Bank and First Republic collapsing. A significant part of their failure was a big carry trade that went wrong when the curve inverted.

However, even with the above, a recession - according to the highly political "recession authority" known as the NBER - hasn't materialised. This is perhaps because of the following.

- When lending standards were at their tightest, the borrowing needs of the economy were low relative to previous cycles.

- Excess savings have been unusually high in this cycle (and were revised higher with the GDP revisions last September), so consumers haven't been as exposed to tight credit as they normally are.

- The Fed unveiled a huge series of measures to ensure the regional bank crisis didn't naturally unravel as it would have done in a free market or perhaps in many previous cycles.

- Whilst the Fed’s tightening has been reducing demand, the supply-side of the economy has bounced back strongly from the pandemic disruption, which has further supported growth and made this cycle unique.

So far so good, however, an inverted yield curve should ultimately be a significant headwind for an economy, as capitalism works best when there is a positive return for taking more risk with lending and investments further out the curve. As such, Reid notes, "the rational investor should be prepared to keep more of their money at the front end, or not lend long-term when the curve is inverted" as you are not giving up yield for being able to sleep at night.

So thanks to a historic flood of fiscal stimulus and a daily orgy of new record debt as discussed earlier...

... which means that the US is now running a 6.5% deficit with unemployment near "historical lows", an unheard of event....

... the economy has not succumbed to the inverted yield curve to date, but while it remains inverted the Fed is encouraging more defensive behavior at some point if sentiment changes. As such, the DB strategist concludes that "the quicker we get back to a normal sloping yield curve the safer the system is."

Spread & Containment

Another major retailer cracks down on self-checkout at its stores

The value retailer is discouraging theft at its self-checkout counters by introducing more associate-assisted checkout transactions in its stores.

Huge retail chains like Walmart (WMT) , Target (TGT) , CVS (CVS) and others have faced a high amount of retail theft, or what they call inventory shrink, since 2020 and have been implementing measures to eliminate those costly losses.

Among the most common measures used by Walmart, Target and some others has been locking up popular items behind glass cases to prevent shoplifting. Customers shopping at these stores have encountered a lot of their favorite products, such as cosmetics, shampoo, over-the-counter drugs and even laundry detergent locked up in those cases.

Related: Target limits self-checkout, makes a change customers will love

Shoppers need to either push a button near the product to alert a worker to unlock the case or, in some situations, run around the store looking for a worker with the proper key to open the case. It's a very inconvenient problem for shoppers, and not all stores are consistent with their lockup policies.

For example, one Walmart store might lock up some of their instant coffee products, while another cross-town Walmart location, or even a Target competitor, doesn't lock up any coffee.

Retail stores have also implemented new self-checkout rules to discourage inventory shrink, but again, stores are inconsistent with their rules. Walmart stores have a 20 items or less rule for their self-checkout lanes to try to steer shoppers with more items to checkout clerks that might help reduce the occurrence of theft. But neither customers, nor workers seem to be observing that rule. Target on March 17 implemented a new 10 items or fewer rule in its self-checkout lanes, but we'll see if anyone enforces it.

These self-checkout requirements are also supposed to speed up the checkout process, but that only works if all the self-check registers are working and an adequate amount of checkout clerks are working registers as well.

The next step for retailers in addressing inventory shrink at self-checkout would be to eliminate self-check altogether.

Pat Greenhouse/The Boston Globe via Getty Images

Five Below cuts back on self-checkout lanes

After finishing the fourth quarter of 2023 with a "higher-than-planned shrink," or higher level of theft than expected in its stores, value retailer Five Below (FIVE) has implemented associate-assisted checkout in all of its stores for 2024, CEO Joel Anderson said on the company's earnings call on March 20.

"In addition, in our high-shrink stores, the primary option for checkout is more of the traditional, over-the-counter associate checkout," Anderson said. "We expect to have 75% of our transactions chain-wide assisted by an associate with a goal of 100% in our highest shrink, highest-risk stores to be fully transacted by an associate."

The retailer also checks receipts and adds guards

"Additionally, in those stores, we’re implementing further mitigation efforts, including receipt checking, additional store payroll and guards. We intend to measure progress as soon as Q2 when we perform a limited number of store counts," Anderson said.

Five Below tested several inventory shrink mitigation initiatives late in the third quarter and into the fourth quarter of 2023, which included product-related tests, front-end initiatives and guard programs, Anderson said in the earnings call. He said the most significant change the Philadelphia-based company made across most of the chain was to limit the number of self-checkout registers that were open, while positioning an associate upfront to further assist customers.

Anderson said he is confident the company's measures will help it over time, but the company has not included any financial impact for shrink reduction in its 2024 guidance. The company, however will aggressively pursue returning to pre-pandemic levels of shrink or offsetting the impact over the next few years, he said.

mitigation pandemic-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges