What is ‘Identity Investing’ and How Much Does it Impact Stock Market Valuations?

It’s not so long ago millennials and Gen Z were being criticized for spending…

This article was originally published by Trading and Investment News.

It’s not so long ago millennials and Gen Z were being criticised for spending all their money on expensive brunches in hipster Shoreditch pop-up venues, and the like. Less poached eggs and avocado on wholegrain toast equals a deposit for your first home, you young whippersnappers! Although, with the average price of a home in gentrified Shoreditch (long gone are its days as an East End slum) now over £728,000, even the most cynical old-timer would have to admit a lot of brunches would have to be sacrificed on the way to a 10%-20% mortgage. And a pre-tax income of over £10k-a-month to stand a chance of getting that mortgage. A first-time buyer on over £10k-a-month probably feels like they’ve earned the right to splurge £20 on brunch if they feel like it. Anyway, I digress. Recently millennials and Gen Z have been attracting flack for another way many have been choosing to spend their hard-earned money. Now they are being criticised for investing. They aren’t, think many, doing it right. Newly-enthused young investors are messing up the stock market for everyone else by backing companies they identify with and not buying shares in perfectly good business models that don’t share their personal values. Like environmental sustainability, paying workers a fair wage etc. It’s all very irresponsible. What is identity investing? To be fair to the commentators who are critical of the methodology many younger investors are perceived to have, the objection, at least for most, is not that they chose to invest in companies they “like”. It’s more that liking a company sometimes seems to be the only criteria for the new breed of investors to buy shares in it. With relative disregard as to whether there is a good financial argument why those shares are currently valued by the market as they are. The term ‘identity investing’ was cleverly coined by The Daily Telegraph journalist Ben Wright to refer to what he describes as “the newest breed of traders who buy stocks simply because they are fans”. Electric car-maker Tesla is put forward as the most obvious example, say critics, of identity investing driving a valuation that has little connection to the actual underlying business. Over the course of 2020, the number of retail investors holding Tesla stock doubled. With many of the small investors in Tesla stock under the age of 34, the surge has been attributed to a year of pandemic-related lockdowns. Many of the new investors made use of having to spend more time at home by starting to trade stocks. Ordinarily, that would be seen as a good thing. We all know state pension systems are looking shaky and any list of prioritised investment advice would have ‘start early’ near the top. But the worry is enthusiastic young investors backing companies without much thought for if their share price represents something approaching fair value could lose their shirts. And then be put off investing for the long term. A single Tesla share was worth $88.60 at the beginning of January 2020. Less than 18 pandemic-blighted months later and the company’s stock trades at $580.88 – a gain of over 550%. And it’s actually dropped a lot since the beginning of the year when January highs saw Tesla shares changing hands for $880.

Presumably a wave of Gen Z identity investors put their Christmas money from Gran and Grandad into Tesla stock. At that point, 12-month gains were at almost 900%. Fantastic for investors who bought in early, or even not so early, 2020 and then sold to bank profits. Less so for investors who bought into the stock in January this year. They’ve lost around 35% of their investment in just a few months.

Is identity investing damaging stock markets for everyone and putting young investors at too much risk?

It’s unusual for a major company’s valuation to show the kind of volatility Tesla’s has exhibited. At least without any major catalyst like sales going through the roof to surprise all previous expectations and a logical reason why they might sustainably stay much higher. Or sales dropping off badly and a logical reason why they may stay depressed.

Neither of those things has happened in Tesla’s case. It’s a company most accept looks to have a promising, even very promising, future as a leader in the new electric car market that will gradually replace traditional models running on petrol or diesel. But does that justify a market capitalisation that makes it the most valuable car manufacturer in the world by a distance?

And more importantly, a valuation that, despite a share price down over 30% this year, still represents a p/e ratio of over x585? Toyota’s is x11 and it sells more vehicles than anyone else. Many times more than Tesla. General Motors trades at a p/e ratio of a little over x9. BMW about the same and Volkswagen, despite a share price that has recovered from the recent emissions scandal to approaching historical highs, trades at a conservative p/e of just x7.5.

Many analysts prefer to look at a forward-looking p/e ratio that divides a company’s current valuation by its projected future revenues. Tesla’s valuation is also eye-watering on that metric at over x130 or x178 taken as a 5-year average.

A single Tesla share was worth $88.60 at the beginning of January 2020. Less than 18 pandemic-blighted months later and the company’s stock trades at $580.88 – a gain of over 550%. And it’s actually dropped a lot since the beginning of the year when January highs saw Tesla shares changing hands for $880.

Presumably a wave of Gen Z identity investors put their Christmas money from Gran and Grandad into Tesla stock. At that point, 12-month gains were at almost 900%. Fantastic for investors who bought in early, or even not so early, 2020 and then sold to bank profits. Less so for investors who bought into the stock in January this year. They’ve lost around 35% of their investment in just a few months.

Is identity investing damaging stock markets for everyone and putting young investors at too much risk?

It’s unusual for a major company’s valuation to show the kind of volatility Tesla’s has exhibited. At least without any major catalyst like sales going through the roof to surprise all previous expectations and a logical reason why they might sustainably stay much higher. Or sales dropping off badly and a logical reason why they may stay depressed.

Neither of those things has happened in Tesla’s case. It’s a company most accept looks to have a promising, even very promising, future as a leader in the new electric car market that will gradually replace traditional models running on petrol or diesel. But does that justify a market capitalisation that makes it the most valuable car manufacturer in the world by a distance?

And more importantly, a valuation that, despite a share price down over 30% this year, still represents a p/e ratio of over x585? Toyota’s is x11 and it sells more vehicles than anyone else. Many times more than Tesla. General Motors trades at a p/e ratio of a little over x9. BMW about the same and Volkswagen, despite a share price that has recovered from the recent emissions scandal to approaching historical highs, trades at a conservative p/e of just x7.5.

Many analysts prefer to look at a forward-looking p/e ratio that divides a company’s current valuation by its projected future revenues. Tesla’s valuation is also eye-watering on that metric at over x130 or x178 taken as a 5-year average.

Source: Morningstar

To put that in context, many investors are worried because the S&P 500 currently trades at a forward-looking p/e ratio of x51 that is many times higher than historical averages. And Tesla’s is several times that.

That isn’t in itself necessarily a damning statistic if Tesla’s profits have a realistic chance of growing to a level to justify that multiple over future years. Does it?

A Forbes analysis asked a team from investment analysts New Age Alpha to assess Tesla’s valuation:

Source: Morningstar

To put that in context, many investors are worried because the S&P 500 currently trades at a forward-looking p/e ratio of x51 that is many times higher than historical averages. And Tesla’s is several times that.

That isn’t in itself necessarily a damning statistic if Tesla’s profits have a realistic chance of growing to a level to justify that multiple over future years. Does it?

A Forbes analysis asked a team from investment analysts New Age Alpha to assess Tesla’s valuation:

“using actuarial methods to calculate the odds that a company will make the profits that investors are expecting. For those who don’t know, actuaries are super mathematicians who try to work out the probabilities of events happening in the future”.The team concluded Tesla was 55% likely to not meet the kind of profit level that would justify its valuation. Put another way, a negative outcome for investors who have bought Tesla shares over the past several months is more likely than not. That is almost certainly why successful tech investors like Baillie Gifford’s Scottish Mortgage Investment Trust have been selling down their stakes and locking in huge profits banked by the phenomenal recent share price gains. All the data suggests it is small, more often than not young, retail investors who have been buying those shares and propping Tesla’s valuation up, even if it has cooled in recent months. As Mr Wright wrote of the identity investing trend that has driven Tesla’s gains, the company’s market capitalisation implies:

“Tesla’s brand and technology become so dominant that the company can earn profit margins that exceed those of Ferrari on a level of production exceeding that of Toyota”.Even the UK’s Financial Conduct Authority is a little concerned. And the regulator doesn’t usually do much until someone starts to worry about a scandal and accusations of the regulator not doing much. In March the regulator warned younger investors are engaging in “unsuitable” high-risk investing. A new breed of ‘gamified’ investment sites and apps is being apportioned much of the blame as to why almost two-thirds of these new investors purchased investments classed as high risk, such as cryptocurrencies. The worry is many are at risk of losing money they cannot afford to lose. Stocks like Tesla and GameStop, are showing the same kind of volatility most associated with cryptocurrencies. The latter is a video games retailer whose valuation has multiplied many times, and seen huge drops, over recent months. That volatility has been driven by a large crowd of mainly inexperienced traders organised through a Reddit forum, trying to teach ‘greedy’ predatory hedge funds a lesson by ‘squeezing’ them out of short positions held on the stock. The fact GameStop is worth ten times more than it was at the start of the year is not down to any major improvement in the company’s outlook, despite ambitions to develop into an online retailer. Instead, its valuation is a result of a crusade against hedge funds supported by mostly young millennial and Gen Z traders.

Is there also an argument in support of identity investing?

But outside of the extremes, there’s also plenty of support for identity investing as long as it remains within some kind of reasonable framework. It’s hard to deny a new generation of investors who refuse to support, even if it means potentially denying themselves maximum returns, companies whose ethos or industry they don’t believe is sustainable, is helping drive change at the boardroom level.

Energy giants like BP and Shell, oil and gas giants that have famously been among the world’s biggest polluters for decades, have committed to becoming ‘carbon-neutral’ by 2050. That is to be achieved by weaning themselves off income from fossil fuels and instead investing heavily in renewables.

Financial markets are providing next-generation food companies, like Beyond Meat which develops and sells plant-based meat alternatives, at the expense of traditional meat companies, which are also now seen as major contributors to global emissions. And that in turn has encouraged venture capital markets to throw money at other food tech companies in areas like lab-grown meats.

The money pouring into the industry is turbo-charging R&D and means there is a genuine possibility most of the meat products we eat won’t involve the slaughter of live animals with a decade or two.

Identity investing is a double-edged sword

The conclusion has to be young identity investors can be a huge force for good in financial markets. But fandom pushing the valuations of certain companies to extremes is also a major risk for financial markets as a whole and particularly for the finances of those investing in potentially massive bubbles.

Most inexperienced investors have a learning curve and starting young means lessons can be absorbed without much long-term damage and plenty of long-term benefit. Let’s just hope the lessons that investing in stocks like Tesla at their current levels don’t prove harsh enough to put large parts of a generation off investing for good. Because identity investing could also prove a major stimulus that rewards sustainable companies and punishes less ethical and more short-sighted rivals.

The post What is ‘identity investing’ and just how much is it impacting stock market valuations? first appeared on Trading and Investment News.

stimulus

pandemic

sp 500

stocks

stimulus

stock markets

oil

uk

Is there also an argument in support of identity investing?

But outside of the extremes, there’s also plenty of support for identity investing as long as it remains within some kind of reasonable framework. It’s hard to deny a new generation of investors who refuse to support, even if it means potentially denying themselves maximum returns, companies whose ethos or industry they don’t believe is sustainable, is helping drive change at the boardroom level.

Energy giants like BP and Shell, oil and gas giants that have famously been among the world’s biggest polluters for decades, have committed to becoming ‘carbon-neutral’ by 2050. That is to be achieved by weaning themselves off income from fossil fuels and instead investing heavily in renewables.

Financial markets are providing next-generation food companies, like Beyond Meat which develops and sells plant-based meat alternatives, at the expense of traditional meat companies, which are also now seen as major contributors to global emissions. And that in turn has encouraged venture capital markets to throw money at other food tech companies in areas like lab-grown meats.

The money pouring into the industry is turbo-charging R&D and means there is a genuine possibility most of the meat products we eat won’t involve the slaughter of live animals with a decade or two.

Identity investing is a double-edged sword

The conclusion has to be young identity investors can be a huge force for good in financial markets. But fandom pushing the valuations of certain companies to extremes is also a major risk for financial markets as a whole and particularly for the finances of those investing in potentially massive bubbles.

Most inexperienced investors have a learning curve and starting young means lessons can be absorbed without much long-term damage and plenty of long-term benefit. Let’s just hope the lessons that investing in stocks like Tesla at their current levels don’t prove harsh enough to put large parts of a generation off investing for good. Because identity investing could also prove a major stimulus that rewards sustainable companies and punishes less ethical and more short-sighted rivals.

The post What is ‘identity investing’ and just how much is it impacting stock market valuations? first appeared on Trading and Investment News.

stimulus

pandemic

sp 500

stocks

stimulus

stock markets

oil

uk

Uncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

International

Angry Shouting Aside, Here’s What Biden Is Running On

Angry Shouting Aside, Here’s What Biden Is Running On

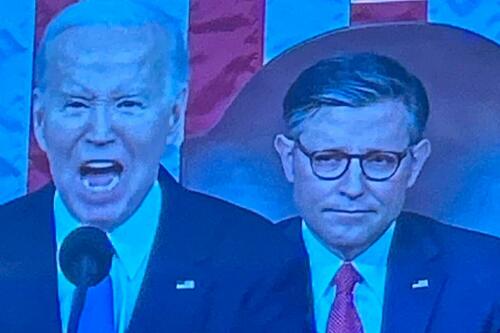

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union…

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union address - in which he insisted that the American economy is doing better than ever, blamed inflation on 'corporate greed,' and warned that Donald Trump poses an existential threat to the republic.

But in between the angry rhetoric, he also laid out his 2024 election platform - for which additional details will be released on March 11, when the White House sends its proposed budget to Congress.

To that end, Goldman Sachs' Alec Phillips and Tim Krupa have summarized the key points:

Taxes

While railing against billionaires (nothing new there), Biden repeated the claim that anyone making under $400,000 per year won't see an increase in their taxes. He also proposed a 21% corporate minimum tax, up from 15% on book income outlined in the Inflation Reduction Act (IRA), as well as raising the corporate tax rate from 21% to 28% (which would promptly be passed along to consumers in the form of more inflation). Goldman notes that "Congress is unlikely to consider any of these proposals this year, they would only come into play in a second Biden term, if Democrats also won House and Senate majorities."

Biden once again tells the complete lie that "nobody earning less than $400,000/year will pay additional penny in federal taxes."

— RNC Research (@RNCResearch) March 8, 2024

FACT: Biden has *already* raised the tax burden on Americans making as little as $20,000 per year. pic.twitter.com/VrZ1m0rzG3

Biden also called on Congress to restore the pandemic-era child tax credit.

Immigration

Instead of simply passing a slew of border security Executive Orders like the Trump ones he shredded on day one, Biden repeated the lie that Congress 'needs to act' before he can (translation: send money to Ukraine or the US border will continue to be a sieve).

As immigration comes into even greater focus heading into the election, we continue to expect the Administration to tighten policy (e.g., immigration has surged 20pp the last 7 months to first place with 28% in Gallup’s “most important problem” survey). As such, we estimate the foreign-born contribution to monthly labor force growth will moderate from 110k/month in 2023 to around 70-90k/month in 2024. -GS

SEE IT: Biden gets boo-ed while talking about his immigration bill. WATCH pic.twitter.com/O5FmkYx3xM

— Simon Ateba (@simonateba) March 8, 2024

Ukraine

Biden, with House Speaker Mike Johnson doing his best impression of a bobble-head, urged Congress to pass additional assistance for Ukraine based entirely on the premise that Russia 'won't stop' there (and would what, trigger article 5 and WW3 no matter what?), despite the fact that Putin explicitly told Tucker Carlson he has no further ambitions, and in fact seeks a settlement.

‼️ Breaking: Putin wants a negotiated settlement to what’s happening in Ukraine.

— Ed (@EdMagari) February 9, 2024

In a surprising turn of events, Tucker Carlson could be the key to peace, potentially playing a crucial role in ending the current conflict????️ pic.twitter.com/IKN8ajlEUX

As Goldman estimates, "While there is still a clear chance that such a deal could come together, for now there is no clear path forward for Ukraine aid in Congress."

China

Biden, forgetting about all the aggressive tariffs, suggested that Trump had been soft on China, and that he will stand up "against China's unfair economic practices" and "for peace and stability across the Taiwan Strait."

SOTU FACT CHECK:

— Wesley Hunt (@WesleyHuntTX) March 8, 2024

Biden claims we’re in a strong position to take on China.

No president in our lifetime has been WEAKER on China than Biden. pic.twitter.com/Y73JsIzmM3

Healthcare

Lastly, Biden proposed to expand drug price negotiations to 50 additional drugs each year (an increase from 20 outlined in the IRA), which Goldman said would likely require bipartisan support "even if Democrats controlled Congress and the White House," as such policies would likely be ineligible for the budget "reconciliation" process which has been used in previous years to pass the IRA and other major fiscal party when Congressional margins are just too thin.

So there you have it. With no actual accomplishments to speak of, Biden can only attack Trump, lie, and make empty promises.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International12 hours ago

International12 hours agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges