International

Wells Fargo Misses Across The Board As Rate Hikes Grind Mortgage Banking To A Halt

Wells Fargo Misses Across The Board As Rate Hikes Grind Mortgage Banking To A Halt

Wells Fargo – once the largest US mortgage lender but now…

Wells Fargo - once the largest US mortgage lender but now just a sad shadow of its former self, mired in scandal and Fed regulation - again missed analysts’ earnings estimates as home lending slowed and the bank set aside more reserves than expected for loans it expects to turn bad as Fed rate hikes push the economy into a recession.

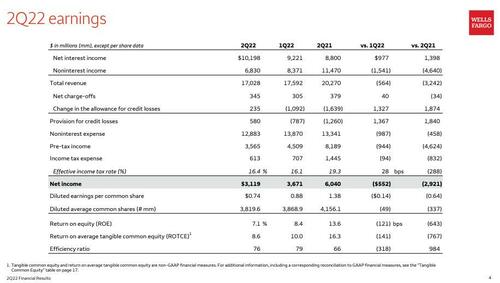

Here are the details:

- Revenue $17.03 billion, down 16% y/y, missed estimate of $17.54 billion

- Commercial banking revenue $2.49 billion, +18% y/y

- Corporate and investment banking revenue $3.57 billion, +7% y/y

- Wealth & investment management total revenue $3.71 billion, +4.8% y/y,

- EPS 74c, missed estimate 80c

Net interest income rose to $10.2 billion, up $1.4 billion Y/Y and matching analysts expectations, with the 16% increase demonstrating the boost banks are already getting from the Fed’s rate hikes. As the bank notes, "net interest income up $977 million, or 11%, from 1Q22 as higher earning asset yields, higher loan balances, lower MBS premium amortization, and one additional day in the quarter were partially offset by higher funding costs and lower interest income from loans purchased from securitization pools and PPP loans."

Unfortunately, what good news there was in interest income was more than offset by the devastation in noninterest income, which was down $4.6 billion, or 40%, from 2Q21 as net gains from equity securities were down $3.3 billion "on lower results in our affiliated venture capital and private equity businesses driven by market conditions and included $576 million of impairments in 2Q22."

But the real punch in the guts was the $1 billion decline in mortgage banking revenue from $1.336 billion to just $287 million, which was driven primarily by lower originations. It missed analysts’ $392.4 million estimate and helped bring second-quarter net income down to $3.12 billion, below the $3.19 billion analysts had expected. In short, the mortgage pipeline "bread and butter" that Wells Fargo needs to grow is catastrophically clogged up.

The Fed’s rapid rate increases, intended to tamp down surging inflation, have helped banks’ net interest margins while threatening to squelch consumers’ demand for loans. The rising rates already have sharply reduced the number of customers refinancing their mortgages and have weighed on home-sales activity as well, Chief Financial Officer Mike Santomassimo said.

And one look at the chart below shows that it's only going to get worse: expect total originations in Q3 to drop to the lowest level on record!

It wasn't just mortgage loan originations though: auto loans have also collapsed as the highest rates in over a decade mean fewer Americans can afford to take out loans.

Understandably, with the mortgage market collapsing, the bank had to slash costs and non-interest expenses were $12.9 billion in the quarter, down 3.4% from a year earlier, if higher than analysts expected. Cost-cutting has been a key part of Scharf’s plan to remake the firm since taking over almost three years ago, including by trimming the workforce. Headcount fell to 243,674 at the end of the second quarter, from 246,577 three months earlier.

More ominously, Wells reported a surge in loan-loss provisions to $580 million, higher than the consensus estimate of $414.7 million, and up sharply from a reserve release of $787 million in Q1. That marks a turnaround from last year when a $1.26 billion release of provisions padded results, and brought second-quarter net income to $3.12 billion, below the $3.19 billion analysts had expected. The bank said that consumer net loan charge-offs down $13 million to 33 bps of average loans (annualized), as lower losses in auto loans and other consumer loans were partially offset by higher credit card losses. Nonperforming assets decreased $878 million, or 13%, on a $624 million decline in residential mortgage nonaccrual loans primarily due to sustained payment performance of borrowers after exiting COVID-19-related accommodation programs, and a $234 million decline in commercial nonaccrual loans

Also, net of $345 million in charge offs, Wells Fargo's total allowance for loan losses rose by just over $200 million to $12.9 trillion from $12.9 trillion the previous quarter.

Why the sharp build in reserves? Chief Executive Officer Charlie Scharf made it clear that he expects much more pain especially in the core mortgage banking area: “The Federal Reserve has made it clear that it will take actions necessary to reduce inflation, and this will certainly reduce economic growth... In addition, the war in Ukraine adds additional risk to the downside.”

As Bloomberg notes, the report offers another look at how the biggest US lenders fared through a quarter marked by rate hikes, persistent inflation and recession fears. Rival JPMorgan Chase & Co. temporarily suspended share buybacks and reported second-quarter results that fell short of analysts’ estimates on Thursday, driving its shares down 3.5%.

“It will be a challenging market in the mortgage business for the next couple quarters as things start to stabilize and we see where the path of rates are going to go,” Santomassimo said Friday on an conference call with reporters. Wells Fargo is among firms that have been laying off and reassigning staff in its mortgage division. He also pointed to a big slowdown in refinancings: "It’s impacting our volumes, as we expected in the last quarter."

“As we have seen in the last couple quarters -- big moves in rates,” CFO Mike Santomassimo said on a call Friday after the bank reported second-quarter earnings, which showed a steep drop in mortgage income.

Finally, adding insult to injury, recall that Wells Fargo also remains under a costly Fed-imposed asset cap limiting its size to its level at the end of 2017, as punishment for widespread crime at the bank. Period-end assets declined 3.3% from a year ago to $1.88 trillion, even as average laons outstanding rose to $927 billion while deposits continued to shrink, sliding to $1.446 trillion, roughly the same as a year ago.

Shares of San Francisco-based Wells Fargo, which fell 19% this year through Thursday, dropped 3.4% to $37.42 in early trading in New York, but have since rebounded alongside the broader move higher in futures.

The investor presentation is below (pdf link)

International

The Grand Realpolitik Divergence

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively…

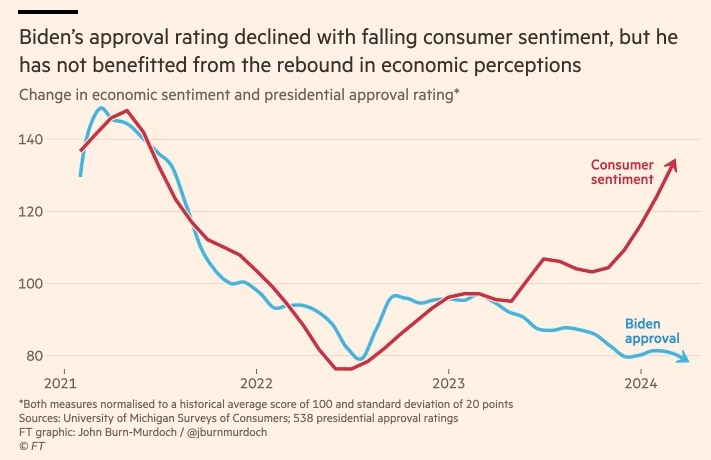

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively impacted incumbent approval ratings. President Biden’s approval ratings remain unaffected despite recent economic improvements, suggesting a decoupling of economic sentiment and political fortunes. This phenomenon, which contrasts with stable economic-political linkages in Europe, is attributed to the U.S.’s heightened partisan divide, where political allegiance increasingly dictates economic perception, challenging the traditional belief that “it’s the economy, stupid” in American politics.

Key Points:

- President Clinton’s political advisor, James Carville, highlighted the economy’s role in political success during 1992 presidential campaign with assertion, “It’s the economy, stupid.”

- Voter sentiment has traditionally linked to economic performance, affecting incumbent party success.

- Recent trends show a disconnect between the U.S. economy’s health and President Biden’s approval ratings.

- The COVID-19 pandemic and inflation crisis may have influenced this anomaly, yet the shift predates these events.

- Research indicates a decoupling of economic sentiment and presidential approval in the U.S. since Obama’s tenure.

- This phenomenon seems unique to the U.S., with European governments’ popularity still tied to economic conditions.

- S. political polarization may explain the decoupling, with partisan views influencing economic perceptions.

- Studies suggest that political biases skew individual economic assessments, impacting presidential approval.

- The current U.S. political climate suggests economic policy impact on electoral decisions is diminishing.

- Contrasts with Europe, where economic sentiment is more uniform across political lines, suggesting a more rational political-economic relationship.

Source: Financial Times

european europe pandemic covid-19International

Wake-Up Call

Wake-Up Call

Authored by James Howard Kunstler via Kunstler.com,

“Those who organized the disaster will take advantage of the inevitable…

Authored by James Howard Kunstler via Kunstler.com,

“Those who organized the disaster will take advantage of the inevitable discontent arising from efforts to overcome it, for if there is one thing that they are skilled in, it is demagoguery.”

- Theodore Dalrymple

Can you feel it? The tension rising to the red-line? It runs clear through all of Western Civ. We are ruled by governments of fiends. But now, the sun rides higher in the sky. The sap is rising in the northern forests. The earth heaves. The buds swell and blush. Something is in the air. The animals are waking from their long winter sleep. The natives are restless.

The two traditional political divisions, liberal and conservative died with Covid. Now there are simply the sane versus the insane. The sane have had enough of being pushed around by the insane. The insane don’t register much of what reality tries to tell them. They have a body of insane ideas to comfort and protect them from the reality’s rigors. To call that body of ideas an “ideology” is way too polite.That the insane call themselves “progressive,” is a signature of their insanity.

Progress toward what better state of things? Toward a supremacy of fiends, sadists, degenerates, and morons seizing riches and power by every dishonest means possible outside the rule of law and common decency? It’s not even suitable to call them “communists.” They lack the necessary idealism for that.

They don’t expect to put their shoulders to the wheel with their fellow man. They just want to grab your stuff and then kill you so they don’t have to hear any complaints.

The insane do not believe any of the theoretical bullshit they want to force you to swallow. They don’t care about climate change. It’s just a cudgel they use to beat everyone over the head so they can steal your stuff. They don’t care about “democracy.” It’s just a line of bullshit to cover up their election-stealing. Do you suppose that sane people would keep using electronic vote-tabulating machines that were demonstrably connected to the Internet, and thus hackable, if they cared about election integrity? Of course not. They would arrange p.d.q. to junk them and use paper ballots, and only in person at polling places, with “absentee” exceptions only for people out of the country.

The insane do not care about public health. Everything that is known about the Covid-19 vaccinations tells you that they are unsafe and don’t prevent infection or transmission of a flu-like illness that might not even be what it was officially labeled as. Our public health officials in the FDA, the CDC, and in other corners of the Department of health and Human Services, lie about everything they’re responsible for. This week, the CDC (under Director Mandy Cohen) released a 148-page study on myocarditis reactions to mRNA shots. Every word on every page of the document was redacted. The CDC printed countless copies of the report with 148 utterly blank pages, and then proffered them to the news media. How is that not insane?

The insane do not care about the rule of law. The conduct of “Lawfare” is the subversion of the law by dishonest means. It is a species of racketeering. And that is why Lawfare rogues such Marc Elias, Norm Eisen, Andrew Weissmann, Mary McCord, Lisa Monaco, Matthew Graves, and Merrick Garland, should be charged under the federal RICO statutes for conspiring to deprive sane citizens of their rights and property in the many cases related to the 1/6/21 riot at the US Capitol.

It is, so far, an abiding mystery of contemporary history as to how New York Attorney General Letitia James managed to get away with prosecuting a real estate case against Donald Trump that was no more than victimless business-as-usual between a borrower and his lenders. Ms. James ran for that elected office promising to “get” Mr. Trump on something, anything. That is not how the rule of law works. Under the rule of law, first you determine that there is a crime and then look for who did the crime.

Letitia James must be insane and/or pretty stupid. The short-term gain of stealing Mr. Trump’s property under a false color-of-law and creating impediments to his election campaign, will, sooner or later, blow back at her as a matter of malicious prosecution and, plausibly, racketeering as well. (With whom did she conspire to bring this case? We shall find out.) She will eventually be disgraced publicly as her teammate Fani Willis has already been disgraced in Fulton County, Georgia. I’ll tell you something that all sane people now know but won’t talk about for fear of being crushed by the levers of Lawfare: this looks like a concerted effort by people-of-color to railroad people of non-color. If you think that is a good thing for race relations in our country, then you are insane.

Here are a bunch of other things that are insane: Re-litigating the first amendment is insane. It means what it says, and states it plainly. The open border is insane. No credible sovereign polity would allow it. It would be opposed with force, if necessary. Turning children into transsexuals on a wholesale basis is insane, and fiendishly so. Everybody knows that it is not good for the children or for our society as a whole. But fiends got to fiend, and if you try to deprive them of being fiends then you are guilty of “hate.”

The war in Ukraine is insane. We certainly didn’t ignite it in the service of “democracy.” Our pawn there, Mr. Zelensky, canceled the national elections last year. The war was arguably an effort by our CIA to deprive Russia of its market for natgas in Europe, and thus deprive Russia of a great deal of money, that is, of prosperity. The project failed. Russia overcame NATO’s proxy army and found other markets for its gas. Blowing up the Nord Stream pipelines only served to impoverish and weaken our NATO allies, who no longer have affordable gas to run their industries. The leaders of those allies were too insane to recognize that the Nord Stream op was an act-of-war against them. They were also busy destroying themselves, like the USA, with open borders. They will end up in a new medievalism, ruled by savages. You’d have to be insane to arrange that for yourself.

What’s most obviously insane in our country is that the insane party is pretending to nominate the mentally unfit White House place-keeper, “Joe Biden,” for reelection. You would think that if this party wanted to retain power, they would run a candidate who, though insane, was not also visibly senile. But the rank and file of this party are too insane to see that this dodge is not working. They are pretending with all their might that this is okay, that the growing faction of the sane don’t notice.

Sensing the growing impatience with insanity among the voters, the insane party has reached its point of terminal desperation. What will they try next? Murder? Why not? Nothing else seemed to work. They are too far gone in their insanity to understand that winter is over. We’ve entered the season of rebirth and renewal, starting with a renewed appreciation for being sane and for that indispensable ingredient that makes liberty in a free society possible: good faith. Really, the only question left is: how rough do they intend to play to prevent the return of sanity and good faith?

* * *

Support his blog by visiting Jim’s Patreon Page or Substack

International

Failed deal leaves another airline facing bankruptcy, liquidation

A planned sale of the airline brand has fallen through, and that leaves its future very much in doubt.

The business model for airlines has always been tricky and multiple major airlines around the world have needed government bailouts in order to survive. Traditionally, because airlines are essential services, that money has been there both in the United States and around the world.

In the U.S., about $54 billion was given to airlines to help them survive the covid pandemic. Had that not happened, it's very possible a major carrier would have gone bankrupt. More importantly, every carrier would have had to go into survival mode.

Related: Bad meat forces popular grocery brand into Chapter 11 bankruptcy

That would have mean laying off pilots, and other key personnel that could not be replaced quickly. Had the U.S. not ponied up and rescued its airline industry, it's likely that prices for airfare would be highly elevated and overall capacity would be greatly decreased.

It's a situation that was not unique to the U.S. The former Air Italia actually closed in 2021 but later began flying again as ITA Airways after a government bailout. In addition, Germany's Lufthansa and Sweden's SAS have received bailout packages (although those are being challenged in court).

Now, with Spirit Airlines (SAVE) facing an uncertain future and bankruptcy rumors in the U.S., another big airline has seen a major deal collapse, which puts its future in doubt.

Image source: Shutterstock/TheStreet

South African Airways faces survival risk

While many Americans may not be overly familiar with South African Airlines (SAA). it's part of the global "Star Alliance," which means it's connected to many of the world's biggest airlines.

"The Star Alliance network was formed in 1997 by Air Canada, Lufthansa, Scandinavian Airlines, Thai, and United Airlines. For the first time, these carriers began working together to offer our customers a worldwide reach and an improved travel experience," SAA shared on its website.

The Alliance has gotten much bigger since its early days.

"Since then, the Alliance has grown to 26 member airlines, including South African Airways which joined the Alliance in 2006. The Star Alliance carriers are among the most respected in the world. To become a member, an airline must offer and comply with the highest industry standards of customer service, security and technical infrastructure. The 26 member airlines operate together more than 18,500 flights a day, reaching 1,330 airports in 192 countries," SAA added.

Now, after a failed deal to sell a majority interest in SAA, the airline faces a threat to its survival.

SAA has 12-18 months left

For three years, the government of South Africa has been negotiating to sell a majority interest in SAA to Takatso Consortium. That's a controversial decision that the South African government intends to investigate.

"The Portfolio Committee on Public Enterprises has reached a decision to refer the matter of the Takatso Consortium’s purchase of a 51% stake in South African Airways (SAA) to the Special Investigating Unit (SIU) for further investigation," according to a media statement from the South African Parliament.

The failed sale puts the future of SAA in a very precarious place.

"The government estimates SAA can sustain itself financially for the next 12 to 18 months. The government has also come to the conclusion that the flag carrier will no longer receive any bailout money. SAA will have to survive on its own or find a new merger partner," World Airline News reported.

SAA's problems actually predate the covid pandemic as it was close to being liquidated in 2019 before filing for bankruptcy which allowed it to keep operating.

The pandemic, however, did hasten its breakdown and greatly contributed to its current dire situation.

Takatso Consortium pulled out because it did not believe the price being asked was a good value.

"At the end of the day it wasn't about the political pressure, the noise that you are hearing. It came down to, businesswise, as an investor, does this make sense for your stakeholders? Can you continue to drag this process along?" consortium spokesperson Thulasizwe Simelane told DW.com.

.

bankruptcy pandemic africa canada germany sweden

-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoKey Events This Week: All Eyes On Core PCE Amid Deluge Of Fed Speakers