Government

Weekly Investment update – Everything is gonna be alright

For the past three weeks, financial markets have been ruled by the unknowns related to the Omicron variant and those surrounding the US Federal Reserve’s monetary policy plans. Now that Fed policymakers have met and have flagged their intentions, optimism

For the past three weeks, financial markets have been ruled by the unknowns related to the Omicron variant and those surrounding the US Federal Reserve’s monetary policy plans. Now that Fed policymakers have met and have flagged their intentions, optimism appears to dominate. A phrase taught in healthcare comes to mind: primum non nocere, or before intervening, first consider the risk of harm. In the case of central bank policy, this could be read as ‘above all, be sure not to surprise.’

Changing gears for US monetary policy

The conclusions of the latest meeting of the US Federal Reserve’s FOMC (Federal Open Market Committee) can be summarised in a few words:

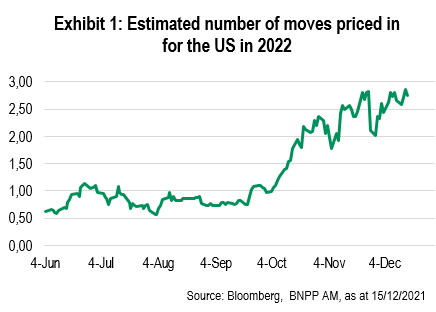

- A faster reduction of the pandemic-era asset purchases (i.e., accelerated tapering), ending quantitative easing by mid-March 2022

- Flagging three key rates increases in 2022, three more in 2023, and another two in 2024 in the dot plot, or table summarising the levels of rates deemed appropriate by FOMC members.

At first glance, these steps constitute a resolutely more hawkish turn in the Fed’s monetary policy compared to September when the US central bank last published its summary of economic projections and November when it announced initial moves to taper its USD 120 billion/month in purchases of US Treasury bonds and mortgage-backed securities.

Was it really a surprise?

US bond yields ended virtually unchanged after the Fed’s announcement: the 10-year yield was at 1.46% on 15 December after 1.44% the previous day and 1.52% a week earlier. Two-year yields held at 0.66% and were down slightly on the previous week’s 0.68%. These levels may shift in the coming days, but the market’s sanguine reaction combined with a surge in equity valuations does raise eyebrows.

Two explanations come to mind.

On the one hand, Chair Jerome Powell’s comments since his hearing before Congress in late November had prepared the ground, leading the market to expect these announcements.

On the other hand, despite the Fed’s upward revision of its inflation forecasts from 2.3% to 2.7% at the end of 2022 for the core PCE personal expenditure consumption deflator excluding food and energy and the removal of ‘transitory’ from its qualification of inflation, the expected level for the federal funds rate at the end of 2024 is 2.125%. That is below the longer-term (or equilibrium) level estimated at 2.5%.

Is the Fed simultaneously both dovish and hawkish? To reflect this paradox, do we need to start calling it a ‘Schrödinger’s Fed’? Who will open the box to determine which way it is leaning?

Health situation: Still assessing Omicron

With medical authorities forecasting that the Omicron variant, which is at least as contagious as Delta, is likely to become dominant in a few weeks, governments are taking action: they are accelerating vaccine booster campaigns and imposing restrictions on travels.

Investors are focusing on any reassuring news and central banks appear to be minimising Omicron risk, having shifted away from coronavirus as the decisive element in their monetary policy decisions. Initial test results show that three doses of vaccines offer enough protection and there are preliminary indications that patients infected with Omicron are less likely to suffer from severe forms of coronavirus.

Arguably, government decisions to restrict or tighten existing restrictions had already been taken in the face of the fifth (Delta) wave, so even before the emergence of Omicron. Of course, one could worry about another sudden slowdown in global activity. To head off another spike in infections, the health policy focus will be on accelerating booster campaigns.

China: Time for action as growth slows

While developed economies tend to avoid a zero-Covid policy, it remains in force in China and continues to weigh on the economy. It seems unlikely that the authorities will abandon this approach to the pandemic in the near future. Indeed, the Winter Olympics and the National People’s Congress in March could be jeopardised should the epidemic resume.

After GDP growth slowed in Q3, recent data does not show a sharp acceleration of industrial activity. October and November numbers are signalling that consumers have become hesitant.

Thus, it is no surprise that the recent Politburo meeting and the Central Economic Work Conference (CEWC) are indicating a swing to a more proactive economic policy to support investment and confidence.

The CEWC has underlined that ‘stability’ of growth will be a priority in 2022. It specified the three areas of pressures on growth – supply shocks, contracting demand and weakening expectations. These will be addressed in 2022. In an initial move, the People’s Bank of China cut its reserve requirement rate for some banks by 50bp on 15 December. It may decide on a further easing next year.

How are the other economies doing as the year draws to a close?

The cyclical picture is mixed.

US retail sales disappointed in November, but they are 20% above their pre-pandemic level. There appears to be a certain normalisation: After massive purchases of household goods, especially electronic products, consumption could now turn to services. The regional manufacturing survey of the New York Fed improved slightly in December as current conditions improved and new orders rose. Delivery times remain long, but have declined in what could be a first sign of bottlenecks diminishing.

Flash results from purchasing manager surveys for December revealed a slowdown in growth in the eurozone. The composite index fell to its lowest in nine months as a result of a decline in the services index (from 55.9 to 53.3) over health restrictions.

The manufacturing index fell significantly less (from 58.4 to 58) and production rose. Tensions in supply chains appear to have eased.

For now, let’s keep our faith in central bankers and assume we are facing a still positive economic outlook for 2022. It is time to celebrate the end of another eventful year.

The Weekly Investment Update will take a pause before returning in the New Year on 6 January 2022. In the meantime, we wish all our readers a very happy holiday season.

Any views expressed here are those of the author as of the date of publication, are based on available information, and are subject to change without notice. Individual portfolio management teams may hold different views and may take different investment decisions for different clients. The views expressed in this podcast do not in any way constitute investment advice.

The value of investments and the income they generate may go down as well as up and it is possible that investors will not recover their initial outlay. Past performance is no guarantee for future returns.

Investing in emerging markets, or specialised or restricted sectors is likely to be subject to a higher-than-average volatility due to a high degree of concentration, greater uncertainty because less information is available, there is less liquidity or due to greater sensitivity to changes in market conditions (social, political and economic conditions). Some emerging markets offer less security than the majority of international developed markets. For this reason, services for portfolio transactions, liquidation and conservation on behalf of funds invested in emerging markets may carry greater risk.

Writen by Nathalie Benatia. The post Weekly Investment update – Everything is gonna be alright appeared first on Investors' Corner - The official blog of BNP Paribas Asset Management, the sustainable investor for a changing world.

treasury bonds bonds pandemic coronavirus emerging markets monetary policy fomc open market committee fed federal reserve us treasury congress vaccine gdp chinaInternational

Beloved mall retailer files Chapter 7 bankruptcy, will liquidate

The struggling chain has given up the fight and will close hundreds of stores around the world.

It has been a brutal period for several popular retailers. The fallout from the covid pandemic and a challenging economic environment have pushed numerous chains into bankruptcy with Tuesday Morning, Christmas Tree Shops, and Bed Bath & Beyond all moving from Chapter 11 to Chapter 7 bankruptcy liquidation.

In all three of those cases, the companies faced clear financial pressures that led to inventory problems and vendors demanding faster, or even upfront payment. That creates a sort of inevitability.

Related: Beloved retailer finds life after bankruptcy, new famous owner

When a retailer faces financial pressure it sets off a cycle where vendors become wary of selling them items. That leads to barren shelves and no ability for the chain to sell its way out of its financial problems.

Once that happens bankruptcy generally becomes the only option. Sometimes that means a Chapter 11 filing which gives the company a chance to negotiate with its creditors. In some cases, deals can be worked out where vendors extend longer terms or even forgive some debts, and banks offer an extension of loan terms.

In other cases, new funding can be secured which assuages vendor concerns or the company might be taken over by its vendors. Sometimes, as was the case with David's Bridal, a new owner steps in, adds new money, and makes deals with creditors in order to give the company a new lease on life.

It's rare that a retailer moves directly into Chapter 7 bankruptcy and decides to liquidate without trying to find a new source of funding.

Image source: Getty Images

The Body Shop has bad news for customers

The Body Shop has been in a very public fight for survival. Fears began when the company closed half of its locations in the United Kingdom. That was followed by a bankruptcy-style filing in Canada and an abrupt closure of its U.S. stores on March 4.

"The Canadian subsidiary of the global beauty and cosmetics brand announced it has started restructuring proceedings by filing a Notice of Intention (NOI) to Make a Proposal pursuant to the Bankruptcy and Insolvency Act (Canada). In the same release, the company said that, as of March 1, 2024, The Body Shop US Limited has ceased operations," Chain Store Age reported.

A message on the company's U.S. website shared a simple message that does not appear to be the entire story.

"We're currently undergoing planned maintenance, but don't worry we're due to be back online soon."

That same message is still on the company's website, but a new filing makes it clear that the site is not down for maintenance, it's down for good.

The Body Shop files for Chapter 7 bankruptcy

While the future appeared bleak for The Body Shop, fans of the brand held out hope that a savior would step in. That's not going to be the case.

The Body Shop filed for Chapter 7 bankruptcy in the United States.

"The US arm of the ethical cosmetics group has ceased trading at its 50 outlets. On Saturday (March 9), it filed for Chapter 7 insolvency, under which assets are sold off to clear debts, putting about 400 jobs at risk including those in a distribution center that still holds millions of dollars worth of stock," The Guardian reported.

After its closure in the United States, the survival of the brand remains very much in doubt. About half of the chain's stores in the United Kingdom remain open along with its Australian stores.

The future of those stores remains very much in doubt and the chain has shared that it needs new funding in order for them to continue operating.

The Body Shop did not respond to a request for comment from TheStreet.

bankruptcy pandemic canadaGovernment

Are Voters Recoiling Against Disorder?

Are Voters Recoiling Against Disorder?

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super…

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super Tuesday primaries have got it right. Barring cataclysmic changes, Donald Trump and Joe Biden will be the Republican and Democratic nominees for president in 2024.

With Nikki Haley’s withdrawal, there will be no more significantly contested primaries or caucuses—the earliest both parties’ races have been over since something like the current primary-dominated system was put in place in 1972.

The primary results have spotlighted some of both nominees’ weaknesses.

Donald Trump lost high-income, high-educated constituencies, including the entire metro area—aka the Swamp. Many but by no means all Haley votes there were cast by Biden Democrats. Mr. Trump can’t afford to lose too many of the others in target states like Pennsylvania and Michigan.

Majorities and large minorities of voters in overwhelmingly Latino counties in Texas’s Rio Grande Valley and some in Houston voted against Joe Biden, and even more against Senate nominee Rep. Colin Allred (D-Texas).

Returns from Hispanic precincts in New Hampshire and Massachusetts show the same thing. Mr. Biden can’t afford to lose too many Latino votes in target states like Arizona and Georgia.

When Mr. Trump rode down that escalator in 2015, commentators assumed he’d repel Latinos. Instead, Latino voters nationally, and especially the closest eyewitnesses of Biden’s open-border policy, have been trending heavily Republican.

High-income liberal Democrats may sport lawn signs proclaiming, “In this house, we believe ... no human is illegal.” The logical consequence of that belief is an open border. But modest-income folks in border counties know that flows of illegal immigrants result in disorder, disease, and crime.

There is plenty of impatience with increased disorder in election returns below the presidential level. Consider Los Angeles County, America’s largest county, with nearly 10 million people, more people than 40 of the 50 states. It voted 71 percent for Mr. Biden in 2020.

Current returns show county District Attorney George Gascon winning only 21 percent of the vote in the nonpartisan primary. He’ll apparently face Republican Nathan Hochman, a critic of his liberal policies, in November.

Gascon, elected after the May 2020 death of counterfeit-passing suspect George Floyd in Minneapolis, is one of many county prosecutors supported by billionaire George Soros. His policies include not charging juveniles as adults, not seeking higher penalties for gang membership or use of firearms, and bringing fewer misdemeanor cases.

The predictable result has been increased car thefts, burglaries, and personal robberies. Some 120 assistant district attorneys have left the office, and there’s a backlog of 10,000 unprosecuted cases.

More than a dozen other Soros-backed and similarly liberal prosecutors have faced strong opposition or have left office.

St. Louis prosecutor Kim Gardner resigned last May amid lawsuits seeking her removal, Milwaukee’s John Chisholm retired in January, and Baltimore’s Marilyn Mosby was defeated in July 2022 and convicted of perjury in September 2023. Last November, Loudoun County, Virginia, voters (62 percent Biden) ousted liberal Buta Biberaj, who declined to prosecute a transgender student for assault, and in June 2022 voters in San Francisco (85 percent Biden) recalled famed radical Chesa Boudin.

Similarly, this Tuesday, voters in San Francisco passed ballot measures strengthening police powers and requiring treatment of drug-addicted welfare recipients.

In retrospect, it appears the Floyd video, appearing after three months of COVID-19 confinement, sparked a frenzied, even crazed reaction, especially among the highly educated and articulate. One fatal incident was seen as proof that America’s “systemic racism” was worse than ever and that police forces should be defunded and perhaps abolished.

2020 was “the year America went crazy,” I wrote in January 2021, a year in which police funding was actually cut by Democrats in New York, Los Angeles, San Francisco, Seattle, and Denver. A year in which young New York Times (NYT) staffers claimed they were endangered by the publication of Sen. Tom Cotton’s (R-Ark.) opinion article advocating calling in military forces if necessary to stop rioting, as had been done in Detroit in 1967 and Los Angeles in 1992. A craven NYT publisher even fired the editorial page editor for running the article.

Evidence of visible and tangible discontent with increasing violence and its consequences—barren and locked shelves in Manhattan chain drugstores, skyrocketing carjackings in Washington, D.C.—is as unmistakable in polls and election results as it is in daily life in large metropolitan areas. Maybe 2024 will turn out to be the year even liberal America stopped acting crazy.

Chaos and disorder work against incumbents, as they did in 1968 when Democrats saw their party’s popular vote fall from 61 percent to 43 percent.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Government

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The U.S. Department of Veterans Affairs (VA) reviewed no data when deciding in 2023 to keep its COVID-19 vaccine mandate in place.

VA Secretary Denis McDonough said on May 1, 2023, that the end of many other federal mandates “will not impact current policies at the Department of Veterans Affairs.”

He said the mandate was remaining for VA health care personnel “to ensure the safety of veterans and our colleagues.”

Mr. McDonough did not cite any studies or other data. A VA spokesperson declined to provide any data that was reviewed when deciding not to rescind the mandate. The Epoch Times submitted a Freedom of Information Act for “all documents outlining which data was relied upon when establishing the mandate when deciding to keep the mandate in place.”

The agency searched for such data and did not find any.

“The VA does not even attempt to justify its policies with science, because it can’t,” Leslie Manookian, president and founder of the Health Freedom Defense Fund, told The Epoch Times.

“The VA just trusts that the process and cost of challenging its unfounded policies is so onerous, most people are dissuaded from even trying,” she added.

The VA’s mandate remains in place to this day.

The VA’s website claims that vaccines “help protect you from getting severe illness” and “offer good protection against most COVID-19 variants,” pointing in part to observational data from the U.S. Centers for Disease Control and Prevention (CDC) that estimate the vaccines provide poor protection against symptomatic infection and transient shielding against hospitalization.

There have also been increasing concerns among outside scientists about confirmed side effects like heart inflammation—the VA hid a safety signal it detected for the inflammation—and possible side effects such as tinnitus, which shift the benefit-risk calculus.

President Joe Biden imposed a slate of COVID-19 vaccine mandates in 2021. The VA was the first federal agency to implement a mandate.

President Biden rescinded the mandates in May 2023, citing a drop in COVID-19 cases and hospitalizations. His administration maintains the choice to require vaccines was the right one and saved lives.

“Our administration’s vaccination requirements helped ensure the safety of workers in critical workforces including those in the healthcare and education sectors, protecting themselves and the populations they serve, and strengthening their ability to provide services without disruptions to operations,” the White House said.

Some experts said requiring vaccination meant many younger people were forced to get a vaccine despite the risks potentially outweighing the benefits, leaving fewer doses for older adults.

“By mandating the vaccines to younger people and those with natural immunity from having had COVID, older people in the U.S. and other countries did not have access to them, and many people might have died because of that,” Martin Kulldorff, a professor of medicine on leave from Harvard Medical School, told The Epoch Times previously.

The VA was one of just a handful of agencies to keep its mandate in place following the removal of many federal mandates.

“At this time, the vaccine requirement will remain in effect for VA health care personnel, including VA psychologists, pharmacists, social workers, nursing assistants, physical therapists, respiratory therapists, peer specialists, medical support assistants, engineers, housekeepers, and other clinical, administrative, and infrastructure support employees,” Mr. McDonough wrote to VA employees at the time.

“This also includes VA volunteers and contractors. Effectively, this means that any Veterans Health Administration (VHA) employee, volunteer, or contractor who works in VHA facilities, visits VHA facilities, or provides direct care to those we serve will still be subject to the vaccine requirement at this time,” he said. “We continue to monitor and discuss this requirement, and we will provide more information about the vaccination requirements for VA health care employees soon. As always, we will process requests for vaccination exceptions in accordance with applicable laws, regulations, and policies.”

The version of the shots cleared in the fall of 2022, and available through the fall of 2023, did not have any clinical trial data supporting them.

A new version was approved in the fall of 2023 because there were indications that the shots not only offered temporary protection but also that the level of protection was lower than what was observed during earlier stages of the pandemic.

Ms. Manookian, whose group has challenged several of the federal mandates, said that the mandate “illustrates the dangers of the administrative state and how these federal agencies have become a law unto themselves.”

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex