International

Week Ahead: Macro and Prices

The market has much to digest. The Bank of England’s new purchases of Gilts coincided with a reassessment of the trajectory of Fed policy. After the hawkish…

The market has much to digest. The Bank of England's new purchases of Gilts coincided with a reassessment of the trajectory of Fed policy. After the hawkish FOMC decision and forecasts, the market briefly thought the terminal rate could be 5.25-5.50% in the middle of next year. However, by the end of last week, it had returned to around 4.5% at the end of Q1 23. Italy has a right-wing government, and what it means for the country's debt and relationship with the EU are being debated. The cabinet will begin taking shape, and it could help shape investors' expectations. Italy's premium had jumped 30-40 since a little before the election.

The rapid referendums in eastern Ukraine and Russia's annexation of the territories, after taking Crimea in 2014 point to a new phase in the conflict. Some observers are linking Russia's mobilization and rush for a referendum--even by its trumped-up standards, to the meeting with China's Xi rather than the setback of Russian forces at the hands of the Ukrainians armed to the teeth with US weapons and intelligence.

Sometimes the narrative is about macro developments, but recently the price action itself has been the narrative. Central banks from several emerging markets are believed to have intervened to support their currencies, and Japan became the first G10 central bank to materially protest what the market was doing with the yen (still to be sorted out if it was about a level--less likely--than the one-way market--more likely). It looks like the initial estimates of a record JPY3.0 trillion (~$21 bln) was fairly close. BOJ figures suggest it was closer to the JPY2.85 trillion, which seems like a lot for a few nights of sound sleep. Still, the pullback in US yields helps protect the JPY145 level.

Sterling's collapsed the new government's mini-budget spurred the Bank of England to comment. It was monitoring developments and would take the necessary measures to bring inflation down, and review both fiscal policy and sterling at its November 3 meeting. However, seeming to rule out an emergency meeting, which did not validate the sense of urgency seen by investors and businesses weighed on sterling. Yet, when systemic risks arose, the BOE stepped in. It announced a bond-buying program distinct from QE and it seemed to stop the panic. The Gilt market stabilized and sterling recovered to almost where it was before the government's fiscal initiative. The swaps market has a 150 bp hike at the next BOE meeting nearly fully discounted.

The price action in the debt markets is also the narrative. The US 2-year yield has risen from almost 3.5% at the end of August to nearly 4.35% in late September. It looks poised to re-test 4.0%. In early August, the US benchmark 10-year yield tested 2.50%. It poked above 4.0% last week before falling back below 3.70% before the weekend. The 10-year breakeven (the difference between the yield of the inflation-protected and conventional security) slipped below 2.10% before the weekend, its lowest since February 2021. The two-year breakeven slipped below 2% at the end of last week for the first time since late 2020.

The two-month rally in US equities indices has fully unwound. Europe's Stoxx 600 and the MSCI Asia Pacific Index also fell to new lows for the year last week. The general re-pricing of assets from a zero-interest rate environment to higher rates is a difficult process and it has become a moving target.

Oil prices rallied almost 60% in the first half of the year and since mid-June, WTI has tumbled by nearly more than 35%, leaving it up less than 7% for the year. The US retail price for gasoline has risen over the last few days but did slip a little in September, its third consecutive monthly decline. At an average of around $3.80 a gallon, it has risen by slightly more than 15% since the end of last year. A broader measure of commodity prices, the CRB Index, has also pulled back since the mid-June peak. It has fallen by nearly 20%.

There are a few data points next week that do stand out. First, is the US jobs report. The median forecast in Bloomberg's survey is for a 250k increase in non-farm payrolls, which includes an estimated 13k net loss of government jobs. The numbers have been so distorted by the shutdown and re-opening and shifting preferences that it may be difficult to know what is a normal number. In the four-year before the pandemic, the US averaged less than 200k additions a month. That means that the 250k median forecast (Bloomberg's survey), which would be the least since December 2020 will likely be seen as a robust figure by Fed officials.

Of course, there are other dimensions that will be watched. These include the unemployment rate (which rose to 3.7% from 3.5%), the participation rate (increased to 62.4% from 62.1%, to match the highest since March 2020), and the average hourly earnings ( a 0.3% month-over-month increase will slow the year-over-year pace to 5.0% or slightly below). The JOLTS report on job openings appears seems to be attracting diminishing interest, even though Chair Powell still referred to it. Canada also reports September employment figures. It has lost full-time jobs for the three months through August.

We would make the case for US auto sales being notable too. They are expected to have edged higher, and at 13.5 mln (SAAR) it would be the most since April. Although, through August auto sales are off about 15% year-over-year, a 13.5 mln unit pace September would be the second consecutive month of year-over-year improvement. In the current strong dollar environment trade figures are interesting, though the advanced goods balance report steals most of its thunder. Still, part of the issue is that the Fed does not meet until November 2, and the key for policy is not the real sector, provided the jobs report is broadly in line with expectations, is CPI (October 13).

Japan's Tankan Survey (October 3) rarely moves the market, and this may be doubly true now as large business sentiment is better than for small businesses. Corporate profits are the highest in more than 50 years as the foreign earnings translate into more yen. Given the policy divergence, and the intervention to support the yen, Tokyo's September CPI will be watched as a good indicator of the national figures. Headline CPI may hold below 3%. The core rate (excludes fresh food) may have edged up from 2.6% in August. This could be the near-term peak, as the supplemental budget will offer new protection from energy and wheat prices and energy prices fall faster than the yen.

The Reserve Bank of Australia and New Zealand meet. The market is slightly more confident that New Zealand's central bank will hike by 50 bp than Australia's. The RBA has hiked at every meeting since May for a total of 225 bp, bringing the target rate to 2.35%. It is clear that it is not done but it has signaled that after four half-point moves it could slow. Since it last met, the Australian dollar has fallen nearly 4.5% to two-and-a-half year lows near $0.6435. The RBNZ began its tightening cycle last October and has lifted the target rate by 275 bp to 3.0%. The swaps market has Australia's terminal rate between 4.25% and 4.50% in Q3 23. The terminal rate for the RBNZ is seen closer to 5.0%

Let's turn now to the foreign exchange price action.

Dollar Index: On September 20, the Dollar Index posted an outside up day by trading on both sides of the previous day's range and settling above its high. The rally that it signaled was completed in the middle of last week as DXY made new 20-year highs and then reversed lower and settled below the previous session's low. This key reversal saw follow-through selling to a new five-day low ahead of the weekend slightly above 111.55. That nearly met the (62.8%) retracement of the advance from September 20 (~111.45). Initial resistance is now near 112.80 and then 113.20. The MACD and Slow Stochastic are rolling over in over-extended territory. The 20-day moving average, the middle of the Bollinger Band is near 110.80.

Euro: The euro's recovery off the 20-year low set in the middle of last week (~$0.9535) stalled ahead of the weekend about three cents higher. Like the Dollar Index, it met the (61.8%) retracement objective of the move since September 20. It also stopped shy of the 20-day moving average (~$0.9890). Initial support is seen near $0.9700, and a break of $0.9650 would signal a return to the lows. The MACD firmed slightly last week but it has not established an uptrend. The Slow Stochastic has turned higher and it is still oversold. Parity is a key cap now.

Japanese Yen: The BOJ's intervention has helped steady the dollar-yen exchange rate. The market has been reluctant to push the dollar back above JPY145.00. Since the middle of the week, the greenback has largely held above JPY144.00. The sideways movement has seen the MACD trend lower. The Slow Stochastic has also been trending lower but steadied last week. The pullback in US rates may be a contributing factor to the stability of the exchange rate. After briefly pushing above 4% in the middle of the week the 10-year US Treasury traded below 3.70% before the weekend. The two-year US yield reached almost 4.35% at the start of last week and finished below 4.18%.

British Pound: Sterling traded in a wide range last week. It began by extending the route after the new government's fiscal message and falling to its lowest level since the end of Bretton Woods, reaching $1.0350. The BOE's measures to address the threat to systemic stability helped spur a short-covering rally in sterling that lifted to a high at the end of the week of about $1.1235. Recall that it finished the previous week (September 23 near $1.0860 and traded almost to $1.1275 before the mini budget. The pre-weekend high met a technical retracement objective (~61.8% of the leg lower that began on September 13 from almost $1.1740). The momentum indicators have turned higher from oversold territory, and, of note, the Slow Stochastic is leaving a bullish divergence in its wake. While we think the market's response to the fiscal measures, which were largely what Prime Minister Truss had advocated during her campaign was exaggerated, the blow to sentiment was serious. Sterling needs to overcome resistance in the $1.1275-$1.1300 area to signal a deeper recovery, a loss of $1.09 could see $1.0750-$1.0800.

Canadian Dollar: Weak US stocks and an aggressive Federal Reserve kept the Canadian dollar on the defense last week. The greenback made a new two-and-a-half-year high near CAD1.3835 in the middle of the week. There was no follow-through USD selling after the key reversal on Wednesday. Support was found near CAD1.3600. The MACD is still rising but is stretched. The Slow Stochastic turned lower. The US dollar rose for its third consecutive week and seven of the nine weeks since the end of July. The Canadian dollar is no longer the best G10 performer this year against the US dollar. It lost top billing to the Swiss franc, which is almost 7% compared to the Loonie's 8% decline. More than half of this year's decline in the Canadian dollar took place in September (~-4.35%).

Australian Dollar: As we saw with the Canadian dollar, so too with the Australian dollar: The seemingly favorable price action in the middle of last week did not see follow-through action. Instead, weak consolidation was seen in the last two sessions. The Aussie slumped to a new two-year low near $0.6365 on September 28 and recovered to close a little bit above $0.6520. Before the weekend it traded to almost $0.6450. The MACD is at its lowest level since mid-May, and although it has not turned, it looks poised to do so in the coming days. The Slow Stochastic has curled up and from slightly above the low set earlier in September. Overcoming the $0.6575-$0.6600 area now would lift the tone. The futures market leans (~60%) in favor a of 50 bp hike by the RBA on October 4, essentially unchanged last week. A half-point move would lift the target rate to 2.85%. The terminal rate is seen a little over 4% near mid-2023. The RBNZ meets on October 5. The market is more confident that it hikes 50 bp and again in November, its last meeting year. That would put the target rate at 4%. The terminal rate is seen closer to 5.25% in early Q3 23.

Mexican Peso: As part of its broad rally, the US dollar pushed to MXN20.58 on September 28, its highest level in nearly two months. It reversed dramatically low and close that day near MXN20.1255. After the key reversal, there was no immediate follow-through selling, but ahead of the weekend, the greenback fell to new lows for the week around MXN20.09. The MACD is not clear, though the Slow Stochastic is curling lower. Last week, a few central European currencies gained against the dollar (Czech, Bulgaria, and Romania, but not Russia or Hungary), and after them was the peso. The peso's gain of about 0.5% was enough to ensure a gain for the month, albeit small (less than 0.2%). We suspect there is potential now toward the lower end of the recent range (~MXN19.80).

Chinese Yuan: Before the weeklong holiday in China during the first week of October, officials drew the line in the sand. Reports suggested that it put banks on notice that they should be prepared for intervention. How do the banks prepare? Apparently, they cut their long dollar exposure. The dollar fell from CNY7.25 in the middle of last week to almost CNY7.0835 before the weekend. The greenback gapped lower last Thursday and Friday and both times the gap was quickly closed. The dollar settled near CNY7.1150, while against the offshore yuan the dollar finished a little below CNH7.1300. Given the sensitivity and official scrutiny, look for the dollar to trade within recent ranges against the offshore yuan during next week's holiday.

Disclaimer

Government

The Grinch Who Stole Freedom

The Grinch Who Stole Freedom

Authored by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

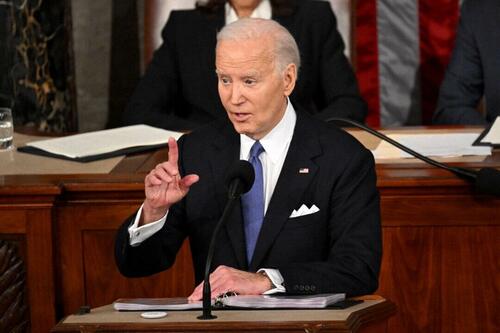

Before President Joe Biden’s State of the…

Authored by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

Before President Joe Biden’s State of the Union address, the pundit class was predicting that he would deliver a message of unity and calm, if only to attract undecided voters to his side.

He did the opposite. The speech revealed a loud, cranky, angry, bitter side of the man that people don’t usually see. It seemed like the real Joe Biden I remember from the old days, full of venom, sarcasm, disdain, threats, and extreme partisanship.

The base might have loved it except that he made reference to an “illegal” alien, which is apparently a trigger word for the left. He failed their purity test.

The speech was stunning in its bile and bitterness. It’s beyond belief that he began with a pitch for more funds for the Ukraine war, which has killed 10,000 civilians and some 200,000 troops on both sides. It’s a bloody mess that could have been resolved early on but for U.S. tax funding of the conflict.

Despite the push from the higher ends of conservative commentary, average Republicans have turned hard against this war. The United States is in a fiscal crisis and every manner of domestic crisis, and the U.S. president opens his speech with a pitch to protect the border in Ukraine? It was completely bizarre, and lent some weight to the darkest conspiracies about why the Biden administration cares so much about this issue.

From there, he pivoted to wildly overblown rhetoric about the most hysterically exaggerated event of our times: the legendary Jan. 6 protests on Capitol Hill. Arrests for daring to protest the government on that day are growing.

The media and the Biden administration continue to describe it as the worst crisis since the War of the Roses, or something. It’s all a wild stretch, but it set the tone of the whole speech, complete with unrelenting attacks on former President Donald Trump. He would use the speech not to unite or make a pitch that he is president of the entire country but rather intensify his fundamental attack on everything America is supposed to be.

Hard to isolate the most alarming part, but one aspect really stood out to me. He glared directly at the Supreme Court Justices sitting there and threatened them with political power. He said that they were awful for getting rid of nationwide abortion rights and returning the issue to the states where it belongs, very obviously. But President Biden whipped up his base to exact some kind of retribution against the court.

Looking this up, we have a few historical examples of presidents criticizing the court but none to their faces in a State of the Union address. This comes two weeks after President Biden directly bragged about defying the Supreme Court over the issue of student loan forgiveness. The court said he could not do this on his own, but President Biden did it anyway.

Here we have an issue of civic decorum that you cannot legislate or legally codify. Essentially, under the U.S. system, the president has to agree to defer to the highest court in its rulings even if he doesn’t like them. President Biden is now aggressively defying the court and adding direct threats on top of that. In other words, this president is plunging us straight into lawlessness and dictatorship.

In the background here, you must understand, is the most important free speech case in U.S. history. The Supreme Court on March 18 will hear arguments over an injunction against President Biden’s administrative agencies as issued by the Fifth Circuit. The injunction would forbid government agencies from imposing themselves on media and social media companies to curate content and censor contrary opinions, either directly or indirectly through so-called “switchboarding.”

A ruling for the plaintiffs in the case would force the dismantling of a growing and massive industry that has come to be called the censorship-industrial complex. It involves dozens or even more than 100 government agencies, including quasi-intelligence agencies such as the Cybersecurity and Infrastructure Security Agency (CISA), which was set up only in 2018 but managed information flow, labor force designations, and absentee voting during the COVID-19 response.

A good ruling here will protect free speech or at least intend to. But, of course, the Biden administration could directly defy it. That seems to be where this administration is headed. It’s extremely dangerous.

A ruling for the defense and against the injunction would be a catastrophe. It would invite every government agency to exercise direct control over all media and social media in the country, effectively abolishing the First Amendment.

Close watchers of the court have no clear idea of how this will turn out. But watching President Biden glare at court members at the address, one does wonder. Did they sense the threats he was making against them? Will they stand up for the independence of the judicial branch?

Maybe his intimidation tactics will end up backfiring. After all, does the Supreme Court really think it is wise to license this administration with the power to control all information flows in the United States?

The deeper issue here is a pressing battle that is roiling American life today. It concerns the future and power of the administrative state versus the elected one. The Constitution contains no reference to a fourth branch of government, but that is what has been allowed to form and entrench itself, in complete violation of the Founders’ intentions. Only the Supreme Court can stop it, if they are brave enough to take it on.

If you haven’t figured it out yet, and surely you have, President Biden is nothing but a marionette of deep-state interests. He is there to pretend to be the people’s representative, but everything that he does is about entrenching the fourth branch of government, the permanent bureaucracy that goes on its merry way without any real civilian oversight.

We know this for a fact by virtue of one of his first acts as president, to repeal an executive order by President Trump that would have reclassified some (or many) federal employees as directly under the control of the elected president rather than have independent power. The elites in Washington absolutely panicked about President Trump’s executive order. They plotted to make sure that he didn’t get a second term, and quickly scratched that brilliant act by President Trump from the historical record.

This epic battle is the subtext behind nearly everything taking place in Washington today.

Aside from the vicious moment of directly attacking the Supreme Court, President Biden set himself up as some kind of economic central planner, promising to abolish hidden fees and bags of chips that weren’t full enough, as if he has the power to do this, which he does not. He was up there just muttering gibberish. If he is serious, he believes that the U.S. president has the power to dictate the prices of every candy bar and hotel room in the United States—an absolutely terrifying exercise of power that compares only to Stalin and Mao. And yet there he was promising to do just that.

Aside from demonizing the opposition, wildly exaggerating about Jan. 6, whipping up war frenzy, swearing to end climate change, which will make the “green energy” industry rich, threatening more taxes on business enterprise, promising to cure cancer (again!), and parading as the master of candy bar prices, what else did he do? Well, he took credit for the supposedly growing economy even as a vast number of Americans are deeply suffering from his awful policies.

It’s hard to imagine that this speech could be considered a success. The optics alone made him look like the Grinch who stole freedom, except the Grinch was far more articulate and clever. He’s a mean one, Mr. Biden.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

International

Chinese migration to US is nothing new – but the reasons for recent surge at Southern border are

A gloomier economic outlook in China and tightening state control have combined with the influence of social media in encouraging migration.

The brief closure of the Darien Gap – a perilous 66-mile jungle journey linking South American and Central America – in February 2024 temporarily halted one of the Western Hemisphere’s busiest migration routes. It also highlighted its importance to a small but growing group of people that depend on that pass to make it to the U.S.: Chinese migrants.

While a record 2.5 million migrants were detained at the United States’ southwestern land border in 2023, only about 37,000 were from China.

I’m a scholar of migration and China. What I find most remarkable in these figures is the speed with which the number of Chinese migrants is growing. Nearly 10 times as many Chinese migrants crossed the southern border in 2023 as in 2022. In December 2023 alone, U.S. Border Patrol officials reported encounters with about 6,000 Chinese migrants, in contrast to the 900 they reported a year earlier in December 2022.

The dramatic uptick is the result of a confluence of factors that range from a slowing Chinese economy and tightening political control by President Xi Jinping to the easy access to online information on Chinese social media about how to make the trip.

Middle-class migrants

Journalists reporting from the border have generalized that Chinese migrants come largely from the self-employed middle class. They are not rich enough to use education or work opportunities as a means of entry, but they can afford to fly across the world.

According to a report from Reuters, in many cases those attempting to make the crossing are small-business owners who saw irreparable damage to their primary or sole source of income due to China’s “zero COVID” policies. The migrants are women, men and, in some cases, children accompanying parents from all over China.

Chinese nationals have long made the journey to the United States seeking economic opportunity or political freedom. Based on recent media interviews with migrants coming by way of South America and the U.S.’s southern border, the increase in numbers seems driven by two factors.

First, the most common path for immigration for Chinese nationals is through a student visa or H1-B visa for skilled workers. But travel restrictions during the early months of the pandemic temporarily stalled migration from China. Immigrant visas are out of reach for many Chinese nationals without family or vocation-based preferences, and tourist visas require a personal interview with a U.S. consulate to gauge the likelihood of the traveler returning to China.

Social media tutorials

Second, with the legal routes for immigration difficult to follow, social media accounts have outlined alternatives for Chinese who feel an urgent need to emigrate. Accounts on Douyin, the TikTok clone available in mainland China, document locations open for visa-free travel by Chinese passport holders. On TikTok itself, migrants could find information on where to cross the border, as well as information about transportation and smugglers, commonly known as “snakeheads,” who are experienced with bringing migrants on the journey north.

With virtual private networks, immigrants can also gather information from U.S. apps such as X, YouTube, Facebook and other sites that are otherwise blocked by Chinese censors.

Inspired by social media posts that both offer practical guides and celebrate the journey, thousands of Chinese migrants have been flying to Ecuador, which allows visa-free travel for Chinese citizens, and then making their way over land to the U.S.-Mexican border.

This journey involves trekking through the Darien Gap, which despite its notoriety as a dangerous crossing has become an increasingly common route for migrants from Venezuela, Colombia and all over the world.

In addition to information about crossing the Darien Gap, these social media posts highlight the best places to cross the border. This has led to a large share of Chinese asylum seekers following the same path to Mexico’s Baja California to cross the border near San Diego.

Chinese migration to US is nothing new

The rapid increase in numbers and the ease of accessing information via social media on their smartphones are new innovations. But there is a longer history of Chinese migration to the U.S. over the southern border – and at the hands of smugglers.

From 1882 to 1943, the United States banned all immigration by male Chinese laborers and most Chinese women. A combination of economic competition and racist concerns about Chinese culture and assimilability ensured that the Chinese would be the first ethnic group to enter the United States illegally.

With legal options for arrival eliminated, some Chinese migrants took advantage of the relative ease of movement between the U.S. and Mexico during those years. While some migrants adopted Mexican names and spoke enough Spanish to pass as migrant workers, others used borrowed identities or paperwork from Chinese people with a right of entry, like U.S.-born citizens. Similarly to what we are seeing today, it was middle- and working-class Chinese who more frequently turned to illegal means. Those with money and education were able to circumvent the law by arriving as students or members of the merchant class, both exceptions to the exclusion law.

Though these Chinese exclusion laws officially ended in 1943, restrictions on migration from Asia continued until Congress revised U.S. immigration law in the Hart-Celler Act in 1965. New priorities for immigrant visas that stressed vocational skills as well as family reunification, alongside then Chinese leader Deng Xiaoping’s policies of “reform and opening,” helped many Chinese migrants make their way legally to the U.S. in the 1980s and 1990s.

Even after the restrictive immigration laws ended, Chinese migrants without the education or family connections often needed for U.S. visas continued to take dangerous routes with the help of “snakeheads.”

One notorious incident occurred in 1993, when a ship called the Golden Venture ran aground near New York, resulting in the drowning deaths of 10 Chinese migrants and the arrest and conviction of the snakeheads attempting to smuggle hundreds of Chinese migrants into the United States.

Existing tensions

Though there is plenty of precedent for Chinese migrants arriving without documentation, Chinese asylum seekers have better odds of success than many of the other migrants making the dangerous journey north.

An estimated 55% of Chinese asylum seekers are successful in making their claims, often citing political oppression and lack of religious freedom in China as motivations. By contrast, only 29% of Venezuelans seeking asylum in the U.S. have their claim granted, and the number is even lower for Colombians, at 19%.

The new halt on the migratory highway from the south has affected thousands of new migrants seeking refuge in the U.S. But the mix of push factors from their home country and encouragement on social media means that Chinese migrants will continue to seek routes to America.

And with both migration and the perceived threat from China likely to be features of the upcoming U.S. election, there is a risk that increased Chinese migration could become politicized, leaning further into existing tensions between Washington and Beijing.

Meredith Oyen does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

congress pandemic deaths south america mexico chinaGovernment

Is the National Guard a solution to school violence?

School board members in one Massachusetts district have called for the National Guard to address student misbehavior. Does their request have merit? A…

Every now and then, an elected official will suggest bringing in the National Guard to deal with violence that seems out of control.

A city council member in Washington suggested doing so in 2023 to combat the city’s rising violence. So did a Pennsylvania representative concerned about violence in Philadelphia in 2022.

In February 2024, officials in Massachusetts requested the National Guard be deployed to a more unexpected location – to a high school.

Brockton High School has been struggling with student fights, drug use and disrespect toward staff. One school staffer said she was trampled by a crowd rushing to see a fight. Many teachers call in sick to work each day, leaving the school understaffed.

As a researcher who studies school discipline, I know Brockton’s situation is part of a national trend of principals and teachers who have been struggling to deal with perceived increases in student misbehavior since the pandemic.

A review of how the National Guard has been deployed to schools in the past shows the guard can provide service to schools in cases of exceptional need. Yet, doing so does not always end well.

How have schools used the National Guard before?

In 1957, the National Guard blocked nine Black students’ attempts to desegregate Central High School in Little Rock, Arkansas. While the governor claimed this was for safety, the National Guard effectively delayed desegregation of the school – as did the mobs of white individuals outside. Ironically, weeks later, the National Guard and the U.S. Army would enforce integration and the safety of the “Little Rock Nine” on orders from President Dwight Eisenhower.

One of the most tragic cases of the National Guard in an educational setting came in 1970 at Kent State University. The National Guard was brought to campus to respond to protests over American involvement in the Vietnam War. The guardsmen fatally shot four students.

In 2012, then-Sen. Barbara Boxer, a Democrat from California, proposed funding to use the National Guard to provide school security in the wake of the Sandy Hook school shooting. The bill was not passed.

More recently, the National Guard filled teacher shortages in New Mexico’s K-12 schools during the quarantines and sickness of the pandemic. While the idea did not catch on nationally, teachers and school personnel in New Mexico generally reported positive experiences.

Can the National Guard address school discipline?

The National Guard’s mission includes responding to domestic emergencies. Members of the guard are part-time service members who maintain civilian lives. Some are students themselves in colleges and universities. Does this mission and training position the National Guard to respond to incidents of student misbehavior and school violence?

On the one hand, New Mexico’s pandemic experience shows the National Guard could be a stopgap to staffing shortages in unusual circumstances. Similarly, the guards’ eventual role in ensuring student safety during school desegregation in Arkansas demonstrates their potential to address exceptional cases in schools, such as racially motivated mob violence. And, of course, many schools have had military personnel teaching and mentoring through Junior ROTC programs for years.

Those seeking to bring the National Guard to Brockton High School have made similar arguments. They note that staffing shortages have contributed to behavior problems.

One school board member stated: “I know that the first thought that comes to mind when you hear ‘National Guard’ is uniform and arms, and that’s not the case. They’re people like us. They’re educated. They’re trained, and we just need their assistance right now. … We need more staff to support our staff and help the students learn (and) have a safe environment.”

Yet, there are reasons to question whether calls for the National Guard are the best way to address school misconduct and behavior. First, the National Guard is a temporary measure that does little to address the underlying causes of student misbehavior and school violence.

Research has shown that students benefit from effective teaching, meaningful and sustained relationships with school personnel and positive school environments. Such educative and supportive environments have been linked to safer schools. National Guard members are not trained as educators or counselors and, as a temporary measure, would not remain in the school to establish durable relationships with students.

What is more, a military presence – particularly if uniformed or armed – may make students feel less welcome at school or escalate situations.

Schools have already seen an increase in militarization. For example, school police departments have gone so far as to acquire grenade launchers and mine-resistant armored vehicles.

Research has found that school police make students more likely to be suspended and to be arrested. Similarly, while a National Guard presence may address misbehavior temporarily, their presence could similarly result in students experiencing punitive or exclusionary responses to behavior.

Students deserve a solution other than the guard

School violence and disruptions are serious problems that can harm students. Unfortunately, schools and educators have increasingly viewed student misbehavior as a problem to be dealt with through suspensions and police involvement.

A number of people – from the NAACP to the local mayor and other members of the school board – have criticized Brockton’s request for the National Guard. Governor Maura Healey has said she will not deploy the guard to the school.

However, the case of Brockton High School points to real needs. Educators there, like in other schools nationally, are facing a tough situation and perceive a lack of support and resources.

Many schools need more teachers and staff. Students need access to mentors and counselors. With these resources, schools can better ensure educators are able to do their jobs without military intervention.

F. Chris Curran has received funding from the US Department of Justice, the Bureau of Justice Assistance, and the American Civil Liberties Union for work on school safety and discipline.

army governor pandemic mexico-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex