Week Ahead – Georgia reopening fallout, three big rate decisions, and big Tech earnings

Week Ahead – Georgia reopening fallout, three big rate decisions, and big Tech earnings

Global equities and the US dollar appear to be approaching a possible turning point with the stimulus trade. Global equities have been widely supported by unprecedented stimulus from central banks and governments, but that seems to be losing some of its firepower, while the steady demand for US Treasuries has buoyed the dollar. The next major move with risk appetite will likely stem from expectations on when key economies reopen.

In the US, Georgia will give key insights to how comfortable businesses and consumers are with reopening their economy. The risks of seeing a spike in cases over the next few weeks seem fairly high and that could eventually set them back even further if they have to return to lockdown mode. Georgia is one of the most important stories right now as it could potentially provide a path on what to expect when other states reach their thresholds to begin reopening.

The focus next week will remain on COVID-19, rate decisions by BOJ, Fed and ECB, big tech earnings, a plethora of data shows how bad economic conditions got in the first quarter and how China’s recovery is unfolding.

The Fed’s handling of the coronavirus pandemic has many investors looking beyond the April 29th policy meeting. The Fed’s action has been quick and so far effective in alleviating many strains in the financial system. The Fed should take a pass at this meeting after already delivering a smorgasbord of stimulus measures, which include cutting rates to near zero, massive QE, supporting money market mutual funds, repo operations, support for small-and mid-sized business, relief to state and local governments, all while working with Congress.

A great amount of attention will go to the US advance reading of first quarter GDP. The economy likely contracted anywhere between -7.0% to -1.0% since the coronavirus only impacted the month of March. The consensus estimate is for a 3.7% drop. Expectations are already bad for second quarter GDP to fall nearly 40%, but if the baseline is much worse than expected, we could see risk aversion prevail.

Earnings season heats up this week with huge results from technology, industrial, finance and energy stocks. Thursday will be the main event with both Apple and Amazon reporting after the close.

Country

US Politics

Everyone is watching Georgia. Governor Brian Kemp’s decision to allow some nonessential businesses to reopen means business owners (gyms, barber shops, bowling alleys) have to decide if they are confident enough to open for business. Georgia was late to the game in issuing a stay-at-home order and they will be the first state to reopen large parts of their economy.

Immediately, investors will closely watch how many business owners move forward in opening up, how many employees show up for work and whether consumers are comfortable to go back to stores. The

spread of COVID-19 might take up to two weeks, so if cases spike then, this will likely push back other governors in easing lockdown measures..

UK

The UK may be heading for its sharpest contraction in more than a century, with the lockdown still having at least a couple of weeks to go and easing measures likely to be very gradual thereafter. The PMI data this week was horrific but the same is true everywhere. The all-important services sector unsurprisingly shrank at a phenomenal pace, leaving the 35% contraction estimates last week looking perfectly feasible. On the bright side, the trend of new cases and deaths is looking promising.

Italy

Italy is continuing on a positive trajectory and some small shops are starting to reopen, coming as a relief to the huge number of SME’s in the country. It comes with strict conditions and the lack of tourism and cautious consumer behaviour means it’s going to continue to be extremely tough, but it’s a crucial first step after weeks of lockdown.

Spain

The country is continuing to see cases and deaths broadly move in the right direction, although the last few days has seen slightly increasing cases while deaths have been broadly stable. The government is taking a very cautious approach, warning this week that they are aiming to ease lockdown measures in the second half of May. The country has the second highest number of confirmed cases behind the US and imposed among the most strict lockdown measures.

European Union

EU leaders underwent more painful negotiations this week as they work towards a recovery package for the bloc, estimated to be around €1 trillion. That may sound promising, except the leaders ended the meeting agreeing to leave the details for a future meeting. We all know how that’s going to go. Once again we’re seeing the drawbacks of a group of countries that have different ideas of what a union actually is, wasting time trying to agree on that and responding slowly to the actual crisis at hand.

ECB

The ECB loosened restrictions on its collateral requirements this week, allowing for assets that have been downgraded to junk since 7 April, as long as they remain in the upper tier (two notches into junk). The move eases pressure on banks to ensure they continue to have access to the central banks liquidity operations and lend to boost the economy. Further measures may be announced but nothing specific is expected from the ECB meeting next week, with many central banks increasingly making decisions in emergency meetings when necessary. That said, this may set a precedent on willingness to accept junk debt for its operations, which may encourage some tweaking to other bond buying programs at the meeting in order to further ease conditions.

Turkey

The CBRT exceeded expectations, cutting rates by 100 basis points this week, adding to measures last week to mitigate the economic impact. The central bank claimed the inflation outlook is favourable, citing

weaker commodity prices even as the currency plunges back towards the depths of August 2018 against the dollar.

Russia

Following Friday’s 50 basis points rate cut, the Russian central bank seems poised to continue cutting rates further. The CBR GDP forecast sees the economy shrinking by 4-6% and Governor Nabiullina will likely ramp up stimulus efforts at the next policy meeting.

The Russian central bank’s forecast for oil only to rebound to $25 in the fourth quarter suggests a much slower economic recovery is now being priced in and that supports calls for more aggressive action by the CBR.

South Africa

South African President Cyril Ramaphosa has announced that lockdown measures will be eased starting on 1 May, with economic concerns driving the decision. The country has imposed severe restrictions on movement and work over the last month and while many will remain in place or only be eased slightly, it marks a significant change. The country is among those extremely vulnerable to the economic fallout, having already been suffering prior to the spread. Time will tell whether this is a risk worth taking or just premature.

China

China releases Industrial Profits on Monday 27th and the more important official Manufacturing and Non- Manufacturing PMI’s on Thursday 30th. Both sets of data are expected to disappoint, so a better then expected print could see a substantial jump in Mainland markets.

China continues to keep a lid on a secondary (most imported) wave of COVID-19 cases. Predominantly Chinese returning from Russia. A sharp increase will be negative for markets that are banking on peakvirus being near.

Hong Kong

Balance of Trade on Monday. Exp at HKD-71 billion.

HKMA has been intervening to buy US Dollars at the lower end of the band as rate differentials cause HKD to appreciate. Highly highly unlikely peg breaks. Worries mostly political with arrects of protest leaders, rhetoric from China saying basic law doesn’t apply and personnel changes in Government. All will weigh on investor sentiment.

Singapore

No significant data. Lockdown extended and tightened until the end of May. More fiscal stimulus from the government.

Tightened COVID-19 “circuit-breaker” restrictions continue for the 3rd week, most of the economy that can is working from home. A huge increase in COVID-19 cases has occurred this week from worker dormitories. The headline numbers look terrible but it is actually planned for and under control. The

lockdown extension is more worrying with the economy now deep in recession and the REIT market under serious pressure. Potential downside for SIngapore stocks if bankruptcies increase..

India

No significant data next week.

Attention remains focused on the number of COVID-19 cases and a timetable for the easing of lockdown restrictions that were recently extended. Social unrest concerns are elevated. The worst is yet to come for India in all likelihood.

Australia

Inflation Wednesday and New Home Sales on Friday. Closed for ANZAC Day Monday.

The AUD has risen 8.0% this month, and the ASX 200 by 5% this month. Currency consolidated gains but equities have faded along with US ones. Acutely vulnerable to resource price fears, lower oil and poor China data next week.

New Zealand

Balance of Trade due Wednesday with ANZAC Day holiday this Monday. Level 4 lockdown finishes nationally on Tuesday after acceptable COVID-19 progress.

NZD has rallied 3.50% this month, and the stock market by a huge 12.50% on “peak-virus” and a potential China recovery. Disappointments on either front leave the NZD vulnerable to an aggressive downward reversal although level 4 exit is supportive as the country goes back to work.

Japan

Tuesday BoJ rate decision, Thursday Retail Sales and Industrial Production, Friday April Manufacturing PMI.

A heavy data week but the BoJ rate decision is the main event. Rates expected to be unchanged but high change BoJ cancels JGB buying limits ann expands QE programme to support Govt. fiscal stimulus. JPY should weaken although equities should outperform.

Market

Oil

With tank tops almost being reached, energy traders will focus on production cuts. The upcoming week focuses on critical earnings from many major oil companies. BP reports on Tuesday. Valero and Diamond Offshore provide results on Wednesday. Thursday will have updates from Shell, Total, and ConocoPhillips. Friday will draw special attention with earnings results from Chevron and Exxon. Exxon has been one of the more resistant oil majors to rally behind others in participating with production cuts.

Oil prices have been stabilizing, but the OPEC + production cuts that take effect in May still fall several million barrels short of making up the demand shortfall. OPEC + and the Texas Railroad Commission (oil

regulator) will likely debate deeper coordinated production cuts over the next week, with possibly a coordinated announcement happening by May 5th.

Gold

Gold continues to benefit from global stimulus. Gold will likely see steady support from intensifying efforts by central banks that will expand their balance sheets and as governments continue to deliver regular spending aid. This big mix of stimulus seems to be the backbone argument for gold prices to run to the $2,000 an ounce level.

Gold volatility remains on high, especially to the downside as the bullish bets become overcrowded. Gold could see a lot of the bulls rush to the exits if one of the several vaccines that is phase one clinical trials, but that won’t happen for at least a month.

Bitcoin

Bitcoin is starting to show signs of life ahead of its May 12th halving event and as central banks all over the world continuing to unveil fresh stimulus measures. Bitcoin appears to have found a new wave of retail interest that is firmly believing the macro fundamentals support a much higher valuation. Bitcoin’s recent rebound stemmed from expectations that central banks’ stimulus efforts all over the world will not slow down.

Volatility is about to pick up as the halving event will either be the key catalyst for Bitcoin to soar as it has with the prior two other halving moments or if the surge has already been priced in and this will be used as an excuse to sell it.

Key Economic Releases and Events:

Sunday, April 26th

Japan Lower House by-election in Shizuoka Prefecture

New Zealand and Australian banks will be closed in observance of Anzac Day

Monday, April 27th

UK PM Johnson expected to return to work

Bank of Japan (BOJ) Interest Rate Decision: Expected to increase stimulus efforts, may announce unlimited bond purchases

Tuesday, April 28th

Japanese banks will be closed in observance of Showa Day

BP, Caterpillar, and Alphabet earnings

8:00am Hungary Central Bank Interest Rate Decision: No change in policy expected (announced bond purchases at April 7th intra-policy meeting)

10:00am US April Consumer Confidence: 90e v 120 prior

9:30pm AUD Q1 CPI Q/Q: 0.2%e v 0.7% prior; Y/Y: 2.0%e v 1.8% prior

Wednesday, Apr 29th

8:30am US Q1 Advance GDP Annualized Q/Q: -3.7%e v 2.1% prior; Personal Consumption: -1.3%e v 1.8% prior, GDP Price Index: 0.9% v 1.3% prior, Core PCE Q/Q: No est v 1.3% prior

10:00am US Mar Pending Home Sales M/M: -10.0%e v 2.4% prior

2:00pm US FOMC Rate Decision: Expected to keep target range unchanged at 0.00-0.25%

2:30pm US Fed Chair Powell holds post-FOMC meeting press conference

9:00pm China Apr Manufacturing PMI: 51.0e v 52.0 prior; Non-Manufacturing PMI: 52.8e v 52.3 prior

9:00pm New Zealand Apr Final ANZ Business Confidence: No est v -73.1 prior

Thursday, Apr 30th

Amazon and Apple earnings after the close

1:30am France Q1 Preliminary GDP Q/Q: -4.0%e v -0.1% prior; Y/Y: -3.1%e v 0.9% prior

3:00am Spain Q1 Preliminary GDP Q/Q: -4.4%e v 0.4% prior; Y/Y: -2.9%e v 1.8% prior

3:55am Germany Apr Unemployment Change: 50.0K v 1.0K prior

5:00am Euro Zone Q1 Advance Q/Q: -3.9%e v 0.1% prior; Y/Y: -3.4%e v 1.0% prior

5:00am Euro Zone Apr Preliminary CPI M/M: 0.2%e v 0.5% prior; Y/Y: 0.1%e v 0.7% prior

7:45am EUR ECB Interest Rate Decision: Expected to keep interest rates unchanged

8:30am EUR ECB Press Conference

8:30am US Jobless Claims: 3.5Me v 4.43M prior; Continuing Claims: No est 15.98M prior

8:30am CAD Canada Feb GDP M/M: 0.0%e v 0.1% prior; Y/Y: 1.7%e v 1.8% prior

9:45am US Chicago PMI: 40.0e v 47.8 prior

Friday, May 1st

May Day holiday for many countries

10:00am US Apr ISM Manufacturing: 37.5e v 49.1 prio

Uncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

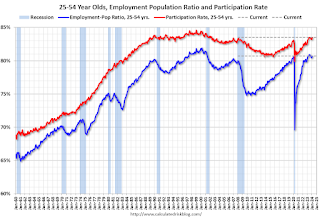

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

Uncategorized

Immune cells can adapt to invading pathogens, deciding whether to fight now or prepare for the next battle

When faced with a threat, T cells have the decision-making flexibility to both clear out the pathogen now and ready themselves for a future encounter.

How does your immune system decide between fighting invading pathogens now or preparing to fight them in the future? Turns out, it can change its mind.

Every person has 10 million to 100 million unique T cells that have a critical job in the immune system: patrolling the body for invading pathogens or cancerous cells to eliminate. Each of these T cells has a unique receptor that allows it to recognize foreign proteins on the surface of infected or cancerous cells. When the right T cell encounters the right protein, it rapidly forms many copies of itself to destroy the offending pathogen.

Importantly, this process of proliferation gives rise to both short-lived effector T cells that shut down the immediate pathogen attack and long-lived memory T cells that provide protection against future attacks. But how do T cells decide whether to form cells that kill pathogens now or protect against future infections?

We are a team of bioengineers studying how immune cells mature. In our recently published research, we found that having multiple pathways to decide whether to kill pathogens now or prepare for future invaders boosts the immune system’s ability to effectively respond to different types of challenges.

Fight or remember?

To understand when and how T cells decide to become effector cells that kill pathogens or memory cells that prepare for future infections, we took movies of T cells dividing in response to a stimulus mimicking an encounter with a pathogen.

Specifically, we tracked the activity of a gene called T cell factor 1, or TCF1. This gene is essential for the longevity of memory cells. We found that stochastic, or probabilistic, silencing of the TCF1 gene when cells confront invading pathogens and inflammation drives an early decision between whether T cells become effector or memory cells. Exposure to higher levels of pathogens or inflammation increases the probability of forming effector cells.

Surprisingly, though, we found that some effector cells that had turned off TCF1 early on were able to turn it back on after clearing the pathogen, later becoming memory cells.

Through mathematical modeling, we determined that this flexibility in decision making among memory T cells is critical to generating the right number of cells that respond immediately and cells that prepare for the future, appropriate to the severity of the infection.

Understanding immune memory

The proper formation of persistent, long-lived T cell memory is critical to a person’s ability to fend off diseases ranging from the common cold to COVID-19 to cancer.

From a social and cognitive science perspective, flexibility allows people to adapt and respond optimally to uncertain and dynamic environments. Similarly, for immune cells responding to a pathogen, flexibility in decision making around whether to become memory cells may enable greater responsiveness to an evolving immune challenge.

Memory cells can be subclassified into different types with distinct features and roles in protective immunity. It’s possible that the pathway where memory cells diverge from effector cells early on and the pathway where memory cells form from effector cells later on give rise to particular subtypes of memory cells.

Our study focuses on T cell memory in the context of acute infections the immune system can successfully clear in days, such as cold, the flu or food poisoning. In contrast, chronic conditions such as HIV and cancer require persistent immune responses; long-lived, memory-like cells are critical for this persistence. Our team is investigating whether flexible memory decision making also applies to chronic conditions and whether we can leverage that flexibility to improve cancer immunotherapy.

Resolving uncertainty surrounding how and when memory cells form could help improve vaccine design and therapies that boost the immune system’s ability to provide long-term protection against diverse infectious diseases.

Kathleen Abadie was funded by a NSF (National Science Foundation) Graduate Research Fellowships. She performed this research in affiliation with the University of Washington Department of Bioengineering.

Elisa Clark performed her research in affiliation with the University of Washington (UW) Department of Bioengineering and was funded by a National Science Foundation Graduate Research Fellowship (NSF-GRFP) and by a predoctoral fellowship through the UW Institute for Stem Cell and Regenerative Medicine (ISCRM).

Hao Yuan Kueh receives funding from the National Institutes of Health.

stimulus covid-19 yuan vaccine stimulusInternational

President Biden Delivers The “Darkest, Most Un-American Speech Given By A President”

President Biden Delivers The "Darkest, Most Un-American Speech Given By A President"

Having successfully raged, ranted, lied, and yelled through…

Having successfully raged, ranted, lied, and yelled through the State of The Union, President Biden can go back to his crypt now.

Whatever 'they' gave Biden, every American man, woman, and the other should be allowed to take it - though it seems the cocktail brings out 'dark Brandon'?

Tl;dw: Biden's Speech tonight ...

-

Fund Ukraine.

-

Trump is threat to democracy and America itself.

-

Abortion is good.

-

American Economy is stronger than ever.

-

Inflation wasn't Biden's fault.

-

Illegals are Americans too.

-

Republicans are responsible for the border crisis.

-

Trump is bad.

-

Biden stands with trans-children.

-

J6 was the worst insurrection since the Civil War.

(h/t @TCDMS99)

Tucker Carlson's response sums it all up perfectly:

"that was possibly the darkest, most un-American speech given by an American president. It wasn't a speech, it was a rant..."

Carlson continued: "The true measure of a nation's greatness lies within its capacity to control borders, yet Bid refuses to do it."

"In a fair election, Joe Biden cannot win"

And concluded:

“There was not a meaningful word for the entire duration about the things that actually matter to people who live here.”

Victor Davis Hanson added some excellent color, but this was probably the best line on Biden:

"he doesn't care... he lives in an alternative reality."

— Tucker Carlson (@TuckerCarlson) March 8, 2024

* * *

Watch SOTU Live here...

* * *

Mises' Connor O'Keeffe, warns: "Be on the Lookout for These Lies in Biden's State of the Union Address."

On Thursday evening, President Joe Biden is set to give his third State of the Union address. The political press has been buzzing with speculation over what the president will say. That speculation, however, is focused more on how Biden will perform, and which issues he will prioritize. Much of the speech is expected to be familiar.

The story Biden will tell about what he has done as president and where the country finds itself as a result will be the same dishonest story he's been telling since at least the summer.

He'll cite government statistics to say the economy is growing, unemployment is low, and inflation is down.

Something that has been frustrating Biden, his team, and his allies in the media is that the American people do not feel as economically well off as the official data says they are. Despite what the White House and establishment-friendly journalists say, the problem lies with the data, not the American people's ability to perceive their own well-being.

As I wrote back in January, the reason for the discrepancy is the lack of distinction made between private economic activity and government spending in the most frequently cited economic indicators. There is an important difference between the two:

-

Government, unlike any other entity in the economy, can simply take money and resources from others to spend on things and hire people. Whether or not the spending brings people value is irrelevant

-

It's the private sector that's responsible for producing goods and services that actually meet people's needs and wants. So, the private components of the economy have the most significant effect on people's economic well-being.

Recently, government spending and hiring has accounted for a larger than normal share of both economic activity and employment. This means the government is propping up these traditional measures, making the economy appear better than it actually is. Also, many of the jobs Biden and his allies take credit for creating will quickly go away once it becomes clear that consumers don't actually want whatever the government encouraged these companies to produce.

On top of all that, the administration is dealing with the consequences of their chosen inflation rhetoric.

Since its peak in the summer of 2022, the president's team has talked about inflation "coming back down," which can easily give the impression that it's prices that will eventually come back down.

But that's not what that phrase means. It would be more honest to say that price increases are slowing down.

Americans are finally waking up to the fact that the cost of living will not return to prepandemic levels, and they're not happy about it.

The president has made some clumsy attempts at damage control, such as a Super Bowl Sunday video attacking food companies for "shrinkflation"—selling smaller portions at the same price instead of simply raising prices.

In his speech Thursday, Biden is expected to play up his desire to crack down on the "corporate greed" he's blaming for high prices.

In the name of "bringing down costs for Americans," the administration wants to implement targeted price ceilings - something anyone who has taken even a single economics class could tell you does more harm than good. Biden would never place the blame for the dramatic price increases we've experienced during his term where it actually belongs—on all the government spending that he and President Donald Trump oversaw during the pandemic, funded by the creation of $6 trillion out of thin air - because that kind of spending is precisely what he hopes to kick back up in a second term.

If reelected, the president wants to "revive" parts of his so-called Build Back Better agenda, which he tried and failed to pass in his first year. That would bring a significant expansion of domestic spending. And Biden remains committed to the idea that Americans must be forced to continue funding the war in Ukraine. That's another topic Biden is expected to highlight in the State of the Union, likely accompanied by the lie that Ukraine spending is good for the American economy. It isn't.

It's not possible to predict all the ways President Biden will exaggerate, mislead, and outright lie in his speech on Thursday. But we can be sure of two things. The "state of the Union" is not as strong as Biden will say it is. And his policy ambitions risk making it much worse.

* * *

The American people will be tuning in on their smartphones, laptops, and televisions on Thursday evening to see if 'sloppy joe' 81-year-old President Joe Biden can coherently put together more than two sentences (even with a teleprompter) as he gives his third State of the Union in front of a divided Congress.

President Biden will speak on various topics to convince voters why he shouldn't be sent to a retirement home.

The state of our union under President Biden: three years of decline. pic.twitter.com/Da1KOIb3eR

— Speaker Mike Johnson (@SpeakerJohnson) March 7, 2024

According to CNN sources, here are some of the topics Biden will discuss tonight:

Economic issues: Biden and his team have been drafting a speech heavy on economic populism, aides said, with calls for higher taxes on corporations and the wealthy – an attempt to draw a sharp contrast with Republicans and their likely presidential nominee, Donald Trump.

Health care expenses: Biden will also push for lowering health care costs and discuss his efforts to go after drug manufacturers to lower the cost of prescription medications — all issues his advisers believe can help buoy what have been sagging economic approval ratings.

Israel's war with Hamas: Also looming large over Biden's primetime address is the ongoing Israel-Hamas war, which has consumed much of the president's time and attention over the past few months. The president's top national security advisers have been working around the clock to try to finalize a ceasefire-hostages release deal by Ramadan, the Muslim holy month that begins next week.

An argument for reelection: Aides view Thursday's speech as a critical opportunity for the president to tout his accomplishments in office and lay out his plans for another four years in the nation's top job. Even though viewership has declined over the years, the yearly speech reliably draws tens of millions of households.

Sources provided more color on Biden's SOTU address:

The speech is expected to be heavy on economic populism. The president will talk about raising taxes on corporations and the wealthy. He'll highlight efforts to cut costs for the American people, including pushing Congress to help make prescription drugs more affordable.

Biden will talk about the need to preserve democracy and freedom, a cornerstone of his re-election bid. That includes protecting and bolstering reproductive rights, an issue Democrats believe will energize voters in November. Biden is also expected to promote his unity agenda, a key feature of each of his addresses to Congress while in office.

Biden is also expected to give remarks on border security while the invasion of illegals has become one of the most heated topics among American voters. A majority of voters are frustrated with radical progressives in the White House facilitating the illegal migrant invasion.

It is probable that the president will attribute the failure of the Senate border bill to the Republicans, a claim many voters view as unfounded. This is because the White House has the option to issue an executive order to restore border security, yet opts not to do so

Maybe this is why?

Most Americans are still unaware that the census counts ALL people, including illegal immigrants, for deciding how many House seats each state gets!

— Elon Musk (@elonmusk) March 7, 2024

This results in Dem states getting roughly 20 more House seats, which is another strong incentive for them not to deport illegals.

While Biden addresses the nation, the Biden administration will be armed with a social media team to pump propaganda to at least 100 million Americans.

"The White House hosted about 70 creators, digital publishers, and influencers across three separate events" on Wednesday and Thursday, a White House official told CNN.

Not a very capable social media team...

The State of Confusion https://t.co/C31mHc5ABJ

— zerohedge (@zerohedge) March 7, 2024

The administration's move to ramp up social media operations comes as users on X are mostly free from government censorship with Elon Musk at the helm. This infuriates Democrats, who can no longer censor their political enemies on X.

Meanwhile, Democratic lawmakers tell Axios that the president's SOTU performance will be critical as he tries to dispel voter concerns about his elderly age. The address reached as many as 27 million people in 2023.

"We are all nervous," said one House Democrat, citing concerns about the president's "ability to speak without blowing things."

The SOTU address comes as Biden's polling data is in the dumps.

BetOnline has created several money-making opportunities for gamblers tonight, such as betting on what word Biden mentions the most.

As well as...

We will update you when Tucker Carlson's live feed of SOTU is published.

Fuck it. We’ll do it live! Thursday night, March 7, our live response to Joe Biden’s State of the Union speech. pic.twitter.com/V0UwOrgKvz

— Tucker Carlson (@TuckerCarlson) March 6, 2024

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges