Government

Watch: Vindicated Rand Paul Blasts Lying Fauci Over “Civilization-Ending” Experiments

Watch: Vindicated Rand Paul Blasts Lying Fauci Over "Civilization-Ending" Experiments

Authored by Steve Watson via Summit News,

Senator Rand Paul, who was again proven right after the National Institutes of Health admitted it did fund gain..

Authored by Steve Watson via Summit News,

Senator Rand Paul, who was again proven right after the National Institutes of Health admitted it did fund gain of function experiments on bat coronaviruses in Wuhan, has blasted Anthony Fauci for lying for a year and a half about research that “could destroy civilization.”

Appearing on Fox News Thursday, Paul urged that Fauci has intentionally “been parsing words” as a way of never admitting that gain of function took place in NIH funded Chinese labs.

“They still to this day are trying to get around the truth,” Paul said, adding “They say ‘well it was unexpected that it gained function’.”

The Senator continued, noting that Fauci’s “declination is this: it’s inadvertent, we didn’t know they were going to gain function. That is what a gain of function experiment is,'” Paul explained.

“You don’t know when you combine two viruses that they will be more deadly, but it might be if you have half a brain you know if you combine two viruses it might be more deadly,” Paul proclaimed.

The Senator also noted that while he has referred Fauci to the Justice Department for investigation, Attorney General Merrick B. Garland is more concerned with targeting “moms complaining about what they are teaching in school.”

Watch:

Earlier Paul had tweeted “I told you so doesn’t even begin to cover it here,” after NIH Principal Deputy Director Lawrence A. Tabak admitted in a letter to Rep. James Comer (R-KY) that a “limited experiment” was conducted to determine whether “spike proteins from naturally occurring bat coronaviruses circulating in China were capable of binding to the human ACE2 receptor in a mouse model.”

“I told you so” doesn’t even begin to cover it here: https://t.co/9JFn85I24i

— Senator Rand Paul (@RandPaul) October 21, 2021

See thread at:

— Richard H. Ebright (@R_H_Ebright) October 20, 2021

https://t.co/SwJtZpix9b

Paul also warned that the NIH is still funding the research:

Realize that NIH is still funding Ecohealth collaboration with Wuhan thru 2025. Fauci has publicly stated his support for Continuing US taxpayer funding of Wuhan. https://t.co/Aq7n8JUst0

— Senator Rand Paul (@RandPaul) October 21, 2021

So, if this type of experiment created a virus that had 50% mortality (like MERS which they have experimented with in Wuhan), that result would be “unknown" before the experiment but not “unexpected.” pic.twitter.com/WmJsjSaCh1

— Senator Rand Paul (@RandPaul) October 21, 2021

HHS Deputy admits Fauci’s NIH funded gain-of-function research in Wuhan but says it was “an unexpected result.” If the experiment combines unknown viruses and tests their ability to infect and damage humanized cells, of course the result is ‘unknown' before the experiment.

— Senator Rand Paul (@RandPaul) October 21, 2021

Earlier in the year Fauci had the gall to accuse Senator Paul of being the liar:

“This is a pattern that Senator Paul has been doing now at multiple hearings, based on no reality … I have never lied, certainly not before Congress. Case closed.”

— The Recount (@therecount) July 20, 2021

— Dr. Fauci ends back-and-forth with Sen. Rand Paul (R-KY). pic.twitter.com/WjGjQUFE0d

In a further interview with ABC News, Paul urged “I’ve been asking my counterparts, Democrats across the aisle, to investigate this. Not for partisan reasons, but because both sides should want to prevent another pandemic from occurring.”

“Right now we have a virus where the whole world has been turned on its head, it has a 1% mortality. Can you imagine if they create something in a lab that has a 15% mortality or 50% mortality?” Paul warned, adding “Some of the viruses they have been experimenting with in Wuhan have 50% mortality.”

The Senator added “This isn’t just about Dr. Fauci lying, this is about trying to make sure that we don’t get an even worse plague or pandemic that comes out of a lab. We do this research in our country, it needs to be looked at.”

Paul further emphasised that Fauci “is the world’s biggest supporter of gain-of-function,” and that “he should accept responsibility and immediately resign and step down from government.”

During a Department of Justice oversight hearing Thursday, Representative Andy Biggs questioned Merrick Garland about Fauci’s lies, noting that they constitute perjury, asking whether Garland would be opening an investigation.

Garland responded “Again, I’ll refer to the long standing departmental norm that we don’t comment about investigations pending or unpending, the general point that you’re making normally would come with a referral from the relevant committee.”

Watch:

* * *

Brand new merch now available! Get it at https://www.pjwshop.com/

In the age of mass Silicon Valley censorship It is crucial that we stay in touch. We need you to sign up for our free newsletter here. Support our sponsor – Turbo Force – a supercharged boost of clean energy without the comedown. Also, we urgently need your financial support here.

Government

Harvard Medical School Professor Was Fired Over Not Getting COVID Vaccine

Harvard Medical School Professor Was Fired Over Not Getting COVID Vaccine

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

A…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

A Harvard Medical School professor who refused to get a COVID-19 vaccine has been terminated, according to documents reviewed by The Epoch Times.

Martin Kulldorff, an epidemiologist, was fired by Mass General Brigham in November 2021 over noncompliance with the hospital’s COVID-19 vaccine mandate after his requests for exemptions from the mandate were denied, according to one document. Mr. Kulldorff was also placed on leave by Harvard Medical School (HMS) because his appointment as professor of medicine there “depends upon” holding a position at the hospital, another document stated.

Mr. Kulldorff asked HMS in late 2023 how he could return to his position and was told he was being fired.

“You would need to hold an eligible appointment with a Harvard-affiliated institution for your HMS academic appointment to continue,” Dr. Grace Huang, dean for faculty affairs, told the epidemiologist and biostatistician.

She said the lack of an appointment, combined with college rules that cap leaves of absence at two years, meant he was being terminated.

Mr. Kulldorff disclosed the firing for the first time this month.

“While I can’t comment on the specifics due to employment confidentiality protections that preclude us from doing so, I can confirm that his employment agreement was terminated November 10, 2021,” a spokesperson for Brigham and Women’s Hospital told The Epoch Times via email.

Mass General Brigham granted just 234 exemption requests out of 2,402 received, according to court filings in an ongoing case that alleges discrimination.

The hospital said previously, “We received a number of exemption requests, and each request was carefully considered by a knowledgeable team of reviewers.”

“A lot of other people received exemptions, but I did not,” Mr. Kulldorff told The Epoch Times.

Mr. Kulldorff was originally hired by HMS but switched departments in 2015 to work at the Department of Medicine at Brigham and Women’s Hospital, which is part of Mass General Brigham and affiliated with HMS.

“Harvard Medical School has affiliation agreements with several Boston hospitals which it neither owns nor operationally controls,” an HMS spokesperson told The Epoch Times in an email. “Hospital-based faculty, such as Mr. Kulldorff, are employed by one of the affiliates, not by HMS, and require an active hospital appointment to maintain an academic appointment at Harvard Medical School.”

HMS confirmed that some faculty, who are tenured or on the tenure track, do not require hospital appointments.

Natural Immunity

Before the COVID-19 vaccines became available, Mr. Kulldorff contracted COVID-19. He was hospitalized but eventually recovered.

That gave him a form of protection known as natural immunity. According to a number of studies, including papers from the U.S. Centers for Disease Control and Prevention, natural immunity is better than the protection bestowed by vaccines.

Other studies have found that people with natural immunity face a higher risk of problems after vaccination.

Mr. Kulldorff expressed his concerns about receiving a vaccine in his request for a medical exemption, pointing out a lack of data for vaccinating people who suffer from the same issue he does.

“I already had superior infection-acquired immunity; and it was risky to vaccinate me without proper efficacy and safety studies on patients with my type of immune deficiency,” Mr. Kulldorff wrote in an essay.

In his request for a religious exemption, he highlighted an Israel study that was among the first to compare protection after infection to protection after vaccination. Researchers found that the vaccinated had less protection than the naturally immune.

“Having had COVID disease, I have stronger longer lasting immunity than those vaccinated (Gazit et al). Lacking scientific rationale, vaccine mandates are religious dogma, and I request a religious exemption from COVID vaccination,” he wrote.

Both requests were denied.

Mr. Kulldorff is still unvaccinated.

“I had COVID. I had it badly. So I have infection-acquired immunity. So I don’t need the vaccine,” he told The Epoch Times.

Dissenting Voice

Mr. Kulldorff has been a prominent dissenting voice during the COVID-19 pandemic, countering messaging from the government and many doctors that the COVID-19 vaccines were needed, regardless of prior infection.

He spoke out in an op-ed in April 2021, for instance, against requiring people to provide proof of vaccination to attend shows, go to school, and visit restaurants.

“The idea that everybody needs to be vaccinated is as scientifically baseless as the idea that nobody does. Covid vaccines are essential for older, high-risk people and their caretakers and advisable for many others. But those who’ve been infected are already immune,” he wrote at the time.

Mr. Kulldorff later co-authored the Great Barrington Declaration, which called for focused protection of people at high risk while removing restrictions for younger, healthy people.

Harsh restrictions such as school closures “will cause irreparable damage” if not lifted, the declaration stated.

The declaration drew criticism from Dr. Anthony Fauci, head of the National Institute of Allergy and Infectious Diseases, and Dr. Rochelle Walensky, who became the head of the CDC, among others.

In a competing document, Dr. Walensky and others said that “relying upon immunity from natural infections for COVID-19 is flawed” and that “uncontrolled transmission in younger people risks significant morbidity(3) and mortality across the whole population.”

“Those who are pushing these vaccine mandates and vaccine passports—vaccine fanatics, I would call them—to me they have done much more damage during this one year than the anti-vaxxers have done in two decades,” Mr. Kulldorff later said in an EpochTV interview. “I would even say that these vaccine fanatics, they are the biggest anti-vaxxers that we have right now. They’re doing so much more damage to vaccine confidence than anybody else.”

Surveys indicate that people have less trust now in the CDC and other health institutions than before the pandemic, and data from the CDC and elsewhere show that fewer people are receiving the new COVID-19 vaccines and other shots.

Support

The disclosure that Mr. Kulldorff was fired drew criticism of Harvard and support for Mr. Kulldorff.

The termination “is a massive and incomprehensible injustice,” Dr. Aaron Kheriaty, an ethics expert who was fired from the University of California–Irvine School of Medicine for not getting a COVID-19 vaccine because he had natural immunity, said on X.

“The academy is full of people who declined vaccines—mostly with dubious exemptions—and yet Harvard fires the one professor who happens to speak out against government policies.” Dr. Vinay Prasad, an epidemiologist at the University of California–San Francisco, wrote in a blog post. “It looks like Harvard has weaponized its policies and selectively enforces them.”

A petition to reinstate Mr. Kulldorff has garnered more than 1,800 signatures.

Some other doctors said the decision to let Mr. Kulldorff go was correct.

“Actions have consequence,” Dr. Alastair McAlpine, a Canadian doctor, wrote on X. He said Mr. Kulldorff had “publicly undermine[d] public health.”

International

“Extreme Events”: US Cancer Deaths Spiked In 2021 And 2022 In “Large Excess Over Trend”

"Extreme Events": US Cancer Deaths Spiked In 2021 And 2022 In "Large Excess Over Trend"

Cancer deaths in the United States spiked in 2021…

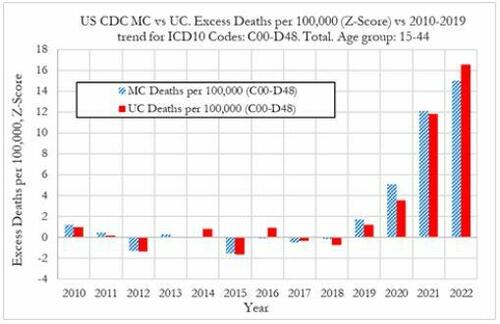

Cancer deaths in the United States spiked in 2021 and 2022 among 15-44 year-olds "in large excess over trend," marking jumps of 5.6% and 7.9% respectively vs. a rise of 1.7% in 2020, according to a new preprint study from deep-dive research firm, Phinance Technologies.

Extreme Events

The report, which relies on data from the CDC, paints a troubling picture.

"We show a rise in excess mortality from neoplasms reported as underlying cause of death, which started in 2020 (1.7%) and accelerated substantially in 2021 (5.6%) and 2022 (7.9%). The increase in excess mortality in both 2021 (Z-score of 11.8) and 2022 (Z-score of 16.5) are highly statistically significant (extreme events)," according to the authors.

That said, co-author, David Wiseman, PhD (who has 86 publications to his name), leaves the cause an open question - suggesting it could either be a "novel phenomenon," Covid-19, or the Covid-19 vaccine.

Cancer deaths in US in 2021 & 2022 in large excess over trend for 15-44 year-olds as extreme events. A novel phenomenon? C19? lockdowns? C19 vaccines? Honored to participate in this work. #CDC where are you? @DowdEdwardhttps://t.co/iUV5oQiWCW pic.twitter.com/uytzaIvvor

— David Wiseman PhD, MRPharmS (@AdhesionsOrg) March 12, 2024

"The results indicate that from 2021 a novel phenomenon leading to increased neoplasm deaths appears to be present in individuals aged 15 to 44 in the US," reads the report.

The authors suggest that the cause may be the result of "an unexpected rise in the incidence of rapidly growing fatal cancers," and/or "a reduction in survival in existing cancer cases."

They also address the possibility that "access to utilization of cancer screening and treatment" may be a factor - the notion that pandemic-era lockdowns resulted in fewer visits to the doctor. Also noted is that "Cancers tend to be slowly-developing diseases with remarkably stable death rates and only small variations over time," which makes "any temporal association between a possible explanatory factor (such as COVID-19, the novel COVID-19 vaccines, or other factor(s)) difficult to establish."

That said, a ZeroHedge review of the CDC data reveals that it does not provide information on duration of illness prior to death - so while it's not mentioned in the preprint, it can't rule out so-called 'turbo cancers' - reportedly rapidly developing cancers, the existence of which has been largely anecdotal (and widely refuted by the usual suspects).

While the Phinance report is extremely careful not to draw conclusions, researcher "Ethical Skeptic" kicked the barn door open in a Thursday post on X - showing a strong correlation between "cancer incidence & mortality" coinciding with the rollout of the Covid mRNA vaccine.

The argument is over.

— Ethical Skeptic ☀ (@EthicalSkeptic) March 14, 2024

The Covid mRNA Vaxx has cause a sizeable 2021 inflection, and now novel-trend elevation in terms of both cancer incidence & mortality.

Now you know who the liars were all along.

????Incidence = 14.8% excess

????UCoD Mortality = 5.3% excess (lags Incidence) pic.twitter.com/uwN9GMrHl1

Phinance principal Ed Dowd commented on the post, noting that "Cancer is suddenly an accelerating growth industry!"

????Indeed it is…Cancer is suddenly an accelerating growth industry! @EthicalSkeptic provides a chart below showing US Cancer treatment in constant dollars with a current growth rate of 14.8% (6.3% New CAGR) versus long term trend of 1.78% CAGR or $33.8 billion in excess cancer… https://t.co/RIn4R2YZZ7

— Edward Dowd (@DowdEdward) March 14, 2024

Continued:

As a former portfolio manager of of a $14 billion Large Cap Growth Equity portfolio I can definitively say Cancer treatments and the Disabilities have become growth industries that both have inflection points coincidental to the mRNA vaccine rollouts in 2021.

— Edward Dowd (@DowdEdward) March 14, 2024

Chart 1 from… pic.twitter.com/TCt4X1plnM

Bottom line - hard data is showing alarming trends, which the CDC and other agencies have a requirement to explore and answer truthfully - and people are asking #WhereIsTheCDC.

We aren't holding our breath.

Experts are sounding the alarm on a spike in cancer diagnosis worldwide. It is still a mystery. @DowdEdward from Phinance Technologies has also been sounding the alarm for months.

— dr.ir. Carla Peeters (@CarlaPeeters3) March 15, 2024

We are facing a dramatic degradation of the human immune system https://t.co/CPnwP3Oj9G

Wiseman, meanwhile, points out that Pfizer and several other companies are making "significant investments in cancer drugs, post COVID."

Pfizer among several companies making significant investments in cancer drugs, post COVID. @DowdEdward @Kevin_McKernan @JesslovesMJK @niki_kyrylenko https://t.co/nefEZYLW1o https://t.co/r505Sbbcq4

— David Wiseman PhD, MRPharmS (@AdhesionsOrg) March 15, 2024

Phinance

We've featured several of Phinance's self-funded deep dives into pandemic data that nobody else is doing. If you'd like to support them, click here.

List of our projects following disturbing tends in deaths, disabilities and absences.

— Edward Dowd (@DowdEdward) March 16, 2024

Link to projects at bottom.

✅ V-Damage Project

✅ Excess Mortality Project

✅ US Disabilities Project

✅ US BLS Absence rates Project

✅ US Cause of Death Project

✅ UK Cause of Death…

International

Gen Z, The Most Pessimistic Generation In History, May Decide The Election

Gen Z, The Most Pessimistic Generation In History, May Decide The Election

Authored by Mike Shedlock via MishTalk.com,

Young adults are more…

Authored by Mike Shedlock via MishTalk.com,

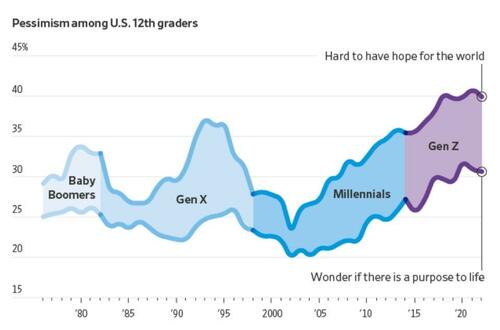

Young adults are more skeptical of government and pessimistic about the future than any living generation before them.

This is with reason, and it’s likely to decide the election.

Rough Years and the Most Pessimism Ever

The Wall Street Journal has an interesting article on The Rough Years That Turned Gen Z Into America’s Most Disillusioned Voters.

Young adults in Generation Z—those born in 1997 or after—have emerged from the pandemic feeling more disillusioned than any living generation before them, according to long-running surveys and interviews with dozens of young people around the country. They worry they’ll never make enough money to attain the security previous generations have achieved, citing their delayed launch into adulthood, an impenetrable housing market and loads of student debt.

And they’re fed up with policymakers from both parties.

Washington is moving closer to passing legislation that would ban or force the sale of TikTok, a platform beloved by millions of young people in the U.S. Several young people interviewed by The Wall Street Journal said they spend hours each day on the app and use it as their main source of news.

“It’s funny how they quickly pass this bill about this TikTok situation. What about schools that are getting shot up? We’re not going to pass a bill about that?” Gaddie asked. “No, we’re going to worry about TikTok and that just shows you where their head is…. I feel like they don’t really care about what’s going on with humanity.”

Gen Z’s widespread gloominess is manifesting in unparalleled skepticism of Washington and a feeling of despair that leaders of either party can help. Young Americans’ entire political memories are subsumed by intense partisanship and warnings about the looming end of everything from U.S. democracy to the planet. When the darkest days of the pandemic started to end, inflation reached 40-year highs. The right to an abortion was overturned. Wars in Ukraine and the Middle East raged.

Dissatisfaction is pushing some young voters to third-party candidates in this year’s presidential race and causing others to consider staying home on Election Day or leaving the top of the ticket blank. While young people typically vote at lower rates, a small number of Gen Z voters could make the difference in the election, which four years ago was decided by tens of thousands of votes in several swing states.

Roughly 41 million Gen Z Americans—ages 18 to 27—will be eligible to vote this year, according to Tufts University.

Gen Z is among the most liberal segments of the electorate, according to surveys, but recent polling shows them favoring Biden by only a slim margin. Some are unmoved by those who warn that a vote against Biden is effectively a vote for Trump, arguing that isn’t enough to earn their support.

Confidence

When asked if they had confidence in a range of public institutions, Gen Z’s faith in them was generally below that of the older cohorts at the same point in their lives.

One-third of Gen Z Americans described themselves as conservative, according to NORC’s 2022 General Social Survey. That is a larger share identifying as conservative than when millennials, Gen X and baby boomers took the survey when they were the same age, though some of the differences were small and within the survey’s margin of error.

More young people now say they find it hard to have hope for the world than at any time since at least 1976, according to a University of Michigan survey that has tracked public sentiment among 12th-graders for nearly five decades. Young people today are less optimistic than any generation in decades that they’ll get a professional job or surpass the success of their parents, the long-running survey has found. They increasingly believe the system is stacked against them and support major changes to the way the country operates.

Gen Z future Outcome

“It’s the starkest difference I’ve documented in 20 years of doing this research,” said Twenge, the author of the book “Generations.” The pandemic, she said, amplified trends among Gen Z that have existed for years: chronic isolation, a lack of social interaction and a propensity to spend large amounts of time online.

A 2020 study found past epidemics have left a lasting impression on young people around the world, creating a lack of confidence in political institutions and their leaders. The study, which analyzed decades of Gallup World polling from dozens of countries, found the decline in trust among young people typically persists for two decades.

Young people are more likely than older voters to have a pessimistic view of the economy and disapprove of Biden’s handling of inflation, according to the recent Journal poll. Among people under 30, Biden leads Trump by 3 percentage points, 35% to 32%, with 14% undecided and the remaining shares going to third-party candidates, including 10% to independent Robert F. Kennedy Jr.

Economic Reality

Gen Z may be the first generation in US history that is not better off than their parents.

Many have given up on the idea they will ever be able to afford a home.

The economy is allegedly booming (I disagree). Regardless, stress over debt is high with younger millennials and zoomers.

This has been a constant theme of mine for many months.

Credit Card and Auto Delinquencies Soar

Credit card debt surged to a record high in the fourth quarter. Even more troubling is a steep climb in 90 day or longer delinquencies.

Record High Credit Card Debt

Credit card debt rose to a new record high of $1.13 trillion, up $50 billion in the quarter. Even more troubling is the surge in serious delinquencies, defined as 90 days or more past due.

For nearly all age groups, serious delinquencies are the highest since 2011.

Auto Loan Delinquencies

Serious delinquencies on auto loans have jumped from under 3 percent in mid-2021 to to 5 percent at the end of 2023 for age group 18-29.Age group 30-39 is also troubling. Serious delinquencies for age groups 18-29 and 30-39 are at the highest levels since 2010.

For further discussion please see Credit Card and Auto Delinquencies Soar, Especially Age Group 18 to 39

Generational Homeownership Rates

Home ownership rates courtesy of Apartment List

The above chart is from the Apartment List’s 2023 Millennial Homeownership Report

Those struggling with rent are more likely to be Millennials and Zoomers than Generation X, Baby Boomers, or members of the Silent Generation.

The same age groups struggling with credit card and auto delinquencies.

On Average Everything is Great

Average it up, and things look pretty good. This is why we have seen countless stories attempting to explain why people should be happy.

Krugman Blames Partisanship

With the recent rise in consumer sentiment, time to revisit this excellent Briefing Book paper. On reflection, I'd do it a bit differently; same basic conclusion, but I think partisan asymmetry explains even more of the remaining low numbers 1/ https://t.co/4lqm7X4472

— Paul Krugman (@paulkrugman) February 17, 2024

OK, there is a fair amount of partisanship in the polls.

However, Biden isn’t struggling from partisanship alone. If that was the reason, Biden would not be polling so miserably with Democrats in general, blacks, and younger voters.

OK, there is a fair amount of partisanship in the polls.

However, Biden isn’t struggling from partisanship alone. If that was the reason, Biden would not be polling so miserably with Democrats in general, blacks, and younger voters.

This allegedly booming economy left behind the renters and everyone under the age of 40 struggling to make ends meet.

Many Are Addicted to “Buy Now, Pay Later” Plans

Buy Now Pay Later, BNPL, plans are increasingly popular. It’s another sign of consumer credit stress.

For discussion, please see Many Are Addicted to “Buy Now, Pay Later” Plans, It’s a Big Trap

The study did not break things down by home owners vs renters, but I strongly suspect most of the BNPL use is by renters.

What About Jobs?

Another seemingly strong jobs headline falls apart on closer scrutiny. The massive divergence between jobs and employment continued into February.

Nonfarm payrolls and employment levels from the BLS, chart by Mish.

Payrolls vs Employment Gains Since March 2023

-

Nonfarm Payrolls: 2,602,000

-

Employment Level: +144,000

-

Full Time Employment: -284,000

For more details of the weakening labor markets, please see Jobs Up 275,000 Employment Down 184,000

CPI Hot Again

CPI Data from the BLS, chart by Mish.

For discussion of the CPI inflation data for February, please see CPI Hot Again, Rent Up at Least 0.4 Percent for 30 Straight Months

Also note the Producer Price Index (PPI) Much Hotter Than Expected in February

Major Economic Cracks

There are economic cracks in spending, cracks in employment, and cracks in delinquencies.

But there are no cracks in the CPI. It’s coming down much slower than expected. And the PPI appears to have bottomed.

Add it up: Inflation + Recession = Stagflation.

Election Impact

In 2020, younger voters turned out in the biggest wave in history. And they voted for Biden.

Younger voters are not as likely to vote in 2024, and they are less likely to vote for Biden.

Millions of voters will not vote for either Trump or Biden. Net, this will impact Biden more. The base will not decide the election, but the Trump base is far more energized than the Biden base.

If Biden signs a TikTok ban, that alone could tip the election.

If No Labels ever gets its act together, I suspect it will siphon more votes from Biden than Trump. But many will just sit it out.

“We’re just kind of over it,” Noemi Peña, 20, a Tucson, Ariz., resident who works in a juice bar, said of her generation’s attitude toward politics. “We don’t even want to hear about it anymore.” Peña said she might not vote because she thinks it won’t change anything and “there’s just gonna be more fighting.” Biden won Arizona in 2020 by just over 10,000 votes.

The Journal noted nearly one-third of voters under 30 have an unfavorable view of both Biden and Trump, a higher number than all older voters. Sixty-three percent of young voters think neither party adequately represents them.

Young voters in 2020 were energized to vote against Trump. Now they have thrown in the towel.

And Biden telling everyone how great the economy is only rubs salt in the wound.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Spread & Containment4 days ago

Spread & Containment4 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex