Use Of Digital Technology To Build Resilient Portfolios

Use Of Digital Technology To Build Resilient Portfolios. Going Beyond 60/40 Traditional Asset Allocation. Q3 2020 hedge fund letters, conferences and more 60/40 Portfolios have been the safe harbour of institutional investors for decades, their steady…

Use Of Digital Technology To Build Resilient Portfolios. Going Beyond 60/40 Traditional Asset Allocation.

Get The Full Ray Dalio Series in PDF

Get the entire 10-part series on Ray Dalio in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues

Q3 2020 hedge fund letters, conferences and more

60/40 Portfolios have been the safe harbour of institutional investors for decades, their steady state. For decades, they have exhibited much better risk-adjusted returns than both Equity and Bond pure-plays; displaying only marginally lower returns than pure Equity long-only, for a fraction of the volatility.

However, in the next 10 years, Bonds are unlikely to save the day during Equity market storms. After a 40+ year rally, Bonds hit the zero bound on interest rates, now even in the US, and any price increase from here is mathematically compromised. If another Dot-Com Bubble Burst, or if another Lehman, February 2018, March 2020 event were to occur, the loss for balanced portfolios would be far greater than back then. Largely, this is a by-product of the market fragility crafted by a decade of relentless interventionism from Central banks and forceful manipulation of price discovery on publicly traded assets. It spiralled positive feedback loops across the market system (from excess risk taking and leverage, to accept no covenants / no collateral when lending, to Buybacks mania, IPOs frenzy, retail trading fever pitch), sending the market into a far-from-equilibrium state. 2020 will go down in history as the supreme testament to Central Bank omnipotence over markets: financial markets performance VS performance of the economy.

At the same time, the risk of equity drawdowns is greater than ever, given (i) valuations at all-time record highs and (ii) a narrow market leadership where few stocks account for all of the gains and 30%+ of market cap. Drawdowns kept increasing in magnitude over the last few years, while shortening in tempo (flash crashes), to reach earthquake-sized-shaped moves in 2020. Further, faster, larger gap downs seem baked in the cake, owing to a chronic state of inherent, profound market fragility.

What can be done to protect portfolios in the decade to come and what can be added to the flawed 60/40 mix? Gold? Bitcoin? Private Assets? CTAs as crisis alpha? Long volatility as an asset class? Here below we propose Fasanara’s alternative asset class: the extensive use of technology in both Digital Lending and Digital Assets, which harnesses novel investment tools born out of technological progress and digital disruption in financial services and payments. Here’s to a promising Digital Future!

Table Of Contents:

The 60/40 Portfolio Steady State System Is Broken

- Bonds Are Obscenely Expensive, And No Longer Able To Hedge Equities

- Equities Are Obscenely Expensive, And Likely To Exhibit Large Drawdowns

- False Diversification Leads To Profound Portfolio Fragility

- What Can Be Done To Pursue Financial Resiliency In 2021

Digital Future

- Digital Lending:

- Platformification Of Credit & Banking

- FinTech Evolution Opening Up New Capital Markets For The Real Economy

- Embedded Finance & FinTech Ecosystems

- Digital Assets:

- The New Currencies, Private & Public

- Bankless DeFi Ecosystems

- Trading-wise, Volatility And Inefficiency Are Monetizable To Generate Uncorrelated Returns

The 60/40 Portfolio Steady State System Is Broken

After a long run spanning over several decades, the 60/40 default state has reached its terminus. It was followed by most participants of the institutionalised asset management world. It is now unsustainable. Empirical evidence for it is overwhelming.

The first forensic evidence for this is the sheer magnitude of money printing the system got addicted to, and the inability for it to perpetuate endlessly into the future. MMT theories think differently but, crucially, the marginal effectiveness of new units of credit is already at or below zero across major economies. Money multipliers and velocity of money have collapsed over time. No wonder many market participants – and people in general – have lost trust in the system, and seek supply-constrained, ownerless, open-source alternatives (no shortage of arguments and data points for this narrative).

Since the beginning of the COVID crisis alone, the G10 major econ0mies have injected a whopping $15 trillion overall in monetary and fiscal stimulus measures. This includes an increase in central bank balance sheets since the crisis erupted, new government cash injections and spending pledges, as well as about $7 trillion worth of quasi-fiscal loan and credit guarantees.

But the largesse predates 2020. Really it can be traced back to the Global Financial Crisis. In the US alone, the mothership of global financial markets, increases in the Fed’s balance sheet added to the US Government’s budget outlays, deficits, and US total debt. All increased in unison over the period to then blow up in 2020.

To those arguing that the equity rally is sustainable on strong economic fundamentals to materialise in the years ahead (as the vaccines take hold), the following overarching questions remain: what about the 20+ trillion that got us here? What about yields at zero, mechanically forcing investors into nearby asset classes? Is that real demand and real price discovery / fair value? How much of today’s prices of bonds and equities is attributable to that? How much of the 20+ trillion is replicable in the future? At what marginal effectiveness? If so, what breakeven escape velocity and inflation is needed to get us out of the deep hole?

Further excruciating dilemmas include: how do we know how much printing is enough? How much divergence between the real economy and financial markets is sustainable? And, what happens if we are near a tipping point in both?

The second piece of evidence is pure mathematics for the largest asset class on the planet: Bonds. The price of a bond is inversely correlated to its yield. The yield is (was) floored at zero. When the yield is zero, duration equals maturity, and is the longest possible. When the yield is below zero, the bond still pulls to par - inevitably - at maturity, meaning that the negative yield is nothing more than a tax – it did nothing to change the mathematics of the instrument. This means that bond prices cannot rally further when yields hit the zero bound of interest rates. They can have moments of glory and momentarily positive mark-to-markets; but those are fleeting gains, paper gains, to vanish as the bond approaches its legal maturity. Except if Central Banks buy those bonds at negative yields, before the pull-to-par. However, this is just a subsidy (and a needless paradox). In other words, a tax first, a subsidy later, the illusion of a profit, the mirage of an asset class, the wishful thinking of an entire investor base. All in all, a giant paradox. To heavily regulated investors, still a good return of capital (ROC); however, from a risk management perspective, the greatest failure of the theory, a catastrophe of a position with the largest negative convexity. An oxymoron to a rational investment decision.

None of this is new - we have drawn in zero and negative rates since 2016 - but it is always worth reminding ourselves of its lunacy and futility. None of this is to say that zero-ish rates will disappear tomorrow. In fact, they will likely last for years to come. The point is to stress the inadequacy of 60/40 balanced portfolios, unfit for today’s markets, reminding us how they have moved from being safe harbours of capital to time bombs. Akin to the anachronism of swords in modern warfare.

Source: IMF-Fiscal Monitor Oct 2020 (Data as of 11-Sep-20); World Economic Outlook Database - Oct 2020; World Economic Outlook Database - Oct 2020

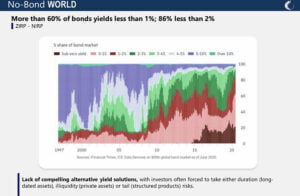

Globally, 90% of the bond universe yields less than 2%, 70% less than 1%. To a sober mind, these are dramatic figures.

If you are holding a long-dated Nestle bond as a safe haven asset, in the hope that it will help ameliorate portfolio performance during an equity drawdown, you are setting yourself up for a rude awakening. A simple 1% move up in interest rates will wipe out almost 20% of its value.

Possibly more than you lost on the equity part of the portfolio during that specific drawdown. Did you hold the bond for the income it generates then? Not really, the yield is zero-ish.

On equities, there is no shortage of evidence that current equity valuations are merely driven by Central Bank liquidity injections and government fiscal stimulus, both reaching biblical proportions in 2020. Valuations are merely ornamental, episodic: nobody cares, since long. Unsurprisingly, economic narratives at the margin are handy as always: (i) the technology revolution can justify 9x price performance in just a few months in a world ravaged by a pandemic (imagination factor / it is different this time), (ii) unlimited supply of money printing/MMT holds the promise of eternal bonanza (dream factor / sky is the limit axiom), (iii) hubris has no downside as Central Banks have your back (greed factor), (iv) don’t fight the FED (fear factor / FOMO / TINA).

We argue that the current state is not only fragile (built on the thin ice of liquidity momentum), but also unsustainable, as it gives rise to levels of income inequality which are incompatible with the status quo. Nowhere was it more visible than in 2020, where the divarication between stellar financial markets performance (concentrated at the top and with only a handful of players) and dismal real economy performance (affecting the bottom 60%) was in full display. A tipping point may be nearing, when a steep reset in prices and a realignment in societal cohorts becomes inevitable in an effort to stem off political revolution. As we get closer to reaching this redistribution, hefty volatility for markets should be a sober investor’s baseline scenario, with no line of defence in bonds to resort to. This is especially painful for institutional investors who must rely on regular income distributions and profit realisations over the lifecycle of the investment: the first are nil at zero rates, the second are uncertain if they are needed during drawdowns. False diversification across balanced portfolios has disseminated across, making overcompensation to the downside during downturns ever more likely ipso facto exacerbating the magnitude of those expected drawdowns. No wonder the size of drawdowns has been steadily increasing over recent years, while their tempo also fastened, e.g. August 2015, January/February 2016, Feb 2018, Q4 2018, March 2020.

One could say that both bonds and equities are in ‘Fugazi territory’. The market system has been degrading for years now, over-extending into a far-from-equilibrium state, where the dynamics of criticality apply. We have long argued that we are going through a critical transition, at the edge of chaos, and that during ‘phase transition zone’ chaotic conditions apply: markets move little and slowly at first, and then fast and big suddenly, the very definition of chaotic behaviour. Furious eruptions after intermittent periods of illusory peace, within a context of radical uncertainty. The magnitude of variations kept on increasing in recent years, like the patterns of seismic waves preceding an earthquake.

These outbursts of volatility are more structural than episodic. The next crisis is wrongly assumed to resemble the past ones: 1929’s Great Depression, 1987’s Black Monday, 2000’s Dot-Com Bubble Burst, 2008’s Global Financial Crisis. We believe it could be more of a transformational event, more comparable to a 1971’s End of Bretton Woods -type scenario: a deep break from the status quo, a transition into a new paradigm altogether. At present, the transformation is taking place in an evolutionary manner: some aspects of the financial system are being gradually tweaked, while other parts are changing exponentially. A point of fracture and non-linear discontinuity is easily imaginable.

In our recent piece The Market Economy In 2025: A Visualization Exercise | Emergence of New Capital Markets, we envisioned the novel capital markets (FinTech Ecosystems, Platformification) of the not so distant future as a radically different operating environment from the one we are accustomed to with a different reserve currency system from the US Dollar: a multiverse of fiat currencies (USD, CNH, XDR), and/or a different setting altogether with digital currencies at the helm, either non-government sponsored (Libra et al, Bitcoin et al, Altcoins) or government-sponsored (Central Bank Digital Currencies), or a combination of all of the above. Chaos will play a role in determining the end destination, the random walk of markets and economies past the tipping point / critical threshold of a system long gone into degradation, spinning through the loops of runaway effects.

Digital Future

As we travel towards market catharsis, what can institutional investors do to protect themselves against portfolio volatility in the next decade?

One antidote against transformative markets in disruption is to embrace the novelty itself, embrace the future now. Balanced portfolios can morph into future-proof, tech-enabled portfolios, using technology and innovation to seek resiliency, anti-bubble formation. The digital portfolios of the future are already implementable today and at scale.

We can think of two additions to a classic balanced portfolio that would make it fit for time travel:

- Digital Lending: Platform-ification of Credit & Banking / the New Capital Markets for the Real Economy / Embedded Finance / FinTech Infrastructure / FinTech Ecosystems; and

- Digital Assets: Now Institutional, No Longer a Fluke / Legitimate Scepticism Missed Two Key Points: (i) the Unmet Need / Lack of Alternatives in the Real Economy and (ii) the Availability of Sources of Alpha in Trading.

Digital Lending, FinTech Platformification

In the face of chaos and radical uncertainty, policymakers have resorted to throwing the kitchen sink at it, using monetary and fiscal singularity under the clout of COVID. This is unlikely to change any time soon, preventing normal market operations from resuming.

As money flows concentrate further into the largest stocks / asset managers, the by-product is that capital allocation into smaller worthy projects outside of market hype will have to happen outside public markets and the traditional institutionalised asset management industry, through alternative specialist funding channels (i.e. non-bank lenders and often non-asset managers as well). Novel and parallel capital markets will keep emerging, as a way for the system to rebalance itself, away from elitist market bubbles, plugged straight into the real economy.

We are on the cusp of the deepest, fastest, most consequential disruption to the financial system infrastructure in modern history. The emergence of new capital markets is upon us.

As outlined in our latest scenario report ‘The Market Economy In 2025: Emergence of New Capital Markets’, we foresee the emergence of a radically different financial system.

While in a not-too-distant future banks will likely be profoundly transformed, banking activity will remain at the centre of economic activity and value creation. A wave of non-bank lenders have already started to fill the funding gap left by traditional lenders exiting less profitable activities to retrench into mainstream markets, and will continue to do so to an ever-increasing extent once the value proposition becomes ever more apparent in the next few years. We are close to reaching a critical threshold in this process, leading to mass adoption of alternative lending solutions.

In this future environment, institutional investors should look beyond traditional, highly overvalued equity and fixed income markets to generate stable, sustainable returns. Everything is tradable and investable around us, in this new paradigm and Digital Lending will be the cornerstone of this structural shift.

With traditional capital markets failing to allocate capital efficiently, alternative sources of funding are being sought after by the real economy. This demand has already started to attract supply in the form of data-driven open ecosystems and marketplaces. These solutions substitute rigid, centralized top-down structures (such as banks) for meritocratic, bottom-up markets. New capital markets offer sustainable and especially resilient funding to the real economy. This is in stark contrast to the traditional focus on efficiency, ultimately leading to fragility, as seen during the COVID-19 outbreak. The new ecosystem will be accompanied by widespread adoption of the latest technologies and services such as Embedded Finance, FinTech Marketplaces, Tokenization, Cryptography, Decentralized Finance (De-Fi), and Blockchain.

These new capital markets, characterised by advanced technologies, new asset classes, and completely new investment opportunities make us excited for the future to arrive soon. In 2025!

Digital Assets

What a year it has been. More than a decade after birth, Digital Assets - the new currencies and their decentralised ecosystems - had a year for the books in 2020.

On the one hand, adoption and market penetration grew significantly, thanks to the vote of confidence from Big Techs and FinTechs. One watershed moment was in October, when PayPal embraced cryptocurrency by becoming a marketplace for Bitcoin transactions. The Bitcoin community, which had steadily grown to several millions over its 12 previous years, was suddenly increased by 350 million users, virtually overnight. PayPal also enabled 20 million active merchants in the US to accept Bitcoin. Square, a sizeable FinTech digital bank, saw an inflection point in 2020 on Bitcoin revenues, having started trading it in 2018. According to market sources, PayPal and Square clients have been buying most of the new Bitcoin supply entering the market each day: within three weeks of its launch, PayPal clients had bought approximately 70% of Bitcoin’s new supply, driving a sizeable surge in prices.

In the institutional asset management world, a few known names embraced the trend, with the notable entries of Ruffer and One River, on the grounds of seeking hedges against inflation and monetary disorder. Earlier on in the year, Insurance giant Massachusetts Mutual also ventured into the new asset class. MassMutual said that the investment gives it a "measured yet meaningful exposure to a growing economic aspect of our increasingly digital world." In our view, cryptocurrencies are not necessarily an alternative to gold, nor are they necessarily a harbour against monetary madness. It is our sense that their price likely benefited from the tsunami of Central Banks/Governments’ liquidity inundating financial markets indirectly on account of the laws of communicating vessels, in more ways than one. By the same token, not necessarily the price of cryptocurrencies must increase to celestial levels to prove adoption and success - it is likely but not a necessity. Interestingly though, at times where alpha is hard to extract, the new asset class exhibits traits which are uncommon in today’s traditional markets: inefficiency and volatility. More volatile than the EURUSD, more inefficient than US treasuries. Both monetizable to produce uncorrelated returns/income in liquid formats. A most scarce resource nowadays.

On the other side of the spectrum, regulation poses the toughest event risk ahead for the nascent asset class. 2020 saw regulators tackle Ripple (XRP) and BitMEX, after meddling with Facebook’s Libra in 2019 and it will likely affect other cryptocurrencies, especially the stablecoin ecosystem, in addition to exchanges and altcoins in the months ahead, and it is definitively a trend to watch most closely for operators in the sector. In parallel, Central Banks are looking to launch their own versions of digital currencies, the CBDCs (Central Bank Digital Currencies): Live tested by China on a large scale experiments, theorized and tested by the European Central Bank, the Fed, the Swiss National Bank and the Riksbank, to name a few examples.

Year 2021 will give a clear sense of direction in the race between adoption rates and proposed regulation.

As we argued in a previous piece, Digital Currencies are not removed from the context of an over-arching global trend of De-Dollarization that will likely gather momentum in the years ahead thanks to the double hit of China’s conflicting interests and the advent of digital technologies. Soon enough, the US Dollar will be dethroned as the sole global reserve currency, making room for other currencies, either fiat national (CNH, XRD), digital national (CBDCs), digital non-national (Bitcoin et al, Libra et al), or a blend.

Furthermore, a major shift is taking place from centralized finance (Ce-Fi) to decentralized finance (De-Fi). Ce-Fi is traditional, middle-man orchestrated, finance. De-Fi is the new world of decentralised finance a new digital operating system offering an alternative to the traditional banking infrastructure. Here, financial actors interact directly under the overarching rules of cryptographically enforced computer software. Last summer, we saw a first display of what this ecosystem can offer. In the short span of 3 months, the industry drowned market participants in new lending protocols, derivatives trading, insurance, mom-and-pop market-making liquidity pools and asset management solutions (actively managed by a community voting on investment strategies). This market is currently trading a billion dollars per day, generating millions in fees daily .

Alessandro and Nikita, from Fasanara’s Digital Assets team, wrote a review of the crypto market in 2020, available on our portal at this link: READ HERE.

All in all, as FinTech platforms, Embedded Finance, Digital Currencies, Blockchain/De-Fi arise and evolve, the liquidity gap between public and New Age private markets will keep on shrinking, grabbing the full attention of institutional investors in the process.

Digital Speed, Digital Access

Data, storage, algorithms, cloud computing, open-source software are now accessible at scale and at low cost. The era of Artificial Intelligence has begun. If the asset management industry join in, adopting new technologies to remain relevant, they stand to achieve big gains in quality, speed, autonomy, cost efficiency, transparency and inclusion.

The rapid migration to digital technologies driven by COVID will continue well into the recovery period. But are the portfolios of institutional investors able to keep pace?

The combination of exponential technologies - AI/Machine Learning, FinTech ecosystems, Blockchain/DeFi, computational processing power, sensors, Internet of Things, Robotics, AR/Virtual Reality, 3D printing, Web 3.0 - is what enables small teams to experiment and aim at moonshots, democratising access to building the foundations of the market systems of the future. The landscape is changing exponentially and wholeheartedly, and these inventive tools are now available to teams with evolutionary ideas to help shape the Digital Future. Financial markets are at the epicentre of the earthquake.

60/40 Digital-Enhanced

Traditionally, alternative strategies are added to classic 60/40 portfolios to improve risk-adjusted performance. Ideally, a true diversifier is a fixed-income type addition, providing income while minimising volatility, in reasonably liquid formats. At Fasanara, we try to do exactly that. Future-proofing institutional portfolios for the next decade, helping to surrogate today’s largest deficiency: fixed income.

Before we leave, a cheeky model of a 60/40 portfolio after the inclusion of Digital; Fasanara's special recipe of Digital, of course. The slide shows the improvement in performance per units of risk over the past 6 years. Admittedly, the period covers one big crisis moment only: February/March 2020. We have yet to see how it will navigate the next few, lying in wait.

Thank you for all your support last year.

Wishing you and your loved ones a happy and healthy New Year.

Here’s to a promising 2021.

Fasanara Capital

The post Use Of Digital Technology To Build Resilient Portfolios appeared first on ValueWalk.

bonds us treasuries pandemic covid-19 equities stocks cryptocurrency bitcoin blockchain crypto xrp link currencies us dollar crypto goldInternational

Economic Trends, Risks and the Industrial Market

By a show of hands, I.CON West keynote speaker Christine Cooper, Ph.D., managing director and chief U.S. economist with CoStar Group, polled attendees…

By a show of hands, I.CON West keynote speaker Christine Cooper, Ph.D., managing director and chief U.S. economist with CoStar Group, polled attendees on their economic outlook – was it bright or bleak? The group responded largely positively, with most indicating they felt the economy was doing better than not.

Four years ago, the World Health Organization declared COVID-19 a global pandemic, seemingly halting life as we knew it. And although those early days of the pandemic seem like a long time ago, we’re still in recovery from two of its major consequences: 1) the $4 trillion in economic stimulus that the U.S. government showered on consumers; and 2) the aggressive monetary policies that have created ripple effects on the industrial markets.

Cooper began with an overview of the economic environment, which she called “the good news.” The nation’s GDP is strong, and the economy gained momentum in the second half of 2023 – we saw economic growth of 4.9% and 3.2% in Q3 and Q4 respectively — much higher than expected. “The reason is consumers,” Cooper said. “When things get tough, we go shopping. This generates sales and economic activity. But how long can it last?”

Consumer sentiment continues to be healthy, and employment is good, although a shortage of workers could impact that moving forward. The U.S. added 275,000 jobs in January, far exceeding expectations. “The Fed raising interest rates hasn’t done what it normally does – slow job growth and the economy,” said Cooper. In addition, the $4 trillion given to keep households afloat during the pandemic has simply padded checking accounts, she said, as consumers couldn’t immediately spend the money because everyone was staying home, and the supply chain was clogged. The money was banked, and there’s still a lot of it to be spent.

Cooper addressed economic risks and the weak points that industrial real estate professionals should be mindful of right now, including mortgage rates that remain at 20-year highs, stalling the housing market, particularly for new home buyers. Mid-pandemic years of 2020-2021 had strong home sales, driven by people moving out of the city or roommates dividing into two properties for more space and protection against the virus. Homeowners who refinanced in the early stages of the pandemic were fortunate and aren’t willing to list their houses for sale quite yet.

“The housing market is a big driver of industrial demand – think furniture, appliances and all the durable goods that go into a home. This equates to warehouse space demand,” said Cooper.

Interest rates on consumer credit are spiking and leading economic indexes are still signaling a recession ahead. Financial markets are indicating the same, with a current probability of 61.5% that we will be in a recession by 2025. However, Cooper said, while all signs point to a recession, economists everywhere say the same thing as the economy seemingly continues to surprise us: “This time is different.”

Consumers are still holding the economy up with solid job and wage gains, yet higher borrowing costs are weighing on business activity and the housing market. Inflation has eased meaningfully but remains a bit too high for comfort. We’ve so far avoided the recession that everyone predicted, and the Federal Reserve appears ready to cut rates this year.

For the industrial markets, the good news is that retailer corporate profits are beginning to bounce back after slowing in 2021 and 2022, with retail sales accelerating.

A slowdown in industrial space absorption was reflected in all the key markets – Atlanta, Chicago, Columbus, Dallas-Fort Worth, Houston, the Inland Empire, Los Angeles, New Jersey and Phoenix – but was worst in the southern California markets, which have since been rebounding.

“Supply responded to strong demand,” Cooper said. “In 2021, 307 million square feet were delivered, followed by 395 million in 2022. In 2023, we saw 534 million square feet delivered – that’s almost 33% higher than the year before.”

The top 20 markets for 2023 deliveries measured by square feet are the expected hot spots: Dallas-Fort Worth (71 million square feet) leads the pack by almost double its follower of Chicago (37 million), then Houston (35 million), Phoenix (30 million) and Atlanta (29 million). Measured by share of inventory, emerging markets like Spartanburg, Pennsylvania, topped the list at 15 million square feet, followed by Austin (10 million), Phoenix and Dallas-Fort Worth (7 million), and Columbus (6 million).

“Developers are more focused on big box distribution projects, and 90% of what’s being delivered is 100,000 square feet or more,” Cooper said. Around 400 million square feet of space currently under construction is unleased, in addition to the around 400,000 square feet that remained unleased in 2023. “Putting supply and demand together, industrial vacancy rate is rising and could peak at 6-7% in 2024,” she said.

In conclusion, Cooper said that industrial real estate is rebalancing from its boom-and-bust years. Pandemic-related demands and accelerated e-commerce growth created a surge in 2021 and 2022, and the strong supply response that began in 2022 will continue to unfold through 2024. With rising interest rates putting a damper on demand in 2023, vacancies began to move higher and will continue to rise this year.

“Consumers are spending and will continue to do so, and interest rates are likely to fall this year,” said Cooper. “We can hope for a recovery from the full effects of the pandemic in 2025.”

This post is brought to you by JLL, the social media and conference blog sponsor of NAIOP’s I.CON West 2024. Learn more about JLL at www.us.jll.com or www.jll.ca.

recession consumer sentiment pandemic covid-19 stimulus economic growth emerging markets fed federal reserve home sales mortgage rates real estate housing market recession gdp recovery interest rates stimulus world health organizationInternational

Pharma and biotech’s top R&D spenders in 2023: a $153B total with M&A as a focus

At a time when biotech is still counting its losses as a thaw gradually sets in after the long market winter, pharma has been on a tear. M&A took off…

At a time when biotech is still counting its losses as a thaw gradually sets in after the long market winter, pharma has been on a tear. M&A took off in Q4 as the industry’s biggest R&D spenders either rolled the dice on the back of their blockbuster bonanzas, were forced to address gaping holes in the pipeline in the face of looming patent expirations, or simply had no choice in the face of repeated setbacks.

For some, it was all of the above.

As a result, Merck flipped into the lead position generally occupied by Roche with an M&A-inflated expense line for research. The companies joined a hunt for new drugs frequently focused on Phase III; premiums are in — heavy preclinical risks are out of favor. The majors followed some well-worn paths into immunology and oncology. And 2024 kicked off with a new round of buyouts and licensing deals.

The sudden end of Covid as a vaccine, drug and diagnostic market left the likes of Pfizer scrambling to convince investors that they had an exciting new plan. (It’s not working so far.) Eli Lilly has become one of the most valuable companies on the planet as obesity drugs go mainstream. Leaders like Takeda kept upping the ante on the R&D budget as the numbers frayed, with all but Pfizer and Bristol Myers Squibb — two of the most deeply off-balance biopharmas — spending more in 2023. Across the board, we saw $153 billion accounted for in R&D budget lines for last year — which would have registered as a record even without the sudden bolus of spending at Merck.

New, promising drugs at biotechs aren’t getting cheaper. And some of the blockbusters pharma has to cover as the patent cliff approaches will demand multiple replacement franchises.

The Big 15 have the money, desire and need to do much, much more in R&D. And all signs indicate that we’ll see more through 2024.

- Merck

- Roche

- J&J

- Novartis

- AstraZeneca

- Pfizer

- Eli Lilly

- Bristol Myers Squibb

- GSK

- AbbVie

- Sanofi

- Gilead

- Takeda

- Amgen

- Novo Nordisk

1. Merck: The BD team is remaking the pipeline, and they are moving fast

The big picture: Merck moved up to the top of the list this year by bundling a mother lode of M&A and drug licensing deals into the R&D expense line. Otherwise, the top slot would have gone to Roche, the traditional top title holder in the R&D 15.

Merck has been parlaying its unchallenged position as number one in the PD-1 game with Keytruda — a drug that earned $25 billion last year but will face a loss of exclusivity as patents start to expire in 2028 — into a host of big deals in 2023. Keytruda, meanwhile, has cruised to 39 approvals, leaving Bristol Myers’ Opdivo in its wake.

Too much commercial success, though, doesn’t translate into unending praise. Analysts had been grumbling for some time that Merck wasn’t doing enough to diversify its pipeline bets. But that’s been changing.

Merck tallied $5.5 billion upfront for its Daiichi Sankyo deal — picking up rights to three ADCs in the move — along with the across-the-slate hikes in costs for clinical programs, bigger payrolls and benefits. There was another charge for the $11.4 billion that went to buying Prometheus and Imago. Prometheus accounted for $10.8 billion of that — one of the biggest deals that followed the $11.5 billion Acceleron buyout in 2021. With $690 million in cash for a group of partners that includes Moderna, Orna and Orion.

Merck kicked off the new year with a $680 million buyout of Harpoon Therapeutics, underscoring its enduring interest in the oncology market. And it’s leaving no popular stone unturned, capturing attention with its expressed interest in GLP-1 combos as the next generation of weight loss drugs takes shape.

Merck CEO Rob Davis also recently made it clear that the pharma giant can afford more $1 billion-to-$15 billion deals, making it a top candidate for more deals in 2024.

Merck’s firepower on the deals side, though, is needed after some deep wrinkles marred the pipeline plan, like the FDA’s back-to-back CRLs for chronic cough drug gefapixant. The data, however, never matched up to Merck’s rhetoric. Failures in Alzheimer’s and depression underscored Merck’s traditional ill fortunes in neuro.

Merck has a few years to plan for its next big thing. They show every sign of remaining focused on the big prize ahead.

2. Roche: 2023 was a tough year. Will 2024 be any better on the R&D side?

- R&D spending 2023: $16.1 billion/group — pharma and diagnostics (14.2 billion CHF)

- R&D spending 2022: $16 billion/group (14.1 billion (CHF)

- Change: —

- Revenue: $67 billion (58.7 billion CHF, -7% from 63.3 billion CHF in 2022)

- R&D as a % of revenue: 24%

- R&D chiefs: Hans Clevers (pRED), Aviv Regev (gRED), CMO Levi Garraway

- Ticker: $RHHBY — down 4.8% in the past year

The big picture: It’s not easy being Roche. The behemoth has long had a near-omnivorous approach to R&D, buying up and down the pipeline at all stages with a big appetite for oncology ahead of neuro, ophthalmology and immunology. This year, it’s had to contend with the elimination of its Covid revenue, once a big player on the diagnostics side as testing soared during the pandemic. They’ve had to lower investors’ expectations of 2024 sales to an embarrassingly modest level and saw their stock price slide.

It’s surprising they have any growth, given the corresponding knockoff competition building for Lucentis and Esbriet, but you can’t play with market expectations. They’ll kill you every time you’re off.

Roche found some silver linings in the Vabysmo franchise and they’ve been a significant player on the M&A side, scoring the Carmot buyout for $3 billion after bagging Telavant for $7.1 billion back in October, paying a price for something Pfizer all but gave away to Roivant. James Sabry and the BD team, meanwhile, have kept up their globetrotting ways, uncorking a slate of deals for JP Morgan.

Sabry moved to global BD chief at Roche after winning his spurs at Genentech, and he’s been in the game for quite a long time. His résumé includes a stint as a biotech CEO. He’s the doyen of dealmakers and isn’t sitting on the sidelines. Hope grows eternal at Roche, and to keep it growing, Sabry has to stay busy.

“We have in total 12 NMEs that could potentially transition into a Phase III during this year,” CEO Thomas Schinecker told analysts hopefully during their Q4 call.

On this scale, Roche tends to do things on a wholesale basis. So when execs recently unveiled a pipeline review, they mapped 146 programs covering 82 new molecular entities. That can be hard to keep up with. If raw numbers like that were a good indicator of future success, though, Roche wouldn’t have these troubles.

It’s less difficult to follow the culls. That includes a slate of neurology drugs, with several axed from the oncology area. The write-offs include the longtime disappointment crenezumab, which had been partnered with AC Immune in Alzheimer’s. Roche recently handed back crenezumab as well as semorinemab after working with AC Immune for close to an R&D generation. Some analysts gave up long ago.

We’ve also been hearing complaints about a lack of upcoming pivotal clinical data to arouse enthusiasm. But Roche has two big R&D groups at work trying to counter those impressions, with gRED (Genentech) and pRED (the traditional Roche research group) at bat. They now have a straight-up GLP-1/GIP drug in the clinic for obesity, with oral therapies in the works alongside many others. It may be late to the obesity game with the Carmot buyout, but Roche still sees opportunities worth paying for.

Execs are promising to play a better R&D game, prioritizing their best assets and piling on resources. But Roche has always been willing to invest heavily in R&D. Now the company needs to see some clinical cards fall its way. This has not been a patient market.

3. J&J: Under new management, J&J doubles down on the innovative side of R&D. Can they still surprise us?

The big picture: J&J typically has weighed in heavy on R&D, particularly if you add its medtech work to the total. Even after splitting that out, though, it’s still in the top five, hoovering up large numbers of early-stage licensing deals while occasionally nabbing something major in the $1 billion-plus category.

Last year the pharma giant punted its consumer division, following the footsteps of many major industry outfits, and shut down its work in infectious diseases and vaccines. RSV, a highly competitive field now, went out the window with a host of smaller programs and alliances. Its major fields of interest zero in on oncology, immunology, cardio and retinal disorders. And they chipped in close to $2 billion to join the ADC hunt in January with its acquisition of Ambrx.

J&J earned a rep for out-of-the-box thinking in oncology under former oncology R&D chief Peter Lebowitz, striking a deal with China’s Legend that delivered an approved drug — Carvykti — and following up with a $245 million pact to gain worldwide rights to another CAR-T from CBMG, a low-profile Chinese biotech that erupted into mainstream view with its Big Pharma deal.

Now the big questions about J&J focus on its new leadership after Joaquin Duato moved into the CEO’s role in 2022 and John Reed — leaping into his third Big Pharma R&D posting in 10 years, following Roche and Sanofi — takes command of the global R&D side of the company.

They have plenty of motivation to hustle up major new approvals. Stelara — raking in more than $10 billion a year — will see its patent protection erode in the US in 2025, with Europe moving first this year. That will take a few big wins to cover.

But J&J has been making big promises for years. Just a few months ago, it touted 20 drugs in the pipeline that could fuel 5% to 7% growth through 2030. One of the prime candidates is a drug they picked up from Protagonist: JNJ-2113, an IL-23 they believe can bring in blockbuster revenue in immunology. J&J, though, is likely far from done when it comes to new deals. Oncology R&D has been changing rapidly in the wake of the Inflation Reduction Act, with researchers moving up OS as a primary initial focus in Phase III. And it’s going to take a behemoth effort to deliver on these numbers, with likely failures and shortfalls along the way.

Don’t look for J&J to cut R&D anytime soon. They have a big agenda.

4. Novartis: Another streamlining move is wrapping up as Novartis vows to get back to basics in R&D — again

The big picture: Novartis CEO Vas Narasimhan has been crystal clear about the Big Pharma’s M&A strategy. He’s sticking with the industry sweet spot now in favor: picking up late-stage assets below the $5 billion range. A few weeks ago, that led Novartis to MorphoSys, where they have been partnered for years while distancing themselves from rumors of a pricey Cytokinetics play.

And it springs right off another $3 billion acquisition — for Chinook — that went straight to positive Phase III data for the kidney drug atrasentan, which likely wasn’t much of a surprise inside Novartis.

These days, Narasimhan and Novartis are all about focus. They want to make a deeper impact where they emphasize their priorities — cardio, immunology, neuroscience and oncology. And they also want to be leaders where they are centered, slashing oncology while emphasizing at every opportunity that they jumped out front in radioligands, now a hot commodity in R&D.

Lest anyone forget, Novartis was a pioneer in autologous CAR-T and has held on as it slowly works through all the challenges a cutting-edge technology can inspire.

Narasimhan had been five years before the mast as CEO, after being promoted from development chief, and he’s revising a pipeline strategy away from something he describes now as akin to everything everywhere all at once. Downsizing in 2023 was the big focus, dropping programs, reassigning scientists and promising a swifter pace — a never-ending problem in Big Pharma land. Narasimhan has also been pushing “seamlessness,” projecting a new era of cooperation among scientists and sales.

There’s nothing new about streamlining at Novartis, though. Narasimhan had a billion dollars of cuts in mind back in the spring of 2022. And periodically, the company has been well-known for going in and ironing out budgets. Changes have included an exit for development chief John Tsai, now a biotech CEO, who was replaced by Shreeram Aradhye. Fiona Marshall took the helm at NIBR in the fall of 2022, taking the place of Jay Bradner, who left and later wound up running R&D at Amgen.

The recent cleanup at Novartis included the end of the deal for BeiGene’s PD-1, an area that proved enormously frustrating to Novartis. Their TIGIT pact ended last summer. Phase II for GT005, a gene therapy it picked up in the $800 million Gyroscope buyout, didn’t end well. That program got the axe. And their anti-TGFß antibody, picked up in a small deal with Xoma nine years ago, failed after execs once billed it as a high-risk, high-reward play. Other setbacks include Adakveo, which faced global regulatory challenges following the failure of the Phase III confirmatory study. At the beginning of this year, there was a snafu in Phase III for ligelizumab, once billed as a top asset for peanut allergies.

Warning clouds have also formed around their top-selling drug Entresto, as Novartis fights a battle against the IRA and price negotiations.

The CEO, though, has been able to transition while the stock price was headed up, with a few big drugs driving revenue growth as a struggling Sandoz finally got the heave-ho in a spinout. Their franchise drug Kisqali, for example, is now billed as a $4 billion earner at the peak. As a result, their story has played well on Wall Street. Investors want to see the money and the trajectory. R&D follows sales in priority when it comes to the majors.

5. AstraZeneca: Pascal Soriot never takes defeat lying down. And that stubborn attitude has delivered big dividends as another big R&D test takes shape

The big picture: Back in 2018, AstraZeneca reported R&D expenses just under $6 billion. In the past five years, that big line item has grown 85%, and investors have seen the stock price grow 56%.

The R&D leaders at AstraZeneca have changed, but CEO Pascal Soriot has become a longtime fixture at the company. During his stint he took the weakest pipeline in biopharma and turned it into one of the strongest, building a slate of blockbuster oncology franchises while building a research machine based in Cambridge, UK, that consumes about $1 out of every $4 in revenue. He bet the ranch on Enhertu and won, with some analysts bullishly projecting peak sales that will break $10 billion. And he’s kept many of the promises he had to fire out to investors to keep an unwanted Pfizer takeover at bay in the way back when.

So what’s next?

That’s a question that’s vexing quite a few analysts. AstraZeneca is a restless player and the company takes a lot of chances — which means it racks up a lot of setbacks.

A major initiative aimed at protecting its revenue involves its legal fight against the IRA, which AstraZeneca has so far lost. Its next big ADC with Daiichi Sankyo, Dato-DXd, has sparked a running debate on its potential approval and some analysts have doubted if it can live up to the hype following weak PFS results for the TROP2 ADC. Last summer an early-stage GLP-1 went down in flames, unable to take the heat in a kitchen currently controlled by the commercial chefs at Novo Nordisk and Eli Lilly. Lokelma, picked up in a 2015 buyout, got hit when R&D decided to quash two Phase III studies, denting once-big hopes for blockbuster status. And Soriot has recently been forced to finally give up on one old failure when he finally punted roxadustat’s US rights.

Soriot, though, is a weathered player when it comes to setbacks. Every loss is an opportunity to do better the next time, and no one can be more stubborn. You could see that play out over Covid when its vaccine came in for some undue criticism that blighted its impact in the face of the mRNA stars. That spurred some angry responses as execs dug in. But there was an unexpected upside. The giant didn’t have to readjust as the Covid market went pfffffft.

Their next step: A couple of months ago AstraZeneca touted its new vaccine platform, buying Icosavax for $838 million in cash while contributing an RSV vaccine to the pipeline — a field where GSK has made major headway — and a virus-like particle platform that the company intends to build on.

Volrustomig, a PD-1/CTLA-4 bispecific antibody, has been accelerated into Phase III, with Soriot claiming a leadership spot in bispecifics: “Our portfolio of bispecifics has the potential to replace the first-generation checkpoint inhibitors across a range of cancers.”

And that GLP-1 fail? Last November AstraZeneca paid $185 million to gain a Phase I GLP-1 drug out of China’s Eccogene. And now they’re mapping combo studies with some of their other drugs in a play at creating the next wave of obesity therapies with an edge.

Word in biopharma is that Soriot has been devoting a considerable amount of face time to China, where he committed the company years ago. That’s another one of those market promises that has seen plenty of ups and downs. But Soriot tends to win the big gambles more than he loses, and in this industry, seeing it through can be a major long-term advantage.

6. Pfizer: What the hell happened to the Covid king?

The big picture: There was one brief, shining moment — or two — when Pfizer could seemingly do no wrong. It had taken a leading role in breaking through scientific barriers to create a new Covid vaccine in record time, harvested a bumper crop of cash and CEO Albert Bourla was the darling of the world’s favored pharma industry.

That was then.

Now, Bourla and his team are having a tough time convincing Wall Street that the company can do even simple things right. They paid $43 billion to bag Seagen and mount a major new campaign on the cancer front, but its stock has been blighted and the focus turned to cost-cutting as revenue plunged. There was fresh humiliation when Roivant flipped a drug it had grabbed from Pfizer for lunch money and sold it to Roche for $7.1 billion a year later. And Pfizer has lost the narrative in convincing investors it can get back to growth.

That somewhat hapless rep was burnished considerably when Pfizer reported that its first try at an oral GLP-1 obesity drug had flopped. It’s still working to move the dial in the hottest new field in pharma, but so is a long list of rivals. Instead of spurring renewed faith in Pfizer, the obesity play turned into another example of getting it wrong, and the focus at Pfizer shifted squarely to downsizing and cost-cutting in acknowledgment of the new reality that set in.

Bourla, though, is committed to pushing the story that a new period of growth lies ahead. And it’s not proving easy.

At the end of February, Pfizer made its best pitch for oncology, underscoring plans to seize the leadership role in genitourinary and breast cancer while making promises for eight-plus possible blockbusters in the next six years. R&D promises, though, are easy to make and hard to keep. Right now, the clarion call in pharma is “show me the money.”

With Covid and the mRNA revolution forgotten like last season’s hit show, there’s an enormous gap now that will be devilishly hard to bridge. But don’t expect anyone at Pfizer to stop trying anytime soon.

7. Eli Lilly: Built for the long term, Lilly’s day has arrived — and they don’t want to let go

The big picture: Historically, Eli Lilly has been known as a ponderously slow pharma outfit that often slowly cruised its way into Phase III squalls. But that view is so 2017. In 2024, Lilly has rebranded itself as the Big Pharma engine that could, and did, blow out expectations. And if it’s still not quite as nimble as some analysts might like, its ability to deliver in massively expensive late-stage studies for drugs aimed at big populations has made it a darling of quite the investor crowd.

Lilly, for example, was thwarted at getting an accelerated approval for its Alzheimer’s med, but that didn’t really cut expectations, with blockbuster peak sales projections — even as Biogen/Eisai’s Leqembi suffers from dimming prospects as their high hopes are lowered by the reality of limited sales in the face of limited efficacy.

That pales, though, in comparison to the bright rainbow that’s emerged in obesity. Lilly continues to work up manufacturing capacity to meet demand for its new obesity version of tirzepatide, the GLP-1/GIP drug building up the diabetes franchise, where neither of the two leaders has been able to meet a seemingly limitless demand.

Lilly attracted considerable attention for its vow to build out manufacturing capacity ahead of Phase III data for its next-gen oral version, orforglipron, while clearly so unhappy about Novo’s decision to muscle in and snap up Catalent that CEO Dave Ricks is grousing about the antitrust implications of their rival’s move. Lilly, though, has bragging rights to solid pivotal data in a market that is nowhere close to saturation point.

Like a lot of the big spenders on the list, Eli Lilly has been hunting new immunology drugs and plunked down $2.4 billion for Dice last summer. That was part of a full slate of acquisitions, including a pair of small ADC companies. Following yet another hot trend, there was a $1.4 billion deal for Point, which put them into radiopharmaceuticals.

Lilly nabbed two new drug approvals last year as it waited on the 2 big franchises in obesity and Alzheimer’s. That’s a testament to the progress that Dan Skovronsky spurred after the global player made him R&D chief 6 years ago. Eli Lilly execs still may not always be first, in an industry where first can be tremendously important to commercialization. But they’ve been right where it counts big in drug development, and it will take a therapeutic earthquake to alter that perception anytime in the near term.

8. Bristol Myers Squibb: A rough year spurs a cut in R&D spending and some major late-stage R&D deals

The big picture: This is a terrible time to try and explain why your Big Pharma company has structural issues that flattened or eroded sales revenue. Pfizer understands that and Bristol Myers got a bad taste of it as its shares slid 18% in the last year.

In both cases, the CEOs stepped up with a transition plan. The companies did some deals, but the late-stage stuff wasn’t cheap. And in Bristol Myers’ case, a new CEO was able to draw a line between its aging franchises and the new arrivals on the market, which saw some growth. The company line now: Just wait for the big pipeline hits to come and give us some time to weather the decline of these legacy drugs and you’ll love what you see.

Investors may not be cheering, but Bristol Myers’ stock did get some traction out of it in the last few weeks.

It was clear well before 2023 arrived that Bristol Myers understood it was facing some of those dreaded headwinds. That 2% drop in R&D spending highlighted the tight rein on spending for what remains a top 10 player in the pharma R&D world. Major figures in R&D, headed by Rupert Vessey, exited the company — in Vessey’s case, later making the flip to biotech at Flagship. And there was an unusual spat with Dragonfly after the pharma giant walked away from its $650 million investment.

New CEO Chris Boerner spotlighted the immediate strategy at hand: M&A. Mirati and KRAS came their way for $5.8 billion. RayzeBio happily landed a premium on top of the premium they had just scored in an IPO, as Bristol Myers followed rivals into radiopharmaceuticals. The $14 billion Karuna buyout put them into a late-stage race on Alzheimer’s, another R&D category that’s been enjoying a renaissance some years after pharma fled the scene.

Boerner’s bottom line in the Q4 review is that the company will steer more into bolt-on plays — rather than big buyouts — and licensing deals like the SystImmune alliance. That sets the stage for a “transition” period that will last until 2028, four long years ahead, when it’s promising “top-tier” results. It will also be looking at lower-priced competition for Opdivo.

Even before 2028, though, BMS will start losing patent protection on Eliquis. They’ve already begun price negotiations with Medicare. And Eliquis earned $12.2 billion in 2022, making it their number-one franchise. That’s left Bristol Myers and Pfizer, both under huge pressure to perform and do more late-stage deals, backing a full-court press in the courts to keep generics at bay.

Bristol Myers has had an active dealmaking arm for years, including in the wake of its big $74 billion buyout of Celgene, which also delivered Vessey to the pharma giant. That was just five years ago after Celgene had fallen on some troubled times. Celgene had been a standout in the licensing field, known for sampling a wide variety of drug plays in the industry pipeline. One of Bristol’s big failures, though, was ceding the high ground in PD-1 to Merck’s Keytruda, which has been buoying its rival for years. Bristol needs major drug franchises to make a difference in this world, and any future setbacks on the leading drugs it’s been buying now will not be welcome by investors.

There is a path forward for Bristol, of course, even as it vows to pay down debt. But it’s fairly narrow, and this field is known for some treacherous results.

9. GSK: After picking up some badly-needed revenue steam, what’s next for R&D?

The big picture: Tony Wood is still shy of his second anniversary as the CSO at GSK, but with an RSV vaccine riding high as a new blockbuster franchise and Shingrix looking every bit the long-distance franchise player GSK needs, he has a reassuring revenue foundation to work with. ViiV’s steady work in HIV — where GSK is a majority owner — also offers a confidence-building revenue stream. And the departure of the consumer unit is well into the rearview mirror now.

Its stock has done well, too, up 28% in the past year.

That’s quite a changed picture from the early days of his predecessor, Hal Barron, who came in with deep oncology experience and a big need to demonstrate a broad-based pipeline reorganization to overcome a well-earned rep for underperformance. Wood’s first moves in R&D were largely defensive, giving up some major alliances — such as a partnership with Adaptimmune — that looked shaky.

GSK has made a lot of early bets, and the risks involved naturally portend that many of its deals won’t survive. You can see that in play right through its recent decision to dump a pair of Vir partnerships in infectious diseases.

In their place, GSK has been inking major new development deals with the likes of China’s Hansoh, for ADCs. Oncology, though, is still only a small performer overall. And it’s been a focus for a while.

GSK spent a billion dollars upfront to bag a mid-stage asthma drug at Aiolos in a rare M&A deal. There was also the $2 billion Bellus buyout last fall, with an eye to creating a new franchise for chronic cough. But there’s been a notable absence of any splashy deals at GSK, with a reorg in research that offers GSK’s latest take on improving efficiency.

We’ll see how that goes.

In the meantime, GSK is doing what it can to stir up some excitement for late-stage drugs like depemokimab (again in asthma), camlipixant (from Bellus) as well as the antibiotic gepotidacin for UTIs/gonorrhea. It’s an uphill fight, though, without much megablockbuster razzmatazz built in. But GSK is a careful player.

After getting stuck with the rep for having one of the worst pipelines in pharma, though, reliable and steady progress with a high-profile launch in RSV will suit just fine. At least for now. It’s likely that investors will keep pressing for something big in Phase III, and that could cost CEO Emma Walmsley a considerable amount of BD money.

10. AbbVie: The slow-motion collapse of Humira keeps them focused on the bottom line while growing R&D spending

The big picture: As Rick Gonzalez finishes his final run as CEO, he’s able to look back on a year that saw AbbVie complete its revamp period as the long-awaited — long, long-awaited — arrival of generic Humira bites into its old cash cow.

The great split at Abbott that created AbbVie set up a scenario where the company would pull out every stop to milk Humira for every conceivable dollar possible, delivering mega-returns while Gonzalez became the poster child of patent reform. The bottom line for AbbVie’s team: What’s repeated waves of congressional criticism with the stock price on the line?

Now AbbVie is able to boost expected revenue on the two big drugs developed on Gonzalez’s watch — Skyrizi and Rinvoq — with two new acquisitions to feed future sales projections. The buyout of Botox created a new, highly reliable franchise for AbbVie’s commercial team to lean on.

AbbVie is skilled at acquiring and building revenue. It had its eyes set on the ADC drug Elahere when it acquired ImmunoGen for $10 billion. Initially approved in 2022 for ovarian cancer, the drug is now being positioned for earlier lines of therapy.

Less than a week after the ImmunoGen deal was announced, AbbVie was back for a late-stage acquisition with the $8.7 billion for Cerevel’s neuro play. The deal will bring in clinical-stage assets for schizophrenia, Parkinson’s and dementia, as CNS moves back into a warmer phase in Wall Street circles. Both buyouts underscore Big Pharma’s considerable appetite for new products, with premiums in play for de-risked drug programs.

Gonzalez’s departure barely caused a murmur on the markets, which is a testament to his success in delivering for shareholders a secure, long-term rebuild. His legacy is a company with a ruthless rep for shepherding drug revenue while building a big interest in curtailing patents for pharma. But looking only at the numbers, he proved the winner at the company as the game was played during his tenure.

11. Sanofi: Paul Hudson is still out to make a great first impression in R&D

The big picture: When Paul Hudson showed up in San Francisco for JP Morgan in January, ready to talk up plans for the road ahead, he noted: “It feels like a lot longer than four years that we’ve been on this journey.”

But Hudson has always been more comfortable sounding like a newly-coined CEO, plotting a turnaround. And in the last few months, he’s played every card in that deck. The announcement late last year that Sanofi is bumping its R&D budget is central to that theme, though the news of its impact on profitability led to a rout of the stock price. And he delights in spotlighting late-stage assets, even though a slate of his early bets failed or have yet to prove themselves.

In what is now standard in pharma, Hudson made what he could out of the news he was spinning out the consumer division. Again, though, investors were less than thrilled by the gambit.

This time around the PR track, Hudson has boasting rights to the recently approved RSV drug Beyfortus, which comes with some big peak sales projections from Jefferies and much, much less from others. We’ll know soon enough if this is a winner or the latest disappointment at Sanofi. And, as always, there’s the Sanofi touchstone: Its megablockbuster Dupixent, which the pharma giant was able to partner on with Regeneron years ago — keeping the franchise fresh and expanding. Dupixent is the cash cow that gives Sanofi the financial strength needed to move ahead.

And that means there’s capacity for more dealmaking.

Not long after the San Francisco appearance, Hudson followed up on his M&A assurances with a $1.7 billion drug buyout, carving out a Phase II drug for a rare disease called alpha-1 antitrypsin deficiency, or AATD. It fits right into the zone for 2024, where pharma can only get positive attention for something within sight of an approval.

Like others on this list, Sanofi’s R&D rep will ultimately rest on its ability to deliver on the 12 would-be blockbusters the company is betting on. That includes three “products in a pipeline“: amlitelimab, frexalimab and SAR441566 (oral TNFR1si). They’re followed by tolebrutinib, lunsekimig, rilzabrutinib, an anti-TL1A in IBD, an IRAK4 degrader and itepekimab for COPD.

Behind it all, Hudson has also been promising to make Sanofi a leader in AI-assisted pharma operations. Sanofi, though, has been promising a makeover in innovation for well over a decade and has done nothing to prove it’s worked beyond staying on track with the megablockbuster it got from Regeneron. One breakout franchise delivered on Hudson’s watch would change that in a heartbeat.

We’re waiting.

12. Gilead: The CEO gambled on big innovation — and often lost. But the wagers keep coming

The big picture: Daniel O’Day jumped into the CEO job at Gilead five years ago and hit the ground running. He hasn’t stopped, even though some of his biggest bets have run into brick walls.

That was apparent weeks ago with the news that Gilead would ice its work on blood cancer involving magrolimab, the CD47 drug picked up in a $5 billion buyout back in 2020. Their mid-stage work on solid tumors ground to a halt shortly after.

Rehashing and refocusing their deal with Arcus, putting in significantly more money while axing one of the Phase IIIs, didn’t help.

Gilead’s rep was built around HIV, where it has remained dominant, though more than a bit taken for granted. The old regime’s follow-up — after a cloudburst of cash for curing hep C that quickly dried up — was to buy out Kite and take a pioneering position in CAR-T, which hasn’t lived up to the financial hype that attended its arrival, despite the clear scientific innovation it brought to the field.

The stock was hammered hard in January after Trodelvy — acquired in the 2020 Immunomedics buyout, which achieved blockbuster status last year — failed a Phase III in second-line lung cancer.

But when you raise doubts and see your stock sinking, counter with a late-stage buyout. That’s clearly what O’Day had in mind when he plunked down more than $4 billion to buy CymaBay after the biotech unveiled late-stage data on seladelpar. Gilead bought a would-be blockbuster with a PDUFA date. And that’s a sign of some desperation at a company that badly needs a breakout.

13. Takeda: Moving up another notch on the top 15, as profitability wobbles, Takeda execs are still reaching for the golden ring in R&D

- R&D spending 2023: $4.93 billion

- R&D spending 2022: $4.49 billion

- Change: +10%

- Revenue: $29.54 billion

- R&D as a % of revenue: 17%

- R&D chief: Andy Plump

- Ticker: $TAK — down 8.4% in the past year

The big picture: Takeda has been aggressively taking chances in R&D right from the time CEO Christophe Weber and R&D chief Andy Plump teamed up to remake the aging Japanese pharma company into a global drug player back in 2015. That meant steadily upping the ante in R&D — now up another slot in this year’s rankings — and investing in deals like the Shire buyout, which gave Plump his base in the Cambridge/Boston hub, along with a big stake in rare diseases.

For Takeda, that mission meant a broad effort to develop a major pipeline, from collaborations through Phase III. More recently, it’s been about concentrating their new work around a pair of key deals, particularly the $4 billion acquisition of Nimbus’ TYK2. It likely wasn’t much of a surprise, but their drug — which also has a $2 billion rider for milestones — cleared a Phase IIb hurdle in psoriatic arthritis.

For Takeda, it’s a clear indication of just how popular it is these days for pharma players to zero in on late-stage therapies in search of relatively near-term approvals.

Want more evidence of that?

Takeda bet $400 million in cash and more than a billion dollars in milestones to gain rights to Hutchmed’s fruquintinib and then was rewarded with an approval for treatment-naive cases of colorectal cancer in the fall. And they demonstrated its continued appetite in the rare disease space with the recent $300 million deal for Protagonist’s late-stage drug rusfertide, designed to treat a rare blood disease called polycythemia vera (PV).

The risks it’s taken on have been readily apparent to Takeda’s leaders, with its decision to drop Exkivity after flunking the Phase III NSCLC confirmatory trial, a Phase II fail for its key metachromatic leukodystrophy program, as well as a decision to drop Theravance as a partner after a seven-year alliance. The late-stage setbacks cost Takeda a $770 million write-down. Add in a loss of exclusivity for Vyvanse in 2023 — a $3 billion blockbuster in fiscal 2022 — and you have the outlines of unsteady performance for the pharma player, with Weber promising to do better in the near term.

Takeda is unusual in the Big Pharma world for winding up its fiscal year at the end of March. In order to do an apples-to-apples comparison, they prepared a summary of their R&D expenses and revenue for all of 2023 for Endpoints News.

14. Amgen: Capitalizing on a history of striking high-profile deals, Amgen stays in the spotlight

The big picture: Amgen is a considerable distance from spending on research like the top 10 players in our R&D 15, but it frequently finds ways to box competitively in the biggest heavyweight category. It had done that with KRAS, taking a legit scientific advance that couldn’t quickly move the dial in a major way on the commercial side. That happens a lot in oncology. And now it’s in the spotlight with an obesity drug — branded as MariTide now — with hopes to take on the likes of Eli Lilly and Novo Nordisk.

The chutzpah originates with longtime CEO Bob Bradway, who has parlayed his Wall Street cred as a former banker at Morgan Stanley into major league status with a savvy understanding of the numbers and investors. He skillfully navigated the $28 billion Horizon buyout last year, bagging a lineup of commercial therapies as the company looks for the approaching patent cliff on Enbrel, a reliable blockbuster that has kept the revenue flowing in.

Amgen may not do a lot in M&A or Phase III, but what it does do, it does with style.

To complete the Horizon deal, Bradway had to orchestrate a deal with the FTC to skirt its objections to price bundling, which essentially leaves the pharma company on commercial probation with regular reporting to the federal agency. That took skill and boldness while maintaining the CEO’s rep for delivering on the bottom line. Its stock is up 18% over the past year.

Analysts will be watching carefully to see how Jay Bradner does in the top R&D post after the Harvard prof-and-former-NIBR chief assumes the seat of David Reese, now chief technology officer. Reese seems truly energized in his new role heading up tech, and Bradner is a die-hard research enthusiast who loves nothing better than jumping into conversations about the details of target degeneration.

Amgen is all about message.

15. Novo Nordisk: The longtime diabetes franchise player has a breakout run going in obesity — with vows to stay in front

- R&D spending 2023: $4.7 billion (32.4 billion Danish Krone)

- R&D spending 2022: $3.5 billion (24 billion Danish Krone)

- Change: 34%

- Revenue: $22 billion (232.2 billion Danish Krone)

- R&D as a % of revenue: 14%

- R&D chief: Marcus Schindler

- Ticker: $NOVO — up 87% in the past year

The big picture: R&D spending as a percentage of sales has edged up a bit in the last few years, but the key driver here is GLP-1, where Novo has capitalized on its first-in-class leadership position in obesity. After decades spent in the shadow of chronic R&D failure, safety issues and a recent swarm of largely ineffective drugs, the obesity field is crushing it. That has swelled sales revenue as semaglutide glowed, so Novo’s research spending has boomed at a fast pace.

Now that the good times are rolling, and Novo already has a well-earned rep as a realistic and committed player in diabetes, which didn’t come cheap or easy, the new player on the R&D 15 is promising to stay out front — no easy task with Eli Lilly gunning for it. Novo has been snapping up new obesity tech at a furious pace, determined to stay out front.

Its one limiting factor here has been manufacturing capacity. Novo can’t satisfy the demand for a drug that is now a staple of public conversation, as the field gets a boost from a wide range of celebrities, including Oprah Winfrey. That’s marketing you could buy, but don’t have to. It’s coming for free.

With uncharacteristic bravado, Novo doubled down by striking a deal to acquire the global CDMO giant Catalent for $16.5 billion, and Lilly has been fuming about the antitrust aspects as CEO Dave Ricks complains that worldwide manufacturing capacity has either been maxed out or is not easily converted from its existing uses.

Novo’s commitment to growing R&D has international implications that far exceed the limits of its home country of Denmark, extending to hubs in Oxford, Seattle and Beijing. Most recently, Novo has committed to boosting its Boston-area research hub. And it’s likely to remain a key player in its dominant fields — unless some other tech can topple the megablockbuster that is remaking this company.

Novo may be at the end of this list in terms of R&D spending, but it has overachieved with its success for semaglutide. It has the capacity to do more and should continue to climb for several years to come as it makes a case for continued growth.

Postscript: Regeneron, with $4.44 billion in research spending — up 23% over $3.6 billion in 2022 — deserves an honorable mention in the competitive 16th spot. This year, Regeneron expects R&D spending to top up at or close to $5 billion. The company’s value has swollen on the success of its high-profile founders, Len Schleifer and George Yancopoulos, who continue to build the company — hitting a market cap in excess of $100 billion with the stock up 29% over the past year. Regeneron will likely find its way into the top 15 at some point, and we’ll be watching for it.

depression pandemic vaccine treatment testing fda preclinical therapy europe uk chinaUncategorized

Bitcoin on Wheels: The Story of Bitcoinetas

Meet the Bitcoinetas, a fleet of transformative vehicles on a mission to spread the bitcoin message everywhere they go. From Argentina to South Africa,…

You may have seen that picture of Michael Saylor in a bitcoin-branded van, with a cheerful guy right next to the car door. This one:

That car is the Bitcoineta European Edition, and the cheerful guy is Ariel Aguilar. Ariel is part of the European Bitcoineta team, and has previously driven another similar car in Argentina. In fact, there are currently five cars around the world that carry the name Bitcoineta (in some cases preceded with the Spanish definite article “La”).

Argentina: the original La Bitcoineta

The story of Bitcoinetas begins with the birth of 'La Bitcoineta' in Argentina, back in 2017. Inspired by the vibrancy of the South American Bitcoin community, the original Bitcoineta was conceived after an annual Latin American Conference (Labitconf), where the visionaries behind it recognized a unique opportunity to promote Bitcoin education in remote areas. Armed with a bright orange Bitcoin-themed exterior and a mission to bridge the gap in financial literacy, La Bitcoineta embarked on a journey to bring awareness of Bitcoin's potential benefits to villages and towns that often remained untouched by mainstream financial education initiatives. Operated by a team of dedicated volunteers, it was more than just a car; it was a symbol of hope and empowerment for those living on the fringes of financial inclusion.

Ariel was part of that initial Argentinian Bitcoineta team, and spent weeks on the road when the car became a reality. The original dream to bring bitcoin education even to remote areas within Argentina and other South American countries came true, and the La Bitcoineta team took part in dozens of local bitcoin meetups in the subsequent years.

One major hiccup came in late 2018, when the car was crashed into while parked in Puerto Madryn. The car was pretty much destroyed, but since the team was possessed by a honey badger spirit, nothing could stop them from keeping true to their mission. It is a testament to the determination and resilience of the Argentinian team that the car was quickly restored and returned on its orange-pilling quest soon after.

Over the more than 5 years that the Argentinian Bitcoineta has been running, it has traveled more than 80,000 kilometers - and as we’ll see further, it inspired multiple similar initiatives around the world.

Follow La Bitcoineta’s journey:

Twitter: https://twitter.com/labitcoineta

Instagram: https://www.instagram.com/bitcoineta/

El Salvador: Bitcoin Beach

In early 2021, the president of El Salvador passed the Bitcoin Law, making bitcoin legal tender in the country. The Labitconf team decided to celebrate this major step forward in bitcoin adoption by hosting the annual conference in San Salvador, the capital city of El Salvador. And correspondingly, the Argentinian Bitcoineta team made plans for a bold 7000-kilometer road trip to visit the Bitcoin country with the iconic Bitcoin car.

However, it proved to be impossible to cross so many borders separating Argentina and Salvador, since many governments were still imposing travel restrictions due to a Covid pandemic. So two weeks before the November event, the Labitconf team decided to fund a second Bitcoineta directly in El Salvador, as part of the Bitcoin Beach circular economy. Thus the second Bitcoineta was born.

The eye-catching Volkswagen minibus has been donated to the Bitcoin Beach team, which uses the car for the needs of its circular economy based in El Zonte.

Follow Bitcoin Beach:

Twitter: https://twitter.com/Bitcoinbeach

South Africa: Bitcoin Ekasi

Late 2021 saw one other major development in terms of grassroots bitcoin adoption. On the other side of the planet, in South Africa, Hermann Vivier initiated the Bitcoin Ekasi project. “Ekasi” is a colloquial term for a township, and a township in the South African context is an underdeveloped urban area with a predominantly black population, a remnant of the segregationist apartheid regime. Bitcoin Ekasi emerged as an attempt to introduce bitcoin into the economy of the JCC Camp township located in Mossel Bay, and has gained a lot of success on that front.

Bitcoin Ekasi was in large part inspired by the success of the Bitcoin Beach circular economy back in El Salvador, and the respect was mutual. The Bitcoin Beach team thus decided to pass on the favor they received from the Argentinian Bitcoineta team, and provided funds to Bitcoin Ekasi for them to build a Bitcoineta of their own.