US Futures On Edge Ahead Of “Extraordinarily Elevated” CPI Print

US Futures On Edge Ahead Of "Extraordinarily Elevated" CPI Print

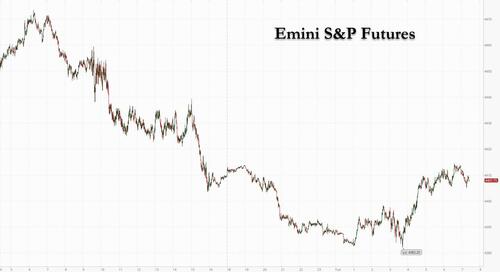

US index futures were flat on Tuesday, rebounding off overnight session lows…

US index futures were flat on Tuesday, rebounding off overnight session lows as investors braced for red hot inflation data which the White House yesterday called "extraordinarily elevated" and which will likely boost the argument for aggressive monetary tightening - perhaps even a 75bps or intermeeting rate hike - despite a looming economic slowdown. Nasdaq futures were 0.2% higher, while S&P futures were flat after dropping as much as 0.5%.

China’s Premier Li Keqiang issued a third warning about economic growth risks in less than a week but Chinese stocks bounced back over bets that policy makers will take measures to support the economy. The rate on 10-year Treasuries rose to the highest since 2018 as the global bond rout continued, rising for an 8th straight day as high as 2.83% before easing. The Bloomberg dollar index was set to extend its longest winning streak since 2020, rising for a ninth day. Both trends reflect expectations that the Fed will implement its fastest monetary tightening since 1994. The euro weakened. Oil staged a partial recovery after a tumble that saw crude erase most of the gains sparked by Russia’s invasion of Ukraine. China’s virus outbreaks and mobility curbs, in pursuit of a controversial Covid-zero strategy, are imperiling demand.

“What we’re faced with this year is stagflation,” Kathryn Rooney Vera, head of global macro research at Bulltick LLC, said on Bloomberg Television. “It’s a very complicated environment that the Fed has found itself in” and the market is pricing in potentially 50 basis points of hikes at each of the next two policy meetings, she added. Meanwhile, the Peterson Institute for International Economics expects a global recession by the end of the year due to Covid-related shutdowns in China and the Russia-Ukraine war

In premarket trading, Apple was flat after Citi said that it was likely to announce an incremental stock buyback of $80b-$90b and raise its dividend by 5-10% when it reports 2Q results later this month, according to Citi. Hewlett Packard Enterprise fell 3.6% after Morgan Stanley downgraded the stock to underweight and lowered its industry view for telecom and networking equipment to cautious from in-line, citing demand data. Other notable premarket movers include:

- Cisco (CSCO US) drop as much as 2.1% in premarket after Citi cuts rating to sell from neutral, citing competition and more difficult year-over-year comparisons for quarters ahead.

- Biodesix (BDSX US) surges 79% premarket after its chairman, board members revealed they had bought shares in the biotechnology firm.

- Coinbase (COIN US) price target cut by Mizuho Securities for a second straight week, this time citing analysis which suggests the cryptocurrency exchange is losing market share to other platforms. Shares up 0.8% premarket.

- Aeglea BioTherapeutics (AGLE US) shared added data from the PEACE Phase 3 study of pegzilarginase for the treatment of arginase 1 deficiency, with shares gaining 31% premarket.

Global growth optimism sank to a fresh all-time low, with recession fears surging in the world’s investment community, according to the latest monthly Bank of America survey of fund managers. The next major test for markets looms later Tuesday, when the U.S. is expected to unveil an inflation print for March of more than 8%, the highest since early 1982 (see our CPI preview here).

One of the more dangerous scenarios for markets “is that we have to raise rates at such a pace that it will clamp down on growth,” Kathryn Kaminski, chief research strategist at AlphaSimplex Group, said on Bloomberg Television. “That’s the scenario that most people are worried about.”

“These concerns over inflation are likely to remain in focus over the next two days,” said Michael Hewson, chief analyst at CMC Markets in London. “Today’s CPI numbers look set to seal the deal on a 50 basis-point rate move at the Federal Reserve’s May meeting, a move that bond markets are already discounting with the prospect of more to come.”

In Europe, stocks pared some losses as energy benefits from oil’s rally, while global yields slightly cool their ascent. Declines in the personal care and healthcare industries outweighed gains for energy and mining companies, with the Stoxx Europe 600 Index down 0.5% and the Euro Stoxx 50 falling 0.9%. IBEX outperformed, dropping 0.3%, DAX lags, dropping 1.1%. Health care, banks and financial services are the worst performing sectors. Energy is the best performing sector of Stoxx 600. Banking stocks were among the biggest decliners in Europe as concern over the impact of war in Ukraine and the possibility of recession started to impact profit estimates. Deutsche Bank AG and Commerzbank AG led the drop after stake sales worth a combined 1.75 billion euros ($1.9 billion) in Germany’s two largest listed banks. Russian stocks fell for a third day. Dubai Electricity & Water Authority jumped in its trading debut after raising $6.1 billion in the world’s second-biggest initial public offering this year. In the U.K., living standards fell at the fastest pace in more than eight years in February as wages lagged further behind the rate of inflation.

Earlier in the session, Asia’s stock benchmark pared much of its early drop on Tuesday, with Chinese shares bouncing back on speculation that policy makers will step in to support the economy. The MSCI Asia Pacific Index was down 0.6% as of 6:00 p.m. in Singapore after falling as much as 1%. The CSI 300 Index advanced by the most this month as traders bet that authorities may step up monetary-policy easing or relax some of the most severe Covid-19 restrictions. The broader risk-off sentiment remained, however, as lockdowns in China and higher U.S. interest rates dim the region’s growth prospects. Industrial firms were among the biggest drags on the MSCI measure, while chipmakers and electronic-hardware stocks followed U.S. tech peers lower as the 10-year Treasury yield climbed above 2.8%. “Investors globally are looking to hold defensive stocks and sell cyclical stocks that may be affected economically, and machinery-related stocks are one of the more economically sensitive ones,” said Shogo Maekawa, a strategist at JPMorgan Asset Management. Key gauges in Japan, the Philippines and South Korea led equity declines. Chinese tech stocks edged higher after a volatile trading day, as investors tipped toward optimism after Beijing’s approval of new video game licenses. China’s Covid-Zero policy remains a concern for international investors and is expected to continue to weigh on Asian shares, with the regional benchmark trading at its lowest since March 16.

Sri Lanka warned of an unprecedented default and halted payments on foreign debt, an extraordinary step taken to preserve its dwindling dollar stockpile for essential food and fuel imports.

Japanese equities dropped, dragged by technology shares for a second day amid ongoing concerns over inflation and Federal Reserve monetary policy. Electronics and machinery makers were the biggest drags on the Topix, which fell 1.4%. Fast Retailing and Tokyo Electron were the largest contributors to a 1.8% loss in the Nikkei 225. The yen slightly extended losses to around 125.5 per dollar after weakening 0.8% Monday. “Earnings will start coming out now, and I think it will still take some time before the uncertainty clears up and people start to buy back,” said said Shogo Maekawa, a strategist at JPMorgan Asset Management. “Investors globally are looking to hold defensive stocks and sell cyclical stocks that may be affected economically, and machinery-related stocks are one of the more economically sensitive ones.”

Australian stocks fell, led by the healthcare sector: the S&P/ASX 200 index fell 0.4% to close at 7,454.00, with the health sector falling most. Imugene was the biggest decliner on the benchmark gauge. Mining company Regis rose for a fourth day to the highest since Oct. 25, leading gains in the materials sector. In New Zealand, the S&P/NZX 50 index fell 0.4% to 11,889.17

In rates, treasuries remained cheaper across the curve after paring declines that were led by bunds as ECB and BOE policy-tightening premium increased further. U.S. yields cheaper by up to 2bp across front-end of the curve which underperforms slightly; 10-year yields around 2.79%, higher by ~1bp, with German 10-year cheaper by an additional 1bp. Focal points for U.S. session include March CPI data -- with 5-year TIPS breakeven rate ~25bp off its March peak -- and $34b 10-year note reopening. Monday’s 3-year auction was solid; cycle concludes Wednesday with $20b 30-year bond reopening. Gilts and bunds extended their drop as the market set pre-CPI positioning. U.K.’s 10-year debt sale had a bid-to-cover ratio of 2.64. Germany’s 2-year notes sale ahead, while U.S. 10-year sale is due after inflation data later Tuesday.

In FX, the greenback traded mixed against its Group-of-10 peers and the Bloomberg Dollar Spot Index edged up 0.1%, advancing for a ninth consecutive session - its longest winning stretch since 2020 - as traders bet on the Federal Reserve hiking rates to counter heated price growth, with the Australian dollar outperforming while the Swiss franc lagged. Hedge funds faded the euro move below 1.0860, while trimming dollar-yen longs above 125.50, two Europe-based traders say.

- The euro neared $1.0850 before paring losses; the bund curve bear steepens Germany’s ZEW investor expectations fell to to -41.0 (estimate -48.5) in April from -39.3 in March

- The pound fell below 1.30 per dollar, while gilts inched lower, led by the long end of the curve. U.K. jobs data showed a strong labor market, although average earnings excluding bonuses adjusted for prices dropped the most since late 2013 year-on-year. U.K. retailers warned that inflation is curbing demand, recording a sharp slowdown in sales in March.

- The Australian and New Zealand dollars erased an Asia session loss against the U.S. dollar. Australian sovereign bonds followed Treasuries lower and in view of a bounce in crude oil and iron ore, the latter of which arrested a five-day slide. Australian business sentiment surged as firms passed on increasing costs to consumers, reflecting strong underlying demand that highlights both economic momentum and gathering inflationary pressures

- The yen weakened for an eighth day before U.S. CPI numbers that are expected to reinforce the economic and monetary policy divergence between America and Japan. Five-year bonds outperformed after a solid auction. The yen’s implied and historical volatility may not be in the driver’s seat for the Group-of-10, but traders are betting it’s the currency that can move the most over the next month

Bitcoin is firmer and is holding onto the USD 40k mark after pronounced pressure in yesterday's session saw a breach of the level and a subsequent fall to a USD 39.21k overnight low. Bitcoin has dropped for seven days out of the past eight.

In commodities, crude futures advanced with WTI trading within Monday’s range, adding 3.2% to around $97. Brent rises 3.4% above $101. Spot gold falls roughly $2 to trade around $1,950/oz. Base metals are mixed; LME tin falls 0.6% while LME nickel gains 1.5%.

Looking at the day ahead, today brings the ever-important US CPI release. Consensus expects the monthly gain in headline CPI of +1.2% will push the year-on-year rate to +8.4%, the highest since 1981. However, many economists also think that March is the peak in the year-on-year rates for both headline and core. Elsewhere in the US, there’s the March NFIB small business optimism index. We’ll also get February UK unemployment and the April German ZEW survey. Finally, central bank speakers today include the Fed’s Brainard and Barkin.

Market Snapshot

- S&P 500 futures down 0.2% to 4,402.00

- STOXX Europe 600 down 0.8% to 454.78

- MXAP down 0.5% to 172.46

- MXAPJ little changed at 573.96

- Nikkei down 1.8% to 26,334.98

- Topix down 1.4% to 1,863.63

- Hang Seng Index up 0.5% to 21,319.13

- Shanghai Composite up 1.5% to 3,213.33

- Sensex down 0.7% to 58,579.23

- Australia S&P/ASX 200 down 0.4% to 7,453.98

- Kospi down 1.0% to 2,666.76

- German 10Y yield little changed at 0.86%

- Euro down 0.2% to $1.0862

- Brent Futures up 2.2% to $100.65/bbl

- Gold spot up 0.0% to $1,954.10

- U.S. Dollar Index up 0.24% to 100.17

Top Overnight News from Bloomberg

- Global growth optimism has sunk to an all-time low, with recession fears surging in the world’s investment community, according to the latest Bank of America Corp. fund manager survey

- Some Russian exporters face difficulties selling foreign currency proceeds in the market, newspaper Vedomosti reports, citing unidentified people close to the government, Bank of Russia and some exporters

- Global crude markets have swung from chaos to calm in just a few weeks as frenzied trading and a run- up in prices triggered by Russia’s invasion of Ukraine gives way to a return to more normal conditions

- U.K. living standards fell at the fastest pace in more than eight years in February as wages lagged further behind the rate of inflation. Average earnings excluding bonuses rose 4.1% from a year earlier, the Office for National Statistics said Tuesday. Adjusted for prices over the same period, however, they dropped 1.3%, the most since late 2013

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks followed suit to the losses across global counterparts amid higher yields and inflationary concerns. ASX 200 was dragged lower by weakness across defensives and tech but with losses in the broader market somewhat contained amid the improvement in NAB Business Confidence and Conditions. Nikkei 225 declined despite recent currency depreciation and the ruling LDP seeking to provide cash handouts. Hang Seng and Shanghai Comp were indecisive with early support in the former as gaming and internet stocks were boosted by China’s resumption of videogame approvals following a 9-month suspension. However, the gains for the Hong Kong benchmark were later pared and the mainland bourse was also cautious amid ongoing COVID woes.

Top Asian News

- China Tech Stocks Slide as Risks Outweigh Game Approval Uplift

- Tencent Soars After China Ends Eight-Month Gaming Freeze

- Macau Premium Mass Operators to Outperform Peers: Citi

- Australia Minister To Make Rare Solomon Islands Trip, ABC says

European bourses are subdued, Euro Stoxx 50 -0.7%, but off lows as participants await the US CPI metrics for fresh insight into the inflation narrative and for any read across to ongoing yield upside. The breakdown features relatively broad-based losses as the CAC 40 is in-line after Monday's election inspired outperformance while Banking names lag initially in a pullback from that session’s strength while Energy & Tech fare better. Stateside, futures are attempting to move into positive territory, ES Unch., but are yet to find a robust foothold.

Top European News

- German Investor Mood Sours Further Amid War-Driven Inflation

- U.K. Workers See Biggest Fall in Living Standards in Eight Years

- U.K. Labor Market Missing Almost 600,000 People Since Covid Hit

- EasyJet Sees Summer Flight Capacity Approaching 2019 Levels

Fixed Income

- Bonds bounce after sliding once more and setting fresh yield highs; 10 year T-note, Bunds and Gilts off new 119-10+, 154.27 and 118.42 cycle lows.

- UK and German debt may be gleaning some comfort from solid covers at Schatz and 2032 DMO auctions.

- Treasuries await US CPI and 10 year supply.

FX:

- Greenback grinds higher before US CPI with White House officials upping the ante for a hot set of inflation data, DXY eclipses last Friday's peak within a firmer 100.230-99.923 range.

- Aussie resilient after increases in NAB business sentiment and conditions and Kiwi underpinned awaiting 25bp or 50bp from the RBNZ, overnight; AUD/USD bounces off 0.7400 and NZD/USD keeps grip of 0.6800 handle.

- Euro holds above recent low and 2022 trough with some traction from Germany’s ZEW survey showing not as bad as feared economic sentiment and current conditions, EUR/USD above 1.0850 vs 1.0836 last Friday and 1.0806 y-t-d base.

- Sterling treading water around 1.3000 after mixed UK jobs and earnings, Loonie looking for support via decent option expiry interest at 1.2650 or chart levels after dropping through 200 DMA before BoC on Wednesday.

- Yen and Franc yield to divergent dynamics; USD/JPY poised below 2015 peak and USD/CHF rebounds from low 0.9300 zone.

- Japanese Finance Minister Suzuki said FX stability is important but did not comment on FX levels, while he added they are watching closely with vigilance how FX moves could impact Japan's economy. Suzuki also noted that excess FX volatility and disorderly FX moves could have an adverse effect on Japan's economy, while they will respond to FX as appropriate while communicating with the US and other countries.

Commodities:

- Crude benchmarks are continuing to regain composure after Monday's pressure, with WTI and Brent in proximity to highs of USD 97.72/bbl and USD 102.15/bbl respectively.

- European Commission official said the EU repeated its call during a meeting with OPEC for oil producers to look at whether they can increase deliveries, according to Reuters.

- US President Biden will on Tuesday lay out plans to extend the availability of higher biofuels-blended gasoline during the summer in a bit to control fuel costs, according to Reuters sources.

- Spot gold and silver are contained, particularly in the context of yesterday's price action, ahead of the key US events on the schedule.

US Event Calendar

- 06:00: March SMALL BUSINESS OPTIMISM dropped to 93.2, est. 95.0, prior 95.7

- 08:30: March CPI YoY, est. 8.4%, prior 7.9%; CPI MoM, est. 1.2%, prior 0.8%

- 08:30: March CPI Ex Food and Energy YoY, est. 6.6%, prior 6.4%; CPI Ex Food and Energy MoM, est. 0.5%, prior 0.5%

- 08:30: March Real Avg Hourly Earning YoY, prior -2.6%, revised -2.5%

- 08:30: March Real Avg Weekly Earnings YoY, prior -2.3%, revised -2.2%

- 14:00: March Monthly Budget Statement, est. -$190b, prior -$659.6b

DB's Tim Wessel concludes the overnight wrap

Yesterday was painted with a panoply of senior-level gatherings. The EU foreign ministers met in Luxembourg, where they weighed whether to sanction Russia’s energy sector. Those closer to Russia’s border were quicker to advocate for a ban on oil imports. The idea was not ruled out, with several EU countries seeking more time to transition energy supplies before signing up for an outright ban. This, as Russia posted its biggest current account surplus in nearly three decades on the back of strong energy export revenues. Germany is also ready to send weapons to Ukraine according to Chancellor Scholz. Austrian Chancellor Nehammer, meanwhile, became the first European head of state to meet with President Putin in person since his invasion. Nehammer expressed pessimism on peace prospects following the discussion.

Farther afield, President Biden met with Indian Prime Minister Modi. Biden pledged to help India diversify its energy sources in an attempt to persuade India from increasing purchases of Russian energy exports.

Finally, as we go to press this morning, the Pentagon is monitoring claims that Russia used a chemical agent in Mariupol. A number of news agencies have reported the accusation, but as of yet, none have been able to verify the original claim. If true, that would mark a much-feared escalation in tactics as Ukraine braces for a renewed assault on its territory in the east. After starting the week off on a weak foot, S&P 500 futures are down another -0.41% this morning.

Back to yesterday, Treasury yields continued their blistering selloff and curve re-steepening. Chicago Fed President Evans, owner of an inimitable dovish CV, thought that a +50bp hike in May was not only possible, but likely. He went on to say that policy should get to neutral by December, a range he pegged between 2.25% and 2.5%, which implies at least two +50bp hikes this year. The implied probability of a +50bp hike in May edged to a cycle high of 91.2%, with the amount of anticipated 2022 policy rate tightening hitting its own high at +255bps. 10yr Treasury yields gained another +8.0bps to 2.78%, their highest levels since January 2019, with breakevens (+4.3bps) and real yields (+3.7bps) each contributing. 2s10s steepened another +9.6bps to +27.4bps, its highest level in a month.

Much like how the Fed’s rhetoric has shaded ever more restrictive over the last few months, so too has their recent handicapping of a soft landing turned more pessimistic. Once a widely-accepted base case, yesterday Governor Waller was much more blunt, if not fatalistic, noting that interest rates are a “brute-force tool” and that there will be some “collateral damage” when they are used to slow inflation.

US equities took some collateral damage yesterday, with the S&P 500 down -1.69% to start the week, with every sector in the red, bringing YTD performance down to -7.42%. Energy (-3.11%) led the declines on the fall in oil prices, with brent crude futures down -4.18% to close below $100 for the first time in a month. Mega-cap tech names underperformed, with FANG+ falling -3.03%, given the discount rate hit to valuations, capping off five straight days of declines that has brought the FANG+ -11.73% lower. The index is now down -17.69% on the year.

It was a similar story in Europe, with year-end OIS rates increasing +5.4bps to +67.6bps, a cycle high, suggesting some probability that the deposit rate could end the year in positive territory. 10yr bund yields climbed +10.9bps to 0.82%, the highest level since 2015, while 10yr gilts gained +9.7bps to 1.85%, their highest since 2016. European stocks were a touch more resilient, with the STOXX 600 falling -0.59%.

In Europe, markets were also reacting to the first round of the French election. French assets outperformed as President Macron’s lead over Marine Le Pen was slightly wider than the final polls had implied. In particular, the spread of French 10yr yields over bunds narrowed by -5.2bps, coming down from its 2-year high last Friday. Furthermore, the CAC 40 (+0.12%) outperformed all the other major European equity indices.

The second round is set for later this month, and polls over the last 24 hours were a bit more favorable to Macron than the readings from late last week. Macron leads Le Pen by 55%-45% in Opinionway’s poll, and then 54.5%-45.5% in Odoxa’s. Ifop was somewhat narrower, at 52.5%-47.5%, but even that was wider than the 51%-49% margin they reported Sunday night. Harris had a 53-47% margin, also wider than its previous reading. For those after further information on the election, Marc de-Muizon from DB’s European economics team has published his takeaways following the first round (link here).

The other major thematic story is the continued Covid spread in China, their strict lockdown response, and the downstream impacts on supply chains and markets. Asian equities are broadly in the red to start trading this morning, with tech shares also lagging on the increase in long-dated sovereign yields. The Nikkei (-1.44%) is leading losses, which comes as Japanese PPI rose to +9.5% in March, while the February figure was revised to a four-decade high of +9.7%.

Oil prices have partially retraced yesterday’s big decline, with Brent futures rising +1.33% to $99.79/bbl. 10yr Treasury yields continue to forge a path higher, increasing +4.2bps to a three-year high of 2.82% this morning. The yield curve has shifted higher in parallel, with 2yr yields not far behind at +3.7bps.

There wasn’t a massive amount of data yesterday, but we did get the monthly GDP reading for February from the UK. That showed the economy grew by just +0.1% that month (vs. +0.2% expected). Consumers increased their inflation expectations for the year ahead to +6.6%, while three-year inflation dropped to +3.7%, according to the New York Fed’s survey.

To the day ahead, today brings the ever-important US CPI release. Our US econ and rates team put our their joint-preview, here. They’re expecting the monthly gain in headline CPI of +1.3% will push the year-on-year rate to +8.6%, the highest since 1981. However, they think that March is the peak in the year-on-year rates for both headline and core.

Elsewhere in the US, there’s the March NFIB small business optimism index. We’ll also get February UK unemployment and the April German ZEW survey. Finally, central bank speakers today include the Fed’s Brainard and Barkin.

Uncategorized

Homes listed for sale in early June sell for $7,700 more

New Zillow research suggests the spring home shopping season may see a second wave this summer if mortgage rates fall

The post Homes listed for sale in…

- A Zillow analysis of 2023 home sales finds homes listed in the first two weeks of June sold for 2.3% more.

- The best time to list a home for sale is a month later than it was in 2019, likely driven by mortgage rates.

- The best time to list can be as early as the second half of February in San Francisco, and as late as the first half of July in New York and Philadelphia.

Spring home sellers looking to maximize their sale price may want to wait it out and list their home for sale in the first half of June. A new Zillow® analysis of 2023 sales found that homes listed in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical U.S. home.

The best time to list consistently had been early May in the years leading up to the pandemic. The shift to June suggests mortgage rates are strongly influencing demand on top of the usual seasonality that brings buyers to the market in the spring. This home-shopping season is poised to follow a similar pattern as that in 2023, with the potential for a second wave if the Federal Reserve lowers interest rates midyear or later.

The 2.3% sale price premium registered last June followed the first spring in more than 15 years with mortgage rates over 6% on a 30-year fixed-rate loan. The high rates put home buyers on the back foot, and as rates continued upward through May, they were still reassessing and less likely to bid boldly. In June, however, rates pulled back a little from 6.79% to 6.67%, which likely presented an opportunity for determined buyers heading into summer. More buyers understood their market position and could afford to transact, boosting competition and sale prices.

The old logic was that sellers could earn a premium by listing in late spring, when search activity hit its peak. Now, with persistently low inventory, mortgage rate fluctuations make their own seasonality. First-time home buyers who are on the edge of qualifying for a home loan may dip in and out of the market, depending on what’s happening with rates. It is almost certain the Federal Reserve will push back any interest-rate cuts to mid-2024 at the earliest. If mortgage rates follow, that could bring another surge of buyers later this year.

Mortgage rates have been impacting affordability and sale prices since they began rising rapidly two years ago. In 2022, sellers nationwide saw the highest sale premium when they listed their home in late March, right before rates barreled past 5% and continued climbing.

Zillow’s research finds the best time to list can vary widely by metropolitan area. In 2023, it was as early as the second half of February in San Francisco, and as late as the first half of July in New York. Thirty of the top 35 largest metro areas saw for-sale listings command the highest sale prices between May and early July last year.

Zillow also found a wide range in the sale price premiums associated with homes listed during those peak periods. At the hottest time of the year in San Jose, homes sold for 5.5% more, a $88,000 boost on a typical home. Meanwhile, homes in San Antonio sold for 1.9% more during that same time period.

| Metropolitan Area | Best Time to List | Price Premium | Dollar Boost |

| United States | First half of June | 2.3% | $7,700 |

| New York, NY | First half of July | 2.4% | $15,500 |

| Los Angeles, CA | First half of May | 4.1% | $39,300 |

| Chicago, IL | First half of June | 2.8% | $8,800 |

| Dallas, TX | First half of June | 2.5% | $9,200 |

| Houston, TX | Second half of April | 2.0% | $6,200 |

| Washington, DC | Second half of June | 2.2% | $12,700 |

| Philadelphia, PA | First half of July | 2.4% | $8,200 |

| Miami, FL | First half of June | 2.3% | $12,900 |

| Atlanta, GA | Second half of June | 2.3% | $8,700 |

| Boston, MA | Second half of May | 3.5% | $23,600 |

| Phoenix, AZ | First half of June | 3.2% | $14,700 |

| San Francisco, CA | Second half of February | 4.2% | $50,300 |

| Riverside, CA | First half of May | 2.7% | $15,600 |

| Detroit, MI | First half of July | 3.3% | $7,900 |

| Seattle, WA | First half of June | 4.3% | $31,500 |

| Minneapolis, MN | Second half of May | 3.7% | $13,400 |

| San Diego, CA | Second half of April | 3.1% | $29,600 |

| Tampa, FL | Second half of June | 2.1% | $8,000 |

| Denver, CO | Second half of May | 2.9% | $16,900 |

| Baltimore, MD | First half of July | 2.2% | $8,200 |

| St. Louis, MO | First half of June | 2.9% | $7,000 |

| Orlando, FL | First half of June | 2.2% | $8,700 |

| Charlotte, NC | Second half of May | 3.0% | $11,000 |

| San Antonio, TX | First half of June | 1.9% | $5,400 |

| Portland, OR | Second half of April | 2.6% | $14,300 |

| Sacramento, CA | First half of June | 3.2% | $17,900 |

| Pittsburgh, PA | Second half of June | 2.3% | $4,700 |

| Cincinnati, OH | Second half of April | 2.7% | $7,500 |

| Austin, TX | Second half of May | 2.8% | $12,600 |

| Las Vegas, NV | First half of June | 3.4% | $14,600 |

| Kansas City, MO | Second half of May | 2.5% | $7,300 |

| Columbus, OH | Second half of June | 3.3% | $10,400 |

| Indianapolis, IN | First half of July | 3.0% | $8,100 |

| Cleveland, OH | First half of July | 3.4% | $7,400 |

| San Jose, CA | First half of June | 5.5% | $88,400 |

The post Homes listed for sale in early June sell for $7,700 more appeared first on Zillow Research.

federal reserve pandemic home sales mortgage rates interest ratesGovernment

Survey Shows Declining Concerns Among Americans About COVID-19

Survey Shows Declining Concerns Among Americans About COVID-19

A new survey reveals that only 20% of Americans view covid-19 as "a major threat"…

A new survey reveals that only 20% of Americans view covid-19 as "a major threat" to the health of the US population - a sharp decline from a high of 67% in July 2020.

What's more, the Pew Research Center survey conducted from Feb. 7 to Feb. 11 showed that just 10% of Americans are concerned that they will catch the disease and require hospitalization.

"This data represents a low ebb of public concern about the virus that reached its height in the summer and fall of 2020, when as many as two-thirds of Americans viewed COVID-19 as a major threat to public health," reads the report, which was published March 7.

According to the survey, half of the participants understand the significance of researchers and healthcare providers in understanding and treating long COVID - however 27% of participants consider this issue less important, while 22% of Americans are unaware of long COVID.

What's more, while Democrats were far more worried than Republicans in the past, that gap has narrowed significantly.

"In the pandemic’s first year, Democrats were routinely about 40 points more likely than Republicans to view the coronavirus as a major threat to the health of the U.S. population. This gap has waned as overall levels of concern have fallen," reads the report.

More via the Epoch Times;

The survey found that three in ten Democrats under 50 have received an updated COVID-19 vaccine, compared with 66 percent of Democrats ages 65 and older.

Moreover, 66 percent of Democrats ages 65 and older have received the updated COVID-19 vaccine, while only 24 percent of Republicans ages 65 and older have done so.

“This 42-point partisan gap is much wider now than at other points since the start of the outbreak. For instance, in August 2021, 93 percent of older Democrats and 78 percent of older Republicans said they had received all the shots needed to be fully vaccinated (a 15-point gap),” it noted.

COVID-19 No Longer an Emergency

The U.S. Centers for Disease Control and Prevention (CDC) recently issued its updated recommendations for the virus, which no longer require people to stay home for five days after testing positive for COVID-19.

The updated guidance recommends that people who contracted a respiratory virus stay home, and they can resume normal activities when their symptoms improve overall and their fever subsides for 24 hours without medication.

“We still must use the commonsense solutions we know work to protect ourselves and others from serious illness from respiratory viruses, this includes vaccination, treatment, and staying home when we get sick,” CDC director Dr. Mandy Cohen said in a statement.

The CDC said that while the virus remains a threat, it is now less likely to cause severe illness because of widespread immunity and improved tools to prevent and treat the disease.

“Importantly, states and countries that have already adjusted recommended isolation times have not seen increased hospitalizations or deaths related to COVID-19,” it stated.

The federal government suspended its free at-home COVID-19 test program on March 8, according to a website set up by the government, following a decrease in COVID-19-related hospitalizations.

According to the CDC, hospitalization rates for COVID-19 and influenza diseases remain “elevated” but are decreasing in some parts of the United States.

International

Rand Paul Teases Senate GOP Leader Run – Musk Says “I Would Support”

Rand Paul Teases Senate GOP Leader Run – Musk Says "I Would Support"

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump…

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump into the race to become the next Senate GOP leader, and Elon Musk was quick to support the idea. Republicans must find a successor for periodically malfunctioning Mitch McConnell, who recently announced he'll step down in November, though intending to keep his Senate seat until his term ends in January 2027, when he'd be within weeks of turning 86.

So far, the announced field consists of two quintessential establishment types: John Cornyn of Texas and John Thune of South Dakota. While John Barrasso's name had been thrown around as one of "The Three Johns" considered top contenders, the Wyoming senator on Tuesday said he'll instead seek the number two slot as party whip.

Paul used X to tease his potential bid for the position which -- if the GOP takes back the upper chamber in November -- could graduate from Minority Leader to Majority Leader. He started by telling his 5.1 million followers he'd had lots of people asking him about his interest in running...

Thousands of people have been asking if I'd run for Senate leadership...

— Rand Paul (@RandPaul) March 8, 2024

...then followed up with a poll in which he predictably annihilated Cornyn and Thune, taking a 96% share as of Friday night, with the other two below 2% each.

????????️VOTE NOW ????️ ???? Who would you like to be the next Senate leader?

— Rand Paul (@RandPaul) March 8, 2024

Elon Musk was quick to back the idea of Paul as GOP leader, while daring Cornyn and Thune to follow Paul's lead by throwing their names out for consideration by the Twitter-verse X-verse.

I would support Rand Paul and suspect that other candidates will not actually run polls out of concern for the results, but let’s see if they will!

— Elon Musk (@elonmusk) March 8, 2024

Paul has been a stalwart opponent of security-state mass surveillance, foreign interventionism -- to include shoveling billions of dollars into the proxy war in Ukraine -- and out-of-control spending in general. He demonstrated the latter passion on the Senate floor this week as he ridiculed the latest kick-the-can spending package:

This bill is an insult to the American people. The earmarks are all the wasteful spending that you could ever hope to see, and it should be defeated. Read more: https://t.co/Jt8K5iucA4 pic.twitter.com/I5okd4QgDg

— Senator Rand Paul (@SenRandPaul) March 8, 2024

In February, Paul used Senate rules to force his colleagues into a grueling Super Bowl weekend of votes, as he worked to derail a $95 billion foreign aid bill. "I think we should stay here as long as it takes,” said Paul. “If it takes a week or a month, I’ll force them to stay here to discuss why they think the border of Ukraine is more important than the US border.”

Don't expect a Majority Leader Paul to ditch the filibuster -- he's been a hardy user of the legislative delay tactic. In 2013, he spoke for 13 hours to fight the nomination of John Brennan as CIA director. In 2015, he orated for 10-and-a-half-hours to oppose extension of the Patriot Act.

Among the general public, Paul is probably best known as Capitol Hill's chief tormentor of Dr. Anthony Fauci, who was director of the National Institute of Allergy and Infectious Disease during the Covid-19 pandemic. Paul says the evidence indicates the virus emerged from China's Wuhan Institute of Virology. He's accused Fauci and other members of the US government public health apparatus of evading questions about their funding of the Chinese lab's "gain of function" research, which takes natural viruses and morphs them into something more dangerous. Paul has pointedly said that Fauci committed perjury in congressional hearings and that he belongs in jail "without question."

Musk is neither the only nor the first noteworthy figure to back Paul for party leader. Just hours after McConnell announced his upcoming step-down from leadership, independent 2024 presidential candidate Robert F. Kennedy, Jr voiced his support:

Mitch McConnell, who has served in the Senate for almost 40 years, announced he'll step down this November.

— Robert F. Kennedy Jr (@RobertKennedyJr) February 28, 2024

Part of public service is about knowing when to usher in a new generation. It’s time to promote leaders in Washington, DC who won’t kowtow to the military contractors or…

In a testament to the extent to which the establishment recoils at the libertarian-minded Paul, mainstream media outlets -- which have been quick to report on other developments in the majority leader race -- pretended not to notice that Paul had signaled his interest in the job. More than 24 hours after Paul's test-the-waters tweet-fest began, not a single major outlet had brought it to the attention of their audience.

That may be his strongest endorsement yet.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex