US Futures, European Markets Rise After China’s First Rate Cut In 2 Years

US Futures, European Markets Rise After China’s First Rate Cut In 2 Years

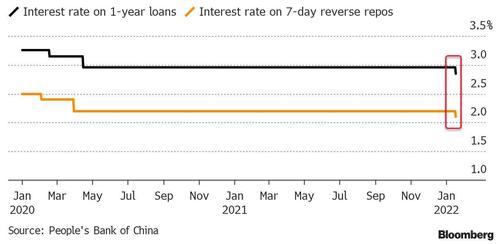

US equity futures, European bourses and Asian markets were all broadly higher after China unexpectedly cut official policy rates for the first time since 2020…

…

US equity futures, European bourses and Asian markets were all broadly higher after China unexpectedly cut official policy rates for the first time since 2020...

... to counter an economic slowdown. A real-estate slump and partial Covid shutdowns are among the challenges for the world’s second-largest economy. The move contrasts with the shift toward tighter monetary policy in the U.S. and elsewhere to contain price pressures.

“The PBOC really has started the New Year in a different position to, let’s say, other global banks and we do expect to see further easing or supportive measures, both monetary-wise as well as from a fiscal stance,” Catherine Yeung, investment director at Fidelity International, said on Bloomberg Television. The Chinese move has prompted speculation that the current round of global central bank tightening will be short lived, which will be good news for high-duration tech stocks.

While the US is closed for MLK Day, US equity futures reversed earlier losses and traded near session highs, up 8 points or 0.2% to 4,662, as the tri-state area found itself covered under several inches of snow.

Europe’s Stoxx 600 Index and U.S. futures rose, while Asian shares closed modestly in the red. The dollar and oil were little changed.

Even thought cash bond markets are closed, Treasury futs suggested yields had risen above 1.80% to a new multi year high, after yields tumbled Friday on concerns about more hawkish Federal Reserve policy to fight inflation. JPMorgan Chief Executive Officer Jamie Dimon, whose blank plunged after reporting disappointing trading revenues and surging expenses, said Friday the central bank could raise rates as many as seven times and traders are reconsidering an earlier kickoff for the first European Central Bank rate increase in more than a decade. Jamie Dimon will, of course, be dead wrong as he has been wrong about bitcoin.

Despite today's rise in futures, sentiment remains subdued and rallies are sold. The advance of the omicron virus strain, the start of the earnings season and a boom in mergers and acquisitions are also coloring sentiment. Investors are looking for signs that companies can sustain profit growth despite rising risks.

Meanwhile as part of its weekly pep talk (last week, JPM's Marko Kolanovic said it was time to buy the dip, the second week in a row the bank urged clients to do just that), JPMorgan said global company earnings will defy doomsayers and skeptics once again this season and surprise to the upside - a view at odds with recent warnings that inflation, rising rates, supply chain bottlenecks and slowing economic growth will curb companies’ prospects following last year’s blockbuster earnings growth.

Ironically, it was JPMorgan's earnings that sent the Dow sliding on Friday: Wall Street banks kicked off the earnings season with mixed results last week, disappointing investors and tamping down some profit expectations for this year.

“Given the record inflation backdrop and historically tight labor market, investor focus is on margins -- demonstrating pricing power, passing on rising costs to the customer,” Julian Emanuel, chief equity and quantitative strategist at Evercore ISI, wrote in a note.

European equities returning toward session highs after initially fading opening gains in a choppy start to the week. Euro Stoxx 50 gains as much as 0.7%. FTSE 100 and IBEX avoid the early fade seen in other equity indexes. Media, consumer products, tech and miners are the strongest sectors. Among individual movers on Monday, Unilever Plc shares fell more than 7%, while GlaxoSmithKline Plc rose, as the consumer-products company considers making a higher offer for Glaxo’s consumer unit. Equipment maker BE Semiconductor rose to the highest since the stock’s 1995 listing after Oddo and Deutsche Bank boosted their price targets. In corporate developments, Credit Suisse Group AG’s Chairman Antonio Horta-Osorio was ousted for breaching Covid quarantine rules, throwing the Swiss financial giant into fresh turmoil as it struggles to emerge from a series of scandals.

Here are some of the biggest European movers today:

- Stadler Rail surges as much as 8%, their best day since March 2020, following a contract win. The announcement of the company’s largest-ever contract marks “another major success,” Vontobel says.

- Equipment maker BE Semiconductor rises as much as 6.3% to EU88.34 in Amsterdam trading, hitting the highest since the stock’s 1995 listing, after Oddo and Deutsche Bank boosted their price targets.

- Siltronic declines as much as 11% after the company cast doubt on the planned $5.3b takeover by Taiwan’s GlobalWafers, saying the German Economy Ministry’s feedback so far was opaque and offered no clear resolution on how to win approval for the deal.

- Ageas falls as much as 12%, the most since April 2020, after Belgium’s Federal Holding and Investment Company (FPIM) acquired a 6.3% stake in the reported takeover target.

- Darktrace drops as much as 8.1% after the Telegraph reported Shadowfall is shorting the cybersecurity software firm.

- Maersk slides as much as 6%, adding to Friday’s 4.4% tumble, after Nordea downgraded the Danish shipping firm to hold from buy, saying the exceptional demand situation will normalize in 2023.

- Credit Suisse falls as much as 2.2% in Zurich after the Swiss bank ousted its chairman, leaving a number of analysts questioning the bank’s leadership.

Earlier in the session, Asian stocks fell as China’s economic data showed a slowdown in growth during the last quarter, with the nation’s central bank cutting a key interest rate for the first time in almost two years. The MSCI Asia Pacific Index dropped as much as 0.4%, slipping for a third session amid a slump in financials and materials. Mainland China’s CSI 300 Index closed up less than 1% after the People’s Bank of China cut two policy interest rates. China’s economy grew 4% in the final quarter of 2021 from a year earlier, a pace slower than during the previous three months. “The market seems to be unimpressed by GDP data and the rate cut because they probably anticipated more policy support,” said Margaret Yang, strategist at DailyFX. “The main concerns remain property and loan curbs, the ‘zero-Covid’ policy and a weak consumer market.” Benchmarks in Vietnam and South Korea were among the biggest decliners in the region. The Kospi lost more than 1% before a retail subscription for LG Energy Solution’s share float, the largest in the country’s history. Tencent and Meituan were among the biggest drags on the MSCI Asia Pacific Index. Asian stocks have outperformed their U.S. and European peers so far this year on cheaper valuations, as well as expectations that the worst of China’s tech clampdown has passed and confidence the region can quell omicron waves with timely social-distancing curbs. Tighter U.S. monetary policy is, however, weighing on regional shares and heavyweight tech stocks.

In FX, the Bloomberg Dollar Spot Index was little changed and the dollar was steady to weaker against all Group-of-10 peers apart from the yen; most currencies were confined in a narrow range with U.S. financial markets shut for a holiday. The euro inched up after testing the $1.14 handle and bund yields rose, led by the long end. Money markets today briefly wagered on 10-basis-points of ECB tightening as soon as September, the first time a move that month has been seen since before the omicron coronavirus variant roiled markets. The Canadian dollar and the Norwegian krone rose as Brent oil traded near the highest intraday level since 2014; the market tightened amid concerns about the impact of omicron eased. Norway’s exports surged to a record last year, helped by higher demand for fossil fuels, fish and metals. The pound was steady, with market focus on labor market and inflation data due later this week. Gilts yields rose by 3-4bps across the curve. The Bank of England is likely to hike its key rate at its next meeting, according to the median of a poll of economists. The yen weakened from the strongest in a month after hawkish comments from Fed officials on Friday spurred buying back of dollars; bonds stayed in a narrow range before a BOJ policy decision Tuesday. Overnight volatility in the yen remains subdued even amid speculation the Bank of Japan could change its view on price risks for the first time since 2014 when it sets policy on Tuesday.

In rates, Bunds and gilt curves bear steepen; gilts 1-2bps cheaper to bunds across the curve. Peripheral spreads tighten with 5y Italy outperforming. Money markets briefly price in 10bps of tightening by September before fading. Cash USTs stay closed for U.S. holiday but futures suggest the 10Y yield is currrently around 1.82% (see chart above).

In commodities, WTI back off Asia’s best levels to trade near $84, Brent is flat near $86. Spot gold drifts around the middle of Friday’s range close to $1,821/oz. Most base metals are in the red with LME nickel and copper underperforming.

There is nothing on the US economic calendar as the US is closed for MLK Day.

Top Overnight News from Bloomberg

- China’s central bank cut its key interest rate for the first time in almost two years to help bolster an economy that’s lost momentum because of a property slump and repeated virus outbreaks

- China’s population crisis continued to worsen in 2021, with the latest birth figures again sliding despite government efforts to encourage families to have more children

- Boris Johnson faces another bruising week, with his future as U.K. prime minister in the balance amid a furious public backlash over rule-breaking parties at his Downing Street office

- Governor Haruhiko Kuroda starts his last full year at the helm of Bank of Japan amid hints of public discontent over rising prices that could shape the direction of the central bank after he leaves or even as soon as coming months

- Emerging-market central banks were the first in the world to raise interest rates from their pandemic lows last year. That proactive tightening is starting to pay off big time in boosting returns from their local bonds

- As U.S. President Joe Biden’s administration looks to deter Russia from invading Ukraine, doubts are being raised about Germany’s readiness to confront President Vladimir Putin. When Foreign Minister Annalena Baerbock travels to Russia this week, her task will be to demonstrate that any questions over the new Berlin government’s resolve are misplaced

A more detailed look at global markets courtesy of Newqsuawk

Major bourses in Europe have kicked off the week mostly positive (Euro Stoxx 50 +0.5%; Stoxx 600 +0.4%) following a similar handover from the APAC session, which derived some support from Wall Street’s recovery on Friday – with US cash markets closed today for Martin Luther King Day. US futures see a holiday-shortened session but trade with little conviction in early European hours and within narrow parameters, albeit off the worst levels printed overnight. Back to Europe, a divergence is evident between the EUR-bourses (namely the AEX) and the non-EUR indices amid one main factor: Monday M&A which saw GSK (+4.7%) rejecting Unilever’s (-6.8%) GBP 50bln bid for GSK’s Consumer Health unit, with some reports suggesting the latter could up the offer to some GBP 60bln. This in turn jolted the Healthcare sector at the open (GSK accounts for around 9%) whilst the Personal and Household Goods sector is simultaneously pressured (Unilever accounts for around 13.5%) – thus underpinning the FTSE 100 (+0.7%) and the SMI (+0.6%) while the AEX (-0.6%) sits as the regional laggard. Delving deeper into the sectors, Basic Resources resides as one of the top performers as base metals are buoyed by China topping GDP growth expectations. Autos and Oil & Gas sit towards the bottom, with the latter seeing oil prices wane off best levels throughout the morning. In terms of individual movers, Credit Suisse (-1.2%) is weighed on after Chairman Antonio Horta-Osorio resigned with immediate effect after an internal company probe found he had broken the UK's Covid-19 quarantine rules in July. Darktrace (-4.5%) is lower as short-seller ShadowFall criticised the Co's performance, accounting and culture. ShadowFall confirmed that it had placed a bet against Darktrace in October, although the size was not disclosed. Siltronic (-7.0%) slumps as key requirements are still outstanding with regards to Germany's approval of the Co's sale to Taiwan's GlobalWafers. EDF (-2.1%) feels no reprieve as it cut output at its 1.3GW French oil and gas plant amid strikes, whilst the firm was also downgraded at HSBC. Looking at analyst commentary, Credit Suisse said value stocks usually see outperformance as yields rise, and the bank remains overweight Europe, UK and Japan. From a sectorial standpoint, Credit Suisse remains overweight on Financials, Mining, and Construction Materials, whilst the bank suggests it is too early to add tech. The bank suggests that yields in the 2-2.5% region will pose problems for equities as earnings, growth, fund flows and corporate purchases will be impacted.

In FX, the Dollar is waning again and the index is only just holding above 95.000 within a 95.291-035 band by virtue of upside in Usd/Jpy amidst firmer US Treasury yields and a steeper curve in wake of more hawkish Fed rhetoric via Williams as the last official speaker before the pre-January FOMC blackout. Meanwhile, the Yen has failed to glean full benefit from upbeat Japanese data in the form of machinery orders on the eve of the BoJ amidst reports that Tokyo and surrounding areas could be on the brink of entering quasi-emergency status due to the ongoing spread of COVID. However, the headline pair faces resistance above 114.50 via a Fib retracement level (114.58 representing 38.2% of the retreat from 116.35 to 113.48 this month) and 21 DMA (114.86), while nearest support is at the 50 DMA (114.27) and not far from decent option expiry interest (1 bn at 114.20). Note, thinner than average volumes, even for a Monday given MLK Day in the US.

- CAD/NZD/CHF/EUR/AUD/GBP - While the Yen lags and Greenback flags, firm crude prices are underpinning the Loonie ahead of Canadian manufacturing sales and the BoC’s Business Outlook Survey that will be eyed for any early signs of adverse impact from the Omicron outbreak. Usd/Cad is currently towards the base of a 1.2508-57 range, while Nzd/Usd and Aud/Usd are hovering on 0.6800 and 0.7200 respective handles, but the Kiwi is marginally outperforming the Aussie against the backdrop of weakness in metals and mixed Chinese data. Aud/Nzd has been mostly a fraction under 1.0600 awaiting NZIER consumer sentiment in advance of electronic card retail sales, Aussie jobs and NZ manufacturing PMI later in the week. Elsewhere, the Franc has rebounded from sub-0.9150 and is firmer against the Euro between 1.0445-28 parameters even though weekly Swiss sight deposits indicate more SNB intervention, while Eur/Usd is contained within 1.1400-34 bounds and Cable is meandering from 1.3662-90 in the run up to a trio of top tier UK releases, including employment and earnings, inflation and retail sales.

- SCANDI/EM - The Nok and Sek are pivoting 10.0000 and 10.3000 vs the Eur without too much reaction to Norway's trade surplus widening significantly to Nok 100+ bn, or Sweden’s mini budget showing Sek 18 bn set aside for pandemic-related measures, but the Cnh and Cny are both maintaining momentum around 6.3500 against the Usd following the aforementioned contrasting Chinese macro releases whereby GDP and IP beat consensus, but retail sales missed, plusPBoC easing via 10 bp reductions in the 1 year MLF and 7 day reverse repo. Conversely, the Rub continues to suffer from geopolitical and diplomatic angst as NATO pledges to reinforce Eastern members of the organisation if Russia decides to attack Ukraine.

In commodities, WTI and Brent front-month futures trade with no conviction but hold onto Friday’s gains, whilst overnight price action saw the latter reach prices last seen in 2014. The complex is underpinned by the mild upside bias across stocks, coupled with reopening vibes, geopolitical risk premia and the inability for some OPEC producers to ramp up output. To elaborate, weekend news flow regarding COVID was more sanguine from Europe, with nations set to ease COVID rules, albeit China’s Beijing city moves the other way amid its zero-COVID policy ahead of the winter Olympics. Geopolitical updates have been abundant, with the Russia/Ukraine situation tensions still heightened, while North Korea launched more projectiles. Further, Emirates News Agency noted three oil tanker explosions in the Al-Musaffah area in Abu Dhabi – potentially via drones emanating from Yemeni Houthis. Finally, reports via Argus Media on Friday suggested "The 19 Opec+ countries participating in the production restraint deal hiked their collective output by just 300k BPD in December, according to Argus' survey.”, suggesting the producers were around 650k BPD below their targets. WTI and Brent remain not far off the USD 84/bbl and USD 86/bbl marks respectively, with eyes on any further measures implemented by large oil consumers (such as the US and China) to reign in prices and avoid a larger knock-on effect on inflation. Elsewhere, spot gold is uneventful and trades around USD 1,820/oz mark – under the USD 1,830/oz resistance zone and above the 21 DMA at USD 1,802/oz. LME copper meanwhile was on a firmer footing following the Chinese GDP metrics overnight but has given up its earlier gains in early European hours with prices inching back towards USD 9,500/t.

DB's Jim Reid concludes the overnight wrap

Hope you had a good weekend. Fog and a very bad back stopped me golfing and I went swimming with the family instead. Two 12 year old boys clattered into me in the pool as they were involved in a horrendously aggressive play fight. I was furious as I got a good whack, and was about to give the man looking after them a piece of my mind, when I realised they were identical twins. My anger immediately turned to sympathy and when the Dad came over to apologise I said that I fully understood. Mine are only 4 and they wrestle, punch, slap, and trip each other up all the time. I thought they'd grow out of this but if these 12 years old boys were anything to go by I'm now very worried.

Talking of fights, it's becoming increasingly clear that 2022 is going to be a year where it's all about the battle between the Fed and financial conditions. After paying lip service to inflation for most of 2021, they have now got the bit between their teeth and in my opinion every meeting after March is live from a policy perspective. So if financial conditions don't tighten then we could have 7 hikes given how far behind the curve the Fed is on inflation. However a more likely outcome is that the Fed will be more measured as consistent rate hikes will probably lead to occasion market wobbles and gaps between the hikes. We will see. The other thing to look out for is a potential 50bps hike along the way and even as the opening gambit in March. This might feel fanciful but remember that since June, the pricing of various Fed Funds and taper/QT landmarks have repeatedly gone from zero to probable in relatively short order.

Our head of global economics Peter Hooper published a "What's in the tails?" piece last night looking at how there is an increasing risk that the Fed may want to move more quickly to neutral and even toward a restrictive monetary policy stance. He outlines what scenarios would need to happen for such an outcome. So while the team keep their 4 rate hikes and QT central view, they are acknowledging the upside risks to this. See the piece here.

After a late and notably bond sell off on Friday, that helped 10yr Treasury yields to end the week at fresh 2-year highs, markets will get some breathing space today with a US holiday and a Fed that are in their blackout period ahead of next week's FOMC.

The week has kicked off with China's monthly data dump but the PBOC upstaged this by surprisingly cutting rates on its medium term loans ahead of the GDP release. In the first move since April 2020, the PBOC lowered its one-year medium term lending facility (MLF) rate by 10bps to 2.85% from 2.95% and slashed the seven-day repurchase rate to 2.1% from 2.2%. Additionally, the central bank injected 700 bn yuan ($110 bn) worth of liquidity via the MLF and added 100 billion yuan of liquidity via reverse repos. Separately, data showed Q4 GDP expanded +4.0% y/y beating Bloomberg forecast of 3.3%. However, the rise was more muted in the last three months (+4.9%) as a real estate downturn combined with strict Covid-19 curbs hit activity.

Other economic data showed that industrial production in China jumped by +4.3% in December from a year ago surpassing market expectations of a +3.7% growth. In addition to this, Fixed asset investment for 2021 advanced by +4.9%, topping market expectations for +4.8% rise. However, retail sales missed expectations (+3.8%) with only a +1.7% gain in December from a year earlier, its slowest increase since August 2020.

In early trade today, markets across Asia are off to a cautious start. Japan's Nikkei (+0.84%) is inching higher, recouping losses from the previous two sessions, with the CSI (+0.86%) and Shanghai Composite (+0.59%) trading in positive territory. Elsewhere, the Kospi (-1.34%) and Hang Seng (-0.59%) are losing ground. In other data news, Japan's core machinery orders grew +3.4% in November (+3.8% last month), rising for the second straight month, suggesting a decent private demand-led recovery in the world's third-biggest economy.

In terms of the rest of the week, earnings season will begin to gather some momentum, with 39 S&P 500 companies reporting. Elsewhere the Bank of Japan will be making its latest monetary policy decision tomorrow which is unlikely to see much change now but reputable press reports are suggesting they are ready to become more hawkish in the coming months with a credible Reuters story late last week suggested they are prepared to raise rates before inflation reaches 2%. This is still someway off but if the BoJ can become more hawkish then that says something about the global direction of travel for monetary policy.

Otherwise on the data front, there’ll be further developments on inflation as the UK releases its CPI print for December, with our economist expecting a further rise to +5.3% on a year-on-year basis. If realised, that would be the highest CPI print since March 1992. That’ll also be the last CPI reading ahead of the BoE’s next policy decision on February 3, where our economist is expecting a further 25 basis point hike.

In terms of more details on earnings season, with 39 S&P 500 companies reporting ahead of the two peak weeks, the highlights are Goldman Sachs and BNY Mellon tomorrow, before we hear from UnitedHealth Group, Bank of America, Procter & Gamble, ASML, Morgan Stanley, Charles Schwab, US Bancorp and United Airlines on Wednesday. Finally on Thursday, there’s reports from Netflix, Union Pacific and American Airlines Group. For those interested, DB's asset allocation team have put out a Q4 earnings preview (link here).

Recapping last week now, global sovereign yields drifted lower most of the week after ripping higher to start the year. However a sizable selloff on Friday took us to fresh 2 year yield highs. Equity markets ended the week lower but enjoyed some respite from the otherwise torrid start to the year.

Diving in, there was a chorus of Fed speakers this week ahead of their January FOMC communications blackout. Foremost among them, Chair Powell and Governor Brainard testified before the Senate Banking Committee as part of their hearings for respective (re)nominations as Chair and Vice Chair of the Fed. They set the tone that was broadly echoed by other Governors and regional Presidents over the week: the first rate hike was likely coming in March (in line with our US economists expectations), and QT would be employed sometime in 2022 to fight inflation. We ended the week with a 97% probability of a March hike, the highest this cycle, and 2 full hikes priced by the June FOMC. Our economists are expecting 4 rate hikes this year, in addition to QT beginning, and the market is currently pricing around 3.8 hikes through the year.

The growing consensus around earlier Fed tightening lifted 2yr treasury yields +10.5bps this week, most of it via a +7.4bps increase on Friday. Farther out the curve, 10yr treasury yields were a bit calmer compared to the week before, ending the week +2.2bps higher (+8.0bps Friday) after drifting lower most of the week before a sharp end week sell-off. In Europe, 10yr bunds and gilts fell a modest -0.3bps (+4.4bps Friday) and -2.8bps (+4.5bps Friday) respectively but closed before the last leg of the US bond sell off.

The S&P 500 managed its first consecutive days of increases in 2022 last week, but still fell -0.30% on the week (+0.08% Friday), bringing it -2.17% lower to start the year. European equities were not spared, with the STOXX 600 falling -1.05% (-1.01% Friday), the DAX down -0.40% (-0.93% Friday) and the CAC lower by -1.06% (-0.81% Friday). Higher real 10yr treasury yields have been a big culprit so far, having increased an additional +7.2bps this week (+7.6bps Friday) to -0.70%, their highest level since April. However they were at -0.88bp late on Wednesday so a pretty choppy week. Risk sentiment was also likely impacted by geopolitics. In particular, the talks between US, its NATO allies, and Russia proving less-than-optimal.

Crude oil had another strong week, with Brent increasing +5.77% (+2.41% Friday) and WTI up +6.81% (+2.60% Friday). Oil is once again making a strong bid to be the best performing asset in 2022, with both Brent and WTI up over +10% to start the year. US earnings season kicked off with releases from major financials, JPM, Wells Fargo, and Blackrock. The two banks beat sales and revenue expectations but had below consensus revenues stemming from FICC trading. Blackrock posted higher earnings but lower sales per share than expected.

Turning to data, despite shrinking in Q4, German GDP grew 2.7 percent over 2021, driven by strong government spending, net exports, and investment. Private consumption was stagnant as real disposable income fell with rising prices.

US CPI reached 7.0 percent year-over-year in December, in line with expectations and the highest level since 1982. Core CPI increased 5.5 percent, year-over-year, slightly higher than consensus expectations. Price increases were broad-based across components. US retail sales declined -1.9 percent month-over-month in December, well below consensus expectations, perhaps a reflection of US consumers bringing holiday shopping forward to avoid any supply chain-driven delays.

Government

Vaccine-skeptical mothers say bad health care experiences made them distrust the medical system

Vaccine skepticism, and the broader medical mistrust and far-reaching anxieties it reflects, is not just a fringe position in the 21st century.

Why would a mother reject safe, potentially lifesaving vaccines for her child?

Popular writing on vaccine skepticism often denigrates white and middle-class mothers who reject some or all recommended vaccines as hysterical, misinformed, zealous or ignorant. Mainstream media and medical providers increasingly dismiss vaccine refusal as a hallmark of American fringe ideology, far-right radicalization or anti-intellectualism.

But vaccine skepticism, and the broader medical mistrust and far-reaching anxieties it reflects, is not just a fringe position.

Pediatric vaccination rates had already fallen sharply before the COVID-19 pandemic, ushering in the return of measles, mumps and chickenpox to the U.S. in 2019. Four years after the pandemic’s onset, a growing number of Americans doubt the safety, efficacy and necessity of routine vaccines. Childhood vaccination rates have declined substantially across the U.S., which public health officials attribute to a “spillover” effect from pandemic-related vaccine skepticism and blame for the recent measles outbreak. Almost half of American mothers rated the risk of side effects from the MMR vaccine as medium or high in a 2023 survey by Pew Research.

Recommended vaccines go through rigorous testing and evaluation, and the most infamous charges of vaccine-induced injury have been thoroughly debunked. How do so many mothers – primary caregivers and health care decision-makers for their families – become wary of U.S. health care and one of its most proven preventive technologies?

I’m a cultural anthropologist who studies the ways feelings and beliefs circulate in American society. To investigate what’s behind mothers’ vaccine skepticism, I interviewed vaccine-skeptical mothers about their perceptions of existing and novel vaccines. What they told me complicates sweeping and overly simplified portrayals of their misgivings by pointing to the U.S. health care system itself. The medical system’s failures and harms against women gave rise to their pervasive vaccine skepticism and generalized medical mistrust.

The seeds of women’s skepticism

I conducted this ethnographic research in Oregon from 2020 to 2021 with predominantly white mothers between the ages of 25 and 60. My findings reveal new insights about the origins of vaccine skepticism among this demographic. These women traced their distrust of vaccines, and of U.S. health care more generally, to ongoing and repeated instances of medical harm they experienced from childhood through childbirth.

As young girls in medical offices, they were touched without consent, yelled at, disbelieved or threatened. One mother, Susan, recalled her pediatrician abruptly lying her down and performing a rectal exam without her consent at the age of 12. Another mother, Luna, shared how a pediatrician once threatened to have her institutionalized when she voiced anxiety at a routine physical.

As women giving birth, they often felt managed, pressured or discounted. One mother, Meryl, told me, “I felt like I was coerced under distress into Pitocin and induction” during labor. Another mother, Hallie, shared, “I really battled with my provider” throughout the childbirth experience.

Together with the convoluted bureaucracy of for-profit health care, experiences of medical harm contributed to “one million little touch points of information,” in one mother’s phrase, that underscored the untrustworthiness and harmful effects of U.S. health care writ large.

A system that doesn’t serve them

Many mothers I interviewed rejected the premise that public health entities such as the Centers for Disease Control and Prevention and the Food and Drug Administration had their children’s best interests at heart. Instead, they tied childhood vaccination and the more recent development of COVID-19 vaccines to a bloated pharmaceutical industry and for-profit health care model. As one mother explained, “The FDA is not looking out for our health. They’re looking out for their wealth.”

After ongoing negative medical encounters, the women I interviewed lost trust not only in providers but the medical system. Frustrating experiences prompted them to “do their own research” in the name of bodily autonomy. Such research often included books, articles and podcasts deeply critical of vaccines, public health care and drug companies.

These materials, which have proliferated since 2020, cast light on past vaccine trials gone awry, broader histories of medical harm and abuse, the rapid growth of the recommended vaccine schedule in the late 20th century and the massive profits reaped from drug development and for-profit health care. They confirmed and hardened women’s suspicions about U.S. health care.

The stories these women told me add nuance to existing academic research into vaccine skepticism. Most studies have considered vaccine skepticism among primarily white and middle-class parents to be an outgrowth of today’s neoliberal parenting and intensive mothering. Researchers have theorized vaccine skepticism among white and well-off mothers to be an outcome of consumer health care and its emphasis on individual choice and risk reduction. Other researchers highlight vaccine skepticism as a collective identity that can provide mothers with a sense of belonging.

Seeing medical care as a threat to health

The perceptions mothers shared are far from isolated or fringe, and they are not unreasonable. Rather, they represent a growing population of Americans who hold the pervasive belief that U.S. health care harms more than it helps.

Data suggests that the number of Americans harmed in the course of treatment remains high, with incidents of medical error in the U.S. outnumbering those in peer countries, despite more money being spent per capita on health care. One 2023 study found that diagnostic error, one kind of medical error, accounted for 371,000 deaths and 424,000 permanent disabilities among Americans every year.

Studies reveal particularly high rates of medical error in the treatment of vulnerable communities, including women, people of color, disabled, poor, LGBTQ+ and gender-nonconforming individuals and the elderly. The number of U.S. women who have died because of pregnancy-related causes has increased substantially in recent years, with maternal death rates doubling between 1999 and 2019.

The prevalence of medical harm points to the relevance of philosopher Ivan Illich’s manifesto against the “disease of medical progress.” In his 1982 book “Medical Nemesis,” he insisted that rather than being incidental, harm flows inevitably from the structure of institutionalized and for-profit health care itself. Illich wrote, “The medical establishment has become a major threat to health,” and has created its own “epidemic” of iatrogenic illness – that is, illness caused by a physician or the health care system itself.

Four decades later, medical mistrust among Americans remains alarmingly high. Only 23% of Americans express high confidence in the medical system. The United States ranks 24th out of 29 peer high-income countries for the level of public trust in medical providers.

For people like the mothers I interviewed, who have experienced real or perceived harm at the hands of medical providers; have felt belittled, dismissed or disbelieved in a doctor’s office; or spent countless hours fighting to pay for, understand or use health benefits, skepticism and distrust are rational responses to lived experience. These attitudes do not emerge solely from ignorance, conspiracy thinking, far-right extremism or hysteria, but rather the historical and ongoing harms endemic to the U.S. health care system itself.

Johanna Richlin does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

disease control extremism pandemic covid-19 vaccine treatment testing fda deathsGovernment

Is the National Guard a solution to school violence?

School board members in one Massachusetts district have called for the National Guard to address student misbehavior. Does their request have merit? A…

Every now and then, an elected official will suggest bringing in the National Guard to deal with violence that seems out of control.

A city council member in Washington suggested doing so in 2023 to combat the city’s rising violence. So did a Pennsylvania representative concerned about violence in Philadelphia in 2022.

In February 2024, officials in Massachusetts requested the National Guard be deployed to a more unexpected location – to a high school.

Brockton High School has been struggling with student fights, drug use and disrespect toward staff. One school staffer said she was trampled by a crowd rushing to see a fight. Many teachers call in sick to work each day, leaving the school understaffed.

As a researcher who studies school discipline, I know Brockton’s situation is part of a national trend of principals and teachers who have been struggling to deal with perceived increases in student misbehavior since the pandemic.

A review of how the National Guard has been deployed to schools in the past shows the guard can provide service to schools in cases of exceptional need. Yet, doing so does not always end well.

How have schools used the National Guard before?

In 1957, the National Guard blocked nine Black students’ attempts to desegregate Central High School in Little Rock, Arkansas. While the governor claimed this was for safety, the National Guard effectively delayed desegregation of the school – as did the mobs of white individuals outside. Ironically, weeks later, the National Guard and the U.S. Army would enforce integration and the safety of the “Little Rock Nine” on orders from President Dwight Eisenhower.

One of the most tragic cases of the National Guard in an educational setting came in 1970 at Kent State University. The National Guard was brought to campus to respond to protests over American involvement in the Vietnam War. The guardsmen fatally shot four students.

In 2012, then-Sen. Barbara Boxer, a Democrat from California, proposed funding to use the National Guard to provide school security in the wake of the Sandy Hook school shooting. The bill was not passed.

More recently, the National Guard filled teacher shortages in New Mexico’s K-12 schools during the quarantines and sickness of the pandemic. While the idea did not catch on nationally, teachers and school personnel in New Mexico generally reported positive experiences.

Can the National Guard address school discipline?

The National Guard’s mission includes responding to domestic emergencies. Members of the guard are part-time service members who maintain civilian lives. Some are students themselves in colleges and universities. Does this mission and training position the National Guard to respond to incidents of student misbehavior and school violence?

On the one hand, New Mexico’s pandemic experience shows the National Guard could be a stopgap to staffing shortages in unusual circumstances. Similarly, the guards’ eventual role in ensuring student safety during school desegregation in Arkansas demonstrates their potential to address exceptional cases in schools, such as racially motivated mob violence. And, of course, many schools have had military personnel teaching and mentoring through Junior ROTC programs for years.

Those seeking to bring the National Guard to Brockton High School have made similar arguments. They note that staffing shortages have contributed to behavior problems.

One school board member stated: “I know that the first thought that comes to mind when you hear ‘National Guard’ is uniform and arms, and that’s not the case. They’re people like us. They’re educated. They’re trained, and we just need their assistance right now. … We need more staff to support our staff and help the students learn (and) have a safe environment.”

Yet, there are reasons to question whether calls for the National Guard are the best way to address school misconduct and behavior. First, the National Guard is a temporary measure that does little to address the underlying causes of student misbehavior and school violence.

Research has shown that students benefit from effective teaching, meaningful and sustained relationships with school personnel and positive school environments. Such educative and supportive environments have been linked to safer schools. National Guard members are not trained as educators or counselors and, as a temporary measure, would not remain in the school to establish durable relationships with students.

What is more, a military presence – particularly if uniformed or armed – may make students feel less welcome at school or escalate situations.

Schools have already seen an increase in militarization. For example, school police departments have gone so far as to acquire grenade launchers and mine-resistant armored vehicles.

Research has found that school police make students more likely to be suspended and to be arrested. Similarly, while a National Guard presence may address misbehavior temporarily, their presence could similarly result in students experiencing punitive or exclusionary responses to behavior.

Students deserve a solution other than the guard

School violence and disruptions are serious problems that can harm students. Unfortunately, schools and educators have increasingly viewed student misbehavior as a problem to be dealt with through suspensions and police involvement.

A number of people – from the NAACP to the local mayor and other members of the school board – have criticized Brockton’s request for the National Guard. Governor Maura Healey has said she will not deploy the guard to the school.

However, the case of Brockton High School points to real needs. Educators there, like in other schools nationally, are facing a tough situation and perceive a lack of support and resources.

Many schools need more teachers and staff. Students need access to mentors and counselors. With these resources, schools can better ensure educators are able to do their jobs without military intervention.

F. Chris Curran has received funding from the US Department of Justice, the Bureau of Justice Assistance, and the American Civil Liberties Union for work on school safety and discipline.

army governor pandemic mexicoGovernment

Chinese migration to US is nothing new – but the reasons for recent surge at Southern border are

A gloomier economic outlook in China and tightening state control have combined with the influence of social media in encouraging migration.

The brief closure of the Darien Gap – a perilous 66-mile jungle journey linking South American and Central America – in February 2024 temporarily halted one of the Western Hemisphere’s busiest migration routes. It also highlighted its importance to a small but growing group of people that depend on that pass to make it to the U.S.: Chinese migrants.

While a record 2.5 million migrants were detained at the United States’ southwestern land border in 2023, only about 37,000 were from China.

I’m a scholar of migration and China. What I find most remarkable in these figures is the speed with which the number of Chinese migrants is growing. Nearly 10 times as many Chinese migrants crossed the southern border in 2023 as in 2022. In December 2023 alone, U.S. Border Patrol officials reported encounters with about 6,000 Chinese migrants, in contrast to the 900 they reported a year earlier in December 2022.

The dramatic uptick is the result of a confluence of factors that range from a slowing Chinese economy and tightening political control by President Xi Jinping to the easy access to online information on Chinese social media about how to make the trip.

Middle-class migrants

Journalists reporting from the border have generalized that Chinese migrants come largely from the self-employed middle class. They are not rich enough to use education or work opportunities as a means of entry, but they can afford to fly across the world.

According to a report from Reuters, in many cases those attempting to make the crossing are small-business owners who saw irreparable damage to their primary or sole source of income due to China’s “zero COVID” policies. The migrants are women, men and, in some cases, children accompanying parents from all over China.

Chinese nationals have long made the journey to the United States seeking economic opportunity or political freedom. Based on recent media interviews with migrants coming by way of South America and the U.S.’s southern border, the increase in numbers seems driven by two factors.

First, the most common path for immigration for Chinese nationals is through a student visa or H1-B visa for skilled workers. But travel restrictions during the early months of the pandemic temporarily stalled migration from China. Immigrant visas are out of reach for many Chinese nationals without family or vocation-based preferences, and tourist visas require a personal interview with a U.S. consulate to gauge the likelihood of the traveler returning to China.

Social media tutorials

Second, with the legal routes for immigration difficult to follow, social media accounts have outlined alternatives for Chinese who feel an urgent need to emigrate. Accounts on Douyin, the TikTok clone available in mainland China, document locations open for visa-free travel by Chinese passport holders. On TikTok itself, migrants could find information on where to cross the border, as well as information about transportation and smugglers, commonly known as “snakeheads,” who are experienced with bringing migrants on the journey north.

With virtual private networks, immigrants can also gather information from U.S. apps such as X, YouTube, Facebook and other sites that are otherwise blocked by Chinese censors.

Inspired by social media posts that both offer practical guides and celebrate the journey, thousands of Chinese migrants have been flying to Ecuador, which allows visa-free travel for Chinese citizens, and then making their way over land to the U.S.-Mexican border.

This journey involves trekking through the Darien Gap, which despite its notoriety as a dangerous crossing has become an increasingly common route for migrants from Venezuela, Colombia and all over the world.

In addition to information about crossing the Darien Gap, these social media posts highlight the best places to cross the border. This has led to a large share of Chinese asylum seekers following the same path to Mexico’s Baja California to cross the border near San Diego.

Chinese migration to US is nothing new

The rapid increase in numbers and the ease of accessing information via social media on their smartphones are new innovations. But there is a longer history of Chinese migration to the U.S. over the southern border – and at the hands of smugglers.

From 1882 to 1943, the United States banned all immigration by male Chinese laborers and most Chinese women. A combination of economic competition and racist concerns about Chinese culture and assimilability ensured that the Chinese would be the first ethnic group to enter the United States illegally.

With legal options for arrival eliminated, some Chinese migrants took advantage of the relative ease of movement between the U.S. and Mexico during those years. While some migrants adopted Mexican names and spoke enough Spanish to pass as migrant workers, others used borrowed identities or paperwork from Chinese people with a right of entry, like U.S.-born citizens. Similarly to what we are seeing today, it was middle- and working-class Chinese who more frequently turned to illegal means. Those with money and education were able to circumvent the law by arriving as students or members of the merchant class, both exceptions to the exclusion law.

Though these Chinese exclusion laws officially ended in 1943, restrictions on migration from Asia continued until Congress revised U.S. immigration law in the Hart-Celler Act in 1965. New priorities for immigrant visas that stressed vocational skills as well as family reunification, alongside then Chinese leader Deng Xiaoping’s policies of “reform and opening,” helped many Chinese migrants make their way legally to the U.S. in the 1980s and 1990s.

Even after the restrictive immigration laws ended, Chinese migrants without the education or family connections often needed for U.S. visas continued to take dangerous routes with the help of “snakeheads.”

One notorious incident occurred in 1993, when a ship called the Golden Venture ran aground near New York, resulting in the drowning deaths of 10 Chinese migrants and the arrest and conviction of the snakeheads attempting to smuggle hundreds of Chinese migrants into the United States.

Existing tensions

Though there is plenty of precedent for Chinese migrants arriving without documentation, Chinese asylum seekers have better odds of success than many of the other migrants making the dangerous journey north.

An estimated 55% of Chinese asylum seekers are successful in making their claims, often citing political oppression and lack of religious freedom in China as motivations. By contrast, only 29% of Venezuelans seeking asylum in the U.S. have their claim granted, and the number is even lower for Colombians, at 19%.

The new halt on the migratory highway from the south has affected thousands of new migrants seeking refuge in the U.S. But the mix of push factors from their home country and encouragement on social media means that Chinese migrants will continue to seek routes to America.

And with both migration and the perceived threat from China likely to be features of the upcoming U.S. election, there is a risk that increased Chinese migration could become politicized, leaning further into existing tensions between Washington and Beijing.

Meredith Oyen does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

congress pandemic deaths south america mexico china-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex