International

Trending Penny Stocks to Add to Your Watchlist Right Now

Here’s three trending penny stocks to add to your watchlist

The post Trending Penny Stocks to Add to Your Watchlist Right Now appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

3 Penny Stocks That Are Trending in Late November 2021

Finding trending penny stocks can be a great way to get ahead and stay ahead in the stock market. To do so, investors need to first understand exactly what trends are at play with penny stocks, and how they could affect certain companies. This involves thinking outside of the box and staying up to date with all the latest news and events.

[Read More] 5 Penny Stocks To Buy Now According To Insiders In November 2021

Right now, industries such as biotech, tech, esports, mining, and a few others are seeing more attention than usual. While no one can predict the future, for now, these industries continue to attract investors of all types. With that in mind, let’s take a look at three penny stocks that are trending right now.

3 Trending Penny Stocks to Watch Right Now

- Yatsen Holding Limited (NYSE: YSG)

- TMC The Metals Company Inc. (NASDAQ: TMC)

- Enthusiast Gaming Holdings Inc. (NASDAQ: EGLX)

Yatsen Holding Limited (NYSE: YSG)

Yatsen Holding Limited is a company that offers a variety of beauty products. The company’s products are sold under the Little Ondine, Abby’s Choice, and Perfect Diary brands. Yatsen is involved in both the development and sale of these products. Primarily, Yatsen’s products are sold in China, which offers a major market for the company. Among its product lineups are brush sets, mirrors, makeup sponges, perfumes, and more. These products are sold via e-commerce and physical stores. Having both of these sales channels has helped to greatly increase YSG’s reach.

On November 18th, the company released its third-quarter financial results for 2021. The company’s total net revenues during this period went up 6% year over year. In addition to this positive news, its gross margin went up to 67.9% compared to 65.7% last year in the same period. Yatsen’s gross sales for the third quarter went up 8.3% in this period as well. These numbers are highly encouraging for investors and the company alike. They signal solid growth which has occurred despite the pandemic.

“Looking ahead, as we embark upon the next phase of our development, we expect to continue shifting our revenue mix towards higher-quality and more profitable growth, underpinned by sustained investments in our brand’s brand equities and R&D. We are confident that despite some short-term pain, our strategic initiatives will allow us to emerge stronger with a clear path to long-term sustainable growth.”

The Chairman and CEO of Yatsen, Mr. Jinfeng Huang

Although shares of YSG stock are down by more than 80% YTD, it looks like it is witnessing a slight bullish turnaround right now. With this in mind, will YSG be on your list of penny stocks to watch?

TMC The Metals Company Inc. (NASDAQ: TMC)

TMC The Metals Company is a penny stock that has climbed by a very respectable 17% in the past five days. If you’re not familiar, TMC is a company that explores for battery-grade metals in Canada. These battery-grade metals include copper, nickel sulfate, cobalt sulfate, and manganese products. The Metals Company has various subsidiaries that hold the exploration rights to three polymetallic nodule contract areas in the Clarion Clipperton Zone in the Pacific Ocean.

[Read More] 3 Reddit Penny Stocks You Need to Know About Right Now

On November 16th, the company entered an agreement with Kongsberg Digital to develop a digital twin of its deep-sea operating environment. This news comes before a polymetallic nodule collection system test is due to take place. The companies plan to create the world’s first digital twin for the subsea nodule collection. This is a core component of a larger Adaptive Management System for enabling sub-sea operations in targeted environmental impact thresholds.

“Polymetallic nodules sit on the seafloor in complete darkness at 4-km depths but we plan to collect them in clear sight and in a manner that is accessible and accountable to the regulator and stakeholders from anywhere in the world.

The Digital Twin will give us visibility — that’s the first critical step. From there, we will keep gathering data, learning, predicting, and adapting our operations with environmental protection and operational efficiency in mind.”

Chairman and CEO of The Metals Company, Gerard Barron

Right now, anything relating to electric vehicles is seeing increased attention. And while TMC’s role in this is removed slightly, it is still highly correlated to the EV industry. With solid gains in the past week, does TMC deserve a spot on your penny stocks watchlist moving forward?

Enthusiast Gaming Holdings Inc. (NASDAQ: EGLX)

Enthusiast Gaming Holdings Inc. is an entertainment and gaming penny stock that has pushed up by a sizable 22% in the past five days. This company’s business expands across entertainment, media, esports, content, and more.

Currently, Enthusiast has about 100 gaming-related websites under its belt. It also operates the Enthusiast Gaming Live Expo which is a video-game-related expo. Enthusiast owns and manages esports teams in Call of Duty, Valorant, Overwatch, and more. If you’re not familiar, the Esports industry has taken off in the past few years. With several major players seeing heightened attention, EGLX is attracting more volume than its average.

On November 18th, the company announced that it has achieved record unique visitor traffic in the United States. In October 2021, its U.S. unique visitors grew to 47.8 million. Between Twitch and Roblox, Enthusiast was ranked second in overall Games. Since July, the company has gone up 5 spots on Comscore’s Top 100 Properties ranking the largest internet properties in the U.S. across all categories.

“This Comscore data shows the continued growth and attractiveness of our platforms to the coveted U.S. Gen Z and Millennial audience. Gaming continues to take a greater share of overall Internet traffic, and we are proud to be next to companies like Twitch and Roblox in taking a greater share of overall gaming traffic.”

The CEO of Enthusiast Gaming, Adrian Montgomery

As gaming continues to grow in the U.S. and around the world, will EGLX stock be on your watchlist in the future?

Can Penny Stocks Continue to be Profitable in 2021?

With only a month and a half left to go in 2021, investors continue to search for the best penny stocks to buy. Although it can be challenging given the sheer number of penny stocks out there, using a proper trading strategy combined with research can be a great way to start.

[Read More] Top Penny Stocks to Invest in Right Now? Check These 3 Out

If we consider what’s going on in the world, making a list of penny stocks to buy can be much easier than previously imagined. With all of that in mind, do you think that penny stocks can continue to be profitable in 2021?

The post Trending Penny Stocks to Add to Your Watchlist Right Now appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

nasdaq equities stocks pandemic penny stocks canada chinaGovernment

Analysts issue unexpected crude oil price forecast after surge

Here’s what a key investment firm says about the commodity.

Oil is an asset defined by volatility.

U.S. crude prices stood above $60 a barrel in January 2020, just as the covid pandemic began. Three months later, prices briefly went negative, as the pandemic crushed demand.

By June 2022 the price rebounded all the way to $120, as fiscal and monetary stimulus boosted the economy. The price fell back to $80 in September 2022. Since then, it has bounced between about $65 and $90.

Over the past two months, the price has climbed 15% to $82 as of March 20.

Bullish factors for oil prices

The move stems partly from indications that economic growth this year will be stronger than analysts expected.

Related: The Fed rate decision won't surprise markets. What happens next might

Vanguard has just raised its estimate for 2024 U.S. GDP growth to 2% from 0.5%.

Meanwhile, China’s factory output and retail sales exceeded forecasts in January and February. That could boost oil demand in the country, the world's No. 1 oil importer.

Also, drone strokes from Ukraine have knocked out some of Russia’s oil refinery capacity. Ukraine has hit at least nine major refineries this year, erasing an estimated 11% of Russia’s production capacity, according to Bloomberg.

“Russia is a gas station with an army, and we intend on destroying that gas station,” Francisco Serra-Martins, chief executive of drone manufacturer Terminal Autonomy, told the news service. Gasoline, of course, is one of the products made at refineries.

Speaking of gas, the recent surge of oil prices has sent it higher as well. The average national price for regular gas totaled $3.52 per gallon Wednesday, up 7% from a month ago, according to the American Automobile Association. And we’re nearing the peak driving season.

Another bullish factor for oil: Iraq said Monday that it’s cutting oil exports by 130,000 barrels per day in coming months. Iraq produced much more oil in January and February than its OPEC (Organization of Petroleum Exporting Countries) target.

Citigroup’s oil-price forecast

Yet, not everyone is bullish on oil going forward. Citigroup analysts see prices falling through next year, Dow Jones’s Oil Price Information Service (OPIS) reports.

More Economic Analysis:

- Bond markets tell Fed rate story that stocks still ignore

- February inflation surprises with modest uptick, but core pressures ease

- Vanguard unveils bold interest rate forecast ahead of Fed meeting

The analysts note that supply is at risk in Israel, Iran, Iraq, Libya, and Venezuela. But Saudi Arabia, the UAE, Kuwait, and Russia could easily make up any shortfall.

Moreover, output should also rise this year and next in the U.S., Canada, Brazil, and Guyana, the analysts said. Meanwhile, global demand growth will decelerate, amid increased electric vehicle use and economic weakness.

Regarding refineries, the analysts see strong gains in capacity and capacity upgrades this year.

What if Donald Trump is elected president again? That “would likely be bearish for oil and gas," as Trump's policies could boost trade tension, crimping demand, they said.

The analysts made predictions for European oil prices, the world’s benchmark, which sat Wednesday at $86.

They forecast a 9% slide in the second quarter to $78, then a decline to $74 in the third quarter and $70 in the fourth quarter.

Next year should see a descent to $65 in the first quarter, $60 in the second and third, and finally $55 in the fourth, Citi said. That would leave the price 36% below current levels.

U.S. crude prices will trade $4 below European prices from the second quarter this year until the end of 2025, the analysts maintain.

Related: Veteran fund manager picks favorite stocks for 2024

stimulus economic growth pandemic dow jones stocks fed army trump gdp stimulus oil iran brazil canada european russia ukraine chinaInternational

Disney remote jobs: the most magical WFH careers on earth?

Disney employs hundreds of thousands of employees at its theme parks and elsewhere, but the entertainment giant also offers opportunities for remote w…

The Walt Disney Co. (DIS) is a major entertainment and media company that operates amusement parks, produces movies and television shows, airs news and sports programs, and sells Mickey Mouse and Star Wars merchandise at its retail stores across the U.S.

While most of the jobs at the multinational entertainment conglomerate require working with people — such as at its theme parks, film-production facilities, cruise ships, or corporate offices — there are also opportunities for remote work at Disney. And while remote typically means working from home, with Disney, it could also mean working in a non-corporate office and being able to move from one location to another and conduct business outside normal working hours.

Related: Target remote jobs: What type of work and how much does it pay?

What remote jobs are available at Disney?

Many companies, including Disney, have called employees to return to the office for work in the wake of the COVID-19 pandemic, and the bulk of the company’s positions are forward-facing, meaning they involve meeting with clients and customers on a regular basis.

Still, there are some jobs at the “most magical company on earth” that are listed as remote and don’t require frequent in-person interaction with people, including opportunities in data entry and sales.

On Disney’s career website, there are limited positions available where the work is completely remote. One listing, for example, is for a “graphics interface coordinator covering sporting events.” This role involves working on nights, weekends, and holidays — times when corporate offices tend to be closed — and it may make sense for the company to hire people who can work from home or to travel and work in a location separate from the game venue.

Some of the senior roles that are shown on the website involve managers who can oversee remote teams, whether that be in sales or data. Sometimes, a supervisor overseeing staff who work outside corporate offices may be responsible for hiring freelancers who work remotely.

On the employment website Indeed, there are limited positions listed. A job listing for a manager in enterprise underwriting for a federal credit union indicates weekend duty, working outside of an 8 a.m. to 5 p.m. schedule, and being able to work in different locations. The listed annual salary range of $84,960 to $132,000, though, is well above the national annual average of around $50,000.

Internationally, Disney offers remote work in India, largely in the field of software development for its India-based streaming platform, Disney+ Hotstar.

The company also offers some hybrid schemes, which involve a mixture of in-office and remote work. For a mid-level animator position based in San Francisco, the role would involve being in the office and working from home occasionally.

How much do remote jobs at Disney pay?

Pay for remote jobs at Disney varies significantly based on location. A salary for a freelance artist in New York City, for example, may be higher than for the same job in Orlando, Florida.

Disney lists actual salary ranges in some of its job postings. For example, the yearly pay for a California-based compensation manager who works with clients is $129,000 to $165,000.

In an online search for “remote jobs at Disney,” results range from $30 to $39 an hour, for data entry, or $28.50 to $38 an hour for social media customer support.

How can I apply for remote jobs at Disney?

You can look for remote jobs on Disney's career site, and type “remote” in the search field. Listings may also appear on career-data websites, including Indeed and Glassdoor.

How many employees does Disney have?

In 2023, Disney employed about 225,000 people globally, of which around 77% were full-time, 16% part-time, and 7% seasonal. The majority of the workers, around 167,000, were in the U.S.

Disney says that a significant number of its employees, including many of those who work at its theme parks, along with most writers, directors, actors, and production personnel, belong to unions. It’s not immediately known how many remote workers at the company, if any, are union members.

india pandemic covid-19International

The Digest #194

Poor Charlie’s Almanack, Ben Graham, GAAP accounting, John Templeton, AI dystopia, Inflation, Bloomstran on Berkshire, Intuitive Surgical, The lessons…

Poor Charlie’s Almanack

Poor Charlie’s Almanack: The Essential Wit and Wisdom of Charles T. Munger was first published in 2005 as a “coffee table” style book. It was beautifully presented but came with a high price tag. It was also heavy, somewhat unwieldy to read, and not very portable. The book’s format and price probably limited its reach.

Stripe Press published a new edition of the book shortly after Mr. Munger died last year at the age of ninety-nine. Amazon and other vendors instantly sold all available inventory. After waiting for three months, I finally received my copy last week.

Peter Kaufman is the editor of all editions of the book and I suspect that his main goal two decades ago was to honor Charlie Munger’s wisdom in a format that was not expected to “go viral.” In 2005, Charlie Munger was well known in the Berkshire Hathaway shareholder community and in the value investing world, but he was not as prominent as he became during his final decade. The clear purpose of the new edition is to disseminate his ideas as widely as possible.

The new edition is abridged to reduce repetitive content and I will withhold judgment about the wisdom of this abridgment until I finish reading the book. Since the heart of the book is comprised of speeches given by Charlie Munger, there are definitely cases where the same ideas are presented again and again.

Great books can be read many times while remaining highly relevant. I found this to be the case when I reread Charlie Munger’s Harvard School commencement address delivered in June 1986 when his youngest son was among the graduates. In the speech, Mr. Munger “inverts” the typical advice delivered in such speeches by explaining how the graduates should go about guaranteeing a life of failure and misery through time-tested strategies such as ingesting drugs and indulging in envy and resentment.

I am not sure how many graduates were convinced by Charlie Munger on that early summer day, but I suspect that most of them remember the speech because it was so unconventional. In contrast, I have no recollection of the commencement addresses when I graduated from high school or college, or even who the speaker was.

Articles

A Memorial for Charlie Munger by John Harvey Taylor, March 12, 2024. This is a brief account of a recent memorial service for Charlie Munger at Harvard-Westlake School. “We learned Sunday that someone once asked if he knew how to play the piano. ‘I don’t know,’ he said. ‘I’ve never tried.’ Yet he tried and finished so much in his century. Imagine what he is making of eternity.” (Episcopal Diocese of Los Angeles)

Benjamin Graham: Big Moments on the Way to Big Earnings, March 2024. Ben Graham’s granddaughter reflects on the challenges Graham experienced when he applied for college. “Most graduating seniors make their college plans in advance, but Ben Graham had no money for tuition. All through the long days of arduous farm labor, my grandfather dreamed of winning a Pulitzer Scholarship.” (Beyond Ben Graham)

Graham’s “Unpopular Large Caps” Part 2: Thoughts on Diversification by John Huber, March 19, 2024. “I would segment these ideas into two groups: core operating investments and bargain assets. In the former, you want to be very selective in picking a relatively small number of companies you intend to own for the long term. In the latter, you’d want to think like the insurance underwriter, buying as many as you can to ensure that the law of large numbers is on your side.” (Base Hit Investing)

Warren Buffett Minds the GAAP by Donald E. Graham, March 13, 2024. “I have a challenge for the FASB and the SEC: If you believe today’s accounting rules present a clearer picture of Berkshire’s results, put it to a test. Ask Berkshire’s shareholders if they prefer the present method of reporting earnings over the status quo ante. I don’t believe a single informed shareholder would say so. The rule is confusing and uninformative.” (WSJ)

- Berkshire Hathaway’s Distorted Quarterly Results, August 7, 2022. “Berkshire’s net income figure has been totally useless for analytical purposes since 2018. This is true on an annual basis and even more true on a quarterly basis.” (The Rational Walk)

Sir John Templeton: The Gentleman Bargain Hunter by Kingswell, March 12, 2024. “Templeton, who passed away in 2008, arrived on the investing scene with a series of uber-profitable contrarian bets in the early days of World War II — and continued to outwit Mr. Market with maddening consistency for the next several decades.” (Kingswell)

They Praised AI at SXSW—and the Audience Started Booing by Ted Gioia, March 19, 2024. Many recent innovations seem to have a dystopian aura. Apparently, this sentiment is not restricted to the usual luddites (old men shouting at clouds) but is shared by some of the attendees of SXSW. What seems cool to tech bros in Silicon Valley might not seem so cool to those outside tech culture. (The Honest Broker)

We Still Don’t Believe How Much Things Cost by Rachel Wolfe and Rachel Louise Ensign, March 12, 2024. People tend to focus on the aggregate amount of inflation over the past few years and interpreted transitory to mean that price spikes would reverse. Of course, politicians and economists only meant that the rate of inflation would decrease, not that prices would ever return to pre-pandemic levels. (WSJ)

My 2023 Apple Report Card by John Gruber, March 18, 2024. A solid report card overall from a widely read technology blog. (Daring Fireball)

Podcasts

Christopher Bloomstran on Buffett, Berkshire, Munger, and China, March 19, 2024. 1 hour, 1 minute. Video. Also be sure to check out the latest Semper Augustus client letter which has a lengthy section on Berkshire Hathaway. (Value After Hours)

Renaissance Technologies, March 18, 2024. 3 hours, 10 minutes. Notes. “Renaissance Technologies is the best performing investment firm of all time. And yet no one at RenTec would consider themselves an ‘investor’, at least in any traditional sense of the word. It’d rather be more accurate to call them scientists — scientists who’ve discovered a system of math, computers and artificial intelligence that has evolved into the greatest money making machine the world has ever seen.” (Acquired)

- Review of The Man Who Solved the Market, December 28, 2019 (Rational Walk)

Intuitive Surgical: Robotic Precision, March 20, 2024. 1 hour, 6 minutes. Transcript. “Intuitive creates robotic products to assist minimally invasive surgeries. Its Da Vinci system is a pioneer in this area as it increases the efficiency & accuracy of surgery and reduces the burden on the surgeons themselves.” (Business Breakdowns)

The Lessons of History (Will & Ariel Durant), March 18, 2023. 53 minutes. Notes. “In every age men have been dishonest and governments have been corrupt.” (Founders)

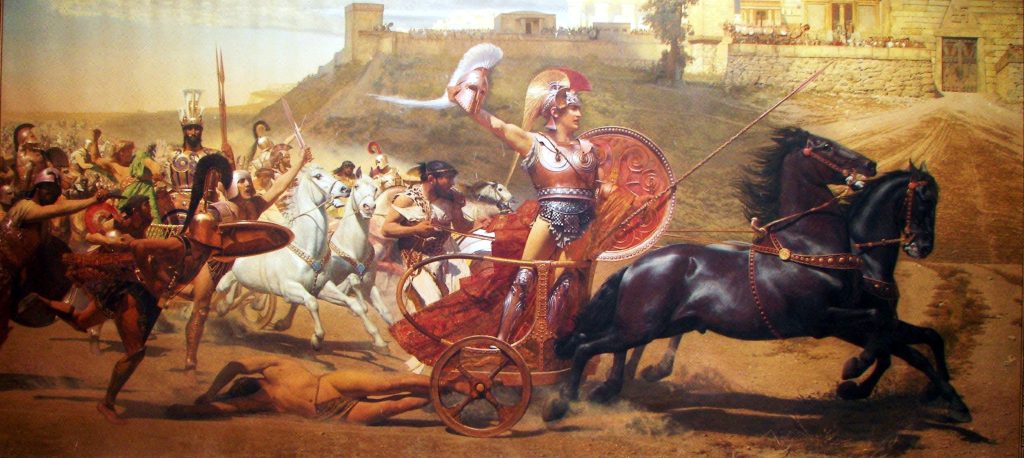

A Classicist Believes that Homer Directly Dictated the Iliad, and Was Also an Excellent Horseman, March 14, 2024. 53 minutes. “The Iliad is the world’s greatest epic poem—heroic battle and divine fate set against the Trojan War. Its beauty and profound bleakness are intensely moving, but great questions remain: Where, how, and when was it composed and why does it endure?” (History Unplugged)

Triumph of Achilles

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

china pandemic-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex