International

Top 10 Long-Term Stocks For Investors To Buy and Hold

Building a portfolio with the top 10 long-term stocks can help investors build long-term wealth over time.

The post Top 10 Long-Term Stocks For Investors…

Building a portfolio with the top 10 long-term stocks can help investors build wealth over time. The key to long-term wealth-building prospects and managing risk is having a good foundation.

New investors should look for stocks that offer the best combination of potential and risk aversion. So, the best long-term stocks listed below should serve as good starting points.

What is a Long-Term Stock?

Day trading stocks should not get confused with the best long-term investments. In contrast to traders that seek to profit from intraday volatility and low-priced stocks, long-term investors are more concerned with the long-term performance of companies.

In other words, the best long-term stocks are not necessarily the best performers today, but those that have the most potential to capitalize on secular trends in the long run. With that said, here are the top 10 long-term stocks to buy and hold.

Top 10 Long-Term Stocks To Buy and Hold

Coca-Cola (Nasdaq: COKE)

Coca-Cola is one of America’s most popular beverage companies, providing more than 4,100 drinks under 500 well-known brands. This includes…

- Coca-Cola

- Diet Coke

- Coca-Cola Zero

- Sprite

- Fanta

- Minute Maid

- Powerade

Even outside of America, it has a strong brand. Coca-Cola is a globally recognized company known by consumers around the world, including Europe, Latin America, Asia and Africa. With 250 bottling companies, 900 manufacturing plants and 27 million retail outlets, the company has a massive global scale. Moreover, Coca-Cola stock has been a part of Warren Buffett’s portfolio for decades. And it pays a respectable dividend of 2.8%.

Johnson & Johnson (NYSE: JNJ)

Johnson & Johnson is one of the biggest consumer healthcare product companies in the world. In every drugstore, Johnson & Johnson products can be found on the shelves. With its consumer health, pharmaceuticals and medical device products leading the way in sales, Johnson & Johnson is a mainstay in the economy. Some of its popular consumer health product brands include…

- Band-Aid

- Listerine

- Visine

- Aveeno

- Neutrogena

- Neosporin

- Benadryl

- Sudafed

Moreover, the company offers more than over-the-counter products. Johnson & Johnson sells surgical tools, hip and knee replacements, blood glucose monitoring equipment and catheters in its medical devices segment. Investing in healthcare is a safe bet because people will always need healthcare products. And the essential nature of Johnson & Johnson’s products enables the company to maintain its scale as an industry leader. Furthermore, the stock pays a healthy dividend yield of 2.3%.

Alphabet (Nasdaq: GOOGL)

With the help of Google and YouTube, Alphabet dominates the search engine universe and online video. The company became the fourth company to reach a market cap of over $1 trillion on January 16, 2020. Moreover, you probably use Alphabet’s services every day. The company’s products and services include…

- Google Chrome

- Android

- Nest

- Fitbit

- Waze

- Google Search

- Google Maps

- Gmail

- YouTube

Moreover, the company doesn’t stop there. It provides many other apps and services as well. Its three business divisions are Google Services, Google Cloud and Other Bets. If you aren’t familiar with Other Bets, it’s Alphabet’s venture capital and private equity division. This division is home to emerging companies at various stages of development.

Alphabet has announced that its stock will be split 20-for-1 on July 15. By splitting its stock, the tech giant could gain entry into the Dow Jones Industrial Average. Following the split, GOOGL stock might become more accessible to retail investors.

Berkshire Hathaway (NYSE: BRK.A)

Investing in Berkshire stock is like betting on Warren Buffett, the world’s fifth-richest person with a net worth of $112 billion as of May 13, 2022. Furthermore, it means owning a slice of both renowned and obscure companies. Berkshire owns a wide variety of businesses, some in their entirety, others in part. The second group consists mostly of common stocks of major American companies. Its four major holdings account for a big part of Berkshire’s value, consisting of…

- Apple (Nasdaq: AAPL)

- Bank of America (BYSE: BAC)

- American Express (NYSE: AXP)

- Coca-Cola (NYSE: KO)

Buffett took control of the company in 1965. Had you invested $1,000 then, your investment would have been worth millions of dollars by 2022. So, it’s no surprise this company made the list of top 10 long-term stocks.

Shopify (NYSE: SHOP)

Globally, Shopify is one of the top e-commerce stocks. Shopify allows online retailers of all sizes and experience levels to create their online presence or “Shopify” websites. The company makes it easy for any business to maintain an online presence in today’s increasingly competitive online market.

New investors still have time to add Shopify to their portfolios even though it’s seen a large run-up in recent years. Although the transition from retail to online e-commerce was already well underway, the COVID-19 pandemic emphasized the need for businesses to operate online. Almost every business needs an online presence today, and Shopify provides the perfect solution.

Apple (Nasdaq: AAPL)

It’s no surprise that this company made the list. Apple’s product offerings and services consistently drive record financials for this tech giant. Moreover, Apple became the first U.S. company to land a market capitalization of $1 trillion in 2018.

Moreover, a global brand like Apple hasn’t escaped Warren Buffett’s attention. That’s why Berkshire Hathaway is one of Apple’s largest shareholders. As of May 2022, Apple is the largest holding in the Berkshire Hathaway portfolio. The company owns 887.1 million shares with a market value of $157.5 billion.

This company dominates other tech stocks. As of the third quarter of 2021, Apple held a 47% share of the U.S. smartphone market. As of the fourth quarter, it had a market share of 29.2% in the tablet industry. Furthermore, this company isn’t going anywhere anytime soon. It continues to be a key player in its industry, giving long-term investors of AAPL stock a unique opportunity.

Netflix (Nasdaq: NFLX)

Internationally and domestically, Netflix is recognized as one of the leading video streaming services. However, the company has a reasonable price tag, given its position as an industry leader.

Additionally, Netflix stock has already turned ordinary investors into millionaires, and the momentum is still going. In the years to come, Netflix hopes to make new highs, and there’s nothing that suggests it won’t be a market leader for the foreseeable future.

With traditional cable companies losing market share and the rest of the world becoming more internet-accessible, Netflix will benefit most from the growing addressable market. Investing in Netflix now will most likely make investors happy ten years down the road, even after the incredible run.

Keep Reading This Article and Find Out the Final 3 Long Term Stocks to Buy and Hold!

You’ll also receive occasional special offers from Oxford Club and our affiliates. You can unsubscribe at any time. Privacy Policy | Newsletter FAQ

Government

Five Aerospace Investments to Buy as Wars Worsen Copy

Five aerospace investments to buy as wars worsen give investors a chance to acquire shares of companies focused on fortifying national defense. The five…

Five aerospace investments to buy as wars worsen give investors a chance to acquire shares of companies focused on fortifying national defense.

The five aerospace investments to buy provide military products to help protect freedom amid Russia’s ongoing onslaught against Ukraine that began in February 2022, as well as supply arms in the Middle East used after Hamas militants attacked and murdered civilians in Israel on Oct. 7. Even though the S&P 500 recently reached all-time highs, these five aerospace investments have remained reasonably priced and rated as recommendations by seasoned analysts and a pension fund chairman.

State television broadcasts in Russia show the country’s soldiers advancing further into Ukrainian territory, but protests have occurred involving family members of those serving in perilous conditions in the invasion of their neighboring nation to be brought home. Even though hundreds of thousands of Russians also have fled to other countries to avoid compulsory military service, the aggressor’s President Vladimir Putin has vowed to continue to send additional soldiers into the fierce fighting.

While Russia’s land-grab of Crimea and other parts of Ukraine show no end in sight, Israel’s war with Hamas likely will last for at least additional months, according to the latest reports. United Nations’ leaders expressed alarm on Dec. 26 about intensifying Israeli attacks that killed more than 100 Palestinians over two days in part of the Gaza Strip, when 15 members of the Israel Defense Force (IDF) also lost their lives.

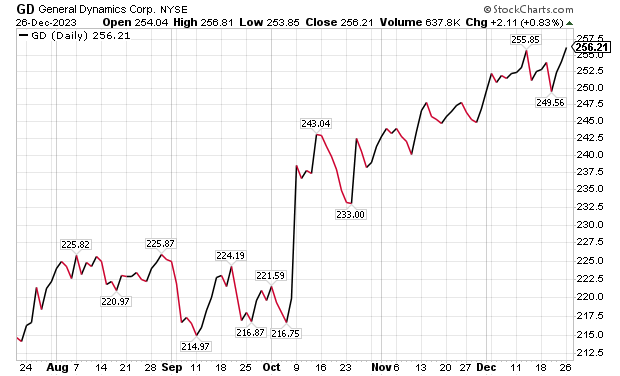

Five Aerospace Investments to Buy as Wars Worsen: General Dynamics

One of the five aerospace investments to buy as wars worsen is General Dynamics (NYSE: GD), a Reston, Virginia-based aerospace company with more than 100,000 employees in 70-plus countries. A key business unit of General Dynamics is Gulfstream Aerospace Corporation, a manufacturer of business aircraft. Other segments of General Dynamics focus on making military products such as Abrams tanks, Stryker fighting vehicles, ASCOD fighting vehicles like the Spanish PIZARRO and British AJAX, LAV-25 Light Armored Vehicles and Flyer-60 lightweight tactical vehicles.

For the U.S. Navy and other allied armed forces, General Dynamics builds Virginia-class attack submarines, Columbia-class ballistic missile submarines, Arleigh Burke-class guided missile destroyers, Expeditionary Sea Base ships, fleet logistics ships, commercial cargo ships, aircraft and naval gun systems, Hydra-70 rockets, military radios and command and control systems. In addition, the company provides radio and optical telescopes, secure mobile phones, PIRANHA and PANDUR wheeled armored vehicles and mobile bridge systems.

Chicago-based investment firm William Blair & Co. is among those recommending General Dynamics. The Chicago firm gave an “outperform” rating to General Dynamics in a Dec. 21 research note.

Gulfstream is seeking G700 FAA certification by the end of 2023, suggesting potentially positive news in the next 10 days, William Blair wrote in its recent research note. The investment firm projected that General Dynamics would trade upward upward upon the G700’s certification.

“General Dynamics’ 2023 aircraft delivery guidance of approximately 134 planes assumes that 19 G700s are delivered in the fourth quarter,” wrote William Blair’s aerospace and defense analyst Louie DiPalma. “Even if deliveries fall short of this target, we believe investors will take a glass-half-full approach upon receipt of the certification.”

Chart courtesy of www.stockcharts.com.

Five Aerospace Investments to Buy as Wars Worsen: GD Outlook

The G700 is a major focus area for investors because it is Gulfstream’s most significant aircraft introduction since the iconic G650 in 2012, DiPalma wrote. Gulfstream has the highest market share in the long-range jet segment of the private aircraft market, the highest profit margin of aircraft peers and the most premium business aviation brand, he added.

“The aircraft remains immensely popular today with corporations and high-net-worth individuals,” Di Palma wrote. “Elon Musk has reportedly placed an order for a G700 to go along with his existing G650. Qatar Airways announced at the Paris Air Show that 10 G700 aircraft will become part of its fleet.”

G700 deliveries and subsequent G800 deliveries are expected to be the cornerstone of Gulfstream’s growth and margin expansion for the next decade, DiPalma wrote. This should lead to a rebound in the stock price as the margins for the G700 and G800 are very attractive, he added.

Management’s guidance is for the aerospace operating margin to increase from about 13.2% in 2022 to roughly 14.0% in 2023 and 15.8% in 2024. Longer term, a high-teens profit margin appears within reach, DiPalma projected.

In other General Dynamics business segments, William Blair expects several yet-unannounced large contract awards for General Dynamics IT, to go along with C$1.7 billion, or US$1.29 billion, in General Dynamics Mission Systems contracts announced on Dec. 20 for the Canadian Army. General Dynamics shares are poised to have a strong 2024, William Blair wrote.

Five Aerospace Investments to Buy as Wars Worsen: VSE Corporation

Alexandria, Virginia-based VSE Corporation’s (NASDAQ: VSEC) price-to-earnings (P/E) valuation multiple of 22 received support when AAR Corp. (NYSE: AIR), a Wood Dale, Illinois, provider of aviation services, announced on Dec. 21 that it would acquire the product support business of Triumph Group (NYSE: TGI), a Berwyn, Pennsylvania, supplier of aerospace services, structures and systems. AAR’s purchase price of $725 million reflects confidence in a continued post-pandemic aerospace rebound.

VSE, a provider of aftermarket distribution and repair services for land, sea and air transportation assets used by government and commercial markets, is rated “outperform” by William Blair. The company’s core services include maintenance, repair and operations (MRO), parts distribution, supply chain management and logistics, engineering support, as well as consulting and training for global commercial, federal, military and defense customers.

“Robust consumer travel demand and aging aircraft fleets have driven elevated maintenance visits,” William Blair’s DiPalma wrote in a Dec. 21 research note. “The AAR–Triumph deal is valued at a premium 13-times 2024 EBITDA multiple, which was in line with the valuation multiple that Heico (NYSE: HEI) paid for Wencor over the summer.”

VSE currently trades at a discounted 9.5 times consensus 2024 earnings before interest, taxes, depreciation and amortization (EBITDA) estimates, as well as 11.6 times consensus 2023 EBITDA.

Five Aerospace Investments to Buy as Wars Worsen: VSE Undervalued?

“We expect that VSE shares will trend higher as investors process this deal,” DiPalma wrote. “VSE shares trade at 9.5 times consensus 2024 adjusted EBITDA, compared with peers and M&A comps in the 10-to-14-times range. We think that VSE’s multiple will expand as it closes the divestiture of its federal and defense business and makes strategic acquisitions. We see consistent 15% annual upside for shares as VSE continues to take share in the $110 billion aviation aftermarket industry.”

William Blair reaffirmed its “outperform” rating for VSE on Dec. 21. The main risk to VSE shares is lumpiness associated with its aviation services margins, Di Palma wrote. However, he raised 2024 estimates to further reflect commentary from VSE’s analysts’ day in November.

Chart courtesy of www.stockcharts.com.

Five Aerospace Investments to Buy as Wars Worsen: HEICO Corporation

HEICO Corporation (NYSEL: HEI), is a Hollywood, Florida-based technology-driven aerospace, industrial, defense and electronics company that also is ranked as an “outperform” investment by William Blair’s DiPalma. The aerospace aftermarket parts provider recently reported fourth-quarter financials above consensus analysts’ estimates, driven by 20% organic growth in HEICO’s flight support group.

HEICO’s management indicated that the performance of recently acquired Wencor is exceeding expectations. However, HEICO leaders offered color on 2024 organic growth and margin expectations that forecast reduced gains. Even though consensus estimates already assumed slowing growth, it is still not a positive for HEICO, DiPalma wrote.

William Blair forecasts 15% annual upside to HEICO’s shares, based on EBITDA growth. HEICO’s management cited a host of reasons for its quarterly outperformance, highlighted by the continued commercial air travel recovery. The company also referenced new product introductions and efficiency initiatives.

HEICO’s defense product sales increased by 26% sequentially, marking the third consecutive sequential increase in defense product revenue. The company’s leaders conveyed that defense in general is moving in the right direction to enhance financial performance.

Chart courtesy of www.stockcharts.com.

Five Dividend-paying Defense and Aerospace Investments to Purchase: XAR

A fourth way to obtain exposure to defense and aerospace investments is through SPDR S&P Aerospace and Defense ETF (XAR). That exchange-traded fund tracks the S&P Aerospace & Defense Select Industry Index. The fund is overweight in industrials and underweight in technology and consumer cyclicals, said Bob Carlson, a pension fund chairman who heads the Retirement Watch investment newsletter.

Bob Carlson, who heads Retirement Watch, answers questions from Paul Dykewicz.

XAR has 34 securities, and 44.2% of the fund is in the 10 largest positions. The fund is up 25.82% in the last 12 months, 22.03% in the past three months and 7.92% for the last month. Its dividend yield recently measured 0.38%.

The largest positions in the fund recently were Axon Enterprise (NASDAQ: AXON), Boeing (NYSE: BA), L3Harris Technologies (NYSE: LHX), Spirit Aerosystems (NYSE: SPR) and Virgin Galactic (NYSE: SPCE).

Chart courtesy of www.stockcharts.com

Five Dividend-paying Defense and Aerospace Investments to Purchase: PPA

The second fund recommended by Carlson is Invesco Aerospace & Defense ETF (PPA), which tracks the SPADE Defense Index. It has the same underweighting and overweighting as XAR, he said.

PPA recently held 52 securities and 53.2% of the fund was in its 10 largest positions. With so many holdings, the fund offers much reduced risk compared to buying individual stocks. The largest positions in the fund recently were Boeing (NYSE: BA), RTX Corp. (NYSE: RTX), Lockheed Martin (NYSE: LMT), Northrop Grumman (NYSE: NOC) and General Electric (NYSE:GE).

The fund is up 19.07% for the past year, 50.34% in the last three months and 5.30% during the past month. The dividend yield recently touched 0.69%.

Chart courtesy of www.stockcharts.com

Other Fans of Aerospace

Two fans of aerospace stocks are Mark Skousen, PhD, and seasoned stock picker Jim Woods. The pair team up to head the Fast Money Alert advisory service They already are profitable in their recent recommendation of Lockheed Martin (NYSE: LMT) in Fast Money Alert.

Mark Skousen, a scion of Ben Franklin, meets with Paul Dykewicz.

Jim Woods, a former U.S. Army paratrooper, co-heads Fast Money Alert.

Bryan Perry, who heads the Cash Machine investment newsletter and the Micro-Cap Stock Trader advisory service, recommends satellite services provider Globalstar (NYSE American: GSAT), of Covington, Louisiana, that has jumped 50.00% since he advised buying it two months ago. Perry is averaging a dividend yield of 11.14% in his Cash Machine newsletter but is breaking out with the red-hot recommendation of Globalstar in his Micro-Cap Stock Trader advisory service.

Bryan Perry heads Cash Machine, averaging an 11.14% dividend yield.

Military Equipment Demand Soars amid Multiple Wars

The U.S. military faces an acute need to adopt innovation, to expedite implementation of technological gains, to tap into the talents of people in various industries and to step-up collaboration with private industry and international partners to enhance effectiveness, U.S. Joint Chiefs of Staff Gen. Charles Q. Brown Jr. told attendees on Nov 16 at a national security conference. Prime examples of the need are showed by multiple raging wars, including the Middle East and Ukraine. A cold war involves China and its increasingly strained relationships with Taiwan and other Asian nations.

The shocking Oct. 7 attack by Hamas on Israel touched off an ongoing war in the Middle East, coupled with Russia’s February 2022 invasion and continuing assault of neighboring Ukraine. Those brutal military conflicts show the fragility of peace when determined aggressors are willing to use any means necessary to achieve their goals. To fend off such attacks, rapid and effective response is required.

“The Department of Defense is doing more than ever before to deter, defend, and, if necessary, defeat aggression,” Gen. Brown said at the National Security Innovation Forum at the Johns Hopkins University Bloomberg Center in Washington, D.C.

One of Russia’s war ships, the 360-foot-long Novocherkassk, was damaged on Dec. 26 by a Ukrainian attack on the Black Sea port of Feodosia in Crimea. This video of an explosion at the port that reportedly shows a section of the ship hit by aircraft-guided missiles.

Chairman Joint Chiefs of Staff Gen. Charles Q. Brown, Jr.

Photo By: Benjamin Applebaum

National security threats can compel immediate action, Gen. Brown said he quickly learned since taking his post on Oct. 1.

“We may not have much warning when the next fight begins,” Gen. Brown said. “We need to be ready.”

In a pre-recorded speech at the national security conference, Michael R. Bloomberg, founder of Bloomberg LP, told the John Hopkins national security conference attendees about the critical need for collaboration between government and industry.

“Building enduring technological advances for the U.S. military will help our service members and allies defend freedom across the globe,” Bloomberg said.

The “horrific terrorist attacks” against Israel and civilians living there on Oct. 7 underscore the importance of that mission, Bloomberg added.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Attention Holiday Gift Buyers! Consider purchasing Paul’s inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases or autographed copies! Follow Paul on Twitter @PaulDykewicz. He is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper, after writing for the Baltimore Business Journal and Crain Communications.

The post Five Aerospace Investments to Buy as Wars Worsen Copy appeared first on Stock Investor.

dow jones sp 500 nasdaq stocks pandemic etf micro-cap army recovery russia ukraine chinaGovernment

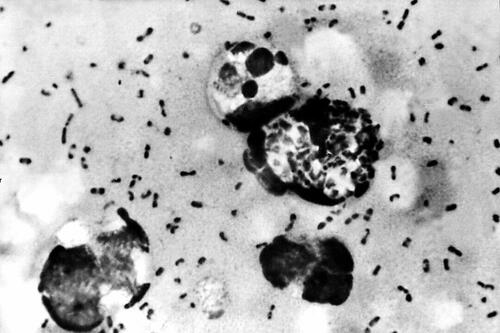

Health Officials: Man Dies From Bubonic Plague In New Mexico

Health Officials: Man Dies From Bubonic Plague In New Mexico

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Officials in…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Officials in New Mexico confirmed that a resident died from the plague in the United States’ first fatal case in several years.

The New Mexico Department of Health, in a statement, said that a man in Lincoln County “succumbed to the plague.” The man, who was not identified, was hospitalized before his death, officials said.

They further noted that it is the first human case of plague in New Mexico since 2021 and also the first death since 2020, according to the statement. No other details were provided, including how the disease spread to the man.

The agency is now doing outreach in Lincoln County, while “an environmental assessment will also be conducted in the community to look for ongoing risk,” the statement continued.

“This tragic incident serves as a clear reminder of the threat posed by this ancient disease and emphasizes the need for heightened community awareness and proactive measures to prevent its spread,” the agency said.

A bacterial disease that spreads via rodents, it is generally spread to people through the bites of infected fleas. The plague, known as the black death or the bubonic plague, can spread by contact with infected animals such as rodents, pets, or wildlife.

The New Mexico Health Department statement said that pets such as dogs and cats that roam and hunt can bring infected fleas back into homes and put residents at risk.

Officials warned people in the area to “avoid sick or dead rodents and rabbits, and their nests and burrows” and to “prevent pets from roaming and hunting.”

“Talk to your veterinarian about using an appropriate flea control product on your pets as not all products are safe for cats, dogs or your children” and “have sick pets examined promptly by a veterinarian,” it added.

“See your doctor about any unexplained illness involving a sudden and severe fever, the statement continued, adding that locals should clean areas around their home that could house rodents like wood piles, junk piles, old vehicles, and brush piles.

The plague, which is spread by the bacteria Yersinia pestis, famously caused the deaths of an estimated hundreds of millions of Europeans in the 14th and 15th centuries following the Mongol invasions. In that pandemic, the bacteria spread via fleas on black rats, which historians say was not known by the people at the time.

Other outbreaks of the plague, such as the Plague of Justinian in the 6th century, are also believed to have killed about one-fifth of the population of the Byzantine Empire, according to historical records and accounts. In 2013, researchers said the Justinian plague was also caused by the Yersinia pestis bacteria.

But in the United States, it is considered a rare disease and usually occurs only in several countries worldwide. Generally, according to the Mayo Clinic, the bacteria affects only a few people in U.S. rural areas in Western states.

Recent cases have occurred mainly in Africa, Asia, and Latin America. Countries with frequent plague cases include Madagascar, the Democratic Republic of Congo, and Peru, the clinic says. There were multiple cases of plague reported in Inner Mongolia, China, in recent years, too.

Symptoms

Symptoms of a bubonic plague infection include headache, chills, fever, and weakness. Health officials say it can usually cause a painful swelling of lymph nodes in the groin, armpit, or neck areas. The swelling usually occurs within about two to eight days.

The disease can generally be treated with antibiotics, but it is usually deadly when not treated, the Mayo Clinic website says.

“Plague is considered a potential bioweapon. The U.S. government has plans and treatments in place if the disease is used as a weapon,” the website also says.

According to data from the U.S. Centers for Disease Control and Prevention, the last time that plague deaths were reported in the United States was in 2020 when two people died.

International

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Is there a light forming when it comes to the long, dark and…

Is there a light forming when it comes to the long, dark and bewildering tunnel of social justice cultism? Global events have been so frenetic that many people might not remember, but only a couple years ago Big Tech companies and numerous governments were openly aligned in favor of mass censorship. Not just to prevent the public from investigating the facts surrounding the pandemic farce, but to silence anyone questioning the validity of woke concepts like trans ideology.

From 2020-2022 was the closest the west has come in a long time to a complete erasure of freedom of speech. Even today there are still countries and Europe and places like Canada or Australia that are charging forward with draconian speech laws. The phrase "radical speech" is starting to circulate within pro-censorship circles in reference to any platform where people are allowed to talk critically. What is radical speech? Basically, it's any discussion that runs contrary to the beliefs of the political left.

Open hatred of moderate or conservative ideals is perfectly acceptable, but don't ever shine a negative light on woke activism, or you might be a terrorist.

Riley Gaines has experienced this double standard first hand. She was even assaulted and taken hostage at an event in 2023 at San Francisco State University when leftists protester tried to trap her in a room and demanded she "pay them to let her go." Campus police allegedly witnessed the incident but charges were never filed and surveillance footage from the college was never released.

It's probably the last thing a champion female swimmer ever expects, but her head-on collision with the trans movement and the institutional conspiracy to push it on the public forced her to become a counter-culture voice of reason rather than just an athlete.

For years the independent media argued that no matter how much we expose the insanity of men posing as women to compete and dominate women's sports, nothing will really change until the real female athletes speak up and fight back. Riley Gaines and those like her represent that necessary rebellion and a desperately needed return to common sense and reason.

In a recent interview on the Joe Rogan Podcast, Gaines related some interesting information on the inner workings of the NCAA and the subversive schemes surrounding trans athletes. Not only were women participants essentially strong-armed by colleges and officials into quietly going along with the program, there was also a concerted propaganda effort. Competition ceremonies were rigged as vehicles for promoting trans athletes over everyone else.

The bottom line? The competitions didn't matter. The real women and their achievements didn't matter. The only thing that mattered to officials were the photo ops; dudes pretending to be chicks posing with awards for the gushing corporate media. The agenda took precedence.

Lia Thomas, formerly known as William Thomas, was more than an activist invading female sports, he was also apparently a science project fostered and protected by the athletic establishment. It's important to understand that the political left does not care about female athletes. They do not care about women's sports. They don't care about the integrity of the environments they co-opt. Their only goal is to identify viable platforms with social impact and take control of them. Women's sports are seen as a vehicle for public indoctrination, nothing more.

The reasons why they covet women's sports are varied, but a primary motive is the desire to assert the fallacy that men and women are "the same" psychologically as well as physically. They want the deconstruction of biological sex and identity as nothing more than "social constructs" subject to personal preference. If they can destroy what it means to be a man or a woman, they can destroy the very foundations of relationships, families and even procreation.

For now it seems as though the trans agenda is hitting a wall with much of the public aware of it and less afraid to criticize it. Social media companies might be able to silence some people, but they can't silence everyone. However, there is still a significant threat as the movement continues to target children through the public education system and women's sports are not out of the woods yet.

The ultimate solution is for women athletes around the world to organize and widely refuse to participate in any competitions in which biological men are allowed. The only way to save women's sports is for women to be willing to end them, at least until institutions that put doctrine ahead of logic are made irrelevant.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges