Government

Three Big Bank Stocks to Buy Despite Risks for Investors

Three big bank stocks to buy show promise for a recovery, despite risks keeping investors wary amid stubbornly high inflation and the potential of a recession…

Three big bank stocks to buy show promise for a recovery, despite risks keeping investors wary amid stubbornly high inflation and the potential of a recession later this year.

The three big bank stocks to buy should be better positioned than smaller regional banks to withstand the current economic headwinds, according to market observers. Nonetheless, muted economic outlooks by some observers, combined with relatively high cash levels and expectations for lower short-term rates, suggests that pessimism is close to levels seen at market lows of the past 20 years, according to BofA Global Research.

Such poor sentiment suggests the 3,800 floor in the S&P will hold for now, but may be followed by a rally to 4,100-4,200, according to the investment firm. Investors currently prefer large caps over small caps, along with quality trumping junk bonds, as the recent shift out of banks was the fastest seen since Russia’s invasion of Ukraine, BofA added.

Three Big Bank Stocks to Buy Despite Macroeconomic Headwinds

The broad macroeconomic picture shows signs of weakness, with employment indicators deteriorating on a year-over-year and sequential basis in recent weeks, BofA opined. Despite rate increases, the unemployment rate in March was 3.5%, down 10 basis points, or 0.10%, from February.

As wage growth eases, the Fed will continue to consider relatively strong unemployment levels and the price indices in setting future rate hikes. While there have been signs of prices cooling, BofA Global Research is less optimistic for a soft landing and expects a mild recession to begin in second-half 2023.

Adjusted retail and food sales, along with credit card balances, are up on a year-over-year basis, as consumers keep spending amid high inflation. Plus, the mortgage backdrop has become progressively more difficult, and higher interest rates are leading to lower originations overall amid worsening affordability, BofA wrote.

Three Big Bank Stocks to Buy Despite

In the Fed’s recent monthly report, the U.S. central bank announced that “loans to commercial banks” jumped to $345.5 billion in March. The Fed’s Discount Window was “wide open,” with the Fed making more short-term loans to banks than it did in the financial crisis of 2008, said Mark Skouen, PhD, who co-heads the Fast Money Alert trading service with seasoned investor Jim Woods.

Mark Skousen co-heads Fast Money Alert.

Bank deposits, which Skousen, a free-market economist, equated to the money supply, fell 2.5% as depositors withdrew billions from their bank accounts. If that trend continues, the United States will be facing a “major credit crunch,” he added.

Skousen wrote to subscribers of his monthly investment newsletter, Forecasts & Strategies, that he laughed when reading the headline of the Federal Reserve monthly report: “The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible and stable financial and monetary system.”

Fed policy is anything but stable, Skousen said.

“While the Biden administration continues to spend money like water, the Fed has imposed a tight money policy, which is likely to create an inflationary recession this year,” Skousen wrote to his subscribers.

Skousen Has Track Record of Profiting in Banking Stocks

Even though investing in banks now is not without real risk, Skousen notched a profit of nearly 8% in just 43 days during 2021 by recommending shares of New York-based Signature Bank (OTCMKTS: SBNY) in Fast Money Alert. Skousen also has recommended banking stocks and call options in his Home Run Trader advisory service.

In Home Run Trader, Skousen recommended US Bancorp (NYSE: USB) for a 3.22% gain during 2007. The next year, Skousen recommended buying Bank of Montreal (NYSE; BMO) for a 10.43% profit, before offering another bullish call in 2012 when he recommended Westpac Banking Corp. (NYSE WBK) before it jumped 13.92%.

Jim Woods, who heads the Bullseye Stock Trader advisory service, while also teaming up with Skousen in Fast Money Alert, recommends both stocks and options. The Bullseye Stock Trader advisory service, is only down in two of its current six recommendations, despite the current market volatility.

Jim Woods heads Bullseye Stock Trader.

Woods wrote in his May 2023 Successful Investing newsletter that banks and the financial sector essentially had free money through minimal interest rates for more than a decade. The Fed then jacked up rates within about 10 months to levels last seen in the 1990s, with the resulting financial stress contributing to the failure of Silicon Valley Bank and others, he added.

Three Big Bank Stocks to Buy Despite Industry Challenges

Bank of America (NYSE: BAC), of Charlotte, North Carolina, is a stock favored by Michelle Connell, who heads the Dallas-based Portia Capital Management. One of the big incentives to owning shares in the bank is its nearly 3% dividend yield that pays shareholders to stay patient for the financial sector to rebound.

Michelle Connell heads Portia Capital Management.

“Since the mortgage and financial crisis of 2008 and 2009, Bank of America has rebuilt its dividend payment record,” Connell continued. “In the last eight years, Bank of America has continued to increase its dividend.”

Bank of America just posted strong metrics for its latest quarter, Connell told me. As the second-biggest bank in America, behind only JPMorgan, Bank of America beat its earnings expectations, reported record inflows of $37 billion in cash deposits from new and existing clients and attracted 14,500 new clients through its Merrill Lynch brokerage and private bank unit, she added.

Despite speculation among forecasters that further bank failures may be afoot, Bank of America’s net interest income met expectations and its leaders are offering guidance of meeting analysts’ estimates in the near term, Connell counseled.

Three Big Bank Stocks to Buy include Those Who Aided First Republic Bank

Another sign of strength is that Bank of America was one of 11 financial institutions that contributed to the $30 billion used shore up First Republic Bank, Connell said. BAC’s Chief Executive Officer Brian Moynihan has done an “amazing job” at the helm since 2010, Connell added.

Moynihan knows his client base and understands how to grow and deliver profits during all phases of an economic cycle, Connell said. Despite Bank of America’s share price sliding 18.45% in the past year and 9.48% so far this year, Berkshire Hathaway’s Chairman and Chief Financial Officer Warren Buffett remains “enamored” with the stock, Connell commented.

Indeed, Bank of America is Buffett’s largest bank holding and his second-largest overall stock position, Connell continued. As far as Bank of America’s potential upside, Connell estimated its share price could rise about 20% from current levels.

Bank of America appears undervalued, Connell indicated, with a price-to-earnings ratio (P/E) ratio of 8.97. The modest P/E gives the bank a “very compelling” price point, Connell said.

“The bank has a solid balance sheet and fundamentals that should help it continue to perform for its clients and stockholders,” Connell said.

Chart courtesy of www.stockcharts.com

JPMorgan Chase Is Among Three Big Bank Stocks to Buy

Another of the three big banks to buy is New York-based JPMorgan Chase (NYSE: JPM), with a $417.2 billion market capitalization. JPMorgan Chase is recommended as a buy in a recent BofA Global Research report, and it fits the investment bank’s description as a “mega-cap bank” that is preferred to regional banks, given its superior liquidity position, diversified revenue profile and credit defensibility.

For example, JPMorgan Chase produces a hefty amount of its revenue internationally and that non-domestic focus is expected to grow, BofA wrote in its research note. JPMorgan continues to invest in China, but cautiously.

The big bank’s management is seeking to grow its business in the Middle East, with Dubai a particular focus, given capital migration into the region. BofA put a $153 price objection on JPMorgan in late February. Positive developments could include better-than-expected credit quality and better interest rate defensibility, BofA wrote.

Chart courtesy of www.stockcharts.com

Citigroup Rounds out Three Big Bank Stocks to Buy

New York-based Citigroup (NYSE: C), with a market capitalization of nearly $100 billion, is another big bank stock that BofA views as a buy. Citigroup built its own brokerage platform but partnered to enter into the insurance business.

The bank’s management continues to hire financial advisers with the goal of adding new clients and funds under management to its business. High net worth individuals with $5-20 million in assets are a coveted niche for growth, BofA wrote.

On the commercial banking side of Citigroup’s business, deposit growth is slowing but its retail deposits are gaining better than the industry, BofA noted. Wealthy customers are moving money into certificates of deposit (CDs) and fixed income products, but the bank’s multi-product offerings are helping to limit attrition.

The bank’s management also is eyeing digital marketing to contribute 30% of its deposit growth. Citigroup’s multi-pronged growth strategy impressed BofA bank analysts to assign the stock a price objective of $60.

Chart courtesy of www.stockcharts.com

CDC Sees Rising Vaccinations Against New Bivalent Variant of COVID-19

The U.S. Centers for Disease Control and Prevention (CDC) reported at least one vaccination against COVID-19 and its bivalent variant has been given to 269,971,358 people, or 81.3% of the U.S. population, as of April 19. Those who have completed the primary COVID-19 doses totaled 230,485,008 of the U.S. population, or 69.4%, according to the CDC.

Also as of April 19, the United States had given a bivalent COVID-19 booster to 52,117,186 people who are age 18 and up, equaling 20.2% of America’s population. Medical studies have shown vaccinations help to keep people healthy and reduce the morbidity from contracting COVID, potentially boosting confidence of consumers to shop at stores, travel and otherwise spend money.

The three big bank stocks to buy offer a way for investors to ride the inevitable recovery of financial services giants whose stock prices have slipped in recent weeks.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. He is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases.

The post Three Big Bank Stocks to Buy Despite Risks for Investors appeared first on Stock Investor.

recession unemployment covid-19 bonds dow jones stocks fed federal reserve cdc disease control recession recovery interest rates unemployment small caps russia ukraine chinaInternational

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexicoGovernment

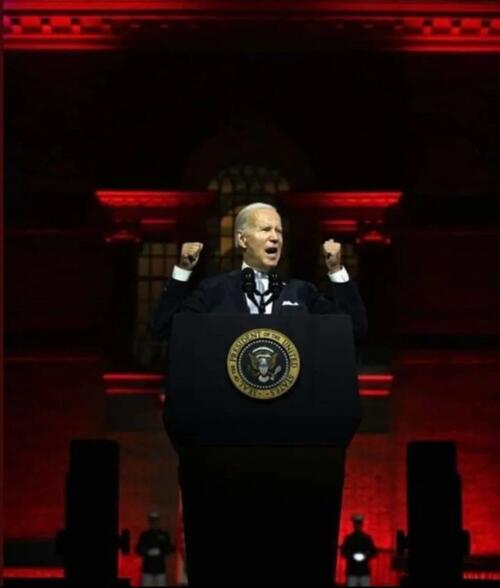

President Biden Delivers The “Darkest, Most Un-American Speech Given By A President”

President Biden Delivers The "Darkest, Most Un-American Speech Given By A President"

Having successfully raged, ranted, lied, and yelled through…

Having successfully raged, ranted, lied, and yelled through the State of The Union, President Biden can go back to his crypt now.

Whatever 'they' gave Biden, every American man, woman, and the other should be allowed to take it - though it seems the cocktail brings out 'dark Brandon'?

Tl;dw: Biden's Speech tonight ...

-

Fund Ukraine.

-

Trump is threat to democracy and America itself.

-

Abortion is good.

-

American Economy is stronger than ever.

-

Inflation wasn't Biden's fault.

-

Illegals are Americans too.

-

Republicans are responsible for the border crisis.

-

Trump is bad.

-

Biden stands with trans-children.

-

J6 was the worst insurrection since the Civil War.

(h/t @TCDMS99)

Tucker Carlson's response sums it all up perfectly:

"that was possibly the darkest, most un-American speech given by an American president. It wasn't a speech, it was a rant..."

Carlson continued: "The true measure of a nation's greatness lies within its capacity to control borders, yet Bid refuses to do it."

"In a fair election, Joe Biden cannot win"

And concluded:

“There was not a meaningful word for the entire duration about the things that actually matter to people who live here.”

Victor Davis Hanson added some excellent color, but this was probably the best line on Biden:

"he doesn't care... he lives in an alternative reality."

— Tucker Carlson (@TuckerCarlson) March 8, 2024

* * *

Watch SOTU Live here...

* * *

Mises' Connor O'Keeffe, warns: "Be on the Lookout for These Lies in Biden's State of the Union Address."

On Thursday evening, President Joe Biden is set to give his third State of the Union address. The political press has been buzzing with speculation over what the president will say. That speculation, however, is focused more on how Biden will perform, and which issues he will prioritize. Much of the speech is expected to be familiar.

The story Biden will tell about what he has done as president and where the country finds itself as a result will be the same dishonest story he's been telling since at least the summer.

He'll cite government statistics to say the economy is growing, unemployment is low, and inflation is down.

Something that has been frustrating Biden, his team, and his allies in the media is that the American people do not feel as economically well off as the official data says they are. Despite what the White House and establishment-friendly journalists say, the problem lies with the data, not the American people's ability to perceive their own well-being.

As I wrote back in January, the reason for the discrepancy is the lack of distinction made between private economic activity and government spending in the most frequently cited economic indicators. There is an important difference between the two:

-

Government, unlike any other entity in the economy, can simply take money and resources from others to spend on things and hire people. Whether or not the spending brings people value is irrelevant

-

It's the private sector that's responsible for producing goods and services that actually meet people's needs and wants. So, the private components of the economy have the most significant effect on people's economic well-being.

Recently, government spending and hiring has accounted for a larger than normal share of both economic activity and employment. This means the government is propping up these traditional measures, making the economy appear better than it actually is. Also, many of the jobs Biden and his allies take credit for creating will quickly go away once it becomes clear that consumers don't actually want whatever the government encouraged these companies to produce.

On top of all that, the administration is dealing with the consequences of their chosen inflation rhetoric.

Since its peak in the summer of 2022, the president's team has talked about inflation "coming back down," which can easily give the impression that it's prices that will eventually come back down.

But that's not what that phrase means. It would be more honest to say that price increases are slowing down.

Americans are finally waking up to the fact that the cost of living will not return to prepandemic levels, and they're not happy about it.

The president has made some clumsy attempts at damage control, such as a Super Bowl Sunday video attacking food companies for "shrinkflation"—selling smaller portions at the same price instead of simply raising prices.

In his speech Thursday, Biden is expected to play up his desire to crack down on the "corporate greed" he's blaming for high prices.

In the name of "bringing down costs for Americans," the administration wants to implement targeted price ceilings - something anyone who has taken even a single economics class could tell you does more harm than good. Biden would never place the blame for the dramatic price increases we've experienced during his term where it actually belongs—on all the government spending that he and President Donald Trump oversaw during the pandemic, funded by the creation of $6 trillion out of thin air - because that kind of spending is precisely what he hopes to kick back up in a second term.

If reelected, the president wants to "revive" parts of his so-called Build Back Better agenda, which he tried and failed to pass in his first year. That would bring a significant expansion of domestic spending. And Biden remains committed to the idea that Americans must be forced to continue funding the war in Ukraine. That's another topic Biden is expected to highlight in the State of the Union, likely accompanied by the lie that Ukraine spending is good for the American economy. It isn't.

It's not possible to predict all the ways President Biden will exaggerate, mislead, and outright lie in his speech on Thursday. But we can be sure of two things. The "state of the Union" is not as strong as Biden will say it is. And his policy ambitions risk making it much worse.

* * *

The American people will be tuning in on their smartphones, laptops, and televisions on Thursday evening to see if 'sloppy joe' 81-year-old President Joe Biden can coherently put together more than two sentences (even with a teleprompter) as he gives his third State of the Union in front of a divided Congress.

President Biden will speak on various topics to convince voters why he shouldn't be sent to a retirement home.

The state of our union under President Biden: three years of decline. pic.twitter.com/Da1KOIb3eR

— Speaker Mike Johnson (@SpeakerJohnson) March 7, 2024

According to CNN sources, here are some of the topics Biden will discuss tonight:

Economic issues: Biden and his team have been drafting a speech heavy on economic populism, aides said, with calls for higher taxes on corporations and the wealthy – an attempt to draw a sharp contrast with Republicans and their likely presidential nominee, Donald Trump.

Health care expenses: Biden will also push for lowering health care costs and discuss his efforts to go after drug manufacturers to lower the cost of prescription medications — all issues his advisers believe can help buoy what have been sagging economic approval ratings.

Israel's war with Hamas: Also looming large over Biden's primetime address is the ongoing Israel-Hamas war, which has consumed much of the president's time and attention over the past few months. The president's top national security advisers have been working around the clock to try to finalize a ceasefire-hostages release deal by Ramadan, the Muslim holy month that begins next week.

An argument for reelection: Aides view Thursday's speech as a critical opportunity for the president to tout his accomplishments in office and lay out his plans for another four years in the nation's top job. Even though viewership has declined over the years, the yearly speech reliably draws tens of millions of households.

Sources provided more color on Biden's SOTU address:

The speech is expected to be heavy on economic populism. The president will talk about raising taxes on corporations and the wealthy. He'll highlight efforts to cut costs for the American people, including pushing Congress to help make prescription drugs more affordable.

Biden will talk about the need to preserve democracy and freedom, a cornerstone of his re-election bid. That includes protecting and bolstering reproductive rights, an issue Democrats believe will energize voters in November. Biden is also expected to promote his unity agenda, a key feature of each of his addresses to Congress while in office.

Biden is also expected to give remarks on border security while the invasion of illegals has become one of the most heated topics among American voters. A majority of voters are frustrated with radical progressives in the White House facilitating the illegal migrant invasion.

It is probable that the president will attribute the failure of the Senate border bill to the Republicans, a claim many voters view as unfounded. This is because the White House has the option to issue an executive order to restore border security, yet opts not to do so

Maybe this is why?

Most Americans are still unaware that the census counts ALL people, including illegal immigrants, for deciding how many House seats each state gets!

— Elon Musk (@elonmusk) March 7, 2024

This results in Dem states getting roughly 20 more House seats, which is another strong incentive for them not to deport illegals.

While Biden addresses the nation, the Biden administration will be armed with a social media team to pump propaganda to at least 100 million Americans.

"The White House hosted about 70 creators, digital publishers, and influencers across three separate events" on Wednesday and Thursday, a White House official told CNN.

Not a very capable social media team...

The State of Confusion https://t.co/C31mHc5ABJ

— zerohedge (@zerohedge) March 7, 2024

The administration's move to ramp up social media operations comes as users on X are mostly free from government censorship with Elon Musk at the helm. This infuriates Democrats, who can no longer censor their political enemies on X.

Meanwhile, Democratic lawmakers tell Axios that the president's SOTU performance will be critical as he tries to dispel voter concerns about his elderly age. The address reached as many as 27 million people in 2023.

"We are all nervous," said one House Democrat, citing concerns about the president's "ability to speak without blowing things."

The SOTU address comes as Biden's polling data is in the dumps.

BetOnline has created several money-making opportunities for gamblers tonight, such as betting on what word Biden mentions the most.

As well as...

We will update you when Tucker Carlson's live feed of SOTU is published.

Fuck it. We’ll do it live! Thursday night, March 7, our live response to Joe Biden’s State of the Union speech. pic.twitter.com/V0UwOrgKvz

— Tucker Carlson (@TuckerCarlson) March 6, 2024

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 hours ago

International2 hours agoWalmart launches clever answer to Target’s new membership program

-

Government1 month ago

Government1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex