This Week in Apps: EU rules Apple’s a monopoly, Spotify and Facebook team up, ATT arrives

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy. The app industry is as hot as ever, with a record 218 billion downloads and $143 billion in…

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry is as hot as ever, with a record 218 billion downloads and $143 billion in global consumer spend in 2020.

Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year.

This week we’re looking at the launch of Apple’s ATT, the Facebook and Spotify team-up and the latest from the EU’s antitrust investigation against Apple.

This Week in Apps will soon be a newsletter! Sign up here: techcrunch.com/newsletters

Top Stories

Here Comes ATT

Apple’s public debut of App Tracking Transparency, or ATT, is the news of the week and possibly of the year. Through a small pop-up message asking users if the app can track them, Apple has disrupted a multibillion-dollar adtech industry, altered the course of tech giants like Facebook and drawn possible lawsuits and antitrust complaints, all in the name of protecting consumer privacy. Apple does believe in privacy and user control — you can tell that from the way the company has built its technology to do things like on-device processing or permissions toggles that let people decide what their apps can and cannot do.

But Apple will also benefit from this particular privacy reform, too. Its own first-party apps can collect data and share it with other first-party apps. That means what you do in apps like the App Store, Apple News, Stocks and others can be used to personalize Apple’s own ads. And the company is prepared to capitalize on this opportunity too, with the addition of a new ad slot on the App Store (in the Suggested section on the Search tab.) If it wants to roll out more ads over time to other businesses — perhaps, those podcasts it got newly interested in after Spotify did? Or in its streaming TV service or fitness solution? Perhaps the ads it sells in Apple News? — then it would have access to valuable data it could use. Oh and the next time you open the App Store or Apple News, you won’t be bothered with one of those pesky warnings! Nope — that’s only for third-parties, a very important distinction! If you want to turn off Apple’s own ability to track you across its growing number of apps, that’s at the VERY bottom of iOS’s Privacy Settings.

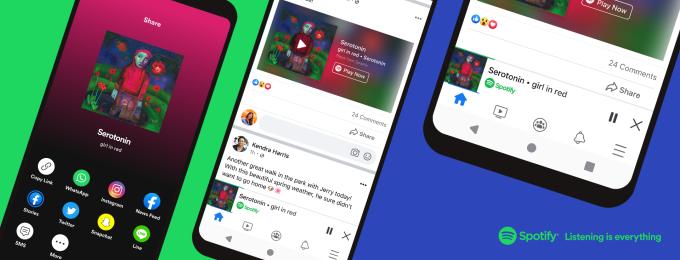

We heard you like Spotify, so we put Spotify in your Facebook app

Image Credits: Spotify

Facebook and Spotify expanded their partnership this week. The companies had earlier announced their plans to make it easier for Facebook users to stream music and podcasts from the Facebook app. On Monday, this integration began rolling out in the form of a miniplayer experience that allows Facebook users to stream from Spotify through the Facebook app on iOS or Android.

The feature is available to both free and paying Spotify users and will allow them each to hear the full song or podcast episode being shared. However, free users will then be moved into “shuffle” mode if they continue to listen after the song plays.

What’s interesting about this integration is that it’s not actually streaming Spotify through Facebook. The miniplayer activates and controls the launch and playback in the Spotify app — which is how the playback is able to continue even as the user scrolls on Facebook or if they minimize the Facebook app altogether. This gives the appearance of Facebook doing the streaming. (Songs on social! Cue Myspace vibes!)

Spotify says users can’t upgrade to Spotify Premium from the miniplayer directly, so there’s no rev share there. It’s also paying the royalties on streams, as usual. But it’s getting massive distribution through Facebook, driving signups and repeat usage, while Facebook gets a way to keep users on its app longer. Win-win. Not coincidentally, both companies now share a common enemy with Apple, whose privacy-focused changes are impacting Facebook’s ad business and whose investments in Apple Music and Podcasts are a threat to Spotify.

Weekly News

Platforms: Apple

Russia’s Federal Antimonopoly Service (FAS) fined Apple $12.1 million for alleged app market abuse, saying Apple gave its own products a competitive advantage.

The EU is charging Apple for its anticompetitive behavior this week, nearly two years after Spotify filed its first complaint about the App Store and Apple Music. The European Commission last year opened its antitrust investigation into Apple’s business, which is also now under fire in the U.S. for similar matters.

On Friday, the European regulators stated that Apple has “abused its dominant position” in the distribution of music streaming services on the App Store, and called it a “monopoly.” The EU doesn’t think Apple should be able to force developers to use its own in-app purchase mechanism nor should it be able to restrict them from telling users where else they can pay — like the developer’s own website, for example.

Spotify founder Daniel Ek seemed happy with the news:

Image Credits: TC

Apple is correct in pointing out that Spotify has built a massive business — which to be fair, was built both on and off the App Store. But it’s claiming a pretty big hand in that. The EU’s belief, meanwhile, is that Spotify might have been even more successful if Apple hadn’t imposed the restrictions it did, and that other smaller, streaming competitors are being harmed, too, but don’t have the power to speak up.

Now that ATT is live, Apple warns developers that it will ban apps from its App Store that offer rewards to users that enable tracking. (But seeing how the App Store is being policed as of late [or not], it seems there could be a dark market established for this sort of thing.)

The Apple-Epic trial is set to start next week. Witnesses include Epic CEO Tim Sweeney and COO Daniel Vogel, Apple CEO Tim Cook, Microsoft Xbox executive Lori Wright, Adrian Ong from Match Group and other current and former Apple execs, including Matt Fischer (App Store VP), Michael Schmid (head of game biz dev for App Store) and Craig Federighi, Eddy Cue, Scott Forstall, Eric Gray, and Phil Schiller, plus many others.

Platforms: Google

Google says it’s updating its Google Play policies for app developers to improve app quality and discoverability. Now banned is keyword stuffing in the app’s title for ASO purposes. Titles will now be limited to 30 characters and can’t use keywords that imply store performance, or promotion in the icon, title or developer name. Icons that mislead users will also be banned. Emoticons and emoji can also no longer be used. The company is additionally cracking down on preview assets to ensure they accurately represent the game or app and give users enough information to make a decision to download. They can’t use words like “free” or best” either, and must be localized and legible.

Image Credits: Google

Adtech

Advertisers told The WSJ that Apple’s ATT gives Apple’s own advertising system a competitive advantage. The adtech industry, which is reeling from Apple’s changes to tracking — it’s giving users the ability to opt-out of being tracked — is making the point that there’s something in it for Apple, too, when ATT goes live.

German advertisers filed an antitrust complaint over ATT, saying the changes will negatively affect their industry with up to a 60% fall in ad revenue. Nine industry associations were behind the complaint, representing other tech giants, like Facebook, and publisher Axel Springer.

Facebook warned investors of “increased ad targeting headwinds in 2021” during its earnings call this week, mainly because of the new version of iOS and its launch of ATT. It also sent a memo to advertisers that detailed how ATT would restrict the availability of ad targeting and analytics tools, and impact audience engagement.

Augmented reality

Image Credits: Apple

Apple updated its Clips app (ver 3.1) to allow users to scan spaces using the LiDAR Scanner on iPhone 12 Pro and iPad Pro models in order to apply video effects to their recordings.

Fintech

Google Pay announced a series of updates for its recently revamped payments app, which include new options for grocery savings, paying for public transit and categorizing your spending. With its redesign, the app is being positioned as a key way for brands and businesses to reach customers with offers at a time when Apple is cracking down on third-party tracking.

MetaMask, the Ethereum wallet app and browser extension, said its MAUs grew 5x since October 2020 to reach 5 million monthly active users.

Social

Image Credits: Instagram

Facebook turns Instagram toward the Clubhouse threat. The company this week announced Instagram Live users could now mute their mics and turn off their videos, which gives the live experience a more casual — and yes, Clubhouse-like, appeal.

Social networking app for women, Peanut, adds live audio rooms. The feature is somewhat like Clubhouse, but without a “stage” or clout-chasing and with topics that appeal to women.

Snapchat now has more Android users than iOS, the company noted during earnings. In Q1 2021, Snapchat reached 280M DAUs, up 22% YoY.

TikTok said it’s opening a “transparency center” in Europe that will allow outside experts to see how TikTok approaches content moderation and recommendations, as well as security and privacy. The company opened a center like this in the U.S. last year following censorship allegations.

TikTok formally announced its new CEO and COO, in a strategic reorg. ByteDance’s CFO Shouzi Chew will now also become CEO of TikTok. Vanessa Pappas, who has served as interim CEO after Disney vet Kevin Mayer’s departure, will take the role of TikTok COO, and continue with her current responsibilities.

Messaging

Telegram says it will add group video calls next month. It has also now added the ability for merchants to natively accept credit card payments in any chat through integrations with eight third-party providers, including Stripe, as well as scheduled voice chats, mini profiles for voice chats and new web versions.

Facebook disclosed there are now 1 million businesses using WhatsApp’s “click to WhatsApp” ads, and announced a new feature that will allow businesses to turn items in the WhatsApp Business Catalogs into Facebook or Instagram ads, saving steps.

Streaming & Entertainment

Image Credits: Pandora

Pandora finally has an iOS home screen widget. What took it so long? The widget comes in three sizes and lets users view and play as many as seven of their most-recently played songs, albums, stations, playlists or podcasts.

The Bally Sports app, which is replacing Fox Sports GO, has now arrived. The app offers livestreamed games, tracks scores, states and standings, and offers game previews and highlights from games.

Dating app S’More is pivoting to become more of a “lifestyle brand” by adding a new feature called S’More TV which will stream dating-related interviews with celebs, like WWE and reality TV stars. The video content could then serve as a conversation starter — something Tinder has done in the past with its interactive series “Swipe Night.”

Clubhouse partners with the NFL for draft week programming. This is the first sports partnership for the audio app and saw the NFL creating a series of draft-themed rooms throughout the week.

Spotify says it will rename Locker Room service (the live audio app and Clubhouse rival it just acquired) “Spotify Greenroom.” The company told investors live audio could mean more than spoken word content — it could also include early previews of new albums, too.

Spotify redesigns “Your Library.” The new version ditches the big tabs at the top for “Music” and “Podcasts” each with their own subsections, for a scrollable horizontal row that places all the content sections on one screen. These work as dynamic filters, allowing you to narrow down your searches. There’s also a grid view available and better sorting options.

Image Credits: Spotify

Health & Fitness

Uber is offering its app to allow customers to schedule their COVID-19 vaccine appointments at nearby Walgreens in the U.S. Uber had previously introduced free and discounted rides to vaccine appointments with the goal of getting essential workers inoculated.

Security

A popular Android app for writing JavaScript code, DroidScript, had its Google advertising suspended and was then removed from the Google Play Store for ad fraud. The founder of the nonprofit DroidScript.org behind the app asked Google for an explanation and got no response, he said. The app was used by over 100K developers, students and professionals.

Researchers said that hundreds of preinstalled apps on Android devices would have access to a log on users’ phones where the sensitive contract tracing information was stored. Google didn’t offer a reward payout for the finding, saying that system logs haven’t been readable by unprivileged apps since the early days of Android.

Funding and M&A

Image Credits: Current

Mobile bank Current raised $220 million in Series D funding after growing its user base to nearly 3 million. The funding was led by a16z and tripled Current’s valuation from the end of last year to now $2.2 billion.

Teen banking app Step raised $100 million in Series C funding led by General Catalyst, after growing to 1.5 million users in six months post-launch. The company also announced Steph Curry as an investor.

Kid-focused fintech Greenlight raised $260 million in Series D funding, doubling its valuation to $2.3 billion. Its round was also led by a16z, which backed Greenlight’s rival, Current.

Vivid Money raised $73 million in Series B funding (€60 million) led by Greenoaks to build a European financial super app.

Snap acquired 3D mapping developer Pixel8earth for $7.6 million. The small team will build out tools that will work with Snapchat’s location-based augmented reality experiences.

Kaia Health raised $75 million in Series C funding led by an unnamed growth equity fund for its digital therapeutics service that offers virtual therapy via an app for musculoskeletal conditions, chronic obstructive pulmonary disease (COPD) and osteoarthritis.

Family tracking app Life360 will acquire wearable location device Jiobit for $37 million. The figure is primarily in stock and debt, but if Jiobit can maintain its existing triple growth rates over the next two calendar years following the deal’s close, the deal price could increase to $54.5 million. The wearable will be added to Life360’s service to allow tracking of those without phones, including pets.

Zynga, via its subsidiary Rollic, acquired Uncosoft, the Turkish game developer behind the hit title High Heels, which has been downloaded over 60M times since its January debut, thanks in part, to TikTok. Deal terms were not available.

Montreal-based Botpress raised $15 million in Series A funding from Decibel and Inovia Capital to help developers build more conversational apps.

Downloads

OnMail

Image Credits: OnMail

The makers of a popular email app Edison Mail have now launched another email app, OnMail. This new iOS app is designed to solve more difficult email problems, like handling overloaded inboxes and mail that spies on you. The app will automatically block tracking pixels (read receipts), suggest emails to unsubscribe from, index your entire history for faster searches, stop ad targeting, and more. Like Basecamp’s Hey, users can also decide who can or cannot enter their inbox, too. And when you want to see your promotions, they’re provided in a visual feed that’s more engaging.

The service, which is also available on the web, works with OnMail email addresses, as well as other accounts like those from Microsoft, Google and others. It will later introduce an Android app, calendar support, Yahoo and Microsoft Exchange support, and two-factor. The company says your name and email is never shared, but it does use anonymized data as part of its Edison Trends (digital commerce) research — users are opted in, but an opt out is available.

stocks covid-19 ethereumUncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentSpread & Containment

Another beloved brewery files Chapter 11 bankruptcy

The beer industry has been devastated by covid, changing tastes, and maybe fallout from the Bud Light scandal.

Before the covid pandemic, craft beer was having a moment. Most cities had multiple breweries and taprooms with some having so many that people put together the brewery version of a pub crawl.

It was a period where beer snobbery ruled the day and it was not uncommon to hear bar patrons discuss the makeup of the beer the beer they were drinking. This boom period always seemed destined for failure, or at least a retraction as many markets seemed to have more craft breweries than they could support.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

The pandemic, however, hastened that downfall. Many of these local and regional craft breweries counted on in-person sales to drive their business.

And while many had local and regional distribution, selling through a third party comes with much lower margins. Direct sales drove their business and the pandemic forced many breweries to shut down their taprooms during the period where social distancing rules were in effect.

During those months the breweries still had rent and employees to pay while little money was coming in. That led to a number of popular beermakers including San Francisco's nationally-known Anchor Brewing as well as many regional favorites including Chicago’s Metropolitan Brewing, New Jersey’s Flying Fish, Denver’s Joyride Brewing, Tampa’s Zydeco Brew Werks, and Cleveland’s Terrestrial Brewing filing bankruptcy.

Some of these brands hope to survive, but others, including Anchor Brewing, fell into Chapter 7 liquidation. Now, another domino has fallen as a popular regional brewery has filed for Chapter 11 bankruptcy protection.

Image source: Shutterstock

Covid is not the only reason for brewery bankruptcies

While covid deserves some of the blame for brewery failures, it's not the only reason why so many have filed for bankruptcy protection. Overall beer sales have fallen driven by younger people embracing non-alcoholic cocktails, and the rise in popularity of non-beer alcoholic offerings,

Beer sales have fallen to their lowest levels since 1999 and some industry analysts

"Sales declined by more than 5% in the first nine months of the year, dragged down not only by the backlash and boycotts against Anheuser-Busch-owned Bud Light but the changing habits of younger drinkers," according to data from Beer Marketer’s Insights published by the New York Post.

Bud Light parent Anheuser Busch InBev (BUD) faced massive boycotts after it partnered with transgender social media influencer Dylan Mulvaney. It was a very small partnership but it led to a right-wing backlash spurred on by Kid Rock, who posted a video on social media where he chastised the company before shooting up cases of Bud Light with an automatic weapon.

Another brewery files Chapter 11 bankruptcy

Gizmo Brew Works, which does business under the name Roth Brewing Company LLC, filed for Chapter 11 bankruptcy protection on March 8. In its filing, the company checked the box that indicates that its debts are less than $7.5 million and it chooses to proceed under Subchapter V of Chapter 11.

"Both small business and subchapter V cases are treated differently than a traditional chapter 11 case primarily due to accelerated deadlines and the speed with which the plan is confirmed," USCourts.gov explained.

Roth Brewing/Gizmo Brew Works shared that it has 50-99 creditors and assets $100,000 and $500,000. The filing noted that the company does expect to have funds available for unsecured creditors.

The popular brewery operates three taprooms and sells its beer to go at those locations.

"Join us at Gizmo Brew Works Craft Brewery and Taprooms located in Raleigh, Durham, and Chapel Hill, North Carolina. Find us for entertainment, live music, food trucks, beer specials, and most importantly, great-tasting craft beer by Gizmo Brew Works," the company shared on its website.

The company estimates that it has between $1 and $10 million in liabilities (a broad range as the bankruptcy form does not provide a space to be more specific).

Gizmo Brew Works/Roth Brewing did not share a reorganization or funding plan in its bankruptcy filing. An email request for comment sent through the company's contact page was not immediately returned.

bankruptcy pandemic social distancing

Government

Walmart joins Costco in sharing key pricing news

The massive retailers have both shared information that some retailers keep very close to the vest.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trump-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges