This is How to Make — and Lose — a Fortune on NFTs

The rise of nonfungible tokens, or NFTs, has been nothing short of astounding this year. Google searches for NFT are up over 600% since mid-February alone.

This article was originally published by Mining.

The rise of nonfungible tokens, or NFTs, has been nothing short of astounding this year. Google searches for NFT are up over 600% since mid-February, hitting initial coin offering mania levels, and the top NFT platforms are turning over millions of dollars each day.

In a single 24-hour period earlier in March, sport collectibles platform NBA Top Shot saw sales of more than $7.89 million, art house OpenSea took in $4.88 million, and digital antique NFT project CryptoPunks netted $3.28 million.

The mainstream media is showing more interest in NFTs than it has in crypto for years, with publications from the BBC to The New York Times running explainers and the odd hit piece. Prices certainly look frothy, with Beeples Everydays selling at Christies for almost $70 million, Jack Dorsey auctioning the first-ever tweet for $2.9 million, and an Alien Crypto Punk changing hands for $7.57 million. Established artists including Banksy and Damien Hirst have jumped onto the trend, along with musical acts Kings of Leon, 3Lau and Aphex Twin.

(Alien Crypto Punk, Larva Labs)

(Alien Crypto Punk, Larva Labs)

At various points, the crypto community thought that either fast, cheap payments; decentralized finance, or DeFi; or the attraction of hard money might bring in the masses it turns out the great unwashed are more interested in owning a JPG.

Colin Goltra, who co-founded the NFT-based Narra Art Gallery in Decentraland, says this is a very good thing, as NFTs are bringing new demographics into crypto, outside of the usual finance and tech types.

Suddenly weve got this fresh blood of people exploring the space with new eyes, says Goltra, who also heads up Binance Philippines, adding: Its refreshing to interact with new community members youre really inspired by the art, you have a lot of fun, and its kind of like a game to collect.

Make sure youre getting some combination of that stuff out of it too because if youre just treating this as financial speculation, honestly, theres probably other games in town for that.

So, how do you get involved? Magazine spoke to some of the leading experts in the field to find out.

A unique opportunity to acquire by way of nifty NFT, this jpeg of me blowing a kiss. 40 million seems reasonable, but I'll take 30 million to expedite a quick sale. The jpeg is infinitely reproducible, but the proof of purchase, being non-fungible, will be yours & yours alone! pic.twitter.com/oM2LJSWa3X

— Stephen Fry (@stephenfry) March 12, 2021

How do you spot value in an NFT?

Unlike DeFi protocols, where you can value a project by comparing its revenue and growth potential to the price of its token and its total value locked, the value of most NFTs is highly subjective, and sentiment can turn in an instant. Earlier this month, CryptoKitties were changing hands for an average price of $1,263. By later in March, that had fallen to $115.

Its also important to understand what youre actually paying for. With digital art, for example, an NFT gives you ownership of a unique token linked to the art, similar to a certificate of authenticity. But you dont own the copyright of the art, nor do you get a physical copy of it, and it doesnt stop anyone else from copying or viewing it.

Australian dance music producer Flume sold a music and animation NFT, Saccade, for $66,000, despite retaining the copyright to the music and leaving it freely available for anyone to watch on YouTube. Castle Island Ventures founder Nic Carter likens buying an NFT to getting an autographed print:

What Im buying is effectively a digitized version of a signed setlist after a gig, or a signed, limited edition album cover. As I jokingly put it, the NFT should be understood as the autograph, not the art.

The blockchain on which the NFT is minted also affects the price, with users paying a premium for Ethereum-based NFTs, given that the network is secure, decentralized and expected to be around for a while. But the choice of blockchain is less of an issue with in-game assets (which may need a faster blockchain) or with something like NBA Top Shot (which uses Flow), as its the only place you can buy licensed NBA memorabilia.

Value drivers

Different categories of NFTs including art, music, in-game items, virtual land and collectibles have different value drivers, explains Andrew Steinwold, managing partner of NFT investment fund Sfermion.

He says that in-game assets derive value from their utility a sword with 10 times the power of the average sword should fetch a higher price, for example while virtual land is priced according to location content and parameters. Crypto arts value is based mainly on an artists reputation, while collectibles derive their value from the narrative that surrounds the asset.

Across all categories, scarcity and uniqueness help drive value provided there is demand, of course. Collectibles often come in various editions which vary by size and have rarity tiers. First editions in a projects series typically command a premium, explains Delphi Digital research analyst Alex Gedevani. Even better if theres historical significance and/or strong narrative behind it like CryptoPunks, the first NFTs.

Alien and Ape Punks are the most prized CryptoPunks. For the blockchain-based game Axie Infinity, where users raise and battle fantasy creatures called Axies, The scarcest, most valuable Axies are Mystic Axies, says Jiho Zirlin, co-founder of Axie creator Sky Mavis. They have rare limited skins and these skins will have a deeper evolutionary tract than other Axie body parts.

On NBA Top Shot, sport Moments with low serial numbers fetch higher prices, as do those where the serial number matches the players jersey number. A collector recently turned down a $1 million offer for a moment with a #1 serial number, which matched player Zion Williamsons jersey number, #1.

BREAKING NEWS

We have news of the first $1 Million offer for an @nba_topshot moment!

It was for the #1 and Jersey Match S1 Holo Zion Williamson.

And @JerLevine turned it down. pic.twitter.com/j0Ct0EH7wI

— OwnTheMoment (@OwnTheMomentNFT) March 11, 2021

The NFT art scene is perhaps the easiest for newcomers to understand. Just as in the real world, well-known artists with bigger social followings command higher prices than newcomers. Make sure to look at an artists overall volume of work: Someone pumping out 10 NFTs per day may soon saturate the market. Counterintuitively, however, big-name artists can actually launch a lot more work than others.

NFTs can be released in editions of 10, 50 or even hundreds of copies similar to a real-world artist running off 500 prints and hand-signing them or they can be released as unique, standalone one-of-one editions.

As you might expect, the one-of-one editions are the most highly prized, and thats why Goltra focuses almost exclusively on them. I do like the idea that I can be the unique owner of beautiful imagery, or a beautiful piece of art, he says.

What should investors avoid?

A big red flag comes up for projects that are only in it for the money, and Gedevani cautions against carbon copy clones of successful projects like CryptoPunks and Hashmarks along with celebrity NFTs that appear to be quick money grabs off their audiences. He doesnt mention Lindsay Lohan or Paris Hilton by name, but he probably doesnt have to.

Another trap is buying stolen art. Russian artist WeirdUndead was outraged to find her stolen work up for sale on OpenSea after someone automatically tokenized it using Tokenized Tweets. She tweeted:

I tried to ignore whole #NFT hysteria but WHAT THE FUCK

I don't give any permission (ESPECIALLY to random jerks) to make tokens from my content and I feel so angry pic.twitter.com/E9UKF1AXug— don't give up, skeleton (@WeirdUndead) March 9, 2021

Its an ongoing problem, given how simple it is to mint NFTs now. Visual artist Rosa Menkman likewise discovered that four of her artworks had been tokenized using another website called MarbleCards and auctioned on OpenSea. Apart from the ethical issues, its hard to see stolen NFT art maintaining value if its creator disavows it.

Even when the art is authentic, Steinwold says its important to assess the background and motivation of the person issuing an NFT:

Are they some famous athlete that learned about NFTs last month? Or are they someone that has been in the NFT ecosystem for years and has thoughtfully crafted assets with a compelling narrative?

Steinwold may be thinking of NFL star Rob Gronkowski, who sold $1.8 million worth of NFT memorabilia on OpenSea.

In the blockchain gaming world, Zirlin recommends steering clear of hyped-up but substance-free new projects, or as he puts it: Chasing the new hot thing, trying to be early to a bad project rather than joining a more established project with potential.

In the art scene, Goltra avoids NFT platforms that arent highly selective about the art they carry, such as OpenSea and Rarible. While he says large open platforms such as these are great for new artists and investors, they present logistical problems.

NON-FUNGIBLE ELONS pic.twitter.com/KZDpYGVWvz

— beeple (@beeple) March 16, 2021

Theres just so much work that you have to sift through to find anything of quality, he says. He prefers platforms with filters, including SuperRare which only offers one-of-one single editions Nifty Gateway and Foundation.

Miko Matsumura, general partner at Gumi Cryptos Capital, recommends avoiding pretty much everything. Almost everything in NFT will be worthless in the future, he says, with limited exceptions for those that can be authenticated as having historical significance, such as CryptoKittes or NBA Top Shot collectibles. Dont buy stuff that has no historical value from sources that have no authority, he warns.

Is a potential financial return the best way to approach NFTs?

In a word, no. Those with whom Magazine spoke agreed that collectors with a genuine interest in a category are the most likely to turn out to be successful in this nascent industry. If someone is heading into a collectibles market with the intention of flipping for profit but doesnt understand the nuances of the project, chances are it may not end well, says Gedevani, adding:

We are still largely in the experimental phase with collectibles across many categories like sports, avatars, game items and more. Its better to focus on niches that genuinely interest you and where you can find an edge.

Gabby Dizon, co-founder of Yield Guild Games and Narra Gallery, says were still so early in the NFT game that its very difficult to gauge potential financial returns. A better strategy is to first buy something you would not mind owning for the next five years, with one eye on factors that might see the value increase, like scarcity, desirability, aesthetics and utility.

That way, even if the market tanks, you still own an NFT you like. For Goltra, The financial stuff is secondary, adding: There are pieces I could purchase as speculative plays but I dont because its not the purpose for me. I just try to buy art that I like or that speaks to me in some way.

I will be burning over $4million of art tonight. pic.twitter.com/B0gks8c4ni

— Mad Dog Jones (@Mad_Dog_Jones) March 16, 2021

Are some NFTs undervalued/overvalued right now?

Mike Winkelmann, the artist known as Beeple, certainly thinks prices are too high at present, telling Fox News: I absolutely think its a bubble, to be quite honest. I go back to the analogy of the beginning of the internet. There was a bubble. And the bubble burst.

Matsumura believes that All types of NFTs are overvalued right now and likens the space to a lottery, where the winners win really big and get all the publicity while the vast, vast majority of people will be losers, economically speaking.

Goltra is also keenly aware the NFT mania could fizzle out, taking those high price tags with it. I know were not immune to market cycles, the way that the rest of the crypto space is, he says. And so, I know that theres a version of this where any media that were doing right now, you know, whenever this next cycle is over, we all look stupid.

Subscribe for thoughtful explorations and leisurely reads from Magazine. The best of blockchain, every Sunday

By subscribing you agree to our Terms of Service and Privacy Policy

But Yat Siu, CEO of Animoca Brands, believes at least one NFT sector is currently not getting enough love, and thats gaming. Our opinion is that game assets are undervalued because NFTs derive value not just from provenance, scarcity, and general demand, but also from their utility, he says.

If you do wish to acquire NFTs primarily as an investment, then aim for assets that have underlying utility in a scarcity-based game or platform that is likely to grow significantly in terms of users your NFTs will have a better chance to increase in value simply due to demand and supply patterns.

As an example of a wise investment, he notes that crates of NFTs for the Formula One-licenced game F1 Delta Time were released for $500 in 2019, some of which contained sought-after Ferraris that have increased in value to as much as $60,000.

How important is it to understand the secondary sales market?

Steinwold calls secondary sales perhaps the most important indicator of an NFTs longevity, and Dizon cites them as the true test of whether an NFT was worth the initial purchase price.

To better understand secondary markets, Gedevani recommends making use of third-party or community-created analytic tools such as MomentRanks, Intangible.market and Evaluate.market, which help investors gauge the value of NBA Top Shot collections.

Overlooking secondary sales is an easy way to make a mistake of buying an overvalued asset that has already run up substantially in a short time period, he says.

How can you maximize the chances of winning an auction?

While you could learn how to code and use bots, as Steinwold suggests or take a short course in auction game theory the best way to win is to not play the game, says Goltra.

Sometimes you can preempt the auction altogether, he says, suggesting you slide into an artists DMs on Twitter or Instagram and negotiate directly.

I think artists want to know that the collector of the art is appreciating it, and they like knowing who their collector is. To be able to actually strike up a conversation and kind of make friends with the artist is actually a best practice in terms of wanting to win something super rare.

What sort of budget do you need?

A couple hundred dollars is a reasonable budget to begin with in most categories, though given the interest in NFT art at present, a couple thousand might be required to snare a one-of-one edition from anyone with a reputation.

To snag an art bargain on a low budget, you might have to work a little harder. I specialize in buying NFTs of up-and-coming artists who are yet undiscovered and whose NFT artworks are selling for much lower prices than more established artists, explains Dizon. Such gems are more likely to be found on open platforms like OpenSea and Rarible though youll need to spend a bit of time combing through the haystack.

The best NFT purchases are from undiscovered talent with little sales history.

Many of the top artists today started selling pieces for less than 1 ETH.

Curation creates new market opportunities – Dig deeper.

— Coopahtroopa (@Cooopahtroopa) March 22, 2021

OpenSea co-founder Alex Atallah says you can turn up hidden gems by looking for artists with few buyers to date but who have strong, unique social media accounts. These are often the ones that will get discovered soon by the NFT community, he says.

Goltra adds that keeping an eye on the upcoming artists with whom better-known artists interact on social media is also instructive. You can kind of tell when theres a new artist thats very prominent, because all the other artists get excited, he says.

Games and collectibles platforms often have very affordable entry points: NBAs Top Shot platform sells common packs for as low as $9, and collector Pranksy claims to have turned $600 into nearly $7 million worth of memorabilia in a few months on the platform.

Siu explains that newer projects sometimes reward early adopters in the community with airdrops and gifts: Getting deeply involved in an NFT project early on is usually a sound strategy because there will often be early adopter drops or gifts for engaged community members, he says, adding: We have given out such rewards in games like F1 Delta Time encouraging players to play more frequently, and some of those rewards ended up becoming quite valuable.

And for those who have no budget at all, you can actually play to earn by raising Axies a pastime that helped numerous Filipino players make it through the pandemic, with some even becoming relatively wealthy in local terms.

There are people making a living playing Axie, says Zirlin. From collectors to play-to-earn grinders in the developing world.

the most impressive @nbatopshot metrics don't have dollar signs:

84% (!) 12 week retention across all collectors

80%+ of eligible users join LE pack drops

300k+ in line this morning for Cool Cats drop

98% (!!!) 12 wk retention across activated* users— Roham (@rohamg) March 22, 2021

How do I research the market?

Some of the better-known NFT news sources include Steinwolds Zima Red podcast and newsletter, Delphi Digitals Delphi Daily, Bankless and The Defiant. Art platforms such as SuperRare also feature interviews with artists and other content.

In addition, you can follow as many NFT accounts on Twitter as possible including WhaleShark, DCL Blogger, Loopify, Linda Xie and more and get involved with NFT communities on Discord, such as those of OpenSea and Token Smart. Zirlin says the Axie Infinity community on Discord is the best way to learn how to raise Axies. I suggest becoming a community member by joining the Discord and meeting the other Axie trainers. Talk to other players that have had successful journeys and try to emulate their paths, he says.

Gedevani says your time is well spent browsing social media, listening to podcasts and experimenting with projects. Thats the fastest way to learn, he explains. Follow the builders/investors in the NFT community who have been through all the ups and downs and are best positioned to navigate this market.

Final words of advice

We are still in the early days for NFTs, and no one really knows how the market will develop, so theres an abundance of caution all around. Matsumura notes that in the current bull market, everyone can appear to be winning and making large paper gains, but sentiment can suddenly flip. Some of those things will go to zero and stay at zero forever, he says.

Dizon encourages buyers to do as much research as possible: Do your homework, make sure you love what you are buying and can afford it, then you can pull the trigger. The best time to sell an NFT is when everyone else is FOMOing in. The worst time to sell an NFT is when you need the money.

Steinwold says a long-term mindset is likely the key to success. We are in a frenzied period right now so be thoughtful in what you purchase. Ask yourself: will this NFT be around in two to three years? He concludes:

ethereum blockchain crypto pandemicThe NFT zeitgeist only caught on to a wider audience the past few months and this revolution will take many years so always play long-term games with long-term people.

International

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

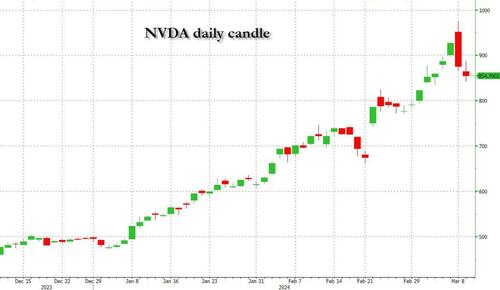

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

Spread & Containment

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19 vaccination was a mistake due to ethical and other concerns, a top government doctor warned Dr. Anthony Fauci after Dr. Fauci promoted mass vaccination.

“Coercing or forcing people to take a vaccine can have negative consequences from a biological, sociological, psychological, economical, and ethical standpoint and is not worth the cost even if the vaccine is 100% safe,” Dr. Matthew Memoli, director of the Laboratory of Infectious Diseases clinical studies unit at the U.S. National Institute of Allergy and Infectious Diseases (NIAID), told Dr. Fauci in an email.

“A more prudent approach that considers these issues would be to focus our efforts on those at high risk of severe disease and death, such as the elderly and obese, and do not push vaccination on the young and healthy any further.”

Employing that strategy would help prevent loss of public trust and political capital, Dr. Memoli said.

The email was sent on July 30, 2021, after Dr. Fauci, director of the NIAID, claimed that communities would be safer if more people received one of the COVID-19 vaccines and that mass vaccination would lead to the end of the COVID-19 pandemic.

“We’re on a really good track now to really crush this outbreak, and the more people we get vaccinated, the more assuredness that we’re going to have that we’re going to be able to do that,” Dr. Fauci said on CNN the month prior.

Dr. Memoli, who has studied influenza vaccination for years, disagreed, telling Dr. Fauci that research in the field has indicated yearly shots sometimes drive the evolution of influenza.

Vaccinating people who have not been infected with COVID-19, he said, could potentially impact the evolution of the virus that causes COVID-19 in unexpected ways.

“At best what we are doing with mandated mass vaccination does nothing and the variants emerge evading immunity anyway as they would have without the vaccine,” Dr. Memoli wrote. “At worst it drives evolution of the virus in a way that is different from nature and possibly detrimental, prolonging the pandemic or causing more morbidity and mortality than it should.”

The vaccination strategy was flawed because it relied on a single antigen, introducing immunity that only lasted for a certain period of time, Dr. Memoli said. When the immunity weakened, the virus was given an opportunity to evolve.

Some other experts, including virologist Geert Vanden Bossche, have offered similar views. Others in the scientific community, such as U.S. Centers for Disease Control and Prevention scientists, say vaccination prevents virus evolution, though the agency has acknowledged it doesn’t have records supporting its position.

Other Messages

Dr. Memoli sent the email to Dr. Fauci and two other top NIAID officials, Drs. Hugh Auchincloss and Clifford Lane. The message was first reported by the Wall Street Journal, though the publication did not publish the message. The Epoch Times obtained the email and 199 other pages of Dr. Memoli’s emails through a Freedom of Information Act request. There were no indications that Dr. Fauci ever responded to Dr. Memoli.

Later in 2021, the NIAID’s parent agency, the U.S. National Institutes of Health (NIH), and all other federal government agencies began requiring COVID-19 vaccination, under direction from President Joe Biden.

In other messages, Dr. Memoli said the mandates were unethical and that he was hopeful legal cases brought against the mandates would ultimately let people “make their own healthcare decisions.”

“I am certainly doing everything in my power to influence that,” he wrote on Nov. 2, 2021, to an unknown recipient. Dr. Memoli also disclosed that both he and his wife had applied for exemptions from the mandates imposed by the NIH and his wife’s employer. While her request had been granted, his had not as of yet, Dr. Memoli said. It’s not clear if it ever was.

According to Dr. Memoli, officials had not gone over the bioethics of the mandates. He wrote to the NIH’s Department of Bioethics, pointing out that the protection from the vaccines waned over time, that the shots can cause serious health issues such as myocarditis, or heart inflammation, and that vaccinated people were just as likely to spread COVID-19 as unvaccinated people.

He cited multiple studies in his emails, including one that found a resurgence of COVID-19 cases in a California health care system despite a high rate of vaccination and another that showed transmission rates were similar among the vaccinated and unvaccinated.

Dr. Memoli said he was “particularly interested in the bioethics of a mandate when the vaccine doesn’t have the ability to stop spread of the disease, which is the purpose of the mandate.”

The message led to Dr. Memoli speaking during an NIH event in December 2021, several weeks after he went public with his concerns about mandating vaccines.

“Vaccine mandates should be rare and considered only with a strong justification,” Dr. Memoli said in the debate. He suggested that the justification was not there for COVID-19 vaccines, given their fleeting effectiveness.

Julie Ledgerwood, another NIAID official who also spoke at the event, said that the vaccines were highly effective and that the side effects that had been detected were not significant. She did acknowledge that vaccinated people needed boosters after a period of time.

The NIH, and many other government agencies, removed their mandates in 2023 with the end of the COVID-19 public health emergency.

A request for comment from Dr. Fauci was not returned. Dr. Memoli told The Epoch Times in an email he was “happy to answer any questions you have” but that he needed clearance from the NIAID’s media office. That office then refused to give clearance.

Dr. Jay Bhattacharya, a professor of health policy at Stanford University, said that Dr. Memoli showed bravery when he warned Dr. Fauci against mandates.

“Those mandates have done more to demolish public trust in public health than any single action by public health officials in my professional career, including diminishing public trust in all vaccines.” Dr. Bhattacharya, a frequent critic of the U.S. response to COVID-19, told The Epoch Times via email. “It was risky for Dr. Memoli to speak publicly since he works at the NIH, and the culture of the NIH punishes those who cross powerful scientific bureaucrats like Dr. Fauci or his former boss, Dr. Francis Collins.”

Government

Trump “Clearly Hasn’t Learned From His COVID-Era Mistakes”, RFK Jr. Says

Trump "Clearly Hasn’t Learned From His COVID-Era Mistakes", RFK Jr. Says

Authored by Jeff Louderback via The Epoch Times (emphasis ours),

President…

Authored by Jeff Louderback via The Epoch Times (emphasis ours),

President Joe Biden claimed that COVID vaccines are now helping cancer patients during his State of the Union address on March 7, but it was a response on Truth Social from former President Donald Trump that drew the ire of independent presidential candidate Robert F. Kennedy Jr.

During the address, President Biden said: “The pandemic no longer controls our lives. The vaccines that saved us from COVID are now being used to help beat cancer, turning setback into comeback. That’s what America does.”

President Trump wrote: “The Pandemic no longer controls our lives. The VACCINES that saved us from COVID are now being used to help beat cancer—turning setback into comeback. YOU’RE WELCOME JOE. NINE-MONTH APPROVAL TIME VS. 12 YEARS THAT IT WOULD HAVE TAKEN YOU.”

An outspoken critic of President Trump’s COVID response, and the Operation Warp Speed program that escalated the availability of COVID vaccines, Mr. Kennedy said on X, formerly known as Twitter, that “Donald Trump clearly hasn’t learned from his COVID-era mistakes.”

“He fails to recognize how ineffective his warp speed vaccine is as the ninth shot is being recommended to seniors. Even more troubling is the documented harm being caused by the shot to so many innocent children and adults who are suffering myocarditis, pericarditis, and brain inflammation,” Mr. Kennedy remarked.

“This has been confirmed by a CDC-funded study of 99 million people. Instead of bragging about its speedy approval, we should be honestly and transparently debating the abundant evidence that this vaccine may have caused more harm than good.

“I look forward to debating both Trump and Biden on Sept. 16 in San Marcos, Texas.”

Mr. Kennedy announced in April 2023 that he would challenge President Biden for the 2024 Democratic Party presidential nomination before declaring his run as an independent last October, claiming that the Democrat National Committee was “rigging the primary.”

Since the early stages of his campaign, Mr. Kennedy has generated more support than pundits expected from conservatives, moderates, and independents resulting in speculation that he could take votes away from President Trump.

Many Republicans continue to seek a reckoning over the government-imposed pandemic lockdowns and vaccine mandates.

President Trump’s defense of Operation Warp Speed, the program he rolled out in May 2020 to spur the development and distribution of COVID-19 vaccines amid the pandemic, remains a sticking point for some of his supporters.

Operation Warp Speed featured a partnership between the government, the military, and the private sector, with the government paying for millions of vaccine doses to be produced.

President Trump released a statement in March 2021 saying: “I hope everyone remembers when they’re getting the COVID-19 Vaccine, that if I wasn’t President, you wouldn’t be getting that beautiful ‘shot’ for 5 years, at best, and probably wouldn’t be getting it at all. I hope everyone remembers!”

President Trump said about the COVID-19 vaccine in an interview on Fox News in March 2021: “It works incredibly well. Ninety-five percent, maybe even more than that. I would recommend it, and I would recommend it to a lot of people that don’t want to get it and a lot of those people voted for me, frankly.

“But again, we have our freedoms and we have to live by that and I agree with that also. But it’s a great vaccine, it’s a safe vaccine, and it’s something that works.”

On many occasions, President Trump has said that he is not in favor of vaccine mandates.

An environmental attorney, Mr. Kennedy founded Children’s Health Defense, a nonprofit that aims to end childhood health epidemics by promoting vaccine safeguards, among other initiatives.

Last year, Mr. Kennedy told podcaster Joe Rogan that ivermectin was suppressed by the FDA so that the COVID-19 vaccines could be granted emergency use authorization.

He has criticized Big Pharma, vaccine safety, and government mandates for years.

Since launching his presidential campaign, Mr. Kennedy has made his stances on the COVID-19 vaccines, and vaccines in general, a frequent talking point.

“I would argue that the science is very clear right now that they [vaccines] caused a lot more problems than they averted,” Mr. Kennedy said on Piers Morgan Uncensored last April.

“And if you look at the countries that did not vaccinate, they had the lowest death rates, they had the lowest COVID and infection rates.”

Additional data show a “direct correlation” between excess deaths and high vaccination rates in developed countries, he said.

President Trump and Mr. Kennedy have similar views on topics like protecting the U.S.-Mexico border and ending the Russia-Ukraine war.

COVID-19 is the topic where Mr. Kennedy and President Trump seem to differ the most.

Former President Donald Trump intended to “drain the swamp” when he took office in 2017, but he was “intimidated by bureaucrats” at federal agencies and did not accomplish that objective, Mr. Kennedy said on Feb. 5.

Speaking at a voter rally in Tucson, where he collected signatures to get on the Arizona ballot, the independent presidential candidate said President Trump was “earnest” when he vowed to “drain the swamp,” but it was “business as usual” during his term.

John Bolton, who President Trump appointed as a national security adviser, is “the template for a swamp creature,” Mr. Kennedy said.

Scott Gottlieb, who President Trump named to run the FDA, “was Pfizer’s business partner” and eventually returned to Pfizer, Mr. Kennedy said.

Mr. Kennedy said that President Trump had more lobbyists running federal agencies than any president in U.S. history.

“You can’t reform them when you’ve got the swamp creatures running them, and I’m not going to do that. I’m going to do something different,” Mr. Kennedy said.

During the COVID-19 pandemic, President Trump “did not ask the questions that he should have,” he believes.

President Trump “knew that lockdowns were wrong” and then “agreed to lockdowns,” Mr. Kennedy said.

He also “knew that hydroxychloroquine worked, he said it,” Mr. Kennedy explained, adding that he was eventually “rolled over” by Dr. Anthony Fauci and his advisers.

MaryJo Perry, a longtime advocate for vaccine choice and a Trump supporter, thinks votes will be at a premium come Election Day, particularly because the independent and third-party field is becoming more competitive.

Ms. Perry, president of Mississippi Parents for Vaccine Rights, believes advocates for medical freedom could determine who is ultimately president.

She believes that Mr. Kennedy is “pulling votes from Trump” because of the former president’s stance on the vaccines.

“People care about medical freedom. It’s an important issue here in Mississippi, and across the country,” Ms. Perry told The Epoch Times.

“Trump should admit he was wrong about Operation Warp Speed and that COVID vaccines have been dangerous. That would make a difference among people he has offended.”

President Trump won’t lose enough votes to Mr. Kennedy about Operation Warp Speed and COVID vaccines to have a significant impact on the election, Ohio Republican strategist Wes Farno told The Epoch Times.

President Trump won in Ohio by eight percentage points in both 2016 and 2020. The Ohio Republican Party endorsed President Trump for the nomination in 2024.

“The positives of a Trump presidency far outweigh the negatives,” Mr. Farno said. “People are more concerned about their wallet and the economy.

“They are asking themselves if they were better off during President Trump’s term compared to since President Biden took office. The answer to that question is obvious because many Americans are struggling to afford groceries, gas, mortgages, and rent payments.

“America needs President Trump.”

Multiple national polls back Mr. Farno’s view.

As of March 6, the RealClearPolitics average of polls indicates that President Trump has 41.8 percent support in a five-way race that includes President Biden (38.4 percent), Mr. Kennedy (12.7 percent), independent Cornel West (2.6 percent), and Green Party nominee Jill Stein (1.7 percent).

A Pew Research Center study conducted among 10,133 U.S. adults from Feb. 7 to Feb. 11 showed that Democrats and Democrat-leaning independents (42 percent) are more likely than Republicans and GOP-leaning independents (15 percent) to say they have received an updated COVID vaccine.

The poll also reported that just 28 percent of adults say they have received the updated COVID inoculation.

The peer-reviewed multinational study of more than 99 million vaccinated people that Mr. Kennedy referenced in his X post on March 7 was published in the Vaccine journal on Feb. 12.

It aimed to evaluate the risk of 13 adverse events of special interest (AESI) following COVID-19 vaccination. The AESIs spanned three categories—neurological, hematologic (blood), and cardiovascular.

The study reviewed data collected from more than 99 million vaccinated people from eight nations—Argentina, Australia, Canada, Denmark, Finland, France, New Zealand, and Scotland—looking at risks up to 42 days after getting the shots.

Three vaccines—Pfizer and Moderna’s mRNA vaccines as well as AstraZeneca’s viral vector jab—were examined in the study.

Researchers found higher-than-expected cases that they deemed met the threshold to be potential safety signals for multiple AESIs, including for Guillain-Barre syndrome (GBS), cerebral venous sinus thrombosis (CVST), myocarditis, and pericarditis.

A safety signal refers to information that could suggest a potential risk or harm that may be associated with a medical product.

The study identified higher incidences of neurological, cardiovascular, and blood disorder complications than what the researchers expected.

President Trump’s role in Operation Warp Speed, and his continued praise of the COVID vaccine, remains a concern for some voters, including those who still support him.

Krista Cobb is a 40-year-old mother in western Ohio. She voted for President Trump in 2020 and said she would cast her vote for him this November, but she was stunned when she saw his response to President Biden about the COVID-19 vaccine during the State of the Union address.

“I love President Trump and support his policies, but at this point, he has to know they [advisers and health officials] lied about the shot,” Ms. Cobb told The Epoch Times.

“If he continues to promote it, especially after all of the hearings they’ve had about it in Congress, the side effects, and cover-ups on Capitol Hill, at what point does he become the same as the people who have lied?” Ms. Cobb added.

“I think he should distance himself from talk about Operation Warp Speed and even admit that he was wrong—that the vaccines have not had the impact he was told they would have. If he did that, people would respect him even more.”

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges