Uncategorized

They Promised “Safe And Effective”; We Got “Sudden And Unexpected”

They Promised "Safe And Effective"; We Got "Sudden And Unexpected"

Authored by Mark Jeftovic via BombThrower.com,

We’re one tragedy away…

Authored by Mark Jeftovic via BombThrower.com,

We’re one tragedy away from pitchforks & torches…

“No one must ever ask where another rabbit was, and anyone who asked ‘Where?’ – must be silenced.”

In the story Watership Down a group of rabbits flee their home warren of Sandleford, ahead of its imminent destruction at the hands of real estate developers. They set out looking for a safe, new home and among their adventures they encounter another warren called Cowslip. There, all the rabbits are uncharacteristically large, affable and seemingly well fed. For awhile, the Sandleford rabbits think they’ve found a safe haven.

There’s only one problem: every once in awhile one of the the rabbits goes missing. It turns out the entire warren is on a farmer’s land who feeds and otherwise takes care of them, but then sets out snares and traps them from time to time for their pelts.

There is only one rule at Cowslip’s Warren, nobody is allowed to ask or talk about any of the missing rabbits.

I want everybody reading this to think of two numbers from asking you two questions:

Question #1) How many people do you know who died of COVID?

I first started hearing rumblings of a new Coronavirus emerging out of China in January 2020 (although it looks now like COVID was already circulating throughout the world by mid-2019).

When I got wind of it, I was emailing friends and colleagues to get N95 masks and to stock up on groceries and medications. It looked bad. By February I was probably one of the first people seen around town wearing an N95 mask. In March I started running a spreadsheet using R0, fatality rates and case-doubling times that were coming out of the CDC, the WHO, and shrieking hysterics like Eric Feigl-Ding:

The famous “HMOG Tweet”.

The screen grab above is the famous “Holy Mother Of God” tweet, which is sometimes speculated as having rang the bell beginning the global COVID panic. Feigl-Ding refers to it himself as a seminal moment, and he’s also since deleted the tweet. It is archived here.

He’s still at it, btw…

This guy has one setting.

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) December 21, 2022

When it was all unfolding, I was initially afraid. My rough model posited that by the end of May we’d have 442,368 cases with as many as 22,118 fatalities and that was just in Toronto. By the end of July, 1.7 million cases and 88,473 fatalities.

I laid out previously what happened and what turned me into a lockdown skeptic: every day I’d plug in the new case and fatality numbers from the city, the province and federal levels and by the end of May I realized that my model was bust. By fall I knew that case numbers were bullshit (it didn’t matter how many people tested positive on a PCR test) and that lockdowns were a bigger problem than the virus.

There weren’t going to be 88K fatalities across the entire country, let alone Toronto (the official fatality count now for all of Canada is 49.5K – and we also now know that most of those, upwards of 90%, were with COVID and not from COVID. Toronto had about 3.7K total fatalities in over two years).

I naively thought this was good news. Surely everybody was looking at the data and surely everybody could see by mid-summer, that even adjusted for seasonality and expecting another wave in the fall, this was nowhere near the THERMONUCLEAR LEVEL EVENT certain prognosticators were promoting.

We all know what happened instead: by fall it had become a full fledged religion and well on its way to mass formation psychosis.

But in the early innings of that, when it looked really bad, I figured it meant that probably about once per week we’d be hearing about somebody within our extended family, circle of friends or colleagues who would die from this. Ditto for celebs, the evening news would be saturated with odes and tributes to noteworthy people who were just felled by COVID. Maybe one or more of my immediate family would die from this. Maybe I would. It was scary.

From our vantage point here in early 2023, I can only think of three celebrities who died with COVID: John Prine, Herman Cain, and much to the delight of the zerocovid lunatics: Meatloaf.

On January 1st, 2022 I surmised that the pandemic was mostly over. During the main run of COVID I did lose about four people within my social circle, none from COVID or even with COVID. That figure doesn’t count another two people I knew about in my area who committed suicide under lockdowns.

So without diminishing the tragedy of any of those 49K Canadians who succumbed with COVID, my number for the first question is zero.

Question #2) How many people do you know who died “suddenly and unexpectedly” over the last 18 months?

Recall how I was expecting to be hearing at least once a week about relatives, acquaintances and colleagues that had died from COVID, but instead didn’t hear anything.

However, when it comes to relatives, friends and acquaintances who have suddenly and unexpectedly dropped dead of a heart attack or some other unanticipated medical event, over the last year to 18 months or so… well that’s a different story.

Three. That’s people in my phone contacts. People I was talking to one day or one week and who were dead the next, add one more for someone I knew from yesteryear who was suddenly and unexpectedly a trending hashtag on Twitter. None of these people were fighting a terminal diagnosis or dealing with “The Big C”. They were just running around, living their lives, and then they weren’t.

Before COVID, before the vaccines, there was always the odd account of somebody dying unexpectedly – maybe one every couple of years. As you age, more people you know pass away, but usually there’s an arc to it: a diagnosis, a treatment, then the passing. I knew one person who died “suddenly and unexpectedly” in January 2020, and it was the first sudden death in my circle in years.

I’m no statistician, but four people I know personally joining the ranks of the “sudden and unexpected” (three of them coronaries), within the span of a little over a year… well that seems a little weird. The reason I think these all have a common thread through them, is three of the four of these people, I would describe as ideologically committed to COVID. They all had their doses and in most cases, their boosters. One I’m unsure of, so all I have there is the sudden massive heart attack.

In my case, the number for the second question is four.

Which of your numbers is bigger?

Which number is larger for the number of people within your circle of friends, family, colleagues and acquaintances who:

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) January 14, 2023

A) died of COVID since 2020, or

B) were vaxxed and then died "Suddenly and Unexpectedly"

When will the corporate media face the music?

In the curious case of the corporate media we have an inversion of sorts which points at a type of hyper-normality in the world (the prevailing official narrative is so absurd and obviously untrue that it takes an act of intentional neurosis to believe it).

I remember when COVID hit, here in Canada there was this one video clip of a body being taken out of a house as announcers breathlessly hyperventilated about the spread of the virus. It was the same video clip and it was reused for weeks, months even.

What is the MSM not amplifying?

They are dutifully ignoring the wave of sudden deaths among our youngsters, children and even middle aged adults. We have video montages circulating on Youtube and Rumble of the endless barrage of people dropping during live streams and sporting events, but for some reason these aren’t being run on endless loop up by the MSM.

In the last few months this tempo of young adults dying suddenly seems to have quickened, and a requirement for being vaccinated or even boosted seems to be a common factor across many of them.

The phenomenon of athletes dropping on the field gives us a bit of a petri dish, because nearly all organized sporting leagues implemented a vaccine requirement on its athletes in order to participate.

I don’t want to cycle through the litany of victims of these tragedies. If you search them up via Google you’ll just get first page results of Reuters funded “fact-checks” explaining why the vaccines have nothing to do with it, or MSM pieces blaming this epidemic of “Sudden Adult Death Syndrome” on climate change and kids having heart attacks from playing video games.

Siri? Explain “gaslighting”

If you can wind your way through all the fact-checks and debunking, you can find the odd mainstream piece that actually looks at the possibility. In September, Science Magazine almost grudgingly admitted,

“COVID-19 vaccines do have a rare but worrisome cardiac side effect. Myocarditis, an inflammation of the heart muscle that can cause chest pain and shortness of breath, has disproportionately struck older boys and young men who received the shots. Only one out of several thousand in those age groups is affected, and most quickly feel better. A tiny number of deaths have been tentatively linked to vaccine myocarditis around the world. But several new studies suggest the heart muscle can take months to heal, and some scientists worry about what this means for patients long term. The U.S. Food and Drug Administration (FDA) has ordered vaccinemakers Pfizer and Moderna to conduct a raft of studies to assess these risks.”

Baseless, my ass.

If you want to look at some actual data on Vaccine Adverse Event Reporting or actuarial data coming out of insurance companies, or actual peer reviewed research papers, or absolute excess mortality data comparing Covid to vaccine deployment, I would recommend Edward Dowd’s “Cause Unknown”, which is a depressing read. From it we can just pull some raw data that presents a pretty compelling case that no matter what is really happening, ignoring it is an act of journalistic malpractice:

Via OpenVaers.com

We know now via the various Twitter Files dumps that Big Tech has been taking their orders from the government, intelligence agencies and Big Pharma (a.k.a The Pharmatrocracy) all along. Should we just assume the corporate press has been as well?

This would explain why instead of undertaking Watergate level investigative reporting into legions of children, athletes and young adults suddenly dropping dead or having heart attacks, strokes and other medical emergencies, live on the air; we’re getting gaslighted about childhood asthma from natural gas stoves.

Let's just bang rocks together from now on.

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) January 12, 2023

MSM beyond salvation at this point. https://t.co/scZ2iBXPkj

I have been wondering if it is possible that the perceived increase in these reports of sudden deaths is the result of a self-perpetuating loop of increased focus on these events. A kind of hysteria of its own. This is why since the onset of COVID, I’ve always tried to find numbers and data – then I follow that data where it leads me. Often times it’s not the same place as what I’m seeing on the television screen.

Anybody can look at a graph, and provided that the data is kosher, see when something is out of whack.

This one is out of Dowd’s book and sourced with CDC data is the aggregate excess mortality rate for millennials since before the pandemic.

We know that the survival rate from COVID goes up dramatically as age comes down. The vast majority of COVID fatalities were in our elderly (many of whom were forced into localized outbreaks where they died locked down and alone).

Two things stand out:

#1) The excess death rates spike higher as the vaccines deploy, reaching their highest when mandates kick in

#2) The trend line is going the wrong direction.

Since the vaccine rollout started, the narrative around them shifted quite radically. Here’s another graph from Cause Unknown, I added the annotations (somewhat off-the-cuff, I will admit, but the overall beats are 100% accurate):

It’s the deaths attributed to COVID before and after the rollout. The vaccines were supposed to effectively drive that to zero. These shots were pitched to the public as a magic bullet, the original announcements were of “95% efficacy” (on a virus we knew by then, had a 99.95% survival rate).

It turns out now, that not only does the vaccine not confer immunity (it was more expedient to change the meaning of the word “vaccine” instead), they didn’t even test if it reduced transmission (if you try to search up either of these, you just get more pages of “fact check” articles admonishing you that whatever it is you’re looking for, it’s a nothing-burger….)

Thanks, Fact Checkers.

The entire point of the vaccine mandates was the premise that “the vaccines stopped transmission”. Everybody said this. They are now telling you they didn’t say this, and the media, with the complicity of Big Tech are telling you it never mattered.

How can anybody be faulted for not knowing what to believe or who to trust?

With the conventional narratives being so ephemeral and one “conspiracy theory” after another being validated (lockdowns, lab leak, vaccine passports…) is it any wonder people are becoming skeptical or outright distrustful of our institutions and media?

The tempo of sudden deaths and tragedies seems to be quantifiably increasing, but policy makers, pundits and the media are mostly doubling down on vaccinations.

This article claims that before 2021 the average annual number of athletes collapsing on the field was 29, and that since 2021 that’s blown out to 1,652 (and counting). For the sake of balance, here’s the AP Fact Check telling you “there’s nothing to see here”, saying, this number “simply cites a blog, goodsciencing.com, for that figure”.

The GoodSciencing article itself derives that number from media reports of each individual incident – and has a footnote with an attribution and a link for every one, all 1,652 of them.

We’re one tragedy away from pitchforks and torches

The disconnect between what the average person on the street is seeing happen right before their eyes and what they’re being told is happening (or not happening) by paternalistic fact-checking media propagandists will soon come to a breaking point.

The only thing that can stop it is for some policymakers and pundits to start throwing the engine brake and try to get out in front of what will be an inevitable public backlash. My fear is this won’t happen.

There is too much invested: the entire regime of Digital IDs and health passports was to be built atop the COVID vaccine deployment. Vaxports were supposed to be the official lubricant of The Great Reset. If it turns out that these things are not only ineffective but harmful, it will set The Fourth Industrial Revolution back decades.

It’s going to take a long time to rebuild public trust and probably not while any incumbents are still in office.

There are glimmers of rationality returning, where we are beginning to see some institutions reverse course instead of doubling down:

-

My alma mater, University of Western Ontario unexpectedly scrapped their vaccine mandate a few weeks after two students died suddenly in October and November. UWO not only required students to be vaccinated in order to attend on-campus classes, they even required at least one booster.

-

The US military ended all vaccine mandates last week.

-

York Region (part of the Greater Toronto Area) also ended their vaccine mandate last week. The City of Toronto this past November.

What I hope is that the tempo of this return to rationality accelerates, and mandatory vaccines are a thing of the past. Otherwise the risk increases that some kind of “George Floyd” moment occurs first. That’s when a particularly vivid tragedy strikes for all to see and it ignites the pent-up resentment, distrust and hostility into outright rage.

That won’t be good for anybody. We know what happened when the French people were told “to eat cake” until they hit a breaking point. The Terrors. Nobody was safe, the violence was undiscerning and total.

The choice we have today is between a complete moratorium on vaccine mandates and some kind of “truth and reconciliation” process to try and earn back the public trust, or something that more closely resembles pitchforks and torches (not to mention guillotines).

I think we’d all prefer the former.

* * *

Bombthrower is the high signal antidote to MSM agitprop. Sign up for The Bombthrower mailing list to get new posts straight into your inbox and get a free copy of our long term thesis on the coming monetary regime change while you’re at it. Bitcoin is up 27% YTD, have we come off the bottom? Get The Crypto Capitalist Premium and Find Out. ($7 Trial)

Uncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

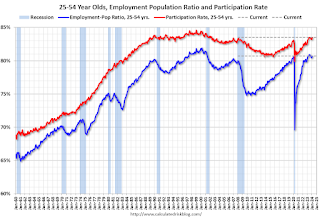

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

Uncategorized

Immune cells can adapt to invading pathogens, deciding whether to fight now or prepare for the next battle

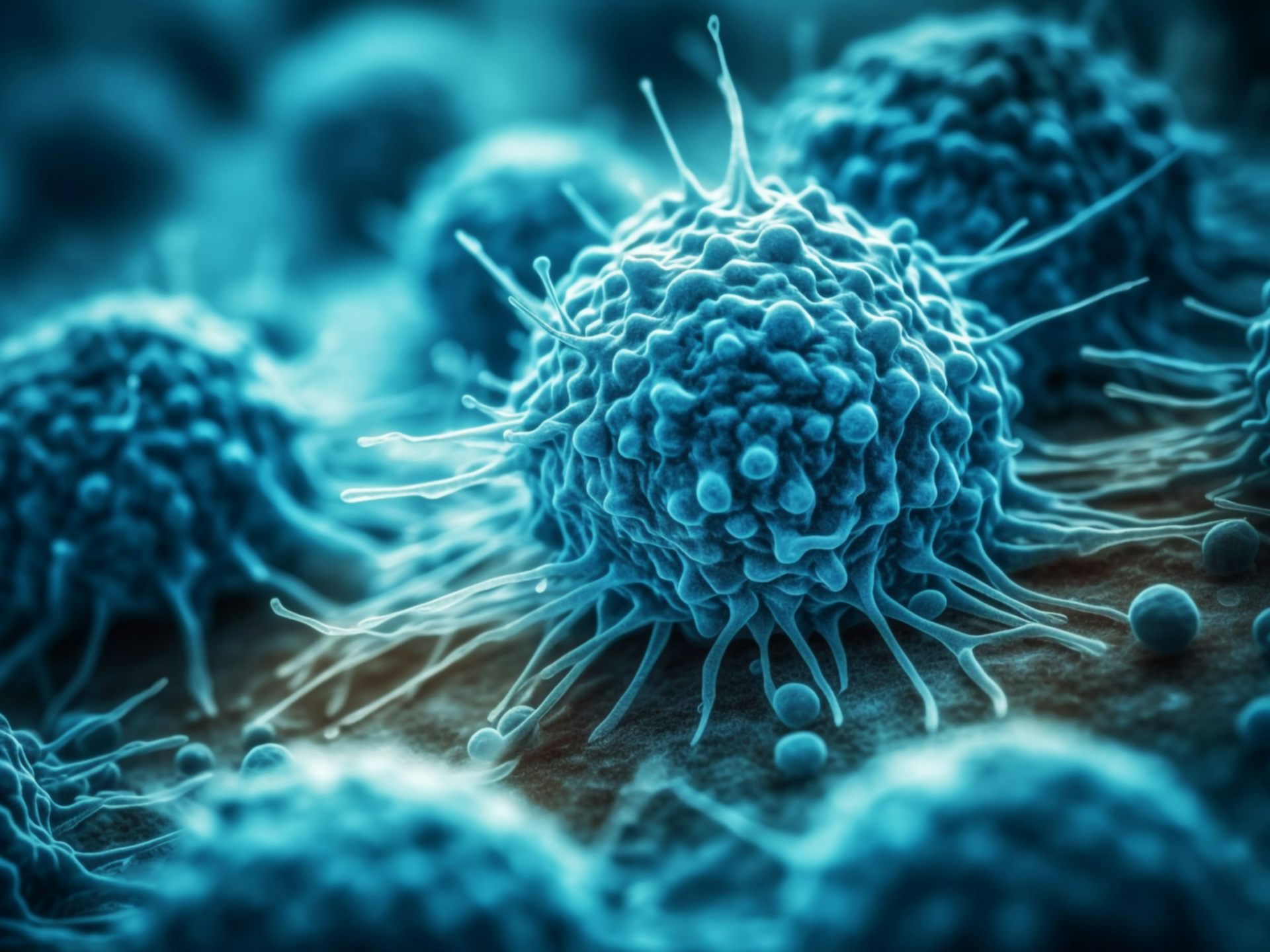

When faced with a threat, T cells have the decision-making flexibility to both clear out the pathogen now and ready themselves for a future encounter.

How does your immune system decide between fighting invading pathogens now or preparing to fight them in the future? Turns out, it can change its mind.

Every person has 10 million to 100 million unique T cells that have a critical job in the immune system: patrolling the body for invading pathogens or cancerous cells to eliminate. Each of these T cells has a unique receptor that allows it to recognize foreign proteins on the surface of infected or cancerous cells. When the right T cell encounters the right protein, it rapidly forms many copies of itself to destroy the offending pathogen.

Importantly, this process of proliferation gives rise to both short-lived effector T cells that shut down the immediate pathogen attack and long-lived memory T cells that provide protection against future attacks. But how do T cells decide whether to form cells that kill pathogens now or protect against future infections?

We are a team of bioengineers studying how immune cells mature. In our recently published research, we found that having multiple pathways to decide whether to kill pathogens now or prepare for future invaders boosts the immune system’s ability to effectively respond to different types of challenges.

Fight or remember?

To understand when and how T cells decide to become effector cells that kill pathogens or memory cells that prepare for future infections, we took movies of T cells dividing in response to a stimulus mimicking an encounter with a pathogen.

Specifically, we tracked the activity of a gene called T cell factor 1, or TCF1. This gene is essential for the longevity of memory cells. We found that stochastic, or probabilistic, silencing of the TCF1 gene when cells confront invading pathogens and inflammation drives an early decision between whether T cells become effector or memory cells. Exposure to higher levels of pathogens or inflammation increases the probability of forming effector cells.

Surprisingly, though, we found that some effector cells that had turned off TCF1 early on were able to turn it back on after clearing the pathogen, later becoming memory cells.

Through mathematical modeling, we determined that this flexibility in decision making among memory T cells is critical to generating the right number of cells that respond immediately and cells that prepare for the future, appropriate to the severity of the infection.

Understanding immune memory

The proper formation of persistent, long-lived T cell memory is critical to a person’s ability to fend off diseases ranging from the common cold to COVID-19 to cancer.

From a social and cognitive science perspective, flexibility allows people to adapt and respond optimally to uncertain and dynamic environments. Similarly, for immune cells responding to a pathogen, flexibility in decision making around whether to become memory cells may enable greater responsiveness to an evolving immune challenge.

Memory cells can be subclassified into different types with distinct features and roles in protective immunity. It’s possible that the pathway where memory cells diverge from effector cells early on and the pathway where memory cells form from effector cells later on give rise to particular subtypes of memory cells.

Our study focuses on T cell memory in the context of acute infections the immune system can successfully clear in days, such as cold, the flu or food poisoning. In contrast, chronic conditions such as HIV and cancer require persistent immune responses; long-lived, memory-like cells are critical for this persistence. Our team is investigating whether flexible memory decision making also applies to chronic conditions and whether we can leverage that flexibility to improve cancer immunotherapy.

Resolving uncertainty surrounding how and when memory cells form could help improve vaccine design and therapies that boost the immune system’s ability to provide long-term protection against diverse infectious diseases.

Kathleen Abadie was funded by a NSF (National Science Foundation) Graduate Research Fellowships. She performed this research in affiliation with the University of Washington Department of Bioengineering.

Elisa Clark performed her research in affiliation with the University of Washington (UW) Department of Bioengineering and was funded by a National Science Foundation Graduate Research Fellowship (NSF-GRFP) and by a predoctoral fellowship through the UW Institute for Stem Cell and Regenerative Medicine (ISCRM).

Hao Yuan Kueh receives funding from the National Institutes of Health.

stimulus covid-19 yuan vaccine stimulusUncategorized

Stock indexes are breaking records and crossing milestones – making many investors feel wealthier

The S&P 500 topped 5,000 on Feb. 9, 2024, for the first time. The Dow Jones Industrial Average will probably hit a new big round number soon t…

The S&P 500 stock index topped 5,000 for the first time on Feb. 9, 2024, exciting some investors and garnering a flurry of media coverage. The Conversation asked Alexander Kurov, a financial markets scholar, to explain what stock indexes are and to say whether this kind of milestone is a big deal or not.

What are stock indexes?

Stock indexes measure the performance of a group of stocks. When prices rise or fall overall for the shares of those companies, so do stock indexes. The number of stocks in those baskets varies, as does the system for how this mix of shares gets updated.

The Dow Jones Industrial Average, also known as the Dow, includes shares in the 30 U.S. companies with the largest market capitalization – meaning the total value of all the stock belonging to shareholders. That list currently spans companies from Apple to Walt Disney Co.

The S&P 500 tracks shares in 500 of the largest U.S. publicly traded companies.

The Nasdaq composite tracks performance of more than 2,500 stocks listed on the Nasdaq stock exchange.

The DJIA, launched on May 26, 1896, is the oldest of these three popular indexes, and it was one of the first established.

Two enterprising journalists, Charles H. Dow and Edward Jones, had created a different index tied to the railroad industry a dozen years earlier. Most of the 12 stocks the DJIA originally included wouldn’t ring many bells today, such as Chicago Gas and National Lead. But one company that only got booted in 2018 had stayed on the list for 120 years: General Electric.

The S&P 500 index was introduced in 1957 because many investors wanted an option that was more representative of the overall U.S. stock market. The Nasdaq composite was launched in 1971.

You can buy shares in an index fund that mirrors a particular index. This approach can diversify your investments and make them less prone to big losses.

Index funds, which have only existed since Vanguard Group founder John Bogle launched the first one in 1976, now hold trillions of dollars .

Why are there so many?

There are hundreds of stock indexes in the world, but only about 50 major ones.

Most of them, including the Nasdaq composite and the S&P 500, are value-weighted. That means stocks with larger market values account for a larger share of the index’s performance.

In addition to these broad-based indexes, there are many less prominent ones. Many of those emphasize a niche by tracking stocks of companies in specific industries like energy or finance.

Do these milestones matter?

Stock prices move constantly in response to corporate, economic and political news, as well as changes in investor psychology. Because company profits will typically grow gradually over time, the market usually fluctuates in the short term, while increasing in value over the long term.

The DJIA first reached 1,000 in November 1972, and it crossed the 10,000 mark on March 29, 1999. On Jan. 22, 2024, it surpassed 38,000 for the first time. Investors and the media will treat the new record set when it gets to another round number – 40,000 – as a milestone.

The S&P 500 index had never hit 5,000 before. But it had already been breaking records for several weeks.

Because there’s a lot of randomness in financial markets, the significance of round-number milestones is mostly psychological. There is no evidence they portend any further gains.

For example, the Nasdaq composite first hit 5,000 on March 10, 2000, at the end of the dot-com bubble.

The index then plunged by almost 80% by October 2002. It took 15 years – until March 3, 2015 – for it return to 5,000.

By mid-February 2024, the Nasdaq composite was nearing its prior record high of 16,057 set on Nov. 19, 2021.

Index milestones matter to the extent they pique investors’ attention and boost market sentiment.

Investors afflicted with a fear of missing out may then invest more in stocks, pushing stock prices to new highs. Chasing after stock trends may destabilize markets by moving prices away from their underlying values.

When a stock index passes a new milestone, investors become more aware of their growing portfolios. Feeling richer can lead them to spend more.

This is called the wealth effect. Many economists believe that the consumption boost that arises in response to a buoyant stock market can make the economy stronger.

Is there a best stock index to follow?

Not really. They all measure somewhat different things and have their own quirks.

For example, the S&P 500 tracks many different industries. However, because it is value-weighted, it’s heavily influenced by only seven stocks with very large market values.

Known as the “Magnificent Seven,” shares in Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia and Tesla now account for over one-fourth of the S&P 500’s value. Nearly all are in the tech sector, and they played a big role in pushing the S&P across the 5,000 mark.

This makes the index more concentrated on a single sector than it appears.

But if you check out several stock indexes rather than just one, you’ll get a good sense of how the market is doing. If they’re all rising quickly or breaking records, that’s a clear sign that the market as a whole is gaining.

Sometimes the smartest thing is to not pay too much attention to any of them.

For example, after hitting record highs on Feb. 19, 2020, the S&P 500 plunged by 34% in just 23 trading days due to concerns about what COVID-19 would do to the economy. But the market rebounded, with stock indexes hitting new milestones and notching new highs by the end of that year.

Panicking in response to short-term market swings would have made investors more likely to sell off their investments in too big a hurry – a move they might have later regretted. This is why I believe advice from the immensely successful investor and fan of stock index funds Warren Buffett is worth heeding.

Buffett, whose stock-selecting prowess has made him one of the world’s 10 richest people, likes to say “Don’t watch the market closely.”

If you’re reading this because stock prices are falling and you’re wondering if you should be worried about that, consider something else Buffett has said: “The light can at any time go from green to red without pausing at yellow.”

And the opposite is true as well.

Alexander Kurov does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

dow jones sp 500 nasdaq stocks covid-19-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges