International

The Station: Rounding up the Tesla Cyber Roundup, a Waymo change up and the mysterious disappearance of Bolt Mobility

The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every weekend in…

The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every weekend in your inbox.

Welcome back to The Station, your central hub for all past, present and future means of moving people and packages from Point A to Point B. This week it’s a dual-hosted event with transportation editor Kirsten Korosec and transportation reporter Rebecca Bellan steering the ship, er, car.

One story that deserves your attention is the mystery around Bolt Mobility.

Bolt Mobility appears to have ceased operations and vanished into the ether, leaving behind dead vehicles and unanswered calls in at least eight U.S. markets.

Representatives from affected cities told TechCrunch they haven’t been able to get ahold of anyone from Bolt, including the company’s CEO Ignacio Tzoumas. In addition to reaching out to as many cities where Bolt had, until recently, been running a service, Rebecca also made multiple attempts to reach Bolt staff members and its investors — to no avail. Even Bolt’s customer service line doesn’t appear to be staffed.

It’s all very mysterious. Bolt had appeared to be on an upward trajectory last year after acquiring the assets of Last Mile Holdings, which opened up 48 new markets to the micromobility operator. The company also had some recent undisclosed investment, which ostensibly could have tided Bolt over long enough to, at the very least, remove its vehicles from the streets and properly dispose of or recycle them.

So what gives? We’re still working that one out, but Alex Wilhelm and Annie Saunders have been pondering the effect that asset depreciation can have on startups like Bolt. For example, we’ve seen with Bird just how lackluster the economics of running shared scooter companies are just from an operations perspective. Wilhelm and Saunders write:

When the cost of vehicle depreciation was factored into its business…it was hugely gross-margin-negative. So, its cash was going into not only operations but funding a huge fleet of gear. Gear that it had to design, manufacture, ship and market in an effort to make its money back. It never quite worked.

Alrighty then, onward!

You can also email us at kirsten.korosec@techcrunch.com and rebecca.techcrunch@gmail.com to share thoughts, criticisms, opinions, or tips. You also can send a direct message to @kirstenkorosec

Micromobbin’

A word on safety.

I keep seeing reports of emergency room visits for e-scooter riders. My initial reaction to news of e-scooter accidents was to blame cars for ruling the roads and cities for not providing enough safe bike lanes. However, there’s also space to push micromobility companies to provide more protections.

In Denver, a rider simply reached up to adjust her glasses and before she knew it was flatlined with a head injury. An easy mistake to make, and one I can see myself making.

Sturdier scooters and helmets offered with all shared micromobility vehicles could make an appreciable difference.

I live in Auckland, where Neuron, Beam and Lime run a service. Neuron and Beam both have helmets attached to their scooters, so it can be done, whereas Lime, for whatever reason, does not. In fact, most scooter companies don’t offer helmets. Instead, they promise to improve safety by spending lord-knows-how-much on computer vision technology to keep riders off sidewalks.

In other news…

Electric moped growth is predicted to double in Asia.

Google Maps is now providing route information updates to cyclists.

India is finalizing its national battery swap program for two- and three-wheeled EVs.

Joyride, a micromobility software provider, has opened up a hardware marketplace to help operators build up their fleets.

— Rebecca Bellan

A little bird

We hear things and we share the tidbits that we can verify.

There is some executive movement over in Waymo land.

Dan Chu, Waymo’s chief product officer, has left the Alphabet subsidiary, according to a few folks in the know (and later confirmed by Waymo). Chu has been at Waymo for eight years and 14 years at Alphabet.

Waymo confirmed Chu’s departure and said he was moving onto a new “professional opportunity in the health tech industry.” The company said Chu was staying on through mid-September “to ensure a smooth transition.”

“We’re grateful to Dan for his product leadership and vision, having helped us launch Waymo One, Waymo Via, and build a world-class Product team,” the company said in a statement.

It appears that Waymo already has a replacement in mind. Saswat Panigrahi, who joined Waymo in 2016 and was most recently vice president of strategy, product management and data science, is taking the CPO spot.

“Panigrahi has been with Waymo for almost six years in a variety of product leadership roles, managing our engineering and commercial roadmaps across ride hailing, long haul trucking and local delivery,” the statement continued.

During his time at Waymo, Panigrahi has been a part of launching the first fully autonomous public commercial service in Phoenix and the start of fully autonomous operations in San Francisco, the company said, adding that prior to joining Waymo he was with Google for four years as senior product manager working on Chrome Browser, Chromebooks and Android.

Deal of the week

Looks like there’s a new micromobility SPAC on the market, and we’re trying not to cringe. Galata Acquisition Corp., a special purpose acquisition company led by Callaway Capital with $146.6 million in trust, has announced plans to merge with Marti Technologies, a micromobility app in Turkey that operates a fleet of over 46,000 e-mopeds, e-bikes and e-scooters. Marti will use the funds from the IPO to strengthen its position in Turkey by deploying additional vehicles across existing and new modalities.

Given the performance of other micromobility companies that have gone public via SPAC – AKA Bird and Helbiz – it’s actually surprising to see Marti decide to go public on the same route, particularly so when many other startups are shunning the public markets until things heat up again.

Other deals that got my attention …

Boatsetter, the Airbnb of renting boats, secured a $38 million Series B round.

Canyon Bikes is getting $30 million to fund its U.S. expansion from LeBron James, who apparently is an avid cyclist.

Hyundai is considering acquiring the remaining stake in 42dot, a South Korea-based lidar-free autonomous mobility platform.

Mobiv Acquisition, a blank-check company led by Peter Bilitsch targeting the electric vehicle industry in Asia and Europe raised $87 million in an IPO.

Nexar, the Israeli dash cam data company, is acquiring Veniam, an IoT company that transfers data from cars to the cloud with its connected vehicle mesh network.

Nikola agreed to acquire Romeo Power in an all-stock $144 million deal, giving the company control over a key part of its supply chain.

Orange EV raised $35 million in a round led by S2G Ventures and CCI to accelerate the adoption of electric yard trucks.

Ottonomy.IO, the autonomous robotics delivery startup, raised $3.3 million in a seed round led by Pi Ventures. The company has raised $4.9 million to date. Connetic Ventures and Branded Hospitality Ventures and Sangeet Kumar, founder and CEO of Addverb Technologies also joined this round.

River, a Bangalore-based startup that makes electric two-wheelers, has closed an $11 million Series A. The round, which was led by Chris Sacca’s Lowercarbon Capital in participation with Toyota Ventures and existing investors Maniv Mobility and Trucks VC, will help the young company set up a manufacturing facility and get its first product ready for sale by early 2023. River has the potential to be a leader in the Indian market, given the government’s plans to push EV sales penetration of two-wheelers up to 80% by 2030.

Notable reads and other tidbits

Autonomous vehicles

Argo AI launched a safety advisory council, an external group of safety experts to help the company advance its autonomous mission and build trust with the public. The council is stacked with some of the best in safety, including former National Transportation Safety Board Chairman Robert Sumwalt, TransSafe Consulting CEO Annette Sandberg, who once led the Federal Motor Carrier Safety Administration and Christopher Doss, the senior managing director of cybersecurity at Ankura and former Assistant Director of the Federal Bureau of Investigation.

Aurora Innovation announced a multiphase commercial pilot to haul freight for Schneider National’s customers in Texas.

Embark conducted a public demo to show how its autonomous trucks would interact with emergency vehicles and law enforcement in Texas.

Innoviz will be supplying its lidar sensors and perception software to all Volkswagen group vehicles with automated driving capabilities.

Pony.ai is suing two former employees who left to start their own autonomous trucking companies over alleged trade secret infringement.

Electric vehicles

GreenPower Motor Company announced the first delivery of its EV Star Cab and Chassis to Workhorse for the production of the latter’s van line which is expected to enter production later this year.

Lamborghini wants to wait and see what kinds of policies the European Union will enforce on ICE vehicles before deciding to go all in on EVs.

Tesla shareholders approved a three-to-one stock split, but they rejected proposals to improve annual reporting on things like racial, sexual and gender harassment and discrimination, lobbying, water risk and use of child labor in the supply chain. Check out other key takeaways from Tesla’s Cyber Roundup.

Speaking of Tesla, Mark Harris, who also writes for TechCrunch, just wrapped up a series on Tesla data for IEEE Spectrum. The Radical Scope of Tesla’s Data Hoard, Tesla’s Autopilot Depends on a Deluge of Data and Who Actually Owns Tesla’s Data? Check it out.

And the final item on the Tesla front, the California DMV has accused Tesla of falsely advertising its FSD beta software, reported the LA Times.

Volkswagen said it would offer a cheaper version of its ID.4 electric compact SUV, with a smaller battery pack, that starts at $37,495 before federal tax credits (and not including the $1,295 destination fee).

Xpeng’s July sales results are in. The Chinese EV company sold 11,524 Smart EVs. While that’s up 43% YoY, it’s down from 15,295 vehicles delivered in June. The breakdown looks like: 6,397 P7 sports sedans, 3,608 P5 smart family sedans and 1,519 G3i smart compact SUVs. In August, Xpeng will accept reservations for its new G9 SUV followed by an official launch in September.

Earnings

Aurora Innovation pushed back the deployment timeline of its commercial autonomous trucking platform. The company closed out Q2 with “collaboration revenue,” which isn’t actually revenue, of $20.7 million and a massive net loss of $1.2 billion.

Fisker said it now has more than 56,000 reservations for the Ocean electric SUV, of which it has 55 prototypes built, and is on track to start production November 17. Despite the promise of revenue in the future, the luxury EV startup closed the second quarter with pretty much no revenue to speak of, a loss per share of $0.36 and a net loss of $106 million, which is down from the $122.1 million loss reported in Q1.

Lordstown Motors reported its first quarterly operating profit of $61.3 million. The embattled EV company still hasn’t delivered any vehicles, so these gains are largely related to the sale of its Ohio factory to Foxconn. The company reaffirmed plans to begin commercial production of its first vehicle this quarter and roll out customer deliveries by the end of 2022.

Lucid Motors slashed its annual production guidance in half due to supply chain and logistics issues. The luxury EV company had originally planned to produce 20,000 Air sedans this year. In February, that number got cut down to 12,000 to 14,000. This week, Lucid said it could maybe deliver 6,000 to 7,000. The company reported $97.3 million in revenue for the second quarter, missing analyst expectations, and an adjusted net loss of $414 million.

Lyft reported record earnings in the second quarter, with revenues of $990.7 million. Net loss for the quarter was $377.2 million. The company’s shares were up 4.07% in after hours trading, after the company convinced investors it was able to offset the costs of increased investments in drivers by cost-cutting internally and taking advantage of a post-COVID travel boom.

Nikola reported $18.1 million in revenues on deliveries of 48 Tre BEVs and four mobile charging trailers. The EV maker, which is trying to move past its tumultuous and troubled past, closed out the quarter with a net loss of $173 million and total liquidity of $841.8 million. The company also announced the locations of three California hydrogen stations to help it scale up its long-term hydrogen distribution solutions.

TuSimple reported a $2.6 million revenue, which was up 73% YoY but missed Wall Street expectations drastically. The self-driving trucking company used the earnings call to address a recent crash of one of its test trucks, in which the truck suddenly veered across the I-10 highway in Tuscon and slammed into a concrete barricade.

Uber came out the gate swinging with its Q2 earnings, during which the company reported revenues of $8.1 billion, up 105% from last year. Gross bookings rose 33% to $29.1 billion from $21.9 billion a year ago. The company finished out the quarter with positive free cash flow, meaning it can now, finally, self-fund. Uber’s shares were up 14.4% after the company reported earnings.

Another tidbit: Uber also sold its 7.8% stake in food delivery company Zomato for over $390 million.

Miscellaneous

General Motors will soon allow drivers to use Super Cruise on more than 400,000 miles of road in the U.S. and Canada, which will double the geographic access to the hands-free driver assistance system.

GM Future Roads and Inrix are offering “Safety View” to transport planners nationwide. The product is a cloud-based application that provides transportation officials with critical insights using crash, vehicle, vulnerable road user and U.S. census data to help prioritize and measure how effective roadway safety projects are and what their impact on communities is.

The two entities also launched a research report that focuses on Washington, D.C. schools. They found more speeding, as well as crashes, to occur around low-income schools than high-income schools; traffic signs didn’t have a large effect on speeding; the built environment is a larger factor in vehicle speeds than signage or specific operating times of school zones.

NYC’s daily subway ridership is still significantly below pre-pandemic levels, according to Observable, a data vis startup that worked with Microsoft and Oxford University to create a fun interactive of the data.

Uber Freight published a white paper that finds for commercializing autonomous trucking in the near-term, the hub-to-hub model is the most practical and economically feasible starting point. The white paper also found, perhaps unsurprisingly, that autonomous trucks will fill job gaps rather than replace human drivers.

UFODrive has launched its electric vehicle rental service in San Francisco. The European company offers both EV rentals and subscriptions, and plans to expand to Austin and New York this year, as well.

U.S. Department of Transportation and Energy announced that all 50 states, D.C. and Puerto Rico have submitted EV infrastructure deployment plans as required under the National Electric Vehicle Infrastructure Formula Program under Biden’s infrastructure bill. The plans will unlock the first round of $5 billion funding available over the next five years to help states build out a national charging network.

Ridehail

TechCrunch got some inside information into how the Lyft layoffs are shaping up since the company shut down its in-house rentals unit. A spoiler: Staff were given 30 days to find a new job within Lyft or be separated from the company, but many are jaded that they weren’t simply placed into new roles and instead have to compete with outsiders.

Uber is testing adding train and coach travel to its app in the U.K. after a tie-up with Berlin-based multimodal travel platform Omio.

testing pandemic south korea india canada european europeInternational

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

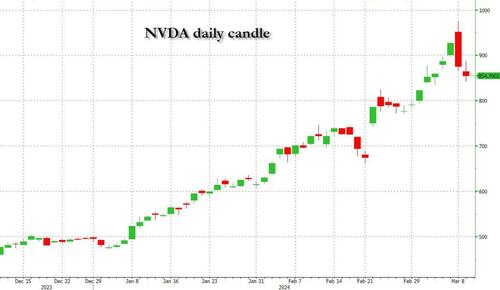

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

Spread & Containment

Trump “Clearly Hasn’t Learned From His COVID-Era Mistakes”, RFK Jr. Says

Trump "Clearly Hasn’t Learned From His COVID-Era Mistakes", RFK Jr. Says

Authored by Jeff Louderback via The Epoch Times (emphasis ours),

President…

Authored by Jeff Louderback via The Epoch Times (emphasis ours),

President Joe Biden claimed that COVID vaccines are now helping cancer patients during his State of the Union address on March 7, but it was a response on Truth Social from former President Donald Trump that drew the ire of independent presidential candidate Robert F. Kennedy Jr.

During the address, President Biden said: “The pandemic no longer controls our lives. The vaccines that saved us from COVID are now being used to help beat cancer, turning setback into comeback. That’s what America does.”

President Trump wrote: “The Pandemic no longer controls our lives. The VACCINES that saved us from COVID are now being used to help beat cancer—turning setback into comeback. YOU’RE WELCOME JOE. NINE-MONTH APPROVAL TIME VS. 12 YEARS THAT IT WOULD HAVE TAKEN YOU.”

An outspoken critic of President Trump’s COVID response, and the Operation Warp Speed program that escalated the availability of COVID vaccines, Mr. Kennedy said on X, formerly known as Twitter, that “Donald Trump clearly hasn’t learned from his COVID-era mistakes.”

“He fails to recognize how ineffective his warp speed vaccine is as the ninth shot is being recommended to seniors. Even more troubling is the documented harm being caused by the shot to so many innocent children and adults who are suffering myocarditis, pericarditis, and brain inflammation,” Mr. Kennedy remarked.

“This has been confirmed by a CDC-funded study of 99 million people. Instead of bragging about its speedy approval, we should be honestly and transparently debating the abundant evidence that this vaccine may have caused more harm than good.

“I look forward to debating both Trump and Biden on Sept. 16 in San Marcos, Texas.”

Mr. Kennedy announced in April 2023 that he would challenge President Biden for the 2024 Democratic Party presidential nomination before declaring his run as an independent last October, claiming that the Democrat National Committee was “rigging the primary.”

Since the early stages of his campaign, Mr. Kennedy has generated more support than pundits expected from conservatives, moderates, and independents resulting in speculation that he could take votes away from President Trump.

Many Republicans continue to seek a reckoning over the government-imposed pandemic lockdowns and vaccine mandates.

President Trump’s defense of Operation Warp Speed, the program he rolled out in May 2020 to spur the development and distribution of COVID-19 vaccines amid the pandemic, remains a sticking point for some of his supporters.

Operation Warp Speed featured a partnership between the government, the military, and the private sector, with the government paying for millions of vaccine doses to be produced.

President Trump released a statement in March 2021 saying: “I hope everyone remembers when they’re getting the COVID-19 Vaccine, that if I wasn’t President, you wouldn’t be getting that beautiful ‘shot’ for 5 years, at best, and probably wouldn’t be getting it at all. I hope everyone remembers!”

President Trump said about the COVID-19 vaccine in an interview on Fox News in March 2021: “It works incredibly well. Ninety-five percent, maybe even more than that. I would recommend it, and I would recommend it to a lot of people that don’t want to get it and a lot of those people voted for me, frankly.

“But again, we have our freedoms and we have to live by that and I agree with that also. But it’s a great vaccine, it’s a safe vaccine, and it’s something that works.”

On many occasions, President Trump has said that he is not in favor of vaccine mandates.

An environmental attorney, Mr. Kennedy founded Children’s Health Defense, a nonprofit that aims to end childhood health epidemics by promoting vaccine safeguards, among other initiatives.

Last year, Mr. Kennedy told podcaster Joe Rogan that ivermectin was suppressed by the FDA so that the COVID-19 vaccines could be granted emergency use authorization.

He has criticized Big Pharma, vaccine safety, and government mandates for years.

Since launching his presidential campaign, Mr. Kennedy has made his stances on the COVID-19 vaccines, and vaccines in general, a frequent talking point.

“I would argue that the science is very clear right now that they [vaccines] caused a lot more problems than they averted,” Mr. Kennedy said on Piers Morgan Uncensored last April.

“And if you look at the countries that did not vaccinate, they had the lowest death rates, they had the lowest COVID and infection rates.”

Additional data show a “direct correlation” between excess deaths and high vaccination rates in developed countries, he said.

President Trump and Mr. Kennedy have similar views on topics like protecting the U.S.-Mexico border and ending the Russia-Ukraine war.

COVID-19 is the topic where Mr. Kennedy and President Trump seem to differ the most.

Former President Donald Trump intended to “drain the swamp” when he took office in 2017, but he was “intimidated by bureaucrats” at federal agencies and did not accomplish that objective, Mr. Kennedy said on Feb. 5.

Speaking at a voter rally in Tucson, where he collected signatures to get on the Arizona ballot, the independent presidential candidate said President Trump was “earnest” when he vowed to “drain the swamp,” but it was “business as usual” during his term.

John Bolton, who President Trump appointed as a national security adviser, is “the template for a swamp creature,” Mr. Kennedy said.

Scott Gottlieb, who President Trump named to run the FDA, “was Pfizer’s business partner” and eventually returned to Pfizer, Mr. Kennedy said.

Mr. Kennedy said that President Trump had more lobbyists running federal agencies than any president in U.S. history.

“You can’t reform them when you’ve got the swamp creatures running them, and I’m not going to do that. I’m going to do something different,” Mr. Kennedy said.

During the COVID-19 pandemic, President Trump “did not ask the questions that he should have,” he believes.

President Trump “knew that lockdowns were wrong” and then “agreed to lockdowns,” Mr. Kennedy said.

He also “knew that hydroxychloroquine worked, he said it,” Mr. Kennedy explained, adding that he was eventually “rolled over” by Dr. Anthony Fauci and his advisers.

MaryJo Perry, a longtime advocate for vaccine choice and a Trump supporter, thinks votes will be at a premium come Election Day, particularly because the independent and third-party field is becoming more competitive.

Ms. Perry, president of Mississippi Parents for Vaccine Rights, believes advocates for medical freedom could determine who is ultimately president.

She believes that Mr. Kennedy is “pulling votes from Trump” because of the former president’s stance on the vaccines.

“People care about medical freedom. It’s an important issue here in Mississippi, and across the country,” Ms. Perry told The Epoch Times.

“Trump should admit he was wrong about Operation Warp Speed and that COVID vaccines have been dangerous. That would make a difference among people he has offended.”

President Trump won’t lose enough votes to Mr. Kennedy about Operation Warp Speed and COVID vaccines to have a significant impact on the election, Ohio Republican strategist Wes Farno told The Epoch Times.

President Trump won in Ohio by eight percentage points in both 2016 and 2020. The Ohio Republican Party endorsed President Trump for the nomination in 2024.

“The positives of a Trump presidency far outweigh the negatives,” Mr. Farno said. “People are more concerned about their wallet and the economy.

“They are asking themselves if they were better off during President Trump’s term compared to since President Biden took office. The answer to that question is obvious because many Americans are struggling to afford groceries, gas, mortgages, and rent payments.

“America needs President Trump.”

Multiple national polls back Mr. Farno’s view.

As of March 6, the RealClearPolitics average of polls indicates that President Trump has 41.8 percent support in a five-way race that includes President Biden (38.4 percent), Mr. Kennedy (12.7 percent), independent Cornel West (2.6 percent), and Green Party nominee Jill Stein (1.7 percent).

A Pew Research Center study conducted among 10,133 U.S. adults from Feb. 7 to Feb. 11 showed that Democrats and Democrat-leaning independents (42 percent) are more likely than Republicans and GOP-leaning independents (15 percent) to say they have received an updated COVID vaccine.

The poll also reported that just 28 percent of adults say they have received the updated COVID inoculation.

The peer-reviewed multinational study of more than 99 million vaccinated people that Mr. Kennedy referenced in his X post on March 7 was published in the Vaccine journal on Feb. 12.

It aimed to evaluate the risk of 13 adverse events of special interest (AESI) following COVID-19 vaccination. The AESIs spanned three categories—neurological, hematologic (blood), and cardiovascular.

The study reviewed data collected from more than 99 million vaccinated people from eight nations—Argentina, Australia, Canada, Denmark, Finland, France, New Zealand, and Scotland—looking at risks up to 42 days after getting the shots.

Three vaccines—Pfizer and Moderna’s mRNA vaccines as well as AstraZeneca’s viral vector jab—were examined in the study.

Researchers found higher-than-expected cases that they deemed met the threshold to be potential safety signals for multiple AESIs, including for Guillain-Barre syndrome (GBS), cerebral venous sinus thrombosis (CVST), myocarditis, and pericarditis.

A safety signal refers to information that could suggest a potential risk or harm that may be associated with a medical product.

The study identified higher incidences of neurological, cardiovascular, and blood disorder complications than what the researchers expected.

President Trump’s role in Operation Warp Speed, and his continued praise of the COVID vaccine, remains a concern for some voters, including those who still support him.

Krista Cobb is a 40-year-old mother in western Ohio. She voted for President Trump in 2020 and said she would cast her vote for him this November, but she was stunned when she saw his response to President Biden about the COVID-19 vaccine during the State of the Union address.

“I love President Trump and support his policies, but at this point, he has to know they [advisers and health officials] lied about the shot,” Ms. Cobb told The Epoch Times.

“If he continues to promote it, especially after all of the hearings they’ve had about it in Congress, the side effects, and cover-ups on Capitol Hill, at what point does he become the same as the people who have lied?” Ms. Cobb added.

“I think he should distance himself from talk about Operation Warp Speed and even admit that he was wrong—that the vaccines have not had the impact he was told they would have. If he did that, people would respect him even more.”

International

There will soon be one million seats on this popular Amtrak route

“More people are taking the train than ever before,” says Amtrak’s Executive Vice President.

While the size of the United States makes it hard for it to compete with the inter-city train access available in places like Japan and many European countries, Amtrak trains are a very popular transportation option in certain pockets of the country — so much so that the country’s national railway company is expanding its Northeast Corridor by more than one million seats.

Related: This is what it's like to take a 19-hour train from New York to Chicago

Running from Boston all the way south to Washington, D.C., the route is one of the most popular as it passes through the most densely populated part of the country and serves as a commuter train for those who need to go between East Coast cities such as New York and Philadelphia for business.

Veronika Bondarenko

Amtrak launches new routes, promises travelers ‘additional travel options’

Earlier this month, Amtrak announced that it was adding four additional Northeastern routes to its schedule — two more routes between New York’s Penn Station and Union Station in Washington, D.C. on the weekend, a new early-morning weekday route between New York and Philadelphia’s William H. Gray III 30th Street Station and a weekend route between Philadelphia and Boston’s South Station.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

According to Amtrak, these additions will increase Northeast Corridor’s service by 20% on the weekdays and 10% on the weekends for a total of one million additional seats when counted by how many will ride the corridor over the year.

“More people are taking the train than ever before and we’re proud to offer our customers additional travel options when they ride with us on the Northeast Regional,” Amtrak Executive Vice President and Chief Commercial Officer Eliot Hamlisch said in a statement on the new routes. “The Northeast Regional gets you where you want to go comfortably, conveniently and sustainably as you breeze past traffic on I-95 for a more enjoyable travel experience.”

Here are some of the other Amtrak changes you can expect to see

Amtrak also said that, in the 2023 financial year, the Northeast Corridor had nearly 9.2 million riders — 8% more than it had pre-pandemic and a 29% increase from 2022. The higher demand, particularly during both off-peak hours and the time when many business travelers use to get to work, is pushing Amtrak to invest into this corridor in particular.

To reach more customers, Amtrak has also made several changes to both its routes and pricing system. In the fall of 2023, it introduced a type of new “Night Owl Fare” — if traveling during very late or very early hours, one can go between cities like New York and Philadelphia or Philadelphia and Washington. D.C. for $5 to $15.

As travel on the same routes during peak hours can reach as much as $300, this was a deliberate move to reach those who have the flexibility of time and might have otherwise preferred more affordable methods of transportation such as the bus. After seeing strong uptake, Amtrak added this type of fare to more Boston routes.

The largest distances, such as the ones between Boston and New York or New York and Washington, are available at the lowest rate for $20.

stocks pandemic japan european-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International4 days ago

International4 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges