The Spirituality Behind Bitcoin

The Spirituality Behind Bitcoin

Authored by Mark Jeftovic via Bombthrower.com,

"they worshiped the dragon because he gave his authority to the beast; and they worshiped the beast, saying ‘Who is like the Beast, and able to wage war agains

Authored by Mark Jeftovic via Bombthrower.com,

"they worshiped the dragon because he gave his authority to the beast; and they worshiped the beast, saying 'Who is like the Beast, and able to wage war against it?'"

If ‘The Beast’ is CCP-style social credit, the answer is Bitcoin

Something I’ve been thinking about more often lately is the almost otherworldly timing of the appearance of Bitcoin on the world stage.

Right at the crescendo of the Global Financial Crisis, as world leaders and central banks were showing that they would never willingly allow consequences to unfold, even worse, they would reward moral hazard and bail out the banks, a mysterious white paper dropped on a cypherpunks mailing list:

Subject: Bitcoin P2P e-cash paper

Satoshi Nakamoto satoshi at vistomail.com Fri Oct 31 14:10:00 EDT 2008

I've been working on a new electronic cash system that's fully peer-to-peer, with no trusted third party.

The paper is available at: http://www.bitcoin.org/bitcoin.pdf

The main properties:

Double-spending is prevented with a peer-to-peer network.

No mint or other trusted parties.

Participants can be anonymous.

New coins are made from Hashcash style proof-of-work.

The proof-of-work for new coin generation also powers the network to prevent double-spending.

Bitcoin: A Peer-to-Peer Electronic Cash System

Abstract. A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without the burdens of going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work. The longest chain not only serves as proof of the sequence of events witnessed, but proof that it came from the largest pool of CPU power. As long as honest nodes control the most CPU power on the network, they can generate the longest chain and outpace any attackers. The network itself requires minimal structure. Messages are broadcasted on a best effort basis, and nodes can leave and rejoin the network at will, accepting the longest proof-of-work chain as proof of what happened while they were gone.

Full paper at: http://www.bitcoin.org/bitcoin.pdf

Satoshi Nakamoto

…and the world changed.

When an idea whose time has come arrives, nothing can stop it. It may take generations to play out and the transition may be tumultuous, but no human agency can resist it. Fire, self-awareness, language, human rights, increasingly higher levels of mental abstraction, energy density and systems of organization. Something is impelling this relentless progression, and since everything born of human activity had to start as an idea, that something has to be thought.

Yet, we live in a world of radical material reductionism. Conventional canon holds that thought is simply a by-product of brain activity. At its most reductive level, thought, and consciousness itself are just accidents of innumerable material processes randomly iterating over billions of years until one day, some apes suddenly became aware of themselves. “The rest is history”, goes the logic.

Contrary to this, we have multiple streams of philosophy, mythology, certain currents of depth psychology and over the last hundred years even science, namely quantum mechanics, that takes a completely different position. The material world is a consequence of non-material reality, not the precursor to it, and that non-material reality is self-aware and conscious:

“I regard consciousness as fundamental. I regard matter as as derivative from consciousness. We cannot get behind consciousness. Everything that we talk about, everything that we talk about as existing, postulates consciousness.”

- Max Planck, emphasis added.

Which is preeminent, consciousness or matter, is the modern day analog of the battle between the Ptolemaic and the heliocentric cosmologies.

I think in the fullness of time, after enough people have been burned at the stake for saying it, we’ll accept that everything occurring in the material world has its origin in a non-material realm. One whose dynamics shape the events of this one. It has a directionality to it that is taking events in a certain direction. Also, to one degree or another, there may be some oppositional forces aligned against it.

On my latest appearance on Steve Bannon’s Warroom I made the point that “Bitcoin is resistance to financial repression”. Bannon had declared previously that “the government is forcing you into crypto and gold”, and before my segment, Congressman Gaetz, speaking on the new IRS regulations to surveil the populace, said that the government was “weaponizing” its bureaucratic apparatus against its own citizenry.

Where I might politely differ from Bannon and Congressman Gaetz is in the idea that this war against the middle class, against the people, isn’t peculiar to the Biden administration. This has been going on for generations, across both parties. It’s the architecture of the modern welfare state. However contrary to what many think, the welfare state isn’t all powerful, it’s fighting for its own survival.

One of the core battlegrounds in this struggle, perhaps the most important one, is around the nature and mechanics of money. The reason why is because the advent of honest money enabled the exchange of value. It meant people could come together and peacefully trade in a way that resulted in mutual benefit. It was a kind of alchemy. Without honest money we are left with force and coercion. Either subtly or overtly.

The book that probably went the furthest in initially “red-pilling” me about the nature of money, how sound money fostered peace and prosperity, while fiat money (“false” money) enabled division, corruption and war, was Ferdinand Lips’ “Gold Wars”. Lips posited that “The Gold War is nothing else than a Third World War. The demise of the classic gold standard would pit the central bankers and political class against the people, ushering in a “monetary dark age”.

What may be unique to the Biden administration, and incumbent politicians across liberal democracies is the quickening. How in the wake of this (likely lab originated) pandemic it all seems to be headed for a blow off top in tyranny, the world over.

Gold has had near mystical connotations for millennia.

Lips, citing the legendary Harry Shultz unpacks the societal detriment that is caused by unsound money:

Money sets a standard that spreads into every area of human activity. No paper money backing, no morality….Layer by layer we are corrupted when money loses certainty… Big Brother was made possible through the absence of automatic controls and loss of individual freedom via non-convertible currency. So, pass the word. Fight for gold. Not for profits, though they are helpful and help us fight for individual freedom, but for a future that returns to sanity in various standards. If we have a gold standard we get golden human standard! The two are intertwined. They are the ultimate cause and effect. Gold blesses.

One wonders what the late Ferdinand Lips would have thought of the situation today. Shultz wrote the last edition of his newsletter in 2011, warning us then that:

“Roughly speaking, the mess we are in is the worst since 17th century financial collapse. Comparisons with the 1930’s are ludicrous. We’ve gone far beyond that. And, alas, the courage & political will to recognize the mess & act wisely to reverse gears, is absent in U.S. leadership, where the problems were hatched & where the rot is by far the deepest.”

But despite the recorded experience over the entire course of monetary history, how fiat currencies always go to zero, every time, no exceptions, the established elites will not return to a sound money standard of their own free will. Doing so would relinquish their own hold on power, and politics today attracts (almost exclusively) disordered, sociopathic personalties.

Enter, digital currencies

In the early 00’s, there was an abortive attempt to fuse sound money with emerging digital payments in systems like e-gold, Pecunix, and Goldmoney (which is still going today). They were centralized and corporate entities, which meant they had definable attack surfaces that prevented them from posing any serious threat to the status quo.

Recently Peter Thiel mused that the mysterious Satoshi Nakamoto, be it a person or a group, probably cut their teeth in that first attempt at a new era sound money in these digital gold currencies.

Today, people just look at “digital money”, whether it’s crypto-currencies like Bitcoin, digital stablecoins like Facebook’s Diem, or the impending Fedcoin and they put it all into the same bucket. This is mistake.

Digital money is just a medium. Just as the internet is a medium. And where the internet can be used to promote repressive, anti-human ideologies like collectivism, woke-ism and transhumanism, and can be the facilitator for surveillance capitalism, it is also an enabler and empowering mechanism for the underdogs.

For alternative press, independent journalism and open discourse, the internet is the great equalizer. It provides the tools for small, medium and home businesses to compete against the 800lb gorillas in their space (the topic of yet another one of my still-in-progress books that got pushed to the back burner). The advent of the internet was a Promethean event. Cooked up in the bowels of the military-industrial complex it was loosed into the world, perhaps with the intent of further enslaving the masses, but it was designed almost too well.

The internet opened the door to emancipation of information.

So to are digital currencies the new medium for value exchange in an emerging networked world. I never tire of citing the late Stephen Zarlenga and his exhaustive study of history showing how control over the monetary system amounts to control over society.

In a networked world, the battle for monetary morality will be played out in cyberspace. Gold will always be an immutable, ageless anchor for value, but on this battlefield, sound money needed ally. This is guerrilla warfare and something truly asymmetric was required.

What the world needed, was Bitcoin. Digital gold.

Where Central Bank Digital Currencies (CBDCs) are the emerging digital cash platforms of indebtedness and servitude, Bitcoin and (real) cryptos are the liberators. They are not the same, they are antipodes, playing out a timeless struggle in a new terrain. (How can you tell the difference between an oppressive and a liberating digital currency? If you hold your own private keys, it’s an emancipatory crypto, if you can’t self-custody, opt-out, or fork-off, it’s EvilCoin).

This battle is ultimately, a spiritual one

Over the years, as much as I tried to ignore it, I finally had to acknowledge my belief that the ultimate impetus to create emancipatory monetary technologies originate from another plane. By that I don’t mean ethnocentrically modelled deities plotting earthly intrigue from Mount Olympus. I mean more along the lines of impulses and dynamics that we can barely understand from our limited vantage point, ultimately originate from a non-material realm from where they project a kind of morphogenic field into the material world, where these tensions play out.

There are various models for this, David Bohm’s Implicate / Explicate Orders, Karl Pribam’s Holoflux Theory – these models are synthesized coherently in the work of Dr. Shelli Renee Joye..

Why believe any of this New Age woo-woo when the material reductionists would tell me that my belief is simply a side effect of an electro-chemical storm in my brain? Mere “qualia”?

After my Bannon appearance I ended up speaking with Joe Allen, who covers transhumanism for the Warroom. He also writes the Singularity Weekly Substack. We talked for over an hour and we discussed atheism vs radical material reductionism. We discussed the difference between the scientific method and Scientism. We talked about Rudolf Steiner, who posited a coming Age of Ahriman, a period in which humanity would become enamoured with materialism and forget its own soul, an era wherein Ahriman himself would incarnate physically in the West. Steiner, who died in 1925, put it as occurring sometime in the late 20th century, someplace in the US or Canada (if I had to bet, my money would be on Mark Zuckerberg).

Left: Rudolf Steiner’s sculpture of Ahriman, circa 1914. Right: Mark Zuckerberg, b. 1984

For anybody who’s ever attempted to read Steiner, it’s mostly impenetrable. My personal theory is that Steiner spent abnormally large swaths of his life in a hypnogogic state. Perhaps without fully realizing it himself. Nonetheless, he pretty much invented bio-organic farming and Waldorf Schools, among other things.

I ended up telling Joe a true story, one that happened to me nearly 30 years ago, but I remember it like it was yesterday. When the material reductionists tell you that everything you think, feel and decide are simply the outcomes of a billiard ball universe: atoms and molecules colliding while neurons and synapses are firing in your brain, they have to admit when pressed; they can’t actually tell you what consciousness really is. Nor how life emerged from inert matter, or how a brain somehow secretes sentience.

And they cannot explain how something like this happens:

The time: 1992-ish, I’m a bohemian, long haired dude going to college in London, Ontario, playing in a metal band, studying computer programming at Fanshawe College, living in a rooming house / hovel: a mattress on a pair of skids on the floor of a small room in a basement (because the basement flooded every time it rained).

Me, with hair. Circa 1992, covering then Ontario Premier Bob Rae’s song “Same Boat Now”

I had just finished an essay for school, about smart card technology and I closed the assignment with some speculation that eventually smart cards could morph into bar codes and implants. I went on to describe how some religious types (I wasn’t one) thought this would play out along biblical lines, as per the Book of Revelations. On a lark, I close out the essay with Revelations 13:17:

"And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name on his hand or his forehead"

At this point, one of my roommates in the hovel, he was a drug dealer who scared the hell out of me, and some of his even scarier friends show up and they were cooking something up that I didn’t want to be a witness to. So I got the hell out of there.

Very agitated and restless at this point I’m trying to figure out where to go, I decide on the University of Western Ontario’s D. B. Weldon Library, a short bus ride up road. “Nobody will know me there, and I can just disappear in there with a book” I think to myself.

On my way I hit the ATM to get my last $5 out of my bank account. I remember thinking about my essay and giving my bank card some extra scrutiny as I pondered those last paragraphs. Number of the Beast, implants, all that stuff.

I’m still nervous and pumped full of anxiety (my living situation wasn’t the greatest in those days). But I remember what happened distinctly:

Once the bus let out on campus, I felt almost trance-like. “In the zone”. I walked into the library cognizant that I had not brought anything with me to read, but the plan was to simply walk in there and pick a ‘random’ book off the shelves, then flop into a chair and read it for the next few hours.

I jump into the elevator. Get off on the 3rd or 4th floor (D. B. Weldon is 5 stories high), and then, again, trancelike – turn walk, turn, walk, turn walk – stop. Reach out to one side and pluck a book off the shelf then flip it open….

"And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name on his hand or his forehead."

The book was Swedenborg’s “Revelations Explained”.

Suffice it to say, if it were in a movie this would be the scene where the violins are doing those short, sharp Psycho-style stabbing notes in the background. I’d experienced synchronicities before, but this one was off the charts.

Until now, I haven’t told too many people about that event. My wife thinks that it wasn’t a synchronicity as much as a demonstration of the power of mind, that on a subconscious level I had memorized the titles and order of everything in the library on previous visits and that somehow I had managed to retrieve that needle from the haystack because of the mental priming of the morning’s events (I guess my wife is somewhat of a “Scully” to my “Mulder”). But that doesn’t explain picking out a book I had never read by an author I had never heard of and flipping it open to the exact page that happened to also quote Revelations 13:17.

When the Internet hit and there were these head fakes toward micropayments and digital cash I would think about this event. Then crypto-currencies came along I started thinking about it more often. My intuition was telling me that Bitcoin wasn’t a “Mark of the Beast” style technology as foretold in prophecy. If anything, Bitcoin, being a liberating and empowering technology would be the opposite of that. An antidote.

Once the pandemic hit, and vax passports went from conspiracy theory to reality in about 18 months I became quite alarmed about the means, motive and opportunity to fuse the impending CBDCs with health passports and China-style social credit systems. Suddenly implants and chips didn’t seem so far-fetched anymore.

When I told Joe Allen this story, he said it reminded him of the wildly memetic Microsoft 2020-06/06/06 patent. It purportedly described a system for human implants that would turn people into crypto-currency miners and reward them with tokens for completing assigned tasks. Best Matrix flick ever.

When I first heard about this one, it was on Facebook and I nearly ripped into the original poster because it was so obviously an unhinged conspiracy theory that could easily be debunked by simply looking up the damn patent number in the bloody database. I mean people …get a grip.

The only problem is that the 2020/060606 patent turns out to be real, it is listed in the WIPO database (not USPTO), and it describes (get this), “A Crypto-Currency System Using Body Activity Data”.

Human body activity associated with a task provided to a user may be used in a mining process of a cryptocurrency system. A server may provide a task to a device of a user which is communicatively coupled to the server. A sensor communicatively coupled to or comprised in the device of the user may sense body activity of the user. Body activity data may be generated based on the sensed body activity of the user. The cryptocurrency system communicatively coupled to the device of the user may verify if the body activity data satisfies one or more conditions set by the cryptocurrency system, and award cryptocurrency to the user whose body activity data is verified.

Jesus Christ. Make it stop.

The WIPO assigned patent filing numbers, as far as I can tell, are simply assigned serially by year. 2019/060606 is Hydrated Caruon Material Powder and Use of it for Preparation of an Electrode for an Electrical Storage Device. 2021/060606 is Nuclear Fuel Uranium Dioxide Pellets Having Improved Fission Gas Capturing Capability.

What were the odds that Microsoft, a global quasi-monopoly, co-founded by Epstein bro and elite-level globalist Bill Gates, would file a patent on a human implantable task/reward system and wind up with this number in it?

Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is Six hundred and sixty-six.”

I’m not saying that we are dealing with actual, literal Biblical prophecy playing out in our time. Because frankly, there are people who think that at every point throughout history.

The timing of the arrival of Bitcoin, the Promethean dynamic behind both it and the Internet, the “signs and wonders” of the quickening, and the rhyming of ultra-long historical cycles, not to mention the unsustainability of the current status quo; this is all building toward some kind of self-organizing criticality. A global Minsky Moment. What I do think is that whatever is driving it all is not originating from a linear, material universe that just so happened to belch out consciousness along the way.

It could be as explainable as our own collective subconsciousness willing or fearing certain dynamics into material reality. It could be larger, extra-dimensional forces that super-sensibly atuned people like Steiner or Swedenborg glimpsed over a century ago and could barely unpack what they experienced into linear terms.

Whatever is happening, it has been unfolding for a long, long time…

It was not precisely a memory. You have already had proof that time is more complex than your science ever imagined. For that memory was not of the past, but of the future -of those years when your race knew that everything was finished. We did what we could, but it was not an easy end. And because we were there, we became identified with your race’s death.

Yes, even while it was still ten thousand years in the future!

It was as if a distorted echo had reverberated round the closed circle of time, from the future to the past. Call it not a memory, but a premonition.

The idea was hard to grasp, and for a moment Jan wrestled with it in silence.

Yet he should have been prepared; he had already received proof enough that cause and event could reverse their normal sequence. There must be such a thing as racial memory, and that memory was somehow independent of time.

To it, the future and the past were one. That was why, thousands of years ago, men had already glimpsed a distorted image of the Overlords, through a mist of fear and terror.

“Now I understand,” said the last man.

- Arthur C Clarke, Childhood’s End

When I confront the spectre of widespread social credit systems, technocratic collectivism or transhumanist ideations of digital immortality, I get a palpable anti-human vibe from them. When I meditate on empowering technologies like cryptography, on structures of decentralization and on the ideals of self-sovereignty it feels just so much more life affirming.

Alas, the zeitgeist today is dominated with the mindset of the former, but fortunately, Prometheus has already made his rounds. If you value freedom, autonomy, universal human rights and believe we are all ‘the offspring of a deathless soul’, then Bitcoin isn’t your enemy, it’s your ally.

"For we wrestle not against flesh and blood, but against principalities, against powers, against the rulers of the darkness of this world, against spiritual wickedness in high places."

* * *

I cover macro tensions between the globalists and sovereign-individual extensively in The Crypto Capitalist Letter, along with a tactical focus on publicly traded crypto stocks. Get the overall investment / macro thesis free when you subscribe to the Bombthrower mailing list, or try the premium service for a month with our fully refundable trial offer.

International

MIPIM 2024 Reflects Mixed Feelings on CRE Recovery

Reportedly, concerns at the forefront include the plunging commercial real estate market (CRE). During the pandemic, many offices were vacated by staff,…

Reportedly, concerns at the forefront include the plunging commercial real estate market (CRE). During the pandemic, many offices were vacated by staff, and businesses established remote work practices. Since then, the market never fully recovered.

Based on Reuters information, the 20,000 attendees include property giants such as LaSalle, Greystar, AEW, Patrizia and Federated Hermes (FHI.N). Some representatives were cautiously optimistic and said there are tentative indications of CRE recovery.

Others, such as the head of Europe at LaSalle Investment Management, Philip La Pierre, could have been more positive. He reportedly said:

There’s a lot of hot air being pushed through the Croisette. So you’ve got to navigate that quite carefully.

Rising borrowing costs and post-pandemic open offices cast a shadow on property investments. Reuters reported that year-on-year European commercial capital values dropped by 13.9% in the last quarter of 2023. La Pierre opined that about 30% of European office space is a waste.

Don’t miss out the latest news, subscribe to LeapRate’s newsletter

The US commercial property sector mirrored the European situation. An 11 March 2024 MSCI report indicated that deteriorating office prices placed a yoke on the performance of the entire property market. This report did, however, note the uptick in the European hotel market.

The post MIPIM 2024 Reflects Mixed Feelings on CRE Recovery appeared first on LeapRate.

real estate pandemic recovery european europeInternational

Net Zero, The Digital Panopticon, & The Future Of Food

Net Zero, The Digital Panopticon, & The Future Of Food

Authored by Colin Todhunter via Off-Guardian.org,

The food transition, the energy…

Authored by Colin Todhunter via Off-Guardian.org,

The food transition, the energy transition, net-zero ideology, programmable central bank digital currencies, the censorship of free speech and clampdowns on protest. What’s it all about? To understand these processes, we need to first locate what is essentially a social and economic reset within the context of a collapsing financial system.

Writer Ted Reece notes that the general rate of profit has trended downwards from an estimated 43% in the 1870s to 17% in the 2000s. By late 2019, many companies could not generate enough profit. Falling turnover, squeezed margins, limited cashflows and highly leveraged balance sheets were prevalent.

Professor Fabio Vighi of Cardiff University has described how closing down the global economy in early 2020 under the guise of fighting a supposedly new and novel pathogen allowed the US Federal Reserve to flood collapsing financial markets (COVID relief) with freshly printed money without causing hyperinflation. Lockdowns curtailed economic activity, thereby removing demand for the newly printed money (credit) in the physical economy and preventing ‘contagion’.

According to investigative journalist Michael Byrant, €1.5 trillion was needed to deal with the crisis in Europe alone. The financial collapse staring European central bankers in the face came to a head in 2019. The appearance of a ‘novel virus’ provided a convenient cover story.

The European Central Bank agreed to a €1.31 trillion bailout of banks followed by the EU agreeing to a €750 billion recovery fund for European states and corporations. This package of long-term, ultra-cheap credit to hundreds of banks was sold to the public as a necessary programme to cushion the impact of the pandemic on businesses and workers.

In response to a collapsing neoliberalism, we are now seeing the rollout of an authoritarian great reset — an agenda that intends to reshape the economy and change how we live.

SHIFT TO AUTHORITARIANISM

The new economy is to be dominated by a handful of tech giants, global conglomerates and e-commerce platforms, and new markets will also be created through the financialisation of nature, which is to be colonised, commodified and traded under the notion of protecting the environment.

In recent years, we have witnessed an overaccumulation of capital, and the creation of such markets will provide fresh investment opportunities (including dodgy carbon offsetting Ponzi schemes) for the super-rich to park their wealth and prosper.

This great reset envisages a transformation of Western societies, resulting in permanent restrictions on fundamental liberties and mass surveillance. Being rolled out under the benign term of a ‘Fourth Industrial Revolution’, the World Economic Forum (WEF) says the public will eventually ‘rent’ everything they require (remember the WEF video ‘you will own nothing and be happy’?): stripping the right of ownership under the guise of a ‘green economy’ and underpinned by the rhetoric of ‘sustainable consumption’ and ‘climate emergency’.

Climate alarmism and the mantra of sustainability are about promoting money-making schemes. But they also serve another purpose: social control.

Neoliberalism has run its course, resulting in the impoverishment of large sections of the population. But to dampen dissent and lower expectations, the levels of personal freedom we have been used to will not be tolerated. This means that the wider population will be subjected to the discipline of an emerging surveillance state.

To push back against any dissent, ordinary people are being told that they must sacrifice personal liberty in order to protect public health, societal security (those terrible Russians, Islamic extremists or that Sunak-designated bogeyman George Galloway) or the climate. Unlike in the old normal of neoliberalism, an ideological shift is occurring whereby personal freedoms are increasingly depicted as being dangerous because they run counter to the collective good.

The real reason for this ideological shift is to ensure that the masses get used to lower living standards and accept them. Consider, for instance, the Bank of England’s chief economist Huw Pill saying that people should ‘accept’ being poorer. And then there is Rob Kapito of the world’s biggest asset management firm BlackRock, who says that a “very entitled” generation must deal with scarcity for the first time in their lives.

At the same time, to muddy the waters, the message is that lower living standards are the result of the conflict in Ukraine and supply shocks that both the war and ‘the virus’ have caused.

The net-zero carbon emissions agenda will help legitimise lower living standards (reducing your carbon footprint) while reinforcing the notion that our rights must be sacrificed for the greater good. You will own nothing, not because the rich and their neoliberal agenda made you poor but because you will be instructed to stop being irresponsible and must act to protect the planet.

NET-ZERO AGENDA

But what of this shift towards net-zero greenhouse gas emissions and the plan to slash our carbon footprints? Is it even feasible or necessary?

Gordon Hughes, a former World Bank economist and current professor of economics at the University of Edinburgh, says in a new report that current UK and European net-zero policies will likely lead to further economic ruin.

Apparently, the only viable way to raise the cash for sufficient new capital expenditure (on wind and solar infrastructure) would be a two decades-long reduction in private consumption of up to 10 per cent. Such a shock has never occurred in the last century outside war; even then, never for more than a decade.

But this agenda will also cause serious environmental degradation. So says Andrew Nikiforuk in the article The Rising Chorus of Renewable Energy Skeptics, which outlines how the green techno-dream is vastly destructive.

He lists the devastating environmental impacts of an even more mineral-intensive system based on renewables and warns:

“The whole process of replacing a declining system with a more complex mining-based enterprise is now supposed to take place with a fragile banking system, dysfunctional democracies, broken supply chains, critical mineral shortages and hostile geopolitics.”

All of this assumes that global warming is real and anthropogenic. Not everyone agrees. In the article Global warming and the confrontation between the West and the rest of the world, journalist Thierry Meyssan argues that net zero is based on political ideology rather than science. But to state such things has become heresy in the Western countries and shouted down with accusations of ‘climate science denial’.

Regardless of such concerns, the march towards net zero continues, and key to this is the United Nations Agenda 2030 for Sustainable Development Goals.

Today, almost every business or corporate report, website or brochure includes a multitude of references to ‘carbon footprints’, ‘sustainability’, ‘net zero’ or ‘climate neutrality’ and how a company or organisation intends to achieve its sustainability targets. Green profiling, green bonds and green investments go hand in hand with displaying ‘green’ credentials and ambitions wherever and whenever possible.

It seems anyone and everyone in business is planting their corporate flag on the summit of sustainability. Take Sainsbury’s, for instance. It is one of the ‘big six’ food retail supermarkets in the UK and has a vision for the future of food that it published in 2019.

Here’s a quote from it:

“Personalised Optimisation is a trend that could see people chipped and connected like never before. A significant step on from wearable tech used today, the advent of personal microchips and neural laces has the potential to see all of our genetic, health and situational data recorded, stored and analysed by algorithms which could work out exactly what we need to support us at a particular time in our life. Retailers, such as Sainsbury’s could play a critical role to support this, arranging delivery of the needed food within thirty minutes — perhaps by drone.”

Tracked, traced and chipped — for your own benefit. Corporations accessing all of our personal data, right down to our DNA. The report is littered with references to sustainability and the climate or environment, and it is difficult not to get the impression that it is written so as to leave the reader awestruck by the technological possibilities.

However, the promotion of a brave new world of technological innovation that has nothing to say about power — who determines policies that have led to massive inequalities, poverty, malnutrition, food insecurity and hunger and who is responsible for the degradation of the environment in the first place — is nothing new.

The essence of power is conveniently glossed over, not least because those behind the prevailing food regime are also shaping the techno-utopian fairytale where everyone lives happily ever after eating bugs and synthetic food while living in a digital panopticon.

FAKE GREEN

The type of ‘green’ agenda being pushed is a multi-trillion market opportunity for lining the pockets of rich investors and subsidy-sucking green infrastructure firms and also part of a strategy required to secure compliance required for the ‘new normal’.

It is, furthermore, a type of green that plans to cover much of the countryside with wind farms and solar panels with most farmers no longer farming. A recipe for food insecurity.

Those investing in the ‘green’ agenda care first and foremost about profit. The supremely influential BlackRock invests in the current food system that is responsible for polluted waterways, degraded soils, the displacement of smallholder farmers, a spiralling public health crisis, malnutrition and much more.

It also invests in healthcare — an industry that thrives on the illnesses and conditions created by eating the substandard food that the current system produces. Did Larry Fink, the top man at BlackRock, suddenly develop a conscience and become an environmentalist who cares about the planet and ordinary people? Of course not.

Any serious deliberations on the future of food would surely consider issues like food sovereignty, the role of agroecology and the strengthening of family farms — the backbone of current global food production.

The aforementioned article by Andrew Nikiforuk concludes that, if we are really serious about our impacts on the environment, we must scale back our needs and simplify society.

In terms of food, the solution rests on a low-input approach that strengthens rural communities and local markets and prioritises smallholder farms and small independent enterprises and retailers, localised democratic food systems and a concept of food sovereignty based on self-sufficiency, agroecological principles and regenerative agriculture.

It would involve facilitating the right to culturally appropriate food that is nutritionally dense due to diverse cropping patterns and free from toxic chemicals while ensuring local ownership and stewardship of common resources like land, water, soil and seeds.

That’s where genuine environmentalism and the future of food begins.

Government

Five Aerospace Investments to Buy as Wars Worsen Copy

Five aerospace investments to buy as wars worsen give investors a chance to acquire shares of companies focused on fortifying national defense. The five…

Five aerospace investments to buy as wars worsen give investors a chance to acquire shares of companies focused on fortifying national defense.

The five aerospace investments to buy provide military products to help protect freedom amid Russia’s ongoing onslaught against Ukraine that began in February 2022, as well as supply arms in the Middle East used after Hamas militants attacked and murdered civilians in Israel on Oct. 7. Even though the S&P 500 recently reached all-time highs, these five aerospace investments have remained reasonably priced and rated as recommendations by seasoned analysts and a pension fund chairman.

State television broadcasts in Russia show the country’s soldiers advancing further into Ukrainian territory, but protests have occurred involving family members of those serving in perilous conditions in the invasion of their neighboring nation to be brought home. Even though hundreds of thousands of Russians also have fled to other countries to avoid compulsory military service, the aggressor’s President Vladimir Putin has vowed to continue to send additional soldiers into the fierce fighting.

While Russia’s land-grab of Crimea and other parts of Ukraine show no end in sight, Israel’s war with Hamas likely will last for at least additional months, according to the latest reports. United Nations’ leaders expressed alarm on Dec. 26 about intensifying Israeli attacks that killed more than 100 Palestinians over two days in part of the Gaza Strip, when 15 members of the Israel Defense Force (IDF) also lost their lives.

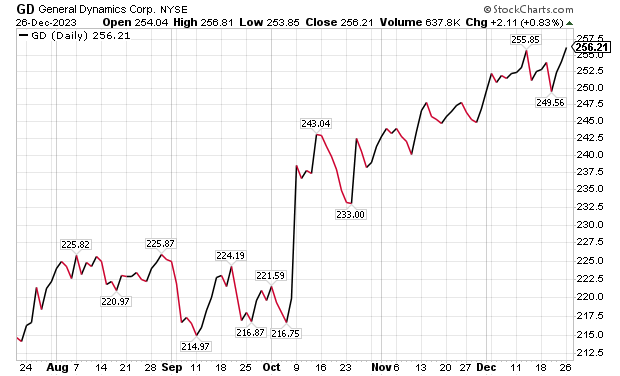

Five Aerospace Investments to Buy as Wars Worsen: General Dynamics

One of the five aerospace investments to buy as wars worsen is General Dynamics (NYSE: GD), a Reston, Virginia-based aerospace company with more than 100,000 employees in 70-plus countries. A key business unit of General Dynamics is Gulfstream Aerospace Corporation, a manufacturer of business aircraft. Other segments of General Dynamics focus on making military products such as Abrams tanks, Stryker fighting vehicles, ASCOD fighting vehicles like the Spanish PIZARRO and British AJAX, LAV-25 Light Armored Vehicles and Flyer-60 lightweight tactical vehicles.

For the U.S. Navy and other allied armed forces, General Dynamics builds Virginia-class attack submarines, Columbia-class ballistic missile submarines, Arleigh Burke-class guided missile destroyers, Expeditionary Sea Base ships, fleet logistics ships, commercial cargo ships, aircraft and naval gun systems, Hydra-70 rockets, military radios and command and control systems. In addition, the company provides radio and optical telescopes, secure mobile phones, PIRANHA and PANDUR wheeled armored vehicles and mobile bridge systems.

Chicago-based investment firm William Blair & Co. is among those recommending General Dynamics. The Chicago firm gave an “outperform” rating to General Dynamics in a Dec. 21 research note.

Gulfstream is seeking G700 FAA certification by the end of 2023, suggesting potentially positive news in the next 10 days, William Blair wrote in its recent research note. The investment firm projected that General Dynamics would trade upward upward upon the G700’s certification.

“General Dynamics’ 2023 aircraft delivery guidance of approximately 134 planes assumes that 19 G700s are delivered in the fourth quarter,” wrote William Blair’s aerospace and defense analyst Louie DiPalma. “Even if deliveries fall short of this target, we believe investors will take a glass-half-full approach upon receipt of the certification.”

Chart courtesy of www.stockcharts.com.

Five Aerospace Investments to Buy as Wars Worsen: GD Outlook

The G700 is a major focus area for investors because it is Gulfstream’s most significant aircraft introduction since the iconic G650 in 2012, DiPalma wrote. Gulfstream has the highest market share in the long-range jet segment of the private aircraft market, the highest profit margin of aircraft peers and the most premium business aviation brand, he added.

“The aircraft remains immensely popular today with corporations and high-net-worth individuals,” Di Palma wrote. “Elon Musk has reportedly placed an order for a G700 to go along with his existing G650. Qatar Airways announced at the Paris Air Show that 10 G700 aircraft will become part of its fleet.”

G700 deliveries and subsequent G800 deliveries are expected to be the cornerstone of Gulfstream’s growth and margin expansion for the next decade, DiPalma wrote. This should lead to a rebound in the stock price as the margins for the G700 and G800 are very attractive, he added.

Management’s guidance is for the aerospace operating margin to increase from about 13.2% in 2022 to roughly 14.0% in 2023 and 15.8% in 2024. Longer term, a high-teens profit margin appears within reach, DiPalma projected.

In other General Dynamics business segments, William Blair expects several yet-unannounced large contract awards for General Dynamics IT, to go along with C$1.7 billion, or US$1.29 billion, in General Dynamics Mission Systems contracts announced on Dec. 20 for the Canadian Army. General Dynamics shares are poised to have a strong 2024, William Blair wrote.

Five Aerospace Investments to Buy as Wars Worsen: VSE Corporation

Alexandria, Virginia-based VSE Corporation’s (NASDAQ: VSEC) price-to-earnings (P/E) valuation multiple of 22 received support when AAR Corp. (NYSE: AIR), a Wood Dale, Illinois, provider of aviation services, announced on Dec. 21 that it would acquire the product support business of Triumph Group (NYSE: TGI), a Berwyn, Pennsylvania, supplier of aerospace services, structures and systems. AAR’s purchase price of $725 million reflects confidence in a continued post-pandemic aerospace rebound.

VSE, a provider of aftermarket distribution and repair services for land, sea and air transportation assets used by government and commercial markets, is rated “outperform” by William Blair. The company’s core services include maintenance, repair and operations (MRO), parts distribution, supply chain management and logistics, engineering support, as well as consulting and training for global commercial, federal, military and defense customers.

“Robust consumer travel demand and aging aircraft fleets have driven elevated maintenance visits,” William Blair’s DiPalma wrote in a Dec. 21 research note. “The AAR–Triumph deal is valued at a premium 13-times 2024 EBITDA multiple, which was in line with the valuation multiple that Heico (NYSE: HEI) paid for Wencor over the summer.”

VSE currently trades at a discounted 9.5 times consensus 2024 earnings before interest, taxes, depreciation and amortization (EBITDA) estimates, as well as 11.6 times consensus 2023 EBITDA.

Five Aerospace Investments to Buy as Wars Worsen: VSE Undervalued?

“We expect that VSE shares will trend higher as investors process this deal,” DiPalma wrote. “VSE shares trade at 9.5 times consensus 2024 adjusted EBITDA, compared with peers and M&A comps in the 10-to-14-times range. We think that VSE’s multiple will expand as it closes the divestiture of its federal and defense business and makes strategic acquisitions. We see consistent 15% annual upside for shares as VSE continues to take share in the $110 billion aviation aftermarket industry.”

William Blair reaffirmed its “outperform” rating for VSE on Dec. 21. The main risk to VSE shares is lumpiness associated with its aviation services margins, Di Palma wrote. However, he raised 2024 estimates to further reflect commentary from VSE’s analysts’ day in November.

Chart courtesy of www.stockcharts.com.

Five Aerospace Investments to Buy as Wars Worsen: HEICO Corporation

HEICO Corporation (NYSEL: HEI), is a Hollywood, Florida-based technology-driven aerospace, industrial, defense and electronics company that also is ranked as an “outperform” investment by William Blair’s DiPalma. The aerospace aftermarket parts provider recently reported fourth-quarter financials above consensus analysts’ estimates, driven by 20% organic growth in HEICO’s flight support group.

HEICO’s management indicated that the performance of recently acquired Wencor is exceeding expectations. However, HEICO leaders offered color on 2024 organic growth and margin expectations that forecast reduced gains. Even though consensus estimates already assumed slowing growth, it is still not a positive for HEICO, DiPalma wrote.

William Blair forecasts 15% annual upside to HEICO’s shares, based on EBITDA growth. HEICO’s management cited a host of reasons for its quarterly outperformance, highlighted by the continued commercial air travel recovery. The company also referenced new product introductions and efficiency initiatives.

HEICO’s defense product sales increased by 26% sequentially, marking the third consecutive sequential increase in defense product revenue. The company’s leaders conveyed that defense in general is moving in the right direction to enhance financial performance.

Chart courtesy of www.stockcharts.com.

Five Dividend-paying Defense and Aerospace Investments to Purchase: XAR

A fourth way to obtain exposure to defense and aerospace investments is through SPDR S&P Aerospace and Defense ETF (XAR). That exchange-traded fund tracks the S&P Aerospace & Defense Select Industry Index. The fund is overweight in industrials and underweight in technology and consumer cyclicals, said Bob Carlson, a pension fund chairman who heads the Retirement Watch investment newsletter.

Bob Carlson, who heads Retirement Watch, answers questions from Paul Dykewicz.

XAR has 34 securities, and 44.2% of the fund is in the 10 largest positions. The fund is up 25.82% in the last 12 months, 22.03% in the past three months and 7.92% for the last month. Its dividend yield recently measured 0.38%.

The largest positions in the fund recently were Axon Enterprise (NASDAQ: AXON), Boeing (NYSE: BA), L3Harris Technologies (NYSE: LHX), Spirit Aerosystems (NYSE: SPR) and Virgin Galactic (NYSE: SPCE).

Chart courtesy of www.stockcharts.com

Five Dividend-paying Defense and Aerospace Investments to Purchase: PPA

The second fund recommended by Carlson is Invesco Aerospace & Defense ETF (PPA), which tracks the SPADE Defense Index. It has the same underweighting and overweighting as XAR, he said.

PPA recently held 52 securities and 53.2% of the fund was in its 10 largest positions. With so many holdings, the fund offers much reduced risk compared to buying individual stocks. The largest positions in the fund recently were Boeing (NYSE: BA), RTX Corp. (NYSE: RTX), Lockheed Martin (NYSE: LMT), Northrop Grumman (NYSE: NOC) and General Electric (NYSE:GE).

The fund is up 19.07% for the past year, 50.34% in the last three months and 5.30% during the past month. The dividend yield recently touched 0.69%.

Chart courtesy of www.stockcharts.com

Other Fans of Aerospace

Two fans of aerospace stocks are Mark Skousen, PhD, and seasoned stock picker Jim Woods. The pair team up to head the Fast Money Alert advisory service They already are profitable in their recent recommendation of Lockheed Martin (NYSE: LMT) in Fast Money Alert.

Mark Skousen, a scion of Ben Franklin, meets with Paul Dykewicz.

Jim Woods, a former U.S. Army paratrooper, co-heads Fast Money Alert.

Bryan Perry, who heads the Cash Machine investment newsletter and the Micro-Cap Stock Trader advisory service, recommends satellite services provider Globalstar (NYSE American: GSAT), of Covington, Louisiana, that has jumped 50.00% since he advised buying it two months ago. Perry is averaging a dividend yield of 11.14% in his Cash Machine newsletter but is breaking out with the red-hot recommendation of Globalstar in his Micro-Cap Stock Trader advisory service.

Bryan Perry heads Cash Machine, averaging an 11.14% dividend yield.

Military Equipment Demand Soars amid Multiple Wars

The U.S. military faces an acute need to adopt innovation, to expedite implementation of technological gains, to tap into the talents of people in various industries and to step-up collaboration with private industry and international partners to enhance effectiveness, U.S. Joint Chiefs of Staff Gen. Charles Q. Brown Jr. told attendees on Nov 16 at a national security conference. Prime examples of the need are showed by multiple raging wars, including the Middle East and Ukraine. A cold war involves China and its increasingly strained relationships with Taiwan and other Asian nations.

The shocking Oct. 7 attack by Hamas on Israel touched off an ongoing war in the Middle East, coupled with Russia’s February 2022 invasion and continuing assault of neighboring Ukraine. Those brutal military conflicts show the fragility of peace when determined aggressors are willing to use any means necessary to achieve their goals. To fend off such attacks, rapid and effective response is required.

“The Department of Defense is doing more than ever before to deter, defend, and, if necessary, defeat aggression,” Gen. Brown said at the National Security Innovation Forum at the Johns Hopkins University Bloomberg Center in Washington, D.C.

One of Russia’s war ships, the 360-foot-long Novocherkassk, was damaged on Dec. 26 by a Ukrainian attack on the Black Sea port of Feodosia in Crimea. This video of an explosion at the port that reportedly shows a section of the ship hit by aircraft-guided missiles.

Chairman Joint Chiefs of Staff Gen. Charles Q. Brown, Jr.

Photo By: Benjamin Applebaum

National security threats can compel immediate action, Gen. Brown said he quickly learned since taking his post on Oct. 1.

“We may not have much warning when the next fight begins,” Gen. Brown said. “We need to be ready.”

In a pre-recorded speech at the national security conference, Michael R. Bloomberg, founder of Bloomberg LP, told the John Hopkins national security conference attendees about the critical need for collaboration between government and industry.

“Building enduring technological advances for the U.S. military will help our service members and allies defend freedom across the globe,” Bloomberg said.

The “horrific terrorist attacks” against Israel and civilians living there on Oct. 7 underscore the importance of that mission, Bloomberg added.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Attention Holiday Gift Buyers! Consider purchasing Paul’s inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases or autographed copies! Follow Paul on Twitter @PaulDykewicz. He is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper, after writing for the Baltimore Business Journal and Crain Communications.

The post Five Aerospace Investments to Buy as Wars Worsen Copy appeared first on Stock Investor.

dow jones sp 500 nasdaq stocks pandemic etf micro-cap army recovery russia ukraine china-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges