The Only “Covid Recovery” Stock You’ll Need

Investors AlleyThe Only “Covid Recovery” Stock You’ll Need

Dear Reader, I have seen and heard about a wide range of stocks that investment pundits recommend you buy to profit from the recovery from the coronavirus pandemic. With stock prices zooming…

Investors Alley

The Only “Covid Recovery” Stock You’ll Need

Dear Reader,

I have seen and heard about a wide range of stocks that investment pundits recommend you buy to profit from the recovery from the coronavirus pandemic.

With stock prices zooming higher through 2021, it’s hard to determine which “recovery” stocks still have room to run. Here is one that will do very well in your portfolio.

EPR Properties (EPR) operates as a real estate investment trust (REIT) that primarily owns properties leased to entertainment and “experiential” businesses. The pandemic-triggered shutdown landed directly on EPR’s tenants.

Before the pandemic, EPR spent a decade as an outstanding dividend growth stock. You won’t find many companies with this type of dividend history:

• Monthly dividend payments

• Average yield around 6%

• Annual dividend growth of 7%

EPR had all the characteristics of a buy-and-hold-forever stock until the pandemic moved “forever” to early 2020. EPR suspended dividend payments in April of last year.

EPR owns movie theaters and seven other types of experiential real estate properties. As a REIT, EPR owns the properties and collects the rent or lease payments. Here are the property types and percent of revenue produced by each:

In August 2021, EPR restarted monthly dividends at a $0.25 per share rate. At the current $50.50 share price, EPR yields 5.9%, right at the historical average. Here are the catalysts for EPR to outperform over the next year or longer.

For the 2021 third quarter, EPR collected 90% of contractual cash revenue. That percentage will continue to climb to 100%.

Before the shutdown, the EPR dividend was $0.385 per share. As the company gets back to full cash collection, I expect the dividend to ramp up from the current $0.25 to its pre-crash rate.

EPR shares traded in the high $70s, pre-crash. A growing dividend plus the market pricing this stock to yield 6% means the share price will continue to appreciate.

After more than a half spent in relative isolation, many people are clamoring for experiential activities. The properties EPR owns offer entertainment choices near where people live. Movies, restaurants, and other entertainment venues are roaring back.

Now, through the crash and recovery, I provided recommendations to my Dividend Hunter subscribers on when to sell EPR and when to get back in. I did the same for all the stocks on the Dividend Hunter high-yield investments list.

If you want to get those updates, as well as the full list of 30+ high-yield, low-risk Dividend Hunter stocks, click here for more info.

[TRENDING NOW]: This 36-Month Accelerated Income Plan Pays Your Bills For Life...

Even In Downturns and Market Crashes

One simple plan takes minutes to set up, yet could pay all your bills for life. No longer will your mailbox be stuffed with ‘payment due’ envelopes.

This is our most powerful plan we’ve ever put together... and over 20,000 retirement investors have already used its recommendations.

There is still time to start generating $4,084 per month for life... but the window is closing. Click here for complete details.

The Only “Covid Recovery” Stock You’ll Need

Tim Plaehn

International

The Realpolitik Grand Divergence

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively…

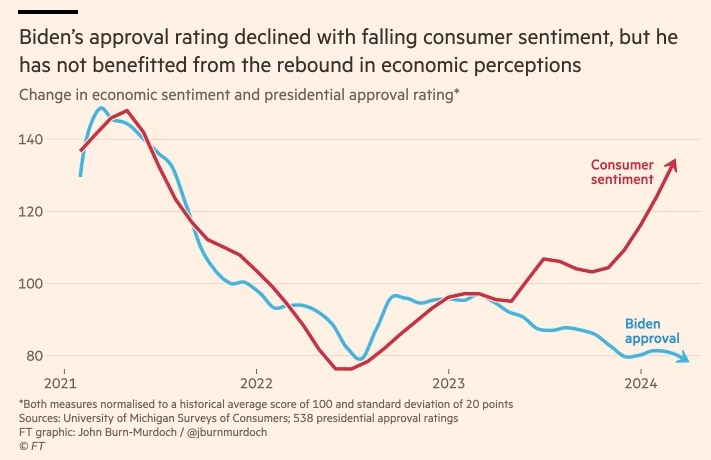

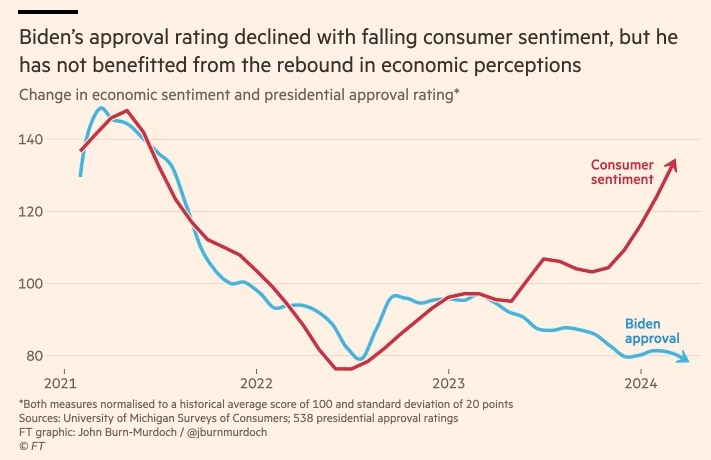

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively impacted incumbent approval ratings. President Biden’s approval ratings remain unaffected despite recent economic improvements, suggesting a decoupling of economic sentiment and political fortunes. This phenomenon, which contrasts with stable economic-political linkages in Europe, is attributed to the U.S.’s heightened partisan divide, where political allegiance increasingly dictates economic perception, challenging the traditional belief that “It’s the economy, stupid” in American politics.

Key Points:

- President Clinton’s political advisor, James Carville, highlighted the economy’s role in political success during 1992 presidential campaign with assertion, “It’s the economy, stupid.”

- Voter sentiment has traditionally linked to economic performance, affecting incumbent party success.

- Recent trends show a disconnect between the U.S. economy’s health and President Biden’s approval ratings.

- The COVID-19 pandemic and inflation crisis may have influenced this anomaly, yet the shift predates these events.

- Research indicates a decoupling of economic sentiment and presidential approval in the U.S. since Obama’s tenure.

- This phenomenon seems unique to the U.S., with European governments’ popularity still tied to economic conditions.

- U.S. political polarization may explain the decoupling, with partisan views influencing economic perceptions.

- Studies suggest that political biases skew individual economic assessments (confirmation bias) impacting presidential approval.

- The current U.S. political climate suggests economic policy impact on electoral decisions is diminishing.

- Contrasts with Europe, where economic sentiment is more uniform across political lines, suggesting a more rational political-economic relationship.

Source: Financial Times

european europe pandemic covid-19Government

FDA Settles Ivermectin Case, Agrees To Remove Controversial ‘Stop It’ Post

FDA Settles Ivermectin Case, Agrees To Remove Controversial ‘Stop It’ Post

Authored by Zachary Steiber via The Epoch Times (emphasis ours),

The…

Authored by Zachary Steiber via The Epoch Times (emphasis ours),

The U.S. Food and Drug Administration (FDA) has agreed to remove social media posts and webpages that urged people to stop taking ivermectin to treat COVID-19, according to a settlement dated March 21.

The FDA has already removed a page that said: “Should I take ivermectin to prevent or treat COVID-19? No.”

Within 21 days, the FDA will remove another page titled, “why you should not use ivermectin to treat or prevent COVID-19,” according to the settlement announcement, which was filed with federal court in southern Texas.

“The FDA has not authorized or approved ivermectin for use in preventing or treating COVID-19 in humans or animals,” the page currently states. It also says that data do not show ivermectin is effective against COVID-19, despite how some studies it cites show ivermectin is effective against the illness.

The FDA in the settlement is also agreeing to delete multiple social media posts that came out strongly against ivermectin, including one that stated: “You are not a horse. You are not a cow. Seriously, y’all. Stop it.”

In exchange, doctors who sued the agency are dismissing their claims, the filing states.

“FDA loses its war on ivermectin and agrees to remove all social media posts and consumer directives regarding ivermectin and COVID, including its most popular tweet in FDA history,” Dr. Mary Talley Bowden, one of the doctors, said in a statement. “This landmark case sets an important precedent in limiting FDA overreach into the doctor-patient relationship.”

“We are extremely pleased with the outcome of the settlement as it is a victory for every doctor and patient in the United States,” added Dr. Paul Marik, chief scientific officer of the FLCCC Alliance and another plaintiff. “The FDA interfered in the practice of medicine with their irresponsible language and posts about ivermectin. We will never know how many lives were affected because patients were denied access to a lifesaving treatment because their doctor was ‘just following the FDA.’”

An FDA spokesperson told The Epoch Times in an email that the agency “has chosen to resolve this lawsuit rather than continuing to litigate over statements that are between two and nearly four years old.”

“FDA has not admitted any violation of law or any wrongdoing, disagrees with the plaintiffs’ allegation that the agency exceeded its authority in issuing the statements challenged in the lawsuit, and stands by its authority to communicate with the public regarding the products it regulates,” the spokesperson said. “FDA has not changed its position that currently available clinical trial data do not demonstrate that ivermectin is effective against COVID-19. The agency has not authorized or approved ivermectin for use in preventing or treating COVID-19.”

Ivermectin was approved by the FDA in 1996 to treat several conditions, including onchocerciasis, a tropical disease caused by a parasitic worm.

In the United States, it’s common for doctors to prescribe medicine off-label, or for a different purpose than the one for which the medicine is approved.

After some doctors began prescribing ivermectin for COVID-19, the FDA ramped up its campaign, including the Aug. 21, 2021, post on Twitter, now known as X.

Dr. Bowden and two other doctors sued the FDA, arguing the agency’s actions went beyond its authority, as conferred on it by Congress.

U.S. District Judge Jeffrey Brown dismissed the case in 2022, ruling that the FDA did not act outside the authority. But an appeals court in 2023 ruled in favor of the doctors, finding that the agency “has identified no authority allowing it to recommend consumers ‘stop’ taking medicine.”

Between the time of the ruling and the settlement, the FDA refused to change any of its statements on ivermectin, and asked for a fresh dismissal of the suit.

The Case

Drs. Robert Apter, Bowden, and Marik brought the case in 2022. They said they suffered repercussions after prescribing ivermectin to patients with COVID-19, and that the FDA was to blame.

Dr. Apter, for instance, said that pharmacists refused to fill the prescriptions, citing the FDA.

“This refusal delays his patients in obtaining their prescribed treatment—when early intervention is paramount—while they look for a pharmacy to fill their prescription, if they can find one at all,” the suit states.

He also said that insurance companies were refusing to pay for ivermectin to treat COVID-19.

The suit said the FDA illegally interfered with the relationships between the doctors and patients. The doctors said with regard to ivermectin, the FDA overstepped the authority conferred on it in the Federal Food, Drug, and Cosmetic Act.

Government lawyers argued that the FDA was acting within the confines of the law, and succeeded in getting the dismissal.

Judge Brown, appointed under President Donald Trump, said the FDA’s powers were only limited with regard to medical devices.

“As there is no statute limiting the FDA’s actions here, it cannot have acted outside of any statutory limitations,” he wrote in his ruling. “Further, it cannot be said that the FDA had no colorable basis of authority. The FDA is charged by Congress with protecting public health and ensuring that regulated medical products are safe and effective, among other things.”

A three-judge panel of the U.S. Court of Appeals for the Fifth Circuit disagreed, finding that the law did not authorize the FDA to give medical advice.

“FDA can inform, but it has identified no authority allowing it to recommend consumers ‘stop’ taking medicine,” U.S. Circuit Judge Don Willett, appointed under President Trump, wrote for the court. The appeals court remanded the case back to the district court.

International

The Grand Realpolitik Divergence

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively…

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively impacted incumbent approval ratings. President Biden’s approval ratings remain unaffected despite recent economic improvements, suggesting a decoupling of economic sentiment and political fortunes. This phenomenon, which contrasts with stable economic-political linkages in Europe, is attributed to the U.S.’s heightened partisan divide, where political allegiance increasingly dictates economic perception, challenging the traditional belief that “it’s the economy, stupid” in American politics.

Key Points:

- President Clinton’s political advisor, James Carville, highlighted the economy’s role in political success during 1992 presidential campaign with assertion, “It’s the economy, stupid.”

- Voter sentiment has traditionally linked to economic performance, affecting incumbent party success.

- Recent trends show a disconnect between the U.S. economy’s health and President Biden’s approval ratings.

- The COVID-19 pandemic and inflation crisis may have influenced this anomaly, yet the shift predates these events.

- Research indicates a decoupling of economic sentiment and presidential approval in the U.S. since Obama’s tenure.

- This phenomenon seems unique to the U.S., with European governments’ popularity still tied to economic conditions.

- S. political polarization may explain the decoupling, with partisan views influencing economic perceptions.

- Studies suggest that political biases skew individual economic assessments, impacting presidential approval.

- The current U.S. political climate suggests economic policy impact on electoral decisions is diminishing.

- Contrasts with Europe, where economic sentiment is more uniform across political lines, suggesting a more rational political-economic relationship.

Source: Financial Times

european europe pandemic covid-19-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoKey Events This Week: All Eyes On Core PCE Amid Deluge Of Fed Speakers

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoA Blue State Exodus: Who Can Afford To Be A Liberal