The Lithium Breakthrough That Could Transform The Mining Industry

The

lithium-technology space is in a desperate race to build a better battery in

time to keep pace with an energy transition that is mainstreaming electric

vehicles.

Certain companies in this space working on battery breakthroughs are soaring.

Quantumsca

The lithium-technology space is in a desperate race to build a better battery in time to keep pace with an energy transition that is mainstreaming electric vehicles.

Certain companies in this space working on battery breakthroughs are soaring.

Quantumscape has gained nearly 60% in October thanks to the development progress in its solid-state lithium battery for EVs.

It’s all about coming up with a better battery that’s cheaper and holds its charge longer, and the rush to the finish line here has created no less than a “Battery Arms Race”.

But we think betting on which one of these companies will reach the solid-state commercial finish line first means nothing without serious breakthroughs in the exploration and extraction of one of the key metals that underpin the entire EV and energy storage equation: Lithium.

A lithium shortage could stall the EV push and halt the battery arms race in its tracks. As it stands, it is questionable at best whether lithium supplies can keep up with the forecast of a huge increase in demand.

The Western world may have a critical weakness in the lithium-ion supply chain, according to a Forbes report.

A key problem isn’t just the lack of new lithium discoveries in North America—it’s the difference between two different kinds of lithium mining processes…

And until now, one of them has largely been off limits due to environmental concerns and prohibitive costs.

Medaro Mining (CSE:MEDA; OTCMKTS:MEDAF), a Canadian junior lithium explorer, isn’t just sitting on lithium exploration territory…

It’s also behind what we think could become one of the biggest potential breakthroughs lithium mining has ever seen. The technology it’s developing could be the key to unlocking a new treasure trove of lithium from hard rock mining.

It could reduce hard-rock lithium mining costs by up to 30-50%.

The Company holds an interest in a JV to develop a novel, ESG-compliant processing technology designed to greatly simplify and accelerate lithium recovery in hard-rock mining and aimed at lowering production costs and improving production quality and efficiency.

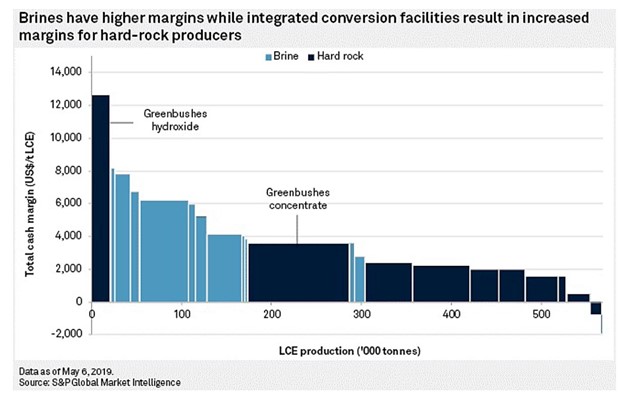

The ultimate goal: To make hardrock lithium manufacturing cheaper than production from brine sources.

In our view, Medaro Mining isn’t just another player in a crowded but slow-moving lithium production space. Its technology, if developed and commercialized, could be an integral part of the future of lithium mining.

Here are 5 reasons to keep a very close eye on Medaro Mining (CSE:MEDA; OTCMKTS:MEDAF) right now:

#1 Exciting Potential in This Innovative New Lithium Extraction Tech

The technology Medaro is developing could unlock significant value in lithium reserves that have until now been considered uneconomical. In this energy transition market, a developed technology with that potential could reverberate across industries and around the world. It could create potential cost savings for everyone from lithium producers to battery makers along the surging EV and energy storage industries.

The cost savings for lithium mining could be up to 30-50%.

Lithium is used in a huge cross-section of industries—not just EVs, though the EV revolution is what makes the demand picture problematic for supply.

This most famous of battery metals can be obtained either from subsurface brines or spodumene-bearing pegmatite deposits. Lithium from the brine is much easier to extract because you pump the lithium-bearing brines out of the ground and then treat them to form lithium carbonate or lithium hydroxide. The process doesn’t involve traditional mining. But we need more supply than North America’s brine deposits can offer.

That brings us to hard-rocking mining of spodumene pegmatite deposits, which requires traditional mining and processing through which lithium is extracted and converted to lithium carbonate and/or lithium hydroxide.

Medaro Mining’s plan is to develop its new technology to disrupt the hard-rock lithium mining industry by making the processing better, more efficient and cheaper through a system of rapid extraction and reduced transport costs.

The end game here is to make hard-rocking lithium mining as cheap and efficient—if not more so—than extraction of lithium from the brine.

If successfully developed, the technology could completely reshape the future of hardrock lithium mining and manufacturing.

And it could be battery-grade lithium ready for the market.

This could reduce supply chain costs and bottlenecks and might be scalable at an industrial level, with potentially global implications for the industry.

And it could be made easy for end-users: the Medaro technology could be installed directly at lithium producers’ sites.

Hard-rock lithium miners might set up Medaro-licensed processing facilities right next to their mines. That could mean they would be able to ship battery grade lithium and valuable by-products directly to markets.

Remote location? Limited room for a processing facility? Likely not a problem. Medaro’s technology is aimed to be compact, modular and highly scalable.

If successfully developed, the Medaro Mining (CSE:MEDA; OTCMKTS:MEDAF) technology could be implemented in remote areas close to productive mines. A Medaro-designed processing facility might be built almost anywhere, with scalability potential of up to 50-100 tonnes per day, or more, in the roughest terrains.

#2 A Potential Major ESG Boost for Lithium

Medaro’s HLT lithium recovery process is a unique solvent extraction technology aimed to rapidly manufacture high-purity forms of Lithium Carbonate (Li2CO3), Lithium Hydroxide (LiOH), and lithium metal (Li).

Not only does preliminary technical and economic analysis indicate that Medaro’s technology could lower spodumene processing costs by up to 50%, but the entire system could be powered by clean energy, including hydroelectric, solar or wind power.

There is potential for minimal cleanup costs.

Medaro’s HLT lithium recovery process is a dual closed loop thermochemical technology:

It uses no hydrocarbons, no sulfur, or chlorine. In fact, it employs only materials that are abundant on earth.

The technology requires only three feedstock materials:

- Spodumene concentrate

- High-purity Carbon Dioxide (CO2), which is consumed in forming lithium carbonate

- High-purity water (H2O), which is consumed in forming lithium hydroxide

And there are no associated CO2 emissions because this is a closed-loop process run on clean energy. That alone may mean lower costs and a much smaller manufacturing footprint.

With the single exception of the calcination of spodumene, which takes place at a temperature of 1000-1100°C, all of the chemical reactions occur at temperatures below 250 °C.

A negligible amount of solid waste—all of it benign—is created in the process.

Dual closed-loop ensures solvents, leachates, and precipitants are continually recycled.

Virtually zero waste equals significant potential savings compared to other methods.

#3 A Green Mining Story—All the Way

We think this could be one of the most compelling “green mining” narratives out there right now.

Medaro Mining (CSE:MEDA; OTCMKTS:MEDAF) was created specifically with this in mind.

Its innovative lithium technology could green the industry …

Its lithium land packages might hold great commercial potential.

The company also has what could be a highly promising uranium mining play.

And we think it’s all about going green in an ESG investment environment that is pushing big money into the space at breakneck speed.

Medaro’s Superb Lake Property in Ontario’s Thunder Bay Mining District is an exploration stage prospect covering nearly 2,200 hectares with 8 mining claims. The results of four samples taken here indicate lithium oxide values in the range of 1.77% to 4.03%.

Medaro has a second lithium property in Quebec’s James Bay Mining Region. Here, Medaro has acquired the rights to the Cyr South Lithium Property covering over 2,700 hectares with 52 mining claims.

This property is right near the Galaxy Resources lithium project, which has a 40-million-tonne resource indication. So, when Medaro saw the opportunity, they jumped on it quickly.

If a commercially viable lithium resource is found and developed, battery-grade Lithium Carbonate production could net Medaro up to $20,000/tonne, while battery-grade Lithium Hydroxide could fetch up to $22,000/tonne.

But while the founders of Medaro were busy hunting for more and bigger lithium assets, they came across the technology that, once developed, could change everything. Now that this technology is in hand and being developed, they’re still on the hunt for even bigger lithium assets where it can be deployed.

And in the meantime, Medaro is also scooping up uranium deals, with more “green” in mind.

On November 2, Medaro entered into an option agreement with Skyharbour Resources Inc. (TSX-V.SYH) (OTCQB:SYHBF) to acquire up to a 100% interest in the Yurchison Uranium property in Northern Saskatchewan.

This is a massive, nearly 56,000-hectare property with 12 mineral claims. Yurchison is a historical uranium play where prospecting has returned significant uranium mineralization from 0.09% to 0.30%. The recovery potential here could be strong, and is expected to host copper, zinc and molybdenum mineralization, as well.

Even better in our view, this play is on-strike with giant Rio Tinto’s Janice Lake property.

The possible revenue lines could continue with the potential for Medaro to sell the by-products of its extraction technology, including potentially lucrative commercial-grade aluminum hydroxide and silica …

Medaro Mining (CSE:MEDA; OTCMKTS:MEDAF) could fetch up to $1,000/tonne for its by-product commercial grades of low sodium alumina, calcium carbonate and silica.

#4 The Global Licensing Opportunity

We think the real gold mine here could be a global technology licensing opportunity, for which Medaro and its JV partner would control all the intellectual property rights. With the targeted savings of up to 30-50% compared to traditional lithium processing operations, Medaro aims to patent and license the technology to derive multiple, potential long-term revenue generation.

The technology is in the piping and instrumentation design phase, and once that is concluded, the JV will be ready to design, build and operate their first pilot plant.

And in our view they’ve got the management team that could bring it all home.

James G. Blencoe, Ph.D. is the man behind the development of the technology, and Medaro’s CTO. Dr. Blencoe is a widely published scientist and engineer who has been inventing new technologies since the early 2000s. He has decades of geoscience and geochemistry experience and has served as CTO and Chief Scientist for a number of innovative companies across North America.

CEO & Director Hugh Maddin is a veteran executive for mineral holding companies, while President & Director Faizaan Lalani has a proven track record in this space as CFO of United Lithium Corp. Director Shaun Mann has decades of mining experience and has held senior roles at major mining companies, including with Goldcorp and Newmont during their $10-billion mega-merger.

#5 The Bottom Line: Cost-Reduction and ESG Focused

Medaro Mining (CSE:MEDA; OTCMKTS:MEDAF), which has the right to acquire 100% of the developed tech and control the global licensing of its JV, reports it is getting high recovery of lithium in tests so far. The extraction process is said to be a fast process that could have huge cost-reduction implications for a supply chain that desperately needs it.

The emphasis here is on green mining and manufacturing, and we think that should resonate with the big capital pouring into environmentally friendly plays right now—especially those feeding into the energy transition, which is nothing without EVs and batteries for renewable energy storage.

We think investors should also love the diversity of this play: Not only is Medaro’s JV developing a potentially game-changing technology that could operate entirely on renewable energy, but it also has options on lithium properties in known mining districts and a large uranium play next to giant Rio Tinto.

Combine this with a zero-debt company that looks on track to be very well-capitalized, and we think you have one of the best potential plays in the energy transition—and from a corner that no one may have been expecting.

The global implications could be profound if this technology is proven up and commercialized because among the multiple possible revenue lines is a licensing potential that we think could set up hard-rock miners around the world with a unique new extraction process that could save them up to 50% in processing costs.

That’s the number that we think should get everyone’s attention soon enough.

Other companies to watch as the push to “electrify everything” kicks into overdrive:

Thanks to a massive influx of millennial money and the multi-trillion-dollar green energy boom, Tesla Inc. (NASDAQ:TSLA) has emerged as one of the fastest-growing stocks of all time.. And though it’s been caught in some controversial stances this year, like Elon Musk’s decision to buy…and then sell bitcoin, the company is still as promising as ever. Even after Musk sold off as much as 10% of his holdings in the company, Tesla is still going strong, holding just under all time highs at $1,163 per share.

Elon Musk is truly a visionary of the times. From his electric vehicle innovations and space ambitions to his forward-thinking approach to cryptocurrencies, Elon Musk may well become the first trillionaire, and Tesla shareholders are set to ride the wave. In fact, ee released the first Tesla Roadster back in 2008, making electric vehicles cool when people were laughing at first-gen electric vehicles. Since then, Tesla’s stock has skyrocketed by over 14,000%. And it’s not just about cars, either. Musk is looking towards a much bigger picture, building the foundation for an electrified future on all fronts.

Yet Elon Musk’s jewel has not been trouble-free, either. In February, Tesla said it would recall more than 130,000 vehicles on safety concerns. These regarded touchscreen failures that could lead to the loss of several safety-related features while driving, CNBC reported at the time.

Traditional automakers aren’t going to be left behind, either. Both Ford and GM are betting big on this emerging new industry.

GreenPower Motor Company (TSX:GPV) is an exciting company that produces larger-scale electric transportation. Right now, it is primarily focused on the North American market, but the sky is the limit as the pressure to go green grows. GreenPower has been on the frontlines of the electric movement, manufacturing affordable battery-electric busses and trucks for over ten years. From school busses to long-distance public transit, GreenPower’s impact on the sector can’t be ignored.

NFI Group (TSX:NFI) is another one of Canada’s most exciting companies in the electric vehicle space. It produces transit busses and motorcycles. NFI had a difficult start to the year, but it since cut its debt and begun to address its cash flow struggles in a meaningful way. Though it remains down from January highs, NFI still offers investors a promising opportunity to capitalize on the electric vehicle boom.

Recently, NFI has seen an uptick in insider stock purchases which is often a sign that the board and management strongly believe in the future of the company. In addition to its increasingly positive financial reports, it is also one of the few in the business that actually pay dividends out to its investors.

Another way to get some indirect exposure to the booming tech, EV and mineral industries is through AutoCanada (TSX:ACQ), a company that operates auto-dealerships through Canada. The company carries a wide variety of new and used vehicles and has all types of financial options available to fit the needs of any consumer. While sales have slumped this year due to the COVID-19 pandemic, AutoCanada will likely see a rebound as both buying power and the demand for electric vehicles increases. As more new exciting EVs hit the market, AutoCanada will surely be able to ride the wave.

Canada’s Silicon Valley is all in on the sustainability race, too. Shopify Inc (TSX:SHOP) Canada’s own e-commerce giant helps users build their own online stores. It has huge clients – everyone from Tesla to Budweiser are on board. And the company is beloved by millennial investors. In addition to its revolutionary approach on e-commerce, Shopify is playing an increasingly active role in creating a greener tomorrow. It has committed to spending at least $5 million annually to help combat climate change. It’s even making cuts throughout its own operations, decommissioning its data centers and sourcing renewable power for its buildings. Thanks the these efforts, Shopify has posted a return of nearly 50% this year alone, and is showing no signs of slowing.

Mogo Finance Technology Inc. (TSX:MOGO) is a new spin on unsecured credit, which is a burgeoning sub-segment of FinTech. Providing loan management, the ability to track spending, stress-free mortgages, and even credit score tracking, Mogo is at the forefront of an online movement to assist users with their financial needs.

Mogo’s software analyzes borrowers instantly and greatly reduces the traditionally cumbersome underwriting process for loans. It’s online only, so there’s very low overhead and a ton of cash to spend on marketing. Labeled as “the Uber of finance” by CNBC, Mogo is definitely turning heads.

With increasing membership growth and revenue lines continuing to improve, and a platform which many banks have failed to offer, Mogo could well become an acquisition target in the near future.

By. Tom Kool

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

This news release contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are forward-looking statements. Forward-looking statements in this material include the Medaro Mining Corp. (the “Company”) joint venture (JV) with Global Lithium Extraction Technologies Inc. to develop a proprietary method of lithium extraction; that the Company will succeed in the development and commercialization of the proprietary technology to extract lithium which is highly cost effective, efficient and clean; that the Company will be able to earn its option to acquire ownership in its lithium projects; that the Company’s lithium projects will have commercial amounts of lithium which may be extracted and developed using its proposed technology or otherwise; that the market for lithium will continue to grow to billions of dollars; that the Company will be able to produce sufficient quantities of lithium to supply major contracts worldwide or be otherwise able to commercialize its business; that the Company’s JV will be able to develop, commercialize and license the technology on a global scale; that the technology will be able reduce extraction costs by up to 50%; that the technology will be implemented in remote areas close to productive mines; that the Company will design processing facilities for lithium extraction using the technology developed by the JV; that the technology will be able to extract commercial amounts of lithium; that the Company will be able to earn its option to acquire ownership in its uranium project; that the Company’s uranium project will have commercial amounts of uranium which may be developed. Forward-looking statements are subject to a number of risks and uncertainties, which may cause actual outcomes to differ materially from those discussed in the forward-looking statements. Risks that could change or prevent these statements from coming to fruition include that the Company’s JV may be unable to successfully develop a proprietary method of lithium extraction; that the Company may be unsuccessful in the development of its proposed technology, or even if developed, that the Company may be unable to commercialize the technology or otherwise be able to extract lithium by a method which is cost effective, efficient or clean; that the Company may fail to be able to develop lithium extraction facilities or to license its technology; that the Company may fail to fulfill its obligations under its option agreements in respect of its lithium and uranium projects and be unable to acquire ownership in the properties; that the Company’s lithium and uranium projects may be fail to have any or sufficient commercially viable amounts of lithium or uranium which may be extracted and/or developed; that the market for lithium may not grow as quickly or as much as anticipated; that the Company may not be able to finance its intended development of technology and/or the maintenance/development of its lithium and uranium properties; competitors may offer cheaper or better products; markets don’t develop for the products as expected; intellectual property rights may not protect the Company’s processes and the Company’s technology may infringe on the intellectual property of others; and the Company may not be able to carry out its business plans as expected. The forward-looking information contained herein is given as of the date hereof and the writer assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

ADVERTISEMENT. This communication is for entertainment purposes only. Never invest purely based on our communication. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively, “Oilprice.com”) are being paid ninety thousand USD for this article as part of a larger marketing campaign for CSE:MEDA. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication. The information in this report and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.

nasdaq tsx stocks pandemic covid-19 bitcoin goldGovernment

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentSpread & Containment

Another beloved brewery files Chapter 11 bankruptcy

The beer industry has been devastated by covid, changing tastes, and maybe fallout from the Bud Light scandal.

Before the covid pandemic, craft beer was having a moment. Most cities had multiple breweries and taprooms with some having so many that people put together the brewery version of a pub crawl.

It was a period where beer snobbery ruled the day and it was not uncommon to hear bar patrons discuss the makeup of the beer the beer they were drinking. This boom period always seemed destined for failure, or at least a retraction as many markets seemed to have more craft breweries than they could support.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

The pandemic, however, hastened that downfall. Many of these local and regional craft breweries counted on in-person sales to drive their business.

And while many had local and regional distribution, selling through a third party comes with much lower margins. Direct sales drove their business and the pandemic forced many breweries to shut down their taprooms during the period where social distancing rules were in effect.

During those months the breweries still had rent and employees to pay while little money was coming in. That led to a number of popular beermakers including San Francisco's nationally-known Anchor Brewing as well as many regional favorites including Chicago’s Metropolitan Brewing, New Jersey’s Flying Fish, Denver’s Joyride Brewing, Tampa’s Zydeco Brew Werks, and Cleveland’s Terrestrial Brewing filing bankruptcy.

Some of these brands hope to survive, but others, including Anchor Brewing, fell into Chapter 7 liquidation. Now, another domino has fallen as a popular regional brewery has filed for Chapter 11 bankruptcy protection.

Image source: Shutterstock

Covid is not the only reason for brewery bankruptcies

While covid deserves some of the blame for brewery failures, it's not the only reason why so many have filed for bankruptcy protection. Overall beer sales have fallen driven by younger people embracing non-alcoholic cocktails, and the rise in popularity of non-beer alcoholic offerings,

Beer sales have fallen to their lowest levels since 1999 and some industry analysts

"Sales declined by more than 5% in the first nine months of the year, dragged down not only by the backlash and boycotts against Anheuser-Busch-owned Bud Light but the changing habits of younger drinkers," according to data from Beer Marketer’s Insights published by the New York Post.

Bud Light parent Anheuser Busch InBev (BUD) faced massive boycotts after it partnered with transgender social media influencer Dylan Mulvaney. It was a very small partnership but it led to a right-wing backlash spurred on by Kid Rock, who posted a video on social media where he chastised the company before shooting up cases of Bud Light with an automatic weapon.

Another brewery files Chapter 11 bankruptcy

Gizmo Brew Works, which does business under the name Roth Brewing Company LLC, filed for Chapter 11 bankruptcy protection on March 8. In its filing, the company checked the box that indicates that its debts are less than $7.5 million and it chooses to proceed under Subchapter V of Chapter 11.

"Both small business and subchapter V cases are treated differently than a traditional chapter 11 case primarily due to accelerated deadlines and the speed with which the plan is confirmed," USCourts.gov explained.

Roth Brewing/Gizmo Brew Works shared that it has 50-99 creditors and assets $100,000 and $500,000. The filing noted that the company does expect to have funds available for unsecured creditors.

The popular brewery operates three taprooms and sells its beer to go at those locations.

"Join us at Gizmo Brew Works Craft Brewery and Taprooms located in Raleigh, Durham, and Chapel Hill, North Carolina. Find us for entertainment, live music, food trucks, beer specials, and most importantly, great-tasting craft beer by Gizmo Brew Works," the company shared on its website.

The company estimates that it has between $1 and $10 million in liabilities (a broad range as the bankruptcy form does not provide a space to be more specific).

Gizmo Brew Works/Roth Brewing did not share a reorganization or funding plan in its bankruptcy filing. An email request for comment sent through the company's contact page was not immediately returned.

bankruptcy pandemic social distancing

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges