International

The Great Reconciliation Of Asset Prices In 2022

The Great Reconciliation Of Asset Prices In 2022

Authored by Michael Pento via PentoPort.com,

The coming new year will be fraught with risk due to the removal of central bank and government supports. This could very likely lead to the collap

Authored by Michael Pento via PentoPort.com,

The coming new year will be fraught with risk due to the removal of central bank and government supports. This could very likely lead to the collapse of the most overvalued stock market in history.

According to the Conference Board, US economic growth is set to slow from 5.5% annual growth for all of 2021, to 3.5% during 2022. Of course, Wall Street apologists almost never predict a recession until we are in the middle of one. Nevertheless, it is clear that the growth of the economy will slow significantly next year. And, in the view of Pento Portfolio Strategies, the risk of a recession and an asset bubble collapse is high.

S&P 500 EPS growth will plunge from 45% this year, to just 5-6% in ’22. Again, this is the optimistic view that leaves a great deal of room for error to the downside and virtually zero to the upside. After all, you can only open up an economy once following a global pandemic, and that already happened this year. And, it will be nearly impossible to comp the previous two years’ $6 trillion fiscal support, along with the $4.6 trillion expansion of the monetary base.

We recently learned from the Bureau of Labor Statistics (BLS) that Consumer Price Inflation (CPI) surged by 6.8%, and Producer Price Inflation (PPI) shot up by 9.6% y/y in November. This helped to send Real Average Hourly Earnings down by 1.9 percent from November 2020 to 2021. CPI is running at a 40-year high and is at a rate that is 3.4 times higher than the Fed’s asinine 2% target.

Of course, the clueless Fed finally started reacting to all this inflation by announcing at the December FOMC meeting that it would be speeding up the pace of its taper by two times. But this is happening just when the rate of inflation is actually peaking. In reality, Fed-Head Jerome Powell had no choice but to expedite the tapering of his QE program. After all, it is an untenable notion that the Fed should be adding to the supply of money at a breakneck pace when CPI is the highest since 1982. But without question, Mr. Powell deserves much derision for waiting until inflation reached a multi-decade high before starting to taper asset purchases, let alone begin to raise interest rates off the current level of 0%.

It will take (ten) 25 basis point rate hikes to reach a 2.5% Fed Funds Rate (FFR), which the FOMC now regards as a neutral overnight lending rate. Powell believes a neutral FFR would be 50 bps above the FOMC’s 2% inflation target—assuming inflation falls to that level. In spite of these plans, the chances are very small that the Fed will end up being able to hike rates very much at all before the entire artificial economic construct comes crashing down. This is because the yield curve is already rapidly heading towards inversion even before the tapering of QE has really even begun. An inverted yield curve is a predictor of a recession that has worked 100% of the time. The spread between 2 and 10-year Notes has already contracted from 159 bps at the end of March to just about 75 bps today. Meaning, by the time the QE taper is consummated, there probably won’t be very much room at all to hike rates before an inversion takes place.

But regardless of the Fed’s feckless nature, the fact remains that the biggest buyer and direct supporter of Mortgage-Backed Securities and Treasury Bonds, along with its stated support of corporate debt (including Junk bonds), will be exiting the market entirely come March ‘22. This leaves a tremendously dangerous vacuum in place, especially in non-government-backed debt. The Fed’s QE program has kept the massive real estate and equity bubbles afloat, as well as the $12 trillion worth of Business debt from imploding. But Powell’s Put has expired because inflation is now a big problem.

Then, you must factor in the stubborn COVID Delta variant and the new and more contagious Omicron mutation, which Mr. Powell now views as potentially adding upward pressure on inflation. This could cause the Fed to tighten its monetary policies even more quickly. The consumer will also be left with the complete lack of any fiscal support of any significance next year, after receiving $50k on average per American family over the previous two years.

The truth is, the solvency of nearly every developed nation on earth is contingent on interest rates that remain in the sub-basement of history–AKA, record lows and around zero percent. This is only possible if central banks maintain complete domination of free-market forces and keep their hydraulic presses down on yields. Let’s be honest, without the backstop of these state-owned entities, solvency and inflation concerns would combine to force yields much higher. In the case of the US, with CPI inflation at 6.8% and a national debt-to-income ratio above 725%, it would be impossible for a 10-year Treasury bond to yield just 1.4% without the heavy hand of the Federal Reserve. The point here is that the US has immense solvency and inflation problem now, yet still enjoys record-low borrowing costs thanks to the Fed.

However, this function is now changing. A central bank can usually usurp the free market regarding its sovereign borrowing costs as long as both solvency and inflation concerns are quiescent. For example, the Fed has yet to truly exit its yield curve suppression programs, which have existed for the better part of the last two decades, because consumer price inflation was not an issue. This is true even though our Nation’s debt to GDP ratio is higher today than any time since WWII. Up until this point, that growing trend towards insolvency has been veiled thanks to the central bank’s interventions. But the resurgence of inflation, in conjunction with that humongous debt burden, has become extremely problematic.

In the absence of inflation, central banks have been able to print enough money to ameliorate recessions, bear markets, real estate debacles, and solvency concerns–such as the European debt crisis circa 2012. Where Bond yields in the southern periphery soared to 40% before European Central Bank chief Mario Draghi promised to monetize the debt issues away. Again, he could only accomplish that because inflation was not a concern a decade ago in the Eurozone.

Turning back to the US, the next recession, which is likely to occur in ’22, will cause solvency concerns to spike as revenue collapses and the National Debt-to-Federal-income ratio soars. However, this time around the Fed’s ability to monetize away collapsing asset prices and crumbling economic growth will be fettered by an inflation rate that is already many times greater than it is comfortable with.

That leaves the Fed and Treasury with a dangerous dilemma: allow asset prices and the economy to implode, which will certainly fix the inflation problem; but will most likely lead to a depression. Or, try and pull the economy and assets higher by once again borrowing and printing multiple trillions of dollars, which will send the rate of inflation skyrocketing from its 40-year high. That will risk destroying confidence in the USD and any faith that remains in the bond market. Therefore, the stock market and economy would collapse anyway as inexorably rising inflation pulls yields on sovereign, municipal and corporate bonds ever higher.

Wall Street’s perma-bulls will never admit that the Fed’s Put has now expired. Of course, the Powell Pivot will indeed happen once again as he continues to meander between hawkish and dovish depending on the lagging economic data he receives. But his next pivot back to an uber dove will only occur ex-post the Great Reconciliation of Asset Prices. This is why a buy-and-hold strategy no longer works and why identifying inflation and deflation cycles has become so critical.

* * *

Michael Pento is the President and Founder of Pento Portfolio Strategies, produces the weekly podcast called, “The Mid-week Reality Check” and Author of the book “The Coming Bond Market Collapse.”

International

Net Zero, The Digital Panopticon, & The Future Of Food

Net Zero, The Digital Panopticon, & The Future Of Food

Authored by Colin Todhunter via Off-Guardian.org,

The food transition, the energy…

Authored by Colin Todhunter via Off-Guardian.org,

The food transition, the energy transition, net-zero ideology, programmable central bank digital currencies, the censorship of free speech and clampdowns on protest. What’s it all about? To understand these processes, we need to first locate what is essentially a social and economic reset within the context of a collapsing financial system.

Writer Ted Reece notes that the general rate of profit has trended downwards from an estimated 43% in the 1870s to 17% in the 2000s. By late 2019, many companies could not generate enough profit. Falling turnover, squeezed margins, limited cashflows and highly leveraged balance sheets were prevalent.

Professor Fabio Vighi of Cardiff University has described how closing down the global economy in early 2020 under the guise of fighting a supposedly new and novel pathogen allowed the US Federal Reserve to flood collapsing financial markets (COVID relief) with freshly printed money without causing hyperinflation. Lockdowns curtailed economic activity, thereby removing demand for the newly printed money (credit) in the physical economy and preventing ‘contagion’.

According to investigative journalist Michael Byrant, €1.5 trillion was needed to deal with the crisis in Europe alone. The financial collapse staring European central bankers in the face came to a head in 2019. The appearance of a ‘novel virus’ provided a convenient cover story.

The European Central Bank agreed to a €1.31 trillion bailout of banks followed by the EU agreeing to a €750 billion recovery fund for European states and corporations. This package of long-term, ultra-cheap credit to hundreds of banks was sold to the public as a necessary programme to cushion the impact of the pandemic on businesses and workers.

In response to a collapsing neoliberalism, we are now seeing the rollout of an authoritarian great reset — an agenda that intends to reshape the economy and change how we live.

SHIFT TO AUTHORITARIANISM

The new economy is to be dominated by a handful of tech giants, global conglomerates and e-commerce platforms, and new markets will also be created through the financialisation of nature, which is to be colonised, commodified and traded under the notion of protecting the environment.

In recent years, we have witnessed an overaccumulation of capital, and the creation of such markets will provide fresh investment opportunities (including dodgy carbon offsetting Ponzi schemes) for the super-rich to park their wealth and prosper.

This great reset envisages a transformation of Western societies, resulting in permanent restrictions on fundamental liberties and mass surveillance. Being rolled out under the benign term of a ‘Fourth Industrial Revolution’, the World Economic Forum (WEF) says the public will eventually ‘rent’ everything they require (remember the WEF video ‘you will own nothing and be happy’?): stripping the right of ownership under the guise of a ‘green economy’ and underpinned by the rhetoric of ‘sustainable consumption’ and ‘climate emergency’.

Climate alarmism and the mantra of sustainability are about promoting money-making schemes. But they also serve another purpose: social control.

Neoliberalism has run its course, resulting in the impoverishment of large sections of the population. But to dampen dissent and lower expectations, the levels of personal freedom we have been used to will not be tolerated. This means that the wider population will be subjected to the discipline of an emerging surveillance state.

To push back against any dissent, ordinary people are being told that they must sacrifice personal liberty in order to protect public health, societal security (those terrible Russians, Islamic extremists or that Sunak-designated bogeyman George Galloway) or the climate. Unlike in the old normal of neoliberalism, an ideological shift is occurring whereby personal freedoms are increasingly depicted as being dangerous because they run counter to the collective good.

The real reason for this ideological shift is to ensure that the masses get used to lower living standards and accept them. Consider, for instance, the Bank of England’s chief economist Huw Pill saying that people should ‘accept’ being poorer. And then there is Rob Kapito of the world’s biggest asset management firm BlackRock, who says that a “very entitled” generation must deal with scarcity for the first time in their lives.

At the same time, to muddy the waters, the message is that lower living standards are the result of the conflict in Ukraine and supply shocks that both the war and ‘the virus’ have caused.

The net-zero carbon emissions agenda will help legitimise lower living standards (reducing your carbon footprint) while reinforcing the notion that our rights must be sacrificed for the greater good. You will own nothing, not because the rich and their neoliberal agenda made you poor but because you will be instructed to stop being irresponsible and must act to protect the planet.

NET-ZERO AGENDA

But what of this shift towards net-zero greenhouse gas emissions and the plan to slash our carbon footprints? Is it even feasible or necessary?

Gordon Hughes, a former World Bank economist and current professor of economics at the University of Edinburgh, says in a new report that current UK and European net-zero policies will likely lead to further economic ruin.

Apparently, the only viable way to raise the cash for sufficient new capital expenditure (on wind and solar infrastructure) would be a two decades-long reduction in private consumption of up to 10 per cent. Such a shock has never occurred in the last century outside war; even then, never for more than a decade.

But this agenda will also cause serious environmental degradation. So says Andrew Nikiforuk in the article The Rising Chorus of Renewable Energy Skeptics, which outlines how the green techno-dream is vastly destructive.

He lists the devastating environmental impacts of an even more mineral-intensive system based on renewables and warns:

“The whole process of replacing a declining system with a more complex mining-based enterprise is now supposed to take place with a fragile banking system, dysfunctional democracies, broken supply chains, critical mineral shortages and hostile geopolitics.”

All of this assumes that global warming is real and anthropogenic. Not everyone agrees. In the article Global warming and the confrontation between the West and the rest of the world, journalist Thierry Meyssan argues that net zero is based on political ideology rather than science. But to state such things has become heresy in the Western countries and shouted down with accusations of ‘climate science denial’.

Regardless of such concerns, the march towards net zero continues, and key to this is the United Nations Agenda 2030 for Sustainable Development Goals.

Today, almost every business or corporate report, website or brochure includes a multitude of references to ‘carbon footprints’, ‘sustainability’, ‘net zero’ or ‘climate neutrality’ and how a company or organisation intends to achieve its sustainability targets. Green profiling, green bonds and green investments go hand in hand with displaying ‘green’ credentials and ambitions wherever and whenever possible.

It seems anyone and everyone in business is planting their corporate flag on the summit of sustainability. Take Sainsbury’s, for instance. It is one of the ‘big six’ food retail supermarkets in the UK and has a vision for the future of food that it published in 2019.

Here’s a quote from it:

“Personalised Optimisation is a trend that could see people chipped and connected like never before. A significant step on from wearable tech used today, the advent of personal microchips and neural laces has the potential to see all of our genetic, health and situational data recorded, stored and analysed by algorithms which could work out exactly what we need to support us at a particular time in our life. Retailers, such as Sainsbury’s could play a critical role to support this, arranging delivery of the needed food within thirty minutes — perhaps by drone.”

Tracked, traced and chipped — for your own benefit. Corporations accessing all of our personal data, right down to our DNA. The report is littered with references to sustainability and the climate or environment, and it is difficult not to get the impression that it is written so as to leave the reader awestruck by the technological possibilities.

However, the promotion of a brave new world of technological innovation that has nothing to say about power — who determines policies that have led to massive inequalities, poverty, malnutrition, food insecurity and hunger and who is responsible for the degradation of the environment in the first place — is nothing new.

The essence of power is conveniently glossed over, not least because those behind the prevailing food regime are also shaping the techno-utopian fairytale where everyone lives happily ever after eating bugs and synthetic food while living in a digital panopticon.

FAKE GREEN

The type of ‘green’ agenda being pushed is a multi-trillion market opportunity for lining the pockets of rich investors and subsidy-sucking green infrastructure firms and also part of a strategy required to secure compliance required for the ‘new normal’.

It is, furthermore, a type of green that plans to cover much of the countryside with wind farms and solar panels with most farmers no longer farming. A recipe for food insecurity.

Those investing in the ‘green’ agenda care first and foremost about profit. The supremely influential BlackRock invests in the current food system that is responsible for polluted waterways, degraded soils, the displacement of smallholder farmers, a spiralling public health crisis, malnutrition and much more.

It also invests in healthcare — an industry that thrives on the illnesses and conditions created by eating the substandard food that the current system produces. Did Larry Fink, the top man at BlackRock, suddenly develop a conscience and become an environmentalist who cares about the planet and ordinary people? Of course not.

Any serious deliberations on the future of food would surely consider issues like food sovereignty, the role of agroecology and the strengthening of family farms — the backbone of current global food production.

The aforementioned article by Andrew Nikiforuk concludes that, if we are really serious about our impacts on the environment, we must scale back our needs and simplify society.

In terms of food, the solution rests on a low-input approach that strengthens rural communities and local markets and prioritises smallholder farms and small independent enterprises and retailers, localised democratic food systems and a concept of food sovereignty based on self-sufficiency, agroecological principles and regenerative agriculture.

It would involve facilitating the right to culturally appropriate food that is nutritionally dense due to diverse cropping patterns and free from toxic chemicals while ensuring local ownership and stewardship of common resources like land, water, soil and seeds.

That’s where genuine environmentalism and the future of food begins.

Government

Five Aerospace Investments to Buy as Wars Worsen Copy

Five aerospace investments to buy as wars worsen give investors a chance to acquire shares of companies focused on fortifying national defense. The five…

Five aerospace investments to buy as wars worsen give investors a chance to acquire shares of companies focused on fortifying national defense.

The five aerospace investments to buy provide military products to help protect freedom amid Russia’s ongoing onslaught against Ukraine that began in February 2022, as well as supply arms in the Middle East used after Hamas militants attacked and murdered civilians in Israel on Oct. 7. Even though the S&P 500 recently reached all-time highs, these five aerospace investments have remained reasonably priced and rated as recommendations by seasoned analysts and a pension fund chairman.

State television broadcasts in Russia show the country’s soldiers advancing further into Ukrainian territory, but protests have occurred involving family members of those serving in perilous conditions in the invasion of their neighboring nation to be brought home. Even though hundreds of thousands of Russians also have fled to other countries to avoid compulsory military service, the aggressor’s President Vladimir Putin has vowed to continue to send additional soldiers into the fierce fighting.

While Russia’s land-grab of Crimea and other parts of Ukraine show no end in sight, Israel’s war with Hamas likely will last for at least additional months, according to the latest reports. United Nations’ leaders expressed alarm on Dec. 26 about intensifying Israeli attacks that killed more than 100 Palestinians over two days in part of the Gaza Strip, when 15 members of the Israel Defense Force (IDF) also lost their lives.

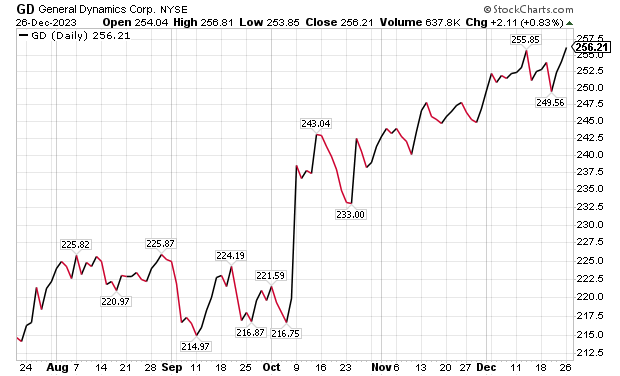

Five Aerospace Investments to Buy as Wars Worsen: General Dynamics

One of the five aerospace investments to buy as wars worsen is General Dynamics (NYSE: GD), a Reston, Virginia-based aerospace company with more than 100,000 employees in 70-plus countries. A key business unit of General Dynamics is Gulfstream Aerospace Corporation, a manufacturer of business aircraft. Other segments of General Dynamics focus on making military products such as Abrams tanks, Stryker fighting vehicles, ASCOD fighting vehicles like the Spanish PIZARRO and British AJAX, LAV-25 Light Armored Vehicles and Flyer-60 lightweight tactical vehicles.

For the U.S. Navy and other allied armed forces, General Dynamics builds Virginia-class attack submarines, Columbia-class ballistic missile submarines, Arleigh Burke-class guided missile destroyers, Expeditionary Sea Base ships, fleet logistics ships, commercial cargo ships, aircraft and naval gun systems, Hydra-70 rockets, military radios and command and control systems. In addition, the company provides radio and optical telescopes, secure mobile phones, PIRANHA and PANDUR wheeled armored vehicles and mobile bridge systems.

Chicago-based investment firm William Blair & Co. is among those recommending General Dynamics. The Chicago firm gave an “outperform” rating to General Dynamics in a Dec. 21 research note.

Gulfstream is seeking G700 FAA certification by the end of 2023, suggesting potentially positive news in the next 10 days, William Blair wrote in its recent research note. The investment firm projected that General Dynamics would trade upward upward upon the G700’s certification.

“General Dynamics’ 2023 aircraft delivery guidance of approximately 134 planes assumes that 19 G700s are delivered in the fourth quarter,” wrote William Blair’s aerospace and defense analyst Louie DiPalma. “Even if deliveries fall short of this target, we believe investors will take a glass-half-full approach upon receipt of the certification.”

Chart courtesy of www.stockcharts.com.

Five Aerospace Investments to Buy as Wars Worsen: GD Outlook

The G700 is a major focus area for investors because it is Gulfstream’s most significant aircraft introduction since the iconic G650 in 2012, DiPalma wrote. Gulfstream has the highest market share in the long-range jet segment of the private aircraft market, the highest profit margin of aircraft peers and the most premium business aviation brand, he added.

“The aircraft remains immensely popular today with corporations and high-net-worth individuals,” Di Palma wrote. “Elon Musk has reportedly placed an order for a G700 to go along with his existing G650. Qatar Airways announced at the Paris Air Show that 10 G700 aircraft will become part of its fleet.”

G700 deliveries and subsequent G800 deliveries are expected to be the cornerstone of Gulfstream’s growth and margin expansion for the next decade, DiPalma wrote. This should lead to a rebound in the stock price as the margins for the G700 and G800 are very attractive, he added.

Management’s guidance is for the aerospace operating margin to increase from about 13.2% in 2022 to roughly 14.0% in 2023 and 15.8% in 2024. Longer term, a high-teens profit margin appears within reach, DiPalma projected.

In other General Dynamics business segments, William Blair expects several yet-unannounced large contract awards for General Dynamics IT, to go along with C$1.7 billion, or US$1.29 billion, in General Dynamics Mission Systems contracts announced on Dec. 20 for the Canadian Army. General Dynamics shares are poised to have a strong 2024, William Blair wrote.

Five Aerospace Investments to Buy as Wars Worsen: VSE Corporation

Alexandria, Virginia-based VSE Corporation’s (NASDAQ: VSEC) price-to-earnings (P/E) valuation multiple of 22 received support when AAR Corp. (NYSE: AIR), a Wood Dale, Illinois, provider of aviation services, announced on Dec. 21 that it would acquire the product support business of Triumph Group (NYSE: TGI), a Berwyn, Pennsylvania, supplier of aerospace services, structures and systems. AAR’s purchase price of $725 million reflects confidence in a continued post-pandemic aerospace rebound.

VSE, a provider of aftermarket distribution and repair services for land, sea and air transportation assets used by government and commercial markets, is rated “outperform” by William Blair. The company’s core services include maintenance, repair and operations (MRO), parts distribution, supply chain management and logistics, engineering support, as well as consulting and training for global commercial, federal, military and defense customers.

“Robust consumer travel demand and aging aircraft fleets have driven elevated maintenance visits,” William Blair’s DiPalma wrote in a Dec. 21 research note. “The AAR–Triumph deal is valued at a premium 13-times 2024 EBITDA multiple, which was in line with the valuation multiple that Heico (NYSE: HEI) paid for Wencor over the summer.”

VSE currently trades at a discounted 9.5 times consensus 2024 earnings before interest, taxes, depreciation and amortization (EBITDA) estimates, as well as 11.6 times consensus 2023 EBITDA.

Five Aerospace Investments to Buy as Wars Worsen: VSE Undervalued?

“We expect that VSE shares will trend higher as investors process this deal,” DiPalma wrote. “VSE shares trade at 9.5 times consensus 2024 adjusted EBITDA, compared with peers and M&A comps in the 10-to-14-times range. We think that VSE’s multiple will expand as it closes the divestiture of its federal and defense business and makes strategic acquisitions. We see consistent 15% annual upside for shares as VSE continues to take share in the $110 billion aviation aftermarket industry.”

William Blair reaffirmed its “outperform” rating for VSE on Dec. 21. The main risk to VSE shares is lumpiness associated with its aviation services margins, Di Palma wrote. However, he raised 2024 estimates to further reflect commentary from VSE’s analysts’ day in November.

Chart courtesy of www.stockcharts.com.

Five Aerospace Investments to Buy as Wars Worsen: HEICO Corporation

HEICO Corporation (NYSEL: HEI), is a Hollywood, Florida-based technology-driven aerospace, industrial, defense and electronics company that also is ranked as an “outperform” investment by William Blair’s DiPalma. The aerospace aftermarket parts provider recently reported fourth-quarter financials above consensus analysts’ estimates, driven by 20% organic growth in HEICO’s flight support group.

HEICO’s management indicated that the performance of recently acquired Wencor is exceeding expectations. However, HEICO leaders offered color on 2024 organic growth and margin expectations that forecast reduced gains. Even though consensus estimates already assumed slowing growth, it is still not a positive for HEICO, DiPalma wrote.

William Blair forecasts 15% annual upside to HEICO’s shares, based on EBITDA growth. HEICO’s management cited a host of reasons for its quarterly outperformance, highlighted by the continued commercial air travel recovery. The company also referenced new product introductions and efficiency initiatives.

HEICO’s defense product sales increased by 26% sequentially, marking the third consecutive sequential increase in defense product revenue. The company’s leaders conveyed that defense in general is moving in the right direction to enhance financial performance.

Chart courtesy of www.stockcharts.com.

Five Dividend-paying Defense and Aerospace Investments to Purchase: XAR

A fourth way to obtain exposure to defense and aerospace investments is through SPDR S&P Aerospace and Defense ETF (XAR). That exchange-traded fund tracks the S&P Aerospace & Defense Select Industry Index. The fund is overweight in industrials and underweight in technology and consumer cyclicals, said Bob Carlson, a pension fund chairman who heads the Retirement Watch investment newsletter.

Bob Carlson, who heads Retirement Watch, answers questions from Paul Dykewicz.

XAR has 34 securities, and 44.2% of the fund is in the 10 largest positions. The fund is up 25.82% in the last 12 months, 22.03% in the past three months and 7.92% for the last month. Its dividend yield recently measured 0.38%.

The largest positions in the fund recently were Axon Enterprise (NASDAQ: AXON), Boeing (NYSE: BA), L3Harris Technologies (NYSE: LHX), Spirit Aerosystems (NYSE: SPR) and Virgin Galactic (NYSE: SPCE).

Chart courtesy of www.stockcharts.com

Five Dividend-paying Defense and Aerospace Investments to Purchase: PPA

The second fund recommended by Carlson is Invesco Aerospace & Defense ETF (PPA), which tracks the SPADE Defense Index. It has the same underweighting and overweighting as XAR, he said.

PPA recently held 52 securities and 53.2% of the fund was in its 10 largest positions. With so many holdings, the fund offers much reduced risk compared to buying individual stocks. The largest positions in the fund recently were Boeing (NYSE: BA), RTX Corp. (NYSE: RTX), Lockheed Martin (NYSE: LMT), Northrop Grumman (NYSE: NOC) and General Electric (NYSE:GE).

The fund is up 19.07% for the past year, 50.34% in the last three months and 5.30% during the past month. The dividend yield recently touched 0.69%.

Chart courtesy of www.stockcharts.com

Other Fans of Aerospace

Two fans of aerospace stocks are Mark Skousen, PhD, and seasoned stock picker Jim Woods. The pair team up to head the Fast Money Alert advisory service They already are profitable in their recent recommendation of Lockheed Martin (NYSE: LMT) in Fast Money Alert.

Mark Skousen, a scion of Ben Franklin, meets with Paul Dykewicz.

Jim Woods, a former U.S. Army paratrooper, co-heads Fast Money Alert.

Bryan Perry, who heads the Cash Machine investment newsletter and the Micro-Cap Stock Trader advisory service, recommends satellite services provider Globalstar (NYSE American: GSAT), of Covington, Louisiana, that has jumped 50.00% since he advised buying it two months ago. Perry is averaging a dividend yield of 11.14% in his Cash Machine newsletter but is breaking out with the red-hot recommendation of Globalstar in his Micro-Cap Stock Trader advisory service.

Bryan Perry heads Cash Machine, averaging an 11.14% dividend yield.

Military Equipment Demand Soars amid Multiple Wars

The U.S. military faces an acute need to adopt innovation, to expedite implementation of technological gains, to tap into the talents of people in various industries and to step-up collaboration with private industry and international partners to enhance effectiveness, U.S. Joint Chiefs of Staff Gen. Charles Q. Brown Jr. told attendees on Nov 16 at a national security conference. Prime examples of the need are showed by multiple raging wars, including the Middle East and Ukraine. A cold war involves China and its increasingly strained relationships with Taiwan and other Asian nations.

The shocking Oct. 7 attack by Hamas on Israel touched off an ongoing war in the Middle East, coupled with Russia’s February 2022 invasion and continuing assault of neighboring Ukraine. Those brutal military conflicts show the fragility of peace when determined aggressors are willing to use any means necessary to achieve their goals. To fend off such attacks, rapid and effective response is required.

“The Department of Defense is doing more than ever before to deter, defend, and, if necessary, defeat aggression,” Gen. Brown said at the National Security Innovation Forum at the Johns Hopkins University Bloomberg Center in Washington, D.C.

One of Russia’s war ships, the 360-foot-long Novocherkassk, was damaged on Dec. 26 by a Ukrainian attack on the Black Sea port of Feodosia in Crimea. This video of an explosion at the port that reportedly shows a section of the ship hit by aircraft-guided missiles.

Chairman Joint Chiefs of Staff Gen. Charles Q. Brown, Jr.

Photo By: Benjamin Applebaum

National security threats can compel immediate action, Gen. Brown said he quickly learned since taking his post on Oct. 1.

“We may not have much warning when the next fight begins,” Gen. Brown said. “We need to be ready.”

In a pre-recorded speech at the national security conference, Michael R. Bloomberg, founder of Bloomberg LP, told the John Hopkins national security conference attendees about the critical need for collaboration between government and industry.

“Building enduring technological advances for the U.S. military will help our service members and allies defend freedom across the globe,” Bloomberg said.

The “horrific terrorist attacks” against Israel and civilians living there on Oct. 7 underscore the importance of that mission, Bloomberg added.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Attention Holiday Gift Buyers! Consider purchasing Paul’s inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases or autographed copies! Follow Paul on Twitter @PaulDykewicz. He is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper, after writing for the Baltimore Business Journal and Crain Communications.

The post Five Aerospace Investments to Buy as Wars Worsen Copy appeared first on Stock Investor.

dow jones sp 500 nasdaq stocks pandemic etf micro-cap army recovery russia ukraine chinaGovernment

Health Officials: Man Dies From Bubonic Plague In New Mexico

Health Officials: Man Dies From Bubonic Plague In New Mexico

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Officials in…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

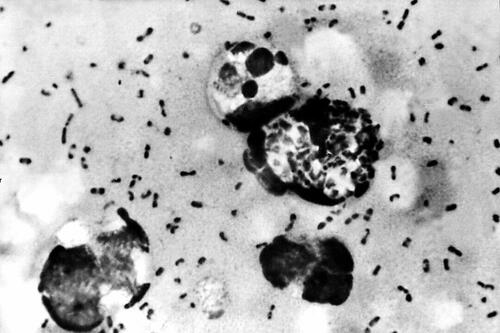

Officials in New Mexico confirmed that a resident died from the plague in the United States’ first fatal case in several years.

The New Mexico Department of Health, in a statement, said that a man in Lincoln County “succumbed to the plague.” The man, who was not identified, was hospitalized before his death, officials said.

They further noted that it is the first human case of plague in New Mexico since 2021 and also the first death since 2020, according to the statement. No other details were provided, including how the disease spread to the man.

The agency is now doing outreach in Lincoln County, while “an environmental assessment will also be conducted in the community to look for ongoing risk,” the statement continued.

“This tragic incident serves as a clear reminder of the threat posed by this ancient disease and emphasizes the need for heightened community awareness and proactive measures to prevent its spread,” the agency said.

A bacterial disease that spreads via rodents, it is generally spread to people through the bites of infected fleas. The plague, known as the black death or the bubonic plague, can spread by contact with infected animals such as rodents, pets, or wildlife.

The New Mexico Health Department statement said that pets such as dogs and cats that roam and hunt can bring infected fleas back into homes and put residents at risk.

Officials warned people in the area to “avoid sick or dead rodents and rabbits, and their nests and burrows” and to “prevent pets from roaming and hunting.”

“Talk to your veterinarian about using an appropriate flea control product on your pets as not all products are safe for cats, dogs or your children” and “have sick pets examined promptly by a veterinarian,” it added.

“See your doctor about any unexplained illness involving a sudden and severe fever, the statement continued, adding that locals should clean areas around their home that could house rodents like wood piles, junk piles, old vehicles, and brush piles.

The plague, which is spread by the bacteria Yersinia pestis, famously caused the deaths of an estimated hundreds of millions of Europeans in the 14th and 15th centuries following the Mongol invasions. In that pandemic, the bacteria spread via fleas on black rats, which historians say was not known by the people at the time.

Other outbreaks of the plague, such as the Plague of Justinian in the 6th century, are also believed to have killed about one-fifth of the population of the Byzantine Empire, according to historical records and accounts. In 2013, researchers said the Justinian plague was also caused by the Yersinia pestis bacteria.

But in the United States, it is considered a rare disease and usually occurs only in several countries worldwide. Generally, according to the Mayo Clinic, the bacteria affects only a few people in U.S. rural areas in Western states.

Recent cases have occurred mainly in Africa, Asia, and Latin America. Countries with frequent plague cases include Madagascar, the Democratic Republic of Congo, and Peru, the clinic says. There were multiple cases of plague reported in Inner Mongolia, China, in recent years, too.

Symptoms

Symptoms of a bubonic plague infection include headache, chills, fever, and weakness. Health officials say it can usually cause a painful swelling of lymph nodes in the groin, armpit, or neck areas. The swelling usually occurs within about two to eight days.

The disease can generally be treated with antibiotics, but it is usually deadly when not treated, the Mayo Clinic website says.

“Plague is considered a potential bioweapon. The U.S. government has plans and treatments in place if the disease is used as a weapon,” the website also says.

According to data from the U.S. Centers for Disease Control and Prevention, the last time that plague deaths were reported in the United States was in 2020 when two people died.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges