Government

The Era Of Sluggish Recoveries

The Era Of Sluggish Recoveries

NOTE: This is an unedited excerpt from a chapter within an upcoming manuscript on MMT and the upcoming recovery. The chapter describes the post-1990 expansions, which were characterised by disappointing growth. This sluggishness is explained from the perspective of MMT. This section is an introduction, and is my way of showing how slow growth surprised the consensus - repeatedly.

The uniformity of experiences was greater in the “Anglo” countries; Japan and euro area countries had somewhat divergent conditions. Japan had an investment boom run out of stem in the mid-1990s, while the euro area countries had a “euro convergence boom” that was the side effect of lower interest rates in countries that previously had weak currencies. That said, conditions converged after the 2001 global technology recession.

This moderation of economic volatility was famously labelled “The Great Moderation” by Ben Bernanke in a speech in 2004. At that time, Bernanke was at the time a governor of the Federal Reserve, but before he became the Chair of the Federal Open Market Committee. The concept of The Great Moderation was mocked after The Financial Crisis, but I would argue that we can at least characterise this era as having a commonality of sluggish recoveries.

Sluggishness Not Expected

One of the interesting aspects of these sluggish recoveries were that they were not expected by the consensus. The conventional view ascribed great importance to central bank policy, and the low level of policy rates was expected to engineer a rapid recovery.

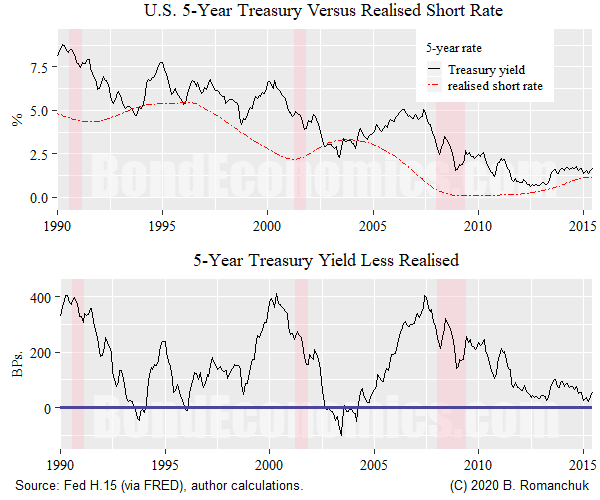

Giving an objective measure of the consensus view is somewhat awkward. I will focus on bond yields, as they are inherently forward-looking, and give a relatively clean time series history. The reason why bond yields are forward-looking as bond investors expect that a bond should provide at least as high a return as holding money-market instruments. The figure above illustrates the historical experience in the United States (the experience in other markets tended to be similar). I will discuss alternative measures of consensus views later. I am also putting aside the question of the term premium – I believe that the 5-year term premium should be small and stable. This is also returned to later.

The top panel shows the 5-year Treasury yield, which is compared to the average of the Fed Funds target rate over the subsequent five years (labelled “realised short rate”). Since the realised rate at a given date requires knowing the level of Fed Funds over the next five years, the time series ends in 2015, which is five years ahead of the chart creation. The bottom panel shows the spread between those rates, in basis points (1 basis point = 0.01%). What the figure shows is that the 5-year yield over the 1990-2015 period was consistently greater than the realised short rate. (For those who are not familiar with bond investing, the implication is that returns on holding bonds was greater than holding money market instruments, which implies that this period was a secular bull market.) There were only a few periods where the 5-year yield was below the average of the realised short rate.

We can focus on the periods that at the end of shaded recession bars. At those time points, we saw small rises in yields (bond bear markets), and an extremely large positive spread between the 5-year yield and the realised path of short rates over the next five years. The mechanism was straightforward: bond market participants believed that rate cuts were excessive, and that the economy would recovery quickly. When this did not happen, Treasury bond yields fell towards the policy rate set by the central bank. The only times that the 5-year Treasury yield fell below realised short-term rates was once the economy was mired in stagnation, and bond market participants got slightly too exuberant in extrapolating low policy rates.

I started working in finance in 1998, and for most of my career, I was a secular bond bull. I can attest to the reality that the government bond market was almost always hated by strategists, who warned that the U.S. economy would kick it into gear, and the Federal Reserve would be forced to hike interest rates to put raging inflation under control.

Admittedly, this perma-bearishness by strategists started to fade by 2012, once the magnitude of the collapse in activity created by the Financial Crisis of 2008 sunk in (and the economic drag created by the crisis in the euro periphery). It was only then that the consensus accepted that the U.S. economy could be stuck in a slow growth path, even with interest rates below the rate of inflation (“negative real rates”) and so-called “money-printing” by the Federal Reserve. One important thing to note is that MMT started to gain prominence at about that time, and part of the attractiveness of the theory was that this stagnation could be much more easily explained. (One could attempt to argue that MMT helped shift the debate, but my feeling is that this is perhaps too dramatic a statement.)

Why Bond Yields instead of Surveys?

One might question the use of bond yields as a measure of consensus – why not a survey of economists?My initial concern is the difficulty of displaying the data in a useful format. It is easy to show a time history of GDP growth up to a certain date, and then forecasts of its path. Unfortunately, that just shows expectations at one point in time. What I want to highlight is the pervasive over-optimism that infected the forecasting community, and so we would need look at multiple forecasts, and the resulting graph is nearly impossible to interpret. By contrast, the bond yield/realised yield spread offers a summary of forecast errors as a single time series.

The next issue is a concern with the quality of consensus economist forecasts. Economists in the surveys play games, and herd together in a dysfunctional fashion. They face limited criticism if their forecast is incorrect, so long as it is amid the consensus. Conversely, bond investors have “skin in the game,” as their bonus (or even job) is at risk if they mis-price securities. As such, I am in the camp that puts more weight on market pricing than economist surveys.

Term Premium

The term premium is a subject that often comes up in the concept of discussing rate expectations. Technically, we should expect the 5-year yield to be higher than the realised average of short-term rates by the term premium (which varies over time). However, I do not find an estimate of a term premium of over 200 basis points to be plausible for a 5-year Treasury Note to be plausible, while that is the level of outperformance that we see at the end of recession periods. The reality is that market participants as well as the economist consensus expected rapid turnarounds that were not realised, and the raw outperformance of 5-year bonds gives us a good feel for the magnitude of the forecast miss.Concluding Remarks

It seems possible that this time will be different: there may be much greater skepticism about the speed of the recovery after the Pandemic of 2020. At the time of writing, very few market commentators are discussing the possibility of a rapid recovery. That said, the tendency of investment strategists and free market economists to over-sell the economic dynamism of the developed economies may once again take over.The next sections [in the process of being written] will now turn to the economic characteristics of modern expansions.

References and Further Reading

- The “Great Moderation” speech by Ben S. Bernanke, made on February 20, 2004. URL: https://www.federalreserve.gov/boarddocs/speeches/2004/20040220/. Bill Mitchell wrote at critique of The Great Moderation in a blog: http://bilbo.economicoutlook.net/blog/?p=7554

- I discuss the relationship between bond yields and expectations in Understanding Government Finance and Interest Rate Cycles: An Introduction.

(c) Brian Romanchuk 2020

Government

Are Voters Recoiling Against Disorder?

Are Voters Recoiling Against Disorder?

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super…

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super Tuesday primaries have got it right. Barring cataclysmic changes, Donald Trump and Joe Biden will be the Republican and Democratic nominees for president in 2024.

With Nikki Haley’s withdrawal, there will be no more significantly contested primaries or caucuses—the earliest both parties’ races have been over since something like the current primary-dominated system was put in place in 1972.

The primary results have spotlighted some of both nominees’ weaknesses.

Donald Trump lost high-income, high-educated constituencies, including the entire metro area—aka the Swamp. Many but by no means all Haley votes there were cast by Biden Democrats. Mr. Trump can’t afford to lose too many of the others in target states like Pennsylvania and Michigan.

Majorities and large minorities of voters in overwhelmingly Latino counties in Texas’s Rio Grande Valley and some in Houston voted against Joe Biden, and even more against Senate nominee Rep. Colin Allred (D-Texas).

Returns from Hispanic precincts in New Hampshire and Massachusetts show the same thing. Mr. Biden can’t afford to lose too many Latino votes in target states like Arizona and Georgia.

When Mr. Trump rode down that escalator in 2015, commentators assumed he’d repel Latinos. Instead, Latino voters nationally, and especially the closest eyewitnesses of Biden’s open-border policy, have been trending heavily Republican.

High-income liberal Democrats may sport lawn signs proclaiming, “In this house, we believe ... no human is illegal.” The logical consequence of that belief is an open border. But modest-income folks in border counties know that flows of illegal immigrants result in disorder, disease, and crime.

There is plenty of impatience with increased disorder in election returns below the presidential level. Consider Los Angeles County, America’s largest county, with nearly 10 million people, more people than 40 of the 50 states. It voted 71 percent for Mr. Biden in 2020.

Current returns show county District Attorney George Gascon winning only 21 percent of the vote in the nonpartisan primary. He’ll apparently face Republican Nathan Hochman, a critic of his liberal policies, in November.

Gascon, elected after the May 2020 death of counterfeit-passing suspect George Floyd in Minneapolis, is one of many county prosecutors supported by billionaire George Soros. His policies include not charging juveniles as adults, not seeking higher penalties for gang membership or use of firearms, and bringing fewer misdemeanor cases.

The predictable result has been increased car thefts, burglaries, and personal robberies. Some 120 assistant district attorneys have left the office, and there’s a backlog of 10,000 unprosecuted cases.

More than a dozen other Soros-backed and similarly liberal prosecutors have faced strong opposition or have left office.

St. Louis prosecutor Kim Gardner resigned last May amid lawsuits seeking her removal, Milwaukee’s John Chisholm retired in January, and Baltimore’s Marilyn Mosby was defeated in July 2022 and convicted of perjury in September 2023. Last November, Loudoun County, Virginia, voters (62 percent Biden) ousted liberal Buta Biberaj, who declined to prosecute a transgender student for assault, and in June 2022 voters in San Francisco (85 percent Biden) recalled famed radical Chesa Boudin.

Similarly, this Tuesday, voters in San Francisco passed ballot measures strengthening police powers and requiring treatment of drug-addicted welfare recipients.

In retrospect, it appears the Floyd video, appearing after three months of COVID-19 confinement, sparked a frenzied, even crazed reaction, especially among the highly educated and articulate. One fatal incident was seen as proof that America’s “systemic racism” was worse than ever and that police forces should be defunded and perhaps abolished.

2020 was “the year America went crazy,” I wrote in January 2021, a year in which police funding was actually cut by Democrats in New York, Los Angeles, San Francisco, Seattle, and Denver. A year in which young New York Times (NYT) staffers claimed they were endangered by the publication of Sen. Tom Cotton’s (R-Ark.) opinion article advocating calling in military forces if necessary to stop rioting, as had been done in Detroit in 1967 and Los Angeles in 1992. A craven NYT publisher even fired the editorial page editor for running the article.

Evidence of visible and tangible discontent with increasing violence and its consequences—barren and locked shelves in Manhattan chain drugstores, skyrocketing carjackings in Washington, D.C.—is as unmistakable in polls and election results as it is in daily life in large metropolitan areas. Maybe 2024 will turn out to be the year even liberal America stopped acting crazy.

Chaos and disorder work against incumbents, as they did in 1968 when Democrats saw their party’s popular vote fall from 61 percent to 43 percent.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Government

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The U.S. Department of Veterans Affairs (VA) reviewed no data when deciding in 2023 to keep its COVID-19 vaccine mandate in place.

VA Secretary Denis McDonough said on May 1, 2023, that the end of many other federal mandates “will not impact current policies at the Department of Veterans Affairs.”

He said the mandate was remaining for VA health care personnel “to ensure the safety of veterans and our colleagues.”

Mr. McDonough did not cite any studies or other data. A VA spokesperson declined to provide any data that was reviewed when deciding not to rescind the mandate. The Epoch Times submitted a Freedom of Information Act for “all documents outlining which data was relied upon when establishing the mandate when deciding to keep the mandate in place.”

The agency searched for such data and did not find any.

“The VA does not even attempt to justify its policies with science, because it can’t,” Leslie Manookian, president and founder of the Health Freedom Defense Fund, told The Epoch Times.

“The VA just trusts that the process and cost of challenging its unfounded policies is so onerous, most people are dissuaded from even trying,” she added.

The VA’s mandate remains in place to this day.

The VA’s website claims that vaccines “help protect you from getting severe illness” and “offer good protection against most COVID-19 variants,” pointing in part to observational data from the U.S. Centers for Disease Control and Prevention (CDC) that estimate the vaccines provide poor protection against symptomatic infection and transient shielding against hospitalization.

There have also been increasing concerns among outside scientists about confirmed side effects like heart inflammation—the VA hid a safety signal it detected for the inflammation—and possible side effects such as tinnitus, which shift the benefit-risk calculus.

President Joe Biden imposed a slate of COVID-19 vaccine mandates in 2021. The VA was the first federal agency to implement a mandate.

President Biden rescinded the mandates in May 2023, citing a drop in COVID-19 cases and hospitalizations. His administration maintains the choice to require vaccines was the right one and saved lives.

“Our administration’s vaccination requirements helped ensure the safety of workers in critical workforces including those in the healthcare and education sectors, protecting themselves and the populations they serve, and strengthening their ability to provide services without disruptions to operations,” the White House said.

Some experts said requiring vaccination meant many younger people were forced to get a vaccine despite the risks potentially outweighing the benefits, leaving fewer doses for older adults.

“By mandating the vaccines to younger people and those with natural immunity from having had COVID, older people in the U.S. and other countries did not have access to them, and many people might have died because of that,” Martin Kulldorff, a professor of medicine on leave from Harvard Medical School, told The Epoch Times previously.

The VA was one of just a handful of agencies to keep its mandate in place following the removal of many federal mandates.

“At this time, the vaccine requirement will remain in effect for VA health care personnel, including VA psychologists, pharmacists, social workers, nursing assistants, physical therapists, respiratory therapists, peer specialists, medical support assistants, engineers, housekeepers, and other clinical, administrative, and infrastructure support employees,” Mr. McDonough wrote to VA employees at the time.

“This also includes VA volunteers and contractors. Effectively, this means that any Veterans Health Administration (VHA) employee, volunteer, or contractor who works in VHA facilities, visits VHA facilities, or provides direct care to those we serve will still be subject to the vaccine requirement at this time,” he said. “We continue to monitor and discuss this requirement, and we will provide more information about the vaccination requirements for VA health care employees soon. As always, we will process requests for vaccination exceptions in accordance with applicable laws, regulations, and policies.”

The version of the shots cleared in the fall of 2022, and available through the fall of 2023, did not have any clinical trial data supporting them.

A new version was approved in the fall of 2023 because there were indications that the shots not only offered temporary protection but also that the level of protection was lower than what was observed during earlier stages of the pandemic.

Ms. Manookian, whose group has challenged several of the federal mandates, said that the mandate “illustrates the dangers of the administrative state and how these federal agencies have become a law unto themselves.”

Government

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex