International

The Demise of Dollar Dominance?

That’s the title I gave for an essay published in the Nikkei today: [Link to article] Here’s the text in English: Every decade, the debate over…

That’s the title I gave for an essay published in the Nikkei today:

[Link to article]

Here’s the text in English:

default pandemic link currencies pound us dollar canadian dollar euro yuan treatment recovery iran russia ukraine chinaEvery decade, the debate over the dollar’s role as the world’s premier currency returns: will America’s currency be dethroned by another country’s? In the 1970’s, it was the Japanese yen or the Deutsche mark. Then with Economic and Monetary Union, the euro was viewed as a contender. In the last decade, the renminbi took up the role as possible aspirant. Where do we stand in 2022?

Before answering that question, it’s important to remember that the one that thing has proven true over the past forty years is the durability of the dollar’s primacy, as shown in Figure 1 — through the global financial crisis, and through the covid pandemic. The dollar remains the primary currency in the holdings of central banks around the world. While there is some uncertainty regarding the exact shares held in each currency (since some central banks do not report the composition of their holdings), the dollar accounts for about 60% of total, far above the euro’s share in the low 20’s. Despite the much heralded rise of China’s currency, the renminbi, its share had only risen to 2.6% by the end of 2021.

Figure 1: Share of foreign exchange reserves in USD (blue), Deutsche mark (orange square), euro (orange line), British pound (red), Japanese yen (green), Chinese yuan (pink). Source: Chinn and Frankel (2008), and IMF COFER.

If we look at other dimensions of the a currency’s role – as a unit of account, a medium of exchange and a store of value – it’s not clear that dollar dominance is under serious threat. About 40% of world trade is invoiced in dollars, somewhat more than that in euros. In terms of foreign exchange trading, the dollar remains by far the dominant currency with 88% of 200% total turnover in dollars. In terms of international messaging for financial transactions (i.e., via SWIFT), the dollar remains a leader, accounting for over 40% of activity. The euro follows at about 35%. Why the handwringing, then?

Sanctions Blowback

Doubts over the dollar’s dominance have come as the sanctions regime imposed on Russia has seemingly struck a crippling blow against the economy. It is thought by some that this demonstration of vulnerability would spur other countries to move away from dollar dependence.

Part of the drama came from sanctioning a major power central bank, since the functioning of the monetary authorities were thought to be protected. In this case, the US, along with Western allies, threatened sanctions against financial institutions engaging in activities with Russian banks, including the Central Bank of Russia. But a substantial portion Russian foreign exchange reserves were held in Western central banks. Not only were financial transactions curtailed, the Russian central bank couldn’t access perhaps a $100 billion of its reserves.

This seeming success contrasts with conventional wisdom regarding the efficacy of financial sanctions. Over previous decades, the US had imposed economic sanctions as a means of trying to alter the behavior of other countries, from Cuba to Libya and to Iran. US attempts to induce Iran to come to an agreement on limiting nuclear proliferation included sanctions, some of them termed “smart sanctions” – targeting individuals and industries, rather than whole economies. While the view of sanctions efficacy was more effective in the wake of the short lived achievement of the Joint Comprehensive Plan of Action (JCPOA) involving Iran, there was still skepticism that sanctions could deter – or constrain – further Russian aggression in the Ukraine.

The wholesale damage wreaked upon the Russian economy has cast a new light on sanctions efficacy. The Russian economy is slated to shrink by 30% by the end of 2022. More importantly, the long term impact of cutting the economy from Western technology and imports is likely to set the Russian economy back decades. The ruble has recovered to its pre-war levels, but this seeming resilience is only a surface gloss; the recovery has been achieved by imposing stringent capital controls, restricting the purchase of foreign exchange, and forcing firms to surrender export proceeds earned in foreign currency.

What makes the effect of sanctions all the more surprising is that Russian policymakers had spent the years after 2014 invasion of Ukraine insulating the economy against economic sanctions. In particular, a hoard of foreign exchange was amassed. This all seemingly demonstrated the enormous power afforded the United States by the dollar’s privileged position as the world’s currency.

Will this dramatic demonstration inspire dedicated moves to diversify away from the dollar, in a way that has not occurred in the past? I think the answer is no.

A Farewell to the Dollar?

The first reason I think it unlikely is that it is extraordinarily difficult to move away from using the dollar, along many dimensions. Consider foreign exchange reserves: Central banks tend to accumulate foreign exchange reserves in the currency in which they are earned – either in exports, or in capital inflows. A large share of export earnings in world trade are invoiced in dollars. About 40% of cross border debt is issued in dollars. In order to change the currency shares of reserves away from the proportions in which they are earned, central banks would have to be determined in selling dollars and buying other currencies such as the euro, pound or yen. This would be an expensive proposition to the extent that markets for assets denominated in these other assets are less liquid, and hence harder to get in and out of. In other words, diversifying reserve holdings out of dollars would be an expensive proposition. Countries would have to incur costs over long periods (holding less secure assets) just to be less reliant on dealing in dollars in the event of a conflict

The second reason I think a concerted move from the dollar is not going to happen is because, in some ways, doing so would be taking the wrong lesson from the events of 2022. It is the multilateral nature of the sanctions that have made them so effective, rather than the fact that the US dollar is involved. Western central banks have frozen Russian foreign reserves held with them (only a portion of reserves are held with the Central Bank of Russia), so that only about $60 billion of the $160 billion was accessible at the end of February.

Case in point, China’s policymakers have apparently concluded that, at least in the short term, there is little way to insulate itself from the type of sanctions treatment meted out to Russia (something on their minds considering the elevated tension between China and Taiwan). In a high level meeting of regulators and bankers in April, leaders concluded that such treatment would devastate the Chinese economy, given the innumerable trade and financlal linkages between the West and China. Even now, Chinese firms have carefully refrained from dealing with sanctioned Russian banks, in order to prevent being sanctioned themselves. But it is not the dollar’s dominance, but rather the dominance of Western finance, and financial infrastructure, which drives Chinese restraint.

But What about the Renminbi?

Throughout the 2010’s, China’s ascent was made manifest by its overtaking of the US economy’s size (at least in purchasing power parity terms). It seemed obvious that an international dominant currency was only a matter of time; the inclusion of the renminbi into the IMF’s Speacial Drawing Right (SDR) seemed to signal the renminbi’s (RMB) time had come. Between 2015 and 2020, the CNY rose from nil to 2% of forex holdings. Turnover in CNY rose from 0% in 2001 to 9% (out of 200%) by 2019.

But no currency can become a major international currency as long as strong restrictions on exist on the cross-border transactions. For some time, it looked as if China had opted for a more open international financial regime. However, since the ascendance of Xi Jinping, it seems that greater financial openness – and the reduction in economic autonomy that would attend it – is no longer a priority. By default, then, a path for the RMB for dominance is now foreclosed. The RMB is already an important regional currency, and will become increasingly so, but its path to being the global currency is now blocked.

So What’s Going to Happen

The dollar is going to retain its dominance because network externalities associated with being a key currency are so strong. That dollar dominance is so strong that a rapid erosion is hard to conceive of. That doesn’t mean that other currencies might not rise in importance (e.g., Australian, Canadian dollar, etc.), other systems for clearing and messaging transactions might develop enough to rival the current incumbents. For the next decade, the international currency regime is likely to look much the same as it does now.

Spread & Containment

Health Officials: Man Dies From Bubonic Plague In New Mexico

Health Officials: Man Dies From Bubonic Plague In New Mexico

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Officials in…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Officials in New Mexico confirmed that a resident died from the plague in the United States’ first fatal case in several years.

The New Mexico Department of Health, in a statement, said that a man in Lincoln County “succumbed to the plague.” The man, who was not identified, was hospitalized before his death, officials said.

They further noted that it is the first human case of plague in New Mexico since 2021 and also the first death since 2020, according to the statement. No other details were provided, including how the disease spread to the man.

The agency is now doing outreach in Lincoln County, while “an environmental assessment will also be conducted in the community to look for ongoing risk,” the statement continued.

“This tragic incident serves as a clear reminder of the threat posed by this ancient disease and emphasizes the need for heightened community awareness and proactive measures to prevent its spread,” the agency said.

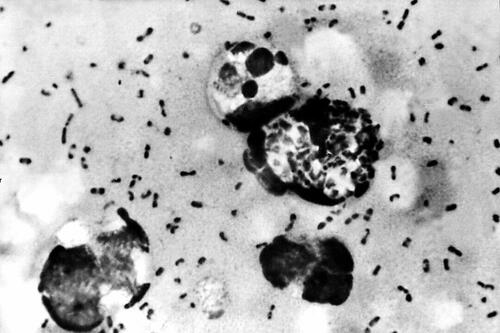

A bacterial disease that spreads via rodents, it is generally spread to people through the bites of infected fleas. The plague, known as the black death or the bubonic plague, can spread by contact with infected animals such as rodents, pets, or wildlife.

The New Mexico Health Department statement said that pets such as dogs and cats that roam and hunt can bring infected fleas back into homes and put residents at risk.

Officials warned people in the area to “avoid sick or dead rodents and rabbits, and their nests and burrows” and to “prevent pets from roaming and hunting.”

“Talk to your veterinarian about using an appropriate flea control product on your pets as not all products are safe for cats, dogs or your children” and “have sick pets examined promptly by a veterinarian,” it added.

“See your doctor about any unexplained illness involving a sudden and severe fever, the statement continued, adding that locals should clean areas around their home that could house rodents like wood piles, junk piles, old vehicles, and brush piles.

The plague, which is spread by the bacteria Yersinia pestis, famously caused the deaths of an estimated hundreds of millions of Europeans in the 14th and 15th centuries following the Mongol invasions. In that pandemic, the bacteria spread via fleas on black rats, which historians say was not known by the people at the time.

Other outbreaks of the plague, such as the Plague of Justinian in the 6th century, are also believed to have killed about one-fifth of the population of the Byzantine Empire, according to historical records and accounts. In 2013, researchers said the Justinian plague was also caused by the Yersinia pestis bacteria.

But in the United States, it is considered a rare disease and usually occurs only in several countries worldwide. Generally, according to the Mayo Clinic, the bacteria affects only a few people in U.S. rural areas in Western states.

Recent cases have occurred mainly in Africa, Asia, and Latin America. Countries with frequent plague cases include Madagascar, the Democratic Republic of Congo, and Peru, the clinic says. There were multiple cases of plague reported in Inner Mongolia, China, in recent years, too.

Symptoms

Symptoms of a bubonic plague infection include headache, chills, fever, and weakness. Health officials say it can usually cause a painful swelling of lymph nodes in the groin, armpit, or neck areas. The swelling usually occurs within about two to eight days.

The disease can generally be treated with antibiotics, but it is usually deadly when not treated, the Mayo Clinic website says.

“Plague is considered a potential bioweapon. The U.S. government has plans and treatments in place if the disease is used as a weapon,” the website also says.

According to data from the U.S. Centers for Disease Control and Prevention, the last time that plague deaths were reported in the United States was in 2020 when two people died.

International

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Is there a light forming when it comes to the long, dark and…

Is there a light forming when it comes to the long, dark and bewildering tunnel of social justice cultism? Global events have been so frenetic that many people might not remember, but only a couple years ago Big Tech companies and numerous governments were openly aligned in favor of mass censorship. Not just to prevent the public from investigating the facts surrounding the pandemic farce, but to silence anyone questioning the validity of woke concepts like trans ideology.

From 2020-2022 was the closest the west has come in a long time to a complete erasure of freedom of speech. Even today there are still countries and Europe and places like Canada or Australia that are charging forward with draconian speech laws. The phrase "radical speech" is starting to circulate within pro-censorship circles in reference to any platform where people are allowed to talk critically. What is radical speech? Basically, it's any discussion that runs contrary to the beliefs of the political left.

Open hatred of moderate or conservative ideals is perfectly acceptable, but don't ever shine a negative light on woke activism, or you might be a terrorist.

Riley Gaines has experienced this double standard first hand. She was even assaulted and taken hostage at an event in 2023 at San Francisco State University when leftists protester tried to trap her in a room and demanded she "pay them to let her go." Campus police allegedly witnessed the incident but charges were never filed and surveillance footage from the college was never released.

It's probably the last thing a champion female swimmer ever expects, but her head-on collision with the trans movement and the institutional conspiracy to push it on the public forced her to become a counter-culture voice of reason rather than just an athlete.

For years the independent media argued that no matter how much we expose the insanity of men posing as women to compete and dominate women's sports, nothing will really change until the real female athletes speak up and fight back. Riley Gaines and those like her represent that necessary rebellion and a desperately needed return to common sense and reason.

In a recent interview on the Joe Rogan Podcast, Gaines related some interesting information on the inner workings of the NCAA and the subversive schemes surrounding trans athletes. Not only were women participants essentially strong-armed by colleges and officials into quietly going along with the program, there was also a concerted propaganda effort. Competition ceremonies were rigged as vehicles for promoting trans athletes over everyone else.

The bottom line? The competitions didn't matter. The real women and their achievements didn't matter. The only thing that mattered to officials were the photo ops; dudes pretending to be chicks posing with awards for the gushing corporate media. The agenda took precedence.

Lia Thomas, formerly known as William Thomas, was more than an activist invading female sports, he was also apparently a science project fostered and protected by the athletic establishment. It's important to understand that the political left does not care about female athletes. They do not care about women's sports. They don't care about the integrity of the environments they co-opt. Their only goal is to identify viable platforms with social impact and take control of them. Women's sports are seen as a vehicle for public indoctrination, nothing more.

The reasons why they covet women's sports are varied, but a primary motive is the desire to assert the fallacy that men and women are "the same" psychologically as well as physically. They want the deconstruction of biological sex and identity as nothing more than "social constructs" subject to personal preference. If they can destroy what it means to be a man or a woman, they can destroy the very foundations of relationships, families and even procreation.

For now it seems as though the trans agenda is hitting a wall with much of the public aware of it and less afraid to criticize it. Social media companies might be able to silence some people, but they can't silence everyone. However, there is still a significant threat as the movement continues to target children through the public education system and women's sports are not out of the woods yet.

The ultimate solution is for women athletes around the world to organize and widely refuse to participate in any competitions in which biological men are allowed. The only way to save women's sports is for women to be willing to end them, at least until institutions that put doctrine ahead of logic are made irrelevant.

International

Congress’ failure so far to deliver on promise of tens of billions in new research spending threatens America’s long-term economic competitiveness

A deal that avoided a shutdown also slashed spending for the National Science Foundation, putting it billions below a congressional target intended to…

Federal spending on fundamental scientific research is pivotal to America’s long-term economic competitiveness and growth. But less than two years after agreeing the U.S. needed to invest tens of billions of dollars more in basic research than it had been, Congress is already seriously scaling back its plans.

A package of funding bills recently passed by Congress and signed by President Joe Biden on March 9, 2024, cuts the current fiscal year budget for the National Science Foundation, America’s premier basic science research agency, by over 8% relative to last year. That puts the NSF’s current allocation US$6.6 billion below targets Congress set in 2022.

And the president’s budget blueprint for the next fiscal year, released on March 11, doesn’t look much better. Even assuming his request for the NSF is fully funded, it would still, based on my calculations, leave the agency a total of $15 billion behind the plan Congress laid out to help the U.S. keep up with countries such as China that are rapidly increasing their science budgets.

I am a sociologist who studies how research universities contribute to the public good. I’m also the executive director of the Institute for Research on Innovation and Science, a national university consortium whose members share data that helps us understand, explain and work to amplify those benefits.

Our data shows how underfunding basic research, especially in high-priority areas, poses a real threat to the United States’ role as a leader in critical technology areas, forestalls innovation and makes it harder to recruit the skilled workers that high-tech companies need to succeed.

A promised investment

Less than two years ago, in August 2022, university researchers like me had reason to celebrate.

Congress had just passed the bipartisan CHIPS and Science Act. The science part of the law promised one of the biggest federal investments in the National Science Foundation in its 74-year history.

The CHIPS act authorized US$81 billion for the agency, promised to double its budget by 2027 and directed it to “address societal, national, and geostrategic challenges for the benefit of all Americans” by investing in research.

But there was one very big snag. The money still has to be appropriated by Congress every year. Lawmakers haven’t been good at doing that recently. As lawmakers struggle to keep the lights on, fundamental research is quickly becoming a casualty of political dysfunction.

Research’s critical impact

That’s bad because fundamental research matters in more ways than you might expect.

For instance, the basic discoveries that made the COVID-19 vaccine possible stretch back to the early 1960s. Such research investments contribute to the health, wealth and well-being of society, support jobs and regional economies and are vital to the U.S. economy and national security.

Lagging research investment will hurt U.S. leadership in critical technologies such as artificial intelligence, advanced communications, clean energy and biotechnology. Less support means less new research work gets done, fewer new researchers are trained and important new discoveries are made elsewhere.

But disrupting federal research funding also directly affects people’s jobs, lives and the economy.

Businesses nationwide thrive by selling the goods and services – everything from pipettes and biological specimens to notebooks and plane tickets – that are necessary for research. Those vendors include high-tech startups, manufacturers, contractors and even Main Street businesses like your local hardware store. They employ your neighbors and friends and contribute to the economic health of your hometown and the nation.

Nearly a third of the $10 billion in federal research funds that 26 of the universities in our consortium used in 2022 directly supported U.S. employers, including:

A Detroit welding shop that sells gases many labs use in experiments funded by the National Institutes of Health, National Science Foundation, Department of Defense and Department of Energy.

A Dallas-based construction company that is building an advanced vaccine and drug development facility paid for by the Department of Health and Human Services.

More than a dozen Utah businesses, including surveyors, engineers and construction and trucking companies, working on a Department of Energy project to develop breakthroughs in geothermal energy.

When Congress shortchanges basic research, it also damages businesses like these and people you might not usually associate with academic science and engineering. Construction and manufacturing companies earn more than $2 billion each year from federally funded research done by our consortium’s members.

Jobs and innovation

Disrupting or decreasing research funding also slows the flow of STEM – science, technology, engineering and math – talent from universities to American businesses. Highly trained people are essential to corporate innovation and to U.S. leadership in key fields, such as AI, where companies depend on hiring to secure research expertise.

In 2022, federal research grants paid wages for about 122,500 people at universities that shared data with my institute. More than half of them were students or trainees. Our data shows that they go on to many types of jobs but are particularly important for leading tech companies such as Google, Amazon, Apple, Facebook and Intel.

That same data lets me estimate that over 300,000 people who worked at U.S. universities in 2022 were paid by federal research funds. Threats to federal research investments put academic jobs at risk. They also hurt private sector innovation because even the most successful companies need to hire people with expert research skills. Most people learn those skills by working on university research projects, and most of those projects are federally funded.

High stakes

If Congress doesn’t move to fund fundamental science research to meet CHIPS and Science Act targets – and make up for the $11.6 billion it’s already behind schedule – the long-term consequences for American competitiveness could be serious.

Over time, companies would see fewer skilled job candidates, and academic and corporate researchers would produce fewer discoveries. Fewer high-tech startups would mean slower economic growth. America would become less competitive in the age of AI. This would turn one of the fears that led lawmakers to pass the CHIPS and Science Act into a reality.

Ultimately, it’s up to lawmakers to decide whether to fulfill their promise to invest more in the research that supports jobs across the economy and in American innovation, competitiveness and economic growth. So far, that promise is looking pretty fragile.

This is an updated version of an article originally published on Jan. 16, 2024.

Jason Owen-Smith receives research support from the National Science Foundation, the National Institutes of Health, the Alfred P. Sloan Foundation and Wellcome Leap.

economic growth covid-19 grants congress vaccine china-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges