Uncategorized

The COVID/Crypto Connection: The Grim Saga Of FTX & Sam Bankman-Fried

The COVID/Crypto Connection: The Grim Saga Of FTX & Sam Bankman-Fried

Authored by Jeffrey Tucker via The Brownstone Institute,

A series…

Authored by Jeffrey Tucker via The Brownstone Institute,

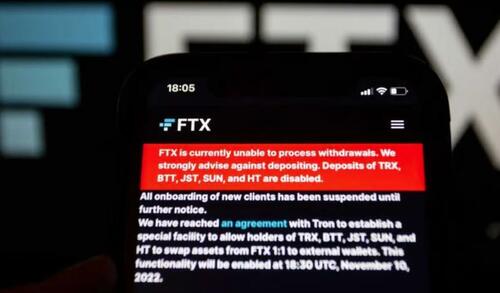

A series of revealing texts and tweets by Sam Bankman-Fried, the disgraced CEO of FTX, the once high-flying but now belly-up crypto exchange, had the following to say about his image as a do-gooder: it is a “dumb game we woke westerners play where we say all the right shibboleths and so everyone likes us.”

Very interesting. He had the whole game going: a vegan worried about climate change, supports every manner of justice (racial, social, environmental) except that which is coming for him, and shells out millions to worthy charities associated with the left. He also bought plenty of access and protection in D.C., enough to make his shady company the toast of the town.

As part of the mix, there is this thing called pandemic planning. We should know what that is by now: it means you can’t be in charge of your life because there are bad viruses out there. As bizarre as it seems, and for reasons that are still not entirely clear, favoring lockdowns, masks, and vaccine passports became part of the woke ideological stew.

This is particularly strange because covid restrictions have been proven, over and over, to harm all the groups about whom woke ideology claims to care so deeply. That includes even animal rights: who can forget the Danish mink slaughter of 2020?

Regardless, it’s just true. Masking became a symbol of being a good person, same as vaccinating, veganism, and flying into fits at the drop of a hat over climate change. None of this has much if anything to do with science or reality. It’s all tribal symbolism in the name of group political solidarity. And FTX was pretty good at it, throwing around hundreds of millions to prove the company’s loyalty to all the right causes.

Among them included the pandemic-planning racket. That’s right: there were deep connections between FTX and Covid that have been cultivated for two years. Let’s have a look.

Earlier this year, the New York Times trumpeted a study that showed no benefit at all to the use of Ivermectin. It was supposed to be definitive. The study was funded by FTX. Why? Why was a crypto exchange so interested in the debunking of repurposed drugs in order to drive governments and people into the use of patented pharmaceuticals, even those like Ramdesivir that didn’t actually work? Inquiring minds would like to know.

Regardless, the study and especially the conclusions turned out to be bogus. David Henderson and Charles Hooper further point out an interesting fact:

“Some of the researchers involved in the TOGETHER trial had performed paid services for Pfizer, Merck, Regeneron, and AstraZeneca, all companies involved in developing COVID-19 therapeutics and vaccines that nominally compete with ivermectin.”

For some reason, SBF just knew that he was supposed to oppose repurposed drugs, though he knew nothing about the subject at all. He was glad to fund a poor study to make it true and the New York Times played its assigned role in the whole performance.

It was just the start. A soft-peddling Washington Post investigation found that Sam and his brother Gabe, who ran a hastily founded Covid nonprofit, “have spent at least $70 million since October 2021 on research projects, campaign donations and other initiatives intended to improve biosecurity and prevent the next pandemic.”

I can do no better than to quote the Washington Post:

The shock waves from FTX’s free fall have rippled across the public health world, where numerous leaders in pandemic-preparedness had received funds from FTX funders or were seeking donations.

In other words, the “public health world” wanted more chances to say: “Give me money so I can keep advocating to lock more people down!” Alas, the collapse of the exchange, which reportedly holds a mere 0.001% of the assets it once claimed to have, makes that impossible.

Among the organizations most affected is Guarding Against Pandemics, the advocacy group headed by Gabe that took out millions in ads to back the Biden administration’s push for $30 billion in funding. As Influence Watch notes: “Guarding Against Pandemics is a left-leaning advocacy group created in 2020 to support legislation that increases government investment in pandemic prevention plans.”

Truly it gets worse:

FTX-backed projects ranged from $12 million to champion a California ballot initiative to strengthen public health programs and detect emerging virus threats (amid lackluster support, the measure was punted to 2024), to investing more than $11 million on the unsuccessful congressional primary campaign of an Oregon biosecurity expert, and even a $150,000 grant to help Moncef Slaoui, scientific adviser for the Trump administration’s “Operation Warp Speed” vaccine accelerator, write his memoir.

Leaders of the FTX Future Fund, a spinoff foundation that committed more than $25 million to preventing bio-risks, resigned in an open letter last Thursday, acknowledging that some donations from the organization are on hold.

And worse:

The FTX Future Fund’s commitments included $10 million to HelixNano, a biotech start-up seeking to develop a next-generation coronavirus vaccine; $250,000 to a University of Ottawa scientist researching how to eradicate viruses from plastic surfaces; and $175,000 to support a recent law school graduate’s job at the Johns Hopkins Center for Health Security. “Overall, the Future Fund was a force for good,” said Tom Inglesby, who leads the Johns Hopkins center, lamenting the fund’s collapse. “The work they were doing was really trying to get people to think long-term … to build pandemic preparedness, to diminish the risks of biological threats.”

More:

Guarding Against Pandemics spent more than $1 million on lobbying Capitol Hill and the White House over the past year, hired at least 26 lobbyists to advocate for a still-pending bipartisan pandemic plan in Congress and other issues, and ran advertisements backing legislation that included pandemic-preparedness funding. Protect Our Future, a political action committee backed by the Bankman-Fried brothers, spent about $28 million this congressional cycle on Democratic candidates “who will be champions for pandemic prevention,” according to the group’s webpage.

I think you get the idea. This is all a racket. FTX, founded in 2019 following Biden’s announcement of his bid for the presidency, by the son of the co-founder of a major Democrat Party political action committee called Mind the Gap, was nothing but a magic-bean Ponzi scheme. It seized on the lockdowns for political, media, and academic cover. Its economic rationale was as nonexistent as its books. The first auditor to have a look has written:

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

It was the worst example of a phony perpetual-motion machine: a token to back a company that itself was backed by the token, which in turn was backed by nothing but political fashion and woke ideology that roped in Larry David, Tom Brady, Katy Perry, Tony Blair, and Bill Clinton to provide a cloak of legitimacy.

Tony Blair, Bill Clinton, and Sam Bankman-Fried in the Bahamas April 2022

And you can’t make this stuff up anymore: FTX had a close relationship with the World Economic Forum and was the favored crypto exchange of the Ukrainian government. It looks for all the world like the money-laundering operation of the Democratic National Committee and the entire lockdown lobby.

I will tell you what infuriates me about these billions in fake money and deep corruptions of politics and science. For years now, my anti-lockdown friends have been hounded for being funded by supposed dark money that simply doesn’t exist. Many brave scientists, journalists, attorneys, and others gave up great careers to stand for principle, exposing the damage caused by the lockdowns, and this is how they have been treated: smeared and displaced.

Brownstone has adopted as many in this diaspora as possible for fellowships as far as the resources (real ones, contributed by caring individuals) can go. But we cannot come anywhere near what is necessary for justice, much less complete with the 8-digit funding regime of the other side.

The Great Barrington Declaration was signed at the offices of the American Institute for Economic Research, which, apparently, six years prior had received a long-spent $60,000 grant from the Koch Foundation, and thus became a “Koch-funded libertarian think tank” which supposedly discredited the GBD, even though none of the authors received a dime.

This gibberish and slander has gone on for years – at the urging of government officials! – and Brownstone itself faces much of the same nonsense, with every manner of fantasy about our supposed power, money, and influence swarming the darker realms of the social-media dudgeons. In fact, the actual Koch Foundation (probably unbeknownst to its founder) was funding the pro-lockdown work of Neil Ferguson, whose ridiculous modeling terrified the world into denying human rights to billions of people the world over.

All this time – while every type of vicious propaganda was unleashed on the world – the pro-lockdown and pro-mandate lobby, including fake scientists and fake studies, were benefiting from millions and billions thrown around by operators of a Ponzi scheme based on cheating, fraud, and $15 billion in leveraged funds that didn’t exist while its principle actors were languishing in a drug-infested $40 million villa in the Bahamas even as they preened about the virtues of “effective altruism” and their pandemic-planning machinery that has now fallen apart.

Then the New York Times, instead of decrying this criminal conspiracy for what it is, writes puff pieces on the founder and how he let his quick-growing company grow too far, too fast, and now needs mainly rest, bless his heart.

The rest of us are left with the bill for this obvious scam that implausibly links crypto and Covid. But just as the money was based on nothing but puffed air, the damage they have wrought on the world is all too real: a lost generation of kids, declined lifespans, millions missing from the workforce, a calamitous fall in public health, millions of kids in poverty due to supply-chain breakages, 19 straight months of falling real incomes, historically high increases in debt, and a dramatic fall in human morale the world over.

So yes, we should all be furious and demand full accountability at the very least. Whatever the final truth, it is likely to be far worse than even the egregious facts listed above. It’s bad enough that lockdowns wrecked life and liberty. To discover that vast support for them was funded by fraud and fakery is a deeper level of corruption that not even the most cynical among us could have imagined.

Uncategorized

One city held a mass passport-getting event

A New Orleans congressman organized a way for people to apply for their passports en masse.

While the number of Americans who do not have a passport has dropped steadily from more than 80% in 1990 to just over 50% now, a lack of knowledge around passport requirements still keeps a significant portion of the population away from international travel.

Over the four years that passed since the start of covid-19, passport offices have also been dealing with significant backlog due to the high numbers of people who were looking to get a passport post-pandemic.

Related: Here is why it is (still) taking forever to get a passport

To deal with these concurrent issues, the U.S. State Department recently held a mass passport-getting event in the city of New Orleans. Called the "Passport Acceptance Event," the gathering was held at a local auditorium and invited residents of Louisiana’s 2nd Congressional District to complete a passport application on-site with the help of staff and government workers.

'Come apply for your passport, no appointment is required'

"Hey #LA02," Rep. Troy A. Carter Sr. (D-LA), whose office co-hosted the event alongside the city of New Orleans, wrote to his followers on Instagram (META) . "My office is providing passport services at our #PassportAcceptance event. Come apply for your passport, no appointment is required."

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

The event was held on March 14 from 10 a.m. to 1 p.m. While it was designed for those who are already eligible for U.S. citizenship rather than as a way to help non-citizens with immigration questions, it helped those completing the application for the first time fill out forms and make sure they have the photographs and identity documents they need. The passport offices in New Orleans where one would normally have to bring already-completed forms have also been dealing with lines and would require one to book spots weeks in advance.

These are the countries with the highest-ranking passports in 2024

According to Carter Sr.'s communications team, those who submitted their passport application at the event also received expedited processing of two to three weeks (according to the State Department's website, times for regular processing are currently six to eight weeks).

While Carter Sr.'s office has not released the numbers of people who applied for a passport on March 14, photos from the event show that many took advantage of the opportunity to apply for a passport in a group setting and get expedited processing.

Every couple of months, a new ranking agency puts together a list of the most and least powerful passports in the world based on factors such as visa-free travel and opportunities for cross-border business.

In January, global citizenship and financial advisory firm Arton Capital identified United Arab Emirates as having the most powerful passport in 2024. While the United States topped the list of one such ranking in 2014, worsening relations with a number of countries as well as stricter immigration rules even as other countries have taken strides to create opportunities for investors and digital nomads caused the American passport to slip in recent years.

A UAE passport grants holders visa-free or visa-on-arrival access to 180 of the world’s 198 countries (this calculation includes disputed territories such as Kosovo and Western Sahara) while Americans currently have the same access to 151 countries.

stocks pandemic covid-19 grantsUncategorized

Fast-food chain closes restaurants after Chapter 11 bankruptcy

Several major fast-food chains recently have struggled to keep restaurants open.

Competition in the fast-food space has been brutal as operators deal with inflation, consumers who are worried about the economy and their jobs and, in recent months, the falling cost of eating at home.

Add in that many fast-food chains took on more debt during the covid pandemic and that labor costs are rising, and you have a perfect storm of problems.

It's a situation where Restaurant Brands International (QSR) has suffered as much as any company.

Related: Wendy's menu drops a fan favorite item, adds something new

Three major Burger King franchise operators filed for bankruptcy in 2023, and the chain saw hundreds of stores close. It also saw multiple Popeyes franchisees move into bankruptcy, with dozens of locations closing.

RBI also stepped in and purchased one of its key franchisees.

"Carrols is the largest Burger King franchisee in the United States today, operating 1,022 Burger King restaurants in 23 states that generated approximately $1.8 billion of system sales during the 12 months ended Sept. 30, 2023," RBI said in a news release. Carrols also owns and operates 60 Popeyes restaurants in six states."

The multichain company made the move after two of its large franchisees, Premier Kings and Meridian, saw multiple locations not purchased when they reached auction after Chapter 11 bankruptcy filings. In that case, RBI bought select locations but allowed others to close.

Image source: Chen Jianli/Xinhua via Getty

Another fast-food chain faces bankruptcy problems

Bojangles may not be as big a name as Burger King or Popeye's, but it's a popular chain with more than 800 restaurants in eight states.

"Bojangles is a Carolina-born restaurant chain specializing in craveable Southern chicken, biscuits and tea made fresh daily from real recipes, and with a friendly smile," the chain says on its website. "Founded in 1977 as a single location in Charlotte, our beloved brand continues to grow nationwide."

Like RBI, Bojangles uses a franchise model, which makes it dependent on the financial health of its operators. The company ultimately saw all its Maryland locations close due to the financial situation of one of its franchisees.

Unlike. RBI, Bojangles is not public — it was taken private by Durational Capital Management LP and Jordan Co. in 2018 — which means the company does not disclose its financial information to the public.

That makes it hard to know whether overall softness for the brand contributed to the chain seeing its five Maryland locations after a Chapter 11 bankruptcy filing.

Bojangles has a messy bankruptcy situation

Even though the locations still appear on the Bojangles website, they have been shuttered since late 2023. The locations were operated by Salim Kakakhail and Yavir Akbar Durranni. The partners operated under a variety of LLCs, including ABS Network, according to local news channel WUSA9.

The station reported that the owners face a state investigation over complaints of wage theft and fraudulent W2s. In November Durranni and ABS Network filed for bankruptcy in New Jersey, WUSA9 reported.

"Not only do former employees say these men owe them money, WUSA9 learned the former owners owe the state, too, and have over $69,000 in back property taxes."

Former employees also say that the restaurant would regularly purchase fried chicken from Popeyes and Safeway when it ran out in their stores, the station reported.

Bojangles sent the station a comment on the situation.

"The franchisee is no longer in the Bojangles system," the company said. "However, it is important to note in your coverage that franchisees are independent business owners who are licensed to operate a brand but have autonomy over many aspects of their business, including hiring employees and payroll responsibilities."

Kakakhail and Durranni did not respond to multiple requests for comment from WUSA9.

bankruptcy pandemicUncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.Click on graph for larger image.

emphasis added

This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment3 days ago

Spread & Containment3 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex