Government

The Build Back Better Act’s macroeconomic boost looks more valuable by the day

In previous work, Adam Hersh highlighted how the Infrastructure Investment and Jobs Act (IIJA) and the Build Back Better Act (BBBA) could provide a backstop against the possibility that economic growth slows due to slack in aggregate demand for goods…

In previous work, Adam Hersh highlighted how the Infrastructure Investment and Jobs Act (IIJA) and the Build Back Better Act (BBBA) could provide a backstop against the possibility that economic growth slows due to slack in aggregate demand for goods and services in the next couple of years. Over the past few months, a pronounced uptick in inflation convinced far too many that the U.S. economy actually faced the opposite problem of macroeconomic overheating—an excess of aggregate demand.

But late last week, the Bureau of Economic Analysis (BEA) released data making it clear that the U.S. economy is not overheating and that aggregate demand support in 2022 and 2023 could be vital to continued economic growth. Given this, the macroeconomic boost provided by the BBBA in coming years could be valuable indeed.

In this post, I argue:

- The U.S. economy is demonstrably not overheating due to excess fiscal stimulus from earlier this year. In fact, deficient demand is as likely to be a constraint on economic growth going forward as constrained supply.

- The inflationary uptick in the spring and summer was driven by a sudden reallocation of spending, not a macroeconomic imbalance of overall aggregate demand and supply. In addition to this sharp reallocation of spending, sectoral supply-side bottlenecks also contributed to pushing up inflation.

- U.S. households would not be better off today had policymakers passed less fiscal relief earlier in 2021. The unexpected reallocation of spending, combined with supply-side bottlenecks, did contribute to the inflationary uptick in mid-year. This inflationary burst did, in turn, keep some of the full potential value of the fiscal relief from reaching households. But inflation-adjusted personal income for U.S. households is unambiguously higher due to the relief measures, and jobs and wage growth are better due to the stimulus provided.

- The data on gross domestic product (GDP) in the third quarter of 2021 released late last week show that the main source of inflationary pressure—the sharp reallocation of spending—is completely gone. The rapid run-up in spending on goods this past year reversed in the third quarter and contracted sharply. Going forward, if policymakers enact more-contractionary macroeconomic policy measures—either cutting back fiscal relief and recovery efforts or raising interest rates—they will commit a bad mistake, slowing growth in 2022 notably and halting the welcome rapid recovery that had been underway.

Below, I expand on each of these points.

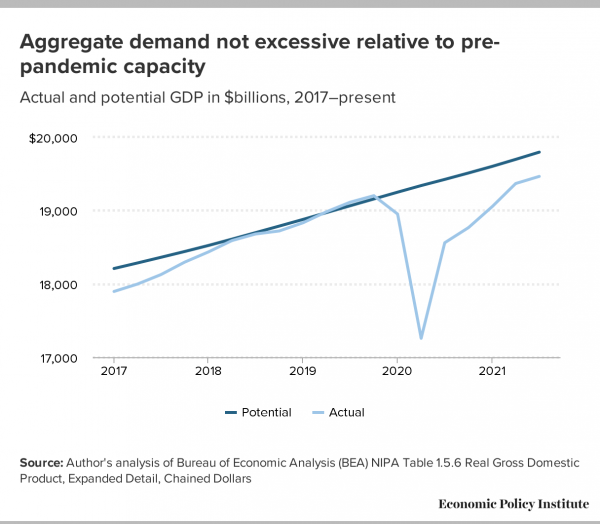

The U.S. macroeconomy is not overheating due to “too much” fiscal relief and recovery provided earlier in 2021. The evidence for this can be seen in Figure A below showing actual GDP and potential GDP over the past few years. As of the third quarter of 2021, actual GDP remained below what the Congressional Budget Office (CBO) estimated potential GDP would be in this quarter. In short, given the productive capacity that existed pre-COVID, the U.S. economy should be easily capable of producing as much GDP as was produced in the third quarter of 2021 without causing any inflationary pressures.

The sharp inflationary uptick seen in the spring and summer of 2021 was not driven by a macroeconomic imbalance of aggregate demand and supply. Instead, it was driven by a very sharp reallocation of spending patterns over the COVID-19 economic recovery. Specifically, over the recovery, U.S. households cut back spending on face-to-face services (like restaurants, hotels, gyms) and significantly increased spending on goods (like clothing, furniture, and autos). This pattern was clear in the data by the end of 2020. At that time, while overall GDP was 3% lower than what prevailed in the last quarter of 2019 (immediately pre-COVID), consumer spending on durable goods was already well over 10% higher than it had been before COVID-19.

On the other hand, spending on recreation services was still 32% lower at the end of 2020 than it had been a year before. Surprisingly, while nearly every sector grew between the end of 2020 and the second quarter of 2021 as the recovery from the COVID-19 economic shock proceeded, this extremely skewed allocation of spending persisted. Figure B below shows GDP from a number of sectors from the fourth quarter of 2020 and the second quarter of 2021, both divided by sectoral GDP in the last quarter before COVID hit (the fourth quarter of 2019). It demonstrates that the bias toward goods and away from services that characterized the early part of the COVID-19 economic recovery persisted (and sometimes became even more biased) into 2021. This can be seen in the fact that the height of the blue bars (normalized GDP by sector at the end of 2020) tends to correlate very tightly with the height of the red circles (normalized GDP by sector in the middle of 2021).

It certainly makes sense that a sharp sectoral reallocation of spending could lead to an uptick in overall inflation. Sectoral inflation is the market’s way of signaling that more productive resources need to flow to a sector to let supply keep up with increased demand. It is potentially surprising, however, that it took as large an inflationary spike as we saw in the spring and summer to accommodate the increased goods production we saw over this time.

Some have argued the simple scale of increased demand for goods is the entire reason for this inflationary spike, with some arguing as a result that this implies that fiscal relief and recovery efforts allowed too-large a surge in goods spending and was the root cause of the spike. This view largely denies any role of unusual supply-chain disruptions or bottlenecks that could have played a part (and which could, if solved quickly, greatly relieve pressure in coming months).

But it does not seem right that the simple scale of increased goods production easily explains the inflationary spike we saw, and it does not seem right that supply-side pressures aren’t visible in the data.

On the first issue, as a share of GDP, goods production in the second quarter of 2021 was 4.5% higher than it had been at the end of 2019. At the macroeconomic level, Phillips curve regressions of inflation rates on estimated output gaps (the gap between potential and actual GDP) would indicate that a 4.5% increase in GDP relative to its normal full employment level would push up inflation rates by about 1.5%. But given that some resources can be shifted into goods production from other sectors (not an option when the entire economy becomes resource-constrained), it seems like the effect on inflation should be more muted than this.

Further, over an 18-month period, normal productivity growth alone should have been sufficient to accommodate almost a third of this rise. Finally, it is far from obvious that goods production in the U.S. economy at the end of 2019 was at its maximum non-inflationary potential. In short, the simple scale of the increase in demand for goods we saw is completely responsible for the inflationary uptick.

On the second issue—supply chain rigidities—the evidence is also highly suggestive. In smoothly functioning markets, a wave of increased demand for goods should send employers skittering to get more hours of work from employees (both current and prospective) to produce more goods. They would put more effort into hiring and would extend hours for the incumbent workforce. In 2021, they haven’t done much of either in many of the most inflation-heavy sectors. Figure C below shows growth in average hourly earnings and average weekly hours for a number of large sectors. The leisure and hospitality sector saw large increases both in hourly earnings and weekly hours, indicating employers trying hard to match growing demand with more workers. Any such employer effort in goods production or distribution is far less visible—neither wages (to attract new workers) nor hours (to get more labor input out of their existing workforce) grew in any significant way over the past year. This seems like a clear failure to force supply to respond to the wave of demand.

Figure D shows another aspect of supply chain rigidity. Between the end of 2020 and the middle of 2021, consumer spending on new and used cars rose by a whopping 16%. Yet over this same period, domestic production of automobiles declined by nearly 4%. In fact, by the second quarter of 2021, domestic production of automobiles was 2.5% lower than it was at the end of 2019, even as spending on new and used cars was 27% higher. Given this extraordinary rise in consumer demand for autos, what besides supply-side dysfunction could explain falling domestic production? The automobile sector was clearly the epicenter of inflationary pressures that were seen in mid-2021.

Critics of the scale of the fiscal relief and recovery measures in the American Rescue Plan (ARP) passed in March 2021 have claimed some vindication from the mid-year inflationary spike. But U.S. households would not be better off today had policymakers passed less fiscal relief.

The real-time criticisms of the ARP did not center on the allocation of spending or on extraordinary rigidity and dysfunction on the supply side of goods production. Instead, they focused on aggregate output gaps, but these gaps (as we showed previously in Figure A) have not even yet been closed, let alone been pushed into inflationary territory. Occasionally, the ARP critics also focused on the perceived excess generosity of unemployment insurance (UI) benefits as potentially driving inflation from the labor market by providing too-much bargaining clout to workers. While the labor market is currently hot in many pockets, it is not sectors with fast wage growth that are driving the inflation in prices.

If the ARP had been less generous with fiscal relief and recovery, it is possible that some of the mid-year inflationary spike would have been muffled. But fiscal relief and recovery measures have boosted personal incomes by nearly 5% thus far into 2021. The acceleration in core inflation over this time has been far less than this.

Even without correcting for “base effects” that exaggerate the acceleration of inflation since the COVID-19 economic shock in 2020, year-over-year core price (excluding food and energy) inflation rose from 1.5% to 3.5%. So, households are still far ahead in terms of inflation-adjusted incomes due to the relief and recovery. If this relief and recovery had been withheld, it is far from clear that only spending on goods would have been cut back. To the degree that faster income growth has helped the still-sluggish growth in face-to-face service sectors, it has boosted labor incomes and job opportunities. This all seems supremely well worth it.

Do I wish that U.S. households had spread out their purchase of goods and reoriented spending toward services over the year, generating a more-gentle rise in inflation? All else equal, sure. But the primary driver of continued depressed spending in face-to-face services remains COVID-19—and the emergence of the Delta variant specifically. Do I also wish producers—both domestic and global—had been better able to ramp up their productive capacity in response to a surge in demand for goods? Again, yes, but a primary bottleneck in the production and distribution of goods globally has been COVID-19, specifically its effects in shutting down port facilities around the world. Policymaking in a pandemic has indeed proven to be hard, but making fiscal policy strongly expansionary over the past year has served the economy well. The big inflation drivers—reallocated spending towards goods and supply chain rigidities—are all about the effects of COVID-19. In this case, public health policy really does become anti-inflation policy.

Going forward, demand—both aggregate and for goods specifically—will not be excessive in the U.S. economy. The third quarter of 2021 saw overall GDP growth slow radically to just 2%. More strikingly, consumer spending on goods contracted significantly. In coming quarters, fiscal policy is set to become substantially less expansionary, putting a large drag on demand growth. There is, in short, very little reason to think that macroeconomic overheating putting further upward pressure on inflation is a large concern going forward.

Absent passage of the IIJA and the BBBA, fiscal policy is already set to become quite contractionary in the next two years. Given the lag with which interest rate increases slow aggregate demand, if the Federal Reserve raises rates in the near future, economic growth could be severely curtailed in 2022 and 2023.

Policymakers shouldn’t overreact to the mid-year inflationary surge that is already levelling off. The Fed should keep rates low and Congress should pass the IIJA and the BBBA. The latter two policies would provide a host of benefits besides simple macroeconomic stabilization, boosting long-run growth and economic security through public investment and deeper social insurance. But they also provide a macroeconomic insurance policy against aggregate demand growing too slowly in coming years, and this insurance policy looks more important to secure with each passing day.

economic shock unemployment pandemic covid-19 economic recovery stimulus economic growth fed federal reserve congress spread epicenter gdp recovery interest rates consumer spending unemployment stimulusInternational

Angry Shouting Aside, Here’s What Biden Is Running On

Angry Shouting Aside, Here’s What Biden Is Running On

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union…

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union address - in which he insisted that the American economy is doing better than ever, blamed inflation on 'corporate greed,' and warned that Donald Trump poses an existential threat to the republic.

But in between the angry rhetoric, he also laid out his 2024 election platform - for which additional details will be released on March 11, when the White House sends its proposed budget to Congress.

To that end, Goldman Sachs' Alec Phillips and Tim Krupa have summarized the key points:

Taxes

While railing against billionaires (nothing new there), Biden repeated the claim that anyone making under $400,000 per year won't see an increase in their taxes. He also proposed a 21% corporate minimum tax, up from 15% on book income outlined in the Inflation Reduction Act (IRA), as well as raising the corporate tax rate from 21% to 28% (which would promptly be passed along to consumers in the form of more inflation). Goldman notes that "Congress is unlikely to consider any of these proposals this year, they would only come into play in a second Biden term, if Democrats also won House and Senate majorities."

Biden once again tells the complete lie that "nobody earning less than $400,000/year will pay additional penny in federal taxes."

— RNC Research (@RNCResearch) March 8, 2024

FACT: Biden has *already* raised the tax burden on Americans making as little as $20,000 per year. pic.twitter.com/VrZ1m0rzG3

Biden also called on Congress to restore the pandemic-era child tax credit.

Immigration

Instead of simply passing a slew of border security Executive Orders like the Trump ones he shredded on day one, Biden repeated the lie that Congress 'needs to act' before he can (translation: send money to Ukraine or the US border will continue to be a sieve).

As immigration comes into even greater focus heading into the election, we continue to expect the Administration to tighten policy (e.g., immigration has surged 20pp the last 7 months to first place with 28% in Gallup’s “most important problem” survey). As such, we estimate the foreign-born contribution to monthly labor force growth will moderate from 110k/month in 2023 to around 70-90k/month in 2024. -GS

SEE IT: Biden gets boo-ed while talking about his immigration bill. WATCH pic.twitter.com/O5FmkYx3xM

— Simon Ateba (@simonateba) March 8, 2024

Ukraine

Biden, with House Speaker Mike Johnson doing his best impression of a bobble-head, urged Congress to pass additional assistance for Ukraine based entirely on the premise that Russia 'won't stop' there (and would what, trigger article 5 and WW3 no matter what?), despite the fact that Putin explicitly told Tucker Carlson he has no further ambitions, and in fact seeks a settlement.

‼️ Breaking: Putin wants a negotiated settlement to what’s happening in Ukraine.

— Ed (@EdMagari) February 9, 2024

In a surprising turn of events, Tucker Carlson could be the key to peace, potentially playing a crucial role in ending the current conflict????️ pic.twitter.com/IKN8ajlEUX

As Goldman estimates, "While there is still a clear chance that such a deal could come together, for now there is no clear path forward for Ukraine aid in Congress."

China

Biden, forgetting about all the aggressive tariffs, suggested that Trump had been soft on China, and that he will stand up "against China's unfair economic practices" and "for peace and stability across the Taiwan Strait."

SOTU FACT CHECK:

— Wesley Hunt (@WesleyHuntTX) March 8, 2024

Biden claims we’re in a strong position to take on China.

No president in our lifetime has been WEAKER on China than Biden. pic.twitter.com/Y73JsIzmM3

Healthcare

Lastly, Biden proposed to expand drug price negotiations to 50 additional drugs each year (an increase from 20 outlined in the IRA), which Goldman said would likely require bipartisan support "even if Democrats controlled Congress and the White House," as such policies would likely be ineligible for the budget "reconciliation" process which has been used in previous years to pass the IRA and other major fiscal party when Congressional margins are just too thin.

So there you have it. With no actual accomplishments to speak of, Biden can only attack Trump, lie, and make empty promises.

Government

Jack Smith Says Trump Retention Of Documents “Starkly Different” From Biden

Jack Smith Says Trump Retention Of Documents "Starkly Different" From Biden

Authored by Catherine Yang via The Epoch Times (emphasis ours),

Special…

Authored by Catherine Yang via The Epoch Times (emphasis ours),

Special counsel Jack Smith has argued the case he is prosecuting against former President Donald Trump for allegedly mishandling classified information is “starkly different” from the case the Department of Justice declined to bring against President Joe Biden over retention of classified documents.

Prosecutors, in responding to a motion President Trump filed to dismiss the case based on selective and vindictive prosecution, said on Thursday this is not the case of “two men ‘commit[ting] the same basic crime in substantially the same manner.”

They argue the similarities are only “superficial,” and that there are two main differences: that President Trump allegedly “engaged in extensive and repeated efforts to obstruct justice and thwart the return of documents” and the “evidence concerning the two men’s intent.”

Special counsel Robert Hur’s report found that there was evidence that President Biden “willfully” retained classified Afghanistan documents, but that evidence “fell short” of concluding guilt of willful retention beyond reasonable doubt.

Prosecutors argue the “strength of the evidence” is a crucial element showing these cases are not “similarly situated.”

“Trump may dispute the Hur Report’s conclusions but he should not be allowed to misrepresent them,” prosecutors wrote, arguing that the defense’s argument to dismiss the case fell short of legal standards.

They point to volume as another distinction: President Biden had 88 classified documents and President Trump had 337. Prosecutors also argued that while President Biden’s Delaware garage “was plainly an unsecured location ... whatever risks are posed by storing documents in a private garage” were “dwarfed” by President Trump storing documents at an “active social club” with 150 staff members and hundreds of visitors.

Defense attorneys had also cited a New York Times report where President Biden was reported to have held the view that President Trump should be prosecuted, expressing concern about his retention of documents at Mar-a-lago.

Prosecutors argued that this case was not “foisted” upon the special counsel, who had not been appointed at the time of these comments.

“Trump appears to contend that it was President Biden who actually made the decision to seek the charges in this case; that Biden did so solely for unconstitutional reasons,” the filing reads. “He presents no evidence whatsoever to show that Biden’s comments about him had any bearing on the Special Counsel’s decision to seek charges, much less that the Special Counsel is a ’stalking horse.'”

8 Other Cases

President Trump has argued he is being subjected to selective and vindictive prosecution, warranting dismissal of the case, but prosecutors argue that the defense has not “identified anyone who has engaged in a remotely similar battery of criminal conduct and not been prosecuted as a result.”

In addition to President Biden, defense attorneys offered eight other examples.

Former Vice President Mike Pence had, after 2023 reports about President Biden retaining classified documents surfaced, retained legal counsel to search his home for classified documents. Some documents were found, and he sent them to the National Archives and Records Administration (NARA).

Prosecutors say this was different from President Trump’s situation, as Vice President Pence returned the documents out of his own initiative and had fewer than 15 classified documents.

Former President Bill Clinton had retained a historian to put together “The Clinton Tapes” project, and it was later reported that NARA did not have those tapes years after his presidency. A court had ruled it could not compel NARA to try to recover the records, and NARA had defined the tapes as personal records.

Prosecutors argue those were tape diaries and the situation was “far different” from President Trump’s.

Former Secretary of State Hillary Clinton had “used private email servers ... to conduct official State Department business,” the DOJ found, and the FBI opened a criminal investigation.

Prosecutors argued this was a different situation where the secretary’s emails showed no “classified” markings and the deletion of more than 31,000 emails was done by an employee and not the secretary.

Former FBI Director James Comey had retained four memos “believing that they contained no classified information.” These memos were part of seven he authored addressing interactions he had with President Trump.

Prosecutors argued there was no obstructive behavior here.

Former CIA Director David Petraeus kept bound notebooks that contained classified and unclassified notes, which he allowed a biographer to review. The FBI later seized the notebooks and Mr. Petraeus took a guilty plea.

Prosecutors argued there was prosecution in Mr. Petraeus’s case, and so President Trump’s case is not selective.

Former national security adviser Sandy Berger removed five copies of a classified document and kept them at his personal office, later shredding three of the copies. When confronted by NARA, he returned the remaining two copies and took a guilty plea.

Former CIA director John Deutch kept a journal with classified information on an unclassified computer, and also took a guilty plea.

Prosecutors argued both Mr. Berger and Mr. Deutch’s behavior was “vastly less egregious than Trump’s” and they had been prosecuted.

Former White House coronavirus response coordinator Deborah Birx had possession of classified materials according to documents retrieved by NARA.

Prosecutors argued that there was no indication she knew she had classified information or “attempted to obstruct justice.”

International

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong european-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International12 hours ago

International12 hours agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges