The 15 Most Influential Crypto Cities In The World

The 15 Most Influential Crypto Cities In The World

Authored by Jeff Benson, Scott Chipolina and Jason Nelson via Decrypt.co,

Crypto is a global community of people who are increasingly living in a digital metaverse. But even as they…

Authored by Jeff Benson, Scott Chipolina and Jason Nelson via Decrypt.co,

Crypto is a global community of people who are increasingly living in a digital metaverse. But even as they embrace a decentralized world, physical places still matter very much—after all, no one can live entirely in a blockchain.

That's why Decrypt has assembled a list of the most influential crypto cities in the world. These 15 places are shaping the technology, culture and policy that make crypto what it is. They were chosen not because they are desirable places to live (though many are) but because, for one reason or another, they have exerted an outsized influence on crypto.

The list was the product of intense debate among a small group of group of Decrypt editors and staff writers and represents regions from around the world. Did your town make the cut? Read on to discover our rankings, beginning with number 15.

15. London, England

London's status as a major financial hub has long given it an edge in attracting crypto innovators. The original Bitcoin wallet provider, Blockchain.com, calls the U.K. capital its home as do newer firms like Ethereum wallet Argent and digital asset custodian Copper.

The city was crucial enough to host the second-ever Devcon, Ethereum's largest event back in 2015.

But its influence is waning. The U.K.'s Financial Conduct Authority (FCA) has taken sharp aim at crypto, chasing off top crypto exchange Binance and telling crypto investors to be “prepared to lose all their money." Couple that with the UK's split from the EU, and companies may give serious consideration to basing their European operations elsewhere.

14. Cheyenne, Wyoming

As New York state was making it tough on crypto companies and the federal government hemmed and hawed over how exactly to construct a regulatory framework, Wyoming went all in. The Republican-led legislature in Cheyenne, the state capital, worked with private industry to craft the most friendly blockchain tech and cryptocurrency laws in the country.

Now, Kraken, Avanti and others are setting up banking outposts in the Cowboy State. More are sure to be coming, thanks to Bitcoin-friendly pols like Senator Cynthia Lummis, who calls Cheyenne home.

13. Lagos, Nigeria

You know when people talk about Bitcoin's use as an inflation hedge? When they talk lovingly about the freedom of peer-to-peer transactions? They're talking about what's going on in Nigeria.

Lagos is the largest city and financial center of Africa's biggest economy, which has been battered by six consecutive years of double-digit inflation.

The Nigerian capital has been ground zero for popular resistance against the central bank's monetary policy and restrictions on cryptocurrency. This year, Nigeria topped the list for peer-to-peer trading volume in Africa—and came in second only to the U.S. worldwide.

12. Tel Aviv, Israel

Tel Aviv is Israel's primary tech hub and a hotspot for startups—it has more per capita than any other city outside California. Blockchain tech is no exception. The city of over 432,000 claims 90 of Israel’s 150 blockchain companies. One such company, Unbound Security, which uses a new type of cryptography to store digital assets, was acquired by Coinbase in November 2021. Bitcoin lender Celsius Network opened an office there in February.

11. Zug, Switzerland

Zug was almost left off the list due to a technicality: It's not big enough to be a city. But the Swiss town of 30,000 punches above its weight. It's the headquarters of the Ethereum Foundation, which helps guide a cryptocurrency with a market cap of nearly $500 billion.

The Zug canton, known as "Crypto Valley," has also attracted Ethereum rivals Tezos, Dfinity, Bancor, and Cardano. And as of this year, those companies can even pay their taxes in crypto. Zug, known for its sleepiness and slopes, drew up the crypto-friendly playbook that more exotic locales like Miami have only just capitalized on.

10. Singapore

Singapore is a major financial hub, and it has only gained stature in the crypto world as China has clamped down on crypto activity and Hong Kong falls under the mainland's orbit. Coinbase and Binance, two of the world's largest exchanges, are seeking licenses from the Monetary Authority of Singapore to operate there.

Even without them, the city-state already has a lively crypto scene that includes the headquarters for market data firm Nansen, exchange Crypto.com, and DeFi protocol Kyber Network.

9. Berlin, Germany

The markets of Kreuzberg district in Berlin became renowned all the way back in 2013 for accepting Bitcoin, at one point having the most cryptocurrency-accepting businesses per meter of anywhere in the world. But Berlin has been hip on the Ethereum scene for almost as long. It was the site of the initial Devcon in 2014, then became the hottest hackathon space in Europe with ETHBerlin. At least 15 blockchain companies today call Berlin home, including Centrifuge and Gnosis.

8. Toronto, Canada

Still waiting for a Bitcoin ETF? Not in Canada. The Ontario Securities Commission, headquartered in Toronto, has approved loads of exchange-traded funds this year—Ethereum, Bitcoin, and crypto combinations—so that they can trade on the Toronto Stock Exchange.

While Bitcoin ETFs have yet to make it to Canada's much bigger neighbor to the south yet, Toronto is known for exporting innovation. It's the adopted home of Ethereum creator Vitalik Buterin and the birthplace of co-founder Joseph Lubin, who went on to build Web3 software and investment company ConsenSys.

7. Lisbon, Portugal

Portugal is one of the few countries that doesn't tax capital gains on cryptocurrency earnings, meaning that digital ledger devotees can let their hair down in Lisbon.

This fall, Ethereum community members and Solana stans descended on the city and its beaches to attend ETHLisbon and Solana Breakpoint. With London's waning influence and Portugal's welcoming attitude toward financial innovation, Lisbon is primed to attract more than just parties and hackathons in the future.

6. New York City, U.S.

Fairly early in Bitcoin's existence, the New York state regulatory framework known as the BitLicense drove out crypto companies like ShapeShift and Kraken. But New York City’s next Mayor, Eric Adams, is pushing to attract and retain companies in the U.S.'s financial capital. Adams has vowed to take his first three paychecks in BTC, upping Miami Mayor Francis Suarez’s commitment to take one paycheck in BTC.

Adams is also looking to create a cryptocurrency specific to NYC.

Even without NYC Coin, it's hard to argue against the city's influence, where Wall Street has blended with fintech to give investors Galaxy Digital, Gemini, Paxos and Grayscale—not to mention ConsenSys and OpenSea.

5. San Salvador, El Salvador

Bitcoin maximalist and El Salvador President Nayib Bukele has become one of the loudest and proudest advocates for the flagship cryptocurrency ever since announcing it as legal tender earlier this year.

Bukele has also shown a commitment to mining Bitcoin with renewable energy—from volcanoes. Though that hasn't caught on yet, the proclamation from San Salvador has other Latin countries that are struggling with inflation and meager foreign reserves thinking about adopting Bitcoin as a national currency, too.

4. Miami, U.S.

With lockdowns and restrictions having limited gatherings for a year, Bitcoin and cryptocurrency advocates needed a place to go. Nearly 15,000 people were welcomed to Bitcoin 2021 Miami by its amiable mayor, Francis Suarez.

Suarez has put crypto at the core of his agenda—pushing to allow city workers to be paid in Bitcoin, advocating for the asset to be added to municipal coffers, and, of course, encouraging companies to set up shop.

Which they did. In June 2021, crypto exchange Blockchain.com announced it would be moving its U.S. headquarters from New York City to Miami. FTX, meanwhile, splashed out tens of millions to get the naming rights for the Miami Heat stadium. Suarez's embrace of Bitcoin has other companies rethinking where to locate their headquarters.

3. Beijing, China

Beijing won't be a crypto fan favorite, but few other cities can boast having such an impact on the industry.

Since 2017, China has prohibited cryptocurrency trading. The Beijing-based government went one better this year when it banned mining. The move sent crypto prices into freefall and fundamentally changed the geopolitical makeup of the Bitcoin mining industry.

In April 2021, China commanded approximately two-thirds of the world’s Bitcoin mining industry. Now, it's all but vanished. But don't discount China's lingering influence.

With a fast-moving centralized government, Beijing could snap its fingers to lower electricity prices and woo back mining firms, as Russia has done. For now, though, it's happy to focus its efforts on the digital yuan. Success with its massive pilot could sway other countries to explore a central bank digital currency.

2. Washington, D.C., U.S.

Crypto markets rise and fall on the legislative and regulatory rumors that leak out of D.C.

And there's been plenty of leaking. Under new chairman Gary Gensler, the SEC has pushed for tougher consumer protection laws, claimed the DeFi space is teeming with unregistered securities, and even threatened to sue one of the biggest companies in the industry, Coinbase. Add that to an infrastructure bill that snuck in language redefining crypto brokers, and you might think the U.S. capital was out to kill crypto.

But Bitcoin advocates like Ted Cruz (R-TX) and Cynthia Lummis (R-WY) have kept the flag flying, while industry lobbying groups such as Coin Center and The Blockchain Association have gained the ear of policymakers while increasing their clout with consumers.

1. San Francisco, U.S.

You may have read that everyone is fleeing San Francisco because of the pandemic. Don't believe the FUD: It still holds sway. Kraken, OKCoin, and Robinhood all have big footprints there—not to mention Coinbase, whose executives are still clustered in San Francisco even as the firm professes to be decentralized. And the Bay Area is home to not only Google but also the crypto-powered search engine that hopes to supplant it: Brave.

Want funding? Chances are you're headed to see Andreessen Horowitz down the road in Menlo Park. Just looking to get off the ground? You'd probably be overjoyed to be accepted to Y Combinator in Mountain View, as Coinbase was.

The Bay Area remains the center of the blockchain universe.

Government

Buyouts can bring relief from medical debt, but they’re far from a cure

Local governments are increasingly buying – and forgiving – their residents’ medical debt.

One in 10 Americans carry medical debt, while 2 in 5 are underinsured and at risk of not being able to pay their medical bills.

This burden crushes millions of families under mounting bills and contributes to the widening gap between rich and poor.

Some relief has come with a wave of debt buyouts by county and city governments, charities and even fast-food restaurants that pay pennies on the dollar to clear enormous balances. But as a health policy and economics researcher who studies out-of-pocket medical expenses, I think these buyouts are only a partial solution.

A quick fix that works

Over the past 10 years, the nonprofit RIP Medical Debt has emerged as the leader in making buyouts happen, using crowdfunding campaigns, celebrity engagement, and partnerships in the private and public sectors. It connects charitable buyers with hospitals and debt collection companies to arrange the sale and erasure of large bundles of debt.

The buyouts focus on low-income households and those with extreme debt burdens. You can’t sign up to have debt wiped away; you just get notified if you’re one of the lucky ones included in a bundle that’s bought off. In 2020, the U.S. Department of Health and Human Services reviewed this strategy and determined it didn’t violate anti-kickback statutes, which reassured hospitals and collectors that they wouldn’t get in legal trouble partnering with RIP Medical Debt.

Buying a bundle of debt saddling low-income families can be a bargain. Hospitals and collection agencies are typically willing to sell the debt for steep discounts, even pennies on the dollar. That’s a great return on investment for philanthropists looking to make a big social impact.

And it’s not just charities pitching in. Local governments across the country, from Cook County, Illinois, to New Orleans, have been directing sizable public funds toward this cause. New York City recently announced plans to buy off the medical debt for half a million residents, at a cost of US$18 million. That would be the largest public buyout on record, although Los Angeles County may trump New York if it carries out its proposal to spend $24 million to help 810,000 residents erase their debt.

Nationally, RIP Medical Debt has helped clear more than $10 billion in debt over the past decade. That’s a huge number, but a small fraction of the estimated $220 billion in medical debt out there. Ultimately, prevention would be better than cure.

Preventing medical debt is trickier

Medical debt has been a persistent problem over the past decade even after the reforms of the 2010 Affordable Care Act increased insurance coverage and made a dent in debt, especially in states that expanded Medicaid. A recent national survey by the Commonwealth Fund found that 43% of Americans lacked adequate insurance in 2022, which puts them at risk of taking on medical debt.

Unfortunately, it’s incredibly difficult to close coverage gaps in the patchwork American insurance system, which ties eligibility to employment, income, age, family size and location – all things that can change over time. But even in the absence of a total overhaul, there are several policy proposals that could keep the medical debt problem from getting worse.

Medicaid expansion has been shown to reduce uninsurance, underinsurance and medical debt. Unfortunately, insurance gaps are likely to get worse in the coming year, as states unwind their pandemic-era Medicaid rules, leaving millions without coverage. Bolstering Medicaid access in the 10 states that haven’t yet expanded the program could go a long way.

Once patients have a medical bill in hand that they can’t afford, it can be tricky to navigate financial aid and payment options. Some states, like Maryland and California, are ahead of the curve with policies that make it easier for patients to access aid and that rein in the use of liens, lawsuits and other aggressive collections tactics. More states could follow suit.

Another major factor driving underinsurance is rising out-of-pocket costs – like high deductibles – for those with private insurance. This is especially a concern for low-wage workers who live paycheck to paycheck. More than half of large employers believe their employees have concerns about their ability to afford medical care.

Lowering deductibles and out-of-pocket maximums could protect patients from accumulating debt, since it would lower the total amount they could incur in a given time period. But if the current system otherwise stayed the same, then premiums would have to rise to offset the reduction in out-of-pocket payments. Higher premiums would transfer costs across everyone in the insurance pool and make enrolling in insurance unreachable for some – which doesn’t solve the underinsurance problem.

Reducing out-of-pocket liability without inflating premiums would only be possible if the overall cost of health care drops. Fortunately, there’s room to reduce waste. Americans spend more on health care than people in other wealthy countries do, and arguably get less for their money. More than a quarter of health spending is on administrative costs, and the high prices Americans pay don’t necessarily translate into high-value care. That’s why some states like Massachusetts and California are experimenting with cost growth limits.

Momentum toward policy change

The growing number of city and county governments buying off medical debt signals that local leaders view medical debt as a problem worth solving. Congress has passed substantial price transparency laws and prohibited surprise medical billing in recent years. The Consumer Financial Protection Bureau is exploring rule changes for medical debt collections and reporting, and national credit bureaus have voluntarily removed some medical debt from credit reports to limit its impact on people’s approval for loans, leases and jobs.

These recent actions show that leaders at all levels of government want to end medical debt. I think that’s a good sign. After all, recognizing a problem is the first step toward meaningful change.

Erin Duffy receives funding from Arnold Ventures.

congress trump pandemicUncategorized

Futures Flat At All-Time High As Bitcoin Surges To Record, Oil Rises

Futures Flat At All-Time High As Bitcoin Surges To Record, Oil Rises

US futures are trading modestly in positive territory and just shy of…

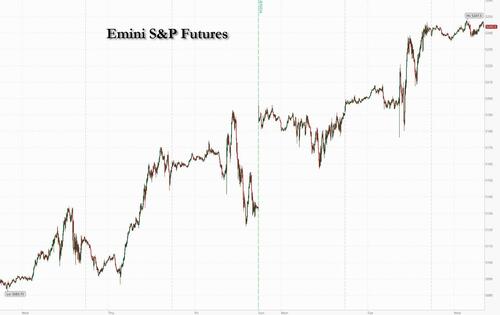

US futures are trading modestly in positive territory and just shy of all time highs, after swinging between gains and losses as Europe trades higher and Asia closed weaker after US markets shrugged of a higher core CPI print and focused on the more constructive disinflation components (Super core 47bps vs 85bps). As of 7:50am, S&P futures traded +0.1% while Nasdaq futures were modestly red; earlier, Germany's DAX hit 18K for first time, while EuroStoxx50 hit 5K for first time in 24 years.

Overnight newsflow was relatively quiet outside of early results from Japan’s wage negotiations which showed majority of companies agreeing to unions demands: previously, BOJ's Ueda said wage negotiations were critical in deciding when to phase out its big stimulus program while Japan PM Kishida noted in Parliament that Japan has not emerged out of deflation, pushing back some expectations of BOJ exiting negative rates next week. UK Jan Industrial Production printed softer, Jan GPD/Manf Production in-line, and EZ Industrial Production printed weaker as well. Donald Trump clinched the Republican presidential nomination, setting up a combative election race with President Joe Biden. Elsewhere, US TSY 10Y yields are trading 1bp higher at 4.17% while bond yields across Europe ticked lower; the Bloomberg dollar index is fractionally lower, WTI crude is +$1.05 at $78.65, and bitcoin just hit a new all time high above $73,000.

In premarket trading, Nvidia shares rose again after the chipmaker rallied 7.2% and added $153 billion in market value on Tuesday. Tesla slipped after Wells Fargo downgraded the stock to underweight from equal-weight. Dollar Tree slumped after reporting fourth-quarter sales and profit that missed Wall Street’s expectations. The retailer also announced plans to close about 600 Family Dollar stores in the first half of the fiscal year.

- Beauty Health soars 21% after the skin-care company reported fourth-quarter sales that topped consensus estimates. The company named Marla Beck as CEO after a stint as interim CEO that began in November.

- Clover Health rises 9% after the Medicare Advantage insurer reported revenue for the fourth quarter that beat the average analyst estimate.

- Dollar Tree slumps 6% after issuing an annual sales outlook that fell short of the average analyst estimate at the midpoint of the forecast range.

- Eli Lilly rises about 1% after teaming up with Amazon.com Inc. to expand its nascent business of selling weight-loss drugs directly to patients.

- Petco (WOOF) rises 3% after the company reported comparable sales for the fourth quarter that topped the consensus estimate. Petco also said Ron Coughlin has stepped down as CEO/Chairman.

- Tesla (TSLA) falls 2% after Wells Fargo cuts the recommendation on the EV maker’s stock to underweight, saying there are fresh risks to EV volumes as price cuts are not having as much impact as before.

- ZIM Integrated Shipping (ZIM) falls 4% after the marine shipping company reported its fourth-quarter results and gave an outlook.

Traders held onto Fed rate cut bets for this year even after US inflation came in higher than expected on Tuesday. Futures are pricing in nearly 70% odds that the central bank will start easing in June and enact at least three quarter-point cuts over the course of 2024. Policymakers next gather March 19-20, where investors will key into the Federal Open Market Committee’s quarterly forecasts for rates, including whether fresh employment and inflation figures have prompted any changes.

“It’s going to be hard for the Fed not to be hawkish in the next meeting as the fight against inflation clearly isn’t won yet,” said Justin Onuekwusi, chief investment officer at wealth manager St. James’s Place. “That print does make you sit up and be alert of the risk inflation remain stubbornly high and that has massive feed-across right across portfolios. Markets may be underestimating impact of sticky inflation as they are still aggressively pricing a June rate cut.”

European stocks rise with the Stoxx 600 hovering near a record high and the Stoxx 50 breaching 5,000 for the first time in 24 years. Retail shares are leading gains after positive updates from Zalando and Inditex. Utilities and banks also outperform. Here are some of the biggest movers on Wednesday:

- Zalando shares jump as much as 18%, the most in five years, after results that analysts describe as positive, with a beat on adjusted ebit for 2023 and updated targets for growth through 2028. RBC analysts say they are confident in the German company’s ability to capture growth as consumer demand recovers.

- Inditex shares climbed as much as 5.2% to a fresh record high after the Zara parent reported what analysts called strong results thanks to continued robust demand for its clothing collections. The Spanish retailer plans to increase its annual dividend by 28% to €1.54 per share. H&M and the broader retail index also gain.

- BNP Paribas rises as much as 3.4% after the lender forecast higher-than-expected profit and stepped up cost savings measures.

- Balfour Beatty shares gain as much as 10%, its biggest intraday gain since August 2022, after the construction and infrastructure group reported full-year adjusted earnings per share that came ahead of consensus expectations. Additionally, the company announced a share buyback of £100 million for 2024. Liberum noted the strength in the company’s Gammon Construction joint venture, with Jardine Matheson.

- E.On shares jump as much as 7%, most in more than a year, after it reported a positive update according to Jefferies, with outlook ahead of consensus. Company also announced CFO Marc Spieker will assume role of COO and Nadia Jakobi is set to become CFO.

- Keywords Studios shares gain as much as 13%, the most since May 2020, after the company maintained FY goals issued in January, offering reassurance in a video game industry marked by layoffs at bellwethers including Sony and Electronic Arts. Keywords provides external technical support to video-game makers.

- Vallourec shares gain 9.8% after ArcelorMittal said it’s buying a stake in the tubular steel company from Apollo Global Management for about €955 million. Analysts highlight the deal triggers M&A speculation around Vallourec, and Oddo BHF expects ArcelorMittal to launch a takeover bid once the six-month lock-up period expires.

- Adidas shares fall as much as 4.1% as a lack of a full-year guidance upgrade from the sportswear maker disappointed some analysts, even as results were in line with January’s pre-released figures. The focus turns to the German firm’s growth outlook for the first quarter, and whether it will indeed see a pick-up in trading in the second half of the year.

- Solvay drops as much as 5.2% after guidance for lower Ebitda in 2024. Analysts note that the chemicals company’s commitment to a stable or growing divided may offset negatives from falling Ebitda. Investors will focus on the soda ash price assumptions, Morgan Stanley said.

- Geberit falls as much as 4.8% after the Swiss maker of building materials missed earnings estimates. The stock had rallied ahead of the earnings, gaining almost 8% from the start of February through Tuesday.

- Stadler Rail shares fall 3.3% after the Swiss train manufacturer’s sales and operating margins came in lower than estimates. The company’s 2024 outlook also weighs on sentiment, according to Vontobel.

The European Central Bank is also poised to start rate cuts soon, with Governing Council member Martins Kazaks saying on Wednesday reductions could come “within the next few meetings.” Bank of France Governor Francois Villeroy de Galhau said borrowing costs may be cut in the spring, with June more likely than April for a first move.

In FX, the Bloomberg Spot Index slips to reverse modest earlier gains while the yen was the weakest of the G-10 currencies, falling 0.2% versus the greenback to 148.05; the krone led G-10 gains. “BOJ Governor Kazuo Ueda clearly indicated yesterday that wages were the last piece of information needed before the central bank could decide whether to end its negative interest rate policy next week, said David Forrester, a senior FX strategist at Credit Agricole CIB in Singapore. “So the partial tally of the spring wage negotiations this Friday will be a decisive factor for the BOJ and the JPY in the coming week.” The pound was flat.

In rates, treasuries edged lower, with US 10-year yields rising 1bps to 4.16%. Gilts fall after data showed the UK economy rebounded in January. UK 10-year yields rise 2bps to 3.96%. Gilts lag across core European rates as market digests an offering of 30-year inflation-linked debt and a wave of domestic data. US session includes 30-year bond reopening, following soft reception for Tuesday’s 10-year sale. Treasury auction cycle concludes with $22b 30-year bond reopening after $39b 10-year reopening tailed by 0.9bp, while Monday’s 3-year new issue stopped through by 1.3bp. WI 30-year yield at ~4.320% is roughly 4bp richer than February refunding, which stopped through by 2bp in a strong auction

In commodities, oil advanced after four days of losses as an industry report pointed to shrinking US crude stockpiles, offsetting wavering OPEC cuts. WTI rose 1.5% to trade near $78.70. Spot gold adds 0.2%. and trades near all time highs.

Bitcoin rises 3% to a record high above $73,000 with Ethereum (+2.7%) also catching wind.

To the day ahead now, and data releases include UK GDP and Euro Area industrial production for January. Central bank speakers include the ECB’s Cipollone and Stournaras. And in the US, there’s a 30yr Treasury auction taking place.

Market Snapshot

- S&P 500 futures little changed at 5,176.25

- STOXX Europe 600 little changed at 506.38

- MXAP down 0.3% to 176.21

- MXAPJ down 0.3% to 540.31

- Nikkei down 0.3% to 38,695.97

- Topix down 0.3% to 2,648.51

- Hang Seng Index little changed at 17,082.11

- Shanghai Composite down 0.4% to 3,043.84

- Sensex down 1.0% to 72,924.23

- Australia S&P/ASX 200 up 0.2% to 7,729.44

- Kospi up 0.4% to 2,693.57

- German 10Y yield little changed at 2.30%

- Euro little changed at $1.0929

- Brent Futures little changed at $81.99/bbl

- Gold spot up 0.0% to $2,158.75

- US Dollar Index little changed at 102.93

Top Overnight News

- US President Biden secured enough votes to clinch the Democratic presidential nomination and Donald Trump secured enough delegates to win the Republican nomination, according to Reuters.

- Eli Lilly (LLY) is partnering with Amazon Pharmacy (AMZN) to deliver prescriptions sold through direct-to-consumer website.

- Some of Japan’s biggest companies, including Toyota, Nissan, and Nippon Steel, hand out large wage hikes to their workers (the biggest increases in decades), paving the way for a BOJ rate hike next week. FT

- China is scrapping a string of infrastructure projects in indebted regions as it struggles to reconcile a need to save money with this year’s target for economic growth. FT

- Chinese state media has touted President Xi Jinping as a market-friendly reformer on par with the paramount leader Deng Xiaoping, in an apparent attempt to dispel skepticism over the country’s growth outlook. BBG

- The European Central Bank will lower borrowing costs in the spring, with June more likely than April for a first move, Bank of France Governor Francois Villeroy de Galhau said. BBG

- Putin says Russia is willing to resolve the Ukraine war “by peaceful means”, but insists Moscow would require security guarantees to do so. BBG

- Donald Trump and Joe Biden have both secured enough delegates to clinch their respective party nominations, cementing a November rematch. The 2024 election is expected to be one of the most expensive on record. BBG

- US crude stockpiles fell by 5.5 million barrels last week, the API is said to have reported, registering the first decline in seven weeks if confirmed by the EIA. Gasoline and distillate supplies also dropped. BBG

- Global dividends hit a record $1.66 trillion last year, according to Janus Henderson. Payouts were up 5%, with almost half the growth coming from the banking sector. It’s the third annual record for dividends and the fund manager expects another all-time high this year. BBG

- Hedge funds are unwinding short Treasury futures bets at a rapid clip, a sign that basis-trade positions are diminishing. This is probably due to asset managers pivoting into investment-grade credit. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as early momentum from the tech-led gains on Wall St was offset by Chinese developer default concerns and as participants digested Japanese wage hike announcements. ASX 200 was led higher by consumer stocks after China's MOFCOM released an interim proposal to remove tariffs on Australian wine although the advances in the index were limited by losses in the mining sector as iron ore prices continued to tumble. Nikkei 225 swung between gains and losses with initial strength reversed amid firm wage hike announcements. Hang Seng and Shanghai Comp. were varied and price action was contained within relatively narrow ranges with the Hong Kong benchmark kept afloat by strength in auto names and tech, while the mainland was pressured amid developer default fears and with the US House set to vote later on the TikTok crackdown bill.

Top Asian News

- Country Garden Holdings (2007 HK) onshore bondholders said they have not received a coupon payment due on Tuesday, while the developer said funds for a CNY 96mln coupon payment due on Tuesday were not fully in place and it plans to do its best to raise money for payment within a 30-day grace period, according to Reuters.

- TikTok US executives told headquarters recently that a ban wasn't an imminent risk, according to WSJ citing sources. However, it was separately reported that the US House plans to vote on the TikTok crackdown bill today at around 10:00EDT (14:00GMT).

European bourses, Stoxx600 (+0.2%), are modestly firmer, though with overall trade rangebound in what has been an uneventful session. The IBEX 35 (+1.3%) outperforms, led higher by post-earning strength in Inditex (+4.2%). European sectors are mixed; Retail outperforms, propped up by gains in Zalando (+13.5%) and Inditex. Autos is found at the foot of the pile, hampered by a poor Volkswagen (-0.8%) update. US equity futures (ES U/C, NQ -0.2%, RTY +0.1%) are trading around the unchanged mark, with slight underperformance in the NQ, paring back some of the strength seen in the prior session.

Top European News

- ECB's Villeroy noted broad agreement in the ECB to start cutting rates in spring as the battle against inflation is being won, while he noted the risk of waiting too long before loosening monetary policy and unduly hurting the economy is now “at least equal” to acting too soon and letting inflation rebound, according to an interview with Le Figaro; In another batch of comments: Says the ECB is winning the battle against inflation; will remain vigilant on inflation but victory is within sight; Spring rate cut remains probably; more likely to cut rates in June than April.

- ECB's Kazaks says ECB rate cut decision will come in the next few meetings; uncertainty remains high, and tensions in the labour market is still high.

- Citi expects BoE to start cutting rates in June (vs prev forecast of August).

Japan

- Japan Chief Cabinet Secretary Hayashi said it is important for wage hikes to spread to mid-sized and small companies, while he added they are seeing strong momentum for wage hikes. It was also reported that Toyota, Nissan, Panasonic, Hitachi & Nippon Steel were among the companies that have responded to unions' wage hike demands in full.

- Japanese PM Kishida says will call for pay hikes exceeding last year at small and mid-sized firms during the meeting with labour union and management; Japan not yet emerging out of deflation.

- BoJ Governor Ueda says BoJ will consider tweaking negative rates, YCC, and other monetary easing tools if the sustained achievement of price target comes into sight. We must scrutinize whether positive wage-inflation cycle merges in deciding whether conditions for phasing out stimulus are falling into place. This year's wage talks is critical in deciding timing on exit from stimulus. Unions have demanded higher pay, seeing many corporate management making offers that will stream in today and beyond. Will scrutinize the wage talk outcomes, as well as other data and information from hearings when making policy decisions.

- Japanese PM Adviser Yata says wage hikes this year likely to exceed last year's; Must continue pay rises next year and thereafter to defeat deflation; must broaden pay hikes to workers nationwide and in every prefecture. When asked if solid wage offers could trigger end to NIRP in march, Yata says government will not meddle with the BoJ's independent policy-making.

- BoJ is reportedly to mull ending all ETF purchases if price goal is in sight; likely to keep buying bonds to keep market stable and to intervene in the event of sharp yield upside, according to Bloomberg sources.

- Japan's Business Lobby Keidanren Head Tokura says wage increases indicated in the preliminary survey of big firms' wage talks are likely to exceed last years levels.

- Early signs of a strong outcome in this year's annual wage talks have heightened changes the BoJ will end its negative interest rate policy next week, according to Reuters sources; "There seems to be enough factors that justify a March policy shift".

FX

- Marginal upside for the USD which has seen DXY kiss the 103 mark in quiet trade. If the level is cleared, yesterday's 103.17 will come into view.

- Uneventful price action for EUR with ECB comments unable to shift the dial. As such, the pair is sticking to a 1.09 handle and within yesterday's 1.0902-43 range.

- GBP is steady vs. the USD and stuck on a 1.27 handle as in-line GDP metrics failed to inspire price action. For now, yesterday's 1.2746-1.2823 range holds.

- JPY is marginally softer vs. the USD but with losses tempered by reports that the BoJ could end ETF purchases. Today's 147.24-89 range sits within yesterday's 146.62-148.18 parameters. More broadly, focus is on in

- AUD is holding up vs. the USD despite falling iron ore prices, with AUD/USD maintaining 0.66 status and within yesterday's 0.6596-0.6627 range. Likewise, NZD/USD is unable to break out of yesterday's 0.6133-6184 range. RBNZ's Conway later today could help to decide direction.

- PBoC set USD/CNY mid-point at 7.0930 vs exp. 7.1775 (prev. 7.0963).

Fixed Income

- Gilts are the relative laggards, at lows of 99.68, with the paper unreactive to the UK's GDP data (which was broadly in-line). The downside can be attributed to Gilts paring some of Tuesday's outperformance following the labour data and a strong DMO sale.

- USTs are essentially unchanged in a quieter session for the US (on paper) after Tuesday's marked CPI moves and a soft 10yr auction, despite the marked concession built in by the post-CPI reaction. Currently holds near session lows at 111-04.

- Bunds are slightly firmer after Tuesday's marked US CPI-induced pressure. Specifics are relatively light thus far, but focus will be on the ECB Operational Framework Review (tentatively due today). Currently, Bunds hold around 133.24, with the peak for today at 133.27.

- Italy sells EUR 7.25bln vs exp. EUR 6-7.25bln 2.95% 2027, 3.50% 2031, 3.25% 2038 BTP Auction and EUR 1.25bln vs exp. EUR 1-1.25bln 4.0% 2031 BTP Green.

- Germany sells EUR 3.738bln vs exp. EUR 4.5bln 2.20% 2034 Bund: b/c 2.29x (prev. 2.10x), average yield 2.31% (prev. 2.38%) & retention 16.9% (prev. 17.5%)

Commodities

- Crude is firmer, taking impetus from Tuesday's bullish private inventory data, with specifics light in the session thus far; Brent holds near session highs at +1.1%.

- Flat trade in gold and a mild upward bias in silver with the Dollar steady, calendar light, and with the ongoing geopolitical landscape potentially providing a modest underlying bid; XAU trades in a tight USD 2,155.86-2,161.66/oz range.

- Base metals are mixed with copper prices outperforming following reports that top Chinese copper smelters have reportedly reached an agreement to take action to curb falling fees.

- Azerbaijan oil production stood at 476k BPD in Feb (prev. 474k BPD in Jan), according to the Energy Ministry.

- Top Chinese copper smelters have reportedly reached an agreement to take action to curb falling fees, according to Reuters sources; smelters to cut output at loss-making plants.

- BP (BP/ LN) and ADNOC suspend USD 2bln talks to take Israel-based Newmed private, via Bloomberg.

Geopolitics: Middle East

- CIA Director Burns said there is "still a possibility" of a Gaza ceasefire deal but added that many complicated issues are still to be worked through.

- US may urge partners and allies to fund a privately run operation to send aid by sea to Gaza that could begin before a much larger US military effort, according to sources cited by Reuters.

- US Central Command announced that Houthis fired a close-range ballistic missile from Yemen toward USS Laboon in the Red Sea on March 12th but it did not impact the vessel, while CENTCOM forces and a coalition vessel successfully engaged and destroyed two unmanned aerial systems launched from Yemen.

Geopolitics: Other

- Ukrainian Army Chief Syrskyi and Ukraine's Defence Minister Umerov held a phone call with US Defense Secretary Austin on weapons delivery to Ukraine, according to Reuters.

- A fire at oil refinery in Ryazan region extinguished, according to the governor cited by Reuters.

US event calendar

- 07:00: March MBA Mortgage Applications 7.1%, prior 9.7%

Government Agenda

- 4 p.m: US President Joe Biden delivers remarks in Milwaukee, Wisconsin on how his investments are rebuilding communities and creating jobs

- 11.15 a.m: US Secretary of State Antony Blinken meets with EU foreign affairs chief Josep Borrell

DB's Jim Reid concludes the overnight wrap

Next stop on the global tour is Singapore as I'm about to board the plane from Melbourne here this evening. My vaguely fascinating fact about Singapore is that my grandfather was a civil engineer there in the 1920s and 1930s and helped build much of its rapid development at the time. He was Scottish and met my Dutch grandmother there and got married without speaking each other's language and being able to understand each other. My wife says she's done the same thing! His brother owned a very successful industrial company on the island and lost all his wealth and his company after the 1929 stock market crash. My entire family were eventually left penniless after the 1930s crash and then WWII. 90 years later and my kids have had the same impact on me!

I'm looking forward to landing in the pretty standard 35 degree heat that Singapore always seems to have on landing. Talking of the heat, even with another hot US inflation print, risk assets put in another strong performance yesterday, with both the S&P 500 (+1.12%) and Europe’s STOXX 600 (+1.00%) driven by strong tech gains (sound familiar?). The highs in the main indices came despite the latest US CPI report for February, which saw inflation come in strongly for a second month running, and led to growing fears that the last phase of getting inflation back to target would be the hardest. But despite the persistence of inflation, investors were remarkably unphased for the most part, and they continue to see a June rate cut as the most likely outcome.

In terms of the details of the report, headline CPI came in at a 6-month high of +0.44%, which meant the year-on-year measure actually ticked up a bit to +3.2% (vs. +3.1% expected). Alongside that, core CPI was at +0.36%, which also meant annual core CPI was also above expectations at +3.8% (vs. +3.7% expected). Some of the blame was placed on shelter inflation, which was up by a monthly +0.43%. But even if you looked at core CPI excluding shelter, it was still up by +0.30%, so it’s difficult to say that shelter was the whole story behind the ongoing persistence. See our US economists’ reaction to the print here.

For the Fed, there must be some concern even if markets show little of this. For instance, if you look at core CPI on a 3-month annualised basis, it rose to +4.2%, so it’s getting harder to explain this away as just one month of bad data. Bear in mind that this is pretty high by historic standards as well, and apart from the post-Covid inflation, 3m core CPI hasn’t been that high since 1991. Alongside that, there was evidence that the inflation was coming from the stickier categories in the consumer basket. In fact the Atlanta Fed’s sticky CPI series is now up by +5.1% on a 3m annualised basis, the fastest it’s been since April 2023. So the concern for markets will be that inflation is showing some signs of rebounding, or at the very least stabilising at above-target levels.

When it comes to the Fed, the report led investors to dial back the rate cuts priced this year by -6.1bps, and futures now see 85bps of cuts by the December meeting. There was also a bit more doubt creeping into the chance of a cut by June, with 78% now priced in, down from 86% the previous day. But even with this slightly hawkish repricing, June is still considered the most likely timing for the first cut, which helped to support risk assets even though the print was above expectations. For the Fed, the most important question now will be how this affects the PCE measure of inflation, which is what they officially target. We won’t find that out until March 29th (Good Friday), but we should get a bit more info from the PPI report tomorrow, which has several components that feed into PCE.

The report led to a selloff for US Treasuries, with the 2yr yield (+5.0bps) up to 4.59%, whilst the 10yr yield (+5.4bps) rose to 4.15%. The 10yr yield had peaked at 4.17% intra-day shortly after the latest 10yr Treasury auction which saw slightly soft demand, with bonds issued +0.9bps above the pre-sale yield.

The fixed income selloff was echoed in Europe too, even if the overall performance was better there, with yields on 10yr bunds (+2.7bps) and OATs (+1.6bps) rising by a smaller amount. At the same time, markets remain confident of an ECB cut by June (priced at 91% vs 95% the day before). This is consistent with the latest ECB commentary, with Austria’s Holzmann (strong hawk) saying that a June cut was more likely than April, while France’s Villeroy suggested that “there’s a very broad agreement” to cut rates by the June meeting.

Yesterday’s main outperformer in the rates space were 10yr gilts (-2.5bps), which came after the UK labour market data was a bit weaker than expected over the three months to January. Notably, wage growth slowed to an 18-month low of +5.6% (vs. +5.7 expected), and the unemployment rate ticked up to 3.9% (vs. 3.8% expected).

Although sovereign bonds struggled yesterday for the most part, there was a much better performance for equities. In the US, the S&P 500 (+1.12%) closed at a new record, with tech stocks and the Magnificent 7 (+2.88%) leading the advance. Nvidia was +7.16% higher. Likewise in Europe, the STOXX 600 (+1.00%) hit an all-time high, and there were new records for the DAX (+1.23%) and the CAC 40 (+0.84%) as well. That said, gains more moderate outside of tech, with the equal-weighted S&P 500 up by +0.26%, while the small-cap Russell 2000 (-0.02%) narrowly lost ground for a 3rd consecutive day.

This backdrop was mostly positive for other risk assets. US HY credit spread fell -6bps, closing just 3bps above their 2-year low reached in late February. Meanwhile, Bitcoin posted a new intra-day high just shy of $73,000, surpassing the market cap of silver. Marion Laboure and Cassidy Ainsworth-Grace's new report this morning discusses the upcoming halving event's impact on Bitcoin prices, along with the Dencun upgrade scheduled for Ethereum today (link here).

Asian equity markets are mixed this morning with the Hang Seng (+0.26%) and the KOSPI (+0.11%) edging higher while the Nikkei (-0.36%) continues to drift back from last week's all time highs. Elsewhere, stocks in mainland China are also seeing losses with the CSI (-0.59%) and the Shanghai Composite (-0.26%) dragged lower by property developers as Country Garden Holdings Co. missed a 96-million-yuan ($13 million) coupon payment on a yuan bond for the first time. Outside of Asia, US stock futures are struggling to gain momentum with those on the S&P 500 (-0.03%) and NASDAQ 100 (-0.06%) flat. In early morning data, the unemployment rate in South Korea unexpectedly dropped to +2.6% in February from January's 3.0% level (v/s +3.0% consensus expectation).

Although the CPI release was the main data focus yesterday, there was also the NFIB’s small business optimism index from the US. That f ell to a 9-month low in February of 89.4 (vs. 90.5 expected). And there were also further signs of softening in the labour market, as the share planning to increase employment was down to a net +12, the lowest since May 2020 at the height of the Covid-19 pandemic. Likewise, the share of firms with positions they weren’t able to fill hit a three-year low of 37%.

To the day ahead now, and data releases include UK GDP and Euro Area industrial production for January. Central bank speakers include the ECB’s Cipollone and Stournaras. And in the US, there’s a 30yr Treasury auction taking place.

Spread & Containment

IFM’s Hat Trick and Reflections On Option-To-Buy M&A

Today IFM Therapeutics announced the acquisition of IFM Due, one of its subsidiaries, by Novartis. Back in Sept 2019, IFM granted Novartis the right to…

Today IFM Therapeutics announced the acquisition of IFM Due, one of its subsidiaries, by Novartis. Back in Sept 2019, IFM granted Novartis the right to acquire IFM Due as part of an “option to buy” collaboration around cGAS-STING antagonists for autoimmune disease.

This secures for IFM what is a rarity for a single biotech company: a liquidity hat trick, as this milestone represents the third successful exit of an IFM Therapeutics subsidiary since its inception in 2015.

Back in 2017, BMS purchased IFM’s NLRP3 and STING agonists for cancer. In early 2019, Novartis acquired IFM Tre for NLRP3 antagonists for autoimmune disease, which are now being studied in multiple Phase 2 studies. Then, later in 2019, Novartis secured the right to acquire IFM Due after their lead program entered clinical development. Since inception, across the three exits, IFM has secured over $700M in upfront cash payments and north of $3B in biobucks.

Kudos to the team, led by CEO Martin Seidel since 2019, for their impressive and continued R&D and BD success.

Option-to-Acquire Deals

These days option-based M&A deals aren’t in vogue: in large part because capital generally remains abundant despite the contraction, and there’s still a focus on “going big” for most startup companies. That said, lean capital efficiency around asset-centric product development with a partner can still drive great returns. In different settings or stages of the market cycle, different deal configurations can make sense.

During the pandemic boom, when the world was awash in capital chasing deals, “going long” as independent company was an easy choice for most teams. But in tighter markets, taking painful levels of equity dilution may be less compelling than securing a lucrative option-based M&A deal.

For historical context, these option-based M&A deals were largely borne out of necessity in far more challenging capital markets (2010-2012) on the venture front, when both the paucity of private financing and the tepid exit environment for early stage deals posed real risks to biotech investment theses. Pharma was willing to engage on early clinical or even preclinical assets with these risk-sharing structures as a way to secure optionality for their emerging pipelines.

As a comparison, in 2012, total venture capital funding into biotech was less than quarter of what it is now, even post bubble contraction, and back then we had witnessed only a couple dozen IPOs in the prior 3 years combined. And most of those IPOs were later stage assets in 2010-2012. Times were tough for biotech venture capital. Option-based deals and capital efficient business models were part of ecosystem’s need for experimentation and external R&D innovation.

Many flavors of these option-based deals continued to get done for the rest of the decade, and indeed some are still getting done, albeit at a much less frequent cadence. Today, the availability of capital on the supply side, and the reduced appetite for preclinical or early stage acquisitions on the demand side, have limited the role of these option to buy transactions in the current ecosystem.

But if the circumstances are right, these deals can still make some sense: a constructive combination of corporate strategy, funding needs, risk mitigation, and collaborative expertise must come together. In fact, Arkuda Therapeutics, one of our neuroscience companies, just announced a new option deal with Janssen.

Stepping back, it’ s worth asking what has been the industry’s success rate with these “option to buy” deals.

Positive anecdotes of acquisition options being exercised over the past few years are easy to find. We’ve seen Takeda exercise its right to acquire Maverick for T-cell engagers and GammaDelta for its cellular immunotherapy, among other deals. AbbVie recently did the same with Mitokinin for a Parkinson’s drug. On the negative side, in a high profile story last month, Gilead bailed on purchasing Tizona after securing that expensive $300M option a few years ago.

But these are indeed just a few anecdotes; what about data since these deal structures emerged circa 2010? Unfortunately, as these are mostly private deals with undisclosed terms, often small enough to be less material to the large Pharma buyer, there’s really no great source of comprehensive data on the subject. But a reasonable guess is that the proportion of these deals where the acquisition right is exercised is likely 30%.

This estimate comes from triangulating from a few sources. A quick and dirty dataset from DealForma, courtesy of Tim Opler at Stifel, suggests 30% or so for deals 2010-2020. Talking to lawyers from Goodwin and Cooley, they also suggest ballpark of 30-50% in their experience. The shareholder representatives at SRS Acquiom (who manage post-M&A milestones and escrows) also shared with me that about 33%+ of the option deals they tracked had converted positively to an acquisition. As you might expect, this number is not that different than milestone payouts after an outright acquisition, or future payments in licensing deals. R&D failure rates and aggregate PoS will frequently dictate that within a few years, only a third of programs will remain alive and well.

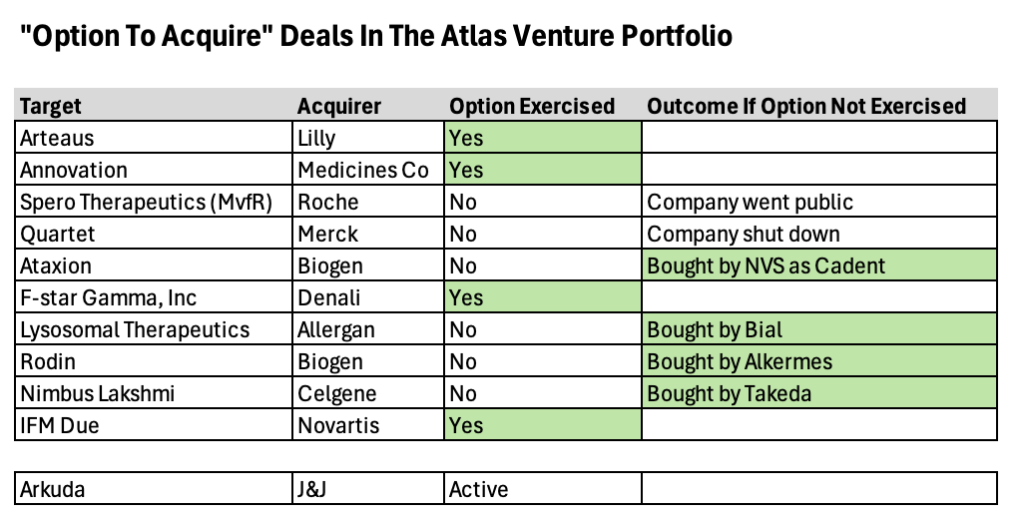

Atlas’ experience with Option-based M&A deals

Looking back, we’ve done nearly a dozen of these option-to-buy deals since 2010. These took many flavors, from strategic venture co-creation where the option was granted at inception (e.g., built-to-buy deals like Arteaus and Annovation) to other deals where the option was sold as part of BD transaction for a maturing company (e.g., Lysosomal Therapeutics for GBA-PD).

Our hit rate with the initial option holder has been about 40%; these are cases where the initial Pharma that bought the option moves ahead and exercises that right to purchase the company. Most of these initial deals were done around pre- or peri-clinical stage assets. But equally interesting, if not more so, is that in situations where the option expired without being exercised, but the asset continued forward into development, all of these were subsequently acquired by other Pharma buyers – and all eight of these investments generated positive returns for Atlas funds. For example, Rodin and Ataxion had option deals with Biogen (here, here) that weren’t exercised, and went on to be acquired by Alkermes and Novartis (here, here). And Nimbus Lakshmi for TYK2 was originally an option deal with Celgene, and went on to be purchased by Takeda.

For the two that weren’t acquired via the option or later, science was the driving factor. Spero was originally an LLC holding company model, and Roche had a right to purchase a subsidiary with a quorum-sensing antibacterial program (MvfR). And Quartet had a non-opioid pain program where Merck had acquired an option. Both of these latter programs were terminated for failing to advance in R&D.

Option deals are often criticized for “capping the upside” or creating “captive companies” – and there’s certainly some truth to that. These deals are structured, typically with pre-specified return curves, so there is a dollar value that one is locked into and the presence of the option right typically precludes a frothy IPO scenario. But in aggregate across milestones and royalties, these deals can still secure significant “Top 1%” venture upside though if negotiated properly and when the asset reaches the market: for example, based only on public disclosures, Arteaus generated north of $300M in payments across the upfront, milestones, and royalties, after spending less than $18M in equity capital. The key is to make sure the right-side of the return tail are included in the deal configuration – so if the drug progresses to the market, everyone wins.

Importantly, once in place, these deals largely protect both the founders and early stage investors from further equity dilution. While management teams that are getting reloaded with new stock with every financing may be indifferent to dilution, existing shareholders (founders and investors alike) often aren’t – so they may find these deals, when negotiated favorably, to be attractive relative to the alternative of being washed out of the cap table. This is obviously less of a risk in a world where the cost of capital is low and funding widely available.

These deal structures also have some other meaningful benefits worth considering though: they reduce financing risk in challenging equity capital markets, as the buyer often funds the entity with an option payment through the M&A trigger event, and they reduce exit risk, as they have a pre-specified path to realizing liquidity. Further, the idea that the assets are “tainted” if the buyer walks hasn’t been borne out in our experience, where all of the entities with active assets after the original option deal expired were subsequently acquired by other players, as noted above.

In addition, an outright sale often puts our prized programs in the hands of large and plodding bureaucracies before they’ve been brought to patients or later points in development. This can obviously frustrate development progress. For many capable teams, keeping the asset in their stewardship even while being “captive”, so they can move it quickly down the R&D path themselves, is an appealing alternative to an outright sale – especially if there’s greater appreciation of value with that option point.

Option-based M&A deals aren’t right for every company or every situation, and in recent years have been used only sparingly across the sector. They obviously only work in practice for private companies, often as alternative to larger dilutive financings on the road to an IPO. But for asset-centric stories with clear development paths and known capital requirements, they can still be a useful tool in the BD toolbox – and can generate attractive venture-like returns for shareholders.

Like others in the biotech ecosystem, Atlas hasn’t done many of these deals in recent funds. And it’s unlikely these deals will come back in vogue with what appears to be 2024’s more constructive fundraising environment (one that’s willing to fund early stage stories), but if things get tighter or Pharma re-engages earlier in the asset continuum, these could return to being important BD tools. It will be interesting to see what role they may play in the broader external R&D landscape over the next few years.

Most importantly, circling back to point of the blog, kudos to the team at IFM and our partners at Novartis!

The post IFM’s Hat Trick and Reflections On Option-To-Buy M&A appeared first on LifeSciVC.

preclinical pandemic mitigation-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges