Tesla stock downgraded amid negative oil prices

Tesla stock downgraded amid negative oil prices

April 22, 2020 Update: Bank of America analyst John Murphy downgraded Tesla stock to Underperform just weeks after upgrading it. He does think the company is a leader in electric vehicles, but he also expects it to experience production issues.

He also predicts a spike and burnout pattern for Tesla’s new vehicles and continuing cash burn from low deliveries and production, high costs and construction of new factories. He also expects the automaker to face competition from other companies as they release new EVs.

BofAML has a $485 price target on Tesla stock, which suggests an approximately 30% decline in the shares.

GLJ Research analyst Gordon Johnson has an even more bearish view of Tesla stock in light of the negative oil prices. He expects the shares to plunge to $70 due to low gas prices, competition and slowing growth.

He believes Chinese retail investors have been driving Tesla’s rally since the company opened its factory in Shanghai. He also believes that even though the automaker has been selling a lot of cars in China, it won’t last. He pointed out that the company has launched eight new car variants over the last two years, but during that timeframe, its sales have only increased 5.5%.

Tesla jumps on Buy initiation, China sales

April 15, 2020 Update: Goldman Sachs analysts initiated coverage of Tesla stock with a Buy rating and $864 price target this week. They like the automaker’s long-term secular growth in the electric vehicle market. Analyst Mark Delaney expects Tesla’s “early-mover advantage and technology cadence” to enable it to continue to hold a solid share of the market and maintain strong gross margins.

He believes Tesla has a significant lead in electric vehicles and expects the Model Y to help the company gain more traction in the SUV market. He also believes the automaker is attractively valued based on its growing revenue. He also likes Tesla’s EBITDA margin compared to that of its peers. He expects Tesla to see a more than 20% compound annual growth rate for the next five years.

Tesla stock also climbed due to a jump in vehicle registrations in China, according to Reuters. Registrations of Tesla vehicles in China surged 450% in March on a month-over-month basis, according to data from auto consultancy LMC Automotive. Overall sales of vehicles in China plummeted more than 43% last month amid pressure from the coronavirus pandemic.

After this afternoon’s gains, Tesla stock is now up by more than 25% for the week.

Tesla stock rises amid record-high China sales

April 9, 2020 Update: Tesla stock has been on a bit of a run this week, alongside major indices like the Dow Jones Industrial Average and S&P 500.

The company surprised investors with solid delivery numbers for the first quarter. Now it has surprised again with data from a third party. The China Passenger Car Association reported that the automaker sold 10,160 vehicles in China last month. That’s a new record for monthly sales in the biggest auto market in the world.

Tesla’s goal is to produce 150,000 Model 3 cars in its factory near Shanghai. The company sold about 30% of the battery electric vehicles sold in China in March, according to the CPCA. Tesla sold about 3,900 vehicles in China in February, an increase from the 2,620 vehicles it sold there in January.

Earlier this week, Jefferies analysts upgraded Tesla stock from Hold to Buy and cut their price target from $800 to $650. They said the automaker is the only one that is legacy-free and in a positive electric-vehicle-sum gain. The analysts also said Tesla is leading the technological transformation in the auto industry.

Also this week, Blue Line Capital President Bill Baruch told CNBC‘s Trading Nation that Tesla stock has a solid floor at the 200-day moving average, which is at $400. He added that that level also served as a ceiling for the shares previously. He believes Tesla stock could climb toward $600, adding that there are some “strong resistance levels” around that level. As of the time of this writing, the shares are up more than 3% at $569.14.

Tesla stock soars after Q1 delivery numbers

April 3, 2020 Update: Tesla stock surged late Thursday and continues to climb today after the company reported solid deliveries for the first quarter. The automaker delivered 88,400 vehicles during the first three months of the year, representing its best first quarter ever, even as the coronavirus continues to impact markets and economies. Analysts had been expecting Tesla to deliver 89,000 vehicles during the first quarter.

Based on that delivery number, Deutsche Bank analyst Emmanuel Rosner is looking for a profit of 5 cents per share, compared with the $1.25 per share in losses he had previously been expecting. Tesla is slated to release its first-quarter earnings report toward the end of April or in early May.

Despite the record first quarter, it’s important to point out that Tesla’s deliveries were down in the quarter compared to where they were in the three quarters before.

Tesla stock downgraded for risk

March 23, 2020 Update: Elazar Advisors downgraded Tesla stock in a Seeking Alpha post earlier this month, and today the firm offered a further explanation for the downgrade. The firm needs three criteria before it rating a stock a Strong Buy.

The three criteria include 45% 12-month upside potential based on earnings one year out, multiplied by historic midpoint P/E. Since Tesla hasn’t had much history with earnings, it didn’t have a P/E, so Elazar just used 45 times. The second criteria is quarterly numbers ahead of consensus, while the third criteria is “wow,” referring to the story, the numbers or some other exciting factor.

As far as trading, the firm requires strong fundamentals, stocks that are moving up, and not allowing losses to run too far. Elazar sold Tesla stock because it felt the wow factor was gone, and losses from the highs were building. The firm also saw earnings risk as sales in Europe were plunging and the coronavirus was ramping up in China. Elazar sees continued risk for Tesla stock as the coronavirus impacts business operations.

Tesla stock continues to dive with the Dow

March 16, 2020 Update: Tesla stock plummeted more than 15% during regular trading hours today, falling alongside the Dow Jones Industrial Average’s 9% drop. The virtual carnage on the stock market is ever more apparent as the day drags on. RBC analysts slashed their price target on Tesla stock due to the coronavirus pandemic, while Bernstein analysts said despite the 40% plunge, the shares still aren’t cheap.

In a note to investors today, RBC analyst Joseph Spak slashed his price target for Tesla stock from $530 to $380 per share and reiterated his Underperform rating. He expects demand for the automaker’s vehicles to be constrained during the second quarter, possibly forcing production to be scaled back.

He now estimates that Tesla will deliver 364,600 vehicles this year, a significant reduction from the 524,200 vehicles he had been estimating before. He noted that the company’s vehicles are luxury vehicles, and consumers will be struggling under the economic fallout of COVID-19. Thus, he believes investors won’t pay as high of a multiple as they had been willing to pay when delivery estimates were higher.

More hedge funds went long on Tesla stock in Q4

March 13, 2020 Update: Many hedge funds have reported that they’re shorting Tesla stock. However, it sounds like more funds became bullish on the stock during the fourth quarter. That means a significant number of hedge funds could have enjoyed significant gains during the first quarter, especially if they got out before the stock dropped.

Insider Monkey reports that as of the end of the fourth quarter, 51 of the hedge funds it tracks had long positions in Tesla stock. That’s a 59% increase from the end of the third quarter. In the fourth quarter of 2018, 47 hedge funds had long positions in Tesla.

Morgan Stanley cuts price target on Tesla stock

March 12, 2020 Update: Morgan Stanley analyst Adam Jonas trimmed his price target for Tesla stock from $500 to $480 a share. He also cut his delivery estimate for this year to 452,000 vehicles. His previous estimate for 2020 was 500,000 vehicles, which he said is now his bull case. He reiterated his Underweight rating on the stock.

In a report today, Jonas cited the coronavirus pandemic as one reason for the reduction. He said the impact on profitability and working capital results in a lower forecast for cash flow. He now estimates Tesla’s cash flow at -$300,000 for this year on an adjusted basis, which results in his lower price target for Tesla stock.

He said one factor is a slight decrease in his expectations of demand rather than supply. He added that Tesla “is in pole position in EVs,” but he adds that the company’s vehicles are a “high priced and discretionary purchase.”

Jonas still forecasts a 10% increase in North American volumes this year, mostly due to what he believes to be a strong backlog for the Model Y offsetting potentially adverse vehicle sales in the first half of the year. He expects volumes in Europe to fall 10% year over year this year as incentives in important markets soften and amid a potential buyer’s strike before the Gigafactory opens in Europe.

According to the China Passenger Car Association, Tesla delivered 3,958 vehicles in February in China, compared to about 3,500 the month before. Jonas said this implies a production run rate of a little over 1,000 units per week as of the end of February. He assumes the production ramp in China will be delayed by about two months due to the coronavirus. He was previously expecting Tesla to be producing 3,000 vehicles per week at the China factory by April. Pushing the timeline back, he estimates between 100,000 and 120,000 vehicle deliveries in China for this year, depending on how the recovery from the coronavirus shutdown goes.

Tesla stock rises as Musk announces 1 millionth vehicle

March 10, 2020 Update: Tesla stock rallied along with the rest of the stock market today as CEO Elon Musk delivered some big news. Last night, he congratulated the Tesla team on manufacturing its 1 millionth vehicle.

Congratulations Tesla team on making our 1,000,000th car!! pic.twitter.com/5M99a9LLQi

— Elon Musk (@elonmusk) March 10, 2020

The automaker has been delivering the Model S, Model X and Model 3, and deliveries of the Model Y are set to begin by the end of the first quarter.

Tesla stock plunged more than 13% yesterday amid a broad-based selloff in equities. However, today brought relief as the S&P 500, Dow Jones Industrial Average and Nasdaq Composite all saw relief.

Tesla stock sells off with the stock market as oil prices plunge

March 9, 2020 Update: Tesla stock plunged amid worries about a price war in oil, which sent crude prices tumbling. Shares of Tesla fell by as much as 14% during regular trading hours, sliding as low as $605 before a broad-based equity selloff triggered a market-wide halt in trading. The last time Tesla stock was trading in this neighborhood was in late January.

Falling oil prices spurred by the breakdown of the OPEC+ alliance are bad for Tesla. Saudi Arabia and Russia are both pouring cheap oil into the market, Bloomberg reported. Cheap oil means lower gas prices, which makes Tesla’s expensive all-electric vehicles a harder sell.

Another problem for Tesla is the sharp downturn in China’s automaker. The nation plays an important role in the company’s growth story.

New Street-high price target for Tesla stock

March 3, 2020 Update: Tesla stock was in the green most of the day today, but by early afternoon, it had flipped into the red, falling as much as 2%. Two analysts weighed in on the EV maker today. One of them offered a Street-high target price, while the other said Tesla stock has more to fall before it will start to rise again.

JMP Securities analyst Joe Osha upgraded Tesla stock from Hold to Market Outperform and set his new price target at $1,060. Excluding price targets that look out years into the future, Osha’s is the highest from major Wall Street firms.

He said although the price target implies an earnings multiple that some may feel seems “excessive,” investors have been buying low-growth automakers at high multiples. Further, Tesla has notched a compound annual growth rate of 23%.

He also said that based on estimates for next year, Tesla stock is trading at around 20 times estimated earnings. That’s not much higher than the S&P 500, which is trading at about 18.2 times estimated earnings for 2021. Osha’s price target is based on 32 times estimated earnings and five times estimated revenue based on 2021 numbers.

He believes the recent pullback caused by the coronavirus presents an opportunity for investors to enter the stock. He also said investors may find more opportunities to buy Tesla stock in the first half of this year as further impacts from the coronavirus become apparent.

Osha also believes Tesla won’t see much competition from other automakers. He believes the electric vehicles from other automakers won’t be able to stand up to Tesla’s EVs.

Wait before buying

Morgan Stanley analyst Adam Jonas still sees Tesla stock as an Underweight and kept his price target at $500 per share. On Monday, he said it’s too early for investors to dive into the stock.

The coronavirus has taken a bite out of Tesla stock because of the important role China plays in the company’s growth. Jonas said he would be bearish on the automaker even without the coronavirus outbreak. He believes investors should prepare themselves for “challenging” earnings numbers for the first quarter.

Excluding the impact from the coronavirus, he expects the company’s first-quarter numbers to be weak. He noted that Tesla has been working through its China production and Model Y ramp and that demand in some parts of Europe has been weaker following a strong fourth quarter.

Jonas recommends that investors wait to see if a difficult first quarter and disruptions to supply occur before deciding whether to buy into Tesla stock again. The coronavirus uncertainty only adds to those concerns, he added.

Tesla up as short-seller calls it “biggest single stock bubble”

Mar. 2, 2020 Update: Tesla stock is back on the rise today following its biggest one-week lost since the initial public offering in June 2010. Longtime bear Mark Spiegel of Stanphyl Capital published an update on his sort of the stock, calling February “a refreshing change” because it actually worked in his favor.

In his most recent letter, which was posted in its entirety by ValueWalk, he called CEO Elon Musk a “securities fraud-committing pathological liar” and again said why he believes the company is in danger. He noted that Tesla raised $2.3 billion in a recent stock offering just weeks after Musk said on the company’s earnings call that “it doesn’t make sense to raise money because we expect to generate cash despite this growth level.”

“In other words, if Elon Musk’s lips are moving, there’s an excellent chance he’s lying,” Spiegel wrote.

He also called investors who are long on Tesla “a mass of idiots bidding this stock to the moon because they think it’s a ‘hypergrowth’ company.” He alleged that the company’s earnings are usually inflated by $200 million or more each quarter due to “its massive ongoing warranty fraud.” He argued that Tesla actually lost money during the fourth quarter.

Spiegel believes demand for the Model Y is “disastrous,” arguing that it will cannibalize sales of the Model 3 and be up against “superior competition from… much nicer electric” vehicles. He called the Cybertruck a “joke of a ‘pickup truck.'”

He also called attention to the number of executive departures, saying that they must be leaving “because Musk is either an outright crook or the world’s biggest jerk to work for (or both).” He noted that Consumer Reports found Tesla’s Autopilot system to be unsafe.

You can read Spiegel’s letter on Tesla stock in its entirety here.

Whitney Tilson email on Tesla

Former hedge fund manager Whitney Tilson told colleagues in an email seen by ValueWalk the following regarding Tesla stock.

Last week I met with someone who I can’t identify, so you’ll just have to trust me when I say he knows what he’s talking about. He told me that the full-self-driving milestone that Tesla announced it reached (something about being able to handle highway entry and exits I recall), which the company used to justify releasing deferred FSD revenue into its income statement (thereby boosting its reported profitability), is a “complete joke” – it wasn’t an important milestone in any way.

The same person, however, said Tesla has some of the best engineers working for it, its battery packs are TWICE as efficient as any other car maker, and he’s optimistic about the Model Y – he doesn’t think there will be production issues (in part because it’s just a slightly modified Model 3) and said they’ve fixed the cold-weather battery issue.

Ron Baron loves Tesla stock

Feb. 28, 2020 Update: Billionaire Ron Baron believes Tesla could be worth $1.5 trillion by 2030. He offered his latest insight into Tesla stock in an interview with Barron’s this week.

He bought almost all of his 1.62 million shares of Tesla stock between 2014 and 2016 at an average price of $219.14 apiece, amounting to $355 million. Baron noted that the company’s annual revenue was only $2.5 billion in 2013 but grew to $25 billion in 2019. He expects to see it hit $33 billion this year.

By 2024, he predicts Tesla’s revenue will be between $100 billion and $125 billion, and he expects Tesla stock to carrying it to a valuation of $300 billion to $400 billion. By 2030, he looks for Tesla’s revenue to be between $750 billion and $1 trillion with operating profit in the range of $150 billion to $200 billion. By then he expects Tesla to be worth $1.5 trillion.

Tesla stock tanks after news of weak China registrations

Feb. 27, 2020 Update: Tesla stock tanked by more than 10% during regular trading hours today as the rest of the stock market pulled back. The shares’ decline was also worsened by a report of disappointing registration numbers on Tesla vehicles in China before the coronavirus outbreak.

Registration data in China revealed a major month-over-month slowdown in demand there. Data from the government-operated China Automotive Information Net revealed that registrations of new Tesla vehicles tumbled 46% from December to January. There were 3,563 Tesla vehicles registered in China last month. Of those vehicles, 2,605 were models that were actually built in China.

Demand for electric vehicles in China has been waning over the last few months, although Tesla had managed to avoid the problems that struck the rest of the industry. However, January’s steep decline in registration numbers indicates that the U.S.-based automaker isn’t immune to the problems faced by the rest of the Chinese EV industry. The nation’s overall vehicle market looks on track for a third consecutive annual decline amid the economic slowdown, trade tensions and now the coronavirus outbreak.

Tesla stock plunged 7% right after the markets opened. The shares were up 86% year to date through Wednesday’s close. Some of the optimism that’s been driving the stock has been due to the start of production at the factory near Shanghai. The automaker started delivering China-built vehicles last month. Tesla hopes to tap into the tax exemptions and subsidies that are only available on domestically built vehicles.

Concerns about the coronavirus are weighing on both Tesla stock and the broader market. U.S. stock indices also plunged during regular trading hours today.

Tesla stock driven by ESG trends instead of short squeeze?

Feb. 24, 2020 Update: Tesla stock plunged along with the rest of the stock market today, falling more than 7% to $834 per share. The shares have bucked the wider trend of the stock market in recent weeks, continuing to rise even while stock indices were falling, but that’s certainly not the case today.

One firm had some interesting insight into what may have been moving Tesla stock over the last several months. Jefferies analyst Christopher Wood said in a note dated Feb. 20 that the trend in ESG (environmental, social and corporate governance) investing may actually be responsible for a significant portion of the stock’s movement.

It has been widely reported that a short squeeze has driven the meteoric rise in Tesla stock, but Wood notes that ESG funds have seen massive flows recently. Tesla may be the quintessential ESG stock.

Wood argues that “big money can be made” in identifying stocks that are likely to capture ESG fund flows. He also suggests that the massive flows to ESG funds may actually be what has been driving the automaker’s shares rather than short covering. He pointed out that Tesla stock had surged 119% so far this year by the time of his report, and its short interest declined only 13% during that same timeframe.

Given the number of hedge fund managers who have said that they are still short Tesla, it is an interesting argument to consider.

Tesla closes stock offering with $2.31 billion gain

Feb. 20, 2020 Update: Tesla informed the Securities and Exchange Commission that it has successfully closed its latest stock offering. The automaker raked in $2.31 billion, easily unloading all 2.65 million shares. The underwriters also immediately exercised their options to buy shares, although they had 30 days to do so.

The total share sale in the offering was 3.05 million shares, which sold for $767 each. The amount expected to be raised was $2.01 billion to $2.31 billion, and Tesla easily managed the full amount at the high end of the range. The automaker said it would use the proceeds for general corporate purposes and to strengthen its balance sheet.

Even though share offerings dilute current shareholders’ investments, Tesla stock soared since the latest offering. However, on Thursday, the shares tumbled following a report about how McAfee was able to trick a Model S into speeding up by 50 miles per hour — using only a piece of tape.

These major funds bought Tesla stock right before it soared

February 18, 2020 Update: Tesla stock continues to soar, unimpeded by anything else in the market. The shares are up another 6% in early trading today after the long three-day holiday weekend. Now we’re hearing that two major hedge funds bought shares just before the latest meteoric rise.

Hyperion Asset Management’s Global Growth Companies Fund is in the top 1% of hedge funds based on returns. It has managed a 28% return over the last three years, surpassing 99% of its peers.

According to Bloomberg, the fund has been focused on investing in companies that can thrive when growth is low through the efficient use of technology. The strategy emphasizes companies that center on different trends of themes Hyperion management believe will last for at least 10 years. Hyperion usually holds stocks for 10 years, and its top holdings include Amazon, Microsoft and Visa.

Another fund, Renaissance Technologies, also invested in Tesla stock before the latest meteoric rise. According to Business Insider, the fund boosted its holdings in the EV maker in December to 3.9 million shares. At the time, the position was worth approximately $1.6 billion. The shares are now worth nearly $3.2 billion following the 91% increase in their value so far this year.

Charlie Munger: I would never buy or short Tesla stock

Feb. 13, 2020 Update: Charlie Munger of Berkshire Hathaway, longtime business partner of Warren Buffett, spoke about Tesla during his address at Daily Journal Corp’s annual meeting. He said he would never buy or short Tesla stock. He called Tesla CEO Elon Musk “peculiar,” adding that “he may overestimate himself, but he may not be wrong all the time.”

Tesla stock initially declined today after the company said in a statement that it will sell $2.3 billion in shares to raise capital. However, after the premarket decline, the shares recovered quickly and were up nearly 2% by 11 a.m. Eastern.

Model Y is one of the most-anticipated vehicles

Feb. 11, 2020 Update: Tesla stock finally seems to be taking a breather today with a climb of less than 1% at midday. Of course, it takes hardly any news to lift Tesla stock, and what we have to report could serve as a bit more fuel for the fire.

Tesla’s Model Y is one of the most-anticipated vehicles for 2020 so far. PartCatalog put together a list of the most-anticipated vehicles for each state in the U.S., and the Model Y captured California, Washington and Hawaii. It’s no surprise that Tesla took its home state of California, but it is interesting that there’s interest in two other states as well.

The most-anticipated vehicle is the much-hyped Ford Bronco with 19 states. The Chevy Corvette Stingray is in second place with 13 states, and the Land Rover Defender is in third place with six states.

Image source: partcatalog.com

Tesla stock climbs as Shanghai factory reopens

Feb. 10, 2020 Update: Tesla stock continued its rapid climb early today as the company reopened production at its factory in Shanghai. The shares briefly topped the $800 level again but dropped back below that level as the early hours of trading continued.

Reuters reported on Friday that Shanghai authorities said they would help companies like Tesla restart product as quickly as possible. The factory there reopened today after an extended Lunar New Year holiday caused by the spread of the coronavirus. Tesla stock continues to be very speculative as today’s gains come days after it was revealed that production in China would restart today.

A short squeeze is also driving Tesla stock as short-sellers are being forced to cover their positions. However, some short-sellers aren’t willing to give up yet, as evidenced by the letters from hedge funds that continue to short the stock.

Concern over Tesla

Feb. 7, 2020 Update: Gene Munster of Loup Ventures, previously known for his analyst reports on Apple, is concerned about Tesla. The venture capitalist noted in a blog post that Tesla stock has soared, doubling the company’s market capitalization over the last month and tripling it since the end of the third quarter. He also said that the excitement that has driven the meteoric rise in Tesla stock presents risk in the short term. He believes bulls may be overlooking a few things.

For example, he expects the first quarter to bring a sequential decline in deliveries. The automaker delivered 112,000 vehicles during the fourth quarter. Munster pointed out that Tesla removed an important statement from its fourth-quarter letter to shareholders. In the second and third quarters of 2019, the company wrote that “deliveries should increase sequentially,” but that statement doesn’t appear in the Q4 letter.

Tesla stock and China

Munster believes it means a significant decline quarter over quarter is in order. He also noted that the company said production will probably outpace deliveries this year. Model 3 production is set to ramp in Shanghai, and Model Y production is beginning in Fremont.

The venture capitalist also noted that the first quarter is usually seasonally weak for automakers due to poor weather, discounts at the end of the year and releases of new models. Tesla also said in its fourth-quarter letter that its finished vehicle inventory level was at 11 days of sales, the lowest in the last four years. Munster said that means the automaker delivered every vehicle it could in the fourth quarter, “leaving many showrooms empty and online inventory searches yielding ‘no results.'”

He also notes that the company has been teasing its upcoming Plaid powertrain, and many Model S and X buyers are likely to wait until it is released. Other factors include the coronavirus impact on Shanghai production.

Tesla stock rumbled 0.46% to $745.52 during regular trading hours.

Hedge funds short Musk

Feb. 6, 2020 Update: Aristides Capital published an update on its short of Tesla stock in its letter to investors dated Feb. 3, 2020, which was reviewed by ValueWalk. Managing Member Christopher Brown had some very harsh words for Tesla CEO Elon Musk.

After doing well shorting Tesla stock most of the year in 2019, Brown said he should have stayed away after covering most of the position in the low $200s. However, he said he dug in a bit too hard in the fourth quarter, explaining that he has written so much on Tesla stock that he has lost his willingness to change to a different view on it.

Aristides covered some of its short of Tesla stock before the company posted its earnings and then covered most of the rest of the position by the end of the month. Brown noted that when companies shift from needing a continual supply of capital to being sustainable on their own, which is how Tesla fans now see the company, the valuation gets expanded.

Another problem for his short of Tesla stock is that the company’s EV competitors didn’t gain as much ground in the market as he thought they would have by now. Additionally, he thought Tesla’s “poor reliability would catch up to it” as the owner base expanded beyond fanboys, but that didn’t happen. Brown sees the automaker as “one of the least reliable brands and also the most loved/highest in loyalty.”

Elon Musk a liar?

Finally, Model 3 orders in the U.S. seems to be going much better than what Brown had expected. But it was his words about Elon Musk that really had an impact.

“Yes, Elon Musk is a narcist and a liar, yes, he has committed multi-billion-dollar securities fraud on more than one occasion, and yes, there is certainly the appearance of some accounting shenanigans at Tesla, but none of that seems to matter,” he wrote. “It’s a ‘cool’ car with a CEO who lied to bailout [sic] Solar City, lied about a takeover, libeled an actual hero, attacks journalists and whistleblowers, and never faces any serious consequences for it whatsoever.”

He also said he won’t promise that he will never short Tesla again, but if he does, it will be because he sees “a huge near-term edge on some sort of catalyst.”

Updates on Tesla stock

Dorsheimer continues to see Tesla as “the leading EV juggernaut and expects the upcoming battery day in April to be a major milestone to help investors understand the automaker’s lead in the EV maker. However, he also believes that patient investors will see a better entry point for Tesla stock if they wait.

Interestingly, advice on Tesla stock is trending so much on Feb. 5 that if you type in “should I” into Google, the top two auto-fill suggestions are “should I buy Tesla stock” and “should I sell Tesla stock.”

Previously: Tesla stock continues its hot streak on Feb. 4, 2020 with another $200 gain in a single day. The shares topped $700 on Monday and then $900 on Tuesday following another 20% gain. The EV maker’s stock has been on a run for months, and it received yet another shot of adrenaline last week from the fourth-quarter earnings release. Tesla Inc. (NASDAQ:TSLA) stock shows no signs of slowing down, and short-sellers have really been taking a hit on it.

Tesla stock: running of the bulls

Shares popped on Feb. 4 following bullish commentary from billionaire Ron Baron on CNBC‘s Squawk Box. The automaker’s valuation topped $160 billion, dwarfing General Motors’ $49.4 billion market capitalization.

In fact, GM, Ford and Chrysler are worth a combined $110 billion, and their combined revenue in 2019 was $425 billion, compared to Tesla’s $25 billion in revenue. Tesla’s stock rise puts it on track to compete with Toyota, which is the most valuable automaker in the world at a market cap of $232.1 billion.

Baron told CNBC that he sees Tesla hitting “at least” $1 trillion in revenue over the next decade. He also said he sees “a lot of growth opportunities from that point going forward.” His fund Baron Capital owns almost 1.63 million shares of Tesla stock, and he said they won’t be selling any of those shares. He believes the latest bull run in the shares is “just the beginning” and predicts that the automaker “could be one of the largest companies in the whole world.”

Tesla stock ratings

Numerous analysts updated their Tesla stock ratings following the company’s 4Q19 earnings release. The most astonishing price target increase came from ARK Invest analysts, who wrote on Feb. 1, 2020 that they expect the shares to be worth $7,000 by 2024. Interestingly, that’s their base case.

Their bull case puts Tesla stock at $15,000 or higher, while their bear case has it at $1,500, well above the $900 current price. One of the biggest factors in their price target increase is their expectation that the automaker will be able to slash costs and boost margins. They see an 80% probability of Tesla reaching 40% margins.

Wedbush analyst Daniel Ives boosted his price target for Tesla stock from $500 to $710 following the company’s Jan. 29 earnings release. He set his bull case for the shares at $1,000 and said he expects the “bull party” to continue. He has a Neutral rating on the stock.

Other ratings

Feb. 5, 2020 Update: Analysts at Canaccord Genuity downgraded Tesla stock in a note dated Feb. 4, 2020. Analyst Jed Dorsheimer said he now rates the shares at Hold, down from Buy, with a $750 price target. Tesla stock powered past $960 per share in trading on Feb. 4 but then pulled back on Feb. 5 following the firm’s downgrade. The stock plunged more than 12% to fall closer to $775 per share.

In his report, Dorsheimer said he saw a balanced risk/ reward for the shares following this week’s meteoric rise. He said they saw a clear buy signal for the stock entering the year, but he believes the coronavirus in China is a clear headwind for Tesla’s new Shanghai factory, which he said calls for “a more pragmatic position.”

“Given the 3,000 per week China Model 3 production expectations in a country that remains on lockdown, we feel a reset of expectations in Q1 is likely and thus needs to be reflected in the valuation,” he wrote.

Ivey wrote in an update on Feb. 3 that he believes the automaker will see 150,000 units of demand out of China alone in the coming year. He also believes the company’s guidance of achieving 500,000 deliveries in 2020 is achievable. He believes Wall Street is looking for between 530,000 and 550,000 deliveries in 2020. The big factor in the number of deliveries to expect include the automaker’s ability to ramp production and demand in China this year and next.

Analysts can’t keep up with price surge

Canaccord Genuity wrote analyst Jed Dorsheimer wrote in his Jan. 30, 2020 update on Tesla stock that the company is “feeling more like Space X.” The automaker posted $7.4 billion in revenue and earnings of $2.14 per share for 4Q19, compared to consensus estimates of $7 billion and $1.77 per share. Dorsheimer said one thing that’s important to note is that the company ended the fourth quarter with $6.3 billion in cash and generated $1 billion in free cash flow, which he believes should quiet concerns about the automaker’s balance sheet. He had a Buy rating and new $750 price target on Tesla stock as of Jan. 30, but the shares have now surpassed $900, putting that target underwater.

Morgan Stanley analyst Adam Jonas remains extremely bearish on Tesla stock with an Underweight rating and $360 price target as of Jan. 31, 2020. He said that in the almost nine years he has been covering the stock, investor commentary has not been as optimistic as it is now following the 4Q19 earnings release. Jonas downgraded the shares to Underweight on Jan. 16.

Hedge fund views of Tesla stock

Multiple hedge funds have covered Tesla stock in their letters to investors. Lakewood Capital wrote about its short of the shares in its fourth-quarter letter to investors dated Jan. 14, 2020. Unsurprisingly, the fund’s short of the automaker was its biggest losing position during the fourth quarter at 85 basis points.

The shares rallied into the end of the year after the company posted a “slight” profit in its third-quarter earnings release, Lakewood’s Anthony Bozza wrote.

“We’ve done this long enough to know that sentiment on stocks like Tesla can be nearly impossible to predict and are [sic] subject to large, sudden price fluctuations, and hence, we size our shorts prudently,” he told investors.

He described the fourth-quarter rally as “frustrating” but added that the position didn’t significantly detract from the fund’s full-year 2019 results.

Although we have seen this story countless times, what’s rather unique in the case of Tesla is the sheer scale of the situation,” he added.

Short-sellers feel the pain

Data from S3 Partners reveals that short-sellers have lost over $8 billion just in the last month alone. On Feb. 3, 2020, short-sellers lost a staggering $2.5 billion just in a single day. Despite the sizable paper losses they have recorded in the last few years, short interest in Tesla remains high with about 24.4 million shares being borrowed and bets against the company valued at more than $15 billion. That amounts to more than 18% of Tesla’s float.

Tesla is the most-shorted stock, and short interest is significantly higher than interest in the next two companies with the second- and third-biggest short interest. Less than 1% of the float is being bet against Apple and Microsoft each.

Short-sellers have been forced to cover some of their position in Tesla. According to S3, they have covered $12.6 billion worth of shares since they were below $200 in June 2019. It’s likely that some of the post-earnings run in late January and early February is the result of short-sellers finally caving and covering their positions.

The post Tesla stock downgraded amid negative oil prices appeared first on ValueWalk.

Government

Survey Shows Declining Concerns Among Americans About COVID-19

Survey Shows Declining Concerns Among Americans About COVID-19

A new survey reveals that only 20% of Americans view covid-19 as "a major threat"…

A new survey reveals that only 20% of Americans view covid-19 as "a major threat" to the health of the US population - a sharp decline from a high of 67% in July 2020.

What's more, the Pew Research Center survey conducted from Feb. 7 to Feb. 11 showed that just 10% of Americans are concerned that they will catch the disease and require hospitalization.

"This data represents a low ebb of public concern about the virus that reached its height in the summer and fall of 2020, when as many as two-thirds of Americans viewed COVID-19 as a major threat to public health," reads the report, which was published March 7.

According to the survey, half of the participants understand the significance of researchers and healthcare providers in understanding and treating long COVID - however 27% of participants consider this issue less important, while 22% of Americans are unaware of long COVID.

What's more, while Democrats were far more worried than Republicans in the past, that gap has narrowed significantly.

"In the pandemic’s first year, Democrats were routinely about 40 points more likely than Republicans to view the coronavirus as a major threat to the health of the U.S. population. This gap has waned as overall levels of concern have fallen," reads the report.

More via the Epoch Times;

The survey found that three in ten Democrats under 50 have received an updated COVID-19 vaccine, compared with 66 percent of Democrats ages 65 and older.

Moreover, 66 percent of Democrats ages 65 and older have received the updated COVID-19 vaccine, while only 24 percent of Republicans ages 65 and older have done so.

“This 42-point partisan gap is much wider now than at other points since the start of the outbreak. For instance, in August 2021, 93 percent of older Democrats and 78 percent of older Republicans said they had received all the shots needed to be fully vaccinated (a 15-point gap),” it noted.

COVID-19 No Longer an Emergency

The U.S. Centers for Disease Control and Prevention (CDC) recently issued its updated recommendations for the virus, which no longer require people to stay home for five days after testing positive for COVID-19.

The updated guidance recommends that people who contracted a respiratory virus stay home, and they can resume normal activities when their symptoms improve overall and their fever subsides for 24 hours without medication.

“We still must use the commonsense solutions we know work to protect ourselves and others from serious illness from respiratory viruses, this includes vaccination, treatment, and staying home when we get sick,” CDC director Dr. Mandy Cohen said in a statement.

The CDC said that while the virus remains a threat, it is now less likely to cause severe illness because of widespread immunity and improved tools to prevent and treat the disease.

“Importantly, states and countries that have already adjusted recommended isolation times have not seen increased hospitalizations or deaths related to COVID-19,” it stated.

The federal government suspended its free at-home COVID-19 test program on March 8, according to a website set up by the government, following a decrease in COVID-19-related hospitalizations.

According to the CDC, hospitalization rates for COVID-19 and influenza diseases remain “elevated” but are decreasing in some parts of the United States.

Government

Rand Paul Teases Senate GOP Leader Run – Musk Says “I Would Support”

Rand Paul Teases Senate GOP Leader Run – Musk Says "I Would Support"

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump…

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump into the race to become the next Senate GOP leader, and Elon Musk was quick to support the idea. Republicans must find a successor for periodically malfunctioning Mitch McConnell, who recently announced he'll step down in November, though intending to keep his Senate seat until his term ends in January 2027, when he'd be within weeks of turning 86.

So far, the announced field consists of two quintessential establishment types: John Cornyn of Texas and John Thune of South Dakota. While John Barrasso's name had been thrown around as one of "The Three Johns" considered top contenders, the Wyoming senator on Tuesday said he'll instead seek the number two slot as party whip.

Paul used X to tease his potential bid for the position which -- if the GOP takes back the upper chamber in November -- could graduate from Minority Leader to Majority Leader. He started by telling his 5.1 million followers he'd had lots of people asking him about his interest in running...

Thousands of people have been asking if I'd run for Senate leadership...

— Rand Paul (@RandPaul) March 8, 2024

...then followed up with a poll in which he predictably annihilated Cornyn and Thune, taking a 96% share as of Friday night, with the other two below 2% each.

????????️VOTE NOW ????️ ???? Who would you like to be the next Senate leader?

— Rand Paul (@RandPaul) March 8, 2024

Elon Musk was quick to back the idea of Paul as GOP leader, while daring Cornyn and Thune to follow Paul's lead by throwing their names out for consideration by the Twitter-verse X-verse.

I would support Rand Paul and suspect that other candidates will not actually run polls out of concern for the results, but let’s see if they will!

— Elon Musk (@elonmusk) March 8, 2024

Paul has been a stalwart opponent of security-state mass surveillance, foreign interventionism -- to include shoveling billions of dollars into the proxy war in Ukraine -- and out-of-control spending in general. He demonstrated the latter passion on the Senate floor this week as he ridiculed the latest kick-the-can spending package:

This bill is an insult to the American people. The earmarks are all the wasteful spending that you could ever hope to see, and it should be defeated. Read more: https://t.co/Jt8K5iucA4 pic.twitter.com/I5okd4QgDg

— Senator Rand Paul (@SenRandPaul) March 8, 2024

In February, Paul used Senate rules to force his colleagues into a grueling Super Bowl weekend of votes, as he worked to derail a $95 billion foreign aid bill. "I think we should stay here as long as it takes,” said Paul. “If it takes a week or a month, I’ll force them to stay here to discuss why they think the border of Ukraine is more important than the US border.”

Don't expect a Majority Leader Paul to ditch the filibuster -- he's been a hardy user of the legislative delay tactic. In 2013, he spoke for 13 hours to fight the nomination of John Brennan as CIA director. In 2015, he orated for 10-and-a-half-hours to oppose extension of the Patriot Act.

Among the general public, Paul is probably best known as Capitol Hill's chief tormentor of Dr. Anthony Fauci, who was director of the National Institute of Allergy and Infectious Disease during the Covid-19 pandemic. Paul says the evidence indicates the virus emerged from China's Wuhan Institute of Virology. He's accused Fauci and other members of the US government public health apparatus of evading questions about their funding of the Chinese lab's "gain of function" research, which takes natural viruses and morphs them into something more dangerous. Paul has pointedly said that Fauci committed perjury in congressional hearings and that he belongs in jail "without question."

Musk is neither the only nor the first noteworthy figure to back Paul for party leader. Just hours after McConnell announced his upcoming step-down from leadership, independent 2024 presidential candidate Robert F. Kennedy, Jr voiced his support:

Mitch McConnell, who has served in the Senate for almost 40 years, announced he'll step down this November.

— Robert F. Kennedy Jr (@RobertKennedyJr) February 28, 2024

Part of public service is about knowing when to usher in a new generation. It’s time to promote leaders in Washington, DC who won’t kowtow to the military contractors or…

In a testament to the extent to which the establishment recoils at the libertarian-minded Paul, mainstream media outlets -- which have been quick to report on other developments in the majority leader race -- pretended not to notice that Paul had signaled his interest in the job. More than 24 hours after Paul's test-the-waters tweet-fest began, not a single major outlet had brought it to the attention of their audience.

That may be his strongest endorsement yet.

Government

The Great Replacement Loophole: Illegal Immigrants Score 5-Year Work Benefit While “Waiting” For Deporation, Asylum

The Great Replacement Loophole: Illegal Immigrants Score 5-Year Work Benefit While "Waiting" For Deporation, Asylum

Over the past several…

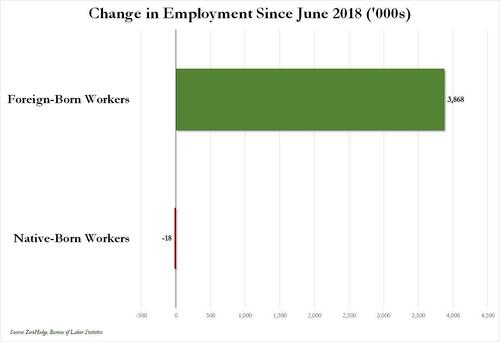

Over the past several months we've pointed out that there has been zero job creation for native-born workers since the summer of 2018...

... and that since Joe Biden was sworn into office, most of the post-pandemic job gains the administration continuously brags about have gone foreign-born (read immigrants, mostly illegal ones) workers.

And while the left might find this data almost as verboten as FBI crime statistics - as it directly supports the so-called "great replacement theory" we're not supposed to discuss - it also coincides with record numbers of illegal crossings into the United States under Biden.

In short, the Biden administration opened the floodgates, 10 million illegal immigrants poured into the country, and most of the post-pandemic "jobs recovery" went to foreign-born workers, of which illegal immigrants represent the largest chunk.

'But Tyler, illegal immigrants can't possibly work in the United States whilst awaiting their asylum hearings,' one might hear from the peanut gallery. On the contrary: ever since Biden reversed a key aspect of Trump's labor policies, all illegal immigrants - even those awaiting deportation proceedings - have been given carte blanche to work while awaiting said proceedings for up to five years...

... something which even Elon Musk was shocked to learn.

Wow, learn something new every day https://t.co/8MDtEEZGam

— Elon Musk (@elonmusk) March 10, 2024

Which leads us to another question: recall that the primary concern for the Biden admin for much of 2022 and 2023 was soaring prices, i.e., relentless inflation in general, and rising wages in particular, which in turn prompted even Goldman to admit two years ago that the diabolical wage-price spiral had been unleashed in the US (diabolical, because nothing absent a major economic shock, read recession or depression, can short-circuit it once it is in place).

Well, there is one other thing that can break the wage-price spiral loop: a flood of ultra-cheap illegal immigrant workers. But don't take our word for it: here is Fed Chair Jerome Powell himself during his February 60 Minutes interview:

PELLEY: Why was immigration important?

POWELL: Because, you know, immigrants come in, and they tend to work at a rate that is at or above that for non-immigrants. Immigrants who come to the country tend to be in the workforce at a slightly higher level than native Americans do. But that's largely because of the age difference. They tend to skew younger.

PELLEY: Why is immigration so important to the economy?

POWELL: Well, first of all, immigration policy is not the Fed's job. The immigration policy of the United States is really important and really much under discussion right now, and that's none of our business. We don't set immigration policy. We don't comment on it.

I will say, over time, though, the U.S. economy has benefited from immigration. And, frankly, just in the last, year a big part of the story of the labor market coming back into better balance is immigration returning to levels that were more typical of the pre-pandemic era.

PELLEY: The country needed the workers.

POWELL: It did. And so, that's what's been happening.

Translation: Immigrants work hard, and Americans are lazy. But much more importantly, since illegal immigrants will work for any pay, and since Biden's Department of Homeland Security, via its Citizenship and Immigration Services Agency, has made it so illegal immigrants can work in the US perfectly legally for up to 5 years (if not more), one can argue that the flood of illegals through the southern border has been the primary reason why inflation - or rather mostly wage inflation, that all too critical component of the wage-price spiral - has moderated in in the past year, when the US labor market suddenly found itself flooded with millions of perfectly eligible workers, who just also happen to be illegal immigrants and thus have zero wage bargaining options.

None of this is to suggest that the relentless flood of immigrants into the US is not also driven by voting and census concerns - something Elon Musk has been pounding the table on in recent weeks, and has gone so far to call it "the biggest corruption of American democracy in the 21st century", but in retrospect, one can also argue that the only modest success the Biden admin has had in the past year - namely bringing inflation down from a torrid 9% annual rate to "only" 3% - has also been due to the millions of illegals he's imported into the country.

We would be remiss if we didn't also note that this so often carries catastrophic short-term consequences for the social fabric of the country (the Laken Riley fiasco being only the latest example), not to mention the far more dire long-term consequences for the future of the US - chief among them the trillions of dollars in debt the US will need to incur to pay for all those new illegal immigrants Democrat voters and low-paid workers. This is on top of the labor revolution that will kick in once AI leads to mass layoffs among high-paying, white-collar jobs, after which all those newly laid off native-born workers hoping to trade down to lower paying (if available) jobs will discover that hardened criminals from Honduras or Guatemala have already taken them, all thanks to Joe Biden.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex