Uncategorized

Taylor Rule Shows Fed Has Unfinished Work On Rates

Taylor Rule Shows Fed Has Unfinished Work On Rates

Authored by Ven Ram, Bloomberg cross-asset strategist,

If the labor market continues to…

Authored by Ven Ram, Bloomberg cross-asset strategist,

If the labor market continues to stay robust, the Federal Reserve will be forced to tighten again after a pause in June to prevent its benchmark rate from falling behind the curve, an application of the Taylor Rule shows.

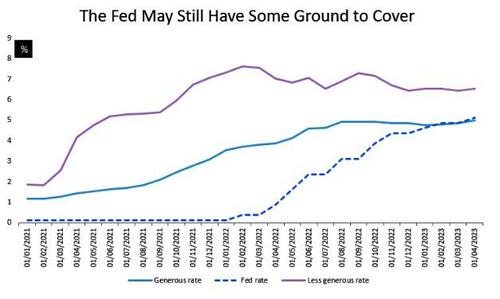

Given still-resistant core inflation, the restrictive rate for the US economy is between 5% and 6.55%, meaning the Fed’s mid rate at 5.125% isn’t yet getting the job done on curbing price pressures.

The chart above shows the Fed’s benchmark rate juxtaposed against a more generous application of the Taylor Rule and a less generous interpretation.

The more generous version is derived from using the Dallas Fed trimmed mean PCE and also assumes that the Fed’s real policy neutral rate is -50 basis points, which in the words of Fed St. Louis President James Bullard represents “an approximate pre-pandemic value” for the US economy. It also uses a phi value - which captures policymakers’ reaction to deviations of inflation from target - of 1.25.

The less generous version is bootstrapped from current inflation, a higher real neutral rate of +50 basis points that is more consistent with the macroeconomic momentum that we have seen in the aftermath of the pandemic, and a phi value of 1.5, which is closer to standard literature.

Core PCE inflation is now running at 4.7%, way above the Fed’s estimate that sees it crumbling to 3.6% this year before settling at 2% over the longer run.

Even though the Fed has raised rates by a phenomenal 500 basis points in the current cycle, core PCE has come off just 70 basis points from its peak of 5.4%.

While Chair Jerome Powell remarked recently that Fed’s “stance of policy is restrictive and we face uncertainty about the lagged effects of our tightening so far,” the stickiness of core inflation will force policymakers to raise rates further, though it doesn’t look likely that they will do so next week.

However, the findings of the analysis aren’t lost on the hawks of the Fed’s policy committee, who underscored in recent weeks that rates may have to climb higher to be restrictive. Back in March, when the economy was passing through the peak of the banking turmoil, seven of 18 members estimated that the Fed’s upper end of its funds rate needed to be at least 5.50% to be restrictive enough. With the stress in the banking sector now appearing to have settled, it is presumable that their numbers may grow, especially considering that core PCE is nowhere near the Fed’s comfort zone.

Interest-rate traders are yet to fully wake up to the possibility that the Fed will have to raise rates again. They are currently assigning only an 80% chance of one 25-basis point move in the cycle. As the analysis shows, the Fed may well have to hike by more than that.

Uncategorized

Walmart and Target make key self-checkout changes to fight theft

Both chains are making changes customers may not like, but self-checkout isn’t going anywhere, according to one industry expert.

In parts of the world, public bathrooms come with a charge, but people pay on the honor system. The money charged allows for better upkeep of the facilities and most people don't mind dropping a small bill or some coins into a lockbox and many of the people who don't are likely dealing with larger problems.

The honor system, however, requires honor. It's based on the idea that most people are trustworthy and that they will pay their fair share.

Related: Beloved mall retailer files Chapter 7 bankruptcy, will liquidate

In the case of a bathroom, people cheating the system are only stealing a low-value service. In the case of self-checkout, a variation on the honor system, people looking to steal by "forgetting" to scan an item can be a very expensive problem.

That has led retailers including Target, Walmart, and Dollar General to make changes. Target has limited the amount of items you can scan at self-checkout at some stores while Dollar General has literally eliminated it in some locations.

Walmart, like Target, has experimented with item limits and limiting the hours of operation for self-checkout. Now, in some stores, the chain has decided to designate some of its self-checkout stations for Walmart+ members and delivery drivers using the Spark app.

Advantage Solutions General Manager Andy Keenan answered some questions about Walmart, self-checkout, and theft from TheStreet via email.

Image source: John Smith/VIEWpress.

What Walmart's self-checkout changes mean

TheStreet: What are the benefits of reserving self-checkout registers for Spark drivers and Walmart+ customers?

Keenan: The benefits include exclusivity and perks of membership, speed, and convenience when shopping.

TheStreet: If this rolls out more broadly, what do you anticipate being the impact on non-Walmart+ customers?

Keenan: There is the potential for non-Walmart+ customers to become agitated, they are losing convenience because they are not enrolled. Customers who are looking for convenience will have fewer options for speed to check out.

TheStreet: Do lane restrictions like limiting lanes to 10 items or fewer help reduce time spent waiting in lines?

Keenan: Yes, but retailers must have a diverse amount of check lane options including 10 items or fewer to ensure that the speed of checkout actually transpires.

TheStreet: Do you believe self-checkout is leading to partial shrink? If so, do you think that this move to shut off self-checkout lanes will help prevent theft in the future?

Keenan: Yes, self-checkout is leading to partial shrink. We believe this tends to be more due to errors in scanning and intentional theft.

There are already front-end transformation tests going on in stores, reducing the number of self-checkouts and shifting back to cashier checkouts in order to measure the reduction in shrink. Early indicators show that a move back to cashier checkouts combined with other shrink initiatives will help prevent theft.

Self-checkout is not going away

While changes are ongoing, Keenan believes self-checkout is here to stay.

“Self-checkout is not, as one recent article called it, a failed experiment. It’s actually part of the next evolution of the retail customer experience, and evolutions take time,” Keenan said in a web post about the findings of the 2024 Advantage Shopper Outlook survey.

He makes it clear that rising labor costs and struggles to find workers make some for of self-checkout inevitable.

“Since the pandemic, there’s been a revolution on hourly labor,” Keenan said. “Labor in certain markets that would cost you $16 an hour now costs you $19 or $20 an hour, and it’s a gig economy. The people who once stood at a checkout stand in the front of a store are now driving for Instacart or DoorDash because the hours are more flexible. They want to make their own schedule, and it’s varied work. Today, most retailers can’t offer that.”

Basically, while there are kinks to work out, self-checkout simply makes sense for retailers.

“The notion that we’re going to pivot away from technology that helps offset labor needs and will ultimately continue to improve customer experience because of some challenges is far-fetched. We need to continue to embrace the technology and realize that it may always be imperfect, but it will always be evolving. The noise that, ‘Oh, self-checkout might not be working,’ that’s just a moment in time,” he added.

bankruptcy pandemicUncategorized

Hitting Home: Housing Affordability in the U.S.

The Issue:

Housing is becoming unaffordable to a widening swathe of the American population. This deteriorating affordability directly impacts American…

The Issue:

Housing is becoming unaffordable to a widening swathe of the American population. This deteriorating affordability directly impacts American lives, including where people choose to live and work. It has also been cited as a major contributor to key social problems like rising homelessness and worsening child wellbeing.

The Facts:

- Median house prices are now 6 times the median income, up from a range of between 4 and 5 two decades ago. In cities along the coasts, the numbers are higher, exceeding 10 in San Francisco.

- The ratio of median rents to median income has also crept from 25 percent to 30 percent in two decades.

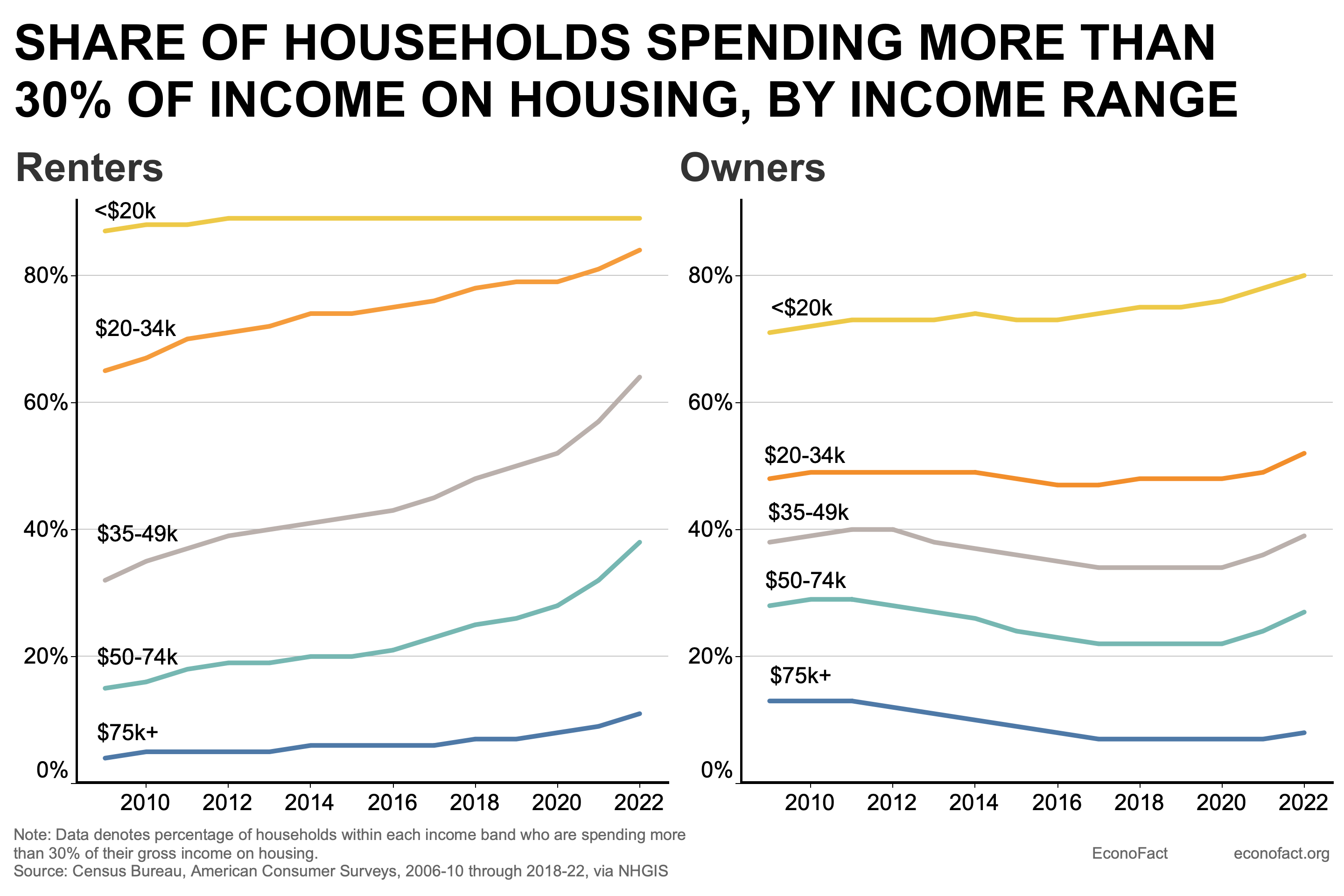

- Households — renters in particular — are increasingly cost-burdened, having to spend more than 30% of their income on rent, mortgage and other housing needs. Among homeowners, about 40 percent of those in the $35-49 income range are cost-burdened. The share of cost-burdened renters in that income range has risen sharply from under 40 percent of households in 2010 to over 60 percent today (see chart).

- Historically, rural and interior areas of the country have been more affordable. But, even prior to the pandemic, migration toward these locations has helped drive faster house price appreciation than in more expensive regions.

- Demographic developments have contributed to the demand-supply imbalance. Supply is crimped by more older Americans opting to age in place. On the demand side, the biggest driver is new household formation. Americans formed about a million new households a year between 2015-2017, but the pace has almost doubled according to the most recent data, largely reflecting a pickup in household formation rates among millennials.

- A long-standing lack of homebuilding, which partly reflects tight regulatory restrictions in many parts of the country, has also contributed to rising home prices.

- More recently, higher interest rates since 2022 have exacerbated these secular trends to make housing even more unaffordable. The mortgage rate on a 30-year home loan soared from 3 ½ percent in early 2022 to nearly 8% in October 2023 as the Fed raised policy interest rates; the mortgage rate had only eased to about 7% in March 2024 as the tightening cycle had peaked. The problem is compounded by mortgage lock-in: higher interest rates have left many homeowners — many of whom bought homes or refinanced at the lows of 2020-21 — with cheaper-than-market mortgages, reluctant to sell their house and reset their mortgage at current, higher rates.

Uncategorized

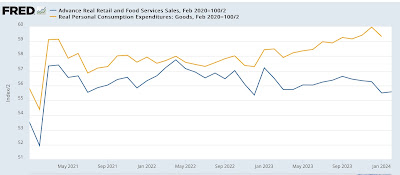

Good news and bad news Thursday: the bad news is real retail sales

– by New Deal democratThe bad economic news this morning was that after taking into account inflation, retail sales, which rose 0.6% nominally, were…

- by New Deal democrat

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges