Stocks Vs. Bonds – What Could Go Wrong?

Stocks Vs. Bonds – What Could Go Wrong?

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Stocks are priced for perfection. Bonds trade at historically low yields despite 7% inflation. What could go wrong?

As fiscal and monetary…

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Stocks are priced for perfection. Bonds trade at historically low yields despite 7% inflation. What could go wrong?

As fiscal and monetary support for the economy and markets wane, valuation extremes are in the crosshairs. While the setup for 2022 is not looking as friendly as 2021, we must realize the environment can change quickly.

For more on the macroeconomic drivers supporting this forecast, please read Part 1 of our 2022 Investment Outlook – Tailwinds Shift To Headwinds.

2022 Investment Outlook for Stocks

Valuations

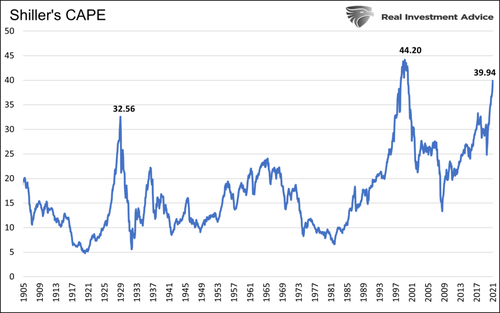

As shown below, as we have highlighted in many articles, valuations are at or near record levels. While nothing limits valuations from rising further, we must consider a reversion to the mean in many cases can result in losses of greater than 40%.

Complicating the valuation story is inflation. The graph below shows that historically periods of low inflation or deflation or inflation running greater than 5% are accompanied by CAPE readings of 25 or less. The current reading is 40.

The graph below uses three popular valuation techniques to quantify longer-term future returns. Based on the data, the ten-year outlook is for low single-digit returns at best. The second graph uses CAPE in a similar fashion to show the 20-year outlook is not much better. While our analysis may seem bearish, we reiterate that nothing says valuations cannot continue to stretch further.

Profit Margins

Corporate profit margins rose to record levels in 2021. Many companies were able to push higher costs onto consumers. At the same time, they were the ultimate beneficiaries of excessive government spending.

As we show below, corporate profits as a percentage of GDP are at the peak of the last decade and well above the 60-year trend leading to the financial crisis. A reversion back to the trend line would result in a 3% decline in profit margins. It is worth considering profit margins tend to revert to and through the trend line. A reversion back to the lows of 2009 and 2002 portends a 50% cut into profit margins. With valuations already at extremes, profit weakness would not support lofty expectations.

The Tail Wagging The Dog- Stock Options

This is where the analysis gets tricky. The graph below from Goldman Sachs shows more volume trading in stock options than the underlying stocks. Options are inherently highly leveraged and volatile. As the amount of options grows versus the shares outstanding, options become the tail wagging the dog.

As we learned over the last two years, dealer hedging of options positions can result in great rallies. Conversely, as we watched in the second half of 2021, the options expiration period was not an investor’s best friend.

Forecasting how options trading might affect stock prices is nearly impossible for a 2022 investment outlook. That said, options have and will continue to influence the market significantly.

One way to track potential volatility is with Gamma flip levels. Gamma helps us understand how dealers hedge options and react by buying or selling the underlying stocks to maintain hedges. SimpleVisor subscribers receive Viking Analytics weekly Gamma Band Update to help them with this task. The graph below from a recent edition shows recommended allocations based on the Gamma of S&P 500 options.

2022 Investment Outlook for Bonds

The outlook for bonds is equally tricky. If you had asked most bond traders a year ago where they thought bond yields would be if inflation approached 7%, most would have said much higher than current levels.

Inflation and Growth Drive Bond Yields

The graph below from Longview Economics show bond yields are abnormally low given the level of inflation. Per the historical relationship between 10-year UST yields and inflation, the 10-year yield should be 4-7%.

To help explain this anomaly, we must consider that bond traders tend to look at inflation beyond a year or two when determining value. Low expected inflation or deflation helps justify negative real yields today. Currently, TIPs markets imply 2.48% inflation for the next ten years. Bond traders must be confident inflation is transitory. If persistently high inflation becomes more likely, bond yields could rise quickly.

Economic growth over the next ten years is likely to be 2% or lower based on productivity and demographic trends. The Fed’s long-range forecast is 1.6-2.2%. The graph below shows the trends for GDP, and yields have been lower for the last 40 years. Note the declining yield trend is steeper than GDP. Some of this is due to the Fed’s influence on rates.

The Fed

As noted in Part 1 of the 2022 Investment outlook, the Fed has been buying nearly 100% of what the Treasury is issuing. To wit- “the Fed has bought nearly $5 trillion of bonds since the pandemic began. In doing so, it came close to absorbing 100% of the net new debt issuance from the government.”

Banks Are Flush With Cash

The graphs below help explain a third important factor keeping yields low. The bottom chart shows deposits at commercial banks are growing much faster than banks are lending money. The banks need to invest deposits, and since they are not lending them out, they frequently invest in U.S. Treasury securities. The upper graph shows the statistically strong correlation (R-squared .76) between the ratio of loans and leases to deposits versus ten-year Treasury yields. Unless the banks are going to start significantly ramping up lending, which we doubt, expect current trends to continue, thus supporting low yields.

Lower Yields

We think inflation is in the process of peaking. Shortages and supply line problems are slowly diminishing. At the same time, demand is normalizing, and there is little fiscal stimulus on the horizon to boost demand further. We offer a big disclaimer. The current environment is anything but typical. While we think inflation will ease, we are mindful that factors, such as rising wages may keep it elevated.

Yields have trended lower for the past 30 years, following economic growth. We think those trends continue in the year ahead.

Some will counter that if the Fed is not buying bonds who will? We do not know, but as we conclude in Taper is Coming: Got Bonds?: “Currently, yields are close to their cycle highs. If we believe the Fed is nearing tapering, yields could be peaking. Based on prior QE taper experiences, a yield decline of 1% or even more may be in store for the next six months to a year if the Fed is, in fact, on the doorsteps of tapering.”

The graph below from the article shows yields tend to fall after periods of QE and when they are reducing their balance sheet (QT) as circled. QT is currently being discussed by Fed members per the two headlines below.

-

BOSTIC SAYS FED COULD EASILY PULL $1.5 TRILLION OF “EXCESS LIQUIDITY” FROM FINANCIAL SYSTEM, THEN WATCH MARKET REACTION FOR FURTHER BALANCE SHEET REDUCTIONS

-

MESTER: ABLE TO LET BAL SHEET TO RUN DOWN FASTER THAN LAST TIME

An ISM Reading That May Make You Rethink Your Stock/Bond Allocations

In a recent daily Commentary we wrote the following. This quick note provides another reason yields may fall in the coming months.

The ISM Manufacturing Index was below expectations at 58.7, an 11-month low. Notably, the prices paid index fell sharply from 82.4 to 68.2, and supplier delivery times fell to a four-month low. The data provide signals that inflationary pressures are fading, at least for the time being.

The first graph below, from Stouff Capital, shows the strong correlation between the difference of new orders and inventories compared to the ISM Index. The differential leads the ISM index by three months. If the correlation holds up, we should see a steep decline in ISM in the coming three months.

The following two graphs show how ISM’s decline may affect bond yields. The first graph below, courtesy of Brett Freeze, shows a statistically strong correlation between nominal ISM (inflation-adjusted) and ten-year UST yields. If the nominal ISM is reversing as it appears, we should expect lower yields. The second graph, courtesy of Mott Capital, charts the correlation of the ISM Prices paid index and inflation expectations. Assuming manufacturing inflation is finally cooling off, inflation expectations should follow. Lower inflation expectations will help reduce bond yields.

Rotations Matter

In 2021, the key to success was understanding when inflationary narratives would dictate market conditions and when deflation narratives drove investors. We do not think 2022 will be as simple.

It is quite possible that value versus growth and low beta versus high beta may be the rotations to key on. As we wrote in An Investment Playbook for Thriving During the Next Market Crash:

“We think it’s likely that value stocks will significantly outperform growth stocks in the event of a sizeable drawdown. Timing the transition from growth to value will be difficult, but such a rotation will likely prove invaluable. You may want to keep the 2000 investment playbook handy.”

Summary

If we learned anything from 2020, the future is far from certain. Not only should we expect the unexpected, but the market reactions to the unexpected may be vastly different than what many assume.

What we discuss above is our best guess as of today. We may be right in some areas and wrong in others. More importantly, we must adjust our expectations as political, economic, and monetary conditions and investor sentiment change.

Navigating 2021 in hindsight was easy. However, a year ago, the outlook was daunting. No doubt 2022 will offer us both risk and rewards. Limiting risks and reaping the rewards will help traverse what offers to be another tricky year.

Maybe, more importantly, relying on trusted economic and market models and not letting psychological biases hinder investment decisions may prove to be the best advice we can offer.

Spread & Containment

You can now enter this country without a passport

Singapore has been on a larger push to speed up the flow of tourists with digital immigration clearance.

In the fall of 2023, the city-state of Singapore announced that it was working on end-to-end biometrics that would allow travelers passing through its Changi Airport to check into flights, drop off bags and even leave and exit the country without a passport.

The latter is the most technologically advanced step of them all because not all countries issue passports with the same biometrics while immigration laws leave fewer room for mistakes about who enters the country.

Related: A country just went visa-free for visitors with any passport

That said, Singapore is one step closer to instituting passport-free travel by testing it at its land border with Malaysia. The two countries have two border checkpoints, Woodlands and Tuas, and as of March 20 those entering in Singapore by car are able to show a QR code that they generate through the government’s MyICA app instead of the passport.

Here is who is now able to enter Singapore passport-free

The latter will be available to citizens of Singapore, permanent residents and tourists who have already entered the country once with their current passport. The government app pulls data from one's passport and shows the border officer the conditions of one's entry clearance already recorded in the system.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

While not truly passport-free since tourists still need to link a valid passport to an online system, the move is the first step in Singapore's larger push to get rid of physical passports.

"The QR code initiative allows travellers to enjoy a faster and more convenient experience, with estimated time savings of around 20 seconds for cars with four travellers, to approximately one minute for cars with 10 travellers," Singapore's Immigration and Checkpoints Authority wrote in a press release announcing the new feature. "Overall waiting time can be reduced by more than 30% if most car travellers use QR code for clearance."

More countries are looking at passport-free travel but it will take years to implement

The land crossings between Singapore and Malaysia can get very busy — government numbers show that a new post-pandemic record of 495,000 people crossed Woodlands and Tuas on the weekend of March 8 (the day before Singapore's holiday weekend.)

Even once Singapore implements fully digital clearance at all of its crossings, the change will in no way affect immigration rules since it's only a way of transferring the status afforded by one's nationality into a digital system (those who need a visa to enter Singapore will still need to apply for one at a consulate before the trip.) More countries are in the process of moving toward similar systems but due to the varying availability of necessary technology and the types of passports issued by different countries, the prospect of agent-free crossings is still many years away.

In the U.S., Chicago's O'Hare International Airport was chosen to take part in a pilot program in which low-risk travelers with TSA PreCheck can check into their flight and pass security on domestic flights without showing ID. The UK has also been testing similar digital crossings for British and EU citizens but no similar push for international travelers is currently being planned in the U.S.

stocks pandemic link testing singapore uk euSpread & Containment

The Virality Project’s Censorship Agenda

The Virality Project’s Censorship Agenda

Authored by Andrew Lowenthal via the Brownstone Institute,

In November 2023 Alex Gutentag and…

Authored by Andrew Lowenthal via the Brownstone Institute,

In November 2023 Alex Gutentag and I reported on the Virality Project’s internal content-flagging system, as released by the US House Committee on the Weaponization of the Federal Government.

Initiated by the Department of Homeland Security (DHS) and the Cybersecurity and Infrastructure Security Agency (CISA) and led by the Stanford Internet Observatory (SIO), the Virality Project sought to censor those who questioned government Covid-19 policies. The Virality Project primarily focused on so-called “anti-vaccine” “misinformation;” however, my Twitter Files investigations with Matt Taibbi revealed this included “true stories of vaccine side effects.”

A further review of the content flagged by the Virality Project demonstrates how they pushed social media platforms to censor such “true stories.” This was often done incompetently and without even a cursory investigation of the original sources. In one instance, the Virality Project reporters told platforms that reports of a child injured in a vaccine trial were “false” due to the timing; citing the dates of a Moderna trial when in fact the child had been in a Pfizer trial.

Trigger-happy researchers-turned-activists at the Virality Project went further, alerting their Big Tech partners (including Facebook, Twitter, Instagram, and TikTok) of protests, jokes, and general dissent.

Led by former CIA fellow Renee DiResta, the Virality Project functioned as an intermediary for government censorship. Ties between the US government and the academic research center were extremely close. DHS had “fellows” embedded at the Stanford Internet Observatory, while SIO had interns embedded at CISA, and former DHS staff contributed to the Virality Project’s final report.

The Virality Project also had contact with the White House and the Office of the Surgeon General, described the CDC as a “partner” in its design documents, and the California Department of Public Health had a login to access the Jira content flagging system, as did CISA personnel.

Kris Krebs and Alex Stamos – former directors of CISA and SIO, respectively – became business partners soon after leaving their positions.

Norwood v. Harrison established that the government “may not induce, encourage or promote private persons to accomplish what it is constitutionally forbidden to accomplish.” Stamos knew this too and put it simply; the government “lacked the legal authorisation” and so they built a consortium to “fill the gap of the things the government could not do themselves.”

Judicial precedents regarding “joint participation” and “pervasive entwinement” between public and private entities make clear that the government cannot outsource to third parties like the Virality Project actions that would be illegal for the government itself to do.

The Virality Project had several unnamed partners that appear in the content-flagging system, including billion-dollar military contractor MITRE and a communications consultancy linked to the Democratic Party, Hattaway. Founder Doug Hattaway was an “advisor and spokesperson for Secretary of State Hillary Clinton, Vice President Al Gore, and Senate Majority Leader Tom Daschle, and provided strategic counsel to the Obama White House and the Democratic leadership of the US House and Senate.” Like the Virality Project, Hattaway worked with the Rockefeller Foundation during the pandemic on issues of disinformation.

The Virality Project does not declare any relationship with MITRE or Hattaway despite providing them access to their Jira system.

The Virality Project was partly funded by the Omidyar Network, which provided $400,000 to VP partner and Pentagon consultant Graphika. Much of the Virality Project’s funding however is unknown and is also not declared on their website.

This and much more have led five plaintiffs, including Harvard and Stanford professors, to accuse the US government of violations of the First Amendment with the Virality Project as one of the key proxies. On March 18, their case will be heard by the US Supreme Court.

The Virality Project and Murthy v. Missouri

The Murthy vs Missouri plaintiffs allege that, “CISA launched a colossal mass surveillance and mass-censorship project calling itself the “Election Integrity Partnership” (and later, the “Virality Project”). The Election Integrity Project (EIP) “monitored 859 million posts on Twitter alone.”

The Virality Project used the same Jira system as EIP for flagging content and included the same core public partners: SIO, the University of Washington Center for an Informed Public, the Atlantic Council’s Digital Forensic Research Lab, and Graphika, with the addition of NYU and the congressionally chartered National Conference on Citizenship.

The Virality Project had extensive contact not only with CISA but also with the White House and the Surgeon General. White House representatives sent direct censorship requests to Twitter including, “Hey folks – Wanted to flag the below tweet and am wondering if we can get moving on the process for having it removed ASAP.” And the more threatening:

“Are you guys fucking serious? I want an answer on what happened here and I want it today.”

Flaherty also conveyed that his communications came with the backing of the very top echelons of the administration: “This is a concern that is shared at the highest (and I mean highest) levels of the WH.”

The Virality Project hosted a launch with the US Surgeon General Vivek Murthy as part of the Surgeon General’s campaign against “misinformation.” In the presentation, Renee DiResta also introduced Matt Masterson, former senior adviser at DHS, and now a “non-resident policy fellow” at SIO.

Murthy ends the presentation by telling Renee, “I just want to say thank you to you, for everything you have done, for being such a great partner.”

At that same time the White House, OSG, and others were on the warpath, claiming social media platforms were “killing people” for allowing so-called “misinformation” to circulate.

With access to the White House, the Surgeon General, CDC, DHS, and CISA, along with top-level relationships with almost every major Western social media platform, the Virality Project was a key, if not the key, coordinating node for Covid-related censorship on the Internet.

The Content-Flagging System

When the Virality Project said it considered, “true stories of vaccine side effects” to be “misinformation,” it wasn’t joking, and it flagged content to its Big Tech partners accordingly.

Perhaps the most egregious was that of Maddie de Garay. Maddie and her siblings were enrolled in the Pfizer vaccine trial at the Cincinnati Children’s Hospital. She was later unblinded and confirmed as being in the vaccine and not the placebo group.

Within 24 hours of her second shot in January 2021, Maddie developed a host of symptoms, including “severe abdominal pain, painful electric shocks on her spine and neck, swollen extremities, ice cold hands, and feet, chest pain, tachycardia, pins and needles in her feet that eventually led to the loss of feeling from her waist down.” To this day Maddie continues to suffer from a lack of feeling in her lower legs, difficulty eating, poor eyesight, and fatigue among other persisting symptoms.

Virality Project staff logged a Jira ticket titled “Maddie’s Story: False claim that 12-year-old was hospitalized due to vaccine trial” and provided extensive documentation of offending “engagement” on social media, including the micro-policing of content citing Maddie’s story with just two likes and two shares.

Much doubt has been cast on the veracity of Maddie’s injuries. Maddie’s mother, Stephanie de Garay, provided me with several doctor’s letters that confirm the link, including that of the emergency room doctor who discharged her on her initial visit. Their diagnosis was “Adverse effect of the vaccine.” Stephanie de Garay also testified under oath in front of the US Congress in November of 2023 regarding her daughter’s experience.

Most egregiously, the idea that the story was “false”rested on the claim that Maddie was in a Moderna trial. But she was in a Pfizer trial, as stated in the posts the Virality Project collected and linked to in the very same ticket.

“Dear Platform Partners,” the reporter writes as they bring the posts to the attention of Google, Facebook, Twitter, TikTok, Medium, Pinterest, and the aforementioned Hattaway Communications:

…very likely false due to issues in timing. The Moderna trial in children [began on March 16], when the participants received their first doses. However, the video claims that Maddie has an MRI scheduled for 03/16, and that these symptoms have been occurring for 1.5 months. Thus, Maddie would have had to have received the second dose of the vaccine during/before February, which is at least a month before the Moderna trials began.

“Ack – thanks for raising!” replies a platform representative.

Not only are our self-appointed censorship overlords micro-managers, they are often incompetent.

The posts were flagged “General: Anti-Vaccination” despite the de Garays volunteering their three children for the vaccine trial.

Some content flagged in the report remained up, and others were taken down. A video of Stephanie de Garay’s testimony was removed from Twitter. Whether or not this was specifically taken down due to the Virality Project report cannot be ascertained, but their intent was clear.

In another instance, the Virality Project wanted people circulating a mainstream media report censored:

“Platforms, this unconfirmed story of a healthy youth athlete who was hospitalized after being vaccinated continues to be used by anti-vaccine activists to spread misinformation about vaccines.”

“ack, thanks” responded a platform representative.

Even a report by an ABC news affiliate, one of the biggest media conglomerates in the United States, fell into the category of “General: anti-vaccination” and “Misleading Headline.”

The main link provided, to a YouTube video, was removed.

The Jira system was set up to track the actions the Big Tech partners took, as illustrated below:

The content was flagged to get platforms to take action.

“Hello Google team – sending this over as our analysts noticed that a google ad on a politico article this morning was peddling the antivax claims from the medical racism video you were monitoring. Is this against your policies?”

“Thanks for flagging – ack and sending for review.”

“Thanks for the heads up – we’re on it”

“Thanks for sharing! Our team is now tracking this.”

And follow-ups from the Virality Project team:

“Were the ads supposed to have been taken down? Just flagging for you, I just checked now and I’m still seeing another medical racism ad.”

Platforms were apologetic when they didn’t get to Virality Project’s flags quickly enough:

“With apologies for the delayed response (was in meetings) – we took action earlier in the afternoon, thanks again for the flags.”

This of course built on the Election Integrity Partnership’s more flagrant “recommendations,” which included:

“We recommend that you all flag as false, or remove the posts below.”

“Hi Facebook, Reddit, and Twitter…we recommend it be removed from your platforms.”

And many more.

The Virality Project was a strategic intermediary between the US government and major social media platforms. As Murthy v. Missouri shows, in many cases the government dispensed even with their chosen intermediary and directly demanded censorship.

With their vast resources, why did Google, Facebook, and Twitter even need an external consortium to flag “misinformation?” The answer of course is they didn’t, the government did. Much like SIO Director Alex Stamos so helpfully reminded us, First Amendment jurisprudence states that the government “may not induce, encourage or promote private persons to accomplish what it is constitutionally forbidden to accomplish.”

The First Amendment protects false speech. There is a cost to false claims, but the cost of censoring true claims is much higher. The alternative is a society where the truth is suppressed and powerful actors become even more unaccountable. The government cannot be made an arbiter of what is true.

In this inverted world, the role of academia and civil society isn’t to harness the internet to better pick up safety signals related to corporate products, it is to shield corporations from public scrutiny. In times gone by such ethical violations would see institutions shut down, but the Stanford Internet Observatory and their consortium partners continue with hardly a dent.

Dr. Aaron Kheriaty is a Murthy v. Missouri plaintiff and was the Director of the Medical Ethics Program at the University of California Irvine before he was fired for challenging the university’s vaccine mandate. Asked for his reaction to this censorship he responded:

While causation in medicine is sometimes difficult to establish, and different evaluating physicians may reach divergent conclusions about a particular case, the Virality Project’s censors (who lacked even basic medical expertise) arrogated to themselves the authority to make veracity judgments about particular medical cases–even overriding the judgments of evaluating physicians. Such censorship is completely antithetical to medical and scientific progress, which relies upon free inquiry and open, public debate.

Much of what the Virality Project flagged was plausible; however, their internet hall monitors, who likely lacked even first aid certificates, deemed themselves arbiters of the truth, and coupled their arrogance with a complimentary laziness and incompetence.

The veracity of the content was of course always irrelevant to the Virality Project, given they considered “true stories” to be “misinformation.”

All told the DHS, CISA, the White House, the Surgeon General, a DNC-aligned communications agency, military contractors, academics, NGOs, and more combined to suppress the stories of real people, including children, who were plausibly injured by the vaccine. They sought to hide it not because it might be false, but precisely because it might be true.

Republished from the author’s Substack

Andrew Lowenthal is a Brownstone Institute fellow and co-founder and former executive director of EngageMedia, an Asia-Pacific digital rights, open and secure technology, and documentary non-profit, and a former fellow of Harvard’s Berkman Klein Center for Internet and Society and MIT’s Open Documentary Lab.

International

This country became first in the world to let in tourists passport-free

Singapore has been on a larger push to speed up the flow of tourists with digital immigration clearance.

In the fall of 2023, the city-state of Singapore announced that it was working on end-to-end biometrics that would allow travelers passing through its Changi Airport to check into flights, drop off bags and even leave and exit the country without a passport.

The latter is the most technologically advanced step of them all because not all countries issue passports with the same biometrics while immigration laws leave fewer room for mistakes about who enters the country.

Related: A country just went visa-free for visitors with any passport

That said, Singapore is one step closer to instituting passport-free travel by testing it at its land border with Malaysia. The two countries have two border checkpoints, Woodlands and Tuas, and as of March 20 those entering in Singapore by car are able to show a QR code that they generate through the government’s MyICA app instead of the passport.

Here is who is now able to enter Singapore passport-free

The latter will be available to citizens of Singapore, permanent residents and tourists who have already entered the country once with their current passport. The government app pulls data from one's passport and shows the border officer the conditions of one's entry clearance already recorded in the system.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

While not truly passport-free since tourists still need to link a valid passport to an online system, the move is the first step in Singapore's larger push to get rid of physical passports.

"The QR code initiative allows travellers to enjoy a faster and more convenient experience, with estimated time savings of around 20 seconds for cars with four travellers, to approximately one minute for cars with 10 travellers," Singapore's Immigration and Checkpoints Authority wrote in a press release announcing the new feature. "Overall waiting time can be reduced by more than 30% if most car travellers use QR code for clearance."

More countries are looking at passport-free travel but it will take years to implement

The land crossings between Singapore and Malaysia can get very busy — government numbers show that a new post-pandemic record of 495,000 people crossed Woodlands and Tuas on the weekend of March 8 (the day before Singapore's holiday weekend.)

Even once Singapore implements fully digital clearance at all of its crossings, the change will in no way affect immigration rules since it's only a way of transferring the status afforded by one's nationality into a digital system (those who need a visa to enter Singapore will still need to apply for one at a consulate before the trip.) More countries are in the process of moving toward similar systems but due to the varying availability of necessary technology and the types of passports issued by different countries, the prospect of agent-free crossings is still many years away.

In the U.S., Chicago's O'Hare International Airport was chosen to take part in a pilot program in which low-risk travelers with TSA PreCheck can check into their flight and pass security on domestic flights without showing ID. The UK has also been testing similar digital crossings for British and EU citizens but no similar push for international travelers is currently being planned in the U.S.

stocks pandemic link testing singapore uk eu-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges