Spread & Containment

Stocks Surge As Earnings Roll-In, But Is Risk Gone?

In this 10-22-21 issue of "Stocks Surge As Earnings Roll-In, But Is Risk Gone?"

Market Surges Toward Previous Highs

It’s Been A Very Long-Time WIthout A Deeper Correction

A Sea Of Liquidity

Portfolio Positioning

Sector & Market Analysis

401k Plan…

In this 10-22-21 issue of “Stocks Surge As Earnings Roll-In, But Is Risk Gone?”

- Market Surges Toward Previous Highs

- It’s Been A Very Long-Time WIthout A Deeper Correction

- A Sea Of Liquidity

- Portfolio Positioning

- Sector & Market Analysis

- 401k Plan Manager

Follow Us On: Twitter, Facebook, Linked-In, Sound Cloud, Seeking Alpha

Is It Time To Get Help With Your Investing Strategy?

Whether it is complete financial, insurance, and estate planning, to a risk-managed portfolio management strategy to grow and protect your savings, whatever your needs are, we are here to help.

Schedule your “FREE” portfolio review today.

Market Surges Toward Previous Highs

Last week, we discussed the “correction being over” for the time being.

“While the market started the week a bit sloppily, the bulls charged back on Thursday as earnings season officially got underway. With the market crossing above significant resistance at the 50-dma and turning both seasonal “buy signals” confirmed, it appears a push for previous highs is possible.

Two factors are driving the rebound. Earnings, so far, are coming in above estimates. Such isn’t surprising as analysts suppressed estimates going into reporting season. Secondly, bond yields declined.“

Chart updated through Friday.

However, to expand on a point from last week, breadth remains dismal, with only 60% of stocks above their respective 50-dma even though the index is at all-time highs.

Moreover, our “money flow buy signal” has reversed to previous highs, but volume has dissipated sharply during the advance.

Our concern is that while the expected rally from support occurred, there has been very little “conviction” to that advance. Therefore, we tend to agree with David Tepper of Appaloosa Management when he stated:

“Sometimes there are times to make money…sometimes there are times not to lose money.“

While the market is within the seasonally strong year, the risk of a correction remains. Such is particularly the case as we head into 2022.

Its Been A Very Long Time Without A Deeper Correction

While investors are quickly returning to a more “bullish” excitement about the market, it is worth remembering the recent 5% correction did little to resolve the longer-term overbought conditions and valuations.

In mid-August, we discussed the market’s 6-straight months of positive returns, a historical rarity. To wit:

“There are several important takeaways from the chart above.”

- All periods of consecutive performance eventually end. (While such seems obvious, it is something investors tend to forget about during long bullish stretches.)

- Given the extremely long-period of market history, such long-stretches of bullish performance are somewhat rare.

- Such periods of performance often, but not always, precede fairly decent market corrections or bear markets.

Unfortunately, as we now know, that streak ended in September with a 5% correction that sent investors scurrying for cover.

There is another streak that is also just as problematic. Currently, the S&P 500 index has gone 344-days without violating the 200-dma. Such is the sixth-longest streak going back to 1960.

While investors are currently starting to believe that a test of the 200-dma won’t happen, there are several points to be mindful of.

- Corrections to the 200-dma, or more, happen on a regular basis.

- Long-stretches above the 200-dma are not uncommon, but all eventually resolve in a mean-reversion.

- Extremely long periods above the 200-dma have often preceded larger drawdowns.

The most crucial point to note is that in ALL CASES, the market eventually tested or violated the 200-dma. Such is just a function of math. For an “average” to exist, the market must trade both above and below that “average price” at some point.

However, a “correction” requires a “catalyst” that changes the investor psychology from “bullish” to “bearish.”

Extremely Depressed Volatility

At the moment, there are plenty of concerns, but investor psychology remains extremely bullish. Most concerns are well known, and, as such, the market discounts them concerning forward expectations, valuations, and earnings projections. However, what causes a sudden “mean reverting event” is an exogenous, unexpected event that surprises investors. In 2020, that was the pandemic-related “shutdown” of the economy.

However, as with an empty “gas can,” a catalyst is ineffective if there is no “fuel” to ignite. Currently, that “fuel” is found in the high levels of market complacency, as shown by the collapse in the volatility index over the last couple of weeks.

“The Volatility Index (VIX) closed at a new 18-month low as the S&P 500 closed at a new multi-year high on Thursday, 10/21/21. If you were wondering, the 18-month low in the VIX Index represents the first occurrence since November 2017.” – Sentiment Trader

It is worth remembering the market had three 10-20% corrections in 2018 as low volatility begets high volatility.

Another measure is the P/E to VIX ratio which recently also peaked at 2.0. Previous peaks have been coincident with short-term corrections and bear markets.

While anything is possible in the near term, complacency has returned to the market very quickly. As noted, while investors are very bullish, there are numerous reasons to remain mindful of the risks.

- Earnings and profit growth estimates are too high

- Stagflation is becoming more prevalent

- Inflation indexes are continuing to rise

- Economic data is surprising to the downside

- Supply chain issues are more presistent than originally believed.

- Inventory problems continue unabated

- Valuations are high by all measures

- Interest rates are rising

You get the idea.

But a more significant problem will set in next year – a contraction of liquidity.

In Case You Missed It

A Sea Of Liquidity

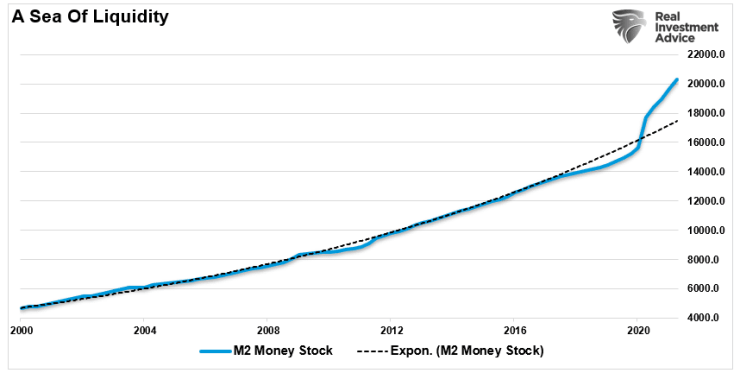

As noted, the unexpected “pandemic-driven economic shutdown” sent the Federal Reserve and Government into fiscal and monetary policy overdrive. Such led to an unimaginable influx of $5 trillion into the economy, sending the “money supply” surging well above the long-term exponential growth trend.

The importance of that “sea of liquidity” is both positive and negative. In the short term, that liquidity supports economic growth, the surge in retail sales into this year, and the explosive recovery in corporate earnings. That liquidity is also flowing into record corporate stock buybacks, retail investing, and a surge in private equity. With all that liquidity sloshing around, it is of no surprise we have seen a near-record surge in the annualized rate of change of the S&P 500 index.

However, as stated, there is a dark side to that liquidity. With the Democrats struggling to pass an infrastructure bill, a looming debt ceiling, and the Fed beginning to “taper” their bond purchases, that liquidity will start to reverse later this year. As shown below, if we look at the annual rate of change in the S&P 500 compared to our “measure of liquidity” (which is M2 less GDP), it suggests stocks could be in trouble heading into next year.

While not a perfect correlation, it is high enough to pay attention to at least. With global central banks cutting back on liquidity, the Government providing less, and inflationary pressures taking care of the rest, it is worth considering increasing risk-management practices.

You can see a complete list of our portfolio management guidelines here.

Portfolio Update

As noted last week, we increased our exposure to technology stocks heading into earnings season. Over the last half of September, the recent additions have paid off well, with the current run back to all-time highs. In our bond holdings, we remain nearly fully exposed to equities, slightly overweight cash, and a tad underweight target duration.

As noted last week:

“While our positioning is bullish, we remain very concerned about the market over the next several months. Historically, stagflationary environments do not mix well with financial markets. Such is because the combination of inflationary pressures and weaker economic growth erodes profit margins and earnings.

Furthermore, expectations heading into 2022 remain exceptionally optimistic, which leaves much room for disappointment. With liquidity getting drained, the Fed reducing monetary accommodation, and two rate hikes scheduled next year, the risk to investors remains elevated.”

A Note On Bond Positioning

I got asked last week to discuss our bond positioning. So we posted the following to RIAPRO subscribers on Friday morning.

“5-year implied inflation expectations are up over 40 basis points (bps) since October 1st. They now stand at a 15+ year high of 2.94%. While inflation expectations rise, the yield curve is flattening. In this case, short maturity bonds are rising in yield much more than longer maturity bonds. The graphs below show what has happened to bond yields since the inflation expectations last peaked on May 18th. As we show the 30-year bond is 26 bps lower since then, while the 2-year note is 26 bps higher. As a result, the 2/30 yield curve has flattened 52 bps over the period.

Our portfolios are set up for the yield curve flattening. The portfolio’s largest bond holding is TLT with a duration of 20 years. The benchmark, AGG, has a duration of 8 years. The models are also not fully vested in the fixed income sleeves to further protect against higher yields.’ – Michael Lebowitz

Conclusion

As noted throughout this week’s message, there are many reasons to suspect the recent rally will fail as the impact of weaker economic growth begins to temper expectations. However, that is not the case today, and the current momentum can undoubtedly carry the markets higher next week.

We will continue to maintain our more bullish stance from that position until the market begins to falter. After that, numerous support levels and warning triggers will tell us it is time to become more “risk-averse” in our allocations.

While that time is not now, don’t become overly complacent, thinking this market can only go higher. Markets have a nasty habit of doing the unexpected just when you feel you have everything figured out.

Have a great weekend.

By Lance Roberts, CIO

Market & Sector Analysis

Analysis & Stock Screens Exclusively For RIAPro Members

S&P 500 Tear Sheet

Performance Analysis

Technical Composite

The technical overbought/sold gauge comprises several price indicators (RSI, Williams %R, etc.), measured using “weekly” closing price data. Readings above “80” are considered overbought, and below “20” are oversold. The current reading is 83.20 out of a possible 100.

Portfolio Positioning “Fear / Greed” Gauge

Our “Fear/Greed” gauge is how individual and professional investors are “positioning” themselves in the market based on their equity exposure. From a contrarian position, the higher the allocation to equities, to more likely the market is closer to a correction than not. The gauge uses weekly closing data.

NOTE: The Fear/Greed Index measures risk from 0-100. It is a rarity that it reaches levels above 90. The current reading is 88.34 out of a possible 100.

Sector Model Analysis & Risk Ranges

How To Read This Table

- The table compares each sector and market to the S&P 500 index on relative performance.

- “MA XVER” is determined by whether the short-term weekly moving average crosses positively or negatively with the long-term weekly moving average.

- The risk range is a function of the month-end closing price and the “beta” of the sector or market. (Ranges reset on the 1st of each month)

- Table shows the price deviation above and below the weekly moving averages.

Weekly Stock Screens

Currently, there are four different stock screens for you to review. The first is S&P 500 based companies with a “Growth” focus, the second is a “Value” screen on the entire universe of stocks, and the last are stocks that are “Technically” strong and breaking above their respective 50-dma.

We have provided the yield of each security and a Piotroski Score ranking to help you find fundamentally strong companies on each screen. (For more on the Piotroski Score – read this report.)

S&P 500 Growth Screen

Low P/B, High-Value Score, High Dividend Screen

Fundamental Growth Screen

Aggressive Growth Strategy

Portfolio / Client Update

The market continued its bullish advance this week after eclipsing the 50-dma last week. Such is good news, as our recent additions to portfolio allocations have performed well. Currently, our portfolios are outperforming our global benchmark by roughly 300 basis points with lower volatility than the S&P 500 index.

There was no need to make changes to our portfolio this week. However, we are watching interest rates closely as it looks like we may be approaching another “buy point” to increase our duration in our bond holdings further. As noted last week:

“We are watching our positions closely and have moved stops up to recent lows for all positions.

Furthermore, after increasing the duration of our bond portfolio, the recent uptick in rates provides another entry point to lengthen our duration once again. If there is a risk-off event in the market, yields will drop to 1% or less providing a nice bump in appreciation in our bond portfolio. In the meantime, we are collecting a bit of income while holding the hedge.“

While it may seem counter-intuitive at the moment, the current bout of inflation will turn into deflation next year as liquidity gets drained from the system. As such, we want to continue to buy bonds at a discounted price to benefit from deflationary pressures when they return.

As noted, while there seems to be minimal risk in the market, don’t be misled. There are numerous risks we are watching that could lead us to reverse course rapidly. Our job remains to protect your capital first and foremost, but we want to capture gains when we can.

Portfolio Changes

During the past week, we made only a single change to portfolios. In addition, we post all trades in real-time at RIAPRO.NET.

*** Trading Update – Equity and Sector Models ***

“This morning we sold 100% of SHY which is under pressure as the market gets more aggressive about pricing in future interest rate hikes. As shown, there is currently a 100% chance the Fed will hike rates twice in 2022, and a 70% chance of three rate hikes.” – 10/22/21

“When the Fed gets more aggressive about rate hikes, the long end of the curve will fall. Therefore, as the 10-year moves toward 1.8-2%, we will become more aggressive buyers of duration. For the meantime, we will leave the money in cash and over the next week or so decide how to deploy it within the fixed income sector.”

All Models:

- Sell 100% of SHY

As always, our short-term concern remains the protection of your portfolio. Accordingly, we remain focused on the differentials between underlying fundamentals and market over-valuations.

Lance Roberts, CIO

THE REAL 401k PLAN MANAGER

A Conservative Strategy For Long-Term Investors

Attention: The 401k plan manager will no longer appear in the newsletter in the next couple of weeks. However, the link to the website will remain for your convenience. Be sure to bookmark it in your browser.

Commentary

The market is now back to a highly overbought position after a sizable rally over the last 7-days. The triggering of the underlying MACD “buy signals” suggests we have entered into the seasonally strong period of the year, which supports keeping allocation long-biased.

However, this is probably a decent opportunity to rebalance holdings and reduce your risk heading into November. In the short term, we suggest maintaining exposures in plan portfolios but start putting new contributions back into cash or stable value holdings for now.

While we have not removed international, emerging, small and mid-cap funds from the allocation model, we suggest avoiding these areas for now and moving those allocations to domestic large-cap.

If you are close to retirement or are concerned about a pickup in volatility, there is nothing wrong with being underweight equities. However, there is likely not a lot of upside in markets heading into next year.

Model Descriptions

Choose The Model That FIts Your Goals

Model Allocations

If you need help after reading the alert, do not hesitate to contact me.

Or, let us manage it for you automatically.

401k Model Performance Analysis

Model performance is a two-asset model of stocks and bonds relative to the weighting changes made each week in the newsletter. Such is strictly for informational and educational purposes only, and one should not rely on it for any reason. Past performance is not a guarantee of future results. Use at your own risk and peril.

Have a great week!

The post Stocks Surge As Earnings Roll-In, But Is Risk Gone? appeared first on RIA.

economic growth pandemic bonds yield curve sp 500 equities stocks monetary policy fed federal reserve link curve flattening gdp recovery interest ratesSpread & Containment

The Coming Of The Police State In America

The Coming Of The Police State In America

Authored by Jeffrey Tucker via The Epoch Times,

The National Guard and the State Police are now…

Authored by Jeffrey Tucker via The Epoch Times,

The National Guard and the State Police are now patrolling the New York City subway system in an attempt to do something about the explosion of crime. As part of this, there are bag checks and new surveillance of all passengers. No legislation, no debate, just an edict from the mayor.

Many citizens who rely on this system for transportation might welcome this. It’s a city of strict gun control, and no one knows for sure if they have the right to defend themselves. Merchants have been harassed and even arrested for trying to stop looting and pillaging in their own shops.

The message has been sent: Only the police can do this job. Whether they do it or not is another matter.

Things on the subway system have gotten crazy. If you know it well, you can manage to travel safely, but visitors to the city who take the wrong train at the wrong time are taking grave risks.

In actual fact, it’s guaranteed that this will only end in confiscating knives and other things that people carry in order to protect themselves while leaving the actual criminals even more free to prey on citizens.

The law-abiding will suffer and the criminals will grow more numerous. It will not end well.

When you step back from the details, what we have is the dawning of a genuine police state in the United States. It only starts in New York City. Where is the Guard going to be deployed next? Anywhere is possible.

If the crime is bad enough, citizens will welcome it. It must have been this way in most times and places that when the police state arrives, the people cheer.

We will all have our own stories of how this came to be. Some might begin with the passage of the Patriot Act and the establishment of the Department of Homeland Security in 2001. Some will focus on gun control and the taking away of citizens’ rights to defend themselves.

My own version of events is closer in time. It began four years ago this month with lockdowns. That’s what shattered the capacity of civil society to function in the United States. Everything that has happened since follows like one domino tumbling after another.

It goes like this:

1) lockdown,

2) loss of moral compass and spreading of loneliness and nihilism,

3) rioting resulting from citizen frustration, 4) police absent because of ideological hectoring,

5) a rise in uncontrolled immigration/refugees,

6) an epidemic of ill health from substance abuse and otherwise,

7) businesses flee the city

8) cities fall into decay, and that results in

9) more surveillance and police state.

The 10th stage is the sacking of liberty and civilization itself.

It doesn’t fall out this way at every point in history, but this seems like a solid outline of what happened in this case. Four years is a very short period of time to see all of this unfold. But it is a fact that New York City was more-or-less civilized only four years ago. No one could have predicted that it would come to this so quickly.

But once the lockdowns happened, all bets were off. Here we had a policy that most directly trampled on all freedoms that we had taken for granted. Schools, businesses, and churches were slammed shut, with various levels of enforcement. The entire workforce was divided between essential and nonessential, and there was widespread confusion about who precisely was in charge of designating and enforcing this.

It felt like martial law at the time, as if all normal civilian law had been displaced by something else. That something had to do with public health, but there was clearly more going on, because suddenly our social media posts were censored and we were being asked to do things that made no sense, such as mask up for a virus that evaded mask protection and walk in only one direction in grocery aisles.

Vast amounts of the white-collar workforce stayed home—and their kids, too—until it became too much to bear. The city became a ghost town. Most U.S. cities were the same.

As the months of disaster rolled on, the captives were let out of their houses for the summer in order to protest racism but no other reason. As a way of excusing this, the same public health authorities said that racism was a virus as bad as COVID-19, so therefore it was permitted.

The protests had turned to riots in many cities, and the police were being defunded and discouraged to do anything about the problem. Citizens watched in horror as downtowns burned and drug-crazed freaks took over whole sections of cities. It was like every standard of decency had been zapped out of an entire swath of the population.

Meanwhile, large checks were arriving in people’s bank accounts, defying every normal economic expectation. How could people not be working and get their bank accounts more flush with cash than ever? There was a new law that didn’t even require that people pay rent. How weird was that? Even student loans didn’t need to be paid.

By the fall, recess from lockdown was over and everyone was told to go home again. But this time they had a job to do: They were supposed to vote. Not at the polling places, because going there would only spread germs, or so the media said. When the voting results finally came in, it was the absentee ballots that swung the election in favor of the opposition party that actually wanted more lockdowns and eventually pushed vaccine mandates on the whole population.

The new party in control took note of the large population movements out of cities and states that they controlled. This would have a large effect on voting patterns in the future. But they had a plan. They would open the borders to millions of people in the guise of caring for refugees. These new warm bodies would become voters in time and certainly count on the census when it came time to reapportion political power.

Meanwhile, the native population had begun to swim in ill health from substance abuse, widespread depression, and demoralization, plus vaccine injury. This increased dependency on the very institutions that had caused the problem in the first place: the medical/scientific establishment.

The rise of crime drove the small businesses out of the city. They had barely survived the lockdowns, but they certainly could not survive the crime epidemic. This undermined the tax base of the city and allowed the criminals to take further control.

The same cities became sanctuaries for the waves of migrants sacking the country, and partisan mayors actually used tax dollars to house these invaders in high-end hotels in the name of having compassion for the stranger. Citizens were pushed out to make way for rampaging migrant hordes, as incredible as this seems.

But with that, of course, crime rose ever further, inciting citizen anger and providing a pretext to bring in the police state in the form of the National Guard, now tasked with cracking down on crime in the transportation system.

What’s the next step? It’s probably already here: mass surveillance and censorship, plus ever-expanding police power. This will be accompanied by further population movements, as those with the means to do so flee the city and even the country and leave it for everyone else to suffer.

As I tell the story, all of this seems inevitable. It is not. It could have been stopped at any point. A wise and prudent political leadership could have admitted the error from the beginning and called on the country to rediscover freedom, decency, and the difference between right and wrong. But ego and pride stopped that from happening, and we are left with the consequences.

The government grows ever bigger and civil society ever less capable of managing itself in large urban centers. Disaster is unfolding in real time, mitigated only by a rising stock market and a financial system that has yet to fall apart completely.

Are we at the middle stages of total collapse, or at the point where the population and people in leadership positions wise up and decide to put an end to the downward slide? It’s hard to know. But this much we do know: There is a growing pocket of resistance out there that is fed up and refuses to sit by and watch this great country be sacked and taken over by everything it was set up to prevent.

Spread & Containment

Another beloved brewery files Chapter 11 bankruptcy

The beer industry has been devastated by covid, changing tastes, and maybe fallout from the Bud Light scandal.

Before the covid pandemic, craft beer was having a moment. Most cities had multiple breweries and taprooms with some having so many that people put together the brewery version of a pub crawl.

It was a period where beer snobbery ruled the day and it was not uncommon to hear bar patrons discuss the makeup of the beer the beer they were drinking. This boom period always seemed destined for failure, or at least a retraction as many markets seemed to have more craft breweries than they could support.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

The pandemic, however, hastened that downfall. Many of these local and regional craft breweries counted on in-person sales to drive their business.

And while many had local and regional distribution, selling through a third party comes with much lower margins. Direct sales drove their business and the pandemic forced many breweries to shut down their taprooms during the period where social distancing rules were in effect.

During those months the breweries still had rent and employees to pay while little money was coming in. That led to a number of popular beermakers including San Francisco's nationally-known Anchor Brewing as well as many regional favorites including Chicago’s Metropolitan Brewing, New Jersey’s Flying Fish, Denver’s Joyride Brewing, Tampa’s Zydeco Brew Werks, and Cleveland’s Terrestrial Brewing filing bankruptcy.

Some of these brands hope to survive, but others, including Anchor Brewing, fell into Chapter 7 liquidation. Now, another domino has fallen as a popular regional brewery has filed for Chapter 11 bankruptcy protection.

Image source: Shutterstock

Covid is not the only reason for brewery bankruptcies

While covid deserves some of the blame for brewery failures, it's not the only reason why so many have filed for bankruptcy protection. Overall beer sales have fallen driven by younger people embracing non-alcoholic cocktails, and the rise in popularity of non-beer alcoholic offerings,

Beer sales have fallen to their lowest levels since 1999 and some industry analysts

"Sales declined by more than 5% in the first nine months of the year, dragged down not only by the backlash and boycotts against Anheuser-Busch-owned Bud Light but the changing habits of younger drinkers," according to data from Beer Marketer’s Insights published by the New York Post.

Bud Light parent Anheuser Busch InBev (BUD) faced massive boycotts after it partnered with transgender social media influencer Dylan Mulvaney. It was a very small partnership but it led to a right-wing backlash spurred on by Kid Rock, who posted a video on social media where he chastised the company before shooting up cases of Bud Light with an automatic weapon.

Another brewery files Chapter 11 bankruptcy

Gizmo Brew Works, which does business under the name Roth Brewing Company LLC, filed for Chapter 11 bankruptcy protection on March 8. In its filing, the company checked the box that indicates that its debts are less than $7.5 million and it chooses to proceed under Subchapter V of Chapter 11.

"Both small business and subchapter V cases are treated differently than a traditional chapter 11 case primarily due to accelerated deadlines and the speed with which the plan is confirmed," USCourts.gov explained.

Roth Brewing/Gizmo Brew Works shared that it has 50-99 creditors and assets $100,000 and $500,000. The filing noted that the company does expect to have funds available for unsecured creditors.

The popular brewery operates three taprooms and sells its beer to go at those locations.

"Join us at Gizmo Brew Works Craft Brewery and Taprooms located in Raleigh, Durham, and Chapel Hill, North Carolina. Find us for entertainment, live music, food trucks, beer specials, and most importantly, great-tasting craft beer by Gizmo Brew Works," the company shared on its website.

The company estimates that it has between $1 and $10 million in liabilities (a broad range as the bankruptcy form does not provide a space to be more specific).

Gizmo Brew Works/Roth Brewing did not share a reorganization or funding plan in its bankruptcy filing. An email request for comment sent through the company's contact page was not immediately returned.

bankruptcy pandemic social distancing

Spread & Containment

Revving up tourism: Formula One and other big events look set to drive growth in the hospitality industry

With big events drawing a growing share of of tourism dollars, F1 offers a potential glimpse of the travel industry’s future.

In late 2023, I embarked on my first Formula One race experience, attending the first-ever Las Vegas Grand Prix. I had never been to an F1 race; my interest was sparked during the pandemic, largely through the Netflix series “Formula 1: Drive to Survive.”

But I wasn’t just attending as a fan. As the inaugural chair of the University of Florida’s department of tourism, hospitality and event management, I saw this as an opportunity. Big events and festivals represent a growing share of the tourism market – as an educator, I want to prepare future leaders to manage them.

And what better place to learn how to do that than in the stands of the Las Vegas Grand Prix?

The future of tourism is in events and experiences

Tourism is fun, but it’s also big business: In the U.S. alone, it’s a US$2.6 trillion industry employing 15 million people. And with travelers increasingly planning their trips around events rather than places, both industry leaders and academics are paying attention.

Event tourism is also key to many cities’ economic development strategies – think Chicago and its annual Lollapalooza music festival, which has been hosted in Grant Park since 2005. In 2023, Lollapalooza generated an estimated $422 million for the local economy and drew record-breaking crowds to the city’s hotels.

That’s why when Formula One announced it would be making a 10-year commitment to host races in Las Vegas, the region’s tourism agency was eager to spread the news. The 2023 grand prix eventually generated $100 million in tax revenue, the head of that agency later announced.

Why Formula One?

Formula One offers a prime example of the economic importance of event tourism. In 2022, Formula One generated about $2.6 billion in total revenues, according to the latest full-year data from its parent company. That’s up 20% from 2021 and 27% from 2019, the last pre-COVID year. A record 5.7 million fans attended Formula One races in 2022, up 36% from 2019.

This surge in interest can be attributed to expanded broadcasting rights, sponsorship deals and a growing global fan base. And, of course, the in-person events make a lot of money – the cheapest tickets to the Las Vegas Grand Prix were $500.

That’s why I think of Formula One as more than just a pastime: It’s emblematic of a major shift in the tourism industry that offers substantial job opportunities. And it takes more than drivers and pit crews to make Formula One run – it takes a diverse range of professionals in fields such as event management, marketing, engineering and beyond.

This rapid industry growth indicates an opportune moment for universities to adapt their hospitality and business curricula and prepare students for careers in this profitable field.

How hospitality and business programs should prepare students

To align with the evolving landscape of mega-events like Formula One races, hospitality schools should, I believe, integrate specialized training in event management, luxury hospitality and international business. Courses focusing on large-scale event planning, VIP client management and cross-cultural communication are essential.

Another area for curriculum enhancement is sustainability and innovation in hospitality. Formula One, like many other companies, has increased its emphasis on environmental responsibility in recent years. While some critics have been skeptical of this push, I think it makes sense. After all, the event tourism industry both contributes to climate change and is threatened by it. So, programs may consider incorporating courses in sustainable event management, eco-friendly hospitality practices and innovations in sustainable event and tourism.

Additionally, business programs may consider emphasizing strategic marketing, brand management and digital media strategies for F1 and for the larger event-tourism space. As both continue to evolve, understanding how to leverage digital platforms, engage global audiences and create compelling brand narratives becomes increasingly important.

Beyond hospitality and business, other disciplines such as material sciences, engineering and data analytics can also integrate F1 into their curricula. Given the younger generation’s growing interest in motor sports, embedding F1 case studies and projects in these programs can enhance student engagement and provide practical applications of theoretical concepts.

Racing into the future: Formula One today and tomorrow

F1 has boosted its outreach to younger audiences in recent years and has also acted to strengthen its presence in the U.S., a market with major potential for the sport. The 2023 Las Vegas race was a strategic move in this direction. These decisions, along with the continued growth of the sport’s fan base and sponsorship deals, underscore F1’s economic significance and future potential.

Looking ahead in 2024, Formula One seems ripe for further expansion. New races, continued advancements in broadcasting technology and evolving sponsorship models are expected to drive revenue growth. And Season 6 of “Drive to Survive” will be released on Feb. 23, 2024. We already know that was effective marketing – after all, it inspired me to check out the Las Vegas Grand Prix.

I’m more sure than ever that big events like this will play a major role in the future of tourism – a message I’ll be imparting to my students. And in my free time, I’m planning to enhance my quality of life in 2024 by synchronizing my vacations with the F1 calendar. After all, nothing says “relaxing getaway” quite like the roar of engines and excitement of the racetrack.

Rachel J.C. Fu does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

spread pandemic-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire