Uncategorized

S&P Futures Hit 6 Week High, Nasdaq Set For Best March Since 2010 Ahead Of Quarter-End Fireworks

S&P Futures Hit 6 Week High, Nasdaq Set For Best March Since 2010 Ahead Of Quarter-End Fireworks

US futures extended gains for the 3rd…

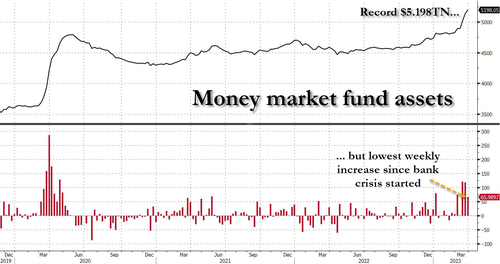

US futures extended gains for the 3rd straight day and are on pace to rise 6 of the past 7 days, led by the Nasdaq 100 which is set for its best March in more than a decade as investors bet on a softening in central-bank policy amid worries about a recession while the slowdown in new money market fund injections eased fears about the ongoing bank run.

Contracts on the Nasdaq 100 were up 0.3% as of 7:45 a.m. in New York, while S&P 500 futures also rose 0.2% hitting the highest level in 6 weeks.

For the month, the tech-heavy gauge is tracking an increase of about 7.7%, its biggest March advance since 2010. The benchmark S&P 500 is also set for a small monthly gain as the rates outlook overshadowed concerns about turmoil in the banking sector and a possible economic contraction.

The dollar strengthened Friday, trimming some of its sharp declines this month. Treasury yields steadied at the end of a quarter of wild swings. Investors have struggled to adjust for banking collapses and the shifting outlook for interest rates amid high inflation and threats to economic growth. The two-year yield was around 4.13% Friday while the 10-year maturity was about 3.55%.

Among notable premarket movers, Nikola Corp. dropped 8.6% after a $100 million share offering priced at a 20% discount to the stock’s last close. Digital World Acquisition Corp., the special-purpose acquisition company merging with Trump Media, rallied as much as 16% following former President Donald Trump’s indictment. Virgin Orbit shares slump a record 40% after the satellite launch provider said it’s ceasing operations indefinitely. Here are the other notable premarket movers:

- Digital World Acquisition, the blank-check firm taking Trump Media public, rallied 8% in premarket trading, advancing along with other stocks tied to Donald Trump after the indictment of the former president. Phunware , a software firm that worked on Trump’s reelection campaign, rose 2.5%, while video platform Rumble gained 14%.

- Advance Auto Parts upgraded to equal-weight at Barclays, which says that rather than a positive call it is based on significant year-to-date underperformance. The stock gains 1.1%.

- Alphabet Inc.’s price target is lowered to $117 from $120 at Piper Sandler, which cites concerns about competition in artificial intelligence technology.

- Blackberry shares drop 3.8% after the cybersecurity company’s fourth- quarter revenue missed analyst estimates, with brokers flagging the impact of some large government deals slipping, as well as needing more convincing that important metrics were recovering.

- Generac shares are down 3% after BofA Global Research downgrades the generator company to underperform from neutral.

- IonQ shares are up more than 4% after the quantum-computing company reported fourth-quarter results that beat expectations and gave a full-year revenue forecast that was ahead of the consensus estimate.

US stocks have experienced a big sector rotation this month with technology stocks rallying amid bets of lower interest rates, while economically-linked cyclical sectors lagged behind following their outperformance at the start of the year. The Nasdaq 100 is up nearly 19% in the first quarter, its best January-March performance since 2012. That rotation prompted momentum-chasing penguins, pardon strategists at Citigroup to upgrade US stocks to overweight from underweight, saying they “perform more defensively than other markets” during earnings recessions.

Michael Hewson, chief market analyst at CMC Markets UK, said US stock markets “have undergone a bit of a crisis of confidence with concern about the effects of much higher rates giving way to concern about the health of the US banking system.”

On the outlook for rates, all eyes Friday are on the so-called PCE Core Deflator, which is expected to show a slight easing of price pressures in February, though it should still be well above target. A round of Fed speakers on Thursday suggested more monetary tightening was necessary to quell inflation, even after the collapse of three US banks this month.

“The Fed’s preferred measure of inflation could generate some volatility within the fixed income markets if we see any surprises,” economists at Rand Merchant Bank in Johannesburg wrote in a note. “Risks are tilted to the upside, and if the data shows that inflation pressures remained strong in February, the inversion of the US yield could deepen even further.”

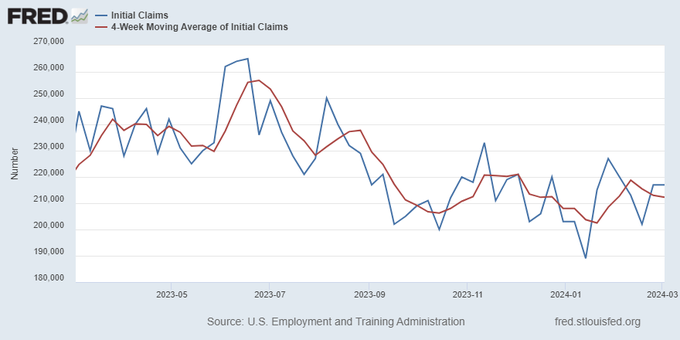

Traders will also be on guard for any choppiness amid quarter-end rebalancing from pension funds and options hedging activity, especially the famous JPM collar which has a 4065 strike. And they continue to debate the extent to which policy makers may cut interest rates this year. Several strategists have said markets are wrong to expect easing by the Fed this this year as the labor market remains robust, though US unemployment claims ticked up for the first time in three weeks.

European stocks are ahead with the Stoxx 600 up 0.3% and on course for a third day of gains. Personal care, retailers and consumer products are the strongest-performing sectors while miners and banks fall. Here are some notable premarket movers:

- Air France-KLM rises as much as 4.5%, IAG 3.2%, Lufthansa 3.3% and EasyJet 3.8% following bullish notes on the sector from Deutsche Bank and Barclays and a slew of upgrades

- Ocado gains as much as 7.9%, while AutoStore falls as much as 12% after a UK court invalidated the two remaining patent lawsuits the Norwegian firm had filed against Ocado

- SAF-Holland rises as much as 7.6%, extending gains following Thursday morning’s results, as Hauck & Aufhaeuser lifts its PT to a new Street high

- CD Projekt soars as much as 9.8% after posting the second-highest quarterly earnings fueled by stronger sales of Cyberpunk 2077 and Witcher 3 games

- Getin Holding soars as much as 27% after the company proposes a record dividend of 0.58 zloty per share, its first payout since 2013

- Computacenter shares gain as much as 3.2% on Friday after the IT reseller posted better-than-expected results, saying demand from most of its largest customers remains solid

- Torm rises as much as 9.6% after holder OCM Njord Holdings Sarl terminated a planned secondary public offering of 5 million class A shares in the Danish tanker operator

- Marston’s shares rise as much as 5.3%, with analysts saying the pub operator’s amendment and extension of its debt facilities should provide some relief for investors

- Jungheinrich shares slide as much as 9.2% after the forklifts and stackers manufacturer’s cautious outlook for 2023 overshadowed a strong end to 2022

- EMIS shares plunged as much as 24% after Britain’s competition regulator said it would investigate UnitedHealth’s deal to acquire the health-technology company

Earlier in the session, Asian stocks headed for a fourth day of gains as data showed China’s economy gained momentum in March, while concerns about global banking turmoil and elevated interest rates eased. The MSCI Asia Pacific Index rose as much as 1.1%, set to cap a second-straight weekly gain, boosted by consumer discretionary and materials shares. Most regional markets gained, led by Japan, South Korea and Hong Kong. Indian shares jumped after returning from a holiday. Chinese stocks got a boost after a report that manufacturing continued to expand amid a strong pickup in services activity and construction. The report offered investors more confidence about an economic rebound after stringent Covid restrictions were dropped. Spinoff plans for JD.com and Alibaba units also lifted sentiment for tech shares. Read: China’s Strong PMIs Show Economic Recovery Gaining Traction The latest data “confirms the early cycle economic recovery is on track, paving the way for earning revisions to stabilize and improve from 2Q,” analysts at UBS Global Wealth Management’s chief investment office wrote in a report. “We expect over 20% upside for MSCI China by year-end, with the recent consolidation presenting an attractive entry point.” Globally, concerns over the financial sector continued to cool and investors digested a round of Federal Reserve commentary. Bank of Boston President Susan Collins said the banking system is sound and more interest-rate increases are needed to bring down inflation.

Japanese stocks rebounded, following US peers higher, as concerns over the financial sector continued to cool and investors digested a round of Fed commentary. The Topix Index rose 1% to 2,003.50 as of market close Tokyo time, while the Nikkei advanced 0.9% to 28,041.48. Mitsui & Co. contributed the most to the Topix Index gain, increasing 7.6%. Out of 2,160 stocks in the index, 1,471 rose and 588 fell, while 101 were unchanged. Meanwhile, Japanese semiconductor-related stocks pared earlier gains after Japan said it will tighten chip gear exports to help restrict tech shipments to China. Japan Trading Firms Gain on Reported Plans to Improve Returns “Besides the stabilizing overseas markets, expectations for firm corporate earnings outlooks are also boosting Japanese equities,” said Rina Oshimo, a senior strategist at Okasan Securities. “Japan’s macro economy this year is more resilient than overseas, mainly driven by reopening growth, and the government’s policy for childcare support is also positive material.

Australian stocks also advanced: the S&P/ASX 200 index rose 0.8% to close at 7,177.80, boosted by mining and bank shares. Stocks across Asia advanced with US and European equity futures, underscoring investor optimism in the face of banking turmoil and elevated interest rates. The benchmark snapped seven weeks of losses, rising 3.2% for the week, the most since the week of Nov. 11. The index also posted a second straight quarter of gains. The focus will now be on Australia’s central bank, which is set to make a rate decision Tuesday. The RBA is expected to keep borrowing costs unchanged at next week’s meeting, delivering its first pause since initiating a policy tightening cycle in May 2022. In New Zealand, the S&P/NZX 50 index fell 0.4% to 11,884.50.

India stocks rallied the most in more than four months on Friday bouncing back from their oversold levels to trim losses for the quarter. The S&P BSE Sensex Index rose 1.8% to 58,991.52 in Mumbai, while the NSE Nifty 50 Index advanced 1.6% to 17,359.75. The gauges posted their biggest single-day rallies since Nov. 11, narrowing their losses for the quarter to 3% and 4%, respectively. Even with the gains this week, the indices clocked their worst quarterly performance since June 2022 after scaling to their record peaks in December. Globally tightening monetary conditions and the impact of inflation have dampened the outlook for economic growth and shrunk the valuation gap that India enjoyed over its peers. Foreigners turned buyers of local shares in March after three straight months of outflows, purchasing a net of $1.4b of stocks through March 28, while domestic institutional investors remain supportive of equities. Reliance Industries contributed the most to the Sensex’s advance, increasing 4.3% after the company firmed up its plan for separating its financial services business, a move that will potentially result into value creation for the country’s biggest listed firm. Out of 30 shares in the Sensex index, 26 rose and 4 fell

In FX, the Bloomberg Dollar Spot Index rose 0.2%, boosted by gain versus the yen; the dollar is set to end the quarter 1.4% lower, its first consecutive quarterly loss in more than two years, amid easing concerns about the global banking sector and money market wagers on Federal Reserve interest-rate cuts. USD/JPY rallied as much as 0.8% as Japan’s fiscal year-end flows dominated and haven bids waned amid easing concerns about the global banking sector; International Monetary Fund said the nation’s central bank should avoid a premature exit from monetary easing.

In rates, US 10-year yields are down 2 bps at 3.537% ahead of the core PCE data due later today. Treasury 2-year yields cheaper by ~2bp on the day with 2s10s flatter by 3bp to -61bp from a high of around -50bp Thursday. Bunds outperform little-changed US 10-year by 2bp while gilts lag by 3bp. Earlier, ECB rate-hike premium was unwound slightly after euro-area core inflation accelerated to 5.7% in March, matching the median forecast. IG dollar issuance slate empty so far; a couple of names priced $1.4b Thursday, leaving March total around $100b vs $150b that was expected. Bund futures rallied as traders trimmed ECB rate bets after euro-area inflation slowed more than expected in March, although the core rate did accelerate. German 10-year yields are flat at 2.37% while the Euro is down 0.2% versus the greenback. US economic data slate includes February personal income/spending with PCE deflator (8:30am), March MNI Chicago PMI (9:45am) and March final University of Michigan sentiment (10am).

In commodites, US crude futures are little changed with WTI at $74.35. Spot gold is also flat around $1,980

Looking to the day ahead. We have quite a busy day data wise, with the US PCE deflator data, the March MNI Chicago PMI and the February personal spending and income data. In Europe, we have the Eurozone March CPI data and the February unemployment. We will also see the release of the Italian March CPI and the January industrial index, the German march unemployment change, February retail sales and the import price index, and lastly the French March CPI. February CPI and consumer spending. Finally, we will hear from several central bankers, including the ECB’s Lagarde and Kazaks, as well as the Fed’s Williams, Waller and Cook.

Market Snapshot

- S&P 500 futures little changed at 4,082.00

- MXAP up 0.6% to 161.90

- MXAPJ up 0.5% to 523.44

- Nikkei up 0.9% to 28,041.48

- Topix up 1.0% to 2,003.50

- Hang Seng Index up 0.4% to 20,400.11

- Shanghai Composite up 0.4% to 3,272.86

- Sensex up 1.7% to 58,952.31

- Australia S&P/ASX 200 up 0.8% to 7,177.75

- Kospi up 1.0% to 2,476.86

- STOXX Europe 600 up 0.2% to 455.58

- German 10Y yield little changed at 2.39%

- Euro down 0.3% to $1.0876

- Brent Futures down 0.9% to $78.54/bbl

- Gold spot down 0.3% to $1,975.10

- US Dollar Index up 0.30% to 102.45

Top Overnight News

- Former President Donald Trump faces a set of legal requirements no American leader has had to confront after being indicted by a Manhattan grand jury on Thursday in a probe of hush money payments to a porn star during his 2016 campaign — a historic event in American law and politics that is certain to divide an already polarized society and electorate: BBG

- The BOJ expanded the range of its planned bond purchases next quarter, giving itself the option to dial back buying. It will buy ¥100 billion to ¥500 billion ($750 million to $3.8 billion) of 10-to-25-year bonds per operation, compared with a range of ¥200 billion to ¥400 billion in the first quarter. It also widened the range of purchase amounts for other maturities above one year. BBG

- The China Securities Regulatory Commission last month released long-awaited guidelines that require all mainland Chinese companies planning share sales outside the domestic A-share market to inform the regulator beforehand. That applies to jurisdictions that have been popular venues for Chinese listings, including Hong Kong and the U.S. Companies in some technology fields that haven’t yet generated revenue will be able to explore listings in Hong Kong, after the city’s stock exchange last week finalized a new set of rules known as Chapter 18C. WSJ

- China’s economic recovery gathered pace in March, with gauges for manufacturing, services and construction activity remaining strong, boosting the outlook for growth this year: BBG

- The U.S. and South Korea are both seeking to extradite captured crypto entrepreneur Do Kwon from Montenegro, authorities in the tiny European nation said this week, setting up competing bids to prosecute him over criminal charges tied to the collapse of his TerraUSD stablecoin. WSJ

- Eurozone inflation has fallen sharply to its lowest level for a year after a decline in energy costs. Harmonized consumer prices in the euro area rose by 6.9 per cent in the year to March, down from 8.5 per cent the previous month, to reach their lowest level since February 2022. The drop, due to a 0.9 per cent fall in energy prices, was steeper than a forecast by economists polled by Reuters, who had expected March eurozone inflation of 7.1%. FT

- Underlying inflation in the euro area hit a record in March, handing ammunition to European Central Bank officials who say interest-rate increases aren’t over yet: BBG

- Banks reduced their borrowings from two Fed backstop lending facilities in the most recent week, a sign that liquidity demand may be stabilizing. US institutions had a combined $152.6 billion in outstanding borrowings, compared with $163.9 billion the previous week. But US banks are facing a new problem as savers flee for higher deposit rates. BBG

- Finland has cleared the last significant hurdle in its bid to join Nato after Turkey’s parliament approved the Nordic country’s accession to the western military alliance. FT

- Investors are still flooding into cash, with $60.1 billion entering money markets funds in the week through Wednesday, according to EPFR data. That brings the quarterly flow into cash to about $508 billion, the most since the very start of the pandemic. BBG

- A majority of Americans don’t think a college degree is worth the cost, according to a new Wall Street Journal-NORC poll, a new low in confidence in what has long been a hallmark of the American dream. The survey, conducted with NORC at the University of Chicago, a nonpartisan research organization, found that 56% of Americans think earning a four-year degree is a bad bet compared with 42% who retain faith in the credential. WSJ

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly firmer at quarter-end as they took impetus from the tech-led gains on Wall Street and with participants digesting a slew of data releases including better-than-expected Chinese PMI figures. ASX 200 was led by the mining and resources sectors after the strong data from Australia’s largest trading partner although the upside was capped ahead of next week’s RBA meeting with a recent Reuters poll showing near-even expectations amongst economists between a hike and a pause. Nikkei 225 gained heading into the end of the fiscal year and climbed back above the 28,000 level after encouraging Industrial Production and Retail Sales data but was off highs with chipmakers later pressured after Japan announced to impose new restrictions on chip-making gear. Hang Seng and Shanghai Comp. were positive after the strong Chinese PMI data in which Manufacturing PMI topped forecasts and Non-Manufacturing PMI rose to its highest since 2011, with the outperformance in Hong Kong led by tech as JD.com plans to spin off its industrials and property units. However, the gains in the mainland were limited amid a deluge of earnings releases including mixed results from China’s mega-banks and with the nation’s largest property developer Country Garden posting its first annual loss since its listing in 2007.

Top Asian News

- Chinese Vice Finance Minister Zhu said China needs to step up fiscal policy adjustments to support the economy and that China will move steadily in implementing preferential tax and fee policies. Zhu also stated that China will effectively ease tax burdens of small firms and household businesses, while he noted that recently announced preferential tax and fee policies will reduce companies' burdens by CNY 480bln per year, according to Reuters.

- China's Ambassador to the EU warned the bloc of ‘peril’ in following the US on trade curbs, while he urged resistance to ‘unwarranted’ pressure and said that Beijing will not be ‘trampled’, according to FT.

- Japan is to impose new restrictions of chip-making gear, according to Bloomberg and Reuters. Japan said it will impose restrictions on 23 types of chip-making equipment from July. Japanese officials said the scope of restrictions went further than the US measures imposed in 2022. Chip-equipment exporters would need licenses for all regions. The measures will affect a broader range of companies than previously expected, according to FT.

- Agricultural Bank of China (1288 HK) says NIM for the banking sector will continue to shrink in Q1; Co. says its NIM faces downward pressure in 2023. Bank of China (3988 HK) CFO says they are to face a mild decline in NIM this year.

- Japan is to end current COVID border measures on May 8th, via TBS; replaced with random genomic surveillance at airports.

European bourses are firmer, Euro Stoxx 50 +0.3%, continuing the positive APAC tone with incremental impetus from as-expected EZ Core HICP. Sectors are mixed with Banks lagging as yields retreat post-HICP while Personal Care/Drug names outperform. Stateside, futures are incrementally in the green with the tone more cautious ahead of PCE data and Fed speak, incl. Williams, thereafter.

Top European News

- UK PM Sunak's office said Britain will join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership Trans-Pacific after the bloc's members reached an agreement on Britain joining the trade pact, while Japan's Economy Minister said they aim for an early signing of UK joining the CPTPP, according to Reuters.

- Sartorius to Buy French Biotech Polyplus for $2.6 Billion

- DSV Slips as JPMorgan Cuts Rating, Prefers Kuehne + Nagel

- Energy Cliff-Edge Threatens Thousands of British Businesses

- German Unemployment Rises More Than Expected on Sluggish Economy

FX

- USD/JPY and Yen crosses still marching higher into month end as importer hedging and buy orders persist, headline pair popped above 133.50 before topping out and DXY holding 102.000+ status as a result.

- Aussie unable to keep hold of 0.6700 handle as AUD/NZD cross retreats through 1.0700 on divergent RBA/RBNZ rate expectations.

- Euro mixed after EZ inflation data showing a softer than forecast headline, but firmer than previous core, EUR/USD sub-1.0900, but EUR/CHF nearer parity than 0.9950.

- Cable unable to hold above 1.2400 irrespective of UK Q4 GDP upgrades as Buck bounces broadly pre-US PCE.

Fixed Income

- EGBs experienced a marked bounce following the EZ inflation measure after dipping on the initial French reading; with the EZ figure showing a larger than expected cooling in the headline while the core measures are stick but were as-expected.

- Specifically, Bunds have been up to a 135.64 peak which saw the associated yield pullback from 2.40% best towards the 2.30% mark.

- USTs and Gilts have been moving in tandem with EGBs; though, USTs are somewhat more cautious ahead of upcoming events with yields slightly firmer as it stands.

- BoJ Q2 Bond Purchase plans; expands range for mid-to-superlong purchases for Q2. Click here for more detail.

Commodities

- WTI and Brent are mixed/flat after settling higher by over USD 1.0bbl on Thursday with the overall tone tentative ahead of the US docket while crude specifically is cognisant of next week's JMMC.

- Specifically, benchmarks are near-unchanged but at the upper-end of USD 73.77-74.67/bbl and USD 78.54-79.18/bbl parameters.

- Metals hold a slight downward bias in otherwise tentative trade for the space with the USD's strength capping any potential upside from the somewhat cauutious tone.

Geopolitics

- Japanese Finance Minister Suzuki said Japan is to extend the suspension of its most favoured nation treatment on tariffs for Russia, while it was also reported that Japan banned Russia-bound exports of steel, aluminium and aircraft from April 7th, according to the Ministry of Economy, Trade and Industry cited by Reuters.

- Turkish parliament approved a bill to clear the way for Finland's NATO accession, according to Reuters.

- Deputy Chairman of the Russian National Security Council says "our army will arrive in Kiev if necessary".

- Belarusian President Lukashenko warns that the West seeks to invade his country with the aim of "destroying" it; The war is not far from us and there are attempts to drag us into it; return of nuclear weapons is not blackmail but a safeguard. Says, talks to resolve the conflict in Ukraine need to commence now, a ceasefire without pre-conditions should be declared.

- Russia's Kremlin says Russian President Putin is to hold an "important" meeting of Security Council today; Foreign Ministry Lavrov to present a new concept of Russian foreign policy. Will talk to Belarussian President next week about Lukashenko's call for immediate peace talks, cContinuation of special military operation is the only way to achieve goals at the moment.

US Event Calendar

- 08:30: Feb. Personal Income, est. 0.2%, prior 0.6%

- Personal Spending, est. 0.3%, prior 1.8%

- Real Personal Spending, est. -0.1%, prior 1.1%

- 08:30: Feb. PCE Deflator MoM, est. 0.3%, prior 0.6%

- Feb. PCE Core Deflator YoY, est. 4.7%, prior 4.7%

- Feb. PCE Deflator YoY, est. 5.1%, prior 5.4%

- Feb. PCE Core Deflator MoM, est. 0.4%, prior 0.6%

- 09:45: March MNI Chicago PMI, est. 43.0, prior 43.6

- 10:00: March U. of Mich. Sentiment, est. 63.2, prior 63.4

- Current Conditions, est. 66.4, prior 66.4

- Expectations, est. 61.4, prior 61.5

- 1 Yr Inflation, est. 3.8%, prior 3.8%

- 5-10 Yr Inflation, est. 2.8%, prior 2.8%

Central Banks

- 15:05: Fed’s Williams Speaks at Housatonic Community College

- 17:45: Fed’s Cook Discusses US Economy and Monetary Policy

- 22:00: Fed’s Waller Discusses the Phillips Curve

DB's Karthik Nagalingam completes the overnight wrap

For a fourth straight day, market behaviour was rather benign with risk-sentiment remaining positive and volatility ebbing. Equity indices in both the US and Europe rose moderately, while longer-dated sovereign yields in the two regions diverged as inflation data is coming back to the foreground. Hotter-than-expected European inflation led to a selloff in bonds, and today we will get more inflation data from both sides of the pond.

Given the calmer market narrative around the global banking system, focus today will be on the US PCE data. Fed members had an approximation of what PCE would look like given recent CPI and PPI prints when they rose rates 25bps last week but seeing how the underlying components are tracking may force market participants to refocus on pricing pressures. However, the market is likely to look through anything but an extraordinary print, given that the recent banking crisis will not be reflected in the data. Our US economists see a +0.36% advance for core PCE in February (+0.57% in January) and m/m declines for both income (-0.1% vs +0.6% in January) and consumption (-0.6% vs +1.8%).

Ahead of the PCE print there was a bevy of Fed speakers yesterday, all of whom highlighted the fact that inflation remained too hot. Boston Fed President Collins (non-voter), while at a conference in Washington DC said, “Inflation remains too high, and recent indicators reinforce my view that there is more work to do.” Separately, Minneapolis Fed President Kashkari (voter) said that the stresses on the banking sector could last longer than expected, but also said that “the services part of the economy has not yet slowed down and … wage growth is still growing faster than what is consistent with our 2% inflation target.” Lastly, Richmond President Barkin (non-voter) said that “if inflation persists, we can react by raising rates further,” and pointed out that the committee was discussing a 50bp hike just a few weeks ago. He had no stated preference on the size of a future rate hike, but he said that continuing to fight inflation was the priority.

These comments did little to change fed futures yesterday, as the market priced in just an extra +4.0bps for the rate following the December Fed meeting, increasing expectations to 4.387%. That was their highest closing level since March 10 - the day of the collapse of Silicon Valley Bank. The expectations around the May meeting rose marginally, with futures now pricing in a 55% chance of a 25bp hike, up from 47% the day before. While fed speakers don’t seem ready to talk about cutting rates, the market is still pricing in over two 25bps rate cuts by year-end after hitting a terminal rate in May.

Against this backdrop, the more policy sensitive US 2yr yield was up +2.1bps to 4.12% – returning to roughly where they were before the most recent Fed rate hike on the 21 March. Meanwhile the US 10yr yield fell back -1.5bps after trading in a tight 6bp range all day, although yields have slightly pulled back (+1.51bps) overnight as we go to print. It was a different story in Europe, as 10yr bund yields rose +4.6bps to 2.37% and German 2yrs rose +9.5bps to 2.75%, their highest level since the third week of March. 10yr OATs (+5.2bps) and BTPs (+8.5bps) underperformed, while 10yr gilts yields rose by +4.6bps as well.

As noted above, the selloff in European bonds began after the German inflation print showed an unexpected acceleration in price growth, with German CPI up to +0.8% (vs +0.7% expected) month-on-month, and +7.8% year-on-year (vs +7.5% expected) on the EU-harmonised measure. Eurozone CPI data for March later today will complete the picture, and our European economists expect euro-area EU-harmonised CPI to fall from 8.6% in February to 7.1% year-on-year, but with risks slightly to the upside following the German print. See their note here.

Following the upside surprise on German CPI, the terminal ECB rate priced in by overnight index swaps for the December meeting climbed +10.7bps to 3.44%, pricing in barely any cuts (5bps) by the end of 2023 with the terminal rate expected for October at 3.49%.

Turning to equities, the S&P 500 was up +0.57% with all but 3 of 24 industry groups gaining on the day. Semiconductors (+1.61%), consumer discretionary retail (+1.21%), and real estate (+1.19%) outperformed. The outperformance of technology continued, leading the NASDAQ (+0.73%) to maintain its trajectory for its best quarter since 2020. The only three S&P 500 industries down on the day were diversified financials (-0.13%), consumer durables (-0.21%) and banks (-1.00%). The underperformance in banks was primarily driven by the regionals with First Republic (-4.0%) the clear laggard, while Fifth Third (-2.6%), Zion (-2.4%), and M&T Bank (-2.3%) were in the next tier of underperformers. The larger banks outperformed with Citi (+0.3%) the only S&P bank constituent higher on the day, while JPM (-0.3%) and BofA (-1.3%) saw smaller losses.

After markets closed, the Fed released their weekly H.4.1 balance sheet data showing how banks were using the Fed’s new bank lending facility and the discount window. Over the prior week, discount window borrowing was down from $110bn to $80bn, there was no further extension of credit to SVB or Signature, and the bank term funding program saw increased borrowing of $64bn from $54bn the week prior. The foreign repo facility, FIMA, saw use fall from $60bn to $55bn. Overall this shows modest improvement across the complex and should add to the narrative that the pain is mostly contained.

In Europe, the STOXX 600 similarly gained on the day (+1.03%), with real estate (+3.74%) as well as information technology (+2.54%) driving performance. Food and Beverage (-0.47%) was the only industry group weaker off the back of the German CPI data, as the finer details of the release showed price inflation for food inched higher. Additionally, unlike in the US, European financials continued to rally back yesterday with as European banks climbed +1.84% and are now up +6.62% on the year. Looking into other bourses, the CAC and the DAX were up +1.06% and +1.26% respectively.

This morning, Asian equity markets have carried over the overnight gains on Wall Street. Across the region, the Hang Seng (+1.46%) is leading gains with the KOSPI (+1.06%), Nikkei (+1.01%), CSI (+0.35%) and the Shanghai Composite (+0.33%) also rising. In overnight trading, US equity futures are pointing to further gains with those on the S&P 500 (+0.28%) and NASDAQ 100 (+0.34%) edging higher.

China equities are outperforming following the official manufacturing PMI beating expectations at 51.9, and the non-manufacturing PMI rising to 58.2 in March. That is the non-manufacturing index’s highest level since May 2011. This data suggests that the economic recovery in the world’s second biggest economy remains on track even amid weaker global demand and a continued property market downturn.

There was also a batch of economic data out of Japan indicating that inflation in Tokyo is still above trend after coming in at +3.3% y/y in March (vs +3.2% expected) compared to +3.4% recorded last month. At the same time, core Tokyo CPI rose +3.2% y/y (vs +3.1% expected) in March, following a peak of +4.3% back in December. So further improvement but not as much as the market was looking for. Labour market conditions loosened slightly as the unemployment rate unexpectedly rose to +2.6% in February from +2.4% in January, while the jobs to applicant ratio moved lower to +1.34 (vs +1.36 expected). Retail sales jumped +1.4% m/m in February, compared to January’s downwardly revised increase of +0.8%. Meanwhile, industrial production rebounded +4.5% m/m in February (vs +2.7% expected) on easing supply bottlenecks for carmakers.

It was a big day for data release yesterday. Starting with the US, weekly jobless claims came in at 198,000 (vs 196,000 expected) suggesting a slight softening in an otherwise tight labour market. Continued claims was lower than expected (1,689k vs 1,700k expected), having remained in a tight range over the past few months now. The third revision to 4Q’22 US GDP saw annualised quarter-over-quarter GDP taken down to 2.6% (2.7% prior) on the back of lower personal consumption (1.0% vs 1.4% prior). 4Q’22 PCE was revised +0.1pp higher to 4.4%.

In Europe, we had several confidence data points for March in the Eurozone demonstrating a slight weakening relative to February. Economic confidence was down to 99.3 (vs 100 expected), industrial confidence became negative at -0.2 (vs 0.5 expected) and services confidence fell a tenth to 9.4 (vs 10 expected). Consumer confidence remained steady at -19.2. This contrasted with the services-driven improvement in the PMIs for March. Looking on the individual country level, the Spanish CPI rose +1.1% month-on-month (vs +1.6% expected) and +3.1% year-on-year (vs +3.7% expected) year-on-year on the EU-harmonised measure. Italian February PPI came in at -1.3% month-on-month, and 10% year-on-year.

Finally on commodities, oil rose sharply again yesterday for its third gain out of the last 4 days, as Bloomberg reported that it is highly unlikely that exports from Iraq will resume this week. Officials from the Kurdistan Regional Government are set to re-enter discussions with Iraqi officials early next week. WTI crude contracts were up +1.92% to $74.37/bbl whilst Brent crude hit $79.27/bbl after climbing +1.26%.

Now to the day ahead. We have quite a busy day data wise, with the US PCE deflator data, the March MNI Chicago PMI and the February personal spending and income data. From the UK we have the March Lloyds business barometer and the Q4 current account balance. In Europe, we have the Eurozone March CPI data and the February unemployment. We will also see the release of the Italian March CPI and the January industrial index, the German march unemployment change, February retail sales and the import price index, and lastly the French March CPI. February CPI and consumer spending. Finally, we will hear from several central bankers, including the ECB’s Lagarde and Kazaks, as well as the Fed’s Williams, Waller and Cook.

Uncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

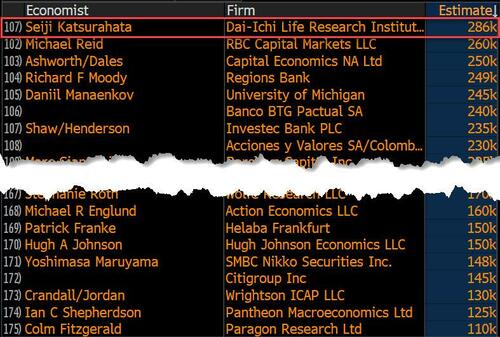

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

Uncategorized

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives…

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives floating around corporate media platforms has been the argument that the American people “just don’t seem to understand how good the economy really is right now.” If only they would look at the stats, they would realize that we are in the middle of a financial renaissance, right? It must be that people have been brainwashed by negative press from conservative sources…

I have to laugh at this notion because it’s a very common one throughout history – it’s an assertion made by almost every single political regime right before a major collapse. These people always say the same things, and when you study economics as long as I have you can’t help but throw up your hands and marvel at their dedication to the propaganda.

One example that comes to mind immediately is the delusional optimism of the “roaring” 1920s and the lead up to the Great Depression. At the time around 60% of the U.S. population was living in poverty conditions (according to the metrics of the decade) earning less than $2000 a year. However, in the years after WWI ravaged Europe, America’s economic power was considered unrivaled.

The 1920s was an era of mass production and rampant consumerism but it was all fueled by easy access to debt, a condition which had not really existed before in America. It was this illusion of prosperity created by the unchecked application of credit that eventually led to the massive stock market bubble and the crash of 1929. This implosion, along with the Federal Reserve’s policy of raising interest rates into economic weakness, created a black hole in the U.S. financial system for over a decade.

There are two primary tools that various failing regimes will often use to distort the true conditions of the economy: Debt and inflation. In the case of America today, we are experiencing BOTH problems simultaneously and this has made certain economic indicators appear healthy when they are, in fact, highly unstable. The average American knows this is the case because they see the effects everyday. They see the damage to their wallets, to their buying power, in the jobs market and in their quality of life. This is why public faith in the economy has been stuck in the dregs since 2021.

The establishment can flash out-of-context stats in people’s faces, but they can’t force the populace to see a recovery that simply does not exist. Let’s go through a short list of the most faulty indicators and the real reasons why the fiscal picture is not a rosy as the media would like us to believe…

The “miracle” labor market recovery

In the case of the U.S. labor market, we have a clear example of distortion through inflation. The $8 trillion+ dropped on the economy in the first 18 months of the pandemic response sent the system over the edge into stagflation land. Helicopter money has a habit of doing two things very well: Blowing up a bubble in stock markets and blowing up a bubble in retail. Hence, the massive rush by Americans to go out and buy, followed by the sudden labor shortage and the race to hire (mostly for low wage part-time jobs).

The problem with this “miracle” is that inflation leads to price explosions, which we have already experienced. The average American is spending around 30% more for goods, services and housing compared to what they were spending in 2020. This is what happens when you have too much money chasing too few goods and limited production.

The jobs market looks great on paper, but the majority of jobs generated in the past few years are jobs that returned after the covid lockdowns ended. The rest are jobs created through monetary stimulus and the artificial retail rush. Part time low wage service sector jobs are not going to keep the country rolling for very long in a stagflation environment. The question is, what happens now that the stimulus punch bowl has been removed?

Just as we witnessed in the 1920s, Americans have turned to debt to make up for higher prices and stagnant wages by maxing out their credit cards. With the central bank keeping interest rates high, the credit safety net will soon falter. This condition also goes for businesses; the same businesses that will jump headlong into mass layoffs when they realize the party is over. It happened during the Great Depression and it will happen again today.

Cracks in the foundation

We saw cracks in the narrative of the financial structure in 2023 with the banking crisis, and without the Federal Reserve backstop policy many more small and medium banks would have dropped dead. The weakness of U.S. banks is offset by the relative strength of the U.S. dollar, which lures in foreign investors hoping to protect their wealth using dollar denominated assets.

But something is amiss. Gold and bitcoin have rocketed higher along with economically sensitive assets and the dollar. This is the opposite of what’s supposed to happen. Gold and BTC are supposed to be hedges against a weak dollar and a weak economy, right? If global faith in the dollar and in the U.S. economy is so high, why are investors diving into protective assets like gold?

Again, as noted above, inflation distorts everything.

Tens of trillions of extra dollars printed by the Fed are floating around and it’s no surprise that much of that cash is flooding into the economy which simply pushes higher right along with prices on the shelf. But, gold and bitcoin are telling us a more honest story about what’s really happening.

Right now, the U.S. government is adding around $600 billion per month to the national debt as the Fed holds rates higher to fight inflation. This debt is going to crush America’s financial standing for global investors who will eventually ask HOW the U.S. is going to handle that growing millstone? As I predicted years ago, the Fed has created a perfect Catch-22 scenario in which the U.S. must either return to rampant inflation, or, face a debt crisis. In either case, U.S. dollar-denominated assets will lose their appeal and their prices will plummet.

“Healthy” GDP is a complete farce

GDP is the most common out-of-context stat used by governments to convince the citizenry that all is well. It is yet another stat that is entirely manipulated by inflation. It is also manipulated by the way in which modern governments define “economic activity.”

GDP is primarily driven by spending. Meaning, the higher inflation goes, the higher prices go, and the higher GDP climbs (to a point). Eventually prices go too high, credit cards tap out and spending ceases. But, for a short time inflation makes GDP (as well as retail sales) look good.

Another factor that creates a bubble is the fact that government spending is actually included in the calculation of GDP. That’s right, every dollar of your tax money that the government wastes helps the establishment by propping up GDP numbers. This is why government spending increases will never stop – It’s too valuable for them to spend as a way to make the economy appear healthier than it is.

The REAL economy is eclipsing the fake economy

The bottom line is that Americans used to be able to ignore the warning signs because their bank accounts were not being directly affected. This is over. Now, every person in the country is dealing with a massive decline in buying power and higher prices across the board on everything – from food and fuel to housing and financial assets alike. Even the wealthy are seeing a compression to their profit and many are struggling to keep their businesses in the black.

The unfortunate truth is that the elections of 2024 will probably be the turning point at which the whole edifice comes tumbling down. Even if the public votes for change, the system is already broken and cannot be repaired without a complete overhaul.

We have consistently avoided taking our medicine and our disease has gotten worse and worse.

People have lost faith in the economy because they have not faced this kind of uncertainty since the 1930s. Even the stagflation crisis of the 1970s will likely pale in comparison to what is about to happen. On the bright side, at least a large number of Americans are aware of the threat, as opposed to the 1920s when the vast majority of people were utterly conned by the government, the banks and the media into thinking all was well. Knowing is the first step to preparing.

The second step is securing your own financial future – that’s where physical precious metals can play a role. Diversifying your savings with inflation-resistant, uninflatable assets whose intrinsic value doesn’t rely on a counterparty’s promise to pay adds resilience to your savings. That’s the main reason physical gold and silver have been the safe haven store-of-value assets of choice for centuries (among both the elite and the everyday citizen).

* * *

As the world moves away from dollars and toward Central Bank Digital Currencies (CBDCs), is your 401(k) or IRA really safe? A smart and conservative move is to diversify into a physical gold IRA. That way your savings will be in something solid and enduring. Get your FREE info kit on Gold IRAs from Birch Gold Group. No strings attached, just peace of mind. Click here to secure your future today.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International13 hours ago

International13 hours agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges