Government

Southern Energy Corp. Announces Update Regarding Equity Financing

THIS ANNOUNCEMENT IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, JAPAN, NEW ZEALAND, SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE,…

THIS ANNOUNCEMENT IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, JAPAN, NEW ZEALAND, SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT CONSTITUTE: (A) A PROSPECTUS OR OFFERING MEMORANDUM; (B) AN ADMISSION DOCUMENT PREPARED IN ACCORDANCE WITH THE AIM RULES; OR (C) AN OFFER FOR SALE OR SUBSCRIPTION OF ANY SECURITIES IN THE COMPANY. THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMENDATION, OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE OR DISPOSE OF ANY SECURITIES OF Southern Energy Corp. IN ANY JURISDICTION IN WHICH ANY SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION (REGULATION 596/2014/EU) AS IT FORMS PART OF UK DOMESTIC LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT 2018, AS AMENDED. UPON PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

DEFINED TERMS USED IN THIS ANNOUNCEMENT HAVE THE SAME MEANING GIVEN TO THEM AS DEFINED IN THE COMPANY'S ANNOUNCEMENT RELEASED AT 17:47 (BST) ON 28 OCTOBER 2021 UNLESS OTHERWISE DEFINED HEREIN.

Southern Energy Corp. ("Southern" or the "Company") (TSXV:SOU)(AIM:SOUC), a U.S.-focused, growth-oriented natural gas producer, is pleased to provide an update following the announcement made on 28 October 2021 regarding its equity financing

Further to the previous announcement, the Company has raised, in aggregate, c. US$10 million (before expenses) through the offering of 114,944,000 Common Shares at a price of C$0.05 per Common Share pursuant to the Prospectus Offering led by Eight Capital, 93,899,553 new Common Shares at a price of 2.94 pence per Common Share pursuant to the Placing, and 41,156,461 new common shares at a price of 2.94 pence per Common Share pursuant to a direct subscription with the Company (the "Subscription") (together, the "Offering"). The Company has filed a final short form prospectus in connection with a Prospectus Offering.

Highlights:

- Equity financing will raise combined gross proceeds of c. US$10 million:

- c. US$4.6 million via a Prospectus Offering of 114,944,000 Common Shares (the "Prospectus Offering Shares");

- c. US$3.8 million via a Placing of 93,899,553 new Common Shares; and

- c. US$1.6 million via a direct subscription with the Company for 41,156,461 new Common Shares (the "Subscription Shares")

(together, the "Offering Shares")

- The net proceeds of the Offering will be used to drill up to three horizontal Selma Chalk wells in the Gwinville field, anticipated to begin in Q4 2021 and for working capital and general corporate purposes

- Subject to successful completion, first production from the wells is expected in Q1 2022

- Participants in the Offering include both new and existing institutional shareholders, as well as certain directors and senior managers of the Company

- Completion of the equity financing will introduce new UK-based investors and is expected to provide additional liquidity to the Company's Common Shares on AIM

Ian Atkinson, President and CEO of Southern, commented:

"We are delighted to provide this update regarding our previously announced equity financing, which will raise over c. US$10 million for the Company.

"The funds raised will immediately be deployed to drive value, with new production anticipated to be added in Q1 2022. Assuming the drilling program is successful, these additional Gwinville wells will add immediate cash flow to the business during a period of strong commodity prices.

"I would like to thank both new and existing shareholders for their support during this process, as we continue to build a robust, highly cash-generative business."

Admission and Total Voting Rights

The Prospectus Offering is expected to close on or about 24 November, 2021, subject to customary closing conditions.

The new common shares to be issued pursuant to the Offering will be issued credited as fully paid and will rank pari passu in all respects with the existing Common Shares from their admission to trading on AIM ("Admission").

The Company has applied to the London Stock Exchange plc for Admission of the Offering Shares and to the TSXV for approval of the listing of the Prospectus Offering Shares.

Subject to, inter alia, the placing agreement entered into between the Company, Hannam & Partners and Canaccord Genuity Limited having become unconditional and not having been terminated in accordance with its terms, it is expected that admission to trading on AIM of the Placing Shares and Subscription Shares will occur at 8:00 am on or around 24 November 2021.

Subject to, inter alia, the agency agreement entered into between the Company and the Agents having become unconditional and not having been terminated in accordance with its terms, as well as final TSXV approval of the listing of the Prospectus Offering Shares, it is expected that admission to trading on AIM and the TSXV of the Prospectus Offering Shares will occur at 8:00 am on or around 24 November 2021.

The Placing, Subscription and the Prospectus Offering are not interconditional and there can be no guarantee that any particular element or elements of the Offering will be completed.

Following Admission of the Offering Shares, the total number of Common Shares in the Company in issue will be 612,597,068 (the "Enlarged Share Capital"). This figure may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in the Company under the FCA's Disclosure Guidance and Transparency Rules.

The securities described herein have not been, and will not be, registered under the U.S. Securities Act or any state securities laws, and accordingly, may not be offered or sold within the United States except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom. This Announcement shall not constitute an offer to sell or the solicitation of an offer to buy any of the Company's securities to, or for the account or benefit of, persons in the United States, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. There has been and will be no public offer of the Company's securities in Australia, Japan, South Africa, the United States or elsewhere, other than the Prospectus Offering in each of the provinces of Canada, except Québec.

The Prospectus Offering is made only by prospectus. The final short form prospectus contains important detailed information about the securities being offered. Copies of the prospectus may be obtained on SEDAR at www.sedar.com or by contacting the lead agent at ecm@viiicapital.com. Investors should read the prospectus before making an investment decision.

Director/PDMR Participation

It is noted that certain Directors and PDMRs of the Company have participated in the Prospectus Offering, on the same terms as all other participants, to subscribe for, in aggregate, 4,840,816 Prospectus Offering Shares. Further details regarding individual participation of the Company's Directors and PDMRs is set out in the PDMR notification forms below.

About Southern Energy Corp.

Southern Energy Corp. is a natural gas exploration and production company. Southern has a primary focus on acquiring and developing conventional natural gas and light oil resources in the southeast Gulf States of Mississippi, Louisiana, and East Texas. Our management team has a long and successful history working together and have created significant shareholder value through accretive acquisitions, optimization of existing oil and natural gas fields and the utilization of re-development strategies utilizing horizontal drilling and multi-staged fracture completion techniques.

For further information, please contact:

| Ian Atkinson (President and CEO) Calvin Yau (VP Finance and CFO) | +1 587 287 5401 +1 587 287 5402 |

| Strand Hanson Limited - Nominated & Financial Adviser James Spinney / James Bellman Hannam & Partners - Joint Broker & Joint Bookrunner Samuel Merlin / Ernest Bell Canaccord Genuity - Joint Broker & Joint Bookrunner Henry Fitzgerald-O'Connor / James Asensio | +44 (0) 20 7409 3494 +44 (0) 20 7907 8500 +44 (0) 20 7523 8000 |

| Camarco James Crothers, Billy Clegg, Daniel Sherwen | +44 (0) 20 3757 4980 |

Forward Looking Statements

Certain information included in this Announcement constitutes forward-looking information under applicable securities legislation. Forward-looking information typically contains statements with words such as "anticipate", "believe", "expect", "plan", "intend", "estimate", "propose", "project" or similar words suggesting future outcomes or statements regarding an outlook. Forward-looking information in this Announcement may include, but is not limited to, statements concerning the Offering, including the terms thereof and the use of proceeds of the Offering, the Company's business strategy, objectives, strength and focus and the Company's capital program for the remainder of 2021.

The forward-looking statements contained in this Announcement are based on certain key expectations and assumptions made by Southern, including the timing of and success of future drilling, development and completion activities, the performance of existing wells, the performance of new wells, the availability and performance of facilities and pipelines, the geological characteristics of Southern's properties, the characteristics of its assets, the successful application of drilling, completion and seismic technology, benefits of current commodity pricing hedging arrangements, prevailing weather conditions, prevailing legislation affecting the oil and gas industry, commodity prices, royalty regimes and exchange rates, the application of regulatory and licensing requirements, the availability of capital, labour and services, the creditworthiness of industry partners and the ability to source and complete asset acquisitions.

Although Southern believes that the expectations and assumptions on which the forward- looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Southern can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, the risk that the Offering may not be completed on favorable terms or at all, the risk that the Company may not be able to obtain all necessary regulatory and stock exchange approvals, including the final approval of the TSXV and the London Stock Exchange, the risk that the Company may apply the proceeds of the Offering differently than as stated herein depending on future circumstances; risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks), constraint in the availability of services, negative effects of the current COVID-19 pandemic, commodity price and exchange rate fluctuations, changes in legislation impacting the oil and gas industry, adverse weather or break-up conditions and uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures. These and other risks are set out in more detail in the Preliminary Prospectus and Southern's most recent management's discussion and analysis and annual information form, which are available under the Company's SEDAR profile at www.sedar.com.

The forward-looking information contained in this Announcement is made as of the date hereof and Southern undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, unless required by applicable securities laws. The forward-looking information contained in this Announcement is expressly qualified by this cautionary statement.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

PDMR NOTIFICATION FORMS

| 1 | Details of the person discharging managerial responsibilities / person closely associated | |

| a) | Name | Ian Atkinson |

| 2 | Reason for the notification | |

| a) | Position/status | President and Chief Executive Officer (Director) |

| b) | Initial notification /Amendment | Initial notification |

| 3 | Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor | |

| a) | Name | Southern Energy Corp. |

| b) | LEI | 213800R25GL7J3EBJ698 |

| 4 | Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted | |

| a) | Description of the financial instrument, type of instrument | Common shares in Southern Energy Corp.. |

| Identification code | CA8428131079 | |

| b) | Nature of the transaction | Subscription for new common shares |

| c) | Price(s) and volume(s) | 400,000 common shares at a price of CAD0.05 |

| d) | Aggregated information | N/A |

| e) | Date of the transaction | 24 November 2021 |

| f) | Place of the transaction | Outside of a trading venue |

| 1 | Details of the person discharging managerial responsibilities / person closely associated | |

| a) | Name | Calvin Yau |

| 2 | Reason for the notification | |

| a) | Position/status | VP Finance and CFO |

| b) | Initial notification /Amendment | Initial notification |

| 3 | Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor | |

| a) | Name | Southern Energy Corp. |

| b) | LEI | 213800R25GL7J3EBJ698 |

| 4 | Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted | |

| a) | Description of the financial instrument, type of instrument | Common shares in Southern Energy Corp. |

| Identification code | CA8428131079 | |

| b) | Nature of the transaction | Subscription for new common shares |

| c) | Price(s) and volume(s) | 400,000 common shares at a price of CAD0.05 |

| d) | Aggregated information | N/A |

| e) | Date of the transaction | 24 November 2021 |

| f) | Place of the transaction | Outside of a trading venue |

| 1 | Details of the person discharging managerial responsibilities / person closely associated | |

| a) | Name | Erin Buschert |

| 2 | Reason for the notification | |

| a) | Position/status | VP Land |

| b) | Initial notification /Amendment | Initial notification |

| 3 | Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor | |

| a) | Name | Southern Energy Corp. |

| b) | LEI | 213800R25GL7J3EBJ698 |

| 4 | Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted | |

| a) | Description of the financial instrument, type of instrument | Common shares in Southern Energy Corp. |

| Identification code | CA8428131079 | |

| b) | Nature of the transaction | Subscription for new common shares |

| c) | Price(s) and volume(s) | 400,000 common shares at a price of CAD0.05 |

| d) | Aggregated information | N/A |

| e) | Date of the transaction | 24 November 2021 |

| f) | Place of the transaction | Outside of a trading venue |

| 1 | Details of the person discharging managerial responsibilities / person closely associated | |

| a) | Name | Gary McMurren |

| 2 | Reason for the notification | |

| a) | Position/status | VP Engineering |

| b) | Initial notification /Amendment | Initial notification |

| 3 | Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor | |

| a) | Name | Southern Energy Corp. |

| b) | LEI | 213800R25GL7J3EBJ698 |

| 4 | Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted | |

| a) | Description of the financial instrument, type of instrument | Common shares in Southern Energy Corp. |

| Identification code | CA8428131079 | |

| b) | Nature of the transaction | Subscription for new common shares |

| c) | Price(s) and volume(s) | 400,000 common shares at a price of CAD0.05 |

| d) | Aggregated information | N/A |

| e) | Date of the transaction | 24 November 2021 |

| f) | Place of the transaction | Outside of a trading venue |

| 1 | Details of the person discharging managerial responsibilities / person closely associated | |

| a) | Name | Bruce Beynon |

| 2 | Reason for the notification | |

| a) | Position/status | Director |

| b) | Initial notification /Amendment | Initial notification |

| 3 | Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor | |

| a) | Name | Southern Energy Corp. |

| b) | LEI | 213800R25GL7J3EBJ698 |

| 4 | Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted | |

| a) | Description of the financial instrument, type of instrument | Common shares in Southern Energy Corp. |

| Identification code | CA8428131079 | |

| b) | Nature of the transaction | Subscription for new common shares |

| c) | Price(s) and volume(s) | 1,200,000 common shares at a price of CAD0.05 |

| d) | Aggregated information | N/A |

| e) | Date of the transaction | 24 November 2021 |

| f) | Place of the transaction | Outside of a trading venue |

| 1 | Details of the person discharging managerial responsibilities / person closely associated | |

| a) | Name | Joseph Nally |

| 2 | Reason for the notification | |

| a) | Position/status | Director |

| b) | Initial notification /Amendment | Initial notification |

| 3 | Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor | |

| a) | Name | Southern Energy Corp. |

| b) | LEI | 213800R25GL7J3EBJ698 |

| 4 | Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted | |

| a) | Description of the financial instrument, type of instrument | Common shares in Southern Energy Corp. |

| Identification code | CA8428131079 | |

| b) | Nature of the transaction | Subscription for new common shares |

| c) | Price(s) and volume(s) | 2,040,816 common shares at a price of CAD0.05 |

| d) | Aggregated information | N/A |

| e) | Date of the transaction | 24 November 2021 |

| f) | Place of the transaction | Outside of a trading venue |

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Southern Energy Corp.

View source version on accesswire.com:

https://www.accesswire.com/673749/Southern-Energy-Corp-Announces-Update-Regarding-Equity-Financing

News Provided by ACCESSWIRE via QuoteMedia

tsx pandemic covid-19 tsx venture pence oil africa japan canada european uk euInternational

Health Officials: Man Dies From Bubonic Plague In New Mexico

Health Officials: Man Dies From Bubonic Plague In New Mexico

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Officials in…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

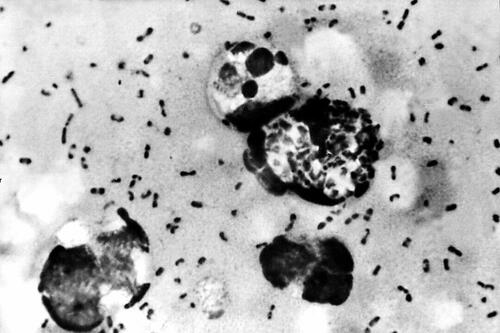

Officials in New Mexico confirmed that a resident died from the plague in the United States’ first fatal case in several years.

The New Mexico Department of Health, in a statement, said that a man in Lincoln County “succumbed to the plague.” The man, who was not identified, was hospitalized before his death, officials said.

They further noted that it is the first human case of plague in New Mexico since 2021 and also the first death since 2020, according to the statement. No other details were provided, including how the disease spread to the man.

The agency is now doing outreach in Lincoln County, while “an environmental assessment will also be conducted in the community to look for ongoing risk,” the statement continued.

“This tragic incident serves as a clear reminder of the threat posed by this ancient disease and emphasizes the need for heightened community awareness and proactive measures to prevent its spread,” the agency said.

A bacterial disease that spreads via rodents, it is generally spread to people through the bites of infected fleas. The plague, known as the black death or the bubonic plague, can spread by contact with infected animals such as rodents, pets, or wildlife.

The New Mexico Health Department statement said that pets such as dogs and cats that roam and hunt can bring infected fleas back into homes and put residents at risk.

Officials warned people in the area to “avoid sick or dead rodents and rabbits, and their nests and burrows” and to “prevent pets from roaming and hunting.”

“Talk to your veterinarian about using an appropriate flea control product on your pets as not all products are safe for cats, dogs or your children” and “have sick pets examined promptly by a veterinarian,” it added.

“See your doctor about any unexplained illness involving a sudden and severe fever, the statement continued, adding that locals should clean areas around their home that could house rodents like wood piles, junk piles, old vehicles, and brush piles.

The plague, which is spread by the bacteria Yersinia pestis, famously caused the deaths of an estimated hundreds of millions of Europeans in the 14th and 15th centuries following the Mongol invasions. In that pandemic, the bacteria spread via fleas on black rats, which historians say was not known by the people at the time.

Other outbreaks of the plague, such as the Plague of Justinian in the 6th century, are also believed to have killed about one-fifth of the population of the Byzantine Empire, according to historical records and accounts. In 2013, researchers said the Justinian plague was also caused by the Yersinia pestis bacteria.

But in the United States, it is considered a rare disease and usually occurs only in several countries worldwide. Generally, according to the Mayo Clinic, the bacteria affects only a few people in U.S. rural areas in Western states.

Recent cases have occurred mainly in Africa, Asia, and Latin America. Countries with frequent plague cases include Madagascar, the Democratic Republic of Congo, and Peru, the clinic says. There were multiple cases of plague reported in Inner Mongolia, China, in recent years, too.

Symptoms

Symptoms of a bubonic plague infection include headache, chills, fever, and weakness. Health officials say it can usually cause a painful swelling of lymph nodes in the groin, armpit, or neck areas. The swelling usually occurs within about two to eight days.

The disease can generally be treated with antibiotics, but it is usually deadly when not treated, the Mayo Clinic website says.

“Plague is considered a potential bioweapon. The U.S. government has plans and treatments in place if the disease is used as a weapon,” the website also says.

According to data from the U.S. Centers for Disease Control and Prevention, the last time that plague deaths were reported in the United States was in 2020 when two people died.

Government

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary of State Mike Pompeo said in a new interview that he’s not ruling out accepting a White House position if former President Donald Trump is reelected in November.

“If I get a chance to serve and think that I can make a difference ... I’m almost certainly going to say yes to that opportunity to try and deliver on behalf of the American people,” he told Fox News, when asked during a interview if he would work for President Trump again.

“I’m confident President Trump will be looking for people who will faithfully execute what it is he asked them to do,” Mr. Pompeo said during the interview, which aired on March 8. “I think as a president, you should always want that from everyone.”

He said that as a former secretary of state, “I certainly wanted my team to do what I was asking them to do and was enormously frustrated when I found that I couldn’t get them to do that.”

Mr. Pompeo, a former U.S. representative from Kansas, served as Central Intelligence Agency (CIA) director in the Trump administration from 2017 to 2018 before he was secretary of state from 2018 to 2021. After he left office, there was speculation that he could mount a Republican presidential bid in 2024, but announced that he wouldn’t be running.

President Trump hasn’t publicly commented about Mr. Pompeo’s remarks.

In 2023, amid speculation that he would make a run for the White House, Mr. Pompeo took a swipe at his former boss, telling Fox News at the time that “the Trump administration spent $6 trillion more than it took in, adding to the deficit.”

“That’s never the right direction for the country,” he said.

In a public appearance last year, Mr. Pompeo also appeared to take a shot at the 45th president by criticizing “celebrity leaders” when urging GOP voters to choose ahead of the 2024 election.

2024 Race

Mr. Pompeo’s interview comes as the former president was named the “presumptive nominee” by the Republican National Committee (RNC) last week after his last major Republican challenger, former South Carolina Gov. Nikki Haley, dropped out of the 2024 race after failing to secure enough delegates. President Trump won 14 out of 15 states on Super Tuesday, with only Vermont—which notably has an open primary—going for Ms. Haley, who served as President Trump’s U.S. ambassador to the United Nations.

On March 8, the RNC held a meeting in Houston during which committee members voted in favor of President Trump’s nomination.

“Congratulations to President Donald J. Trump on his huge primary victory!” the organization said in a statement last week. “I’d also like to congratulate Nikki Haley for running a hard-fought campaign and becoming the first woman to win a Republican presidential contest.”

Earlier this year, the former president criticized the idea of being named the presumptive nominee after reports suggested that the RNC would do so before the Super Tuesday contests and while Ms. Haley was still in the race.

Also on March 8, the RNC voted to name Trump-endorsed officials to head the organization. Michael Whatley, a North Carolina Republican, was elected the party’s new national chairman in a vote in Houston, and Lara Trump, the former president’s daughter-in-law, was voted in as co-chair.

“The RNC is going to be the vanguard of a movement that will work tirelessly every single day to elect our nominee, Donald J. Trump, as the 47th President of the United States,” Mr. Whatley told RNC members in a speech after being elected, replacing former chair Ronna McDaniel. Ms. Trump is expected to focus largely on fundraising and media appearances.

President Trump hasn’t signaled whom he would appoint to various federal agencies if he’s reelected in November. He also hasn’t said who his pick for a running mate would be, but has offered several suggestions in recent interviews.

In various interviews, the former president has mentioned Sen. Tim Scott (R-S.C.), Texas Gov. Greg Abbott, Rep. Elise Stefanik (R-N.Y.), Vivek Ramaswamy, Florida Gov. Ron DeSantis, and South Dakota Gov. Kristi Noem, among others.

International

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Is there a light forming when it comes to the long, dark and…

Is there a light forming when it comes to the long, dark and bewildering tunnel of social justice cultism? Global events have been so frenetic that many people might not remember, but only a couple years ago Big Tech companies and numerous governments were openly aligned in favor of mass censorship. Not just to prevent the public from investigating the facts surrounding the pandemic farce, but to silence anyone questioning the validity of woke concepts like trans ideology.

From 2020-2022 was the closest the west has come in a long time to a complete erasure of freedom of speech. Even today there are still countries and Europe and places like Canada or Australia that are charging forward with draconian speech laws. The phrase "radical speech" is starting to circulate within pro-censorship circles in reference to any platform where people are allowed to talk critically. What is radical speech? Basically, it's any discussion that runs contrary to the beliefs of the political left.

Open hatred of moderate or conservative ideals is perfectly acceptable, but don't ever shine a negative light on woke activism, or you might be a terrorist.

Riley Gaines has experienced this double standard first hand. She was even assaulted and taken hostage at an event in 2023 at San Francisco State University when leftists protester tried to trap her in a room and demanded she "pay them to let her go." Campus police allegedly witnessed the incident but charges were never filed and surveillance footage from the college was never released.

It's probably the last thing a champion female swimmer ever expects, but her head-on collision with the trans movement and the institutional conspiracy to push it on the public forced her to become a counter-culture voice of reason rather than just an athlete.

For years the independent media argued that no matter how much we expose the insanity of men posing as women to compete and dominate women's sports, nothing will really change until the real female athletes speak up and fight back. Riley Gaines and those like her represent that necessary rebellion and a desperately needed return to common sense and reason.

In a recent interview on the Joe Rogan Podcast, Gaines related some interesting information on the inner workings of the NCAA and the subversive schemes surrounding trans athletes. Not only were women participants essentially strong-armed by colleges and officials into quietly going along with the program, there was also a concerted propaganda effort. Competition ceremonies were rigged as vehicles for promoting trans athletes over everyone else.

The bottom line? The competitions didn't matter. The real women and their achievements didn't matter. The only thing that mattered to officials were the photo ops; dudes pretending to be chicks posing with awards for the gushing corporate media. The agenda took precedence.

Lia Thomas, formerly known as William Thomas, was more than an activist invading female sports, he was also apparently a science project fostered and protected by the athletic establishment. It's important to understand that the political left does not care about female athletes. They do not care about women's sports. They don't care about the integrity of the environments they co-opt. Their only goal is to identify viable platforms with social impact and take control of them. Women's sports are seen as a vehicle for public indoctrination, nothing more.

The reasons why they covet women's sports are varied, but a primary motive is the desire to assert the fallacy that men and women are "the same" psychologically as well as physically. They want the deconstruction of biological sex and identity as nothing more than "social constructs" subject to personal preference. If they can destroy what it means to be a man or a woman, they can destroy the very foundations of relationships, families and even procreation.

For now it seems as though the trans agenda is hitting a wall with much of the public aware of it and less afraid to criticize it. Social media companies might be able to silence some people, but they can't silence everyone. However, there is still a significant threat as the movement continues to target children through the public education system and women's sports are not out of the woods yet.

The ultimate solution is for women athletes around the world to organize and widely refuse to participate in any competitions in which biological men are allowed. The only way to save women's sports is for women to be willing to end them, at least until institutions that put doctrine ahead of logic are made irrelevant.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges