Softer detached housing values prompt new round of homebuying activity in hot pockets in the second quarter of 2022, says RE/MAX® Canada

Softer detached housing values prompt new round of homebuying activity in hot pockets in the second quarter of 2022, says RE/MAX® Canada

Canada NewsWire

TORONTO, Aug. 18, 2022

Last gasp effort to realize home ownership sends Q2 sales up over Q1 lev…

Softer detached housing values prompt new round of homebuying activity in hot pockets in the second quarter of 2022, says RE/MAX® Canada

Canada NewsWire

TORONTO, Aug. 18, 2022

Last gasp effort to realize home ownership sends Q2 sales up over Q1 levels in 40 per cent of GTA markets and 31 per cent of Greater Vancouver communities

TORONTO, Aug. 18, 2022 /CNW/ -- While detached housing values show substantial year-over-year gains in the first half of 2022, successive increases to the Bank of Canada's (BOC) overnight rate put a damper on price appreciation in the second quarter of the year in both the Greater Toronto and Vancouver Areas, according to a report released today by RE/MAX Canada.

To illustrate, the 2022 RE/MAX Hot Pocket Communities Report compared market activity in the first and second quarter of 2022 in terms of unit sales and prices, analyzing 60 Toronto Regional Real Estate Board (TRREB) districts, 16 regions within the Real Estate Board of Greater Vancouver (REBGV), and six areas in the Fraser Valley Real Estate Board (FVREB). In the Greater Toronto Area (GTA), the Central and West End of the 416 held up relatively well in terms of average price while Durham, Peel, York, Halton and Dufferin surrendered some of the staggering gains realized in recent years. Preliminary estimates of Q2 median prices in Greater Vancouver's Squamish area and the Sunshine Coast were comparable to first quarter figures, while West Vancouver and Vancouver West/Howe Sound reported moderate increases.

"Buyer sentiment changed virtually overnight as growing geopolitical concerns and spiralling inflation destabilized global markets, leaving the Bank of Canada little option but to raise interest rates," says Christopher Alexander, President, RE/MAX Canada. "Those fast and furious incremental increases placed downward pressure on housing sales and prices, improving affordability on one hand, but eroding it on the other."

RE/MAX found that second quarter values in the GTA were 10 to 15 per cent below Q1 levels in Durham (-14.6 per cent), York (-12.9 per cent), Halton (-12.7 per cent), Dufferin (-12 per cent) and Peel (-11.2 per cent). Just 15 per cent of GTA markets noted an uptick in average price in the second quarter of the compared to the heated first. Five of those markets are located in the central core, including Dufferin Grove, Little Portugal, Trinity-Bellwoods, Palmerston-Little Italy and Kensington-Chinatown (C01); Yonge-St. Clair, Casa Loma, Wychwood and the Annex (C02); Forest Hill South, Oakwood-Vaughan, Humewood-Cedarvale and Yonge-Eglinton (C03); Mount Pleasant East and West (C10); and Leaside and Thorncliffe Park(C11). Three are in the West End, including High Park North, Junction Area, Runnymede-Bloor West Village, Lambton-Baby Point, Dovercourt-Wallace, Emerson and Junction (W02); Stonegate-Queensway(W07); and Islington City Centre, West Etobicoke, West Mall, Markland Wood, Eringate-Centennial-West Deane, Princess, Rosethorn Edenbridge, Humber Valley, Kingsway South (W08). One market that experienced price growth is located the East End – South Riverdale, Greenwood-Coxwell, Blake-Jones and North Riverdale (E01).

DOWNLOAD THE PRICE AND SALES HEAT MAPS: Greater Toronto Area & Greater Vancouver Area/Fraser Valley

"Given that the core has traditionally been more resilient, bolstered by strong demand, a finite supply of homes available for sale, higher household incomes, and greater equity at the top end of the market, the results are not unexpected," says Alexander. "The price softening was clearly more evident in suburban areas and the outer perimeters of the 416, most of which experienced strong upward momentum during the height of the pandemic as buyers sought to leave the city."

Core markets in Vancouver West and West Vancouver/Howe Sound also bucked the downward price trend in in terms of preliminary estimates of Q2 median values, posting increases of 2.4 per cent and just over eight per cent respectively. Squamish and the Sunshine Coast also held steady, with no change reported between the first and second quarters. Seventy-five per cent of markets in Greater Vancouver, however, experienced a downturn in Q2 median values, coming off peak levels reported in the first quarter of the year. Most of the declines reported were below 10 per cent, with one outlier – Whistler/Pemberton, which fell by just over 16 per cent ($3,020,000 vs. $3,622,500). Given fewer sales and the types of detached properties in that particular market, an increase in the number of homes sold at lower price points could drag the median price down. In the Fraser Valley, percentage declines in average price ranged from a low of just over three per cent in Langley to a high of close to 13 per cent in Delta - North between the first and second quarter.

"While we have seen some easing in prices, the sky is nowhere near falling," explains Elton Ash, Executive Vice President, RE/MAX Canada. "In fact, there is relative stability in terms of market conditions, so buyers shouldn't expect big bargains. Sales-to-active listings remain squarely in balanced territory overall and even tight in some areas. In Vancouver, for example, supply was lower this June than last in 50 per cent of markets and sales are down accordingly. This trend will likely keep prices fairly stable moving forward."

RE/MAX REALTORS® also noted a reversal in pandemic trends over the past six months, as work from home situations change and buyers rethink the exodus to suburban and rural areas. Detached home sales rose in 40 per cent (24/60) of markets surveyed in the GTA in the second quarter of 2022, with the vast majority of increases noted the 416 area code (20/60). However, affordable price points also continued to draw buyers. Durham Region was also a hot spot with half of its markets reporting an uptick in home-buying activity (4/8). Greater Vancouver experienced an increase in sales in 31 per cent of markets (5/16), including Island-Gulf, North Vancouver, Squamish, Sunshine Coast and Whistler/Pemberton.

"For those buyers that were active in Q2, improved housing affordability due to easing prices and the threat of higher rates down the road clearly provided the impetus for many to leap into detached home ownership," explains Alexander. "Greater selection, particularly in coveted hot pockets, also played a significant role in April and May as the pandemic-fuelled buying spree drew to a close. Buyers locked into five-year fixed terms as the overnight rate hovered between one per cent in early April to 1.5 per cent in early June."

There have been some existing sellers who have used this opportunity to trade up to larger homes or more desirable neighbourhoods closer to the city. The 'spread' -- the difference between the selling price of an existing property and the purchase price of a new one -- has narrowed considerably, and given mortgage portability, the move can work in favour of the buyer. Condominium and strata owners have also seen benefits in the "spread" as values for their apartments and townhomes have remained relatively stable, while detached housing values have softened.

"Buying intentions overall are expected to remain healthy, even if some buyers pause temporarily," says Ash. "While interest-rate hikes have edged up carrying costs, we can't discount the effect of the tight rental market, which has seen average rents increase by double-digits year-over-year in the GVA and GTA. As potential buyers face those realities, many will still conclude that the benefits of ownership make better financial sense."

Several markets stood out in terms of sales in the Toronto Region. Some of the areas that have seen the greatest activity include Toronto's West End, where a single-detached home on a 50-ft. lot with a price tag under $1.5 million is still a possibility. Both W04 (comprised of Yorkdale-Glen Park, Briar Hill-Belgravia, Maple Leaf, Rustic, Brookhaven-Amesbury, Beechborough-Greenbrook, Mount Dennis, Weston and Humberlea-Pelmo Park) and W06 (which includes Alderwood, Long Branch, New Toronto, and Mimico) noted an uptick in sales in the second quarter compared to the first, with the average price in W04 hovering at just over $1.3 million and the average in W06 sitting at just under $1.5 million.

In the East End of the GTA, sales in E01 climbed 26.5 per cent in the second quarter compared to the first. With close proximity to the downtown core and the Lake Ontario shoreline, and an average price of $1,863,815, this community has proven exceptionally hardy under current circumstances.

Those seeking affordability helped prop up second-quarter sales in Ajax, Whitby, Clarington and Scugog in Durham Region. With the average price of a single-detached home hovering at just over $1 million in Clarington to just over $1.2 million in Ajax, the region has an abundance of entry-level product for cost-conscious buyers.

The top end of the market has also proven resilient overall throughout the GTA, with detached housing sales over $2 million up 10 per cent in the first half of the year compared to the same period in 2021. Not surprisingly, the softening in overall price has brought out the bargain hunters at luxury price points, which would explain the increase in sales in Bedford Park-Nortown, Lawrence Park North and South (C04), Rosedale, Moore Park (C09) and Leaside (C11) in the central core, where average prices hovered at just under $3 million, $4.1 million and $3.126 million respectively in the second quarter of the year.

Some of Vancouver's most durable areas have been in Burnaby, Coquitlam and Port Coquitlam. These established communities are drawing purchasers who are looking for affordable detached housing with good accessibility to the downtown core, with preliminary estimates of the Q2 median values ranging from just $1.445 million in Port Coquitlam to $2.12 million in Burnaby. North Vancouver and Squamish have also held up well, with both experiencing rapid growth well before it was further accelerated by the pandemic.

Despite the softening in housing markets overall, active detached housing listings in June were running almost 19 per cent below the 10-year average in the GTA, approximately 12 per cent below the 10-year average in the GVA and close to nine per cent below the 10-year average in Fraser Valley. This, at a time when builders are pulling up stakes and shelving proposed developments due to softer demand. While the impact of those decisions will not be felt immediately, the decision to withdraw will have major repercussions on housing markets in these major centres down the road.

"Inventory remains a puzzle that policy can't solve in the foreseeable short or long term," says Alexander. "It's a real challenge, as supply of detached homes remains low from a historical perspective and also in the context of population growth and future needs. This will remain a crucial factor impacting Toronto and Vancouver, which are now seen as world-class markets. Tougher market conditions and a possible recession will be major market hurdles, but history reminds us that recessions often bring strong rebounds. There's always a reason buyers say, 'I wish I'd bought back then.' Real estate has traditionally stood the test of time. Looking ahead, urbanization alone will be a significant boon to future housing demand, as Canada's urban population is projected to grow by 10 million by 20501."

1 https://esa.un.org/unpd/wup/Publications/Files/WUP2014-Highlights.pdf

As one of the leading global real estate franchisors, RE/MAX, LLC is a subsidiary of RE/MAX Holdings (NYSE: RMAX) with more than 140,000 agents in almost 9,000 offices with a presence in more than 110 countries and territories. RE/MAX Canada refers to RE/MAX of Western Canada (1998), LLC and RE/MAX Ontario-Atlantic Canada, Inc., and RE/MAX Promotions, Inc., each of which are affiliates of RE/MAX, LLC. Nobody in the world sells more real estate than RE/MAX, as measured by residential transaction sides.

RE/MAX was founded in 1973 by Dave and Gail Liniger, with an innovative, entrepreneurial culture affording its agents and franchisees the flexibility to operate their businesses with great independence. RE/MAX agents have lived, worked and served in their local communities for decades, raising millions of dollars every year for Children's Miracle Network Hospitals® and other charities. To learn more about RE/MAX, to search home listings or find an agent in your community, please visit remax.ca. For the latest news from RE/MAX Canada, please visit blog.remax.ca.

This report includes "forward-looking statements" within the meaning of the "safe harbour" provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as "believe," "intend," "expect," "estimate," "plan," "outlook," "project," and other similar words and expressions that predict or indicate future events or trends that are not statements of historical matters. These forward-looking statements include statements regarding housing market conditions and the Company's results of operations, performance and growth. Forward-looking statements should not be read as guarantees of future performance or results. Forward-looking statements are based on information available at the time those statements are made and/or management's good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. These risks and uncertainties include (1) the global COVID-19 pandemic, which has impacted the Company and continues to pose significant and widespread risks to the Company's business, the Company's ability to successfully close the anticipated reacquisition and to integrate the reacquired regions into its business, (3) changes in the real estate market or interest rates and availability of financing, (4) changes in business and economic activity in general, (5) the Company's ability to attract and retain quality franchisees, (6) the Company's franchisees' ability to recruit and retain real estate agents and mortgage loan originators, (7) changes in laws and regulations, (8) the Company's ability to enhance, market, and protect the RE/MAX and Motto Mortgage brands, (9) the Company's ability to implement its technology initiatives, and (10) fluctuations in foreign currency exchange rates, and those risks and uncertainties described in the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission ("SEC") and similar disclosures in subsequent periodic and current reports filed with the SEC, which are available on the investor relations page of the Company's website at www.remax.com and on the SEC website at www.sec.gov. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Except as required by law, the Company does not intend, and undertakes no duty, to update this information to reflect future events or circumstances.

SOURCE RE/MAX Canada

Uncategorized

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

One month after the inflation outlook tracked…

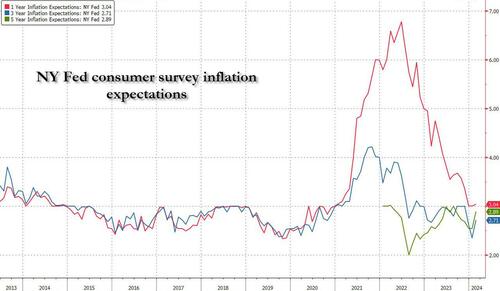

One month after the inflation outlook tracked by the NY Fed Consumer Survey extended their late 2023 slide, with 3Y inflation expectations in January sliding to a record low 2.4% (from 2.6% in December), even as 1 and 5Y inflation forecasts remained flat, moments ago the NY Fed reported that in February there was a sharp rebound in longer-term inflation expectations, rising to 2.7% from 2.4% at the three-year ahead horizon, and jumping to 2.9% from 2.5% at the five-year ahead horizon, while the 1Y inflation outlook was flat for the 3rd month in a row, stuck at 3.0%.

The increases in both the three-year ahead and five-year ahead measures were most pronounced for respondents with at most high school degrees (in other words, the "really smart folks" are expecting deflation soon). The survey’s measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) decreased at all horizons, while the median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—declined at the one- and three-year ahead horizons and remained unchanged at the five-year ahead horizon.

Going down the survey, we find that the median year-ahead expected price changes increased by 0.1 percentage point to 4.3% for gas; decreased by 1.8 percentage points to 6.8% for the cost of medical care (its lowest reading since September 2020); decreased by 0.1 percentage point to 5.8% for the cost of a college education; and surprisingly decreased by 0.3 percentage point for rent to 6.1% (its lowest reading since December 2020), and remained flat for food at 4.9%.

We find the rent expectations surprising because it is happening just asking rents are rising across the country.

At the same time as consumers erroneously saw sharply lower rents, median home price growth expectations remained unchanged for the fifth consecutive month at 3.0%.

Turning to the labor market, the survey found that the average perceived likelihood of voluntary and involuntary job separations increased, while the perceived likelihood of finding a job (in the event of a job loss) declined. "The mean probability of leaving one’s job voluntarily in the next 12 months also increased, by 1.8 percentage points to 19.5%."

Mean unemployment expectations - or the mean probability that the U.S. unemployment rate will be higher one year from now - decreased by 1.1 percentage points to 36.1%, the lowest reading since February 2022. Additionally, the median one-year-ahead expected earnings growth was unchanged at 2.8%, remaining slightly below its 12-month trailing average of 2.9%.

Turning to household finance, we find the following:

- The median expected growth in household income remained unchanged at 3.1%. The series has been moving within a narrow range of 2.9% to 3.3% since January 2023, and remains above the February 2020 pre-pandemic level of 2.7%.

- Median household spending growth expectations increased by 0.2 percentage point to 5.2%. The increase was driven by respondents with a high school degree or less.

- Median year-ahead expected growth in government debt increased to 9.3% from 8.9%.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 0.6 percentage point to 26.1%, remaining below its 12-month trailing average of 30%.

- Perceptions about households’ current financial situations deteriorated somewhat with fewer respondents reporting being better off than a year ago. Year-ahead expectations also deteriorated marginally with a smaller share of respondents expecting to be better off and a slightly larger share of respondents expecting to be worse off a year from now.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now increased by 1.4 percentage point to 38.9%.

- At the same time, perceptions and expectations about credit access turned less optimistic: "Perceptions of credit access compared to a year ago deteriorated with a larger share of respondents reporting tighter conditions and a smaller share reporting looser conditions compared to a year ago."

Also, a smaller percentage of consumers, 11.45% vs 12.14% in prior month, expect to not be able to make minimum debt payment over the next three months

Last, and perhaps most humorous, is the now traditional cognitive dissonance one observes with these polls, because at a time when long-term inflation expectations jumped, which clearly suggests that financial conditions will need to be tightened, the number of respondents expecting higher stock prices one year from today jumped to the highest since November 2021... which incidentally is just when the market topped out during the last cycle before suffering a painful bear market.

International

This is the biggest money mistake you’re making during travel

A retail expert talks of some common money mistakes travelers make on their trips.

Travel is expensive. Despite the explosion of travel demand in the two years since the world opened up from the pandemic, survey after survey shows that financial reasons are the biggest factor keeping some from taking their desired trips.

Airfare, accommodation as well as food and entertainment during the trip have all outpaced inflation over the last four years.

Related: This is why we're still spending an insane amount of money on travel

But while there are multiple tricks and “travel hacks” for finding cheaper plane tickets and accommodation, the biggest financial mistake that leads to blown travel budgets is much smaller and more insidious.

This is what you should (and shouldn’t) spend your money on while abroad

“When it comes to traveling, it's hard to resist buying items so you can have a piece of that memory at home,” Kristen Gall, a retail expert who heads the financial planning section at points-back platform Rakuten, told Travel + Leisure in an interview. “However, it's important to remember that you don't need every souvenir that catches your eye.”

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

According to Gall, souvenirs not only have a tendency to add up in price but also weight which can in turn require one to pay for extra weight or even another suitcase at the airport — over the last two months, airlines like Delta (DAL) , American Airlines (AAL) and JetBlue Airways (JBLU) have all followed each other in increasing baggage prices to in some cases as much as $60 for a first bag and $100 for a second one.

While such extras may not seem like a lot compared to the thousands one might have spent on the hotel and ticket, they all have what is sometimes known as a “coffee” or “takeout effect” in which small expenses can lead one to overspend by a large amount.

‘Save up for one special thing rather than a bunch of trinkets…’

“When traveling abroad, I recommend only purchasing items that you can't get back at home, or that are small enough to not impact your luggage weight,” Gall said. “If you’re set on bringing home a souvenir, save up for one special thing, rather than wasting your money on a bunch of trinkets you may not think twice about once you return home.”

Along with the immediate costs, there is also the risk of purchasing things that go to waste when returning home from an international vacation. Alcohol is subject to airlines’ liquid rules while certain types of foods, particularly meat and other animal products, can be confiscated by customs.

While one incident of losing an expensive bottle of liquor or cheese brought back from a country like France will often make travelers forever careful, those who travel internationally less frequently will often be unaware of specific rules and be forced to part with something they spent money on at the airport.

“It's important to keep in mind that you're going to have to travel back with everything you purchased,” Gall continued. “[…] Be careful when buying food or wine, as it may not make it through customs. Foods like chocolate are typically fine, but items like meat and produce are likely prohibited to come back into the country.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic franceSpread & Containment

A major cruise line is testing a monthly subscription service

The Cruise Scarlet Summer Season Pass was designed with remote workers in mind.

While going on a cruise once meant disconnecting from the world when between ports because any WiFi available aboard was glitchy and expensive, advances in technology over the last decade have enabled millions to not only stay in touch with home but even work remotely.

With such remote workers and digital nomads in mind, Virgin Voyages has designed a monthly pass that gives those who want to work from the seas a WFH setup on its Scarlet Lady ship — while the latter acronym usually means "work from home," the cruise line is advertising as "work from the helm.”

Related: Royal Caribbean shares a warning with passengers

"Inspired by Richard Branson's belief and track record that brilliant work is best paired with a hearty dose of fun, we're welcoming Sailors on board Scarlet Lady for a full month to help them achieve that perfect work-life balance," Virgin Voyages said in announcing its new promotion. "Take a vacation away from your monotonous work-from-home set up (sorry, but…not sorry) and start taking calls from your private balcony overlooking the Mediterranean sea."

Shutterstock

This is how much it'll cost you to work from a cruise ship for a month

While the single most important feature for successful work at sea — WiFi — is already available for free on Virgin cruises, the new Scarlet Summer Season Pass includes a faster connection, a $10 daily coffee credit, access to a private rooftop, and other member-only areas as well as wash and fold laundry service that Virgin advertises as a perk that will allow one to concentrate on work

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

The pass starts at $9,990 for a two-guest cabin and is available for four monthlong cruises departing in June, July, August, and September — each departs from ports such as Barcelona, Marseille, and Palma de Mallorca and spends four weeks touring around the Mediterranean.

Longer cruises are becoming more common, here's why

The new pass is essentially a version of an upgraded cruise package with additional perks but is specifically tailored to those who plan on working from the ship as an opportunity to market to them.

"Stay connected to your work with the fastest at-sea internet in the biz when you want and log-off to let the exquisite landscape of the Mediterranean inspire you when you need," reads the promotional material for the pass.

Amid the rise of remote work post-pandemic, cruise lines have been seeing growing interest in longer journeys in which many of the passengers not just vacation in the traditional sense but work from a mobile office.

In 2023, Turkish cruise line operator Miray even started selling cabins on a three-year tour around the world but the endeavor hit the rocks after one of the engineers declared the MV Gemini ship the company planned to use for the journey "unseaworthy" and the cruise ship line dealt with a PR scandal that ultimately sank the project before it could take off.

While three years at sea would have set a record as the longest cruise journey on the market, companies such as Royal Caribbean (RCL) (both with its namesake brand and its Celebrity Cruises line) have been offering increasingly long cruises that serve as many people’s temporary homes and cross through multiple continents.

stocks pandemic testing-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex