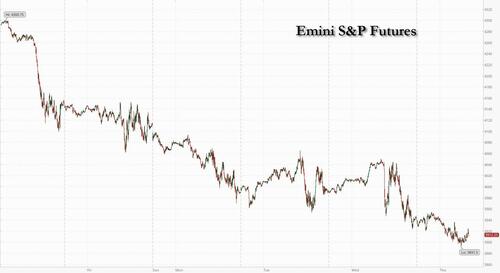

Slow-Motion Crash Drags Futures Below 3,900; Yields, Cryptos Tumble

Slow-Motion Crash Drags Futures Below 3,900; Yields, Cryptos Tumble

The relentless slow-motion crash sparked by the Biden Fed (which is hoping…

The relentless slow-motion crash sparked by the Biden Fed (which is hoping that a market collapse will halt inflation) that has sent stocks lower for the past 6 weeks continued overnight, and Wall Street’s main equity indexes were set for more declines after losing $6.3 trillion in value since their late-March high as stubborn inflation in the world’s biggest economy bolstered the case for more aggressive monetary tightening by the Federal Reserve.

Nasdaq 100 futures were down 0.7% at 730am in New York, a day after the underlying gauge sank to its lowest since November 2020 on concerns that higher-than-expected inflation in April would lead to an even more aggressive pace of policy tightening by the Fed. S&P 500 were last down -1% and dropping below 3,900, the level. And with eminis trading around 3,900 means that stocks are now at bearish Morgan Stanley's year-end base case price target of 3900, and 100 points away from Michael Hartnett's Fed put of 3,800.

The dollar continues its relentless ascent, sending the euro to a five-year low while the yen also perked up, as investors took a cue from a rally in bonds and ploughed into “safe-haven” currencies on concerns about inflation risks to global economic growth. Meanwhile, bonds around the globe are surging as fears mount over an economic slowdown and traders start pricing in the next recession, sending the yield on 10-year German bunds and US Treasuries down more than 10 basis points to about 2.82%.

Among notable premarket moves, Disney shares dropped after the media giant said growth in the second half of the year may not be as fast as previously expected, while Beyond Meat slumped 24% as Barclays downgraded the stock and analysts slashed their price targets following underwhelming results. Bank stocks slump in premarket trading Thursday, set for a sixth straight day of losses. In corporate news, Carlyle Group is set to buy Chinese packaging firm HCP for about $1 billion. Meanwhile, Brookfield Asset Management said it plans to list 25% of its asset-management business in a transaction that would value the new entity at $80 billion. Economic data due late today include initial jobless claims. Here are all the notable premarket movers:

- Disney (DIS US) shares drop 4.8% in premarket trading after the media giant said growth in the second half of the year may not be as fast as previously expected.

- Apple (AAPL US) shares fall as much as 1.4% in premarket trading Thursday, putting them on course to open more than 20% below their January peak.

- Beyond Meat (BYND US) shares slump 24% in US premarket trading as analysts slashed their targets on the plant-based food company following underwhelming results.

- Riot Blockchain (RIOT US) -6.1% in premarket trading, Marathon Digital (MARA US) -5.8%, MicroStrategy (MSTR US)-10% and Coinbase (COIN US) -7.3%

- Zoom (ZM US) shares decline as much as 4.5% in US premarket as Piper Sandler analyst James Fish cut the recommendation on the stock to neutral as he sees limited upside to paid video service.

- Dutch Bros (BROS US) slumps 42% in premarket trading after the drive-thru coffee chain’s guidance lagged analyst estimates, though some analysts see the dip in shares as a buying opportunity.

- Lordstown Motors (RIDE US) shares jump as much as 27% in U.S. premarket trading after the electric truck maker completed the sale of its factory to Foxconn.

- Rivian (RIVN US) gains 2.9% in premarket trading after the electric vehicle startup reaffirmed its annual production guidance, even as it navigates through supply chain snarls.

- Coupang (CPNG US) shares jump as much as 18% in US premarket trading after the Korean e- commerce firm reported a first-quarter loss per share that was narrower than analysts’ expectations.

- Bumble (BMBL US) shares rise 8.3% in premarket after the company reported first-quarter results that beat expectations, despite currency risks and those related to the war in Ukraine.

Cryptocurrency-exposed stocks also fell as digital tokens resumed declines after the collapse of the TerraUSD stablecoin, overnight the largest stablecoin, Tether, broke the buck spooking markets further that the contagion is spreading.

The hotter-than-expected inflation reading for April raised concern the Fed’s hikes aren’t bringing down prices fast enough and policy makers may have to resort to a 75bps move, rather than the half-point pace markets have come to grips with. Worries such a shift would crimp economic growth, combined with Russia’s war in Ukraine and China’s struggles with Covid, are battering risk assets.

The data halted a minor rebound in US equities, which are set for their longest weekly streak of losses since 2011, as investors worried that hawkish moves by central banks at a time of surging commodity prices and slowing earnings growth would spark a recession. While some strategists have said the rout has now made stock valuations attractive, others including Michael Wilson at Morgan Stanley warned of a bigger selloff.

“What these wild market moves are telling us is that investors have very little idea of whether we’re near a short-term base, or whether we’ve got further to fall,” said Michael Hewson, chief market analyst at CMC Markets UK.

“The higher-than-expected CPI figure may further fuel fears that the Fed will take policy higher than expected for longer than expected, draining precious liquidity from markets, which have until late been awash with it,” said Russ Mould, investment director at AJ Bell. “Until we get a meaningful move lower in inflation, not only one print, but a consistent two, three, four prints moving in the right direction, this market may remain range bound,” Mona Mahajan, senior investment strategist at Edward Jones & Co., said on Bloomberg Television.

Citigroup Inc. strategists said growth stocks, including the battered tech sector, will likely remain under pressure as central banks tighten monetary policy, driving yields higher. “Now that central banks are unwinding monetary support, growth stocks’ valuations have further to fall,” strategists including Robert Buckland wrote in a note. They are especially wary of growth stocks in the US, where the Nasdaq 100 is down 27% this year.

In Europe, the Stoxx 600 was down 2.2% with mining and consumer-products stocks leading declines. The Euro Stoxx 50 drops as much as 2.8%, Haven currencies perform well. The Stoxx 600 Basic Resources sub-index erased all YTD gains as a slide in metal prices and concerns about inflation fueled a selloff in the sector. Miners are the biggest laggard in the broader European equity benchmark on Thursday as major miners and steelmakers slip along with copper and iron ore prices. The basic resources sector (the sector is still second-best performing in Europe this year so far) fell as much as 5.6%, briefly erasing all YTD losses, and down to the lowest since January 3. Morgan Stanley strategists had downgraded miners to neutral on Wednesday, saying it’s time to take profits in the sector amid concerns inflation will lead to demand destruction. Here are the biggest movers:

- Telefonica shares rise as much as 4.5% after the Spanish carrier reported what analysts said was a solid set of quarterly earnings.

- STMicroelectronics gains as much as 4.1% as the chipmaker projects annual revenue of more than $20 billion for 2025-2027 period.

- Compass Group climbs as much as 2.5%, adding to Wednesday’s 7.4% advance, with Morgan Stanley lifting its price target to a Street-high.

- JD Sports rises as much as 3% after the UK sportswear chain said like-for-like sales for the 14-week period to May 7 were more than 5% higher than a year earlier.

- AS Roma advances as much as 15% after US billionaire Dan Friedkin made a tender offer for the roughly 13% of the Italian football team he doesn’t already own.

- The Stoxx 600 Basic Resources sub- index erases all YTD gains as a slide in metal prices and concerns about inflation fuel a selloff.

- Rio Tinto declines as much as 6%, Glencore -7.3%, Anglo American -6.9%, ArcelorMittal -4.8%, Antofagasta -7.9%

- Luxury stocks resume their declines after high US inflation bolstered the case for aggressive monetary tightening, deepening fears of an economic slowdown.

- Kering slides as much as 5.6%, Hermes -5.5% and Swatch -3.7%

- SalMar falls as much as 8.2% after the Norwegian salmon farmer published its latest quarterly earnings, which included a miss on operating Ebit.

Earlier in the session, Asian stocks resumed their slide after Wednesday’s modest gains, as US inflation topped estimates and new Covid-19 community cases in Shanghai damped prospects for a reopening. The MSCI Asia Pacific Index fell as much as 2%, with tech giants Alibaba and TSMC weighing the most on the gauge. Chinese shares snapped a two-day advance after Shanghai found two infections outside of isolation centers, pushing back the timeline for a relaxation of growth-sapping lockdowns. US inflation remained above 8% in April, keeping the Federal Reserve on the path of aggressive tightening. That prospect weighed on shares in Asia, as investors also factored in growth implications from continued lockdowns in the world’s second-largest economy. Markets appeared to be unimpressed by China’s Premier Li Keqiang’s comments urging officials to use fiscal and monetary policies to stabilize employment and the economy. Valuations for the MSCI Asia Pacific Index are hurtling toward pandemic lows as the index records a 29% decline from its 2021 peak, posting declines in all but one of the trading sessions so far this month.

“We’ve seen nearly the same amount of foreign investor selling in Asia as we saw during the global financial crisis, even though operating conditions aren’t as bad,” Timothy Moe, chief Asia-Pacific equity strategist at Goldman Sachs, told Bloomberg Television. “On our expected conditions over the next year, somewhere around 13 times should be a fair and appropriate valuation for Asian markets,” he added. Benchmarks in Indonesia and Taiwan were among the biggest decliners in the region, with the Jakarta Composite Index on the cusp of erasing gains for the year. Hong Kong shares also fell as the city intervened to defend its currency for the first time since 2019

In FX, the Bloomberg Dollar Spot Index rose to a fresh two-year high as the greenback climbed versus all of its Group-of-10 peers apart from the yen. The demand for havens sent the yield on 10-year German bunds and US Treasuries down more than 10 basis points. Stops were triggered in the euro below $1.0490 and 1.0450, weighed by EUR/CHF selling and yen buying across the board, according to traders. The yen rose by as much as 1.2% against the greenback as selling in stocks hurt risk sentiment. The BOJ indicated its lack of appetite for changing policy to help address a slide in the yen to a two-decade low during discussions at a meeting last month, according to a summary of opinions from the gathering. The Australian and New Zealand dollars fell on concern that lockdowns in China’s financial capital will extend, dragging economic growth in the world’s biggest buyer of commodities.

In rates, Treasuries extended Wednesday’s rally with yields richer by 6bp to 9bp across the curve, supported by risk-aversion as stocks extend losses. US 10-year yields around 2.82%, down 10bps on the session, and trailing gilts and bunds by 2.2bp and 3bp in the sector; intermediates lead the US curve, richening the 2s5s30s fly by 4bp on the day to tightest levels since March 23. Eurodollars are bid as well with the strip flattening out to early 2024 as rate-hike premium continues to erode. European fixed income extends gains. German and US curves bull-steepen; bunds outperform, richening ~12bps across the belly. Gilts bull-flatten, focusing on soft March GDP data over hawkish comments from BOE’s Ramsden. STIRs are similarly well bid with red pack euribor, eurodollar and sonia futures all up over 10 ticks. The US auction cycle concludes with $22b 30-year bond sale at 1pm ET; Wednesday’s 10-year is trading more than 10bp lower in yield after 1.4bp auction tail. WI 30-year around 2.965% is above auction stops since March 2019 and ~15bp cheaper than April stop-out. Super-long sectors led gains in Japanese bonds even as the 30-year sale was seen sluggish.

In commodities, base metals were under pressure; LME tin slumps over 8%, zinc down over 3.5%. European natural gas surged as much as 13% on supply concerns. Crude futures drop, fading roughly half of Wednesday’s rally. WTI is down over 2% near $103.50. Spot gold trades a narrow range near $1,850/oz. European natural gas prices jumped as disruptions to a key transit route through Ukraine and a move by Moscow to retaliate against sanctions ramped up the risk of supply cuts. Shanghai found two Covid cases outside government-run isolation centers on Wednesday, according to state-run CCTV, dampening prospects for potential easing of lockdowns. Prices of iron ore, the biggest commodity export from Australia, also fell on the news.

Looking at the day, data releases include the US PPI reading for April, the weekly initial jobless claims, and UK GDP for Q1. Central bank speakers include the ECB’s De Cos and Makhlouf. And in the political sphere, US President Biden will be hosting ASEAN leaders at the White House, whilst G7 foreign ministers are meeting in Germany.

Market Snapshot

- S&P 500 futures down 0.6% to 3,907.50

- STOXX Europe 600 down 1.9% to 419.41

- MXAP down 1.7% to 157.21

- MXAPJ down 2.5% to 512.05

- Nikkei down 1.8% to 25,748.72

- Topix down 1.2% to 1,829.18

- Hang Seng Index down 2.2% to 19,380.34

- Shanghai Composite down 0.1% to 3,054.99

- Sensex down 2.1% to 52,935.64

- Australia S&P/ASX 200 down 1.8% to 6,941.03

- Kospi down 1.6% to 2,550.08

- Gold spot down 0.1% to $1,849.85

- U.S. Dollar Index up 0.48% to 104.34

- German 10Y yield little changed at 0.89%

- Euro down 0.6% to $1.0449

- Brent Futures down 2.0% to $105.32/bbl

Top Overnight News from Bloomberg

- The EU is looking at creating bond futures and repurchase agreements to bolster its pandemic-era debt program

- The BOE will have to raise interest rates further to control surging prices, and there’s a risk that the UK’s worst inflation crisis in decades will take longer to ease fully, according to Deputy Governor Dave Ramsden

- The UK economy unexpectedly contracted in March. Gross domestic product fell 0.1% from February, when growth was flat. It meant the economy expanded just 0.8% in the first quarter, less than the 1% forecast by economists

- UK Prime Minister Boris Johnson will spend the next few days considering whether the UK will introduce legislation to override its post- Brexit settlement with the EU, a move that risks sparking a trade war

- A massive sell-off in cryptocurrencies wiped over $200 billion of wealth from the market in just 24 hours, according to estimates from price-tracking website CoinMarketCap

- Finland’s highest-ranking policy makers President Sauli Niinisto and Prime Minister Sanna Marin threw their weight behind an application and Sweden’s government is likely to do so in the coming days

- Sweden’s Riksbank’s target measure, CPIF, accelerated to 6.4% on an annual basis in April, the highest level since 1991, according to data released on Thursday. Economists surveyed by Bloomberg expected prices to rise by 6.2%

A more detailed look at global markets courtesy of Newsquawk

Asia-Pc stocks were pressured after the losses on Wall St where the major indices whipsawed in the aftermath of the firmer than expected CPI data and the DJIA posted a fifth consecutive losing streak. ASX 200 was lower amid heavy losses in tech and with financials subdued after flat earnings from Australia’s largest lender CBA. Nikkei 225 weakened with attention on earnings updates and with SoftBank amongst the worst performers ahead of its results later with the Co. anticipated to have suffered a record quarterly loss. Hang Seng and Shanghai Comp were subdued with early pressure from default concerns after developer Sunac China missed its grace period deadline and warned there was no assurance that the group will be able to meet financial obligations, although the mainland bourse recovered its earlier losses after further policy support pledges by Chinese authorities. SoftBank (9984 JT) - FY revenue JPY 6.2trln (prev. 5.6trln Y/Y). FY net profits -1.7trln (prev. +4.99trln). Foxconn (2317 TT) Q1 net profit TWD 29.45bln (exp. 29.76bln); sees Q2 revenue flat Y/Y, sees smart consumer electronics slightly declining Y/Y.

Top Asian News

- Rupee Tumbles to a Record Low, Stocks Slump on Inflation Woes

- SoftBank Vision Fund Posts a Record Loss as Son’s Bets Fail

- Yen Rebound Tipped as Recession Fears Push Down Treasury Yields

- More Defaults Seen Following Sunac’s Failure: Evergrande Update

European bourses are pressured as overnight risk sentiment reverberated into the region, in a continuation of the post-CPI Wall St. move; Euro Stoxx 50 -2.5%. US futures are lower across the board though the magnitude is less extreme, ES -0.6%; NQ fails to benefit from the yield pullback as participants focus on the normalisation's impact on tech. Walt Disney Co (DIS) - Q2 2022 (USD): Adj. EPS 1.08 (exp. 1.19), Revenue 19.25bln (exp. 20.03bln). Disney+ subscribers 137.7mln (exp. 134.4mln). ESPN+ subscribers 22.3mln (exp. 22.5mln) -5.0% in the pre-market.

Top European News

- UK Retailers Sue Truckmakers Over Alleged Price Fixing

- Rokos Raising $1 Billion as He Joins Macro Hedge Fund Surge

- Siemens Abandons Russian Market After 170-Year Relationship

- Hargreaves Tumbles as Peel Notes Macro, Geopolitical Impacts

FX

- DXY tops 104.500 to set new 2022 peak as risk aversion intensifies.

- Yen regains safe haven premium to buck broadly weak trend vs Dollar, USD/JPY sub-128.50 vs top just over 130.00.

- Aussie and Kiwi flounder as commodities tumble on demand dynamics'; AUD/USD under 0.6900 and NZD/USD below 0.6250.

- Euro and Sterling give up big figure levels with the Pound also undermined by worse than forecast UK data; EUR/USD down through 1.0500 then 1.0450, Cable beneath 1.2200 and eyeing 1.2150 next.

- Swedish Crown holds up in wake of stronger than expected CPI and CPIF metrics; EUR/SEK straddles 10.6000.

- Yuan crushed as PBoC and Chinese Government reaffirm commitment to provide economic support; USD/CNY 6.7900+, USD/CNH just shy of 6.8300.

- Forint falls as NBH Deputy Governor contends that aggressive tightening period is over and future hikes likely more incremental.

- HKMA picks up pace of intervention to defend HKD peg, CNB steps in to support CZK.

Fixed Income

- Debt revival gathers pace amidst risk-off positioning elsewhere.

- Bunds probe 155.00, Gilts reach 120.71 and 10 year T-note nudges 120-00.

- BTP supply encounters few demand issues, unlike second US Quarterly Refunding leg ahead of USD 22bln long bond auction.

Commodities

- WTI and Brent are pressured in what has been a grinding move lower during European hours; however, benchmarks were lifted amid Kremlin/N. Korea updates.

- Currently, the benchmarks are lower by around USD 1.50/bbl.

- IEA OMR: Revises down oil demand growth projections for 2022 by 70k BPD, amid China lockdowns and elevated prices. Overall decline of Russian supply by 1.6mln BPD in May and 2mln BPD in June; could expand to circa. 3mln BPD from July onwards. Click here for more detail.

- OPEC MOMR to be released at 13:00BST/08:00EDT.

- Indian refineries purchased 25-30mln barrels of Russian oil at a discount for delivery in May-June, according to Interfax.

- Spot gold/silver are pressured amid the USD's revival, but, the yellow metal remains in relatively contained parameters around USD 1850/oz.

US Event Calendar

- 08:30: May Initial Jobless Claims, est. 192,000, prior 200,000

- 08:30: April Continuing Claims, est. 1.37m, prior 1.38m

- 08:30: April PPI Final Demand MoM, est. 0.5%, prior 1.4%; YoY, est. 10.7%, prior 11.2%

- 08:30: April PPI Ex Food and Energy MoM, est. 0.6%, prior 1.0%; YoY, est. 8.9%, prior 9.2%

DB's Jim Reid concludes the overnight wrap

It was all about the higher than expected US CPI report yesterday which added to Fed rate expectations, as well as hard landing expectations as revealed through the curve flattening that took place through the rest of the day. Longer dated Treasury yields fell (after initially spiking much higher) and equities fell sharply (S&P 500 -1.65%) after actually being higher for the first half of the US session. So a topsy-turvy day that kept the Vix above 30 for a fifth straight session.

In terms of the details of that report, headline monthly CPI surprised to the upside with a +0.3% gain (vs. +0.2% expected), whilst monthly core CPI also surprised to the upside at +0.6% (vs. +0.4% expected). Thanks to base effects from last year, the year-on-year numbers managed to decline in spite of the upside monthly surprises, but they were also higher than expected with headline CPI at +8.3% (vs. +8.1% expected), and core CPI at +6.2% (vs. +6.0% expected).

Looking at the components, what will concern the Fed is that there are plenty of signs that inflation pressures remain broad and can’t be pinned on transitory shocks like the spike in energy prices of late. For instance, owners’ equivalent rent (which makes up nearly a quarter of the inflation basket) was up +0.45%, which is its fastest monthly pace since June 2006. Rents also remained strong with a +0.56% increase, which is just shy of its February increase and still the second-highest since December 1987. Food prices (+0.9%) also continued to move higher in April, bringing their year-on-year gain to a 41-year high of +9.4%. One consolation might be that the Cleveland Fed’s trimmed mean (which removes the outliers in either direction) saw its smallest monthly increase since last August at +0.45%, even if it’s still increasing well above rates seen throughout the 2010s.

The fact the release surprised on the upside saw an immediate reaction across asset classes, with 10yr Treasury yields bouncing by more than +14bps intraday during the half hour following the report to 3.07%, before reversing all of this to end the day down -7.0bps to 2.92%. Ultimately the decline in real rates (-14.7bps) offset expectations of higher inflation (+8.1bps), but it was a different story at the front-end of the curve, where 2yr yields rose +2.5bps since the report was seen to raise the likelihood of larger hikes at the coming meetings, with the futures-implied rate for the December meeting rising +4.5bps on the day. In Asia, US 10 year yields are another -3.3bps lower with 2yrs flats. This has left the 2s10s curve at 24.3bps after trading as high as 48.5bps on Monday.

In terms of the reaction from Fed officials themselves, Atlanta Fed President Bostic said he would support +50bp hikes until policy reaches neutral, which suggests more +50bp hikes than just the next two meetings, which has been the common line from Fed speakers of late. Markets are placing a 58% chance on a +50bp hike at September, up from 49% the day before. Markets also increased the chance they place on the Fed being forced into a +75bp hike even at the June meeting, pricing a 14% chance versus 10% yesterday. We will also get the May CPI release ahead of the next FOMC meeting in June, but by that point they’ll be in their blackout period, so this is the last print they’ll be able to comment on ahead of their next decision, and will frame the chatter around whether 75bps might be back on the table at some point given inflation looks to be proving stickier than many had expected.

For equities, the CPI print drove indices lower at the open, but they bounced around all day as volatility remained elevated, ultimately closing near the lows. The S&P 500 fell -1.65%, led by tech and mega cap shares, while the Vix ended above 30 for the fifth straight session for the first time since the post-invasion bout of volatility gripped equity markets. As mentioned, tech stocks were the main underperformer, with the NASDAQ down by -3.18% as investors priced in faster hikes from the Fed this year. Separately in Europe, equities outperformed their US counterparts for a 3rd consecutive day, with the STOXX 600 posting a +1.74% advance but closing well before the US slump.

Whilst the main focus yesterday was on the US CPI report, there was significant central bank news in Europe as well after ECB President Lagarde put out a strong signal that July would be when the ECB starts hiking rates for the first time in over a decade. In her remarks, she said that the first hike “will take place some time after the end of net asset purchases”, and that “this could mean a period of only a few weeks”. A July hike would be in line with the call from our own European economists here at DB (link here), who see four consecutive quarter point hikes from July, taking the deposit rate up to +0.50% by year-end. That was then echoed by a separate Bloomberg report later in the session, which said that ECB officials were “increasingly embracing a scenario” where interest rates moved into positive territory by year-end. ECB policy pricing by the end of the year actually fell -1.3bps to 26.5bps, as a broader sovereign bond rally overpowered this.

With other ECB speakers having already been signalling their openness to a July hike, European sovereign bonds reacted more to the US CPI report than Lagarde’s remarks. So we ended up with a similar pattern to Treasuries, whereby yields surged following the US release before falling back to end the day lower on growth fears. Ultimately, that meant yields on 10yr bunds were down -1.5bps at 0.98%, and there was a significant narrowing in peripheral spreads too, with the gap between 10yr Italian yields and bunds down -9.9bps.

Asian equity markets are weaker overnight. The Hang Seng (-0.94%) is the largest underperformer across the region this morning after the Hong Kong Monetary Authority (HKMA) intervened into the currency markets for the first time since 2019 to defend the local dollar from capital outflows. The authority bought about HK$1.589 billion from the market to bolster the exchange rate in order to bring it back within the trading band i.e., between 7.75 and 7.85 versus the US dollar. Elsewhere, the Nikkei (-0.84%), Kospi (-0.56%) are also trading lower. Mainland Chinese stocks are showing a more mixed performance with the Shanghai Composite (+0.17%) higher while the CSI 300 (-0.07%) is a tad lower. Outside of Asia, US stock futures are flat but Euro Stoxx futures are catching down with the late US move last night and are around -2%.

According to the BOJ’s summary of opinions from the April 27-28 meeting, the board brushed aside the idea of countering sharp yen falls with interest rate hikes with several board members arguing in favour of maintaining the central bank’s massive stimulus programme.

Oil prices are lower in early Asian trade, taking a pause after Brent crude futures closed +4.93% higher last night. This morning, the contract is -1.15% down at $106.27/bbl as I type.

Elsewhere in markets, a significant story over the last 24 hours has been the significant price declines in a number of major cryptocurrencies. Bitcoin is at $27,617 as I type, a level not seen since December 2020. Coinbase’s share price was down a further -26.40% yesterday, bringing its losses over the last week alone to almost -60%.

A few other headlines worth highlighting. The Dallas Fed announced that Lorie Logan, the current manager of the Fed’s portfolio, would assume the role of President, which makes her a voter on the FOMC next year. Given her remit has been to manage the balance sheet, little is known about her views about monetary policy as of yet.

Finally on the Brexit front, there was a further ratcheting up in the comments between the UK and the EU over the Northern Ireland Protocol yesterday. UK PM Johnson said that “we need to sort it out”, and Levelling Up Secretary Gove said that “no option is off the table”. From the EU side however, Irish Foreign Minister Coveney said that the EU would need to react if the UK breached international law, and Bloomberg reported that the EU would likely suspend their trade deal with the UK if the UK were to revoke its commitments.

To the day ahead now, and data releases include the US PPI reading for April, the weekly initial jobless claims, and UK GDP for Q1. Central bank speakers include the ECB’s De Cos and Makhlouf. And in the political sphere, US President Biden will be hosting ASEAN leaders at the White House, whilst G7 foreign ministers are meeting in Germany.

Government

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary of State Mike Pompeo said in a new interview that he’s not ruling out accepting a White House position if former President Donald Trump is reelected in November.

“If I get a chance to serve and think that I can make a difference ... I’m almost certainly going to say yes to that opportunity to try and deliver on behalf of the American people,” he told Fox News, when asked during a interview if he would work for President Trump again.

“I’m confident President Trump will be looking for people who will faithfully execute what it is he asked them to do,” Mr. Pompeo said during the interview, which aired on March 8. “I think as a president, you should always want that from everyone.”

He said that as a former secretary of state, “I certainly wanted my team to do what I was asking them to do and was enormously frustrated when I found that I couldn’t get them to do that.”

Mr. Pompeo, a former U.S. representative from Kansas, served as Central Intelligence Agency (CIA) director in the Trump administration from 2017 to 2018 before he was secretary of state from 2018 to 2021. After he left office, there was speculation that he could mount a Republican presidential bid in 2024, but announced that he wouldn’t be running.

President Trump hasn’t publicly commented about Mr. Pompeo’s remarks.

In 2023, amid speculation that he would make a run for the White House, Mr. Pompeo took a swipe at his former boss, telling Fox News at the time that “the Trump administration spent $6 trillion more than it took in, adding to the deficit.”

“That’s never the right direction for the country,” he said.

In a public appearance last year, Mr. Pompeo also appeared to take a shot at the 45th president by criticizing “celebrity leaders” when urging GOP voters to choose ahead of the 2024 election.

2024 Race

Mr. Pompeo’s interview comes as the former president was named the “presumptive nominee” by the Republican National Committee (RNC) last week after his last major Republican challenger, former South Carolina Gov. Nikki Haley, dropped out of the 2024 race after failing to secure enough delegates. President Trump won 14 out of 15 states on Super Tuesday, with only Vermont—which notably has an open primary—going for Ms. Haley, who served as President Trump’s U.S. ambassador to the United Nations.

On March 8, the RNC held a meeting in Houston during which committee members voted in favor of President Trump’s nomination.

“Congratulations to President Donald J. Trump on his huge primary victory!” the organization said in a statement last week. “I’d also like to congratulate Nikki Haley for running a hard-fought campaign and becoming the first woman to win a Republican presidential contest.”

Earlier this year, the former president criticized the idea of being named the presumptive nominee after reports suggested that the RNC would do so before the Super Tuesday contests and while Ms. Haley was still in the race.

Also on March 8, the RNC voted to name Trump-endorsed officials to head the organization. Michael Whatley, a North Carolina Republican, was elected the party’s new national chairman in a vote in Houston, and Lara Trump, the former president’s daughter-in-law, was voted in as co-chair.

“The RNC is going to be the vanguard of a movement that will work tirelessly every single day to elect our nominee, Donald J. Trump, as the 47th President of the United States,” Mr. Whatley told RNC members in a speech after being elected, replacing former chair Ronna McDaniel. Ms. Trump is expected to focus largely on fundraising and media appearances.

President Trump hasn’t signaled whom he would appoint to various federal agencies if he’s reelected in November. He also hasn’t said who his pick for a running mate would be, but has offered several suggestions in recent interviews.

In various interviews, the former president has mentioned Sen. Tim Scott (R-S.C.), Texas Gov. Greg Abbott, Rep. Elise Stefanik (R-N.Y.), Vivek Ramaswamy, Florida Gov. Ron DeSantis, and South Dakota Gov. Kristi Noem, among others.

International

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Is there a light forming when it comes to the long, dark and…

Is there a light forming when it comes to the long, dark and bewildering tunnel of social justice cultism? Global events have been so frenetic that many people might not remember, but only a couple years ago Big Tech companies and numerous governments were openly aligned in favor of mass censorship. Not just to prevent the public from investigating the facts surrounding the pandemic farce, but to silence anyone questioning the validity of woke concepts like trans ideology.

From 2020-2022 was the closest the west has come in a long time to a complete erasure of freedom of speech. Even today there are still countries and Europe and places like Canada or Australia that are charging forward with draconian speech laws. The phrase "radical speech" is starting to circulate within pro-censorship circles in reference to any platform where people are allowed to talk critically. What is radical speech? Basically, it's any discussion that runs contrary to the beliefs of the political left.

Open hatred of moderate or conservative ideals is perfectly acceptable, but don't ever shine a negative light on woke activism, or you might be a terrorist.

Riley Gaines has experienced this double standard first hand. She was even assaulted and taken hostage at an event in 2023 at San Francisco State University when leftists protester tried to trap her in a room and demanded she "pay them to let her go." Campus police allegedly witnessed the incident but charges were never filed and surveillance footage from the college was never released.

It's probably the last thing a champion female swimmer ever expects, but her head-on collision with the trans movement and the institutional conspiracy to push it on the public forced her to become a counter-culture voice of reason rather than just an athlete.

For years the independent media argued that no matter how much we expose the insanity of men posing as women to compete and dominate women's sports, nothing will really change until the real female athletes speak up and fight back. Riley Gaines and those like her represent that necessary rebellion and a desperately needed return to common sense and reason.

In a recent interview on the Joe Rogan Podcast, Gaines related some interesting information on the inner workings of the NCAA and the subversive schemes surrounding trans athletes. Not only were women participants essentially strong-armed by colleges and officials into quietly going along with the program, there was also a concerted propaganda effort. Competition ceremonies were rigged as vehicles for promoting trans athletes over everyone else.

The bottom line? The competitions didn't matter. The real women and their achievements didn't matter. The only thing that mattered to officials were the photo ops; dudes pretending to be chicks posing with awards for the gushing corporate media. The agenda took precedence.

Lia Thomas, formerly known as William Thomas, was more than an activist invading female sports, he was also apparently a science project fostered and protected by the athletic establishment. It's important to understand that the political left does not care about female athletes. They do not care about women's sports. They don't care about the integrity of the environments they co-opt. Their only goal is to identify viable platforms with social impact and take control of them. Women's sports are seen as a vehicle for public indoctrination, nothing more.

The reasons why they covet women's sports are varied, but a primary motive is the desire to assert the fallacy that men and women are "the same" psychologically as well as physically. They want the deconstruction of biological sex and identity as nothing more than "social constructs" subject to personal preference. If they can destroy what it means to be a man or a woman, they can destroy the very foundations of relationships, families and even procreation.

For now it seems as though the trans agenda is hitting a wall with much of the public aware of it and less afraid to criticize it. Social media companies might be able to silence some people, but they can't silence everyone. However, there is still a significant threat as the movement continues to target children through the public education system and women's sports are not out of the woods yet.

The ultimate solution is for women athletes around the world to organize and widely refuse to participate in any competitions in which biological men are allowed. The only way to save women's sports is for women to be willing to end them, at least until institutions that put doctrine ahead of logic are made irrelevant.

Uncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

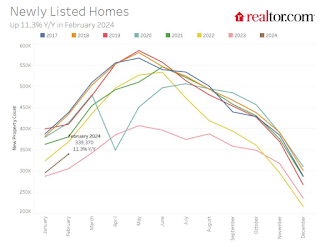

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges