Uncategorized

Shore Bancshares Reports 2022 Financial Results

Shore Bancshares Reports 2022 Financial Results

PR Newswire

EASTON, Md., Jan. 26, 2023

EASTON, Md., Jan. 26, 2023 /PRNewswire/ — Shore Bancshares, Inc. (NASDAQ – SHBI) (the “Company”) reported net income of $8.407 million or $0.42 per diluted comm…

Shore Bancshares Reports 2022 Financial Results

PR Newswire

EASTON, Md., Jan. 26, 2023

EASTON, Md., Jan. 26, 2023 /PRNewswire/ -- Shore Bancshares, Inc. (NASDAQ - SHBI) (the "Company") reported net income of $8.407 million or $0.42 per diluted common share for the fourth quarter of 2022, compared to net income of $9.658 million or $0.49 per diluted common share for the third quarter of 2022, and net income of $2.723 million or $0.16 per diluted common share for the fourth quarter of 2021. Net income for the fiscal year of 2022 was $31.177 million or $1.57 per diluted common share, compared to net income for the fiscal year of 2021 of $15.368 million or $1.17 per diluted common share. Net income, excluding merger related expenses, for the fourth quarter of 2022 was $9.123 million or $0.46 per diluted common share, compared to net income, excluding merger related expenses, of $9.774 million or $0.49 per diluted common share for the third quarter of 2022 and net income, excluding merger related expenses, of $7.914 million or $0.46 per diluted common share for the fourth quarter 2021. Net income, excluding merger related expenses, for the fiscal year of 2022 was $32.728 million or $1.65 per diluted common share compared to net income for the fiscal year of 2021 of $21.237 million or $1.62 per diluted common share. On December 14, 2022, the Company and The Community Financial Corporation ("TCFC") announced that they had entered into a merger agreement pursuant to which TCFC will be merged with and into the Company. The Company anticipates additional merger-related expenses due to the pending TCFC acquisition.

When comparing net income, excluding merger related expenses, for the fourth quarter of 2022 to the third quarter of 2022, net income decreased $651 thousand due to a decrease in net interest income of $372 thousand and an increase in noninterest expense of $1.3 million partially offset by an increase in noninterest income of $518 thousand and a decrease in provision for credit losses of $225 thousand. When comparing net income, excluding merger related expenses, for the fourth quarter of 2022 to the fourth quarter of 2021, net income increased $1.2 million primarily due to increases in net interest income of $6.3 million and noninterest income of $733 thousand offset by increases in noninterest expense of $4.2 million due to the acquisition of Severn Bank ("Severn") in November of 2021.

"We are pleased to report our fourth quarter earnings and fiscal year 2022 financial results," said Lloyd L. "Scott" Beatty, Jr., President and Chief Executive Officer. "In 2022, we experienced significant loan growth of just over 20% and successful integration of Severn. With the recent announcement of our pending merger with TCFC, we expect the future of the combined organizations to be very promising given our ability to help customers with higher loan limits, make greater investments in technology and increased career opportunities for employees."

Balance Sheet Review

Total assets were $3.477 billion at December 31, 2022, a $17.1 million, or less than 1.0%, increase when compared to $3.460 billion at the end of 2021. During 2022, the Company shifted its asset mix by deploying cash and cash equivalents into higher yielding assets which consisted of loans and investment securities. As of December 31, 2022, the Company had 4 Paycheck Protection Program ("PPP') loans totaling $187 thousand that were outstanding.

Total deposits decreased $16.5 million, or less than 1%, when compared to December 31, 2021. The decrease in total deposits was due to decreases in money market and savings accounts of $85.7 million, noninterest-bearing deposits of $65.5 million and time deposits of $35.2 million, partially offset by an increase in interest bearing checking accounts of $170.0 million.

Total stockholders' equity increased $13.6 million, or 3.9%, when compared to December 31, 2021, primarily due to current year earnings, partially offset by an increase in unrealized losses on available for sale securities of $9.1 million. At December 31, 2022, the ratio of total equity to total assets was 10.48% and the ratio of total tangible equity to total tangible assets was 8.67% compared to 10.14% and 8.25% at the end of 2021, respectively.

Review of Quarterly Financial Results

Net interest income was $26.9 million for the fourth quarter of 2022, compared to $27.3 million for the third quarter of 2022 and $20.6 million for the fourth quarter of 2021. The decrease in net interest income when compared to the third quarter of 2022 was primarily due to increases in interest expense on interest-bearing deposits of $2.0 million. In addition, the decrease in the average balance on deposits with other banks of $187.3 million resulted in a decrease in interest income of $802 thousand, partially offset by an increase in interest and fees on loans of $1.7 million and interest on investment securities of $759 thousand. The improvement in interest and fees on loans was due to an increase in the average balance of loans of $140.0 million, or 6.0%. The decrease in interest on deposits at other banks was due to the utilization of cash to fund loan growth with higher yields. The increase in interest on taxable investment securities was driven by an increase in the rates of 33bps and an increase in the average balance within these securities of $43.1 million, or 7.0%.

The increase in net interest income when compared to the fourth quarter of 2021 was primarily due to increases in interest and fees on loans of $7.1 million, interest on taxable investment securities of $2.3 million and interest on deposits with other banks of $495 thousand, partially offset by expense increases in interest-bearing deposits of $3.3 million, short term borrowings of $69 thousand and long-term borrowings of $228 thousand.

The Company's net interest margin decreased to 3.35% for the fourth quarter of 2022 from 3.38% for the third quarter of 2022 and increased compared to 2.87% for the fourth quarter of 2021. The decrease in net interest margin when compared to the third quarter of 2022 was primarily due to higher rates paid on interest bearing deposits and borrowings partially offset by higher yields on earning assets. The increase in net interest margin compared to the fourth quarter of 2021 was due to significantly higher volume as well as improved yields on all earning assets.

The provision for credit losses was $450 thousand for the three months ended December 31, 2022. The comparable amounts were $675 thousand and $(1.7) million for the three months ended September 30, 2022, and December 31, 2021, respectively. The decrease in the provision for credit losses during the fourth quarter of 2022 as compared to the prior quarters was primarily a result of eliminating pandemic related qualitative reserves in the fourth quarter of 2022. Net charge offs for the fourth quarter of 2022 were $84 thousand, compared to net recoveries of $119 thousand for the third quarter of 2022 and net recoveries of $142 thousand for the fourth quarter of 2021. The ratio of the allowance for credit losses to period-end loans, excluding PPP loans and acquired loans, was 0.78% at December 31, 2022, compared to 0.84% at September 30, 2022, and 0.96% at December 31, 2021. The decline in the percentage of the allowance from the third quarter of 2022 was primarily due to eliminating pandemic related qualitative reserves. The decline in the percentage of the allowance from the fourth quarter of 2021 was primarily the result of lower historical loss experience as well as eliminating pandemic related qualitative reserves.

At December 31, 2022 and September 30, 2022, nonperforming assets were $4.0 million and $2.8 million, respectively. The balance of nonperforming assets increased primarily due to an increase in loans 90 days past due still accruing of $1.2 million at December 31, 2022 compared to September 30, 2022. When comparing the fourth quarter of 2022 to the fourth quarter of 2021, nonperforming assets increased $902 thousand, or 29.6%, primarily due to increases in loans 90 days past due and still accruing of $1.3 million, or 262.4% which was a result of growth and timing of matured loans. Accruing TDRs decreased $1.3 million, or 22.3%, compared to the fourth quarter of 2021. The ratio of nonperforming assets and accruing TDRs to total assets at December 31, 2022, and September 30, 2022 was 0.24% and 0.21% respectively, and was 0.25% at December 31, 2021. In addition, the ratio of accruing TDRs to total loans at December 31, 2022 was 0.17% compared to 0.19% at September 30, 2022 and 0.27% at December 31, 2021.

Total noninterest income for the fourth quarter of 2022 increased $518 thousand, or 9.7%, when compared to the third quarter of 2022 and increased $733 thousand, or 14.3%, when compared to the fourth quarter of 2021. The increase compared to the third quarter of 2022 was primarily due to increases in revenue associated with the mortgage division of $887 thousand, or 130.4%, partially offset by decreases in other banking fees of $206 thousand, or 6.5% and service charges on deposit accounts of $163 thousand, or 10.8%. The increase in noninterest income when compared to the fourth quarter of 2021 was primarily due to increases in revenue associated with the mortgage division of $619 thousand, or 65.3% and, service charges on deposit accounts of $112 thousand, or 9.1%.

Total noninterest expense, excluding merger related expenses, for the fourth quarter of 2022 increased $1.3 million or 6.9%, when compared to the third quarter of 2022 and increased $4.2 million, or 26.1%, when compared to the fourth quarter of 2021. The increase in noninterest expense when compared to the third quarter of 2022 was primarily due to an increase in accruals on bonuses and group insurance in the fourth quarter. The increase from the fourth quarter of 2021 was primarily due to increases in salaries and wages, employee related benefits, occupancy expense, data processing, amortization of intangible assets and legal and professional fees, which were all significantly impacted by adding Severn and its operations and the addition of two new branches in 2022.

Review of 2022 Financial Results

Net interest income for 2022 was $101.3 million, an increase of $37.2 million, or 58.0%, when compared to 2021. The increase in net interest income was primarily due to an increase in total interest income of $43.7 million, or 62.2%, specifically interest and fees on loans of $34.3 million, or 53.0%. The improvement in interest and fees on loans was primarily due to the increase in the average balance of $725.2 million, or 46.2%, coupled with accretion income from acquired loans of $3.0 million for 2022. Taxable investment securities and interest on deposits with other banks increased $6.5 million and $2.8 million, respectively, partially offset by an increase in total interest expense of $6.5 million, or 107.7%. The increase in interest expense was primarily the result of an increase in the average balance of interest-bearing deposits of $684.5 million, or 47.5%. Interest on short term and long-term borrowings increased by $988 thousand due to short and long-term advances with the FHLB and junior subordinated debt acquired as part of the Severn acquisition. The long-term advances with the FHLB matured in October of 2022.

The provision for credit losses for 2022 and 2021 was $1.9 million and $(358) thousand, respectively. The increase in provision for credit losses was the result of an increase in loans held for investment in 2022 of $436.9 million. The ratio of the allowance to total loans decreased from 0.66% at December 31, 2021, to 0.65% at December 31, 2022. Excluding PPP loans and acquired loans, the ratio of the allowance for credit losses to period-end loans was 0.78% at December 31, 2022, lower than the 0.96% at December 31, 2021, primarily due to lower historical loss experience and the elimination of pandemic related qualitative factors.

Total noninterest income for 2022 increased $9.6 million, or 71.0%, when compared to the same period in 2021. The increase in noninterest income primarily consisted of revenue associated with the mortgage division of $4.3 million, service charges on deposit accounts of $2.3 million, revenue from Mid-Maryland Title of $1.1 million and other noninterest income of $1.2 million. The increase in other noninterest income was primarily due to increases in rental fee income of $1.3 million.

Total noninterest expense, excluding merger related expenses, for 2022 increased $29.9 million, or 62.0%, when compared to the same period in 2021. The increase was primarily the result of higher salaries, employee benefits, occupancy expense, other intangibles, data processing costs, other noninterest expenses, and FDIC insurance premiums due to significant increases in new and existing customers and the acquisition of Severn and its operations and the addition of two new branches in 2022. In addition, during 2022 the Company recorded merger-related expenses of $1.2 million due to the acquisition of Severn and $935 thousand due to the pending merger with TCFC.

Shore Bancshares Information

Shore Bancshares is a financial holding company headquartered in Easton, Maryland and is the largest independent bank holding company located on Maryland's Eastern Shore. It is the parent company of Shore United Bank. Shore Bancshares engages in trust and wealth management services through Wye Financial Partners, a division of Shore United Bank. Additional information is available at www.shorebancshares.com.

Forward-Looking Statements

The statements contained herein that are not historical facts are forward-looking statements (as defined by the Private Securities Litigation Reform Act of 1995) based on management's current expectations and beliefs concerning future developments and their potential effects on the Company. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of the Company. There can be no assurance that future developments affecting the Company will be the same as those anticipated by management. These statements are evidenced by terms such as "anticipate," "estimate," "should," "expect," "believe," "intend," and similar expressions. Although these statements reflect management's good faith beliefs and projections, they are not guarantees of future performance and they may not prove true. These projections involve risk and uncertainties that could cause actual results to differ materially from those addressed in the forward-looking statements. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions; geopolitical concerns, including the ongoing war in Ukraine; the potential resurgence of the COVID-19 pandemic and related variants and mutations and their impact on the global economy and financial market conditions and our business, results of operations, and financial condition; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Board of Governors of the Federal Reserve System; inflation/deflation, interest rate, market, and monetary fluctuations; volatility and disruptions in global capital and credit markets; the transition away from USD LIBOR and uncertainty regarding potential alternative reference rates, including SOFR; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services; the impact of changes in financial services policies, laws, and regulations, including those concerning taxes, banking, securities, and insurance, and the application thereof by regulatory bodies; cybersecurity threats and the cost of defending against them, including the costs of compliance with potential legislation to combat cybersecurity at a state, national, or global level; and other factors that may affect our future results. For a discussion of these risks and uncertainties, see the section of the periodic reports filed by Shore Bancshares, Inc. with the Securities and Exchange Commission entitled "Risk Factors."

The Company specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements included herein to reflect future events or developments.

Shore Bancshares, Inc. Financial Highlights (Unaudited) (Dollars in thousands, except per share data) | |||||||||||||||||

For the Three Months Ended | For the Year Ended | ||||||||||||||||

December 31, | December 31, | ||||||||||||||||

2022 | 2021 | Change | 2022 | 2021 | Change | ||||||||||||

PROFITABILITY FOR THE PERIOD | |||||||||||||||||

Net interest income | $ | 26,943 | $ | 20,639 | 30.5 | % | $ | 101,302 | $ | 64,130 | 58.0 | % | |||||

Provision for credit losses | 450 | (1,723) | 126.1 | 1,925 | (358) | 637.7 | |||||||||||

Noninterest income | 5,862 | 5,129 | 14.3 | 23,086 | 13,498 | 71.0 | |||||||||||

Noninterest expense | 21,000 | 23,497 | (10.6) | 80,322 | 56,806 | 41.4 | |||||||||||

Income before income taxes | 11,355 | 3,994 | 184.3 | 42,141 | 21,180 | 99.0 | |||||||||||

Income tax expense | 2,948 | 1,271 | 131.9 | 10,964 | 5,812 | 88.6 | |||||||||||

Net income | $ | 8,407 | $ | 2,723 | 208.7 | $ | 31,177 | $ | 15,368 | 102.9 | |||||||

Return on average assets | 0.97 | % | 0.36 | % | 61 | bp | 0.90 | % | 0.66 | % | 24 | bp | |||||

Return on average assets excluding amortization of | 1.09 | 1.07 | 2 | 0.99 | 0.95 | 4 | |||||||||||

Return on average equity | 9.22 | 3.59 | 563 | 8.76 | 6.86 | 190 | |||||||||||

Return on average tangible equity - Non-GAAP (1), (2) | 12.83 | 13.06 | (23) | 11.96 | 11.34 | 62 | |||||||||||

Net interest margin | 3.35 | 2.87 | 48 | 3.15 | 2.94 | 21 | |||||||||||

Efficiency ratio - GAAP | 64.01 | 91.19 | (2,718) | 64.57 | 73.18 | (861) | |||||||||||

Efficiency ratio - Non-GAAP (1), (2) | 59.59 | 60.13 | (54) | 61.21 | 61.15 | 6 | |||||||||||

PER SHARE DATA | |||||||||||||||||

Basic and diluted net income per common share | $ | 0.42 | $ | 0.16 | 167.1 | % | $ | 1.57 | $ | 1.17 | 34.1 | % | |||||

Dividends paid per common share | $ | 0.12 | $ | 0.12 | — | $ | 0.48 | $ | 0.48 | — | |||||||

Book value per common share at period end | 18.34 | 17.71 | 3.6 | ||||||||||||||

Tangible book value per common share at period | 14.87 | 14.12 | 5.3 | ||||||||||||||

Market value at period end | 17.43 | 20.85 | (16.4) | ||||||||||||||

Market range: | |||||||||||||||||

High | 20.85 | 23.19 | (10.1) | 21.41 | 23.19 | (7.7) | |||||||||||

Low | 17.04 | 17.50 | (2.6) | 17.04 | 12.99 | 31.2 | |||||||||||

AVERAGE BALANCE SHEET DATA | |||||||||||||||||

Loans | $ | 2,467,324 | $ | 1,887,126 | 30.7 | % | $ | 2,293,627 | $ | 1,568,468 | 46.2 | % | |||||

Investment securities | 661,968 | 468,724 | 41.2 | 589,842 | 329,890 | 78.8 | |||||||||||

Earning assets | 3,206,591 | 2,842,097 | 12.8 | 3,220,672 | 2,185,123 | 47.4 | |||||||||||

Assets | 3,441,079 | 3,037,262 | 13.3 | 3,444,981 | 2,317,597 | 48.6 | |||||||||||

Deposits | 3,006,734 | 2,547,151 | 18.0 | 3,014,109 | 2,015,624 | 49.5 | |||||||||||

Stockholders' equity | 361,623 | 301,095 | 20.1 | 355,850 | 224,055 | 58.8 | |||||||||||

CREDIT QUALITY DATA | |||||||||||||||||

Net (recoveries) /chargeoffs | $ | 84 | $ | (142) | 159.2 | % | $ | (774) | $ | (414) | (87.0) | % | |||||

Nonaccrual loans | $ | 1,908 | $ | 2,004 | (4.8) | ||||||||||||

Loans 90 days past due and still accruing | 1,841 | 508 | 262.4 | ||||||||||||||

Other real estate owned | 197 | 532 | (63.0) | ||||||||||||||

Total nonperforming assets | 3,946 | 3,044 | 29.6 | ||||||||||||||

Accruing troubled debt restructurings (TDRs) | 4,405 | 5,667 | (22.3) | ||||||||||||||

Total nonperforming assets and accruing TDRs | $ | 8,351 | $ | 8,711 | (4.1) | ||||||||||||

CAPITAL AND CREDIT QUALITY RATIOS | |||||||||||||||||

Period-end equity to assets | 10.48 | % | 10.14 | % | 34 | bp | |||||||||||

Period-end tangible equity to tangible assets - Non-GAAP (1) | 8.67 | 8.25 | 42 | ||||||||||||||

Annualized net (recoveries) to average loans | 0.01 | (0.03) | 4 | (0.03) | % | (0.03) | % | — | bp | ||||||||

Allowance for credit losses as a percent of: | |||||||||||||||||

Period-end loans (3) | 0.65 | 0.66 | (1) | ||||||||||||||

Period-end loans (4) | 0.78 | 0.96 | (18) | ||||||||||||||

Nonaccrual loans | 872.27 | 695.81 | 17,646 | ||||||||||||||

Nonperforming assets | 421.77 | 458.08 | (3,631) | ||||||||||||||

Accruing TDRs | 377.82 | 246.06 | 13,176 | ||||||||||||||

Nonperforming assets and accruing TDRs | 199.29 | 160.07 | 3,922 | ||||||||||||||

As a percent of total loans: | |||||||||||||||||

Nonaccrual loans | 0.07 | 0.09 | (2) | ||||||||||||||

Accruing TDRs | 0.17 | 0.27 | (10) | ||||||||||||||

Nonaccrual loans and accruing TDRs | 0.25 | 0.36 | (11) | ||||||||||||||

As a percent of total loans+other real estate owned: | |||||||||||||||||

Nonperforming assets | 0.15 | 0.14 | 1 | ||||||||||||||

Nonperforming assets and accruing TDRs | 0.33 | 0.41 | (8) | ||||||||||||||

As a percent of total assets: | |||||||||||||||||

Nonaccrual loans | 0.05 | 0.06 | (1) | ||||||||||||||

Nonperforming assets | 0.11 | 0.09 | 2 | ||||||||||||||

Accruing TDRs | 0.13 | 0.16 | (3) | ||||||||||||||

Nonperforming assets and accruing TDRs | 0.24 | 0.25 | (1) | ||||||||||||||

(1) | See the reconciliation table that begins on page 14 of 15. |

(2) | This ratio excludes merger related expenses (Non-GAAP) on page 5. |

(3) | As of December 31, 2022 and December 31, 2021, these ratios include all loans held for investment, including PPP loans of $187 thousand and $27.6 million, respectively. |

(4) | As of December 31, 2022 and December 31, 2021, these ratios exclude PPP loans, acquired loans, and the associated purchase discount mark on the acquired loans from both Severn and Northwest. |

Shore Bancshares, Inc. Consolidated Balance Sheets (Unaudited) (In thousands, except per share data) | |||||||||

December 31, 2022 | |||||||||

December 31, | December 31, | compared to | |||||||

2022 | 2021 | December 31, 2021 | |||||||

ASSETS | |||||||||

Cash and due from banks | $ | 37,661 | $ | 16,919 | 122.6 | ||||

Interest-bearing deposits with other banks | 17,838 | 566,694 | (96.9) | ||||||

Cash and cash equivalents | 55,499 | 583,613 | (90.5) | ||||||

Investment securities available for sale (at fair value) | 83,587 | 116,982 | (28.5) | ||||||

Investment securities held to maturity (at amortized cost) | 559,455 | 404,594 | 38.3 | ||||||

Equity securities, at fair value | 1,233 | 1,372 | (10.1) | ||||||

Restricted securities | 11,169 | 4,159 | 168.6 | ||||||

Loans held for sale, at fair value | 4,248 | 37,749 | (88.7) | ||||||

Loans held for investment | 2,556,107 | 2,119,175 | 20.6 | ||||||

Less: allowance for credit losses | (16,643) | (13,944) | 19.4 | ||||||

Loans, net | 2,539,464 | 2,105,231 | 20.6 | ||||||

Premises and equipment, net | 51,488 | 51,624 | (0.3) | ||||||

Goodwill | 63,266 | 63,421 | (0.2) | ||||||

Other intangible assets, net | 5,547 | 7,535 | (26.4) | ||||||

Other real estate owned, net | 197 | 532 | (63.0) | ||||||

Mortgage servicing rights, at fair value | 5,275 | 4,087 | 29.1 | ||||||

Right of use assets, net | 9,629 | 11,370 | (15.3) | ||||||

Cash surrender value on life insurance | 59,218 | 47,935 | 23.5 | ||||||

Other assets | 28,001 | 19,932 | 40.5 | ||||||

Total assets | $ | 3,477,276 | $ | 3,460,136 | 0.5 | ||||

LIABILITIES | |||||||||

Noninterest-bearing deposits | $ | 862,015 | $ | 927,497 | (7.1) | ||||

Interest-bearing deposits | 2,147,769 | 2,098,739 | 2.3 | ||||||

Total deposits | 3,009,784 | 3,026,236 | (0.5) | ||||||

Securities sold under retail repurchase agreements | — | 4,143 | (100.0) | ||||||

Advances from FHLB - short-term | 40,000 | — | — | ||||||

Advances from FHLB - long-term | — | 10,135 | (100.0) | ||||||

Subordinated debt | 43,072 | 42,762 | 0.7 | ||||||

Total borrowings | 83,072 | 57,040 | |||||||

Lease liabilities | 9,908 | 11,567 | (14.3) | ||||||

Accrued expenses and other liabilities | 10,227 | 14,600 | (30.0) | ||||||

Total liabilities | 3,112,991 | 3,109,443 | 0.1 | ||||||

COMMITMENTS AND CONTINGENCIES | |||||||||

STOCKHOLDERS' EQUITY | |||||||||

Common stock, par value $0.01; authorized 35,000,000 shares | 199 | 198 | 0.5 | ||||||

Additional paid in capital | 201,494 | 200,473 | 0.5 | ||||||

Retained earnings | 171,613 | 149,966 | 14.4 | ||||||

Accumulated other comprehensive (loss) income | (9,021) | 56 | (16,208.9) | ||||||

Total stockholders' equity | 364,285 | 350,693 | 3.9 | ||||||

Total liabilities and stockholders' equity | $ | 3,477,276 | $ | 3,460,136 | 0.5 | ||||

Period-end common shares outstanding | 19,865 | 19,808 | 0.3 | ||||||

Book value per common share | $ | 18.34 | $ | 17.71 | 3.6 | ||||

Shore Bancshares, Inc. Consolidated Statements of Income (Unaudited) (In thousands, except per share data) | |||||||||||||||||

For the Three Months Ended | For the Year Ended | ||||||||||||||||

December 31, | December 31, | ||||||||||||||||

2022 | 2021 | % Change | 2022 | 2021 | % Change | ||||||||||||

INTEREST INCOME | |||||||||||||||||

Interest and fees on loans | $ | 27,664 | $ | 20,564 | 34.5 | % | $ | 99,122 | $ | 64,795 | 53.0 | % | |||||

Interest on investment securities: | |||||||||||||||||

Taxable | 3,945 | 1,663 | 137.2 | 11,507 | 5,006 | 129.9 | |||||||||||

Tax-exempt | 6 | — | 100.0 | 6 | — | 100.0 | |||||||||||

Interest on deposits with other banks | 664 | 169 | 292.9 | 3,210 | 368 | 772.3 | |||||||||||

Total interest income | 32,279 | 22,396 | 44.1 | 113,845 | 70,169 | 62.2 | |||||||||||

INTEREST EXPENSE | |||||||||||||||||

Interest on deposits | 4,554 | 1,272 | 258.0 | 9,983 | 4,461 | 123.8 | |||||||||||

Interest on short-term borrowings | 72 | 3 | 2,300.0 | 74 | 8 | 825.0 | |||||||||||

Interest on long-term borrowings | 710 | 482 | 47.3 | 2,486 | 1,570 | 58.3 | |||||||||||

Total interest expense | 5,336 | 1,757 | 203.7 | 12,543 | 6,039 | 107.7 | |||||||||||

NET INTEREST INCOME | 26,943 | 20,639 | 30.5 | 101,302 | 64,130 | 58.0 | |||||||||||

Provision for credit losses | 450 | (1,723) | 126.1 | 1,925 | (358) | 637.7 | |||||||||||

NET INTEREST INCOME AFTER PROVISION | |||||||||||||||||

FOR CREDIT LOSSES | 26,493 | 22,362 | 18.5 | 99,377 | 64,488 | 54.1 | |||||||||||

NONINTEREST INCOME | |||||||||||||||||

Service charges on deposit accounts | 1,346 | 1,234 | 9.1 | 5,652 | 3,396 | 66.4 | |||||||||||

Trust and investment fee income | 401 | 522 | (23.2) | 1,784 | 1,881 | (5.2) | |||||||||||

Gains on sales and calls of investment securities | — | — | — | — | 2 | — | |||||||||||

Interchange credits | 1,280 | 1,043 | 22.7 | 4,812 | 3,964 | 21.4 | |||||||||||

Mortgage-banking revenue | 1,567 | 948 | 65.3 | 5,210 | 948 | 449.6 | |||||||||||

Title Company revenue | 194 | 247 | (21.5) | 1,340 | 247 | 442.5 | |||||||||||

Other noninterest income | 1,074 | 1,135 | (5.4) | 4,288 | 3,060 | 40.1 | |||||||||||

Total noninterest income | 5,862 | 5,129 | 14.3 | 23,086 | 13,498 | 71.0 | |||||||||||

NONINTEREST EXPENSE | |||||||||||||||||

Salaries and wages | 8,909 | 7,727 | 15.3 | 35,931 | 21,222 | 69.3 | |||||||||||

Employee benefits | 2,786 | 2,271 | 22.7 | 9,908 | 7,262 | 36.4 | |||||||||||

Occupancy expense | 1,694 | 1,263 | 34.1 | 6,242 | 3,690 | 69.2 | |||||||||||

Furniture and equipment expense | 648 | 385 | 68.3 | 2,018 | 1,553 | 29.9 | |||||||||||

Data processing | 1,856 | 1,487 | 24.8 | 6,890 | 5,001 | 37.8 | |||||||||||

Directors' fees | 222 | 170 | 30.6 | 839 | 620 | 35.3 | |||||||||||

Amortization of intangible assets | 460 | 381 | 20.7 | 1,988 | 734 | 170.8 | |||||||||||

FDIC insurance premium expense | 315 | 362 | (13.0) | 1,426 | 1,015 | 40.5 | |||||||||||

Other real estate owned, net | 13 | (2) | 750.0 | 65 | 4 | 1,525.0 | |||||||||||

Legal and professional fees | 636 | 150 | 324.0 | 2,840 | 1,742 | 63.0 | |||||||||||

Merger related expenses | 967 | 7,615 | (87.3) | 2,098 | 8,530 | (75.4) | |||||||||||

Other noninterest expenses | 2,494 | 1,688 | 47.7 | 10,077 | 5,433 | 85.5 | |||||||||||

Total noninterest expense | 21,000 | 23,497 | (10.6) | 80,322 | 56,806 | 41.4 | |||||||||||

Income before income taxes | 11,355 | 3,994 | 184.3 | 42,141 | 21,180 | 99.0 | |||||||||||

Income tax expense | 2,948 | 1,271 | 131.9 | 10,964 | 5,812 | 88.6 | |||||||||||

NET INCOME | $ | 8,407 | $ | 2,723 | 208.7 | $ | 31,177 | $ | 15,368 | 102.9 | |||||||

Weighted average shares outstanding - basic | 19,862 | 17,180 | 15.6 | 19,847 | 13,119 | 51.3 | |||||||||||

Weighted average shares outstanding - diluted | 19,862 | 17,180 | 15.6 | 19,847 | 13,119 | 51.3 | |||||||||||

Basic and diluted net income per common share | $ | 0.42 | $ | 0.16 | 167.1 | $ | 1.57 | $ | 1.17 | 34.1 | |||||||

Dividends paid per common share | 0.12 | 0.12 | — | 0.48 | 0.48 | — | |||||||||||

Shore Bancshares, Inc. Consolidated Average Balance Sheets (Unaudited) (Dollars in thousands)

| |||||||||||||||||||||

For the Three Months Ended | For the Year Ended | ||||||||||||||||||||

December 31, | December 31, | ||||||||||||||||||||

2022 | 2021 | 2022 | 2021 | ||||||||||||||||||

Average | Yield/ | Average | Yield/ | Average | Yield/ | Average | Yield/ | ||||||||||||||

balance | rate | balance | rate | balance | rate | balance | rate | ||||||||||||||

Earning assets | |||||||||||||||||||||

Loans (1), (2), (3) | $ | 2,467,324 | 4.45 | % | $ | 1,887,126 | 4.33 | % | $ | 2,293,627 | 4.33 | % | $ | 1,568,468 | 4.14 | % | |||||

Investment securities | |||||||||||||||||||||

Taxable | 661,519 | 2.39 | 468,724 | 1.42 | 589,729 | 1.95 | 329,890 | 1.52 | |||||||||||||

Tax-exempt (1) | 449 | 6.24 | — | — | 113 | 6.19 | — | — | |||||||||||||

Interest-bearing deposits | 77,299 | 3.40 | 486,247 | 0.14 | 337,203 | 0.95 | 286,765 | 0.13 | |||||||||||||

Total earning assets | 3,206,591 | 4.00 | % | 2,842,097 | 3.11 | % | 3,220,672 | 3.54 | % | 2,185,123 | 3.21 | % | |||||||||

Cash and due from banks | 29,358 | 22,625 | 18,158 | 19,838 | |||||||||||||||||

Other assets | 221,599 | 188,399 | 221,592 | 127,704 | |||||||||||||||||

Allowance for credit losses | (16,469) | (15,859) | (15,441) | (15,068) | |||||||||||||||||

Total assets | $ | 3,441,079 | $ | 3,037,262 | $ | 3,444,981 | $ | 2,317,597 | |||||||||||||

Interest-bearing liabilities | |||||||||||||||||||||

Demand deposits | $ | 670,424 | 1.31 | % | $ | 494,081 | 0.14 | % | $ | 638,105 | 0.61 | % | $ | 450,399 | 0.14 | % | |||||

Money market and savings deposits | 1,043,076 | 0.60 | 1,001,115 | 0.26 | 1,043,032 | 0.35 | 695,056 | 0.21 | |||||||||||||

Certificates of deposit $100,000 or more | 217,051 | 0.79 | 174,268 | 0.49 | 239,927 | 0.57 | 144,209 | 0.84 | |||||||||||||

Other time deposits | 205,293 | 0.62 | 173,975 | 0.50 | 204,536 | 0.56 | 151,429 | 0.78 | |||||||||||||

Interest-bearing deposits | 2,135,844 | 0.85 | 1,843,439 | 0.27 | 2,125,600 | 0.47 | 1,441,093 | 0.31 | |||||||||||||

Securities sold under retail repurchase | |||||||||||||||||||||

agreements and federal funds purchased | — | — | 3,972 | 0.30 | 683 | 0.29 | 3,017 | 0.27 | |||||||||||||

Advances from FHLB - short-term | 7,391 | 3.86 | — | — | 1,863 | 3.86 | — | — | |||||||||||||

Advances from FHLB - long-term | 653 | (6.08) | 6,630 | 2.21 | 7,701 | 0.45 | 1,671 | 0.60 | |||||||||||||

Subordinated debt | 43,031 | 6.64 | 36,589 | 5.12 | 42,917 | 5.71 | 27,528 | 5.67 | |||||||||||||

Total interest-bearing liabilities | 2,186,919 | 0.96 | % | 1,890,630 | 0.37 | % | 2,178,764 | 0.57 | % | 1,473,309 | 0.41 | % | |||||||||

Noninterest-bearing deposits | 870,890 | 703,712 | 888,509 | 574,531 | |||||||||||||||||

Accrued expenses and other liabilities | 21,647 | 141,825 | 21,858 | 45,702 | |||||||||||||||||

Stockholders' equity | 361,623 | 301,095 | 355,850 | 224,055 | |||||||||||||||||

Total liabilities and stockholders' equity | $ | 3,441,079 | $ | 3,037,262 | $ | 3,444,981 | $ | 2,317,597 | |||||||||||||

Net interest spread | 3.04 | % | 2.74 | % | 2.97 | % | 2.80 | % | |||||||||||||

Net interest margin | 3.35 | % | 2.87 | % | 3.15 | % | 2.94 | % | |||||||||||||

(1) | All amounts are reported on a tax-equivalent basis computed using the statutory federal income tax rate of 21.0%, exclusive of nondeductible interest expense. |

(2) | Average loan balances include nonaccrual loans. |

(3) | Interest income on loans includes accreted loan fees, net of costs and accretion of discounts on acquired loans, which are included in the yield calculations. |

Shore Bancshares, Inc. Financial Highlights By Quarter (Unaudited) (Dollars in thousands, except per share data) | ||||||||||||||||||||

4th Quarter | 3rd Quarter | 2nd Quarter | 1st Quarter | 4th Quarter | Q4 2022 | Q4 2022 | ||||||||||||||

2022 | 2022 | 2022 | 2022 | 2021 | compared to | compared to | ||||||||||||||

Q4 2022 | Q3 2022 | Q2 2022 | Q1 2022 | Q4 2021 | Q3 2022 | Q4 2021 | ||||||||||||||

PROFITABILITY FOR THE PERIOD | ||||||||||||||||||||

Taxable-equivalent net interest income | $ | 26,981 | $ | 27,350 | $ | 24,656 | $ | 22,469 | $ | 20,652 | (1.3) | % | 30.6 | % | ||||||

Less: Taxable-equivalent adjustment | 40 | 35 | 38 | 39 | 13 | 14.3 | 207.7 | |||||||||||||

Net interest income | 26,943 | 27,315 | 24,618 | 22,430 | 20,639 | (1.4) | 30.5 | |||||||||||||

Provision for credit losses | 450 | 675 | 200 | 600 | (1,723) | (33.3) | 126.1 | |||||||||||||

Noninterest income | 5,862 | 5,344 | 5,833 | 6,046 | 5,129 | 9.7 | 14.3 | |||||||||||||

Noninterest expense | 21,000 | 18,899 | 20,094 | 20,332 | 23,497 | 11.1 | (10.6) | |||||||||||||

Income before income taxes | 11,355 | 13,085 | 10,157 | 7,544 | 3,994 | (13.2) | 184.3 | |||||||||||||

Income tax expense | 2,948 | 3,427 | 2,658 | 1,931 | 1,271 | (14.0) | 131.9 | |||||||||||||

Net income | $ | 8,407 | $ | 9,658 | $ | 7,499 | $ | 5,613 | $ | 2,723 | (13.0) | 208.7 | ||||||||

Return on average assets | 0.97 | % | 1.11 | % | 0.88 | % | 0.65 | % | 0.36 | % | (14) | bp | 61 | bp | ||||||

Return on average assets excluding amortization | 1.09 | 1.17 | 0.94 | 0.76 | 1.07 | (8) | 2 | |||||||||||||

Return on average equity | 9.22 | 10.72 | 8.52 | 6.45 | 3.59 | (150) | 563 | |||||||||||||

Return on average tangible equity - Non-GAAP (1) | 12.83 | 13.98 | 11.41 | 9.40 | 13.06 | (115) | (23) | |||||||||||||

Net interest margin | 3.35 | 3.38 | 3.10 | 2.78 | 2.87 | (3) | 48 | |||||||||||||

Efficiency ratio - GAAP | 64.01 | 57.87 | 65.99 | 71.40 | 91.19 | 614 | (2,718) | |||||||||||||

Efficiency ratio - Non-GAAP (1), (2) | 59.59 | 55.79 | 63.44 | 66.93 | 60.13 | 380 | (54) | |||||||||||||

PER SHARE DATA | ||||||||||||||||||||

Basic and diluted net income per common share | $ | 0.42 | $ | 0.49 | $ | 0.38 | $ | 0.28 | $ | 0.16 | (13.6) | % | 164.5 | % | ||||||

Dividends paid per common share | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | — | — | |||||||||||||

Book value per common share at period end | 18.34 | 17.99 | 17.77 | 17.73 | 17.71 | 1.9 | 3.6 | |||||||||||||

Tangible book value per common share at period | 14.87 | 14.50 | 14.26 | 14.19 | 14.12 | 2.6 | 5.3 | |||||||||||||

Market value at period end | 17.43 | 17.32 | 18.50 | 20.48 | 20.85 | 0.6 | (16.4) | |||||||||||||

Market range: | ||||||||||||||||||||

High | 20.85 | 20.50 | 21.21 | 21.41 | 23.19 | 1.7 | (10.1) | |||||||||||||

Low | 17.04 | 17.29 | 17.91 | 19.34 | 17.50 | (1.4) | (2.6) | |||||||||||||

AVERAGE BALANCE SHEET DATA | ||||||||||||||||||||

Loans | $ | 2,467,324 | $ | 2,327,279 | $ | 2,217,139 | $ | 2,135,734 | $ | 1,887,126 | 6.0 | % | 30.7 | % | ||||||

Investment securities | 661,968 | 618,378 | 546,252 | 531,017 | 468,724 | 7.0 | 41.2 | |||||||||||||

Earning assets | 3,206,591 | 3,210,233 | 3,189,926 | 3,253,549 | 2,842,097 | (0.1) | 12.8 | |||||||||||||

Assets | 3,441,079 | 3,444,365 | 3,419,168 | 3,477,481 | 3,037,262 | (0.1) | 13.3 | |||||||||||||

Deposits | 3,006,734 | 3,012,658 | 2,993,098 | 3,044,213 | 2,547,151 | (0.2) | 18.0 | |||||||||||||

Stockholders' equity | 361,623 | 357,383 | 353,192 | 353,011 | 301,095 | 1.2 | 20.1 | |||||||||||||

CREDIT QUALITY DATA | ||||||||||||||||||||

Net (recoveries) / chargeoffs | $ | 84 | $ | (119) | $ | (573) | $ | (166) | $ | (142) | 170.6 | % | 159.2 | % | ||||||

Nonaccrual loans | $ | 1,908 | $ | 1,949 | $ | 2,693 | $ | 2,848 | $ | 2,004 | (2.1) | (4.8) | ||||||||

Loans 90 days past due and still accruing | 1,841 | 644 | 803 | 459 | 508 | 185.9 | 262.4 | |||||||||||||

Other real estate owned | 197 | 197 | 197 | 561 | 532 | — | (63.0) | |||||||||||||

Total nonperforming assets | $ | 3,946 | $ | 2,790 | $ | 3,693 | $ | 3,868 | $ | 3,044 | 41.4 | 29.6 | ||||||||

Accruing troubled debt restructurings (TDRs) | $ | 4,405 | $ | 4,458 | $ | 4,894 | $ | 5,004 | $ | 5,667 | (1.2) | (22.3) | ||||||||

Total nonperforming assets and accruing TDRs | $ | 8,351 | $ | 7,248 | $ | 8,587 | $ | 8,872 | $ | 8,711 | 15.2 | (4.1) | ||||||||

CAPITAL AND CREDIT QUALITY RATIOS | ||||||||||||||||||||

Period-end equity to assets | 10.48 | % | 10.36 | % | 10.25 | % | 10.07 | % | 10.14 | % | 12 | bp | 34 | bp | ||||||

Period-end tangible equity to tangible assets - Non-GAAP (1) | 8.67 | 8.52 | 8.39 | 8.22 | 8.25 | 15 | 42 | |||||||||||||

Annualized net (recoveries) to average loans | 0.01 | (0.02) | (0.10) | (0.03) | (0.03) | 3 | 4 | |||||||||||||

Allowance for credit losses as a percent of: | ||||||||||||||||||||

Period-end loans (3) | 0.65 | 0.68 | 0.68 | 0.67 | 0.66 | (3) | (1) | |||||||||||||

Period-end loans (4) | 0.78 | 0.84 | 0.89 | 0.92 | 0.96 | (6) | (18) | |||||||||||||

Nonaccrual loans | 872.27 | 835.15 | 574.94 | 516.50 | 695.81 | 3,712 | 17,646 | |||||||||||||

Nonperforming assets | 421.77 | 583.41 | 419.25 | 380.30 | 458.08 | (16,164) | (3,631) | |||||||||||||

Accruing TDRs | 377.82 | 365.12 | 316.37 | 293.96 | 246.06 | 1,270 | 13,176 | |||||||||||||

Nonperforming assets and accruing TDRs | 199.29 | 224.57 | 180.31 | 165.80 | 160.07 | (2,528) | 3,922 | |||||||||||||

As a percent of total loans: | ||||||||||||||||||||

Nonaccrual loans | 0.07 | 0.08 | 0.12 | 0.13 | 0.09 | (1) | (2) | |||||||||||||

Accruing TDRs | 0.17 | 0.19 | 0.22 | 0.23 | 0.27 | (2) | (10) | |||||||||||||

Nonaccrual loans and accruing TDRs | 0.25 | 0.27 | 0.34 | 0.36 | 0.36 | (2) | (11) | |||||||||||||

As a percent of total loans+other real estate owned: | ||||||||||||||||||||

Nonperforming assets | 0.15 | 0.12 | 0.16 | 0.18 | 0.14 | 3 | 1 | |||||||||||||

Nonperforming assets and accruing TDRs | 0.33 | 0.30 | 0.38 | 0.41 | 0.41 | 3 | (8) | |||||||||||||

As a percent of total assets: | ||||||||||||||||||||

Nonaccrual loans | 0.05 | 0.06 | 0.08 | 0.08 | 0.06 | (1) | (1) | |||||||||||||

Nonperforming assets | 0.11 | 0.08 | 0.11 | 0.11 | 0.09 | 3 | 2 | |||||||||||||

Accruing TDRs | 0.13 | 0.13 | 0.14 | 0.14 | 0.16 | — | (3) | |||||||||||||

Nonperforming assets and accruing TDRs | 0.24 | 0.21 | 0.25 | 0.25 | 0.25 | 3 | (1) | |||||||||||||

(1) | See the reconciliation table that begins on page 14. |

(2) | This ratio excludes merger related expenses (Non-GAAP) on page 10. |

(3) | Includes all loans held for investment, including PPP loan balances for all periods shown. |

(4) | For all periods shown, these ratios exclude PPP loans, acquired loans, and the associated purchase discount mark on the acquired loans from both Severn and Northwest. |

Shore Bancshares, Inc. Consolidated Statements of Income By Quarter (Unaudited) (In thousands, except per share data) | ||||||||||||||||||||

Q4 2022 | Q4 2022 | |||||||||||||||||||

compared to | compared to | |||||||||||||||||||

Q4 2022 | Q3 2022 | Q2 2022 | Q1 2022 | Q4 2021 | Q3 2022 | Q4 2021 | ||||||||||||||

INTEREST INCOME | ||||||||||||||||||||

Interest and fees on loans | $ | 27,664 | $ | 25,924 | $ | 23,452 | $ | 22,085 | $ | 20,564 | 6.7 | % | 34.5 | % | ||||||

Interest on investment securities: | ||||||||||||||||||||

Taxable | 3,945 | 3,186 | 2,392 | 1,985 | 1,663 | 23.8 | 137.2 | |||||||||||||

Tax-exempt | 6 | — | — | — | — | 100.0 | 100.0 | |||||||||||||

Interest on deposits with other banks | 664 | 1,466 | 826 | 254 | 169 | (54.7) | 292.9 | |||||||||||||

Total interest income | 32,279 | 30,576 | 26,670 | 24,324 | 22,396 | 5.6 | 44.1 | |||||||||||||

INTEREST EXPENSE | ||||||||||||||||||||

Interest on deposits | 4,554 | 2,561 | 1,511 | 1,358 | 1,272 | 77.8 | 258.0 | |||||||||||||

Interest on short-term borrowings | 72 | — | — | 2 | 3 | 100.0 | 2,300.0 | |||||||||||||

Interest on long-term borrowings | 710 | 700 | 541 | 534 | 482 | 1.4 | 47.3 | |||||||||||||

Total interest expense | 5,336 | 3,261 | 2,052 | 1,894 | 1,757 | 63.6 | 203.7 | |||||||||||||

NET INTEREST INCOME | 26,943 | 27,315 | 24,618 | 22,430 | 20,639 | (1.4) | 30.5 | |||||||||||||

Provision for credit losses | 450 | 675 | 200 | 600 | (1,723) | (33.3) | 126.1 | |||||||||||||

NET INTEREST INCOME AFTER PROVISION | ||||||||||||||||||||

FOR CREDIT LOSSES | 26,493 | 26,640 | 24,418 | 21,830 | 22,362 | (0.6) | 18.5 | |||||||||||||

NONINTEREST INCOME | ||||||||||||||||||||

Service charges on deposit accounts | 1,346 | 1,509 | 1,438 | 1,359 | 1,234 | (10.8) | 9.1 | |||||||||||||

Trust and investment fee income | 401 | 421 | 447 | 514 | 522 | (4.8) | (23.2) | |||||||||||||

Interchange credits | 1,280 | 1,241 | 1,253 | 1,038 | 1,043 | 3.1 | 22.7 | |||||||||||||

Mortgage-banking revenue | 1,567 | 680 | 1,096 | 1,867 | 948 | 130.4 | 65.3 | |||||||||||||

Title Company revenue | 194 | 397 | 426 | 323 | 247 | (51.1) | (21.5) | |||||||||||||

Other noninterest income | 1,074 | 1,096 | 1,173 | 945 | 1,135 | (2.0) | (5.4) | |||||||||||||

Total noninterest income | 5,862 | 5,344 | 5,833 | 6,046 | 5,129 | 9.7 | 14.3 | |||||||||||||

NONINTEREST EXPENSE | ||||||||||||||||||||

Salaries and wages | 8,909 | 8,562 | 8,898 | 9,562 | 7,727 | 4.1 | 15.3 | |||||||||||||

Employee benefits | 2,786 | 2,191 | 2,269 | 2,662 | 2,271 | 27.2 | 22.7 | |||||||||||||

Occupancy expense | 1,694 | 1,496 | 1,485 | 1,567 | 1,263 | 13.2 | 34.1 | |||||||||||||

Furniture and equipment expense | 648 | 533 | 411 | 429 | 385 | 21.6 | 68.3 | |||||||||||||

Data processing | 1,856 | 1,759 | 1,668 | 1,607 | 1,487 | 5.5 | 24.8 | |||||||||||||

Directors' fees | 222 | 217 | 210 | 190 | 170 | 2.3 | 30.6 | |||||||||||||

Amortization of intangible assets | 460 | 499 | 511 | 517 | 381 | (7.8) | 20.7 | |||||||||||||

FDIC insurance premium expense | 315 | 339 | 429 | 343 | 362 | (7.1) | (13.0) | |||||||||||||

Other real estate owned expenses, net | 13 | 1 | 57 | (6) | (2) | 1,200.0 | 750.0 | |||||||||||||

Legal and professional fees | 636 | 756 | 811 | 637 | 150 | (15.9) | 324.0 | |||||||||||||

Merger related expenses | 967 | 159 | 241 | 730 | 7,615 | 508.2 | (87.3) | |||||||||||||

Other noninterest expenses | 2,494 | 2,387 | 3,104 | 2,094 | 1,688 | 4.5 | 47.7 | |||||||||||||

Total noninterest expense | 21,000 | 18,899 | 20,094 | 20,332 | 23,497 | 11.1 | (10.6) | |||||||||||||

Income before income taxes | 11,355 | 13,085 | 10,157 | 7,544 | 3,994 | (13.2) | 184.3 | |||||||||||||

Income tax expense | 2,948 | 3,427 | 2,658 | 1,931 | 1,271 | (14.0) | 131.9 | |||||||||||||

NET INCOME | $ | 8,407 | $ | 9,658 | $ | 7,499 | $ | 5,613 | $ | 2,723 | (13.0) | 208.7 | ||||||||

Weighted average shares outstanding - basic | 19,862 | 19,852 | 19,847 | 19,828 | 17,180 | 0.1 | 15.6 | |||||||||||||

Weighted average shares outstanding - diluted | 19,862 | 19,852 | 19,847 | 19,828 | 17,180 | 0.1 | 15.6 | |||||||||||||

Basic and diluted net income per common share | $ | 0.42 | $ | 0.49 | $ | 0.38 | $ | 0.28 | $ | 0.16 | (13.6) | 164.5 | ||||||||

Dividends paid per common share | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | — | — | |||||||||||||

Shore Bancshares, Inc. Consolidated Average Balance Sheets By Quarter (Unaudited) (Dollars in thousands) | ||||||||||||||||||||||||||||||

Average balance | ||||||||||||||||||||||||||||||

Q4 2022 | Q4 2022 | |||||||||||||||||||||||||||||

compared to | compared to | |||||||||||||||||||||||||||||

Q4 2022 | Q3 2022 | Q2 2022 | Q1 2022 | Q4 2021 | Q3 2022 | Q4 2021 | ||||||||||||||||||||||||

Average | Yield/ | Average | Yield/ | Average | Yield/ | Average | Yield/ | Average | Yield/ | |||||||||||||||||||||

balance | rate | balance | rate | balance | rate | balance | rate | balance | rate | |||||||||||||||||||||

Earning assets | ||||||||||||||||||||||||||||||

Loans (1), (2), (3) | $ | 2,467,324 | 4.45 | % | $ | 2,327,279 | 4.43 | % | $ | 2,217,139 | 4.25 | % | $ | 2,135,734 | 4.20 | % | $ | 1,887,126 | 4.33 | % | 6.0 | % | 30.7 | % | ||||||

Investment securities | ||||||||||||||||||||||||||||||

Taxable | 661,519 | 2.39 | 618,378 | 2.06 | 546,252 | 1.75 | 531,017 | 1.49 | 468,724 | 1.42 | 7.0 | 41.1 | ||||||||||||||||||

Tax-exempt (1) | 449 | 6.24 | — | — | — | — | — | — | — | — | 100.0 | 100.0 | ||||||||||||||||||

Interest-bearing deposits | 77,299 | 3.40 | 264,576 | 2.20 | 426,535 | 0.78 | 586,798 | 0.18 | 486,247 | 0.14 | (70.8) | (84.1) | ||||||||||||||||||

Total earning assets | 3,206,591 | 4.00 | % | 3,210,233 | 3.78 | % | 3,189,926 | 3.36 | % | 3,253,549 | 3.01 | % | 2,842,097 | 3.11 | % | (0.1) | 12.8 | |||||||||||||

Cash and due from banks | 29,358 | 31,724 | 26,162 | (15,253) | 22,625 | (7.5) | 29.8 | |||||||||||||||||||||||

Other assets | 221,599 | 218,163 | 218,353 | 253,424 | 188,399 | 1.6 | 17.6 | |||||||||||||||||||||||

Allowance for credit losses | (16,469) | (15,755) | (15,273) | (14,239) | (15,859) | 4.5 | 3.8 | |||||||||||||||||||||||

Total assets | $ | 3,441,079 | $ | 3,444,365 | $ | 3,419,168 | $ | 3,477,481 | $ | 3,037,262 | (0.1) | 13.3 | ||||||||||||||||||

Interest-bearing liabilities | ||||||||||||||||||||||||||||||

Demand deposits | $ | 670,424 | 1.31 | % | $ | 646,399 | 0.66 | % | $ | 644,881 | 0.22 | % | $ | 589,737 | 0.16 | % | $ | 494,081 | 0.14 | % | 3.7 | 35.7 | ||||||||

Money market and savings deposits | 1,043,076 | 0.60 | 1,034,580 | 0.35 | 1,019,295 | 0.21 | 1,075,791 | 0.23 | 1,001,115 | 0.26 | 0.8 | 4.2 | ||||||||||||||||||

Certificates of deposit $100,000 or more | 217,051 | 0.79 | 222,697 | 0.55 | 234,325 | 0.58 | 286,587 | 0.40 | 174,268 | 0.49 | (2.5) | 24.6 | ||||||||||||||||||

Other time deposits | 205,293 | 0.62 | 215,014 | 0.51 | 221,714 | 0.54 | 175,683 | 0.57 | 173,975 | 0.50 | (4.5) | 18.0 | ||||||||||||||||||

Interest-bearing deposits | 2,135,844 | 0.85 | 2,118,690 | 0.48 | 2,120,215 | 0.29 | 2,127,798 | 0.26 | 1,843,439 | 0.27 | 0.8 | 15.9 | ||||||||||||||||||

Securities sold under retail repurchase agreements | ||||||||||||||||||||||||||||||

and federal funds purchased | — | — | — | — | — | — | 2,770 | 0.29 | 3,972 | 0.30 | — | (100.0) | ||||||||||||||||||

Advances from FHLB - short-term | 7,391 | 3.86 | — | — | — | — | — | — | — | — | 100.0 | 100.0 | ||||||||||||||||||

Advances from FHLB - long-term | 653 | (6.08) | 10,035 | 0.63 | 10,075 | 0.60 | 10,116 | 0.57 | 6,630 | 2.21 | (93.5) | (90.2) | ||||||||||||||||||

Subordinated debt | 43,031 | 6.64 | 42,953 | 6.33 | 42,876 | 4.93 | 42,804 | 4.93 | 36,589 | 5.12 | 0.2 | 17.6 | ||||||||||||||||||

Total interest-bearing liabilities | 2,186,919 | 0.96 | % | 2,171,678 | 0.60 | % | 2,173,166 | 0.38 | % | 2,183,488 | 0.35 | % | 1,890,630 | 0.37 | % | 0.7 | 15.7 | |||||||||||||

Noninterest-bearing deposits | 870,890 | 893,968 | 872,883 | 916,415 | 703,712 | (2.6) | 23.8 | |||||||||||||||||||||||

Accrued expenses and other liabilities | 21,647 | 21,336 | 19,927 | 24,567 | 141,825 | 1.5 | (84.7) | |||||||||||||||||||||||

Stockholders' equity | 361,623 | 357,383 | 353,192 | 353,011 | 301,095 | 1.2 | 20.1 | |||||||||||||||||||||||

Total liabilities and stockholders' equity | $ | 3,441,079 | $ | 3,444,365 | $ | 3,419,168 | $ | 3,477,481 | $ | 3,037,262 | (0.1) | 13.3 | ||||||||||||||||||

Net interest spread | 3.04 | % | 3.18 | % | 2.98 | % | 2.66 | % | 2.74 | % | ||||||||||||||||||||

Net interest margin | 3.35 | % | 3.38 | % | 3.10 | % | 2.78 | % | 2.87 | % | ||||||||||||||||||||

(1) | All amounts are reported on a tax-equivalent basis computed using the statutory federal income tax rate of 21.0%, exclusive of nondeductible interest expense. |

(2) | Average loan balances include nonaccrual loans. |

(3) | Interest income on loans includes accreted loan fees, net of costs and accretion of discounts on acquired loans, which are included in the yield calculations. |

Shore Bancshares, Inc. Reconciliation of Generally Accepted Accounting Principles (GAAP) and Non-GAAP Measures (Unaudited) (In thousands, except per share data) | ||||||||||||||||||||||

YTD | YTD | |||||||||||||||||||||

Q4 2022 | Q3 2022 | Q2 2022 | Q1 2022 | Q4 2021 | 12/31/2022 | 12/31/2021 | ||||||||||||||||

The following reconciles return on average equity and return on | ||||||||||||||||||||||

Net Income | $ | 8,407 | $ | 9,658 | $ | 7,499 | $ | 5,613 | $ | 2,723 | $ | 31,177 | $ | 15,368 | ||||||||

Net Income - annualized (A) | $ | 33,354 | $ | 38,317 | $ | 30,078 | $ | 22,764 | $ | 10,803 | $ | 31,177 | $ | 15,368 | ||||||||

Net income, excluding net amortization of intangible assets | ||||||||||||||||||||||

and merger related expenses | $ | 9,463 | $ | 10,144 | $ | 8,054 | $ | 6,541 | $ | 8,176 | $ | 34,201 | $ | 22,279 | ||||||||

Net income, excluding net amortization of intangible assets | $ | 37,543 | $ | 40,245 | $ | 32,305 | $ | 26,527 | $ | 32,437 | $ | 34,201 | $ | 22,279 | ||||||||

Return on average assets excluding net amortization of | 1.09 | % | 1.17 | % | 0.94 | % | 0.76 | % | 1.07 | % | 0.99 | % | 0.95 | % | ||||||||

Average stockholders' equity (C) | $ | 361,623 | $ | 357,383 | $ | 353,192 | $ | 353,011 | $ | 301,095 | $ | 355,850 | $ | 224,055 | ||||||||

Less: Average goodwill and other intangible assets | (69,077) | (69,558) | (70,057) | (70,711) | (52,692) | (69,845) | (27,535) | |||||||||||||||

Average tangible equity (D) | $ | 292,546 | $ | 287,825 | $ | 283,135 | $ | 282,300 | $ | 248,403 | $ | 286,005 | $ | 196,520 | ||||||||

Return on average equity (GAAP) (A)/(C) | 9.22 | % | 10.72 | % | 8.52 | % | 6.45 | % | 3.59 | % | 8.76 | % | 6.86 | % | ||||||||

Return on average tangible equity (Non-GAAP) (B)/(D) | 12.83 | % | 13.98 | % | 11.41 | % | 9.40 | % | 13.06 | % | 11.96 | % | 11.34 | % | ||||||||

The following reconciles GAAP efficiency ratio and non-GAAP | ||||||||||||||||||||||

Noninterest expense (E) | $ | 21,000 | $ | 18,899 | $ | 20,094 | $ | 20,332 | $ | 23,497 | $ | 80,322 | $ | 56,806 | ||||||||

Less: Amortization of intangible assets | (460) | (499) | (511) | (517) | (381) | (1,988) | (734) | |||||||||||||||

Merger Expenses | (967) | (159) | (241) | (730) | (7,615) | (2,098) | (8,530) | |||||||||||||||

Adjusted noninterest expense (F) | $ | 19,573 | $ | 18,241 | $ | 19,342 | $ | 19,085 | $ | 15,501 | $ | 76,236 | $ | 47,542 | ||||||||

Net interest income (G) | 26,943 | 27,315 | 24,618 | 22,430 | 20,639 | 101,302 | 64,130 | |||||||||||||||

Add: Taxable-equivalent adjustment | 40 | 35 | 38 | 39 | 13 | 155 | 121 | |||||||||||||||

Taxable-equivalent net interest income (H) | $ | 26,983 | $ | 27,350 | $ | 24,656 | $ | 22,469 | $ | 20,652 | $ | 101,457 | $ | 64,251 | ||||||||

Noninterest income (I) | $ | 5,862 | $ | 5,344 | $ | 5,833 | $ | 6,046 | $ | 5,129 | $ | 23,086 | 13,498 | |||||||||

Less: Investment securities (gains) | — | — | — | — | — | — | (2) | |||||||||||||||

Adjusted noninterest income (J) | $ | 5,862 | $ | 5,344 | $ | 5,833 | $ | 6,046 | $ | 5,129 | $ | 23,086 | $ | 13,496 | ||||||||

Efficiency ratio (GAAP) (E)/(G)+(I) | 64.01 | % | 57.87 | % | 65.99 | % | 71.40 | % | 91.19 | % | 64.57 | % | 73.18 | % | ||||||||

Efficiency ratio (Non-GAAP) (F)/(H)+(J) | 59.59 | % | 55.79 | % | 63.44 | % | 66.93 | % | 60.13 | % | 61.21 | % | 61.15 | % | ||||||||

The following reconciles book value per common share | ||||||||||||||||||||||

Stockholders' equity (L) | $ | 364,285 | $ | 357,221 | $ | 352,777 | $ | 351,864 | $ | 350,693 | ||||||||||||

Less: Goodwill and other intangible assets | (68,813) | (69,288) | (69,787) | (70,299) | (70,956) | |||||||||||||||||

Tangible equity (M) | $ | 295,472 | $ | 287,933 | $ | 282,990 | $ | 281,565 | $ | 279,737 | ||||||||||||

Shares outstanding (N) | 19,865 | 19,858 | 19,850 | 19,843 | 19,808 | |||||||||||||||||

Book value per common share (GAAP) (L)/(N) | $ | 18.34 | $ | 17.99 | $ | 17.77 | $ | 17.73 | $ | 17.71 | ||||||||||||

Tangible book value per common share (Non-GAAP) (M)/(N) | $ | 14.87 | $ | 14.50 | $ | 14.26 | $ | 14.19 | $ | 14.12 | ||||||||||||

The following reconciles equity to assets and tangible | ||||||||||||||||||||||

Stockholders' equity (O) | $ | 364,285 | $ | 357,221 | $ | 352,777 | $ | 351,864 | $ | 350,693 | ||||||||||||

Less: Goodwill and other intangible assets | (68,813) | (69,288) | (69,787) | (70,299) | (70,956) | |||||||||||||||||

Tangible equity (P) | $ | 295,472 | $ | 287,933 | $ | 282,990 | $ | 281,565 | $ | 279,737 | ||||||||||||

Assets (Q) | $ | 3,477,276 | $ | 3,446,804 | $ | 3,442,550 | $ | 3,494,497 | $ | 3,460,136 | ||||||||||||

Less: Goodwill and other intangible assets | (68,813) | (69,288) | (69,787) | (70,299) | (70,956) | |||||||||||||||||

Tangible assets (R) | $ | 3,408,463 | $ | 3,377,516 | $ | 3,372,763 | $ | 3,424,198 | $ | 3,389,180 | ||||||||||||

Period-end equity/assets (GAAP) (O)/(Q) | 10.48 | % | 10.36 | % | 10.25 | % | 10.07 | % | 10.14 | % | ||||||||||||

Period-end tangible equity/tangible assets (Non-GAAP) (P)/(R) | 8.67 | % | 8.52 | % | 8.39 | % | 8.22 | % | 8.25 | % |

Note 1: Management believes that reporting tangible equity and tangible assets more closely approximates the adequacy of capital for regulatory purposes. |

Note 2: Management believes that reporting the non-GAAP efficiency ratio more closely measures its effectiveness of controlling cash-based operating activities. |

View original content to download multimedia:https://www.prnewswire.com/news-releases/shore-bancshares-reports-2022-financial-results-301731847.html

SOURCE Shore Bancshares, Inc.

Uncategorized

Homes listed for sale in early June sell for $7,700 more

New Zillow research suggests the spring home shopping season may see a second wave this summer if mortgage rates fall

The post Homes listed for sale in…

- A Zillow analysis of 2023 home sales finds homes listed in the first two weeks of June sold for 2.3% more.

- The best time to list a home for sale is a month later than it was in 2019, likely driven by mortgage rates.

- The best time to list can be as early as the second half of February in San Francisco, and as late as the first half of July in New York and Philadelphia.

Spring home sellers looking to maximize their sale price may want to wait it out and list their home for sale in the first half of June. A new Zillow® analysis of 2023 sales found that homes listed in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical U.S. home.

The best time to list consistently had been early May in the years leading up to the pandemic. The shift to June suggests mortgage rates are strongly influencing demand on top of the usual seasonality that brings buyers to the market in the spring. This home-shopping season is poised to follow a similar pattern as that in 2023, with the potential for a second wave if the Federal Reserve lowers interest rates midyear or later.

The 2.3% sale price premium registered last June followed the first spring in more than 15 years with mortgage rates over 6% on a 30-year fixed-rate loan. The high rates put home buyers on the back foot, and as rates continued upward through May, they were still reassessing and less likely to bid boldly. In June, however, rates pulled back a little from 6.79% to 6.67%, which likely presented an opportunity for determined buyers heading into summer. More buyers understood their market position and could afford to transact, boosting competition and sale prices.

The old logic was that sellers could earn a premium by listing in late spring, when search activity hit its peak. Now, with persistently low inventory, mortgage rate fluctuations make their own seasonality. First-time home buyers who are on the edge of qualifying for a home loan may dip in and out of the market, depending on what’s happening with rates. It is almost certain the Federal Reserve will push back any interest-rate cuts to mid-2024 at the earliest. If mortgage rates follow, that could bring another surge of buyers later this year.

Mortgage rates have been impacting affordability and sale prices since they began rising rapidly two years ago. In 2022, sellers nationwide saw the highest sale premium when they listed their home in late March, right before rates barreled past 5% and continued climbing.

Zillow’s research finds the best time to list can vary widely by metropolitan area. In 2023, it was as early as the second half of February in San Francisco, and as late as the first half of July in New York. Thirty of the top 35 largest metro areas saw for-sale listings command the highest sale prices between May and early July last year.

Zillow also found a wide range in the sale price premiums associated with homes listed during those peak periods. At the hottest time of the year in San Jose, homes sold for 5.5% more, a $88,000 boost on a typical home. Meanwhile, homes in San Antonio sold for 1.9% more during that same time period.

| Metropolitan Area | Best Time to List | Price Premium | Dollar Boost |

| United States | First half of June | 2.3% | $7,700 |

| New York, NY | First half of July | 2.4% | $15,500 |

| Los Angeles, CA | First half of May | 4.1% | $39,300 |

| Chicago, IL | First half of June | 2.8% | $8,800 |

| Dallas, TX | First half of June | 2.5% | $9,200 |

| Houston, TX | Second half of April | 2.0% | $6,200 |

| Washington, DC | Second half of June | 2.2% | $12,700 |

| Philadelphia, PA | First half of July | 2.4% | $8,200 |

| Miami, FL | First half of June | 2.3% | $12,900 |

| Atlanta, GA | Second half of June | 2.3% | $8,700 |

| Boston, MA | Second half of May | 3.5% | $23,600 |

| Phoenix, AZ | First half of June | 3.2% | $14,700 |

| San Francisco, CA | Second half of February | 4.2% | $50,300 |

| Riverside, CA | First half of May | 2.7% | $15,600 |

| Detroit, MI | First half of July | 3.3% | $7,900 |

| Seattle, WA | First half of June | 4.3% | $31,500 |

| Minneapolis, MN | Second half of May | 3.7% | $13,400 |

| San Diego, CA | Second half of April | 3.1% | $29,600 |

| Tampa, FL | Second half of June | 2.1% | $8,000 |

| Denver, CO | Second half of May | 2.9% | $16,900 |

| Baltimore, MD | First half of July | 2.2% | $8,200 |

| St. Louis, MO | First half of June | 2.9% | $7,000 |

| Orlando, FL | First half of June | 2.2% | $8,700 |

| Charlotte, NC | Second half of May | 3.0% | $11,000 |

| San Antonio, TX | First half of June | 1.9% | $5,400 |

| Portland, OR | Second half of April | 2.6% | $14,300 |

| Sacramento, CA | First half of June | 3.2% | $17,900 |

| Pittsburgh, PA | Second half of June | 2.3% | $4,700 |

| Cincinnati, OH | Second half of April | 2.7% | $7,500 |

| Austin, TX | Second half of May | 2.8% | $12,600 |

| Las Vegas, NV | First half of June | 3.4% | $14,600 |

| Kansas City, MO | Second half of May | 2.5% | $7,300 |

| Columbus, OH | Second half of June | 3.3% | $10,400 |

| Indianapolis, IN | First half of July | 3.0% | $8,100 |

| Cleveland, OH | First half of July | 3.4% | $7,400 |

| San Jose, CA | First half of June | 5.5% | $88,400 |

The post Homes listed for sale in early June sell for $7,700 more appeared first on Zillow Research.

federal reserve pandemic home sales mortgage rates interest ratesUncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

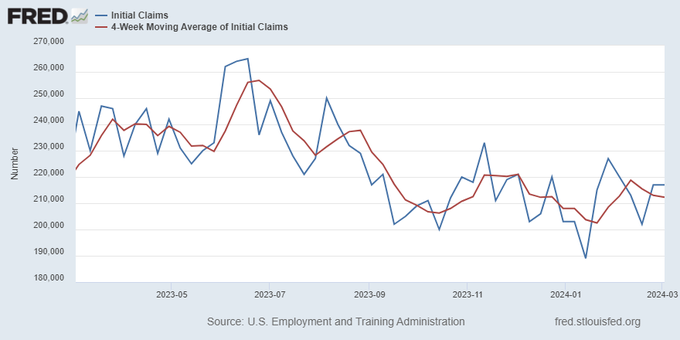

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemployment-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex