Government

Seven Clean Energy Investments to Buy as Biden Seeks U.S. Supply of Critical Materials

Seven clean energy investments to buy should be aided by President Joe Biden’s plans to develop domestic supply of critical materials to avoid dependence…

Seven clean energy investments to buy should be aided by President Joe Biden’s plans to develop domestic supply of critical materials to avoid dependence on China and other countries that may not prove to be consistently reliable trade partners.

The seven clean energy investments to buy are engaged in providing key minerals such as rare earth elements, lithium and cobalt that are needed in products used in computers and household appliances. The Biden administration has been examining U.S. “vulnerabilities” and exploring ways to assure clean energy technologies like batteries, electric vehicles, wind turbines and solar panels have access to the key inputs they need.

The White House projects global demand for these critical minerals will “skyrocket” by 400-600% in the next several decades. The demand for minerals such as lithium and graphite used in electric vehicle (EV) batteries will increase by as much as 4,000%, the Biden administration forecasts.

However, the United States increasingly is dependent on foreign sources for many of the processed versions of these minerals. For example, China controls most of the market for processing and refining for cobalt, lithium, rare earth elements and other critical minerals.

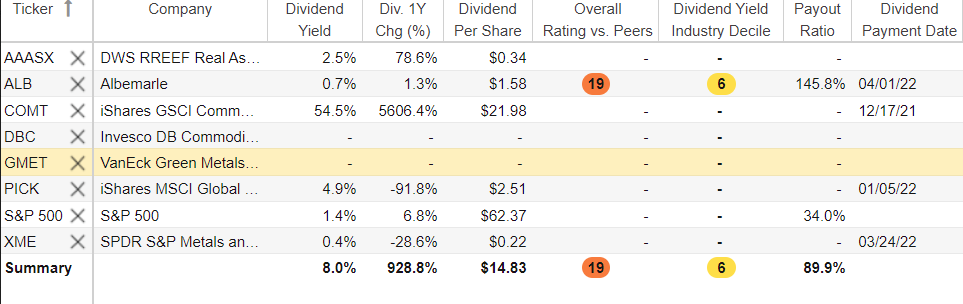

Chart generated using Stock Rover. Activate your 2-week free trial now.

Critical Minerals Supply Chain Needs Domestic Development

In June 2021, the Biden administration released a supply chain assessment that found America’s overreliance on foreign sources and adversarial nations for critical minerals and materials posed national and economic security threats. However, the seven clean energy investments to buy are positioned to tap into these opportunities.

One is Albemarle Corporation (NYSE: ALB), a specialty chemicals manufacturing company in Charlotte, North Carolina, that operates three divisions: lithium, bromine specialties and catalysts. The company ranks among the largest providers of lithium to meet growing demand for electric vehicle (EV) batteries.

“ALB is definitely one to feature,” said Jim Woods, who heads the Successful Investing and Intelligence Report investment newsletters, as well as the Bullseye Stock Trader and High Velocity Options trading services.

Albemarle’s share price has risen 6.46% in the past week and 26.45% for the last month, while falling 3.14% for the year to date, after surging 50.99% in the past 12 months. Albemarle offers a current dividend yield of 0.7% and has averaged a five-year return of 14%.

Chart courtesy of www.stockcharts.com

Albemarle is a current recommendation in the Intelligence Report investment newsletter that Woods leads. The stock is part of his Income Multipliers portfolio that seeks to include dividend-paying investments.

Paul Dykewicz meets with Jim Woods, who leads the Successful Investing and Intelligence Report investment newsletters.

Seven Clean Energy Investments to Buy Include Metals & Mining ETF

The SPDR S&P Metals & Mining ETF (NYSE: XME) seeks to provide investment results that correspond generally to the total return of the S&P Metals and Mining Select Industry Index. The metals & mining segment comprises sub-industries that include aluminum, coal & consumable fuels, copper, diversified metals & mining, gold, precious metals & minerals, silver and steel. Although the fund includes many metals and mining stocks that do not encompass those considered critical materials by the Biden administration, Woods still recommends it for investment purposes.

“If you want targeted sector exposure to U.S. companies engaged in the extraction of metals and other natural resources, then you need XME,” said Jim Woods, editor of Successful Investing, Intelligence Report and Bullseye Stock Trader.

“This exchange traded fund, whose full name is the SPDR S&P Metals & Mining ETF, contains the biggest and arguably the best metals and mining stocks in the market today,” said Woods, who also teams up with Mark Skousen on the Fast Money Alert trading service. “And as natural resource prices climb, XME may also serve as a hedge against commodity inflationary.”

The ETF has been ascending during the past year by climbing 0.32% in the last week, 5.10% in the last month, 39.75% for the year to date and 54.80% in the last 12 months. XME also offers a modest dividend yield of 0.4% and has amassed total assets of $3.5 billion.

Chart courtesy of www.stockcharts.com

Seven Clean Energy Investments to Buy Could Strengthen America’s National Defense

President Biden announced on March 31 that he will issue a directive authorizing the use of the Defense Production Act (DPA) to secure American production of critical materials to reduce reliance on China and other countries for the minerals and materials that power clean energy. Specifically, the DPA will be authorized to support the production and processing of minerals and materials such as lithium, nickel, cobalt, graphite and manganese that are used for large-capacity batteries.

The sectors such as transportation that are supported by these large-capacity batteries account for more than half of U.S. carbon emissions, according to the White House. President Biden also indicated he is reviewing potential uses of DPA for more than minerals and materials to secure “safer, cleaner and more resilient energy” for America.

Russian President Vladimir Putin’s invasion of neighboring Ukraine and his troops’ assaults against hospitals, schools, residential areas, churches, nuclear power plants and a theater used as a shelter serve as a reminder of how quickly critical minerals can be cut off. Russia’s invasion of Ukraine led to a shortage of neon gas and palladium, which are crucial to the manufacture of computer chips.

Roughly 45-54% of the world’s semiconductor-grade neon that is critical for the lasers used to make chips comes from two Ukrainian companies, Ingas and Cryon. Plus, Putin’s invasion of Ukraine has spurred economic sanctions from the United States, the United Kingdom, Canada, Japan, South Korea, Australia and the European Union to pressure him to call his troops home and stop killing civilians in acts of violence that recently led President Biden to blast the Russian leader’s brutality.

Carlson Chooses COMT as Third of Seven Clean Energy Investments to Buy

President Biden’s proposal reinforces several recommendations of Bob Carlson, a pension fund chairman who also heads the Retirement Watch investment newsletter.

Carlson recommended broad-based commodities investments that he said should do well at this time. One is the iShares GSCI Commodity Dynamic Roll Strategy ETF (NASDAQ GM: COMT). That ETF seeks to track the investment results of an index composed of a broad range of commodity exposure.

The fund gives investors access to commodities across energy, metals, agriculture and livestock sectors through a rules-based futures strategy designed to minimize costs associated with futures investing. The ETF also simplifies tax filings by not requiring K-1 tax reporting. The fund further uses a diverse commodities portfolio to help protect against inflation.

Chart courtesy of www.stockcharts.com

COMT has pulled back lately by dipping 0.42% in the past week and 4.02% in the last month, but it is up 30.60% so far in 2022 and 60.34% in the past 12 months.

DBC is Fourth of Seven Clean Energy Investments to Buy

The Invesco DB Commodity Index Tracking Fund (NYSE ARCA: DBC) is another way to invest broadly in commodities, Carlson commented. DBC edged up 1.65% in the last week, dipped 1.85% in the past month, but climbed 26.12% since the start of 2022 and 27.57% in the past 12 months.

The fund is designed for investors who want a cost-effective and convenient way to gain exposure to commodity futures. The rules-based index followed by DBC tracks futures contracts on 14 of the most heavily traded and important physical commodities in the world. The fund and the Index are rebalanced and reconstituted annually in November.

The fund is not suitable for all investors due to its speculative nature. Futures contracts are inherently volatile. Plus, frequent moves of market prices for the underlying futures contracts may cause large losses.

Chart courtesy of www.stockcharts.com

AAASX is Fifth of Seven Clean Energy Investments to Buy

Another choice is a broader-based real assets portfolio such as DWS RREEF Real Assets Fund (AAASX), Carlson continued. The mutual fund aims to create a holistic portfolio of real assets across real estate, infrastructure, natural resource equities, commodity futures and Treasury Inflation-Protected Securities (TIPS).

Even though the fund does not focus solely on clean energy, its broad nature aids in diversification to reduce risk. The fund has produced returns of 0.44% for the past week, 3.42% in the last month, 4.78% since the start of 2022 and 20.69% in the latest 12 months.

Chart courtesy of www.stockcharts.com

PICK Offers the Sixth of Seven Clean Energy Stocks to Buy

Carlson also chose iShares MSCI Global Metals and Mining Producers (PICK). He began recommending the exchange-traded fund (ETF) last fall and has seen it rise by double-digit percentages.

PICK has climbed 1.53% in the past week, 3.61% for the last month, 21.07% so far in 2022 and 25.58% in the past 12 months. The ETF tracks an index of global mining companies that excludes gold and silver miners.

Chart courtesy of www.stockcharts.com

The index consists of 216 stocks, but its capitalization weighting means 50% of the fund is in its 10 largest positions. Top holdings recently consisted of BHP Group Ltd. (NYSE: BHP), Rio Tinto Limited (OTCMKTS: RTNTF), Vale S.A. (NYSE: VALE), Freeport-McMoRan Inc. (NYSE: FCX) and Anglo-American plc (OTCMKTS: NGLOY).

“I was attracted to this ETF even before the invasion of Ukraine,” Carlson commented. “The mining companies had gone through a long bear market. They worked to reduce debt and otherwise clean up their balance sheets. Their more efficient operations mean most of them can profit at relatively low prices for their commodities and will earn strong profits as prices rise. The strong global demand, combined with the recent supply shocks, make them more attractive.”

Bob Carlson, head of Retirement Watch, talks to author Paul Dykewicz.

Roughly 23% of the fund is in North American-based companies. Other leading regions in the fund are the United Kingdom, 13%; Developed Europe, 9%; Emerging Europe, 4.9%; and Africa/Middle East, 4.9%.

Portia Capital Management President Prefers PICK to Provide Mining Diversification

Michelle Connell, a former portfolio manager who now is the president and owner of Dallas-based Portia Capital Management, said she also likes PICK to diversify beyond a pure play mining stock through a single investment.

Michelle Connell, CEO, Portia Capital Management

“There are several reasons for my rationale,” Connell said.

One, PICK holds a “plethora of companies” that have strong fundamentals, Connell counseled. Second, PICK’s dividend yield is compelling at nearly 5%, she added.

PICK provides exposure to worldwide mining and production of diversified metals, except for gold and silver. The investment rationale is to buy a basket of diversified metals — many of them necessary for manufacturing — as an inflation hedge.

One point of caution is that PICK is market-cap-weighted, with its top 10 stock holdings comprising more than 50% of the ETF’s portfolio. As a result, underperformance by any of those key positions could crimp the fund’s returns, Connell continued.

Freeport-McMoRan (NYSE: FCX), of Phoenix, Arizona, ranks near the top of the ETF’s biggest positions. The company owns copper mines across the globe. With copper in short supply and used in many manufacturing processes, including green technology and electric vehicles, Freeport-McMoRan is strong fundamentally and its 12-month upside is 30-40%, Connell continued.

Green Metals Fund Is Seventh of Seven Clean Energy Stocks to Buy

Connell further proposed buying the VanEck Green Metals ETF (NYSE ARCA: GMET) that launched November 9, 2021. She praised its “basket approach” of owning high-risk investments and metals/materials as commodities that could be regarded as high risk.

GMET seeks to track the price and yield performance of the MVIS Global Clean-Tech Metals Index (MVGMETTR). The fund aims to mirror the performance of companies involved in the production, refining, processing and recycling of green metals that are used in the applications, products and processes that enable the energy transition from fossil fuels to cleaner energy sources and technologies.

The ETF has $28.5 million in total net assets and offers dividend income, too. Key selling points for the ETF include the fact that certain metals are critical to energy transition. Its holdings offer comprehensive global exposure, and demand for “green” metals is outstripping supply.

A transition to a low-carbon economy cannot happen without green metals such as cobalt, copper, lithium, rare earths and zinc. The fund’s portfolio provides access to companies involved in the production of green metals globally, including China A-shares. Part of the investment case is that future production of key minerals may not be sufficient to meet supply.

Chart courtesy of www.stockcharts.com

President Biden Calls Putin a ‘War Criminal’ for ‘Brutal’ Acts in Ukraine

The need for sourcing critical materials domestically for clean energy was underscored when President Biden said on Monday, April 4, that he regards Putin as a “war criminal” for ordering Russian soldiers to invade Ukraine, where news reports have documented the rape of women and girls, as well as the execution of some of them and those of many civilian males. With the documented killing of civilians who were bound and shot in the heads and chests, President Biden said he is planning to add further sanctions against Russia.

Putin is “brutal” and the killing of civilians by Russian troops needs to be documented for a potential “wartime trial,” President Biden said. Meanwhile, Ukraine further should be provided with the weapons it needs to “continue the fight” to defend against Russia’s invasion, he added.

The killing of many civilians in Bucha, Ukraine, and other cities in the country is “outrageous,” said President Biden, who previously announced economic sanctions against Russia and called Putin a “butcher” for ordering his troops to attack Ukrainian men, women and children in hospitals, schools, residential areas, churches and a theater used as a shelter. Putin’s forces also attacked Ukrainian nuclear power plants and reportedly were exposed to significant levels of radiation by taking control of them at gunpoint.

Czech Internet Businessman Responds to Horrific Treatment of Ukrainians With Big Donation

Bodies in mass graves, strewn on streets or hidden in homes have shown firsthand the horrors of Russia’s war against Ukraine. The latest corporate leader to speak out against the killings came forward on Monday, April 4, when Ivo Lukačovič, a Czech businessman and founder of internet company Seznam.cz, announced he would send 100 million Kc (roughly €4 million) of his own funds to assist Ukraine.

He cited horrific footage from the town of Bucha that first appeared on April 1 after the retreat of Russian troops from the area. The videos documented corpses of hundreds of dead civilians where the Russian forces had just left.

Fears are high among Ukrainian leaders and others that such atrocities could occur or may already have taken place in other towns and cities still occupied by Russian forces in violation of international law.

The 48-year-old entrepreneur and billionaire posted on Twitter that the video evidence of inhumanity by the Russian troops appalled him. As a result, Luckovich pledged to dedicate part of his private wealth to buy weapons for the Ukrainian army.

In early March, Seznam announced it would allocate up to 100 million Kc to donate to non-governmental organizations (NGOs) and associations helping Ukrainian refugees. In February, Lukačovič personally committed to donate 23 million Kc for that same purpose.

COVID-19 Cases Surge in China, Cause Lockdowns, Take Children from Parents

COVID-19 has caused cases to surge in China, with Shanghai now the country’s hotspot. All 25 million residents there were placed in lockdown, as the Chinese military and extra health workers were sent to assist in the response.

China reported more than 20,000 new cases on Tuesday, April 5, setting a record in the country where the virus originated in Wuhan during 2020 when the global pandemic began. Young children with COVID-19 have been separated forcibly from their parents, fueling public dissent, as Chinese leaders seek to stop the spread of a new, highly contagious subvariant of Omicron, BA.2. The variant also is spreading a new wave of infections in Europe, where COVID cases are climbing in Germany, the Netherlands and Switzerland.

COVID-19 deaths worldwide exceeded 6.1 million to total 6,159,056 on April 6, according to Johns Hopkins University. Cases across the globe have jumped by more than 8 million in the past week to 493,710,804.

U.S. COVID-19 cases, as of April 6, hit 80,209,028, with deaths rising to 982,585. America has the dreaded distinction as the nation with the most COVID-19 cases and deaths.

As of April 5, 255,838,817 people, or 77.1% of the U.S. population, have obtained at least one dose of a COVID-19 vaccine, the CDC reported. Fully vaccinated people total 217,955,850, or 65.6%, of the U.S. population, according to the CDC. In addition, 98,168,087 people have received a booster dose of COVID-19 vaccine, up about 750,000 in the past week, compared to roughly 300,000 during the prior week.

The seven clean energy investments to buy offer one stock and six funds that provide exposure to the shift away from fossil fuels that the Biden administration is advocating. However, many of the funds are diversified in a variety of metals and mining activity to enhance investment returns while the clean energy movement slowly gains ground, as many European countries seek to stop buying oil and natural gas from Russia but need alternative sources of fossil fuel production to fill the void.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for multiple-book pricing.

The post Seven Clean Energy Investments to Buy as Biden Seeks U.S. Supply of Critical Materials appeared first on Stock Investor.

dow jones nasdaq equities stocks pandemic covid-19 real estate etf white house cdc army vaccine treatment spread deaths lockdown new cases commodities gold oil south korea africa japan wuhan canada european europe germany netherlands czech russia ukraine chinaGovernment

The War Between Knowledge And Stupidity

The War Between Knowledge And Stupidity

Authored by Bert Olivier via The Brownstone Institute,

Bernard Stiegler was, until his premature…

Authored by Bert Olivier via The Brownstone Institute,

Bernard Stiegler was, until his premature death, probably the most important philosopher of technology of the present. His work on technology has shown us that, far from being exclusively a danger to human existence, it is a pharmakon – a poison as well as a cure – and that, as long as we approach technology as a means to ‘critical intensification,’ it could assist us in promoting the causes of enlightenment and freedom.

It is no exaggeration to say that making believable information and credible analysis available to citizens at present is probably indispensable for resisting the behemoth of lies and betrayal confronting us. This has never been more necessary than it is today, given that we face what is probably the greatest crisis in the history of humanity, with nothing less than our freedom, let alone our lives, at stake.

To be able to secure this freedom against the inhuman forces threatening to shackle it today, one could do no better than to take heed of what Stiegler argues in States of Shock: Stupidity and Knowledge in the 21st Century (2015). Considering what he writes here it is hard to believe that it was not written today (p. 15):

The impression that humanity has fallen under the domination of unreason or madness [déraison] overwhelms our spirit, confronted as we are with systemic collapses, major technological accidents, medical or pharmaceutical scandals, shocking revelations, the unleashing of the drives, and acts of madness of every kind and in every social milieu – not to mention the extreme misery and poverty that now afflict citizens and neighbours both near and far.

While these words are certainly as applicable to our current situation as it was almost 10 years ago, Stiegler was in fact engaged in an interpretive analysis of the role of banks and other institutions – aided and abetted by certain academics – in the establishment of what he terms a ‘literally suicidal financial system’ (p. 1). (Anyone who doubts this can merely view the award-winning documentary film of 2010, Inside Job, by Charles Ferguson, which Stiegler also mentions on p.1.) He explains further as follows (p. 2):

Western universities are in the grip of a deep malaise, and a number of them have found themselves, through some of their faculty, giving consent to – and sometimes considerably compromised by – the implementation of a financial system that, with the establishment of hyper-consumerist, drive-based and ‘addictogenic’ society, leads to economic and political ruin on a global scale. If this has occurred, it is because their goals, their organizations and their means have been put entirely at the service of the destruction of sovereignty. That is, they have been placed in the service of the destruction of sovereignty as conceived by the philosophers of what we call the Enlightenment…

In short, Stiegler was writing about the way in which the world was being prepared, across the board – including the highest levels of education – for what has become far more conspicuous since the advent of the so-called ‘pandemic’ in 2020, namely an all-out attempt to cause the collapse of civilisation as we knew it, at all levels, with the thinly disguised goal in mind of installing a neo-fascist, technocratic, global regime which would exercise power through AI-controlled regimes of obedience. The latter would centre on ubiquitous facial recognition technology, digital identification, and CBDCs (which would replace money in the usual sense).

Given the fact that all of this is happening around us, albeit in a disguised fashion, it is astonishing that relatively few people are conscious of the unfolding catastrophe, let alone being critically engaged in disclosing it to others who still inhabit the land where ignorance is bliss. Not that this is easy. Some of my relatives are still resistant to the idea that the ‘democratic carpet’ is about to be pulled from under their feet. Is this merely a matter of ‘stupidity?’ Stiegler writes about stupidity (p.33):

…knowledge cannot be separated from stupidity. But in my view: (1) this is a pharmacological situation; (2) stupidity is the law of the pharmakon; and (3) the pharmakon is the law of knowledge, and hence a pharmacology for our age must think the pharmakon that I am also calling, today, the shadow.

In my previous post I wrote about the media as pharmaka (plural of pharmakon), showing how, on the one hand, there are (mainstream) media which function as ‘poison,’ while on the other there are (alternative) media that play the role of ‘cure.’ Here, by linking the pharmakon with stupidity, Stiegler alerts one to the (metaphorically speaking) ‘pharmacological’ situation, that knowledge is inseparable from stupidity: where there is knowledge, the possibility of stupidity always asserts itself, and vice versa. Or in terms of what he calls ‘the shadow,’ knowledge always casts a shadow, that of stupidity.

Anyone who doubts this may only cast their glance at those ‘stupid’ people who still believe that the Covid ‘vaccines’ are ‘safe and effective,’ or that wearing a mask would protect them against infection by ‘the virus.’ Or, more currently, think of those – the vast majority in America – who routinely fall for the Biden administration’s (lack of an) explanation of its reasons for allowing thousands of people to cross the southern – and more recently also the northern – border. Several alternative sources of news and analysis have lifted the veil on this, revealing that the influx is not only a way of destabilising the fabric of society, but possibly a preparation for civil war in the United States.

There is a different way of explaining this widespread ‘stupidity,’ of course – one that I have used before to explain why most philosophers have failed humanity miserably, by failing to notice the unfolding attempt at a global coup d’etat, or at least, assuming that they did notice it, to speak up against it. These ‘philosophers’ include all the other members of the philosophy department where I work, with the honourable exception of the departmental assistant, who is, to her credit, wide awake to what has been occurring in the world. They also include someone who used to be among my philosophical heroes, to wit, Slavoj Žižek, who fell for the hoax hook, line, and sinker.

In brief, this explanation of philosophers’ stupidity – and by extension that of other people – is twofold. First there is ‘repression’ in the psychoanalytic sense of the term (explained at length in both the papers linked in the previous paragraph), and secondly there is something I did not elaborate on in those papers, namely what is known as ‘cognitive dissonance.’ The latter phenomenon manifests itself in the unease that people exhibit when they are confronted by information and arguments that are not commensurate, or conflict, with what they believe, or which explicitly challenge those beliefs. The usual response is to find standard, or mainstream-approved responses to this disruptive information, brush it under the carpet, and life goes on as usual.

‘Cognitive dissonance’ is actually related to something more fundamental, which is not mentioned in the usual psychological accounts of this unsettling experience. Not many psychologists deign to adduce repression in their explanation of disruptive psychological conditions or problems encountered by their clients these days, and yet it is as relevant as when Freud first employed the concept to account for phenomena such as hysteria or neurosis, recognising, however, that it plays a role in normal psychology too. What is repression?

In The Language of Psychoanalysis (p. 390), Jean Laplanche and Jean-Bertrand Pontalis describe ‘repression’ as follows:

Strictly speaking, an operation whereby the subject attempts to repel, or to confine to the unconscious, representations (thoughts, images, memories) which are bound to an instinct. Repression occurs when to satisfy an instinct – though likely to be pleasurable in itself – would incur the risk of provoking unpleasure because of other requirements.

…It may be looked upon as a universal mental process to so far as it lies at the root of the constitution of the unconscious as a domain separate from the rest of the psyche.

In the case of the majority of philosophers, referred to earlier, who have studiously avoided engaging critically with others on the subject of the (non-)‘pandemic’ and related matters, it is more than likely that repression occurred to satisfy the instinct of self-preservation, regarded by Freud as being equally fundamental as the sexual instinct. Here, the representations (linked to self-preservation) that are confined to the unconscious through repression are those of death and suffering associated with the coronavirus that supposedly causes Covid-19, which are repressed because of being intolerable. The repression of (the satisfaction of) an instinct, mentioned in the second sentence of the first quoted paragraph, above, obviously applies to the sexual instinct, which is subject to certain societal prohibitions. Cognitive dissonance is therefore symptomatic of repression, which is primary.

Returning to Stiegler’s thesis concerning stupidity, it is noteworthy that the manifestations of such inanity are not merely noticeable among the upper echelons of society; worse – there seems to be, by and large, a correlation between those in the upper classes, with college degrees, and stupidity.

In other words, it is not related to intelligence per se. This is apparent, not only in light of the initially surprising phenomenon pertaining to philosophers’ failure to speak up in the face of the evidence, that humanity is under attack, discussed above in terms of repression.

Dr Reiner Fuellmich, one of the first individuals to realise that this was the case, and subsequently brought together a large group of international lawyers and scientists to testify in the ‘court of public opinion’ (see 29 min. 30 sec. into the video) on various aspects of the currently perpetrated ‘crime against humanity,’ has drawn attention to the difference between the taxi drivers he talks to about the globalists’ brazen attempt to enslave humanity, and his learned legal colleagues as far as awareness of this ongoing attempt is concerned. In contrast with the former, who are wide awake in this respect, the latter – ostensibly more intellectually qualified and ‘informed’ – individuals are blissfully unaware that their freedom is slipping away by the day, probably because of cognitive dissonance, and behind that, repression of this scarcely digestible truth.

This is stupidity, or the ‘shadow’ of knowledge, which is recognisable in the sustained effort by those afflicted with it, when confronted with the shocking truth of what is occurring worldwide, to ‘rationalise’ their denial by repeating spurious assurances issued by agencies such as the CDC, that the Covid ‘vaccines’ are ‘safe and effective,’ and that this is backed up by ‘the science.’

Here a lesson from discourse theory is called for. Whether one refers to natural science or to social science in the context of some particular scientific claim – for example, Einstein’s familiar theory of special relativity (e=mc2) under the umbrella of the former, or David Riesman’s sociological theory of ‘inner-’ as opposed to ‘other-directedness’ in social science – one never talks about ‘the science,’ and for good reason. Science is science. The moment one appeals to ‘the science,’ a discourse theorist would smell the proverbial rat.

Why? Because the definite article, ‘the,’ singles out a specific, probably dubious, version of science compared to science as such, which does not need being elevated to special status. In fact, when this is done through the use of ‘the,’ you can bet your bottom dollar it is no longer science in the humble, hard-working, ‘belonging-to-every-person’ sense. If one’s sceptical antennae do not immediately start buzzing when one of the commissars of the CDC starts pontificating about ‘the science,’ one is probably similarly smitten by the stupidity that’s in the air.

Earlier I mentioned the sociologist David Riesman and his distinction between ‘inner-directed’ and ‘other-directed’ people. It takes no genius to realise that, to navigate one’s course through life relatively unscathed by peddlers of corruption, it is preferable to take one’s bearings from ‘inner direction’ by a set of values which promotes honesty and eschews mendacity, than from the ‘direction by others.’ Under present circumstances such other-directedness applies to the maze of lies and misinformation emanating from various government agencies as well as from certain peer groups, which today mostly comprise the vociferously self-righteous purveyors of the mainstream version of events. Inner-directness in the above sense, when constantly renewed, could be an effective guardian against stupidity.

Recall that Stiegler warned against the ‘deep malaise’ at contemporary universities in the context of what he called an ‘addictogenic’ society – that is, a society that engenders addictions of various kinds. Judging by the popularity of the video platform TikTok at schools and colleges, its use had already reached addiction levels by 2019, which raises the question, whether it should be appropriated by teachers as a ‘teaching tool,’ or whether it should, as some people think, be outlawed completely in the classroom.

Recall that, as an instance of video technology, TikTok is an exemplary embodiment of the pharmakon, and that, as Stiegler has emphasised, stupidity is the law of the pharmakon, which is, in turn, the law of knowledge. This is a somewhat confusing way of saying that knowledge and stupidity cannot be separated; where knowledge is encountered, its other, stupidity, lurks in the shadows.

Reflecting on the last sentence, above, it is not difficult to realise that, parallel to Freud’s insight concerning Eros and Thanatos, it is humanly impossible for knowledge to overcome stupidity once and for all. At certain times the one will appear to be dominant, while on different occasions the reverse will apply. Judging by the fight between knowledge and stupidity today, the latter ostensibly still has the upper hand, but as more people are awakening to the titanic struggle between the two, knowledge is in the ascendant. It is up to us to tip the scales in its favour – as long as we realise that it is a never-ending battle.

Government

“I Can’t Even Save”: Americans Are Getting Absolutely Crushed Under Enormous Debt Load

"I Can’t Even Save": Americans Are Getting Absolutely Crushed Under Enormous Debt Load

While Joe Biden insists that Americans are doing great…

While Joe Biden insists that Americans are doing great - suggesting in his State of the Union Address last week that "our economy is the envy of the world," Americans are being absolutely crushed by inflation (which the Biden admin blames on 'shrinkflation' and 'corporate greed'), and of course - crippling debt.

The signs are obvious. Last week we noted that banks' charge-offs are accelerating, and are now above pre-pandemic levels.

...and leading this increase are credit card loans - with delinquencies that haven't been this high since Q3 2011.

On top of that, while credit cards and nonfarm, nonresidential commercial real estate loans drove the quarterly increase in the noncurrent rate, residential mortgages drove the quarterly increase in the share of loans 30-89 days past due.

And while Biden and crew can spin all they want, an average of polls from RealClear Politics shows that just 40% of people approve of Biden's handling of the economy.

Crushed

On Friday, Bloomberg dug deeper into the effects of Biden's "envious" economy on Americans - specifically, how massive debt loads (credit cards and auto loans especially) are absolutely crushing people.

Two years after the Federal Reserve began hiking interest rates to tame prices, delinquency rates on credit cards and auto loans are the highest in more than a decade. For the first time on record, interest payments on those and other non-mortgage debts are as big a financial burden for US households as mortgage interest payments.

According to the report, this presents a difficult reality for millions of consumers who drive the US economy - "The era of high borrowing costs — however necessary to slow price increases — has a sting of its own that many families may feel for years to come, especially the ones that haven’t locked in cheap home loans."

The Fed, meanwhile, doesn't appear poised to cut rates until later this year.

According to a February paper from IMF and Harvard, the recent high cost of borrowing - something which isn't reflected in inflation figures, is at the heart of lackluster consumer sentiment despite inflation having moderated and a job market which has recovered (thanks to job gains almost entirely enjoyed by immigrants).

In short, the debt burden has made life under President Biden a constant struggle throughout America.

"I’m making the most money I've ever made, and I’m still living paycheck to paycheck," 40-year-old Denver resident Nikki Cimino told Bloomberg. Cimino is carrying a monthly mortgage of $1,650, and has $4,000 in credit card debt following a 2020 divorce.

"There's this wild disconnect between what people are experiencing and what economists are experiencing."

CBS: Do you attribute the inflation crisis to the pandemic or Biden?

— RNC Research (@RNCResearch) March 15, 2024

WISCONSIN VOTER: "It's been YEARS now since the pandemic — I'm not buying that anymore. At first I did; I'm not buying that anymore because yogurt is STILL going up in price!" pic.twitter.com/apahb65scB

What's more, according to Wells Fargo, families have taken on debt at a comparatively fast rate - no doubt to sustain the same lifestyle as low rates and pandemic-era stimmies provided. In fact, it only took four years for households to set a record new debt level after paying down borrowings in 2021 when interest rates were near zero.

Meanwhile, that increased debt load is exacerbated by credit card interest rates that have climbed to a record 22%, according to the Fed.

[P]art of the reason some Americans were able to take on a substantial load of non-mortgage debt is because they’d locked in home loans at ultra-low rates, leaving room on their balance sheets for other types of borrowing. The effective rate of interest on US mortgage debt was just 3.8% at the end of last year.

Yet the loans and interest payments can be a significant strain that shapes families’ spending choices. -Bloomberg

And of course, the highest-interest debt (credit cards) is hurting lower-income households the most, as tends to be the case.

The lowest earners also understandably had the biggest increase in credit card delinquencies.

"Many consumers are levered to the hilt — maxed out on debt and barely keeping their heads above water," Allan Schweitzer, a portfolio manager at credit-focused investment firm Beach Point Capital Management told Bloomberg. "They can dog paddle, if you will, but any uptick in unemployment or worsening of the economy could drive a pretty significant spike in defaults."

"We had more money when Trump was president," said Denise Nierzwicki, 69. She and her 72-year-old husband Paul have around $20,000 in debt spread across multiple cards - all of which have interest rates above 20%.

Photographer: Jon Cherry/Bloomberg

During the pandemic, Denise lost her job and a business deal for a bar they owned in their hometown of Lexington, Kentucky. While they applied for Social Security to ease the pain, Denise is now working 50 hours a week at a restaurant. Despite this, they're barely scraping enough money together to service their debt.

The couple blames Biden for what they see as a gloomy economy and plans to vote for the Republican candidate in November. Denise routinely voted for Democrats up until about 2010, when she grew dissatisfied with Barack Obama’s economic stances, she said. Now, she supports Donald Trump because he lowered taxes and because of his policies on immigration. -Bloomberg

Meanwhile there's student loans - which are not able to be discharged in bankruptcy.

"I can't even save, I don't have a savings account," said 29-year-old in Columbus, Ohio resident Brittany Walling - who has around $80,000 in federal student loans, $20,000 in private debt from her undergraduate and graduate degrees, and $6,000 in credit card debt she accumulated over a six-month stretch in 2022 while she was unemployed.

"I just know that a lot of people are struggling, and things need to change," she told the outlet.

The only silver lining of note, according to Bloomberg, is that broad wage gains resulting in large paychecks has made it easier for people to throw money at credit card bills.

Yet, according to Wells Fargo economist Shannon Grein, "As rates rose in 2023, we avoided a slowdown due to spending that was very much tied to easy access to credit ... Now, credit has become harder to come by and more expensive."

According to Grein, the change has posed "a significant headwind to consumption."

Then there's the election

"Maybe the Fed is done hiking, but as long as rates stay on hold, you still have a passive tightening effect flowing down to the consumer and being exerted on the economy," she continued. "Those household dynamics are going to be a factor in the election this year."

Meanwhile, swing-state voters in a February Bloomberg/Morning Consult poll said they trust Trump more than Biden on interest rates and personal debt.

Reverberations

These 'headwinds' have M3 Partners' Moshin Meghji concerned.

"Any tightening there immediately hits the top line of companies," he said, noting that for heavily indebted companies that took on debt during years of easy borrowing, "there's no easy fix."

International

Copper Soars, Iron Ore Tumbles As Goldman Says “Copper’s Time Is Now”

Copper Soars, Iron Ore Tumbles As Goldman Says "Copper’s Time Is Now"

After languishing for the past two years in a tight range despite recurring…

After languishing for the past two years in a tight range despite recurring speculation about declining global supply, copper has finally broken out, surging to the highest price in the past year, just shy of $9,000 a ton as supply cuts hit the market; At the same time the price of the world's "other" most important mined commodity has diverged, as iron ore has tumbled amid growing demand headwinds out of China's comatose housing sector where not even ghost cities are being built any more.

Copper surged almost 5% this week, ending a months-long spell of inertia, as investors focused on risks to supply at various global mines and smelters. As Bloomberg adds, traders also warmed to the idea that the worst of a global downturn is in the past, particularly for metals like copper that are increasingly used in electric vehicles and renewables.

Yet the commodity crash of recent years is hardly over, as signs of the headwinds in traditional industrial sectors are still all too obvious in the iron ore market, where futures fell below $100 a ton for the first time in seven months on Friday as investors bet that China’s years-long property crisis will run through 2024, keeping a lid on demand.

Indeed, while the mood surrounding copper has turned almost euphoric, sentiment on iron ore has soured since the conclusion of the latest National People’s Congress in Beijing, where the CCP set a 5% goal for economic growth, but offered few new measures that would boost infrastructure or other construction-intensive sectors.

As a result, the main steelmaking ingredient has shed more than 30% since early January as hopes of a meaningful revival in construction activity faded. Loss-making steel mills are buying less ore, and stockpiles are piling up at Chinese ports. The latest drop will embolden those who believe that the effects of President Xi Jinping’s property crackdown still have significant room to run, and that last year’s rally in iron ore may have been a false dawn.

Meanwhile, as Bloomberg notes, on Friday there were fresh signs that weakness in China’s industrial economy is hitting the copper market too, with stockpiles tracked by the Shanghai Futures Exchange surging to the highest level since the early days of the pandemic. The hope is that headwinds in traditional industrial areas will be offset by an ongoing surge in usage in electric vehicles and renewables.

And while industrial conditions in Europe and the US also look soft, there’s growing optimism about copper usage in India, where rising investment has helped fuel blowout growth rates of more than 8% — making it the fastest-growing major economy.

In any case, with the demand side of the equation still questionable, the main catalyst behind copper’s powerful rally is an unexpected tightening in global mine supplies, driven mainly by last year’s closure of a giant mine in Panama (discussed here), but there are also growing worries about output in Zambia, which is facing an El Niño-induced power crisis.

On Wednesday, copper prices jumped on huge volumes after smelters in China held a crisis meeting on how to cope with a sharp drop in processing fees following disruptions to supplies of mined ore. The group stopped short of coordinated production cuts, but pledged to re-arrange maintenance work, reduce runs and delay the startup of new projects. In the coming weeks investors will be watching Shanghai exchange inventories closely to gauge both the strength of demand and the extent of any capacity curtailments.

“The increase in SHFE stockpiles has been bigger than we’d anticipated, but we expect to see them coming down over the next few weeks,” Colin Hamilton, managing director for commodities research at BMO Capital Markets, said by phone. “If the pace of the inventory builds doesn’t start to slow, investors will start to question whether smelters are actually cutting and whether the impact of weak construction activity is starting to weigh more heavily on the market.”

* * *

Few have been as happy with the recent surge in copper prices as Goldman's commodity team, where copper has long been a preferred trade (even if it may have cost the former team head Jeff Currie his job due to his unbridled enthusiasm for copper in the past two years which saw many hedge fund clients suffer major losses).

As Goldman's Nicholas Snowdon writes in a note titled "Copper's time is now" (available to pro subscribers in the usual place)...

... there has been a "turn in the industrial cycle." Specifically according to the Goldman analyst, after a prolonged downturn, "incremental evidence now points to a bottoming out in the industrial cycle, with the global manufacturing PMI in expansion for the first time since September 2022." As a result, Goldman now expects copper to rise to $10,000/t by year-end and then $12,000/t by end of Q1-25.’

Here are the details:

Previous inflexions in global manufacturing cycles have been associated with subsequent sustained industrial metals upside, with copper and aluminium rising on average 25% and 9% over the next 12 months. Whilst seasonal surpluses have so far limited a tightening alignment at a micro level, we expect deficit inflexions to play out from quarter end, particularly for metals with severe supply binds. Supplemented by the influence of anticipated Fed easing ahead in a non-recessionary growth setting, another historically positive performance factor for metals, this should support further upside ahead with copper the headline act in this regard.

Goldman then turns to what it calls China's "green policy put":

Much of the recent focus on the “Two Sessions” event centred on the lack of significant broad stimulus, and in particular the limited property support. In our view it would be wrong – just as in 2022 and 2023 – to assume that this will result in weak onshore metals demand. Beijing’s emphasis on rapid growth in the metals intensive green economy, as an offset to property declines, continues to act as a policy put for green metals demand. After last year’s strong trends, evidence year-to-date is again supportive with aluminium and copper apparent demand rising 17% and 12% y/y respectively. Moreover, the potential for a ‘cash for clunkers’ initiative could provide meaningful right tail risk to that healthy demand base case. Yet there are also clear metal losers in this divergent policy setting, with ongoing pressure on property related steel demand generating recent sharp iron ore downside.

Meanwhile, Snowdon believes that the driver behind Goldman's long-running bullish view on copper - a global supply shock - continues:

Copper’s supply shock progresses. The metal with most significant upside potential is copper, in our view. The supply shock which began with aggressive concentrate destocking and then sharp mine supply downgrades last year, has now advanced to an increasing bind on metal production, as reflected in this week's China smelter supply rationing signal. With continued positive momentum in China's copper demand, a healthy refined import trend should generate a substantial ex-China refined deficit this year. With LME stocks having halved from Q4 peak, China’s imminent seasonal demand inflection should accelerate a path into extreme tightness by H2. Structural supply underinvestment, best reflected in peak mine supply we expect next year, implies that demand destruction will need to be the persistent solver on scarcity, an effect requiring substantially higher pricing than current, in our view. In this context, we maintain our view that the copper price will surge into next year (GSe 2025 $15,000/t average), expecting copper to rise to $10,000/t by year-end and then $12,000/t by end of Q1-25’

Another reason why Goldman is doubling down on its bullish copper outlook: gold.

The sharp rally in gold price since the beginning of March has ended the period of consolidation that had been present since late December. Whilst the initial catalyst for the break higher came from a (gold) supportive turn in US data and real rates, the move has been significantly amplified by short term systematic buying, which suggests less sticky upside. In this context, we expect gold to consolidate for now, with our economists near term view on rates and the dollar suggesting limited near-term catalysts for further upside momentum. Yet, a substantive retracement lower will also likely be limited by resilience in physical buying channels. Nonetheless, in the midterm we continue to hold a constructive view on gold underpinned by persistent strength in EM demand as well as eventual Fed easing, which should crucially reactivate the largely for now dormant ETF buying channel. In this context, we increase our average gold price forecast for 2024 from $2,090/toz to $2,180/toz, targeting a move to $2,300/toz by year-end.

Much more in the full Goldman note available to pro subs.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment3 days ago

Spread & Containment3 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex