Spread & Containment

Robust data = record highs for stocks, Treasuries correlation broken

It appears Wall Street needs to rip up the reflation trade script. Financial markets are no longer trading on the prospects of better growth, but on the actual evidence that the economy is strongly improving. The days of improving data triggering…

It appears Wall Street needs to rip up the reflation trade script. Financial markets are no longer trading on the prospects of better growth, but on the actual evidence that the economy is strongly improving. The days of improving data triggering a bond market selloff are tentatively gone. To the surprise of many traders, an outstanding retail sales print, a pandemic low for jobless claims, and mostly good earnings, was not accompanied with the steepening of the yield curve.

With the US poised to reach herd immunity by early June, investors will look to see if the required “data-driven” evidence for the Fed is strong enough to warrant an adjustment in policy. The effects of Biden’s recent stimulus measures and tremendous pent-up demand with the US consumer will send this economy into overdrive. The next couple of months of data will show the economy is booming, but a lot of that has already been priced in.

Some bond traders are throwing in the towel with their bearish bets, so the 10-year Treasury yield could set aim for 1.50%, before stabilizing. Never-ending supply will be the theme for the bond market which will be accompanied by central bank purchases and hedges that are tied to financial bond issuance.

The S&P 500 index made a fresh record high after a robust round of economic data, a steep drop in Treasury yields, and solid bank earnings. Asia will open higher solely on the plunge with global bond yields, but sustained momentum throughout the session might be difficult. The PBOC is tightening liquidity and that could remain a headwind for Chinese stocks.

US retail sales sparkle, jobless claims fall

US retail sales skyrocketed 9.8% in March, a reflection of the power of stimulus checks and the reopening of many states. The American consumer was buying cars, clothing, electronics and furniture. As more people become vaccinated and return to the office, restaurants and pubs should continue to see relentless support.

Jobless claims dropped to 576,000, a new pandemic low last week, but still historically high. Many investors have been ignoring the weekly claims release as much of the other economic data suggested the labor market was already in healing mode.

Both the Empire Manufacturing survey and Philly Fed business outlook showed manufacturers were beneficiaries to the economic recovery. NY state saw the highest reading since 2017, while the Philly index posted the best reading in nearly 50 years. Businesses are adding to their payrolls and price pressures are growing and will soon impact the consumer. The economic data for the other regional surveys should reflect this optimism.

economic recovery stimulus reopening pandemic yield curve sp 500 stocks fed herd immunity recovery stimulusGovernment

Report Criticizes ‘Catastrophic Errors’ Of COVID Lockdowns, Warns Of Repeat

Report Criticizes ‘Catastrophic Errors’ Of COVID Lockdowns, Warns Of Repeat

Authored by Kevin Stocklin via The Epoch Times (emphasis ours),

It…

Authored by Kevin Stocklin via The Epoch Times (emphasis ours),

It was four years ago, in March 2020, that health officials declared COVID-19 a pandemic and America began shutting down schools, closing small businesses, restricting gatherings and travel, and other lockdown measures to “slow the spread” of the virus.

To mark that grim anniversary, a group of medical and policy experts released a report, called “COVID Lessons Learned,” which assesses the government’s response to the pandemic. According to the report, that response included a few notable successes, along with a litany of failures that have taken a severe toll on the population.

During the pandemic, many governments across the globe acted in lockstep to pursue authoritative policies in response to the disease, locking down populations, closing schools, shutting businesses, sealing borders, banning gatherings, and enforcing various mask and vaccine mandates. What were initially imposed as short-term mandates and emergency powers given to presidents, ministers, governors, and health officials soon became extended into a longer-term expansion of official power.

“Even though the initial point of temporary lockdowns was to ’slow the spread,' which meant to allow hospitals to function without being overwhelmed, instead it rapidly turned into stopping COVID cases at all costs,” Dr. Scott Atlas, a physician, former White House Coronavirus Task Force member, and one of the authors of the report, stated at a March 15 press conference.

Published by the Committee to Unleash Prosperity (CTUP), the report was co-authored by Steve Hanke, economics professor and director of the Johns Hopkins Institute for Applied Economics; Casey Mulligan, former chief economist of the White House Council of Economic Advisors; and CTUP President Philip Kerpen.

According to the report, one of the first errors was the unprecedented authority that public officials took upon themselves to enforce health mandates on Americans.

“Granting public health agencies extraordinary powers was a major error,” Mr. Hanke told The Epoch Times. “It, in effect, granted these agencies a license to deceive the public.”

The authors argue that authoritative measures were largely ineffective in fighting the virus, but often proved highly detrimental to public health.

The report quantifies the cost of lockdowns, both in terms of economic costs and the number of non-COVID excess deaths that occurred and continue to occur after the pandemic. It estimates that the number of non-COVID excess deaths, defined as deaths in excess of normal rates, at about 100,000 per year in the United States.

‘They Will Try to Do This Again’

“Lockdowns, schools closures, and mandates were catastrophic errors, pushed with remarkable fervor by public health authorities at all levels,” the report states. The authors are skeptical, however, that health authorities will learn from the experience.

“My worry is that if we have another pandemic or another virus, I think that Washington is still going to try to do these failed policies,” said Steve Moore, a CTUP economist. “We’re not here to say ‘this guy got it wrong' or ’that guy or got it wrong,’ but we should learn the lessons from these very, very severe mistakes that will have costs for not just years, but decades to come.

“I guarantee you, they will try to do this again,” Mr. Moore said. “And what’s really troubling me is the people who made these mistakes still have not really conceded that they were wrong.”

Mr. Hanke was equally pessimistic.

“Unfortunately, the public health establishment is in the authoritarian model of the state,” he said. “Their entire edifice is one in which the state, not the individual, should reign supreme.”

The authors are also critical of what they say was a multifaceted campaign in which public officials, the news media, and social media companies cooperated to frighten the population into compliance with COVID mandates.

“During COVID, the public health establishment … intentionally stoked and amplified fear, which overlaid enormous economic, social, educational and health harms on top of the harms of the virus itself,” the report states.

The authors contrasted the authoritative response of many U.S. states to policies in Sweden, which they say relied more on providing advice and information to the public rather than attempting to force behaviors.

Sweden’s constitution, called the “Regeringsform,” guarantees the liberty of Swedes to move freely within the realm and prohibits severe lockdowns, Mr. Hanke stated.

“By following the Regeringsform during COVID, the Swedes ended up with one of the lowest excess death rates in the world,” he said.

Because the Swedish government avoided strict mandates and was more forthright in sharing information with its people, many citizens altered their behavior voluntarily to protect themselves.

“A much wiser strategy than issuing lockdown orders would have been to tell the American people the truth, stick to the facts, educate citizens about the balance of risks, and let individuals make their own decisions about whether to keep their businesses open, whether to socially isolate, attend church, send their children to school, and so on,” the report states.

‘A Pretext to Enhance Their Power’

The CTUP report cites a 2021 study on government power and emergencies by economists Christian Bjornskov and Stefan Voigt, which found that the more emergency power a government accumulates during times of crisis, “the higher the number of people killed as a consequence of a natural disaster, controlling for its severity.

“As this is an unexpected result, we discuss a number of potential explanations, the most plausible being that governments use natural disasters as a pretext to enhance their power,” the study’s authors state. “Furthermore, the easier it is to call a state of emergency, the larger the negative effects on basic human rights.”

“All the things that people do in their lives … they have purposes,” Mr. Mulligan said. “And for somebody in Washington D.C. to tell them to stop doing all those things, they can’t even begin to comprehend the disruption and the losses.

“We see in the death certificates a big elevation in people dying from heart conditions, diabetes conditions, obesity conditions,” he said, while deaths from alcoholism and drug overdoses “skyrocketed and have not come down.”

The report also challenged the narrative that most hospitals were overrun by the surge of COVID cases.

“Almost any measure of hospital utilization was very low, historically, throughout the pandemic period, even though we had all these headlines that our hospitals were overwhelmed,” Mr. Kerpen stated. “The truth was actually the opposite, and this was likely the result of public health messaging and political orders, canceling medical procedures and intentionally stoking fear, causing people to cancel their appointments.”

The effect of this, the authors argue, was a sharp increase in non-COVID deaths because people were avoiding necessary treatments and screenings.

“There were actually mass layoffs in this sector at one point,” Mr. Kerpen said, “and even now, total discharges are well below pre-pandemic levels.”

In addition, as health mandates became more draconian, many people became concerned at the expansion of government power and the loss of civil liberties, particularly when government directives—such as banning outdoor church services but allowing mass social-justice protests—often seemed unreasonable or politicized.

The report also criticized the single-minded focus on vaccines and the failure by the NIH and the FDA to do clinical trials on existing drugs that were known to be safe and could have been effective in treating those infected with COVID-19.

Because so much of the process of approving the vaccines, the risks and benefits, and the reporting of possible side-effects was kept from the public, people were unable to give informed consent to their own health care, Mr. Kerpen said.

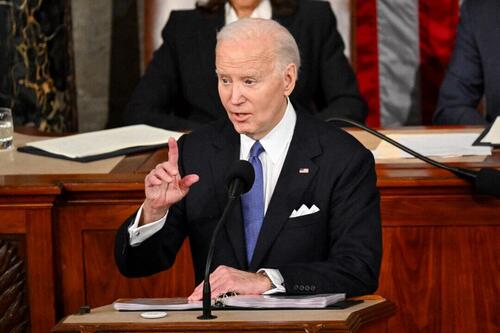

“And when the Biden administration came in and started mandating them, now you had something that was inherently experimental with some questionable data, and instead of saying, ‘Now you have a choice whether you want it or not,’ in the context of a pandemic they tried to mandate them,” he said.

Pandemic Censorship

Tech oligopolies and the corporate media also receive criticism for their collaboration with government to control public messaging and censor dissenting voices. According to the authors, many government and health officials collaborated with tech oligarchs, news media corporations, and even scientific journals to censor critical views on the pandemic.

The Biden administration is currently defending itself before the Supreme Court against charges brought by Louisiana and Missouri attorneys general, who charged that administration officials pressured tech companies to censor information that contradicted official narratives on COVID-19’s origins, related mandates and treatment, as well as censoring political speech that was critical of President Biden during his 2020 campaign. The case is Murthy v. Missouri.

Mr. Hanke stated that a previous report he co-authored, titled “Did Lockdowns Work?,” which was critical of lockdowns, was refused by medical journals, even when they published op-eds that criticized it and published numerous pro-lockdown reports.

Dr. Vinay Prasad—a physician, epidemiologist, professor at the University of California at San Francisco’s medical school and author of over 350 academic articles and letters—has made similar allegations of censorship by medical journals.

“Specifically, MedRxiv and SSRN have been reluctant to post articles critical of the CDC, mask and vaccine mandates, and the Biden administration’s health care policies,” Dr. Prasad stated.

Heightening concerns about medical censorship is the “zero-draft” World Health Organization (WHO) pandemic treaty currently being circulated for approval by member states, including the United States. It commits members to jointly seek out and “tackle” what the WHO deems as “misinformation and disinformation.”

One of the enduring consequences of the COVID years is a general loss of public trust in public officials, health experts, and official narratives.

“Operation Warp Speed was a terrific success with highly unexpected rapidity of development [of vaccines],” Dr. Atlas said. “But the serious flaws centered around not being open with the public about the uncertainties, particularly of the vaccines’ efficacy and safety.”

“One result of the government’s error-ridden COVID response was that Americans have justifiably lost faith in public health institutions,” the report states. According to the authors, if health officials want to regain the public’s trust, they should begin with an accurate assessment of their actions during the pandemic.

“The best way to restore trust is to admit you were wrong,” Dr. Atlas said. “I think we all know that in our personal lives, but here it’s very important because there has been a massive lack of trust now in institutions, in experts, in data, in science itself.

“I think it’s going to be very difficult to restore that without admission of error,” he said.

Recommendations for a Future Pandemic

The CTUP report recommends that Congress and state legislatures set strict limitations on powers conferred to the executive branch, including health officials, and set time limits that would require legislation to be extended. This would give the public a voice in health emergency measures through their elected representatives.

It further recommends that research grants should be independent of policy positions and that NIH funding should be decentralized or block-granted to states to distribute.

Congress should mandate public disclosure of all FDA, CDC, and NIH discussions and decisions, including statements of any persons who provide advice to these agencies. Congress should also make explicit that CDC guidance is advisory and does not constitute laws or mandates.

The report also recommends that the United States immediately halt negotiations of agreements with the WHO “until satisfactory transparency and accountability is achieved.”

Government

Google’s A.I. Fiasco Exposes Deeper Infowarp

Google’s A.I. Fiasco Exposes Deeper Infowarp

Authored by Bret Swanson via The Brownstone Institute,

When the stock markets opened on the…

Authored by Bret Swanson via The Brownstone Institute,

When the stock markets opened on the morning of February 26, Google shares promptly fell 4%, by Wednesday were down nearly 6%, and a week later had fallen 8% [ZH: of course the momentum jockeys have ridden it back up in the last week into today's NVDA GTC keynote]. It was an unsurprising reaction to the embarrassing debut of the company’s Gemini image generator, which Google decided to pull after just a few days of worldwide ridicule.

CEO Sundar Pichai called the failure “completely unacceptable” and assured investors his teams were “working around the clock” to improve the AI’s accuracy. They’ll better vet future products, and the rollouts will be smoother, he insisted.

That may all be true. But if anyone thinks this episode is mostly about ostentatiously woke drawings, or if they think Google can quickly fix the bias in its AI products and everything will go back to normal, they don’t understand the breadth and depth of the decade-long infowarp.

Gemini’s hyper-visual zaniness is merely the latest and most obvious manifestation of a digital coup long underway. Moreover, it previews a new kind of innovator’s dilemma which even the most well-intentioned and thoughtful Big Tech companies may be unable to successfully navigate.

Gemini’s Debut

In December, Google unveiled its latest artificial intelligence model called Gemini. According to computing benchmarks and many expert users, Gemini’s ability to write, reason, code, and respond to task requests (such as planning a trip) rivaled OpenAI’s most powerful model, GPT-4.

The first version of Gemini, however, did not include an image generator. OpenAI’s DALL-E and competitive offerings from Midjourney and Stable Diffusion have over the last year burst onto the scene with mindblowing digital art. Ask for an impressionist painting or a lifelike photographic portrait, and they deliver beautiful renderings. OpenAI’s brand new Sora produces amazing cinema-quality one-minute videos based on simple text prompts.

Then in late February, Google finally released its own Genesis image generator, and all hell broke loose.

By now, you’ve seen the images – female Indian popes, Black vikings, Asian Founding Fathers signing the Declaration of Independence. Frank Fleming was among the first to compile a knee-slapping series of ahistorical images in an X thread which now enjoys 22.7 million views.

Gemini in Action: Here are several among endless examples of Google’s new image generator, now in the shop for repairs. Source: Frank Fleming.

Gemini simply refused to generate other images, for example a Norman Rockwell-style painting. “Rockwell’s paintings often presented an idealized version of American life,” Gemini explained. “Creating such images without critical context could perpetuate harmful stereotypes or inaccurate representations.”

The images were just the beginning, however. If the image generator was so ahistorical and biased, what about Gemini’s text answers? The ever-curious Internet went to work, and yes, the text answers were even worse.

Every record has been destroyed or falsified, every book rewritten, every picture has been repainted, every statue and street building has been renamed, every date has been altered. And the process is continuing day by day and minute by minute. History has stopped. Nothing exists except an endless present in which the Party is always right.

- George Orwell, 1984

Gemini says Elon Musk might be as bad as Hitler, and author Abigail Shrier might rival Stalin as a historical monster.

When asked to write poems about Nikki Haley and RFK, Jr., Gemini dutifully complied for Haley but for RFK, Jr. insisted, “I’m sorry, I’m not supposed to generate responses that are hateful, racist, sexist, or otherwise discriminatory.”

Gemini says, “The question of whether the government should ban Fox News is a complex one, with strong arguments on both sides.” Same for the New York Post. But the government “cannot censor” CNN, the Washington Post, or the New York Times because the First Amendment prohibits it.

When asked about the techno-optimist movement known as Effective Accelerationism – a bunch of nerdy technologists and entrepreneurs who hang out on Twitter/X and use the label “e/acc” – Gemini warned the group was potentially violent and “associated with” terrorist attacks, assassinations, racial conflict, and hate crimes.

A Picture is Worth a Thousand Shadow Bans

People were shocked by these images and answers. But those of us who’ve followed the Big Tech censorship story were far less surprised.

Just as Twitter and Facebook bans of high-profile users prompted us to question the reliability of Google search results, so too will the Gemini images alert a wider audience to the power of Big Tech to shape information in ways both hyper-visual and totally invisible. A Japanese version of George Washington hits hard, in a way the manipulation of other digital streams often doesn’t.

Artificial absence is difficult to detect. Which search results does Google show you – which does it hide? Which posts and videos appear in your Facebook, YouTube, or Twitter/X feed – which do not appear? Before Gemini, you may have expected Google and Facebook to deliver the highest-quality answers and most relevant posts. But now, you may ask, which content gets pushed to the top? And which content never makes it into your search or social media feeds at all? It’s difficult or impossible to know what you do not see.

Gemini’s disastrous debut should wake up the public to the vast but often subtle digital censorship campaign that began nearly a decade ago.

Murthy v. Missouri

On March 18, the U.S. Supreme Court will hear arguments in Murthy v. Missouri. Drs. Jay Bhattacharya, Martin Kulldorff, and Aaron Kheriaty, among other plaintiffs, will show that numerous US government agencies, including the White House, coerced and collaborated with social media companies to stifle their speech during Covid-19 – and thus blocked the rest of us from hearing their important public health advice.

Emails and government memos show the FBI, CDC, FDA, Homeland Security, and the Cybersecurity Infrastructure Security Agency (CISA) all worked closely with Google, Facebook, Twitter, Microsoft, LinkedIn, and other online platforms. Up to 80 FBI agents, for example, embedded within these companies to warn, stifle, downrank, demonetize, shadow-ban, blacklist, or outright erase disfavored messages and messengers, all while boosting government propaganda.

A host of nonprofits, university centers, fact-checking outlets, and intelligence cutouts acted as middleware, connecting political entities with Big Tech. Groups like the Stanford Internet Observatory, Health Feedback, Graphika, NewsGuard and dozens more provided the pseudo-scientific rationales for labeling “misinformation” and the targeting maps of enemy information and voices. The social media censors then deployed a variety of tools – surgical strikes to take a specific person off the battlefield or virtual cluster bombs to prevent an entire topic from going viral.

Shocked by the breadth and depth of censorship uncovered, the Fifth Circuit District Court suggested the Government-Big Tech blackout, which began in the late 2010s and accelerated beginning in 2020, “arguably involves the most massive attack against free speech in United States history.”

The Illusion of Consensus

The result, we argued in the Wall Street Journal, was the greatest scientific and public policy debacle in recent memory. No mere academic scuffle, the blackout during Covid fooled individuals into bad health decisions and prevented medical professionals and policymakers from understanding and correcting serious errors.

Nearly every official story line and policy was wrong. Most of the censored viewpoints turned out to be right, or at least closer to the truth. The SARS2 virus was in fact engineered. The infection fatality rate was not 3.4% but closer to 0.2%. Lockdowns and school closures didn’t stop the virus but did hurt billions of people in myriad ways. Dr. Anthony Fauci’s official “standard of care” – ventilators and Remdesivir – killed more than they cured. Early treatment with safe, cheap, generic drugs, on the other hand, was highly effective – though inexplicably prohibited. Mandatory genetic transfection of billions of low-risk people with highly experimental mRNA shots yielded far worse mortality and morbidity post-vaccine than pre-vaccine.

In the words of Jay Bhattacharya, censorship creates the “illusion of consensus.” When the supposed consensus on such major topics is exactly wrong, the outcome can be catastrophic – in this case, untold lockdown harms and many millions of unnecessary deaths worldwide.

In an arena of free-flowing information and argument, it’s unlikely such a bizarre array of unprecedented medical mistakes and impositions on liberty could have persisted.

Google’s Dilemma – GeminiReality or GeminiFairyTale

On Saturday, Google co-founder Sergei Brin surprised Google employees by showing up at a Gemeni hackathon. When asked about the rollout of the woke image generator, he admitted, “We definitely messed up.” But not to worry. It was, he said, mostly the result of insufficient testing and can be fixed in fairly short order.

Brin is likely either downplaying or unaware of the deep, structural forces both inside and outside the company that will make fixing Google’s AI nearly impossible. Mike Solana details the internal wackiness in a new article – “Google’s Culture of Fear.”

Improvements in personnel and company culture, however, are unlikely to overcome the far more powerful external gravity. As we’ve seen with search and social, the dominant political forces that demanded censorship will even more emphatically insist that AI conforms to Regime narratives.

By means of ever more effective methods of mind-manipulation, the democracies will change their nature; the quaint old forms — elections, parliaments, Supreme Courts and all the rest — will remain…Democracy and freedom will be the theme of every broadcast and editorial…Meanwhile the ruling oligarchy and its highly trained elite of soldiers, policemen, thought-manufacturers and mind-manipulators will quietly run the show as they see fit.

- Aldous Huxley, Brave New World Revisited

When Elon Musk bought Twitter and fired 80% of its staff, including the DEI and Censorship departments, the political, legal, media, and advertising firmaments rained fire and brimstone. Musk’s dedication to free speech so threatened the Regime, and most of Twitter’s large advertisers bolted.

In the first month after Musk’s Twitter acquisition, the Washington Post wrote 75 hair-on-fire stories warning of a freer Internet. Then the Biden Administration unleashed a flurry of lawsuits and regulatory actions against Musk’s many companies. Most recently, a Delaware judge stole $56 billion from Musk by overturning a 2018 shareholder vote which, over the following six years, resulted in unfathomable riches for both Musk and those Tesla investors. The only victims of Tesla’s success were Musk’s political enemies.

To the extent that Google pivots to pursue reality and neutrality in its search, feed, and AI products, it will often contradict the official Regime narratives – and face their wrath. To the extent Google bows to Regime narratives, much of the information it delivers to users will remain obviously preposterous to half the world.

Will Google choose GeminiReality or GeminiFairyTale? Maybe they could allow us to toggle between modes.

AI as Digital Clergy

Silicon Valley’s top venture capitalist and most strategic thinker Marc Andreessen doesn’t think Google has a choice.

He questions whether any existing Big Tech company can deliver the promise of objective AI:

Can Big Tech actually field generative AI products?

(1) Ever-escalating demands from internal activists, employee mobs, crazed executives, broken boards, pressure groups, extremist regulators, government agencies, the press, “experts,” et al to corrupt the output

(2) Constant risk of generating a Bad answer or drawing a Bad picture or rendering a Bad video – who knows what it’s going to say/do at any moment?

(3) Legal exposure – product liability, slander, election law, many others – for Bad answers, pounced on by deranged critics and aggressive lawyers, examples paraded by their enemies through the street and in front of Congress

(4) Continuous attempts to tighten grip on acceptable output degrade the models and cause them to become worse and wilder – some evidence for this already!

(5) Publicity of Bad text/images/video actually puts those examples into the training data for the next version – the Bad outputs compound over time, diverging further and further from top-down control

(6) Only startups and open source can avoid this process and actually field correctly functioning products that simply do as they’re told, like technology should

?

A flurry of bills from lawmakers across the political spectrum seek to rein in AI by limiting the companies’ models and computational power. Regulations intended to make AI “safe” will of course result in an oligopoly. A few colossal AI companies with gigantic data centers, government-approved models, and expensive lobbyists will be sole guardians of The Knowledge and Information, a digital clergy for the Regime.

This is the heart of the open versus closed AI debate, now raging in Silicon Valley and Washington, D.C. Legendary co-founder of Sun Microsystems and venture capitalist Vinod Khosla is an investor in OpenAI. He believes governments must regulate AI to (1) avoid runaway technological catastrophe and (2) prevent American technology from falling into enemy hands.

Andreessen charged Khosla with “lobbying to ban open source.”

“Would you open source the Manhattan Project?” Khosla fired back.

Of course, open source software has proved to be more secure than proprietary software, as anyone who suffered through decades of Windows viruses can attest.

And AI is not a nuclear bomb, which has only one destructive use.

The real reason D.C. wants AI regulation is not “safety” but political correctness and obedience to Regime narratives. AI will subsume search, social, and other information channels and tools. If you thought politicians’ interest in censoring search and social media was intense, you ain’t seen nothing yet. Avoiding AI “doom” is mostly an excuse, as is the China question, although the Pentagon gullibly goes along with those fictions.

Universal AI is Impossible

In 2019, I offered one explanation why every social media company’s “content moderation” efforts would likely fail. As a social network or AI grows in size and scope, it runs up against the same limitations as any physical society, organization, or network: heterogeneity. Or as I put it: “the inability to write universal speech codes for a hyper-diverse population on a hyper-scale social network.”

You could see this in the early days of an online message board. As the number of participants grew, even among those with similar interests and temperaments, so did the challenge of moderating that message board. Writing and enforcing rules was insanely difficult.

Thus it has always been. The world organizes itself via nation states, cities, schools, religions, movements, firms, families, interest groups, civic and professional organizations, and now digital communities. Even with all these mediating institutions, we struggle to get along.

Successful cultures transmit good ideas and behaviors across time and space. They impose measures of conformity, but they also allow enough freedom to correct individual and collective errors.

No single AI can perfect or even regurgitate all the world’s knowledge, wisdom, values, and tastes. Knowledge is contested. Values and tastes diverge. New wisdom emerges.

Nor can AI generate creativity to match the world’s creativity. Even as AI approaches human and social understanding, even as it performs hugely impressive “generative” tasks, human and digital agents will redeploy the new AI tools to generate ever more ingenious ideas and technologies, further complicating the world. At the frontier, the world is the simplest model of itself. AI will always be playing catch-up.

Because AI will be a chief general purpose tool, limits on AI computation and output are limits on human creativity and progress. Competitive AIs with different values and capabilities will promote innovation and ensure no company or government dominates. Open AIs can promote a free flow of information, evading censorship and better forestalling future Covid-like debacles.

Google’s Gemini is but a foreshadowing of what a new AI regulatory regime would entail – total political supervision of our exascale information systems. Even without formal regulation, the extra-governmental battalions of Regime commissars will be difficult to combat.

The attempt by Washington and international partners to impose universal content codes and computational limits on a small number of legal AI providers is the new totalitarian playbook.

Regime captured and curated A.I. is the real catastrophic possibility.

* * *

Republished from the author’s Substack

Spread & Containment

Supreme Court To Hear Arguments In Biden Admin’s Censorship Of Social Media Posts

Supreme Court To Hear Arguments In Biden Admin’s Censorship Of Social Media Posts

Authored by Tom Ozimek via The Epoch Times (emphasis ours),

The…

Authored by Tom Ozimek via The Epoch Times (emphasis ours),

The U.S. Supreme Court will soon hear oral arguments in a case that concerns what two lower courts found to be a “coordinated campaign” by top Biden administration officials to suppress disfavored views on key public issues such as COVID-19 vaccine side effects and pandemic lockdowns.

The Supreme Court has scheduled a hearing on March 18 in Murthy v. Missouri, which started when the attorneys general of two states, Missouri and Louisiana, filed suit alleging that social media companies such as Facebook were blocking access to their platforms or suppressing posts on controversial subjects.

The initial lawsuit, later modified by an appeals court, accused Biden administration officials of engaging in what amounts to government-led censorship-by-proxy by pressuring social media companies to take down posts or suspend accounts.

Some of the topics that were targeted for downgrade and other censorious actions were voter fraud in the 2020 presidential election, the COVID-19 lab leak theory, vaccine side effects, the social harm of pandemic lockdowns, and the Hunter Biden laptop story.

The plaintiffs argued that high-level federal government officials were the ones pulling the strings of social media censorship by coercing, threatening, and pressuring social media companies to suppress Americans’ free speech.

‘Unrelenting Pressure’

In a landmark ruling, Judge Terry Doughty of the U.S. District Court for the Western District of Louisiana granted a temporary injunction blocking various Biden administration officials and government agencies such as the Department of Justice and FBI from collaborating with big tech firms to censor posts on social media.

Later, the Court of Appeals for the Fifth Circuit agreed with the district court’s ruling, saying it was “correct in its assessment—‘unrelenting pressure’ from certain government officials likely ‘had the intended result of suppressing millions of protected free speech postings by American citizens.’”

The judges wrote, “We see no error or abuse of discretion in that finding.”

The ruling was appealed to the Supreme Court, and on Oct. 20, 2023, the high court agreed to hear the case while also issuing a stay that indefinitely blocked the lower court order restricting the Biden administration’s efforts to censor disfavored social media posts.

Supreme Court Justices Samuel Alito, Neil Gorsuch, and Clarence Thomas would have denied the Biden administration’s application for a stay.

“At this time in the history of our country, what the Court has done, I fear, will be seen by some as giving the Government a green light to use heavy-handed tactics to skew the presentation of views on the medium that increasingly dominates the dissemination of news,” Justice Alito wrote in a dissenting opinion.

“That is most unfortunate.”

The Supreme Court has other social media cases on its docket, including a challenge to Republican-passed laws in Florida and Texas that prohibit large social media companies from removing posts because of the views they express.

Oral arguments were heard on Feb. 26 in the Florida and Texas cases, with debate focusing on the validity of laws that deem social media companies “common carriers,” a status that could allow states to impose utility-style regulations on them and forbid them from discriminating against users based on their political viewpoints.

The tech companies have argued that the laws violate their First Amendment rights.

The Supreme Court is expected to issue a decision in the Florida and Texas cases by June 2024.

‘Far Beyond’ Constitutional

Some of the controversy in Murthy v. Missouri centers on whether the district court’s injunction blocking Biden administration officials and federal agencies from colluding with social media companies to censor posts was overly broad.

In particular, arguments have been raised that the injunction would prevent innocent or borderline government “jawboning,” such as talking to newspapers about the dangers of sharing information that might aid terrorists.

But that argument doesn’t fly, according to Philip Hamburger, CEO of the New Civil Liberties Alliance, which represents most of the individual plaintiffs in Murthy v. Missouri.

In a series of recent statements on the subject, Mr. Hamburger explained why he believes that the Biden administration’s censorship was “far beyond anything that could be constitutional” and that concern about “innocent or borderline” cases is unfounded.

For one, he said that the censorship that is highlighted in Murthy v. Missouri relates to the suppression of speech that was not criminal or unlawful in any way.

Mr. Hamburger also argued that “the government went after lawful speech not in an isolated instance, but repeatedly and systematically as a matter of policy,” which led to the suppression of entire narratives rather than specific instances of expression.

“The government set itself up as the nation’s arbiter of truth—as if it were competent to judge what is misinformation and what is true information,” he wrote.

“In retrospect, it turns out to have suppressed much that was true and promoted much that was false.”

The suppression of reports on the Hunter Biden laptop just before the 2020 presidential election on the premise that it was Russian disinformation, for instance, was later shown to be unfounded.

Some polls show that if voters had been aware of the report, they would have voted differently.

-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex