International

Risk Appetites Improve Ahead of the Weekend

Overview: Equities are higher and bonds lower as the week’s activity winds down. Asia Pacific markets rallied, paced by more than 2% gains in Hong Kong…

Overview: Equities are higher and bonds lower as the week's activity winds down. Asia Pacific markets rallied, paced by more than 2% gains in Hong Kong and South Korea. Japan's Nikkei rallied more than 1%, as did China's CSI 300. Most of the large markets but South Korea and Taiwan advanced this week, though only China and Hong Kong are up for the month. Europe's Stoxx 600 is up 1.3% through the European morning, its biggest advance of the week and what looks like the first weekly gain in four weeks. US futures are trading around 0.6%-0.8% higher. The NASDAQ is 4% higher and the S&P 500 is 3.3% stronger on the week coming into today. The US 10-year yield is virtually unchanged today and around 3.08%, is off about 14 bp this week. European bonds are mostly 2-4 bp firmer, and peripheral premiums over Germany have edged up. The US dollar is sporting a softer profile against the major currencies but the Japanese yen. Emerging market currencies are also mostly higher. The notable exception is the Philippine peso, off about 0.6% on the day and 2.2% for the week. Gold fell to a five-day low yesterday near $1822 and is trading quietly today and is firmer near $1830. August WTI is consolidating and remains inside Wednesday’s range (~$101.50-$109.70). It settled at almost $108 last week and assuming it does not rise above there today, it will be the first back-to-back weekly loss since March. US natgas is stabilizing after yesterday’s 9% drop. On the week, it is off about 10% after plummeting 21.5% last week. Europe is not as fortunate. Its benchmark is up for the 10th consecutive session. It soared almost 48% last week and rose another 7.7% this week. Iron ore’s 2% loss today brings the weekly hit to 5.1% after last week’s 14% drop. Copper is trying to stabilize after falling 7.5% in the past two sessions. It is at its lowest level since Q1 21. September wheat is up about 1.5% today to pare this week’s decline to around 8%.

Asia Pacific

Japan's May CPI was spot on expectations, unchanged from April. That keeps the headline at 2.5% and the core rate, which excludes fresh food, at 2.1%, slightly above the 2% target. However, the bulk of that 2.1% rise is attributable to energy prices. Without fresh food and energy, Japan's inflation remains at a lowly 0.8%.

The BOJ says that Japanese inflation is not sustainable, which is another way to say transitory. In turn, that means no change in policy. The fallout though is increasing disruptive. The yield curve control defense roiled the cash-futures basis and the uncertainty about hedging may have contributed to the soft demand at this week's auction. In addition, interest rates swap rates have risen as if the market is seeking compensation for the added uncertainty. Meanwhile, for the fourth session there were no takers of the BOJ's offer to buy bonds at a fixed rate.

The approaching month-end pressures saw the PBOC step up its liquidity provisions and injected the most in three months today. Still, the seven-day repo rate rose 16 bp to 1.17%. In Hong Kong, three-month HIBIOR rose to 1.68%, the highest since April 2020. Australian rates moved in the opposite direct. Australia's three-year yield fell 14 bp today after falling 10 bp in each of the past two sessions. It has fallen every day this week for a cumulative 43 bp drop to 3.20%. It had risen by slightly more than 50 bp the previous week. There was a dramatic shift in expectations for the year-end policy rate. The bill futures imply a year-end rate of 3.17%, which is about 68 bp lower than a week ago. It had risen by a little more than 150 bp in the previous two weeks.

The dollar traded in a two-yen range yesterday, but today is consolidating in a one-yen range above yesterday's low near JPY134.25. The pullback in US yields has been the key development and the dollar is lower for the third consecutive day. If sustained, this would be the longest losing streak for the greenback in three months. The Australian dollar is straddling the $0.6900 level, where options for A$1 bln expire today. It is mired near this week's low, set yesterday near $0.6870. Australia's two-year yield swung back to a discount to the US this week after trading at a premium for most of last week and the start of this week. The greenback was confined to a tight range against the Chinese yuan below CNY6.70 today but holding above CNY6.6920. The greenback traded with a heavier bias this week and snapped a two-week advance with a loss of around 0.3% this week. The PBOC set the dollar's reference rate at CNY6.7000, a little below the median forecast (Bloomberg survey) of CNY6.7008. It was the fourth time this week that the fix was for as weaker dollar/stronger yuan.

Europe

The week that marked the sixth anniversary of the UK referendum to leave the EU could have hardly gone worse. Consider: The May budget report showed a 20% increase in interest rate servicing costs. Inflation edged higher. The flash June composite PMI remained pinned at its lowest level since February 2021. The GfK consumer confidence fell to -41, a new record low. Retail sales slumped by 0.5% in May and excluding gasoline were off 0.7%. Separately, as the polls had warned, the Tories lost both byelection contests held yesterday. And perhaps not totally unrelated, the Cabinet Secretary revealed that at the Prime Minister's request a position his wife in the royal charity was discussed. This continues a pattern that had included trying to appoint her as Johnson's chief of staff when he was the foreign minister and plays on the image of crass favoritism.

The risk of a new crisis in Europe is under-appreciated. In retaliation for Europe's actions, which in earlier periods, would have been regarded as acts of war, Russia has dramatically reduced its gas shipments to Europe. Many Americans and European who scoff at Russia's "special military operation" may be too young to recall that America's more than 10-year war in Vietnam was a police action and never officially a war. Now, the critics are incensed that Moscow has weaponized gas, while overlook the extreme weaponizing of finance. Aren't US and European sanctions a bit like weaponizing the dollar and euro? In any event, Putin has ended the European illusion that it would determine the pace of the decoupling from Russia's energy. Germany's Economic Minister and Vice-Chancellor heralds from the Green Party. The gas "embargo" has forced him to swallow principles and allow an increased use of coal. Habeck increased the gas emergency warning system and drew parallels with the Lehman crisis for the energy sector.

It is with this backdrop that the Swiss National Bank felt obligated to hike its deposit rate by 50 bp last Thursday (June 17). The euro had been trading comfortable in a CHF1.02 to CHF1.05 trading range since mid-April. Judging from the increase in Swiss sight deposits, the SNB may have intervened in late April and early May. However, in recent weeks there was no "need" to intervene and sight deposits fell for four consecutive weeks through June 17. The euro traded at three-and-a-half week lows against the franc yesterday, trading to CHF1.0070 for the first time since March 8. In fact, the Swiss franc is the strongest of the major currencies this week, rising about 1.15% against the dollar and about 0.75% against the euro.

The German IFO survey of investor confidence weakened again but did not seem to impact the euro. The assessment of the business climate slipped (92.3 from 93.0). This reflected the mild downgrade of existing conditions (99.3 from 99.6) and the sharper drop in expectations (85.8 vs. 86.9). This is the most pessimistic outlook since March, which itself was the poorest since May 2020. The euro remains within the range seen Wednesday (~$1.0470-$1.0605). It closed near $1.05 last week. There are options for almost 1.2 bln euros that expire there today but have likely been neutralized. Assuming the euro holds above there, it will be the first weekly gain since the end of May. Par for the course today, sterling is also trading quietly in a narrow half-cent range above $1.2240. If it closes above there, it too will be the first weekly gain in four weeks. Sterling's range this week has been roughly $1.2160 to $1.2325. The US two-year premium over the UK has risen for the Monday and is now around 110 bp, up from about 88 bp in the first part of the week.

America

Bloomberg's survey of 58 economists produced a median forecast of 3.0% for Q2 US GDP. Only five of them see growth lower than 2%. The median has it remaining above 2% in H2 before slowing to what the Fed sees as long-term non-inflationary growth of 1.8% throughout next year. The market does not share this optimism. The shape of the Fed funds and Eurodollar futures curve suggests investors sees the Fed breaking something sooner. Given where inflation is, it is hard to take seriously talk about the Fed front-loading tightening, what it is doing is catching up. But monetary policy impacts with notorious lag, and as several Fed officials have acknowledged, financial conditions began tightening six months before the first hike was delivered. The Fed funds futures strip has terminal rate around 3.5% by late Q1 23. The first cut priced in for Q4 23.

The US reports May new home sales. There are supply issues that are important here, but it will likely be the fifth consecutive monthly decline. Through April, they were off 30% so far this year. New home sales stood at 591k (saar) in April. At the worst of the pandemic, they were at 582k in April 2020. The University of Michigan survey was specifically mentioned by Fed Chair Powell at his press conference following the FOMC's decision to hike by 75 bp. The final report is rarely significantly different than the preliminary report, but it cannot help by draw attention.

Mexico's central bank unanimously delivered the widely expected 75 bp hike in its overnight rate to take it to 7.75%. It was the ninth hike in the cycle that began last June for a cumulative 375 bp. The move followed slightly firmer than expected inflation in the first half of this month (7.88%) and stronger than expected April retail sales. The key is that it matched the Fed's move. It indicated that it will likely move just as "forcefully" at its next meeting in August. The swaps market has almost another 200 bp more of tightening this year. Banxico also revised its inflation forecast. Previously, it saw inflation peaking in Q2 22 at 7.6% and now it says the peak will be 8.1% in Q3. It has inflation finishing the year at 7.5%, up from 6.4%. Separately, reports suggest the US is escalating complaints that President AMLO's energy policies, favoring the state companies, violates the free-trade agreement.

The US dollar rose a little more than 3.5% against the Canadian dollar in the past two weeks as the S&P 500 tumbled nearly 11%. With today's roughly 0.25% pullback, the greenback doubled its loss to 0.50% this week, and the S&P 500 is up about 3.3% this week coming into today. The macro backdrop for the Canadian dollar looks constructive: strong jobs market, better than expected April retail sales reported this week and firmer May price pressures. The market 70 bp hike priced in for the July 13 Bank of Canada meeting. The year-end rate is off four basis points this week to 3.41%. In comparison, the US year-end rate is off about 13 bp this week to about 3.44%. The US dollar is off for the sixth consecutive session against the Mexican peso. The peso is the strongest currency in the world this week, leaving aside the machinations of the Russian rouble, with a 1.8% gain, including today's 0.2% advance through the European morning. The greenback frayed support around MXN20.00 yesterday for the first time in nearly two weeks. It is spending more time below there today with a move to MXN19.96. A convincing break of the MXN19.94 area could signal a move toward MXN19.80. There is a $1 bln option expiring at MXN20.00 today, and the related hedging may have weighed on the dollar.

Disclaimer

bonds yield curve pandemic sp 500 nasdaq equities monetary policy fomc fed home sales currencies us dollar canadian dollar euro yuan gdp interest rates gold south korea mexico japan hong kong canada european europe uk germany russia eu chinaInternational

Health Officials: Man Dies From Bubonic Plague In New Mexico

Health Officials: Man Dies From Bubonic Plague In New Mexico

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Officials in…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

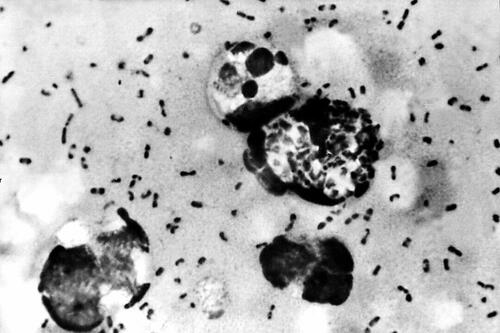

Officials in New Mexico confirmed that a resident died from the plague in the United States’ first fatal case in several years.

The New Mexico Department of Health, in a statement, said that a man in Lincoln County “succumbed to the plague.” The man, who was not identified, was hospitalized before his death, officials said.

They further noted that it is the first human case of plague in New Mexico since 2021 and also the first death since 2020, according to the statement. No other details were provided, including how the disease spread to the man.

The agency is now doing outreach in Lincoln County, while “an environmental assessment will also be conducted in the community to look for ongoing risk,” the statement continued.

“This tragic incident serves as a clear reminder of the threat posed by this ancient disease and emphasizes the need for heightened community awareness and proactive measures to prevent its spread,” the agency said.

A bacterial disease that spreads via rodents, it is generally spread to people through the bites of infected fleas. The plague, known as the black death or the bubonic plague, can spread by contact with infected animals such as rodents, pets, or wildlife.

The New Mexico Health Department statement said that pets such as dogs and cats that roam and hunt can bring infected fleas back into homes and put residents at risk.

Officials warned people in the area to “avoid sick or dead rodents and rabbits, and their nests and burrows” and to “prevent pets from roaming and hunting.”

“Talk to your veterinarian about using an appropriate flea control product on your pets as not all products are safe for cats, dogs or your children” and “have sick pets examined promptly by a veterinarian,” it added.

“See your doctor about any unexplained illness involving a sudden and severe fever, the statement continued, adding that locals should clean areas around their home that could house rodents like wood piles, junk piles, old vehicles, and brush piles.

The plague, which is spread by the bacteria Yersinia pestis, famously caused the deaths of an estimated hundreds of millions of Europeans in the 14th and 15th centuries following the Mongol invasions. In that pandemic, the bacteria spread via fleas on black rats, which historians say was not known by the people at the time.

Other outbreaks of the plague, such as the Plague of Justinian in the 6th century, are also believed to have killed about one-fifth of the population of the Byzantine Empire, according to historical records and accounts. In 2013, researchers said the Justinian plague was also caused by the Yersinia pestis bacteria.

But in the United States, it is considered a rare disease and usually occurs only in several countries worldwide. Generally, according to the Mayo Clinic, the bacteria affects only a few people in U.S. rural areas in Western states.

Recent cases have occurred mainly in Africa, Asia, and Latin America. Countries with frequent plague cases include Madagascar, the Democratic Republic of Congo, and Peru, the clinic says. There were multiple cases of plague reported in Inner Mongolia, China, in recent years, too.

Symptoms

Symptoms of a bubonic plague infection include headache, chills, fever, and weakness. Health officials say it can usually cause a painful swelling of lymph nodes in the groin, armpit, or neck areas. The swelling usually occurs within about two to eight days.

The disease can generally be treated with antibiotics, but it is usually deadly when not treated, the Mayo Clinic website says.

“Plague is considered a potential bioweapon. The U.S. government has plans and treatments in place if the disease is used as a weapon,” the website also says.

According to data from the U.S. Centers for Disease Control and Prevention, the last time that plague deaths were reported in the United States was in 2020 when two people died.

International

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Is there a light forming when it comes to the long, dark and…

Is there a light forming when it comes to the long, dark and bewildering tunnel of social justice cultism? Global events have been so frenetic that many people might not remember, but only a couple years ago Big Tech companies and numerous governments were openly aligned in favor of mass censorship. Not just to prevent the public from investigating the facts surrounding the pandemic farce, but to silence anyone questioning the validity of woke concepts like trans ideology.

From 2020-2022 was the closest the west has come in a long time to a complete erasure of freedom of speech. Even today there are still countries and Europe and places like Canada or Australia that are charging forward with draconian speech laws. The phrase "radical speech" is starting to circulate within pro-censorship circles in reference to any platform where people are allowed to talk critically. What is radical speech? Basically, it's any discussion that runs contrary to the beliefs of the political left.

Open hatred of moderate or conservative ideals is perfectly acceptable, but don't ever shine a negative light on woke activism, or you might be a terrorist.

Riley Gaines has experienced this double standard first hand. She was even assaulted and taken hostage at an event in 2023 at San Francisco State University when leftists protester tried to trap her in a room and demanded she "pay them to let her go." Campus police allegedly witnessed the incident but charges were never filed and surveillance footage from the college was never released.

It's probably the last thing a champion female swimmer ever expects, but her head-on collision with the trans movement and the institutional conspiracy to push it on the public forced her to become a counter-culture voice of reason rather than just an athlete.

For years the independent media argued that no matter how much we expose the insanity of men posing as women to compete and dominate women's sports, nothing will really change until the real female athletes speak up and fight back. Riley Gaines and those like her represent that necessary rebellion and a desperately needed return to common sense and reason.

In a recent interview on the Joe Rogan Podcast, Gaines related some interesting information on the inner workings of the NCAA and the subversive schemes surrounding trans athletes. Not only were women participants essentially strong-armed by colleges and officials into quietly going along with the program, there was also a concerted propaganda effort. Competition ceremonies were rigged as vehicles for promoting trans athletes over everyone else.

The bottom line? The competitions didn't matter. The real women and their achievements didn't matter. The only thing that mattered to officials were the photo ops; dudes pretending to be chicks posing with awards for the gushing corporate media. The agenda took precedence.

Lia Thomas, formerly known as William Thomas, was more than an activist invading female sports, he was also apparently a science project fostered and protected by the athletic establishment. It's important to understand that the political left does not care about female athletes. They do not care about women's sports. They don't care about the integrity of the environments they co-opt. Their only goal is to identify viable platforms with social impact and take control of them. Women's sports are seen as a vehicle for public indoctrination, nothing more.

The reasons why they covet women's sports are varied, but a primary motive is the desire to assert the fallacy that men and women are "the same" psychologically as well as physically. They want the deconstruction of biological sex and identity as nothing more than "social constructs" subject to personal preference. If they can destroy what it means to be a man or a woman, they can destroy the very foundations of relationships, families and even procreation.

For now it seems as though the trans agenda is hitting a wall with much of the public aware of it and less afraid to criticize it. Social media companies might be able to silence some people, but they can't silence everyone. However, there is still a significant threat as the movement continues to target children through the public education system and women's sports are not out of the woods yet.

The ultimate solution is for women athletes around the world to organize and widely refuse to participate in any competitions in which biological men are allowed. The only way to save women's sports is for women to be willing to end them, at least until institutions that put doctrine ahead of logic are made irrelevant.

International

Congress’ failure so far to deliver on promise of tens of billions in new research spending threatens America’s long-term economic competitiveness

A deal that avoided a shutdown also slashed spending for the National Science Foundation, putting it billions below a congressional target intended to…

Federal spending on fundamental scientific research is pivotal to America’s long-term economic competitiveness and growth. But less than two years after agreeing the U.S. needed to invest tens of billions of dollars more in basic research than it had been, Congress is already seriously scaling back its plans.

A package of funding bills recently passed by Congress and signed by President Joe Biden on March 9, 2024, cuts the current fiscal year budget for the National Science Foundation, America’s premier basic science research agency, by over 8% relative to last year. That puts the NSF’s current allocation US$6.6 billion below targets Congress set in 2022.

And the president’s budget blueprint for the next fiscal year, released on March 11, doesn’t look much better. Even assuming his request for the NSF is fully funded, it would still, based on my calculations, leave the agency a total of $15 billion behind the plan Congress laid out to help the U.S. keep up with countries such as China that are rapidly increasing their science budgets.

I am a sociologist who studies how research universities contribute to the public good. I’m also the executive director of the Institute for Research on Innovation and Science, a national university consortium whose members share data that helps us understand, explain and work to amplify those benefits.

Our data shows how underfunding basic research, especially in high-priority areas, poses a real threat to the United States’ role as a leader in critical technology areas, forestalls innovation and makes it harder to recruit the skilled workers that high-tech companies need to succeed.

A promised investment

Less than two years ago, in August 2022, university researchers like me had reason to celebrate.

Congress had just passed the bipartisan CHIPS and Science Act. The science part of the law promised one of the biggest federal investments in the National Science Foundation in its 74-year history.

The CHIPS act authorized US$81 billion for the agency, promised to double its budget by 2027 and directed it to “address societal, national, and geostrategic challenges for the benefit of all Americans” by investing in research.

But there was one very big snag. The money still has to be appropriated by Congress every year. Lawmakers haven’t been good at doing that recently. As lawmakers struggle to keep the lights on, fundamental research is quickly becoming a casualty of political dysfunction.

Research’s critical impact

That’s bad because fundamental research matters in more ways than you might expect.

For instance, the basic discoveries that made the COVID-19 vaccine possible stretch back to the early 1960s. Such research investments contribute to the health, wealth and well-being of society, support jobs and regional economies and are vital to the U.S. economy and national security.

Lagging research investment will hurt U.S. leadership in critical technologies such as artificial intelligence, advanced communications, clean energy and biotechnology. Less support means less new research work gets done, fewer new researchers are trained and important new discoveries are made elsewhere.

But disrupting federal research funding also directly affects people’s jobs, lives and the economy.

Businesses nationwide thrive by selling the goods and services – everything from pipettes and biological specimens to notebooks and plane tickets – that are necessary for research. Those vendors include high-tech startups, manufacturers, contractors and even Main Street businesses like your local hardware store. They employ your neighbors and friends and contribute to the economic health of your hometown and the nation.

Nearly a third of the $10 billion in federal research funds that 26 of the universities in our consortium used in 2022 directly supported U.S. employers, including:

A Detroit welding shop that sells gases many labs use in experiments funded by the National Institutes of Health, National Science Foundation, Department of Defense and Department of Energy.

A Dallas-based construction company that is building an advanced vaccine and drug development facility paid for by the Department of Health and Human Services.

More than a dozen Utah businesses, including surveyors, engineers and construction and trucking companies, working on a Department of Energy project to develop breakthroughs in geothermal energy.

When Congress shortchanges basic research, it also damages businesses like these and people you might not usually associate with academic science and engineering. Construction and manufacturing companies earn more than $2 billion each year from federally funded research done by our consortium’s members.

Jobs and innovation

Disrupting or decreasing research funding also slows the flow of STEM – science, technology, engineering and math – talent from universities to American businesses. Highly trained people are essential to corporate innovation and to U.S. leadership in key fields, such as AI, where companies depend on hiring to secure research expertise.

In 2022, federal research grants paid wages for about 122,500 people at universities that shared data with my institute. More than half of them were students or trainees. Our data shows that they go on to many types of jobs but are particularly important for leading tech companies such as Google, Amazon, Apple, Facebook and Intel.

That same data lets me estimate that over 300,000 people who worked at U.S. universities in 2022 were paid by federal research funds. Threats to federal research investments put academic jobs at risk. They also hurt private sector innovation because even the most successful companies need to hire people with expert research skills. Most people learn those skills by working on university research projects, and most of those projects are federally funded.

High stakes

If Congress doesn’t move to fund fundamental science research to meet CHIPS and Science Act targets – and make up for the $11.6 billion it’s already behind schedule – the long-term consequences for American competitiveness could be serious.

Over time, companies would see fewer skilled job candidates, and academic and corporate researchers would produce fewer discoveries. Fewer high-tech startups would mean slower economic growth. America would become less competitive in the age of AI. This would turn one of the fears that led lawmakers to pass the CHIPS and Science Act into a reality.

Ultimately, it’s up to lawmakers to decide whether to fulfill their promise to invest more in the research that supports jobs across the economy and in American innovation, competitiveness and economic growth. So far, that promise is looking pretty fragile.

This is an updated version of an article originally published on Jan. 16, 2024.

Jason Owen-Smith receives research support from the National Science Foundation, the National Institutes of Health, the Alfred P. Sloan Foundation and Wellcome Leap.

economic growth covid-19 grants congress vaccine china-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges