RISING PRICES AND MORTGAGE RATES MAKE HOMEOWNERSHIP UNAFFORDABLE ACROSS MOST OF THE U.S.

RISING PRICES AND MORTGAGE RATES MAKE HOMEOWNERSHIP UNAFFORDABLE ACROSS MOST OF THE U.S.

PR Newswire

IRVINE, Calif., June 30, 2022

Nearly One-Third of Average Wages Required for Major Home-Ownership Expenses During Second Quarter of 2022; Portion o…

RISING PRICES AND MORTGAGE RATES MAKE HOMEOWNERSHIP UNAFFORDABLE ACROSS MOST OF THE U.S.

PR Newswire

IRVINE, Calif., June 30, 2022

Nearly One-Third of Average Wages Required for Major Home-Ownership Expenses During Second Quarter of 2022; Portion of Wages Consumed by Home Ownership Rises at Fastest Pace This Century; Historic Affordability Plummets to 15-Year Low as Median Home Price Hits $349,000 and Mortgage Rates Top 5 percent

IRVINE, Calif., June 30, 2022 /PRNewswire/ -- ATTOM, a leading curator of real estate data nationwide for land and property data, today released its second-quarter 2022 U.S. Home Affordability Report, showing that median-priced single-family homes and condos are less affordable in the second quarter of 2022 compared to historical averages in 97 percent of counties across the nation with enough data to analyze. That was up from 69 percent of counties that were historically less affordable in the second quarter of 2021, to the highest point since 2007, just before the housing market crashed during the Great Recession of the late 2000s.

The report also shows that the portion of average wages nationwide required for major home-ownership expenses has risen this quarter to 31.5 percent as the median price of a single-family home has hit a new high of $349,000 and 30-year mortgage rates have shot up above 5 percent. The percentage of average wages consumed by those expenses has risen at the fastest quarterly and annual pace since at least 2000.

"Extraordinarily low levels of homes for sale combined with strong demand have caused home prices to soar over the last few years," said Rick Sharga, executive vice president of market intelligence at ATTOM. "But homes remained relatively affordable due to historically low mortgage rates and rising wages. With interest rates almost doubling, homebuyers are faced with monthly mortgage payments that are between 40 and 50% higher than they were a year ago – payments that many prospective buyers simply can't afford."

The report determined affordability for average wage earners by calculating the amount of income needed to meet major monthly home ownership expenses — including mortgage, property taxes and insurance — on a median-priced single-family home, assuming a 20 percent down payment and a 28 percent maximum "front-end" debt-to-income ratio. That required income was then compared to annualized average weekly wage data from the Bureau of Labor Statistics (see full methodology below).

Compared to historical levels, median home prices in 560 of the 575 counties analyzed in the second quarter of 2022 are less affordable than in the past. The latest number is up from 459 of the same group of counties in the first quarter of 2022, 397 in the second quarter of 2021 and just 251, or less than half, two years ago. That increase has continued as the median national home price has spiked 16 percent over the past year while average annual wages across the country have grown just 6 percent.

Major ownership costs on median-priced single-family homes and condos around the U.S. now require more than 28 percent of the average $67,587 wage in the U.S. - a ceiling considered affordable by common lending standards. The current level of 31.5 percent stands at the highest point since the second quarter of 2007 and is up from 26 percent in the first quarter of 2022 and 23.9 percent in the second quarter of last year. Both increases mark the largest jumps since at least 2000.

Affording a home across the nation has gotten significantly tougher in recent months at a time when the U.S. housing market has roared ahead for the 11th straight year but also faces notable headwinds that could slow it down. One major force remains: home prices have continued to soar in 2022 as a large cohort of homebuyers continues chasing an extremely small supply of properties for sale. Elevated demand has helped push the national median home price up over the past year at more than double the pace of wage growth.

But as mortgage rates have steadily climbed this year from just above 3 percent to near 6 percent for a 30-year loan, costs have escalated for buyers. Higher interest rates, growing inflation, soaring fuel costs and a declining stock market all threaten the housing market, which could already be showing signs of strain – May marked the fifth consecutive month of lower existing home sales than the prior month.

View Q2 2022 U.S. Home Affordability Heat Map

As historic affordability continues to decline, major home-ownership expenses on typical homes are now unaffordable to average local wage earners during the second quarter of 2022 in 388, or 67 percent, of the 575 counties in the report, based on the 28-percent guideline. The largest populated counties that are unaffordable are Los Angeles County, CA; Maricopa County (Phoenix), AZ; San Diego County, CA; Orange County, CA (outside Los Angeles) and Kings County (Brooklyn), NY.

The most populous of the 187 counties where major expenses on median-priced homes remain affordable for average local workers in the second quarter of 2022 are Cook County (Chicago), IL; Harris County (Houston), TX; Philadelphia County, PA; Franklin County (Columbus), OH, and Hennepin County (Minneapolis), MN.

Home prices continue to rise at least 10 percent annually in two-thirds of country

Median single-family home and condo prices in the second quarter of 2022 are up by at least 10 percent over the second quarter of 2021 in 373, or 65 percent, of the 575 counties included in the report. Data was analyzed for counties with a population of at least 100,000 and at least 50 single-family home and condo sales in the second quarter of 2022.

Among the 47 counties in the report with a population of at least 1 million, the biggest year-over-year gains in median sales prices during the second quarter of 2022 are in Collin County (Plano), TX (up 28 percent); Hillsborough County (Tampa), FL (up 27 percent); Maricopa County (Phoenix), AZ (up 25 percent); Clark County (Las Vegas), NV (up 24 percent) and Salt Lake County (Salt Lake City), UT (up 24 percent).

Counties with a population of at least 1 million where median prices have gone up the least or decreased, year-over-year, during the second quarter of 2022 are Oakland County, MI (outside Detroit) (down 2 percent); Honolulu County, HI (up 4 percent); Bronx County, NY (up 5 percent); Cook County (Chicago), IL (up 5 percent) and Kings County (Brooklyn), NY (up 6 percent).

Price gains outpace wage growth in nearly 90 percent of markets

Annual home-price appreciation has been greater than weekly annualized wage growth in the second quarter of 2022 in 510 of the 575 counties analyzed in the report (89 percent), with the largest including Los Angeles County, CA; Harris County (Houston), TX; Maricopa County (Phoenix), AZ; San Diego County, CA, and Orange County, CA (outside Los Angeles).

Average annualized wage growth has surpassed home-price appreciation in the second quarter of 2022 in only 65 of the counties in the report (11 percent), including Cook County, (Chicago), IL; Oakland County, MI (outside Detroit); Fairfield County, CT (outside New York City); Erie County (Buffalo), NY, and San Francisco County, CA.

Ownership costs now require more than 28 percent of average local wages in two-thirds of the nation

Major ownership costs on median-priced, single-family homes in the second quarter of 2022 consume more than 28 percent of average local wages in 388 of the 575 counties analyzed (67 percent), assuming a 20 percent down payment. That is up from 52 percent in the first quarter of 2022 for the same group of counties and 44 percent in the second quarter of last year.

"Worsening affordability appears to be having an impact on demand, which could lead to prices plateauing or even correcting modestly in some markets," Sharga noted. "Many potential buyers may elect to continue renting until market conditions improve. Others might adjust their sights and look for smaller properties, or homes that are further away from major metro areas. And it's possible that worsening affordability could accelerate the migratory trends that the COVID-19 pandemic started, as residents in high cost, high tax states who can now work from home look for less expensive places to live."

All but two of counties analyzed have seen an increase in the portion of average local wages consumed by major ownership expenses from both the first to the second quarter of this year and from the second quarter of last year to the same period in 2022.

Counties that require the largest percentage of wages are Santa Cruz County, CA (116 percent of annualized weekly wages needed to buy a home); Marin County, CA (outside San Francisco) (109.6 percent); Kings County (Brooklyn), NY (102.9 percent); Maui County, HI (92 percent) and San Luis Obispo County, CA (88.2 percent).

Aside from Kings County, NY, counties with a population of at least 1 million where major ownership expenses typically consume more than 28 percent of average local wages in the second quarter of 2022 include Orange County, CA (outside Los Angeles) (82.1 percent); Alameda County (Oakland), CA (77.2 percent); Queens County, NY (72.5 percent) and Riverside County, CA (outside Los Angeles) (67.6 percent).

Counties where the smallest portion of average local wages are required to afford the median-priced home during the second quarter of this year are Schuylkill County, PA (outside Allentown) (10.2 percent of annualized weekly wages needed to buy a home); Rock Island County (Moline), IL (12.4 percent); Cambria County, PA (outside Pittsburgh) (12.9 percent); Macon County (Decatur), IL (13.4 percent) and Mercer County, PA (outside Pittsburgh) (13.6 percent).

Counties with a population of at least 1 million where major ownership expenses typically consume less than 28 percent of average local wages in the second quarter of 2022 include Allegheny County (Pittsburgh), PA (17.4 percent); Cuyahoga County (Cleveland), OH (18.4 percent); Philadelphia County, PA (19.1 percent); St. Louis County, MO (21.4 percent) and Cook County (Chicago), IL (25.3 percent).

Four in 10 counties require annual wages of more than $75,000 to afford typical home

Amid the downward affordability trend, annual wages of more than $75,000 are now needed to pay for major costs on the median-priced home purchased during the second quarter of 2022 in 232, or 40 percent, of the 575 markets in the report.

The top 20 highest annual wages required to afford typical homes again are all on the east or west coast, led by New York County (Manhattan), NY ($362,691); San Mateo County (outside San Francisco), CA ($357,567); Marin County (outside San Francisco), CA ($347,958); San Francisco County, CA ($327,220) and Santa Clara County (San Jose), CA ($322,131).

The lowest annual wages required to afford a median-priced home in the second quarter of 2022 are in Schuylkill County, PA (outside Allentown) ($17,595); Cambria County, PA (outside Pittsburgh) ($20,171); Mercer County, PA (outside Pittsburgh) ($23,255); Fayette County, PA (outside Pittsburgh) ($23,638) and Bibb County (Macon), GA ($24,501),

Homeownership less affordable than historic averages in nearly all counties

Among the 575 counties analyzed in the report, 560 (97 percent) are less affordable in the second quarter of 2022 than their historic affordability averages. That is up from 80 percent in the first quarter of 2022, 69 percent a year ago and more than double the 44 percent level in the second quarter of 2020. Historic indexes have worsened this quarter compared to a year ago in all but two of those counties.

Historic affordability nationwide has declined for the sixth quarter in row to the worst level since the second quarter of 2007, near the end of the last housing-market boom.

Counties with a population of at least 1 million that are less affordable than their historic averages (indexes of less than 100 are considered less affordable compared to historic averages) include Maricopa County (Phoenix), AZ (index of 58); Mecklenburg County (Charlotte), NC (59); Travis County (Austin), TX (60); Collin County (Plano), TX (60) and Clark County (Las Vegas), NV (60).

Counties with the worst affordability indexes in the second quarter of 2022 are Clayton County, GA (outside Atlanta) (index of 47); Canyon County, ID (outside Boise) (48); Rankin County (Jackson), MS (48); Maury County, TN (outside Nashville) (49) and Pinal County, AZ (outside Phoenix) (49).

Among counties with a population of at least 1 million, those where the affordability indexes have worsened most from the second quarter of 2021 to the second quarter of 2022 are Hillsborough County (Tampa), FL (index down 30 percent); Clark County (Las Vegas), NV (down 30 percent); Collin County (Plano), TX (down 30 percent); Maricopa County (Phoenix), AZ (down 30 percent) and Pima County, (Tucson), AZ (down 30 percent).

Only 3 percent of markets are more affordable than historic averages

Among the 575 counties in the report, only 15 (3 percent) are more affordable than their historic affordability averages in the second quarter of 2022. That is down from 20 percent of the same group in the prior quarter, 31 percent a year ago and 56 percent in the second quarter of 2020.

Counties with a population of at least 1 million that are more affordable than their historic averages (indexes of more than 100 are considered more affordable compared to historic averages) include Westchester County, NY (outside New York City) (index of 103) and New York County (Manhattan), NY (101).

Counties with the best affordability indexes in the second quarter of 2022 include Macon County (Decatur), IL (index of 129); San Francisco County, CA (115); Mercer County, PA (outside Pittsburgh) (114); Peoria County, IL (107) and Schuylkill County, PA (outside Allentown) (106).

Counties with a population of least 1 million where the affordability index has declined the least from the second quarter of last year to the same period this year are Oakland County, MI (outside Detroit) (index down 11 percent); Cook County (Chicago), IL (down 13 percent); Cuyahoga County (Cleveland), OH (down 17 percent); Westchester County, NY (outside New York City) (down 17 percent) and Bronx County, NY (down 18 percent).

Report Methodology

The ATTOM U.S. Home Affordability Index analyzed median home prices derived from publicly recorded sales deed data collected by ATTOM and average wage data from the U.S. Bureau of Labor Statistics in 575 U.S. counties with a combined population of 254.1 million during the second quarter of 2022. The affordability index is based on the percentage of average wages needed to pay for major expenses on a median-priced home with a 30-year fixed-rate mortgage and a 20 percent down payment. Those expenses include property taxes, home insurance, mortgage payments and mortgage insurance. Average 30-year fixed interest rates from the Freddie Mac Primary Mortgage Market Survey were used to calculate monthly house payments.

The report determined affordability for average wage earners by calculating the amount of income needed for major home ownership expenses on a median-priced home, assuming a loan of 80 percent of the purchase price and a 28 percent maximum "front-end" debt-to-income ratio. For example, the nationwide median home price of $349,000 in the second quarter of 2022 requires an annual wage of $76,155, based on a $69,800 down payment, a $279,200 loan and monthly expenses not exceeding the 28 percent barrier — meaning households would not be spending more than 28 percent of their income on mortgage payments, property taxes and insurance. That required income is more than the $67,587 average wage nationwide based on the most recent average weekly wage data available from the Bureau of Labor Statistics, making a median-priced home nationwide unaffordable for average workers.

About ATTOM

ATTOM provides premium property data to power products that improve transparency, innovation, efficiency and disruption in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation's population. A rigorous data management process involving more than 20 steps validates, standardizes, and enhances the real estate data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. The 20TB ATTOM Data Warehouse fuels innovation in many industries including mortgage, real estate, insurance, marketing, government and more through flexible data delivery solutions that include bulk file licenses, property data APIs, real estate market trends, property reports and more. Also, introducing our newest innovative solution, that offers immediate access and streamlines data management – ATTOM Cloud.

Media Contact:

Christine Stricker

949.748.8428

christine.stricker@attomdata.com

Data and Report Licensing:

949.502.8313

datareports@attomdata.com

View original content to download multimedia:https://www.prnewswire.com/news-releases/rising-prices-and-mortgage-rates-make-homeownership-unaffordable-across-most-of-the-us-301578469.html

SOURCE ATTOM

Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

Uncategorized

‘Bougie Broke’ – The Financial Reality Behind The Facade

‘Bougie Broke’ – The Financial Reality Behind The Facade

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming…

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming to be Bougie Broke share pictures of their fancy cars, high-fashion clothing, and selfies in exotic locations and expensive restaurants. Yet they complain about living paycheck to paycheck and lacking the means to support their lifestyle.

Bougie broke is like “keeping up with the Joneses,” spending beyond one’s means to impress others.

Bougie Broke gives us a glimpse into the financial condition of a growing number of consumers. Since personal consumption represents about two-thirds of economic activity, it’s worth diving into the Bougie Broke fad to appreciate if a large subset of the population can continue to consume at current rates.

The Wealth Divide Disclaimer

Forecasting personal consumption is always tricky, but it has become even more challenging in the post-pandemic era. To appreciate why we share a joke told by Mike Green.

Bill Gates and I walk into the bar…

Bartender: “Wow… a couple of billionaires on average!”

Bill Gates, Jeff Bezos, Elon Musk, Mark Zuckerberg, and other billionaires make us all much richer, on average. Unfortunately, we can’t use the average to pay our bills.

According to Wikipedia, Bill Gates is one of 756 billionaires living in the United States. Many of these billionaires became much wealthier due to the pandemic as their investment fortunes proliferated.

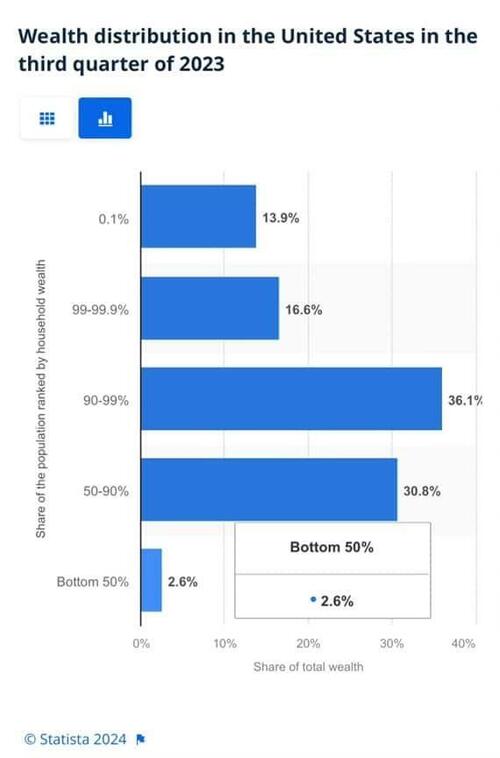

To appreciate the wealth divide, consider the graph below courtesy of Statista. 1% of the U.S. population holds 30% of the wealth. The wealthiest 10% of households have two-thirds of the wealth. The bottom half of the population accounts for less than 3% of the wealth.

The uber-wealthy grossly distorts consumption and savings data. And, with the sharp increase in their wealth over the past few years, the consumption and savings data are more distorted.

Furthermore, and critical to appreciate, the spending by the wealthy doesn’t fluctuate with the economy. Therefore, the spending of the lower wealth classes drives marginal changes in consumption. As such, the condition of the not-so-wealthy is most important for forecasting changes in consumption.

Revenge Spending

Deciphering personal data has also become more difficult because our spending habits have changed due to the pandemic.

A great example is revenge spending. Per the New York Times:

Ola Majekodunmi, the founder of All Things Money, a finance site for young adults, explained revenge spending as expenditures meant to make up for “lost time” after an event like the pandemic.

So, between the growing wealth divide and irregular spending habits, let’s quantify personal savings, debt usage, and real wages to appreciate better if Bougie Broke is a mass movement or a silly meme.

The Means To Consume

Savings, debt, and wages are the three primary sources that give consumers the ability to consume.

Savings

The graph below shows the rollercoaster on which personal savings have been since the pandemic. The savings rate is hovering at the lowest rate since those seen before the 2008 recession. The total amount of personal savings is back to 2017 levels. But, on an inflation-adjusted basis, it’s at 10-year lows. On average, most consumers are drawing down their savings or less. Given that wages are increasing and unemployment is historically low, they must be consuming more.

Now, strip out the savings of the uber-wealthy, and it’s probable that the amount of personal savings for much of the population is negligible. A survey by Payroll.org estimates that 78% of Americans live paycheck to paycheck.

More on Insufficient Savings

The Fed’s latest, albeit old, Report on the Economic Well-Being of U.S. Households from June 2023 claims that over a third of households do not have enough savings to cover an unexpected $400 expense. We venture to guess that number has grown since then. To wit, the number of households with essentially no savings rose 5% from their prior report a year earlier.

Relatively small, unexpected expenses, such as a car repair or a modest medical bill, can be a hardship for many families. When faced with a hypothetical expense of $400, 63 percent of all adults in 2022 said they would have covered it exclusively using cash, savings, or a credit card paid off at the next statement (referred to, altogether, as “cash or its equivalent”). The remainder said they would have paid by borrowing or selling something or said they would not have been able to cover the expense.

Debt

After periods where consumers drained their existing savings and/or devoted less of their paychecks to savings, they either slowed their consumption patterns or borrowed to keep them up. Currently, it seems like many are choosing the latter option. Consumer borrowing is accelerating at a quicker pace than it was before the pandemic.

The first graph below shows outstanding credit card debt fell during the pandemic as the economy cratered. However, after multiple stimulus checks and broad-based economic recovery, consumer confidence rose, and with it, credit card balances surged.

The current trend is steeper than the pre-pandemic trend. Some may be a catch-up, but the current rate is unsustainable. Consequently, borrowing will likely slow down to its pre-pandemic trend or even below it as consumers deal with higher credit card balances and 20+% interest rates on the debt.

The second graph shows that since 2022, credit card balances have grown faster than our incomes. Like the first graph, the credit usage versus income trend is unsustainable, especially with current interest rates.

With many consumers maxing out their credit cards, is it any wonder buy-now-pay-later loans (BNPL) are increasing rapidly?

Insider Intelligence believes that 79 million Americans, or a quarter of those over 18 years old, use BNPL. Lending Tree claims that “nearly 1 in 3 consumers (31%) say they’re at least considering using a buy now, pay later (BNPL) loan this month.”More telling, according to their survey, only 52% of those asked are confident they can pay off their BNPL loan without missing a payment!

Wage Growth

Wages have been growing above trend since the pandemic. Since 2022, the average annual growth in compensation has been 6.28%. Higher incomes support more consumption, but higher prices reduce the amount of goods or services one can buy. Over the same period, real compensation has grown by less than half a percent annually. The average real compensation growth was 2.30% during the three years before the pandemic.

In other words, compensation is just keeping up with inflation instead of outpacing it and providing consumers with the ability to consume, save, or pay down debt.

It’s All About Employment

The unemployment rate is 3.9%, up slightly from recent lows but still among the lowest rates in the last seventy-five years.

The uptick in credit card usage, decline in savings, and the savings rate argue that consumers are slowly running out of room to keep consuming at their current pace.

However, the most significant means by which we consume is income. If the unemployment rate stays low, consumption may moderate. But, if the recent uptick in unemployment continues, a recession is extremely likely, as we have seen every time it turned higher.

It’s not just those losing jobs that consume less. Of greater impact is a loss of confidence by those employed when they see friends or neighbors being laid off.

Accordingly, the labor market is probably the most important leading indicator of consumption and of the ability of the Bougie Broke to continue to be Bougie instead of flat-out broke!

Summary

There are always consumers living above their means. This is often harmless until their means decline or disappear. The Bougie Broke meme and the ability social media gives consumers to flaunt their “wealth” is a new medium for an age-old message.

Diving into the data, it argues that consumption will likely slow in the coming months. Such would allow some consumers to save and whittle down their debt. That situation would be healthy and unlikely to cause a recession.

The potential for the unemployment rate to continue higher is of much greater concern. The combination of a higher unemployment rate and strapped consumers could accentuate a recession.

Government

Congress’ failure so far to deliver on promise of tens of billions in new research spending threatens America’s long-term economic competitiveness

A deal that avoided a shutdown also slashed spending for the National Science Foundation, putting it billions below a congressional target intended to…

Federal spending on fundamental scientific research is pivotal to America’s long-term economic competitiveness and growth. But less than two years after agreeing the U.S. needed to invest tens of billions of dollars more in basic research than it had been, Congress is already seriously scaling back its plans.

A package of funding bills recently passed by Congress and signed by President Joe Biden on March 9, 2024, cuts the current fiscal year budget for the National Science Foundation, America’s premier basic science research agency, by over 8% relative to last year. That puts the NSF’s current allocation US$6.6 billion below targets Congress set in 2022.

And the president’s budget blueprint for the next fiscal year, released on March 11, doesn’t look much better. Even assuming his request for the NSF is fully funded, it would still, based on my calculations, leave the agency a total of $15 billion behind the plan Congress laid out to help the U.S. keep up with countries such as China that are rapidly increasing their science budgets.

I am a sociologist who studies how research universities contribute to the public good. I’m also the executive director of the Institute for Research on Innovation and Science, a national university consortium whose members share data that helps us understand, explain and work to amplify those benefits.

Our data shows how underfunding basic research, especially in high-priority areas, poses a real threat to the United States’ role as a leader in critical technology areas, forestalls innovation and makes it harder to recruit the skilled workers that high-tech companies need to succeed.

A promised investment

Less than two years ago, in August 2022, university researchers like me had reason to celebrate.

Congress had just passed the bipartisan CHIPS and Science Act. The science part of the law promised one of the biggest federal investments in the National Science Foundation in its 74-year history.

The CHIPS act authorized US$81 billion for the agency, promised to double its budget by 2027 and directed it to “address societal, national, and geostrategic challenges for the benefit of all Americans” by investing in research.

But there was one very big snag. The money still has to be appropriated by Congress every year. Lawmakers haven’t been good at doing that recently. As lawmakers struggle to keep the lights on, fundamental research is quickly becoming a casualty of political dysfunction.

Research’s critical impact

That’s bad because fundamental research matters in more ways than you might expect.

For instance, the basic discoveries that made the COVID-19 vaccine possible stretch back to the early 1960s. Such research investments contribute to the health, wealth and well-being of society, support jobs and regional economies and are vital to the U.S. economy and national security.

Lagging research investment will hurt U.S. leadership in critical technologies such as artificial intelligence, advanced communications, clean energy and biotechnology. Less support means less new research work gets done, fewer new researchers are trained and important new discoveries are made elsewhere.

But disrupting federal research funding also directly affects people’s jobs, lives and the economy.

Businesses nationwide thrive by selling the goods and services – everything from pipettes and biological specimens to notebooks and plane tickets – that are necessary for research. Those vendors include high-tech startups, manufacturers, contractors and even Main Street businesses like your local hardware store. They employ your neighbors and friends and contribute to the economic health of your hometown and the nation.

Nearly a third of the $10 billion in federal research funds that 26 of the universities in our consortium used in 2022 directly supported U.S. employers, including:

A Detroit welding shop that sells gases many labs use in experiments funded by the National Institutes of Health, National Science Foundation, Department of Defense and Department of Energy.

A Dallas-based construction company that is building an advanced vaccine and drug development facility paid for by the Department of Health and Human Services.

More than a dozen Utah businesses, including surveyors, engineers and construction and trucking companies, working on a Department of Energy project to develop breakthroughs in geothermal energy.

When Congress shortchanges basic research, it also damages businesses like these and people you might not usually associate with academic science and engineering. Construction and manufacturing companies earn more than $2 billion each year from federally funded research done by our consortium’s members.

Jobs and innovation

Disrupting or decreasing research funding also slows the flow of STEM – science, technology, engineering and math – talent from universities to American businesses. Highly trained people are essential to corporate innovation and to U.S. leadership in key fields, such as AI, where companies depend on hiring to secure research expertise.

In 2022, federal research grants paid wages for about 122,500 people at universities that shared data with my institute. More than half of them were students or trainees. Our data shows that they go on to many types of jobs but are particularly important for leading tech companies such as Google, Amazon, Apple, Facebook and Intel.

That same data lets me estimate that over 300,000 people who worked at U.S. universities in 2022 were paid by federal research funds. Threats to federal research investments put academic jobs at risk. They also hurt private sector innovation because even the most successful companies need to hire people with expert research skills. Most people learn those skills by working on university research projects, and most of those projects are federally funded.

High stakes

If Congress doesn’t move to fund fundamental science research to meet CHIPS and Science Act targets – and make up for the $11.6 billion it’s already behind schedule – the long-term consequences for American competitiveness could be serious.

Over time, companies would see fewer skilled job candidates, and academic and corporate researchers would produce fewer discoveries. Fewer high-tech startups would mean slower economic growth. America would become less competitive in the age of AI. This would turn one of the fears that led lawmakers to pass the CHIPS and Science Act into a reality.

Ultimately, it’s up to lawmakers to decide whether to fulfill their promise to invest more in the research that supports jobs across the economy and in American innovation, competitiveness and economic growth. So far, that promise is looking pretty fragile.

This is an updated version of an article originally published on Jan. 16, 2024.

Jason Owen-Smith receives research support from the National Science Foundation, the National Institutes of Health, the Alfred P. Sloan Foundation and Wellcome Leap.

economic growth covid-19 grants congress vaccine china-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges