Rising interest rates and climbing home prices moderate California home sales in April as statewide median price sets another peak, C.A.R. reports

Rising interest rates and climbing home prices moderate California home sales in April as statewide median price sets another peak, C.A.R. reports

PR Newswire

LOS ANGELES, May 17, 2022

Existing, single-family home sales totaled 419,040 in April on …

Rising interest rates and climbing home prices moderate California home sales in April as statewide median price sets another peak, C.A.R. reports

PR Newswire

LOS ANGELES, May 17, 2022

- Existing, single-family home sales totaled 419,040 in April on a seasonally adjusted annualized rate, down 1.9 percent from March and down 8.5 percent from April 2021.

- April's statewide median home price was $884,890, up 4.2 percent from March and up 8.7 percent from April 2021.

- Year-to-date statewide home sales were down 7.4 percent in April.

LOS ANGELES, May 17, 2022 /PRNewswire/ -- California home sales retreated in April as rising interest rates and higher home prices depressed housing demand even as the statewide median home price set another record for the second straight month, primarily due to strong sales at the top end of the market, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Infographic: https://www.car.org/en/Global/Infographics/April-2022-Sales-and-Price

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 419,040 in April, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2022 if sales maintained the April pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

April's sales pace was down 1.9 percent on a monthly basis from 426,970 in March and down 8.5 percent from a year ago, when 458,170 homes were sold on an annualized basis. The month-to-month April sales decline is in line with the long-run change of -1.6 percent recorded between March and April. The annual sales drop, however, was the biggest decline in the last four months. On a year-to-date basis, sales were down 7.4 percent in April.

"As rates remain on the rise, the sense of urgency to buy is keeping the market highly competitive, especially since housing inventory continues to stay well below pre-pandemic levels," said C.A.R. President Otto Catrina, a Bay Area real estate broker and REALTOR®. "While we will likely see more listings come on to the market as we move further into the home-buying season, the housing shortage issue will likely persist throughout the rest of the year in major metropolitan areas, such as the Bay Area and the Southern California region."

California's median home price set another record in April at $884,890 — surpassing the record of $849,080 set just the previous month. The April price was 4.2 percent higher than the $849,080 recorded in March and 8.7 percent higher than the $814,010 recorded last April. The year-over-year increase was the smallest since June 2020 but was strong enough to establish a new peak price for the state. The month-to-month percent change was higher than the long run average of 2.3 percent recorded between a March and an April in the last 43 years.

A change in the mix of sales continues to play a role in statewide record-setting home prices as sales in high-priced markets remain stronger than their more affordable counterparts. The share of million-dollar home sales increased for the third consecutive month, reaching the highest level on record at 34.7 percent. Home sales priced below $500,000, meanwhile, dipped again in April and hit the lowest level ever. Sales dropped by double-digits for price segments $750,000 and below, while sales above $2 million remained on the rise on a year-over-year basis. The shift in the mix of sales toward high-end homes is expected to persist in the upcoming months.

"California's housing market is moderating from the 12-year-high levels experienced in 2021, as higher mortgage interest rates and soaring home prices are starting to have an adverse impact on housing demand," said C.A.R. Vice President and Chief Economist Jordan Levine. "With April pending home sales recording the worst drop in two years, the affordability challenges that buyers have been encountering are materializing in recent sales trends, and further declines in housing demand could continue in the second half of the year."

Other key points from C.A.R.'s April 2022 resale housing report include:

- At the regional level, home sales in all major California regions declined from a year ago, with three of the five regions falling by double-digits on a year-over-year basis. The Central Coast region continued to have the biggest decline of all regions in April, with sales dropping 21.3 percent from a year ago. Despite being down sharply from last year's unusually high level, April's sales in the Central Coast were only down 2.1 percent from the pre-pandemic average. The San Francisco Bay Area (-18.1 percent) and Southern California (-16.0 percent) were the other two major regions with sales declines exceeding 10 percent from a year ago.

- More than four in five of all counties tracked by C.A.R. experienced a sales decline from a year ago in April 2022, compared to nearly two in three the prior month. Sales in 29 California counties fell more than 10 percent from a year ago, with Mono dropping the most at 70.0 percent, followed by Glenn (-41.7 percent) and Plumas (-29.3 percent). Counties with a sales drop from last year decreased an average of -16.3 percent in April. Only nine counties recorded a sales increase on a year-over-year basis in April, compared to 19 counties in March. Yuba (43.2 percent) had the largest sales growth from last year, followed by Sutter (25.4 percent) and Mariposa (18.2 percent). Through the first four months of 2022, Plumas had the biggest year-to-date sales decline, registering -31.0 percent, while Yuba (+61.3 percent) had the best sales performance of all counties.

- At the regional level, home prices in all major California regions, except the Far North continued to surge from last year by double-digits, with three of them reaching a new record high in April. The San Francisco Bay Area recorded the highest year-over-year price growth with an increase of 15.9 percent, followed by the Central Valley (14.9 percent), the Central Coast (13.4 percent), Southern California (11.7 percent), and the Far North (8.9 percent). The Central Coast and the Far North were the only regions that did not post a new record median price in April.

- At the county level, home prices continued to rise across the state, with 26 counties in California setting new record median highs in April. Forty-five out of 51 counties tracked by C.A.R. recorded a price increase in April, with 33 of them rising 10 percent or more from a year ago. Mono had the biggest year-over-year gain in median price at 142.6 percent, followed by Marin (31.2 percent) and Mariposa (23.3 percent). The median price in six counties dipped from last year, with Plumas dropping the most at -12.5 percent, followed by Glenn (-7.0 percent) and Tehama (-3.3 percent).

- The overall housing supply condition in California improved in April, with the statewide Unsold Inventory Index (UII) inching up slightly from last month and from the same month a year ago. The number of active listings surged more than 20 percent on a year-over-year basis and recorded the highest yearly growth in properties for sale since January 2019. Active listings in April climbed to the highest level in seven months

- Forty of the 51 counties tracked by C.A.R. recorded an increase in active listings on a year-over-year basis in April, compared to 36 counties in March. For the second straight month, Yuba had the biggest increase in homes on the market with a jump of 176.7 percent in growth in active listings from last April. Sutter (108.7 percent) and Glenn (100.0 percent) were the other two counties that also experienced triple-digit annual increases in active listings. On the other hand, eight counties came in short on properties on the market when compared to the same month of last year, with Sonoma dropping the most at -26.2 percent, followed by Mono (-23.3 percent) and Lassen (-21.6 percent).

- The median number of days it took to sell a California single-family home was 8 days in April and 7 days in April 2021.

- C.A.R.'s statewide sales-price-to-list-price ratio* was 104.2 percent in April 2022 and 103.3 percent in April 2021.

- The statewide average price per square foot** for an existing single-family home was $433, up from $383 in April a year ago.

- The 30-year, fixed-mortgage interest rate averaged 4.98 percent in April, up from 3.06 percent in April 2021, according to Freddie Mac. The five-year, adjustable mortgage interest rate averaged 3.70 percent, compared to 2.81 percent in April 2021.

Note: The County MLS median price and sales data in the tables are generated from a survey of more than 90 associations of REALTORS® throughout the state and represent statistics of existing single-family detached homes only. County sales data are not adjusted to account for seasonal factors that can influence home sales. Movements in sales prices should not be interpreted as changes in the cost of a standard home. The median price is where half sold for more and half sold for less; medians are more typical than average prices, which are skewed by a relatively small share of transactions at either the lower end or the upper end. Median prices can be influenced by changes in cost, as well as changes in the characteristics and the size of homes sold. The change in median prices should not be construed as actual price changes in specific homes.

*Sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

**Price per square foot is a measure commonly used by real estate agents and brokers to determine how much a square foot of space a buyer will pay for a property. It is calculated as the sale price of the home divided by the number of finished square feet. C.A.R. currently tracks price-per-square foot statistics for 50 counties.

Leading the way…® in California real estate for more than 110 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with more than 217,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

April 2022 County Sales and Price Activity | |||||||||

April 2022 | Median Sales Price of Existing Single-Family Homes | Sales | |||||||

State/Region/County | April 2022 | March 2022 | April 2021 | Price | Price | Sales | Sales | ||

CA Single-family home | $884,890 | $849,080 | $814,010 | 4.2% | 8.7% | -1.9% | -8.5% | ||

CA Condo/Townhome | $700,000 | $661,000 | $570,000 | 5.9% | 22.8% | -4.0% | -20.0% | ||

Los Angeles Metro Area | $800,000 | $770,000 | $725,000 | 3.9% | 10.3% | -3.0% | -16.8% | ||

Central Coast | $1,050,000 | $1,050,000 | $925,620 | 0.0% | 13.4% | 5.7% | -21.3% | ||

Central Valley | $500,000 | $495,000 | $435,000 | 1.0% | 14.9% | 1.9% | -5.4% | ||

Far North | $400,000 | $395,000 | $367,250 | 1.3% | 8.9% | -1.6% | -9.0% | ||

Inland Empire | $580,000 | $580,000 | $500,000 | 0.0% | 16.0% | -11.7% | -14.4% | ||

San Francisco Bay Area | $1,540,000 | $1,444,720 | $1,328,440 | 6.6% | 15.9% | 5.4% | -18.1% | ||

Southern California | $837,500 | $802,500 | $750,000 | 4.4% | 11.7% | -2.6% | -16.0% | ||

San Francisco Bay Area | |||||||||

Alameda | $1,500,000 | $1,430,000 | $1,300,000 | 4.9% | 15.4% | 3.5% | -15.3% | ||

Contra Costa | $1,050,000 | $965,900 | $990,000 | 8.7% | 6.1% | -6.6% | -20.9% | ||

Marin | $2,112,500 | $1,737,500 | $1,610,000 | 21.6% | 31.2% | 31.1% | -20.4% | ||

Napa | $1,027,000 | $998,000 | $950,000 | 2.9% | 8.1% | 13.7% | -12.2% | ||

San Francisco | $2,057,500 | $2,060,000 | $1,800,000 | -0.1% | 14.3% | 4.5% | -6.3% | ||

San Mateo | $2,401,000 | $2,280,000 | $2,001,000 | 5.3% | 20.0% | 7.6% | -17.3% | ||

Santa Clara | $1,970,000 | $1,950,000 | $1,650,000 | 1.0% | 19.4% | 9.9% | -21.2% | ||

Solano | $640,000 | $604,000 | $555,000 | 6.0% | 15.3% | 17.3% | -4.8% | ||

Sonoma | $871,500 | $833,750 | $777,500 | 4.5% | 12.1% | 9.8% | -25.8% | ||

Southern California | |||||||||

Los Angeles | $801,680 | $781,050 | $728,800 | 2.6% | 10.0% | 2.9% | -12.8% | ||

Orange | $1,325,000 | $1,305,000 | $1,100,000 | 1.5% | 20.5% | 4.3% | -27.6% | ||

Riverside | $630,000 | $620,000 | $545,500 | 1.6% | 15.5% | -9.7% | -12.6% | ||

San Bernardino | $495,000 | $475,000 | $405,000 | 4.2% | 22.2% | -15.6% | -17.6% | ||

San Diego | $975,000 | $950,000 | $825,120 | 2.6% | 18.2% | -1.3% | -12.6% | ||

Ventura | $955,000 | $914,000 | $865,000 | 4.5% | 10.4% | -3.0% | -20.1% | ||

Central Coast | |||||||||

Monterey | $903,500 | $911,000 | $840,000 | -0.8% | 7.6% | -18.9% | -24.2% | ||

San Luis Obispo | $890,000 | $903,000 | $799,950 | -1.4% | 11.3% | 25.5% | -22.8% | ||

Santa Barbara | $1,200,000 | $1,300,000 | $1,100,000 | -7.7% | 9.1% | -3.5% | -23.2% | ||

Santa Cruz | $1,410,000 | $1,600,000 | $1,265,000 | -11.9% | 11.5% | 29.0% | -12.7% | ||

Central Valley | |||||||||

Fresno | $425,000 | $415,000 | $355,000 | 2.4% | 19.7% | 1.2% | -0.7% | ||

Glenn | $281,260 | $320,000 | $302,500 | -12.1% | -7.0% | -17.6% | -41.7% | ||

Kern | $385,000 | $369,750 | $315,000 | 4.1% | 22.2% | -3.5% | -13.1% | ||

Kings | $360,000 | $325,000 | $305,000 | 10.8% | 18.0% | 9.5% | -24.0% | ||

Madera | $418,000 | $430,000 | $378,000 | -2.8% | 10.6% | -3.3% | 3.5% | ||

Merced | $395,000 | $385,000 | $325,000 | 2.6% | 21.5% | 4.2% | 3.4% | ||

Placer | $717,000 | $701,730 | $625,000 | 2.2% | 14.7% | 5.3% | -11.1% | ||

Sacramento | $570,000 | $560,000 | $490,000 | 1.8% | 16.3% | 6.7% | -5.1% | ||

San Benito | $860,000 | $835,000 | $722,500 | 3.0% | 19.0% | 6.7% | -25.0% | ||

San Joaquin | $555,000 | $550,000 | $490,000 | 0.9% | 13.3% | -5.4% | -3.3% | ||

Stanislaus | $485,000 | $470,500 | $419,000 | 3.1% | 15.8% | -3.0% | -2.3% | ||

Tulare | $370,000 | $360,980 | $309,600 | 2.5% | 19.5% | 6.9% | 5.9% | ||

Far North | |||||||||

Butte | $467,250 | $465,000 | $438,500 | 0.5% | 6.6% | 15.6% | -10.3% | ||

Lassen | $245,000 | $243,000 | $253,000 | 0.8% | -3.2% | -32.3% | -8.7% | ||

Plumas | $350,000 | $391,500 | $400,000 | -10.6% | -12.5% | 31.8% | -29.3% | ||

Shasta | $389,000 | $390,000 | $350,000 | -0.3% | 11.1% | -12.8% | -5.5% | ||

Siskiyou | $322,250 | $308,000 | $302,500 | 4.6% | 6.5% | 6.4% | -13.8% | ||

Tehama | $350,000 | $401,880 | $362,000 | -12.9% | -3.3% | 23.5% | 0.0% | ||

Other CA Counties | |||||||||

Amador | $445,000 | $440,000 | $415,000 | 1.1% | 7.2% | 27.7% | -14.3% | ||

Calaveras | $504,500 | $492,000 | $475,000 | 2.5% | 6.2% | 5.3% | 1.0% | ||

Del Norte | $357,500 | $398,000 | $364,170 | -10.2% | -1.8% | -33.3% | -9.1% | ||

El Dorado | $711,000 | $750,000 | $654,750 | -5.2% | 8.6% | 13.6% | -6.9% | ||

Humboldt | $464,300 | $430,000 | $425,000 | 8.0% | 9.2% | 6.2% | 10.1% | ||

Lake | $321,000 | $370,000 | $324,950 | -13.2% | -1.2% | -2.2% | -6.3% | ||

Mariposa | $423,000 | $530,000 | $343,000 | -20.2% | 23.3% | 13.0% | 18.2% | ||

Mendocino | $545,000 | $506,000 | $528,000 | 7.7% | 3.2% | -6.0% | -4.1% | ||

Mono | $2,362,500 | $1,100,000 | $974,000 | 114.8% | 142.6% | -64.7% | -70.0% | ||

Nevada | $617,000 | $559,000 | $555,000 | 10.4% | 11.2% | 0.7% | -16.0% | ||

Sutter | $444,000 | $460,000 | $410,000 | -3.5% | 8.3% | -6.3% | 25.4% | ||

Tuolumne | $437,500 | $450,000 | $367,000 | -2.8% | 19.2% | 14.6% | 13.4% | ||

Yolo | $633,000 | $657,000 | $566,000 | -3.7% | 11.8% | -4.1% | -16.4% | ||

Yuba | $430,000 | $432,500 | $384,700 | -0.6% | 11.8% | 1.9% | 43.2% | ||

r = revised |

April 2022 County Unsold Inventory and Days on Market | ||||||||||

April 2022 | Unsold Inventory Index | Median Time on Market | ||||||||

State/Region/County | April 2022 | March 2022 | April 2021 | April 2022 | March 2022 | April 2021 | ||||

CA Single-family homes | 1.8 | 1.7 | 1.6 | 8.0 | 8.0 | 7.0 | ||||

CA Condo/Townhomes | 1.6 | 1.4 | 1.5 | 8.0 | 7.0 | 9.0 | ||||

Los Angeles Metro Area | 1.9 | 1.7 | 1.7 | 8.0 | 9.0 | 8.0 | ||||

Central Coast | 1.9 | 1.8 | 1.8 | 8.0 | 8.0 | 8.0 | ||||

Central Valley | 1.7 | 1.6 | 1.6 | 7.0 | 7.0 | 6.0 | ||||

Far North | 3.0 | 2.6 | 2.5 | 12.0 | 14.0 | 11.0 | ||||

Inland Empire | 1.9 | 1.6 | 1.7 | 9.0 | 10.0 | 8.0 | ||||

San Francisco Bay Area | 1.5 | 1.4 | 1.3 | 8.0 | 8.0 | 8.0 | ||||

Southern California | 1.8 | 1.6 | 1.6 | 8.0 | 8.0 | 7.0 | ||||

San Francisco Bay Area | ||||||||||

Alameda | 1.5 | 1.4 | 1.3 | 8.0 | 8.0 | 7.0 | ||||

Contra Costa | 1.5 | 1.2 | 1.1 | 8.0 | 7.0 | 7.0 | ||||

Marin | 1.4 | 1.5 | 1.3 | 8.0 | 9.0 | 11.0 | ||||

Napa | 2.3 | 2.5 | 2.4 | 24.5 | 27.0 | 31.0 | ||||

San Francisco | 1.5 | 1.6 | 1.6 | 12.0 | 12.0 | 11.0 | ||||

San Mateo | 1.5 | 1.4 | 1.4 | 8.0 | 7.0 | 8.0 | ||||

Santa Clara | 1.4 | 1.4 | 1.3 | 7.0 | 7.0 | 8.0 | ||||

Solano | 1.3 | 1.4 | 1.1 | 19.0 | 18.0 | 20.0 | ||||

Sonoma | 1.8 | 1.7 | 1.9 | 23.0 | 23.0 | 31.0 | ||||

Southern California | ||||||||||

Los Angeles | 1.9 | 1.8 | 1.8 | 9.0 | 8.0 | 7.0 | ||||

Orange | 1.7 | 1.6 | 1.5 | 7.0 | 6.0 | 7.0 | ||||

Riverside | 1.7 | 1.5 | 1.6 | 10.0 | 11.0 | 8.0 | ||||

San Bernardino | 2.2 | 1.8 | 2.0 | 8.0 | 10.0 | 8.0 | ||||

San Diego | 1.6 | 1.4 | 1.5 | 7.0 | 7.0 | 6.0 | ||||

Ventura | 1.8 | 1.6 | 1.7 | 15.0 | 17.0 | 22.0 | ||||

Central Coast | ||||||||||

Monterey | 2.5 | 1.7 | 2.1 | 9.0 | 9.0 | 10.0 | ||||

San Luis Obispo | 1.8 | 2.1 | 1.8 | 7.0 | 6.0 | 7.0 | ||||

Santa Barbara | 1.7 | 1.5 | 1.6 | 9.0 | 8.0 | 8.0 | ||||

Santa Cruz | 1.6 | 1.8 | 1.7 | 8.0 | 9.0 | 9.0 | ||||

Central Valley | ||||||||||

Fresno | 1.9 | 1.8 | 1.8 | 6.0 | 7.0 | 6.0 | ||||

Glenn | 3.6 | 2.4 | 1.3 | 10.5 | 13.0 | 7.5 | ||||

Kern | 1.9 | 1.6 | 1.7 | 7.0 | 7.0 | 6.0 | ||||

Kings | 1.8 | 1.6 | 1.5 | 7.0 | 6.5 | 6.0 | ||||

Madera | 2.3 | 2.2 | 2.3 | 10.0 | 10.0 | 8.0 | ||||

Merced | 1.9 | 1.9 | 1.7 | 9.0 | 9.5 | 7.0 | ||||

Placer | 1.8 | 1.6 | 1.4 | 6.0 | 6.0 | 5.0 | ||||

Sacramento | 1.4 | 1.4 | 1.4 | 7.0 | 7.0 | 6.0 | ||||

San Benito | 2.5 | 2.3 | 2.1 | 8.0 | 12.0 | 10.0 | ||||

San Joaquin | 1.8 | 1.6 | 1.7 | 7.0 | 7.0 | 6.0 | ||||

Stanislaus | 1.6 | 1.5 | 1.5 | 7.0 | 7.0 | 6.0 | ||||

Tulare | 1.7 | 1.8 | 1.7 | 7.0 | 8.0 | 8.0 | ||||

Far North | ||||||||||

Butte | 2.2 | 2.1 | 1.7 | 7.5 | 8.0 | 7.0 | ||||

Lassen | 4.6 | 2.8 | 5.7 | 70.0 | 99.0 | 71.5 | ||||

Plumas | 5.6 | 5.6 | 4.3 | 61.0 | 57.5 | 100.0 | ||||

Shasta | 2.7 | 2.2 | 2.4 | 8.0 | 12.0 | 7.0 | ||||

Siskiyou | 4.2 | 3.9 | 2.6 | 18.5 | 14.5 | 9.0 | ||||

Tehama | 3.5 | 4.2 | 3.3 | 39.0 | 34.5 | 44.5 | ||||

Other CA Counties | ||||||||||

Amador | 2.9 | 3.1 | 2.0 | 11.5 | 9.0 | 9.0 | ||||

Calaveras | 2.5 | 2.3 | 2.2 | 41.5 | 40.0 | 50.0 | ||||

Del Norte | 4.0 | 2.7 | 3.1 | 69.0 | 88.0 | 165.0 | ||||

El Dorado | 2.0 | 2.0 | 1.7 | 12.0 | 11.0 | 9.0 | ||||

Humboldt | 3.0 | 2.9 | 2.7 | 9.0 | 9.0 | 9.0 | ||||

Lake | 4.0 | 3.5 | 3.0 | 15.0 | 38.0 | 17.0 | ||||

Mariposa | 3.2 | 3.6 | 3.2 | 20.0 | 11.5 | 6.0 | ||||

Mendocino | 6.7 | 5.5 | 4.1 | 39.0 | 56.0 | 40.0 | ||||

Mono | 6.5 | 2.3 | 2.4 | 49.0 | 64.0 | 73.0 | ||||

Nevada | 3.2 | 2.5 | 2.2 | 11.0 | 9.0 | 9.0 | ||||

Sutter | 2.2 | 1.6 | 1.4 | 7.0 | 8.0 | 6.0 | ||||

Tuolumne | 2.4 | 2.5 | 3.0 | 10.0 | 16.5 | 10.0 | ||||

Yolo | 1.8 | 1.4 | 1.5 | 7.0 | 7.0 | 7.0 | ||||

Yuba | 2.0 | 2.0 | 1.2 | 6.0 | 7.0 | 5.0 | ||||

r = revised |

View original content to download multimedia:https://www.prnewswire.com/news-releases/rising-interest-rates-and-climbing-home-prices-moderate-california-home-sales-in-april-as-statewide-median-price-sets-another-peak-car-reports-301549278.html

SOURCE CALIFORNIA ASSOCIATION OF REALTORS

Government

Four Years Ago This Week, Freedom Was Torched

Four Years Ago This Week, Freedom Was Torched

Authored by Jeffrey Tucker via The Brownstone Institute,

"Beware the Ides of March,” Shakespeare…

Authored by Jeffrey Tucker via The Brownstone Institute,

"Beware the Ides of March,” Shakespeare quotes the soothsayer’s warning Julius Caesar about what turned out to be an impending assassination on March 15. The death of American liberty happened around the same time four years ago, when the orders went out from all levels of government to close all indoor and outdoor venues where people gather.

It was not quite a law and it was never voted on by anyone. Seemingly out of nowhere, people who the public had largely ignored, the public health bureaucrats, all united to tell the executives in charge – mayors, governors, and the president – that the only way to deal with a respiratory virus was to scrap freedom and the Bill of Rights.

And they did, not only in the US but all over the world.

The forced closures in the US began on March 6 when the mayor of Austin, Texas, announced the shutdown of the technology and arts festival South by Southwest. Hundreds of thousands of contracts, of attendees and vendors, were instantly scrapped. The mayor said he was acting on the advice of his health experts and they in turn pointed to the CDC, which in turn pointed to the World Health Organization, which in turn pointed to member states and so on.

There was no record of Covid in Austin, Texas, that day but they were sure they were doing their part to stop the spread. It was the first deployment of the “Zero Covid” strategy that became, for a time, official US policy, just as in China.

It was never clear precisely who to blame or who would take responsibility, legal or otherwise.

This Friday evening press conference in Austin was just the beginning. By the next Thursday evening, the lockdown mania reached a full crescendo. Donald Trump went on nationwide television to announce that everything was under control but that he was stopping all travel in and out of US borders, from Europe, the UK, Australia, and New Zealand. American citizens would need to return by Monday or be stuck.

Americans abroad panicked while spending on tickets home and crowded into international airports with waits up to 8 hours standing shoulder to shoulder. It was the first clear sign: there would be no consistency in the deployment of these edicts.

There is no historical record of any American president ever issuing global travel restrictions like this without a declaration of war. Until then, and since the age of travel began, every American had taken it for granted that he could buy a ticket and board a plane. That was no longer possible. Very quickly it became even difficult to travel state to state, as most states eventually implemented a two-week quarantine rule.

The next day, Friday March 13, Broadway closed and New York City began to empty out as any residents who could went to summer homes or out of state.

On that day, the Trump administration declared the national emergency by invoking the Stafford Act which triggers new powers and resources to the Federal Emergency Management Administration.

In addition, the Department of Health and Human Services issued a classified document, only to be released to the public months later. The document initiated the lockdowns. It still does not exist on any government website.

The White House Coronavirus Response Task Force, led by the Vice President, will coordinate a whole-of-government approach, including governors, state and local officials, and members of Congress, to develop the best options for the safety, well-being, and health of the American people. HHS is the LFA [Lead Federal Agency] for coordinating the federal response to COVID-19.

Closures were guaranteed:

Recommend significantly limiting public gatherings and cancellation of almost all sporting events, performances, and public and private meetings that cannot be convened by phone. Consider school closures. Issue widespread ‘stay at home’ directives for public and private organizations, with nearly 100% telework for some, although critical public services and infrastructure may need to retain skeleton crews. Law enforcement could shift to focus more on crime prevention, as routine monitoring of storefronts could be important.

In this vision of turnkey totalitarian control of society, the vaccine was pre-approved: “Partner with pharmaceutical industry to produce anti-virals and vaccine.”

The National Security Council was put in charge of policy making. The CDC was just the marketing operation. That’s why it felt like martial law. Without using those words, that’s what was being declared. It even urged information management, with censorship strongly implied.

The timing here is fascinating. This document came out on a Friday. But according to every autobiographical account – from Mike Pence and Scott Gottlieb to Deborah Birx and Jared Kushner – the gathered team did not meet with Trump himself until the weekend of the 14th and 15th, Saturday and Sunday.

According to their account, this was his first real encounter with the urge that he lock down the whole country. He reluctantly agreed to 15 days to flatten the curve. He announced this on Monday the 16th with the famous line: “All public and private venues where people gather should be closed.”

This makes no sense. The decision had already been made and all enabling documents were already in circulation.

There are only two possibilities.

One: the Department of Homeland Security issued this March 13 HHS document without Trump’s knowledge or authority. That seems unlikely.

Two: Kushner, Birx, Pence, and Gottlieb are lying. They decided on a story and they are sticking to it.

Trump himself has never explained the timeline or precisely when he decided to greenlight the lockdowns. To this day, he avoids the issue beyond his constant claim that he doesn’t get enough credit for his handling of the pandemic.

With Nixon, the famous question was always what did he know and when did he know it? When it comes to Trump and insofar as concerns Covid lockdowns – unlike the fake allegations of collusion with Russia – we have no investigations. To this day, no one in the corporate media seems even slightly interested in why, how, or when human rights got abolished by bureaucratic edict.

As part of the lockdowns, the Cybersecurity and Infrastructure Security Agency, which was and is part of the Department of Homeland Security, as set up in 2018, broke the entire American labor force into essential and nonessential.

They also set up and enforced censorship protocols, which is why it seemed like so few objected. In addition, CISA was tasked with overseeing mail-in ballots.

Only 8 days into the 15, Trump announced that he wanted to open the country by Easter, which was on April 12. His announcement on March 24 was treated as outrageous and irresponsible by the national press but keep in mind: Easter would already take us beyond the initial two-week lockdown. What seemed to be an opening was an extension of closing.

This announcement by Trump encouraged Birx and Fauci to ask for an additional 30 days of lockdown, which Trump granted. Even on April 23, Trump told Georgia and Florida, which had made noises about reopening, that “It’s too soon.” He publicly fought with the governor of Georgia, who was first to open his state.

Before the 15 days was over, Congress passed and the president signed the 880-page CARES Act, which authorized the distribution of $2 trillion to states, businesses, and individuals, thus guaranteeing that lockdowns would continue for the duration.

There was never a stated exit plan beyond Birx’s public statements that she wanted zero cases of Covid in the country. That was never going to happen. It is very likely that the virus had already been circulating in the US and Canada from October 2019. A famous seroprevalence study by Jay Bhattacharya came out in May 2020 discerning that infections and immunity were already widespread in the California county they examined.

What that implied was two crucial points: there was zero hope for the Zero Covid mission and this pandemic would end as they all did, through endemicity via exposure, not from a vaccine as such. That was certainly not the message that was being broadcast from Washington. The growing sense at the time was that we all had to sit tight and just wait for the inoculation on which pharmaceutical companies were working.

By summer 2020, you recall what happened. A restless generation of kids fed up with this stay-at-home nonsense seized on the opportunity to protest racial injustice in the killing of George Floyd. Public health officials approved of these gatherings – unlike protests against lockdowns – on grounds that racism was a virus even more serious than Covid. Some of these protests got out of hand and became violent and destructive.

Meanwhile, substance abuse rage – the liquor and weed stores never closed – and immune systems were being degraded by lack of normal exposure, exactly as the Bakersfield doctors had predicted. Millions of small businesses had closed. The learning losses from school closures were mounting, as it turned out that Zoom school was near worthless.

It was about this time that Trump seemed to figure out – thanks to the wise council of Dr. Scott Atlas – that he had been played and started urging states to reopen. But it was strange: he seemed to be less in the position of being a president in charge and more of a public pundit, Tweeting out his wishes until his account was banned. He was unable to put the worms back in the can that he had approved opening.

By that time, and by all accounts, Trump was convinced that the whole effort was a mistake, that he had been trolled into wrecking the country he promised to make great. It was too late. Mail-in ballots had been widely approved, the country was in shambles, the media and public health bureaucrats were ruling the airwaves, and his final months of the campaign failed even to come to grips with the reality on the ground.

At the time, many people had predicted that once Biden took office and the vaccine was released, Covid would be declared to have been beaten. But that didn’t happen and mainly for one reason: resistance to the vaccine was more intense than anyone had predicted. The Biden administration attempted to impose mandates on the entire US workforce. Thanks to a Supreme Court ruling, that effort was thwarted but not before HR departments around the country had already implemented them.

As the months rolled on – and four major cities closed all public accommodations to the unvaccinated, who were being demonized for prolonging the pandemic – it became clear that the vaccine could not and would not stop infection or transmission, which means that this shot could not be classified as a public health benefit. Even as a private benefit, the evidence was mixed. Any protection it provided was short-lived and reports of vaccine injury began to mount. Even now, we cannot gain full clarity on the scale of the problem because essential data and documentation remains classified.

After four years, we find ourselves in a strange position. We still do not know precisely what unfolded in mid-March 2020: who made what decisions, when, and why. There has been no serious attempt at any high level to provide a clear accounting much less assign blame.

Not even Tucker Carlson, who reportedly played a crucial role in getting Trump to panic over the virus, will tell us the source of his own information or what his source told him. There have been a series of valuable hearings in the House and Senate but they have received little to no press attention, and none have focus on the lockdown orders themselves.

The prevailing attitude in public life is just to forget the whole thing. And yet we live now in a country very different from the one we inhabited five years ago. Our media is captured. Social media is widely censored in violation of the First Amendment, a problem being taken up by the Supreme Court this month with no certainty of the outcome. The administrative state that seized control has not given up power. Crime has been normalized. Art and music institutions are on the rocks. Public trust in all official institutions is at rock bottom. We don’t even know if we can trust the elections anymore.

In the early days of lockdown, Henry Kissinger warned that if the mitigation plan does not go well, the world will find itself set “on fire.” He died in 2023. Meanwhile, the world is indeed on fire. The essential struggle in every country on earth today concerns the battle between the authority and power of permanent administration apparatus of the state – the very one that took total control in lockdowns – and the enlightenment ideal of a government that is responsible to the will of the people and the moral demand for freedom and rights.

How this struggle turns out is the essential story of our times.

CODA: I’m embedding a copy of PanCAP Adapted, as annotated by Debbie Lerman. You might need to download the whole thing to see the annotations. If you can help with research, please do.

* * *

Jeffrey Tucker is the author of the excellent new book 'Life After Lock-Down'

Government

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A U.S. Centers for Disease Control (CDC) paper released Thursday found that thousands of young children have been taken to the emergency room over the past several years after taking the very common sleep-aid supplement melatonin.

The agency said that melatonin, which can come in gummies that are meant for adults, was implicated in about 7 percent of all emergency room visits for young children and infants “for unsupervised medication ingestions,” adding that many incidents were linked to the ingestion of gummy formulations that were flavored. Those incidents occurred between the years 2019 and 2022.

Melatonin is a hormone produced by the human body to regulate its sleep cycle. Supplements, which are sold in a number of different formulas, are generally taken before falling asleep and are popular among people suffering from insomnia, jet lag, chronic pain, or other problems.

The supplement isn’t regulated by the U.S. Food and Drug Administration and does not require child-resistant packaging. However, a number of supplement companies include caps or lids that are difficult for children to open.

The CDC report said that a significant number of melatonin-ingestion cases among young children were due to the children opening bottles that had not been properly closed or were within their reach. Thursday’s report, the agency said, “highlights the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight,” including melatonin.

The approximately 11,000 emergency department visits for unsupervised melatonin ingestions by infants and young children during 2019–2022 highlight the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight.

The CDC notes that melatonin use among Americans has increased five-fold over the past 25 years or so. That has coincided with a 530 percent increase in poison center calls for melatonin exposures to children between 2012 and 2021, it said, as well as a 420 percent increase in emergency visits for unsupervised melatonin ingestion by young children or infants between 2009 and 2020.

Some health officials advise that children under the age of 3 should avoid taking melatonin unless a doctor says otherwise. Side effects include drowsiness, headaches, agitation, dizziness, and bed wetting.

Other symptoms of too much melatonin include nausea, diarrhea, joint pain, anxiety, and irritability. The supplement can also impact blood pressure.

However, there is no established threshold for a melatonin overdose, officials have said. Most adult melatonin supplements contain a maximum of 10 milligrams of melatonin per serving, and some contain less.

Many people can tolerate even relatively large doses of melatonin without significant harm, officials say. But there is no antidote for an overdose. In cases of a child accidentally ingesting melatonin, doctors often ask a reliable adult to monitor them at home.

Dr. Cora Collette Breuner, with the Seattle Children’s Hospital at the University of Washington, told CNN that parents should speak with a doctor before giving their children the supplement.

“I also tell families, this is not something your child should take forever. Nobody knows what the long-term effects of taking this is on your child’s growth and development,” she told the outlet. “Taking away blue-light-emitting smartphones, tablets, laptops, and television at least two hours before bed will keep melatonin production humming along, as will reading or listening to bedtime stories in a softly lit room, taking a warm bath, or doing light stretches.”

In 2022, researchers found that in 2021, U.S. poison control centers received more than 52,000 calls about children consuming worrisome amounts of the dietary supplement. That’s a six-fold increase from about a decade earlier. Most such calls are about young children who accidentally got into bottles of melatonin, some of which come in the form of gummies for kids, the report said.

Dr. Karima Lelak, an emergency physician at Children’s Hospital of Michigan and the lead author of the study published in 2022 by the CDC, found that in about 83 percent of those calls, the children did not show any symptoms.

However, other children had vomiting, altered breathing, or other symptoms. Over the 10 years studied, more than 4,000 children were hospitalized, five were put on machines to help them breathe, and two children under the age of two died. Most of the hospitalized children were teenagers, and many of those ingestions were thought to be suicide attempts.

Those researchers also suggested that COVID-19 lockdowns and virtual learning forced more children to be at home all day, meaning there were more opportunities for kids to access melatonin. Also, those restrictions may have caused sleep-disrupting stress and anxiety, leading more families to consider melatonin, they suggested.

The Associated Press contributed to this report.

International

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

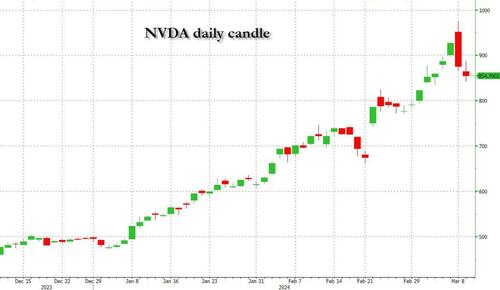

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International4 days ago

International4 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges