RH Stock Analysis: A Buffett-Owned Stock That Has To Go Up?

RH Stock Analysis: A Buffett-Owned Stock That Has To Go Up?

Restoration Hardware Holdings, Inc (NYSE:RH) stock analysis. RH is a stock owned by Warren Buffett so it is a very interesting research prospect. The business model is very interesting and offers scaling opportunities that leads to revenue growth and improving margins.

Q1 2020 hedge fund letters, conferences and more

RH Stock Analysis: A Stock That Must Go UP!

Transcript

Now if you're in the investor at your home, please don't tell anybody in your house about this investment research. Because if you're share with your spouse who is usually the designer in the house like I did, I showed this to my wife and she said, wow, what a beautiful piece of furniture. So I'll probably end up buying pieces of furnitures. Furniture for free thousand dollars, become a member have to redo the whole house. And I will forget about my retirement savings. I will forget about everything I will have to work forever, not even till the end, forever to pay for all these overpriced furniture. So lock yourself somewhere where nobody will see what you're doing and enjoy this analysis.

Good day fellow investors. Welcome to RH (Restoration Hardware) stock analysis. It is a warren buffett owned stock, Berkshire owned stock. So it has a very interesting business model and I really want to discuss the company. And apart from from selling overpriced, sorry, upscale furniture, it has a really interesting business model. So it might be a great investment. And then it has really luxurious financial engineering, which will be a great learning lesson to see how financial analysis is done and the risk reward of investing and pushing the stock price higher.

It's a very interesting stock. And that's why I wanted to make the video. And also the learning outcomes. It's actually a positive investment situation. For those that want to buy such a stock. Then we're going to discuss buybacks and financial engineering, how they can work really well until they don't, but if you sell sooner, then you don't care when they don't. And then stock price versus business value versus real business value creation.

Let's start. So RH Stock, the stock was $32 in 2012, then it went up to 100 down again to $26 2016-17. And then it's spiked. 10 times almost almost $250 just before this crisis and then it went down to 90 when I started researching and we are already at 123.

Very interesting, it's upscale, overpriced furniture, how you want to call it, it has an Ikea business model. It's well managed over the past years, inventory levels went down and, and the management took 400 millions of cash from the inventory levels. However, there is extreme financial engineering using convertible debt and doing a lot of buybacks. And then on top of everything to sweeten the analysis, the CEO sold 150 million of shares just in December 2019 to buy his nice beautiful mansions in the United States.

Now, the business model, it's a very interesting business. So I love IKEA, the business model, I see how it attracts people. People love to buy stuff there and then also eat something probably shitty food but free food, all for $1 breakfast you don't want to find yourself in a Dutch IKEA on a Saturday or Sunday morning because everybody's crazy about those unhealthy breakfast. So [unintelligible] before being there, but try to avoid that.

Now on the business analysis, it's an Ikea model. So they you can socialise their drink your coffee, eat something really enjoy. And you can buy whatever you find there. You sit there, it's, let's say, an upscale entertainment environment that can sell your things then you can become a member and come back for more.

It's a great business model because it's casual. It's luxury, socialising and you buy what you like, and it still has revenues of 2.6 billion, so it's still scalable globally, if the business model that has been proven that it works over the last years continues to expand globally. However, it's also active tremely cyclical demand for overpriced furnishing products depends on discretionary purchasing power, real estate activity and that's the general situation in the economy.

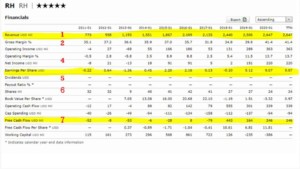

Thus, it makes no money in bad times has to survive but a lot more a lot of money in good times. And if we look at the revenue really exploded over the last 10 years from 700 million to 2.6 billion, so there is growth, line number one, line number two margins are expanding 40%-41% gross margins. That's why you're buying overpriced furniture but it's the experience right?

Nevertheless, great gross margin, leading to high operating incomes, good operating margins, and net income of 220 million in the last 12 months and earnings per share went from negative to $9 per share. Dividends not being paid, but the company line six is doing huge buybacks and the number of shares since they started the buyback went down from 41 million to 19 million, the current non diluted, 24 million is the diluted due to the convertible shares. They have an anti diluting thing, but we'll discuss that later in the financial engineering analysis. Then line seven the free cash flow, this company has $246 million of free cash flow when compared to the market capitalization it gives you a double digit free cash flow yield. So, good business.

However, there is practically no RH stock holder equity or it is 18 million or 19 million shares outstanding. So, the book value is practically $1 per share for a share that you are paying more than $100 for the liabilities total liabilities are 99% of assets. Now, why there is so much liability because of financial engineering and extreme buybacks in 2017 the company decided, okay, how can we take advantage of the low stock price?

Because analysts were uncertain about their new business model of doing this big retail operations. When everybody's going away from retail, they decided to go the opposite way, as you have seen in the video built beautiful retail stores, and it actually worked. Plus they started with humongous buybacks, that pushed the stock price up 9 times over just two and a half years.

When you look at the repurchases of RH common stock, they paid $1 billion in 2017, 250 million in 2018. And another 250 million in 2019. So they spent $1.5 billion on buybacks and the market cap a week ago was $1.6 billion. The issue is that the cumulative earnings over the last four years were just 353 million. And they spent 1.5 billion on buybacks. That is remarkable financial engineering. How did they do it?

They issued that they issued convertible notes, 685 million of convertible notes, they lower their inventory, which is excellent management. So they did something good. It's not just financial engineering. So they got 327 million there. And they made profits of 353 million, as we said. All in all, almost close to 1.5 billion, with a little bit of rebalancing and that's how they did so much buybacks., lower the number of shares outstanding by 50% and push the stock price up 10x.

However, the whole idea is very interesting. They issue convertible bonds so they pay later in shares. And they also paid to hedge the dilution and they issue warrants to hedge the dilution a second time at a higher price. This is complicated. I've written a full analysis report PDF for those that want to read about this interesting financial engineering practice in detail, so you can find that in the link in the description below.

However, just quick overview, so they have issued 2024 convertible bonds and at zero interest rates, so 300 million, it was up to 350 million the potential total offering size. However, on those bonds, they paid a hedge transaction of 91 million so they got 350 million and they paid 91 million to hedge the transaction between the strike price of the bond at 211. And the strike price of the warrants that was around 300 something. No dilution will be until the price of 338 per share. So you get 350 million and you pay 91 million on debt. It's not zero interest, is not zero coupon, but it works if the stock price goes up.

So in this situation, the only goal the management has here is of course, do business as good as possible but push the stock price higher. Why is that? Why do they want to push the stock price higher? Well, don't we all want the stock price to go higher? Yes. But if that is your only goal, it's not creating a sustainable long term business. Then you have to move fast as a shareholder and who is moving fast the CEO he got an option.

To buy a million shares for 50 if the stock reaches $150, or different targets from 100 to 150, and that was created the compensation scheme on May 2, 2017. What happened on May 4, 2017? Well, the company immediately announced 700 million repurchase plan. That's how you push a stock price higher and higher. And then, you see, this is a letter the CEO, written during this crisis.

First, I hope he took the picture before the crisis, not taking the time to make such a picture during the crisis. But then again, he is so confident, secure, happy, blessed during this crisis, so it's really a nice picture. Why is he so confident? Well, if you look at the SEC form for his sold about 150 million of RH shares, in December 2019. Of course, if I would have 115 million in cash of my bank account, in this crisis, I would be very, very happy, relaxed and calm. I wonder if all the other shareholders sold, too.

So the investment proposition is pretty simple. The management will do whatever it takes to push the stock higher, exercise option and sell more and more millions because before the CEO retires, the best for the CEO would be a nice takeover, but he was waiting to still get the two-free years of options he has to get and then sell everything.

The fact is that the stock price doesn't really matter for a buyer for a takeover. So it's the same for the buyer. If buying a company with 40 million shares at 100 or 20 million shares at 200. Doesn't mean much for the buyer, it means for those that are willing to sell those shares If you're a shareholder, you can buy this and then sell as stocks go up because this is about playing the buyback game. And you have to see how that fits you it is luxury financial engineering.

And the risk is there to a year of no profits and no cash flows due to recession, there is no book value, there is no protection, creditors might want to own what is a good cyclical, scalable business. So creditors might want to dilute the current shareholders fast, the convertible bonds, convert them into many as many stocks as possible, and then play the buyback game again. So that is the risk depending on how long this situation lasts. And that can backfire. But of course, if you sold 150 million of stocks in December, then nothing can backfire anymore.

My personal take on RH Stock is at 1.5 billion in market cap with 200 million in growing cash flows in the good environment, it looks like a good business a good deal plus the scalability. But I'm looking for great businesses that focus on the business, not on financial engineering, I feel the financial engineering increases the risk. So you have to see how that fits you. I don't like really investments where I have to move fast take advantage of the trend.

But I still think in this current environment, it's sooner that the stock will go to 250, then 250 because if they can get another convertible loan on the small float, on the higher high short situation, they can push this very quickly to 250. The CEO can get his rewards, and then sell it to someone in a year or two for 300 per share on no increase in market capitalization.

If you enjoyed this analysis, stock analysis is what I do so check my stock market research platform, in the link in the description below, or on my website. Subscribe for more stock analysis and interesting stock market discussions. Thank you and I'll see you in the next video.

The post RH Stock Analysis: A Buffett-Owned Stock That Has To Go Up? appeared first on ValueWalk.

International

Acadia’s Nuplazid fails PhIII study due to higher-than-expected placebo effect

After years of trying to expand the market territory for Nuplazid, Acadia Pharmaceuticals might have hit a dead end, with a Phase III fail in schizophrenia…

After years of trying to expand the market territory for Nuplazid, Acadia Pharmaceuticals might have hit a dead end, with a Phase III fail in schizophrenia due to the placebo arm performing better than expected.

Steve Davis

Steve Davis“We will continue to analyze these data with our scientific advisors, but we do not intend to conduct any further clinical trials with pimavanserin,” CEO Steve Davis said in a Monday press release. Acadia’s stock $ACAD dropped by 17.41% before the market opened Tuesday.

Pimavanserin, a serotonin inverse agonist and also a 5-HT2A receptor antagonist, is already in the market with the brand name Nuplazid for Parkinson’s disease psychosis. Efforts to expand into other indications such as Alzheimer’s-related psychosis and major depression have been unsuccessful, and previous trials in schizophrenia have yielded mixed data at best. Its February presentation does not list other pimavanserin studies in progress.

The Phase III ADVANCE-2 trial investigated 34 mg pimavanserin versus placebo in 454 patients who have negative symptoms of schizophrenia. The study used the negative symptom assessment-16 (NSA-16) total score as a primary endpoint and followed participants up to week 26. Study participants have control of positive symptoms due to antipsychotic therapies.

The company said that the change from baseline in this measure for the treatment arm was similar between the Phase II ADVANCE-1 study and ADVANCE-2 at -11.6 and -11.8, respectively. However, the placebo was higher in ADVANCE-2 at -11.1, when this was -8.5 in ADVANCE-1. The p-value in ADVANCE-2 was 0.4825.

In July last year, another Phase III schizophrenia trial — by Sumitomo and Otsuka — also reported negative results due to what the company noted as Covid-19 induced placebo effect.

According to Mizuho Securities analysts, ADVANCE-2 data were disappointing considering the company applied what it learned from ADVANCE-1, such as recruiting patients outside the US to alleviate a high placebo effect. The Phase III recruited participants in Argentina and Europe.

Analysts at Cowen added that the placebo effect has been a “notorious headwind” in US-based trials, which appears to “now extend” to ex-US studies. But they also noted ADVANCE-1 reported a “modest effect” from the drug anyway.

Nonetheless, pimavanserin’s safety profile in the late-stage study “was consistent with previous clinical trials,” with the drug having an adverse event rate of 30.4% versus 40.3% with placebo, the company said. Back in 2018, even with the FDA approval for Parkinson’s psychosis, there was an intense spotlight on Nuplazid’s safety profile.

Acadia previously aimed to get Nuplazid approved for Alzheimer’s-related psychosis but had many hurdles. The drug faced an adcomm in June 2022 that voted 9-3 noting that the drug is unlikely to be effective in this setting, culminating in a CRL a few months later.

As for the company’s next R&D milestones, Mizuho analysts said it won’t be anytime soon: There is the Phase III study for ACP-101 in Prader-Willi syndrome with data expected late next year and a Phase II trial for ACP-204 in Alzheimer’s disease psychosis with results anticipated in 2026.

Acadia collected $549.2 million in full-year 2023 revenues for Nuplazid, with $143.9 million in the fourth quarter.

depression covid-19 treatment fda clinical trials europeUncategorized

Digital Currency And Gold As Speculative Warnings

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution…

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites.

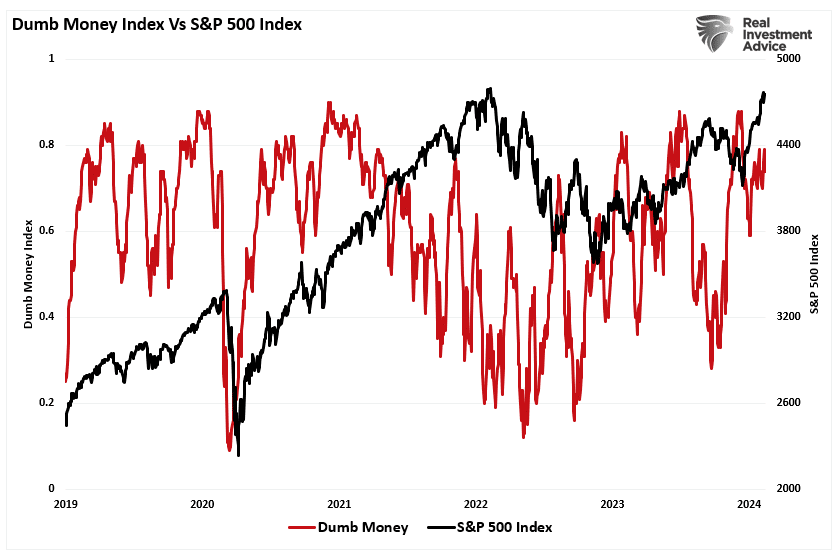

“Such is unsurprising, given that retail investors often fall victim to the psychological behavior of the “fear of missing out.” The chart below shows the “dumb money index” versus the S&P 500. Once again, retail investors are very long equities relative to the institutional players ascribed to being the “smart money.””

“The difference between “smart” and “dumb money” investors shows that, more often than not, the “dumb money” invests near market tops and sells near market bottoms.”

That enthusiasm has increased sharply since last November as stocks surged in hopes that the Federal Reserve would cut interest rates. As noted by Sentiment Trader:

“Over the past 18 weeks, the straight-up rally has moved us to an interesting juncture in the Sentiment Cycle. For the past few weeks, the S&P 500 has demonstrated a high positive correlation to the ‘Enthusiasm’ part of the cycle and a highly negative correlation to the ‘Panic’ phase.”

That frenzy to chase the markets, driven by the psychological bias of the “fear of missing out,” has permeated the entirety of the market. As noted in “This Is Nuts:”

“Since then, the entire market has surged higher following last week’s earnings report from Nvidia (NVDA). The reason I say “this is nuts” is the assumption that all companies were going to grow earnings and revenue at Nvidia’s rate. There is little doubt about Nvidia’s earnings and revenue growth rates. However, to maintain that growth pace indefinitely, particularly at 32x price-to-sales, means others like AMD and Intel must lose market share.”

Of course, it is not just a speculative frenzy in the markets for stocks, specifically anything related to “artificial intelligence,” but that exuberance has spilled over into gold and cryptocurrencies.

Birds Of A Feather

There are a couple of ways to measure exuberance in the assets. While sentiment measures examine the broad market, technical indicators can reflect exuberance on individual asset levels. However, before we get to our charts, we need a brief explanation of statistics, specifically, standard deviation.

As I discussed in “Revisiting Bob Farrell’s 10 Investing Rules”:

“Like a rubber band that has been stretched too far – it must be relaxed in order to be stretched again. This is exactly the same for stock prices that are anchored to their moving averages. Trends that get overextended in one direction, or another, always return to their long-term average. Even during a strong uptrend or strong downtrend, prices often move back (revert) to a long-term moving average.”

The idea of “stretching the rubber band” can be measured in several ways, but I will limit our discussion this week to Standard Deviation and measuring deviation with “Bollinger Bands.”

“Standard Deviation” is defined as:

“A measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is calculated as the square root of the variance.”

In plain English, this means that the further away from the average that an event occurs, the more unlikely it becomes. As shown below, out of 1000 occurrences, only three will fall outside the area of 3 standard deviations. 95.4% of the time, events will occur within two standard deviations.

A second measure of “exuberance” is “relative strength.”

“In technical analysis, the relative strength index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. The RSI is displayed as an oscillator (a line graph that moves between two extremes) and can read from 0 to 100.

Traditional interpretation and usage of the RSI are that values of 70 or above indicate that a security is becoming overbought or overvalued and may be primed for a trend reversal or corrective pullback in price. An RSI reading of 30 or below indicates an oversold or undervalued condition.” – Investopedia

With those two measures, let’s look at Nvidia (NVDA), the poster child of speculative momentum trading in the markets. Nvidia trades more than 3 standard deviations above its moving average, and its RSI is 81. The last time this occurred was in July of 2023 when Nvidia consolidated and corrected prices through November.

Interestingly, gold also trades well into 3 standard deviation territory with an RSI reading of 75. Given that gold is supposed to be a “safe haven” or “risk off” asset, it is instead getting swept up in the current market exuberance.

The same is seen with digital currencies. Given the recent approval of spot, Bitcoin exchange-traded funds (ETFs), the panic bid to buy Bitcoin has pushed the price well into 3 standard deviation territory with an RSI of 73.

In other words, the stock market frenzy to “buy anything that is going up” has spread from just a handful of stocks related to artificial intelligence to gold and digital currencies.

It’s All Relative

We can see the correlation between stock market exuberance and gold and digital currency, which has risen since 2015 but accelerated following the post-pandemic, stimulus-fueled market frenzy. Since the market, gold and cryptocurrencies, or Bitcoin for our purposes, have disparate prices, we have rebased the performance to 100 in 2015.

Gold was supposed to be an inflation hedge. Yet, in 2022, gold prices fell as the market declined and inflation surged to 9%. However, as inflation has fallen and the stock market surged, so has gold. Notably, since 2015, gold and the market have moved in a more correlated pattern, which has reduced the hedging effect of gold in portfolios. In other words, during the subsequent market decline, gold will likely track stocks lower, failing to provide its “wealth preservation” status for investors.

The same goes for cryptocurrencies. Bitcoin is substantially more volatile than gold and tends to ebb and flow with the overall market. As sentiment surges in the S&P 500, Bitcoin and other cryptocurrencies follow suit as speculative appetites increase. Unfortunately, for individuals once again piling into Bitcoin to chase rising prices, if, or when, the market corrects, the decline in cryptocurrencies will likely substantially outpace the decline in market-based equities. This is particularly the case as Wall Street can now short the spot-Bitcoin ETFs, creating additional selling pressure on Bitcoin.

Just for added measure, here is Bitcoin versus gold.

Not A Recommendation

There are many narratives surrounding the markets, digital currency, and gold. However, in today’s market, more than in previous years, all assets are getting swept up into the investor-feeding frenzy.

Sure, this time could be different. I am only making an observation and not an investment recommendation.

However, from a portfolio management perspective, it will likely pay to remain attentive to the correlated risk between asset classes. If some event causes a reversal in bullish exuberance, cash and bonds may be the only place to hide.

The post Digital Currency And Gold As Speculative Warnings appeared first on RIA.

bonds pandemic sp 500 equities stocks bitcoin currencies goldInternational

Four Years Ago This Week, Freedom Was Torched

Four Years Ago This Week, Freedom Was Torched

Authored by Jeffrey Tucker via The Brownstone Institute,

"Beware the Ides of March,” Shakespeare…

Authored by Jeffrey Tucker via The Brownstone Institute,

"Beware the Ides of March,” Shakespeare quotes the soothsayer’s warning Julius Caesar about what turned out to be an impending assassination on March 15. The death of American liberty happened around the same time four years ago, when the orders went out from all levels of government to close all indoor and outdoor venues where people gather.

It was not quite a law and it was never voted on by anyone. Seemingly out of nowhere, people who the public had largely ignored, the public health bureaucrats, all united to tell the executives in charge – mayors, governors, and the president – that the only way to deal with a respiratory virus was to scrap freedom and the Bill of Rights.

And they did, not only in the US but all over the world.

The forced closures in the US began on March 6 when the mayor of Austin, Texas, announced the shutdown of the technology and arts festival South by Southwest. Hundreds of thousands of contracts, of attendees and vendors, were instantly scrapped. The mayor said he was acting on the advice of his health experts and they in turn pointed to the CDC, which in turn pointed to the World Health Organization, which in turn pointed to member states and so on.

There was no record of Covid in Austin, Texas, that day but they were sure they were doing their part to stop the spread. It was the first deployment of the “Zero Covid” strategy that became, for a time, official US policy, just as in China.

It was never clear precisely who to blame or who would take responsibility, legal or otherwise.

This Friday evening press conference in Austin was just the beginning. By the next Thursday evening, the lockdown mania reached a full crescendo. Donald Trump went on nationwide television to announce that everything was under control but that he was stopping all travel in and out of US borders, from Europe, the UK, Australia, and New Zealand. American citizens would need to return by Monday or be stuck.

Americans abroad panicked while spending on tickets home and crowded into international airports with waits up to 8 hours standing shoulder to shoulder. It was the first clear sign: there would be no consistency in the deployment of these edicts.

There is no historical record of any American president ever issuing global travel restrictions like this without a declaration of war. Until then, and since the age of travel began, every American had taken it for granted that he could buy a ticket and board a plane. That was no longer possible. Very quickly it became even difficult to travel state to state, as most states eventually implemented a two-week quarantine rule.

The next day, Friday March 13, Broadway closed and New York City began to empty out as any residents who could went to summer homes or out of state.

On that day, the Trump administration declared the national emergency by invoking the Stafford Act which triggers new powers and resources to the Federal Emergency Management Administration.

In addition, the Department of Health and Human Services issued a classified document, only to be released to the public months later. The document initiated the lockdowns. It still does not exist on any government website.

The White House Coronavirus Response Task Force, led by the Vice President, will coordinate a whole-of-government approach, including governors, state and local officials, and members of Congress, to develop the best options for the safety, well-being, and health of the American people. HHS is the LFA [Lead Federal Agency] for coordinating the federal response to COVID-19.

Closures were guaranteed:

Recommend significantly limiting public gatherings and cancellation of almost all sporting events, performances, and public and private meetings that cannot be convened by phone. Consider school closures. Issue widespread ‘stay at home’ directives for public and private organizations, with nearly 100% telework for some, although critical public services and infrastructure may need to retain skeleton crews. Law enforcement could shift to focus more on crime prevention, as routine monitoring of storefronts could be important.

In this vision of turnkey totalitarian control of society, the vaccine was pre-approved: “Partner with pharmaceutical industry to produce anti-virals and vaccine.”

The National Security Council was put in charge of policy making. The CDC was just the marketing operation. That’s why it felt like martial law. Without using those words, that’s what was being declared. It even urged information management, with censorship strongly implied.

The timing here is fascinating. This document came out on a Friday. But according to every autobiographical account – from Mike Pence and Scott Gottlieb to Deborah Birx and Jared Kushner – the gathered team did not meet with Trump himself until the weekend of the 14th and 15th, Saturday and Sunday.

According to their account, this was his first real encounter with the urge that he lock down the whole country. He reluctantly agreed to 15 days to flatten the curve. He announced this on Monday the 16th with the famous line: “All public and private venues where people gather should be closed.”

This makes no sense. The decision had already been made and all enabling documents were already in circulation.

There are only two possibilities.

One: the Department of Homeland Security issued this March 13 HHS document without Trump’s knowledge or authority. That seems unlikely.

Two: Kushner, Birx, Pence, and Gottlieb are lying. They decided on a story and they are sticking to it.

Trump himself has never explained the timeline or precisely when he decided to greenlight the lockdowns. To this day, he avoids the issue beyond his constant claim that he doesn’t get enough credit for his handling of the pandemic.

With Nixon, the famous question was always what did he know and when did he know it? When it comes to Trump and insofar as concerns Covid lockdowns – unlike the fake allegations of collusion with Russia – we have no investigations. To this day, no one in the corporate media seems even slightly interested in why, how, or when human rights got abolished by bureaucratic edict.

As part of the lockdowns, the Cybersecurity and Infrastructure Security Agency, which was and is part of the Department of Homeland Security, as set up in 2018, broke the entire American labor force into essential and nonessential.

They also set up and enforced censorship protocols, which is why it seemed like so few objected. In addition, CISA was tasked with overseeing mail-in ballots.

Only 8 days into the 15, Trump announced that he wanted to open the country by Easter, which was on April 12. His announcement on March 24 was treated as outrageous and irresponsible by the national press but keep in mind: Easter would already take us beyond the initial two-week lockdown. What seemed to be an opening was an extension of closing.

This announcement by Trump encouraged Birx and Fauci to ask for an additional 30 days of lockdown, which Trump granted. Even on April 23, Trump told Georgia and Florida, which had made noises about reopening, that “It’s too soon.” He publicly fought with the governor of Georgia, who was first to open his state.

Before the 15 days was over, Congress passed and the president signed the 880-page CARES Act, which authorized the distribution of $2 trillion to states, businesses, and individuals, thus guaranteeing that lockdowns would continue for the duration.

There was never a stated exit plan beyond Birx’s public statements that she wanted zero cases of Covid in the country. That was never going to happen. It is very likely that the virus had already been circulating in the US and Canada from October 2019. A famous seroprevalence study by Jay Bhattacharya came out in May 2020 discerning that infections and immunity were already widespread in the California county they examined.

What that implied was two crucial points: there was zero hope for the Zero Covid mission and this pandemic would end as they all did, through endemicity via exposure, not from a vaccine as such. That was certainly not the message that was being broadcast from Washington. The growing sense at the time was that we all had to sit tight and just wait for the inoculation on which pharmaceutical companies were working.

By summer 2020, you recall what happened. A restless generation of kids fed up with this stay-at-home nonsense seized on the opportunity to protest racial injustice in the killing of George Floyd. Public health officials approved of these gatherings – unlike protests against lockdowns – on grounds that racism was a virus even more serious than Covid. Some of these protests got out of hand and became violent and destructive.

Meanwhile, substance abuse rage – the liquor and weed stores never closed – and immune systems were being degraded by lack of normal exposure, exactly as the Bakersfield doctors had predicted. Millions of small businesses had closed. The learning losses from school closures were mounting, as it turned out that Zoom school was near worthless.

It was about this time that Trump seemed to figure out – thanks to the wise council of Dr. Scott Atlas – that he had been played and started urging states to reopen. But it was strange: he seemed to be less in the position of being a president in charge and more of a public pundit, Tweeting out his wishes until his account was banned. He was unable to put the worms back in the can that he had approved opening.

By that time, and by all accounts, Trump was convinced that the whole effort was a mistake, that he had been trolled into wrecking the country he promised to make great. It was too late. Mail-in ballots had been widely approved, the country was in shambles, the media and public health bureaucrats were ruling the airwaves, and his final months of the campaign failed even to come to grips with the reality on the ground.

At the time, many people had predicted that once Biden took office and the vaccine was released, Covid would be declared to have been beaten. But that didn’t happen and mainly for one reason: resistance to the vaccine was more intense than anyone had predicted. The Biden administration attempted to impose mandates on the entire US workforce. Thanks to a Supreme Court ruling, that effort was thwarted but not before HR departments around the country had already implemented them.

As the months rolled on – and four major cities closed all public accommodations to the unvaccinated, who were being demonized for prolonging the pandemic – it became clear that the vaccine could not and would not stop infection or transmission, which means that this shot could not be classified as a public health benefit. Even as a private benefit, the evidence was mixed. Any protection it provided was short-lived and reports of vaccine injury began to mount. Even now, we cannot gain full clarity on the scale of the problem because essential data and documentation remains classified.

After four years, we find ourselves in a strange position. We still do not know precisely what unfolded in mid-March 2020: who made what decisions, when, and why. There has been no serious attempt at any high level to provide a clear accounting much less assign blame.

Not even Tucker Carlson, who reportedly played a crucial role in getting Trump to panic over the virus, will tell us the source of his own information or what his source told him. There have been a series of valuable hearings in the House and Senate but they have received little to no press attention, and none have focus on the lockdown orders themselves.

The prevailing attitude in public life is just to forget the whole thing. And yet we live now in a country very different from the one we inhabited five years ago. Our media is captured. Social media is widely censored in violation of the First Amendment, a problem being taken up by the Supreme Court this month with no certainty of the outcome. The administrative state that seized control has not given up power. Crime has been normalized. Art and music institutions are on the rocks. Public trust in all official institutions is at rock bottom. We don’t even know if we can trust the elections anymore.

In the early days of lockdown, Henry Kissinger warned that if the mitigation plan does not go well, the world will find itself set “on fire.” He died in 2023. Meanwhile, the world is indeed on fire. The essential struggle in every country on earth today concerns the battle between the authority and power of permanent administration apparatus of the state – the very one that took total control in lockdowns – and the enlightenment ideal of a government that is responsible to the will of the people and the moral demand for freedom and rights.

How this struggle turns out is the essential story of our times.

CODA: I’m embedding a copy of PanCAP Adapted, as annotated by Debbie Lerman. You might need to download the whole thing to see the annotations. If you can help with research, please do.

* * *

Jeffrey Tucker is the author of the excellent new book 'Life After Lock-Down'

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International4 days ago

International4 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges