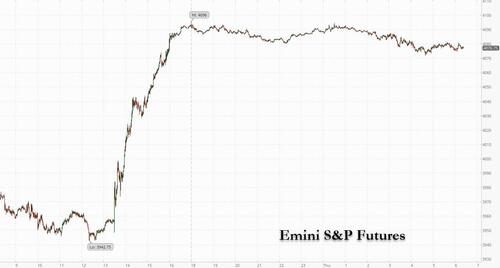

Global stocks climbed and the dollar slipped to a three-month low this morning amid early signs of a softer stance on Covid restrictions from China and after Federal Reserve Chair Jerome Powell confirmed that the pace of interest rate hikes was set to slow. S&P futures were little changed, pausing a rally that added $1.1 trillion to the market value of S&P 500 companies. Nasdaq contracts dropped 0.2% following sharp gains in the previous session.

Markets elsewhere continued to ride high, with Europe’s Stoxx 600 benchmark up more than 0.5% and a range of regional indexes on the cusp of bull-market territory, having gained almost 20% from lows hit in September. A gauge of global shares touched a three-month high. Sentiment got an extra boost after China’s top official in charge of the fight against the coronavirus, Vice Premier Sun Chunlan, said the response was entering a new phase, with the omicron variant weakening and more Chinese getting vaccinated. Beijing also indicated some Covid patients could isolate at home.

The benchmark US index surged to its highest in more than 11 weeks Wednesday, while the Dow confirmed a technical bull market, as Fed Chair Jerome Powell signaled the central bank will slow the pace of interest-rate increases this month. His comments likely cement expectations for the Fed to raise interest rates by 50 basis points when they meet Dec. 13-14, following four straight 75 basis-point moves. The S&P 500 closed above its 200-day moving average for the first time since April on Wednesday.

Still, Powell also stressed that borrowing costs will need to keep rising and remain restrictive for some time to beat inflation, and market strategists warned that uncertainty remains high about the impact of a dovish tilt in policy on inflation and economic growth.

“Stepping back, Powell again reiterated that inflation is too high, flagged the likelihood of higher-for-longer funds rate and warned again against risk of prematurely loosening policy,” said Mark Taylor, a sales trader at Mirabaud Securities. “Slowdown = further tightening, but that isn’t the seasonal concern heading into the final three trading weeks of the year.”

In premarket trading, Salesforce Inc. dropped, after the software company gave an outlook that analysts say reflects a weaker economic environment. Snowflake Inc. also slid on weaker-than-expected revenue outlook. Meanwhile, US-listed Chinese stocks pulled back after their record monthly rally in November. Here are some of the biggest premarket movers this morning:

- US-listed Chinese stocks decline in premarket trading Thursday, after the Nasdaq Golden Dragon China Index gained 42% in November, its best month on record. Alibaba -2.6%, Baidu -0.5%.

- Splunk shares jumped as much as 9.4% in US premarket trading after the software company boosted its revenue guidance for the full year, with analysts positive that demand is holding up despite the macroeconomic backdrop. Brokers did note that Splunk tempered its outlook for cloud revenue, showing that customers could be delaying cloud migration

- Salesforce Inc. shares are down 6.4% in premarket trading, after the software company gave an outlook that analysts say reflects a weaker economic environment. Analysts were also surprised by the exit of co-CEO Bret Taylor, as he became the latest potential successor to leave the company.

- G-III Apparel shares sank as much as 27% in US premarket trading, with the DKNY brand owner set for its worst day since March 2020 after cutting guidance for the full year and saying that its licensing agreements with Calvin Klein and Tommy Hilfiger brands, owned by PVH, will expire in the next five years. .

- Okta shares jump 15% in premarket trading, after the software company gave a fourth- quarter forecast that was stronger than expected. Analysts noted that the results were much better than feared with the company executing sales more effectively, even against a tougher macro backdrop.

- Snowflake slides 6.2% in premarket trading after the software company gave an outlook for product revenue that was weaker than expected. Economic headwinds are pressuring the 4Q outlook, according to analysts, who remain bullish on the company’s longer-term prospects.

- Elastic shares fell 17% in US postmarket trading after the company lowered its revenue forecast for the current fiscal year. The guidance cut and the lack of visibility into FY24 are likely to weigh on investor confidence, analysts said.

- PVH Corp. gained 9.4% in extended trading after the parent company of Calvin Klein and Tommy Hilfiger increased its adjusted earnings per share view for the year. It also expects annual revenue to come in at the top end of its previous guidance range.

- Victoria’s Secret fell in extended trading after issuing an earnings-per-share forecast for the fourth quarter that trailed the average analyst estimate at the midpoint of the range. The retailer also reported a steeper-than-expected decline in third- quarter comparable sales.

Confirming that he has the absolutely worst market timing, literally minutes before one of the biggest market meltups in weeks, JPM's Marko Kolanovic warned turned even more bearish after being ultra bullish all year, and said that the S&P 500 will likely re-test this year’s lows in the first half of 2023, implying a decline of about 12% from current levels against the backdrop of a mild recession and Federal Reserve rate hikes. Finally catching up with most strategists, JPMorgan also now expects a pivot in the Fed’s hawkish policy to fuel a stock recovery in the second half of next year. The bank's target of 4,200 for end-2023 leaves an upside of about 3% from here on; it also means that the S&P will likely close far higher in keeping with JPM's historical error.

The founder of bankrupt cryptocurrency exchange FTX Sam Bankman-Fried denied trying a perpetrate a fraud, while mystery still surrounds missing billions at the firm. More key economic indicators are expected today, with data on consumer spending, unemployment and manufacturing all due this morning.

The buoyant mood knocked the dollar lower against its Group-of-10 counterparts for the third straight day, while Treasury 10-year yields stayed just off two-month lows hit in the wake of Powell’s comments. The yen advanced more than 1% and the euro touched a five-month peak. “There is no one-way bet any more on dollar strength,” said Sarah Hewin, senior economist at Standard Chartered in London. “We had a good signal about a pivot from Powell, so the market has dialed back its expectations on peak rates.”

Focus will now shift to how economic growth will fare in coming quarters. US activity gauges have painted a mixed third-quarter picture, with Wednesday’s daa showing job openings down in October, while Friday’s jobs report is currently forecast to show employers added 200,000 workers to payrolls in November. Later in the day, investors will get to parse the latest US core PCE print -- one of the Fed’s favored inflation gauges.

“The market’s wanting to see whether PCE inflation for November aligns with the soft CPI numbers,” analysts at Mizuho wrote, referring to below-forecast inflation data that kicked off the equity rally in November. There are signs that cooling growth is affecting corporate earnings, especially in the tech sector. Tech shares led losses in US premarket trading, with software maker Salesforce down sharply after an earnings outlook that appeared to reflect a weaker economic environment.

In Europe, the Stoxx 50 rose 0.3% as the prospect of a smaller Fed hike boosts risk appetite. IBEX outperforms, adding 0.8%, CAC 40 is flat but underperforms peers. Real estate, tech and financial services are the strongest-performing sectors. European tech stocks leap in early Thursday trading, following rallies in US peers on Wednesday after Federal Reserve Chair Jerome Powell signaled a slowdown in the pace of interest-rate hikes. Chip stocks surge, with ASML climbing as much as +4.3%, and ASM International +6.5%. Shares in the Swiss lender decline for a 13th straight session, marking their longest run of losses since at least 1989, after JPMorgan cuts earnings estimates and its price target for the Swiss bank following a decline in the wealth unit’s assets under management, and with a material loss expected for 4Q. Here are some other notable European movers:

- Shop Apotheke and Zur Rose gain after Germany’s health minister was reported to have said the country’s digital e-prescriptions program, identified as a major trigger for both firms, should be in place by mid-2023. Shop Apotheke climbs as much as 11% and Zur Rose rises as much as 11%

- Heineken shares rise as much as 3% after confirming its outlook and highlighting higher cost-savings for next year. UBS says Heineken reiterated its commitment to deliver superior growth, well balanced between volume and price mix.

- International Distributions Services gains as much as 5.6% after Exane starts coverage at outperform, writing in note that the Royal Mail owner has levers available to ease concerns over the long term.

- Credit Suisse shares drop as much as 5.5% after JPMorgan cuts earnings estimates and its price target for the Swiss lender following a decline in the wealth unit’s assets under management, and with a material loss expected for 4Q. Shares in the Swiss lender decline for a 13th straight session, marking their longest run of losses since at least 1989.

- RBC says it would take an “incrementally cautious” view on mining stocks heading into 2023, in a note downgrading its rating on Anglo American and Boliden to sector perform. Anglo falls as much as 2.8%, Boliden as much as 2.2%. Also, Glencore falls as much 1.5%

- Pearson, Thomson Reuters and Wolters Kluwer are cut at Exane as the broker says the elevated valuation multiples don’t reflect the expectations of increasing cost inflation and operating margin pressure in 2023. Pearson falls as much as 4%.

Earlier in the session, equities in Asia extended gains after their best monthly rally in 24 years, as concerns eased over China’s Covid measures and the Federal Reserve’s tightening. After capping a 15% gain November, the MSCI Asia Pacific Index jumped as much as 2.5% Thursday, inching closer toward a bull market. Gauges in China, Japan and Taiwan led gains --although Hong Kong’s measures pared -- as a top Chinese official said efforts to combat the virus are entering a new phase with the omicron variant weakening and vaccination rates rising. Investors may look past China’s near-term economic slump “as long as there are positive signs of China’s reopening,” David Chao, global market strategist for Asia Pacific ex-Japan at Invesco, wrote in a note. Traders will watch whether China’s central bank will ease further in December, he added. Regional equities also got a boost from a weaker dollar, after Fed Chair Jerome Powell said that the pace of rate increases may moderate in December. The comments came as ADP Research Institute data showed hiring at US firms cooled last month and wage gains moderated. Asian stocks have battled back as the shift in the Fed’s policy stance and China’s reopening appeared to materialize and foreign funds piled into emerging markets. The exuberance may be on shaky ground, however, as the outlook for global growth dims into next year

Japanese equities rose, following US peers higher after Fed chair Jerome Powell signaled a slower pace of interest rate hikes. Gains were limited by the yen’s surge against the dollar. The Topix rose by less than a point to close at 1,986.46, while the Nikkei advanced 0.9% to 28,226.08. The Japanese currency advanced more than 1% against the greenback. Out of 2,165 stocks in the index, 714 rose and 1,348 fell, while 103 were unchanged. “Fed Chairman Powell’s remarks were within the market’s expectations, which provided a sense of security,” said Hitoshi Asaoka, strategist at Asset Management One

Australia's he S&P/ASX 200 index rose 1% to close at 7,354.40, the highest since May 5, after China appeared to soften its Covid stance and Federal Reserve Chair Jerome Powell signaled a slowdown in the pace of interest-rate hikes. Nine of the 11 sector gauges advanced, with mining and real estate shares rallying most. In New Zealand, the S&P/NZX 50 index rose 0.9% to close at 11,654.56, extending gains for a third day

In FX, the Bloomberg dollar spot index falls 0.5%. CAD and CHF are the weakest performers in G-10 FX, JPY and NZD outperform. BRL (1.8%), KRW (1.5%) lead gains in EMFX. The Dollar Spot Index fell for a third day as the greenback weakened against all of its Group-of-10 peers apart from the Canadian dollar.

- The euro rose to trade at around $1.0450 after briefly giving up gains in early European session. Money managers are amping up bets the dollar will continue to fall. Investors scurried to European and UK debt, following a similar rush for US Treasuries after Federal Reserve Jerome Powell signaled the pace of monetary policy tightening may slow as soon as this month

- The Swiss franc underperformed most Group- of-10 peers. Switzerland’s consumer prices rose 3% from a year earlier

- Japan’s yen and Korea’s won spearheaded a surge in Asian currencies. The Japanese currency rose by as much as 1.3% to 135.84 per dollar; demand at a 10-year bond auction jumped to the highest since 2005

- Australian and New Zealand dollars extended Powell-driven gains, boosted by the signs that China is moving further away from its Covid-Zero mandate. Bonds rose

In rates, Treasuries twist-flattened modestly, as the 2-year yield rose by 2bps and the 30-year yield well by a similar amount. After plunging on Wednesday, the 10Y TSY yield dipped further, and was last trading just below 3.60%. Peripheral spreads are mixed to Germany; Italy tightens, Spain tightens and Portugal widens.

In commodities, oil rose on Thursday supported by investor wariness that OPEC+ may cut supply further at its meeting on Sunday and as easing COVID curbs in China raised hopes about higher demand in the world's top crude importer. Crude gained further support, and the U.S. dollar weakened, after the Federal Reserve Chair opened the door to a slowdown in the pace of rate hikes. Dollar weakness makes oil cheaper for other currency holders and tends to support risk assets. "Oil is finding support on investor optimism that OPEC+ will deliver further cuts in production when they meet," said Ehsan Khoman, analyst at MUFG Bank, in a report. Brent crude was up 44 cents, or 0.5%, to $87.41 a barrel by 0918 GMT, while U.S. West Texas Intermediate crude futures added 55 cents, or 0.7%, to $81.10.

"Barring any negative surprise during Sunday's virtual OPEC+ talks and assuming a healthy compromise on the Russian oil price cap before the EU sanctions kick in on Monday it is tempting to audaciously conclude that the bottom has been found," said Tamas Varga of oil broker PVM. "Inflation has not been defeated but its negative economic impact has probably been mitigated."

Most base metals trade in the green; LME tin rises 1%, outperforming peers. LME lead lags, dropping 0.8%. Spot gold rises roughly $11 to trade near $1,780/oz. Base metals are firmer across the board following the recent China optimism and Dollar-induced boost, with 3M LME copper briefly topping the USD 8,300/t mark.

Sam Bankman-Fried said the FTX US platform is fully funded and he believes withdrawals could be opened, while he denied committing fraud and said that FTX had huge management failures.

To the day ahead now, and data releases include the global manufacturing PMIs for November, German retail sales for October, the Euro Area unemployment rate for October, the US weekly initial jobless claims, personal income and personal spending for October, and the ISM manufacturing for November. Otherwise, central bank speakers include the Fed’s Logan, Bowman and Barr, as well as the ECB’s Lane.

Market Snapshot

- S&P 500 futures down 0.1% to 4,076.50

- STOXX Europe 600 up 0.6% to 442.83

- MXAP up 1.6% to 158.96

- MXAPJ up 1.3% to 515.72

- Nikkei up 0.9% to 28,226.08

- Topix little changed at 1,986.46

- Hang Seng Index up 0.7% to 18,736.44

- Shanghai Composite up 0.4% to 3,165.47

- Sensex up 0.3% to 63,296.21

- Australia S&P/ASX 200 up 1.0% to 7,354.42

- Kospi up 0.3% to 2,479.84

- German 10Y yield little changed at 1.86%

- Euro up 0.3% to $1.0435

- Brent Futures up 0.5% to $87.42/bbl

- Gold spot up 0.5% to $1,777.38

- U.S. Dollar Index down 0.36% to 105.57

Central bank speakers

- 09:15: NY Fed’s Dianne Dobbeck Speaks at FT Banking Summit

- 09:20: Fed’s Logan Speaks at Dallas Breakfast Event

- 09:30: Fed’s Bowman Speaks at Strategy Forum

- 15:00: Fed’s Barr Discusses Bank Capital

Top Overnight News from Bloomberg

- A rush by Japan’s life insurers to protect themselves against a stronger yen may have the paradoxical effect of accelerating gains in the currency

- The yuan is closing in on a key milestone as hints of a China reopening fuel a burst of buying, but some analysts say the rally may soon pause

- ECB Governing Council member Yannis Stournaras said further hikes in borrowing costs should be gradual, following the most aggressive bout of monetary tightening since the euro was introduced

- UK house prices are falling more sharply than expected after a jump in borrowing costs quelled demand, Nationwide Building Society said. The mortgage lender said home prices fell 1.4% in November. That was the second decline in as many months and the fastest drop since June 2020

- Even one of the strongest easing advocates on the BOJ’s board said that a shift in Japan’s long-held deflationary price norms is beginning to materialize, although he didn’t hint at any policy change soon

- BOJ Board Member Asahi Noguchi says that monetary easing needs to be continued persistently to help improve a labor market that remains below its pre-pandemic level

- Wednesday’s Treasury rally may have been more about month- end positioning, according to market participants

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks took impetus from the strong rally on Wall Street after Fed Chair Powell’s speech which signalled the Fed is ready to slow the pace of rate increases as soon as the December meeting, with sentiment in the region also helped by China reopening optimism and with Chinese Caixin PMI data not as bad as feared. ASX 200 was firmer with outperformance in the mining industry amid the heightened global risk appetite and as participants shrugged off the mixed-to-softer domestic data releases. Nikkei 225 was boosted at the open after Japanese firms' recurring profits hit a record for Q3 although the index moved off its highs after hitting resistance just shy of the 28,500 level. Hang Seng and Shanghai Comp advanced after several large Chinese cities relaxed some COVID controls and Vice Premier Sun Chunlan noted that the country’s fight against the virus is entering a new phase, while the latest Caixin Manufacturing PMI data topped forecasts although remained in contraction territory.

Top Asian News

- Beijing is to allow some low-risk COVID patients to home isolate which represents a major COVID policy shift, while COVID protests and stretched infrastructure were said to have led to the change, according to Bloomberg.

- China is to release supplementary COVID-19 measures in the coming days, via Reuters citing sources; to allow positive cases to quarantine at home with conditions, to allow close contacts of positive cases to quarantine at home with conditions. Step up antigen testing for COVID, reduce the frequency of mass testing and regular PCR tests.

- Chinese Vice Premier says weakening pathogenicity of Omicron has created conditions to improve COVID prevention measures, via State Media.

- Beijing City reports 2,126 new local COVID cases (prev. 2,378) during 15 hours to 3pm on Thursday.

- BoJ Board Member Noguchi said the BoJ must maintain monetary easing and keep interest rates at low levels now as achievement of the 2% inflation target remains uncertain. Noguchi noted that they cannot say that Japan has stably and sustainably achieved the BoJ's 2% inflation target, while he added that consumer inflation is likely to fall back below 2% once cost-push factors dissipate.

European equities benefited at the cash-open from the post-Powell surge in US stocks. Fresh macro drivers for Europe have been lacking thus far and therefore some of the enthusiasm at the cash open has scaled back somewhat. Sectors in Europe are mostly firmer with Tech stocks following suit to the strong showing during US hours yesterday, whilst Real Estate names are also posting solid gains. To the downside, Autos, Consumer Products and Energy names are the only sectors in the red. US futures are flat/softer as markets pause for breath following yesterday’s impressive rally which took the ES to just shy of the 4.1k mark. JPMorgan lowers its 2023 S&P 500 EPS forecast to USD 205 (prev. 225); sees the index at 4,200 by end-2023; expects the S&P 500 to re-test its 2022 lows (at around 3,577) in H1 2023

Top European News

- German Ifo says companies are hiring despite the upcoming winter recession, employment barometer increased to 99.6 for November (prev. 97.8). First increase after five consecutive declines.

- Germany's VDMA says Engineering Orders in Oct -12% Y/Y (Domestic -13%; Foreign -11%); Aug-Oct Orders -4% Y/Y (Domestic -8%; Foreign -2%).

- ECB's Stournaras says inflationary pressures will ease, as such advocates the ECB takes greater account of the risk of an economic crisis in monetary policy, via Handelsblatt.

- ECB's Enria says the new risk environment warrants some adjustments to supervisory approach; supervisors will closely scrutinise capital planning and challenge management actions to ensure an appropriate level of conservatism.

FX

- The Dollar index remains suppressed in the post-Powell aftermath of dovishly-received remarks from the Fed Chair, with today's base at 105.30 matching the lows set on the 15th and 28th of November.

- Most G10s are firmer against the USD but to varying degrees.

- The JPY has been the greatest beneficiary of the Powell-induced narrowing in the Fed-BoJ differential and as US yields sold off yesterday.

- The Loonie stands as the underperformer with no clear reason aside from a breather from the Dollar and crude-induced gains yesterday and in the run-up to the Canadian jobs report tomorrow.

- South Africa President Ramaphosa is reportedly considering resigning over the farm scandal, according to Bloomberg.

- PBoC set USD/CNY mid-point at 7.1225 vs exp. 7.1231 (prev. 7.1769)

Fixed Income

- EGBs are bid across the board as participants react to the commentary from Chair Powell on Wednesday; as such, ECB pricing has tilted towards 50bp, Chief Economist Lane speaks later.

- USTs have continued to climb with yields lower across the curve and particularly at the long-end given Powell stressing they do not want to overtighten and ahead of key data including October’s PCE.

- The European morning has digested a substantial amount of supply with over EUR 11bln taken down between France, Spain and the UK; overall, the issuance was well received and marks the last outings for France and Spain this year

Commodities

- WTI Jan and Brent Feb futures are somewhat choppy with the initial upside paring back in recent trade despite a distinct lack of news flow and a steady Dollar at the time.

- Spot gold benefits from the decline in the Dollar as the yellow metal extends on gains above USD 1,775/oz as it sets its sight on the 200 DMA at USD 1,796.07/oz ahead of USD 1,800/oz.

- Base metals are firmer across the board following the recent China optimism and Dollar-induced boost, with 3M LME copper briefly topping the USD 8,300/t mark.

- OPEC November oil output fell 710k BPD from October to 29.10mln BPD after the OPEC+ production cut decision, while quota-bound members complied with 163% of pledged cuts in November, according to a Reuters OPEC survey.

Crypto

- Sam Bankman-Fried said the FTX US platform is fully funded and he believes withdrawals could be opened, while he denied committing fraud and said that FTX had huge management failures.

Geopolitics

- US is considering a dramatic expansion in the training the US military provides to Ukraine including instructing as many as 2,500 Ukrainian soldiers a month in a US base in Germany, according to CNN citing sources.

- Chinese President Xi told European Council President Michel that China will continue to strengthen strategic coordination with the EU and hopes EU will establish an objective and correct perception of China. Xi added that China and EU should strengthen macroeconomic policy coordination and complementary advantages and jointly create new growth engines, and should jointly ensure the safety, stability, and reliability of industrial supply chains. Xi said China will remain open to European companies and hope EU can provide a fair and transparent business environment for Chinese firms, according to Bloomberg.

- Russian Foreign Minister Lavrov says a channel for negotiations has been established between the Russian and US special forces, via Reuters.

- US Defence Secretary Austin informed his Turkish counterpart of his strong opposition to a new Turkish military operation in Syria, according to Reuters.

- US lawmakers are poised to back as much as USD 10bln to bolster Taiwan's defences against growing tensions and threats from China as part of a compromise annual defence authorisation bill, according to Bloomberg.

- Japanese Chief Cabinet Secretary Matsuno said they informed China and Russia through diplomatic channels of severe concerns regarding frequent joint air force activities around Japan, while they are closely monitoring increasing military cooperation between China and Russia with concern, according to Reuters.

US Event Calendar

- 07:30: Nov. Challenger Job Cuts YoY, prior 48.3%

- 08:30: Nov. Initial Jobless Claims, est. 235,000, prior 240,000

- Nov. Continuing Claims, est. 1.57m, prior 1.55m

- 08:30: Oct. Personal Spending, est. 0.8%, prior 0.6%

- Real Personal Spending, est. 0.5%, prior 0.3%

- Personal Income, est. 0.4%, prior 0.4%

- PCE Deflator MoM, est. 0.4%, prior 0.3%; PCE Core Deflator MoM, est. 0.3%, prior 0.5%

- PCE Deflator YoY, est. 6.0%, prior 6.2%; PCE Core Deflator YoY, est. 5.0%, prior 5.1%

- 09:45: Nov. S&P Global US Manufacturing PM, est. 47.6, prior 47.6

- 10:00: Oct. Construction Spending MoM, est. -0.2%, prior 0.2%

- 10:00: Nov. ISM New Orders, est. 48.5, prior 49.2

- ISM Employment, est. 50.0, prior 50.0

- ISM Prices Paid, est. 45.9, prior 46.6

- ISM Manufacturing, est. 49.7, prior 50.2

DB's Jim Reid concludes the overnight wrap

Welcome to December. Since it’s the start of a new month, our usual performance review of financial assets over the last month will be out shortly. November was a very strong month for markets across several asset classes, which makes a change from what we’ve been used to this year. Indeed, the Hang Seng index has just seen its strongest monthly performance since October 1998. However, at the other end of the leaderboard the US dollar has just put in its worst monthly performance in over a decade. Full report in your inboxes soon.

That general optimism through November carried into the final day of the month yesterday, with markets surging thanks to a speech from Fed Chair Powell. He confirmed that “the time for moderating the pace of rate increases may come as soon as the December meeting”, which cemented expectations that the Fed will move away from the 75bp hikes they’ve pursued at the last four meetings in favour of a slower 50bp pace. Furthermore, he said in the Q&A after the speech that “my colleagues and I do not want to overtighten”, which acknowledged some of the concerns that the Fed may end up going too far, particularly given monetary policy operates with time lags. In turn, risk assets surged on the back of Powell’s remarks, with the S&P 500 moving out of negative territory beforehand to end the day up +3.09%.

To be fair, Powell did make some more hawkish points during his speech, but when he did it was generally in line with comments we’d already heard before. For instance, he said that the “ultimate level of rates will need to be somewhat higher than thought at the time of the September meeting”, but this was in line with his language from the November FOMC press conference. Separately, he said that restoring price stability would likely “require holding policy at a restrictive level for some time”, but again this mirrored his remarks at the Jackson Hole speech back in August. So the incremental news was in a slightly more dovish direction.

As a result of the speech, investors moderated their views on the likely pace of rate hikes over the months ahead, with terminal rate pricing down from 5.01% the previous day to 4.92% by the close yesterday. In the meantime, the rate priced for end-2023 came down by an even larger -21.3bps on the day to 4.43%. That prompted a substantial fall in Treasury yields across the curve, with the 10yr yield down -13.9bps on the day to 3.61%, whilst the more policy-sensitive 2yr yield was down -16.3bps to 4.31%. For equities the reaction was buoyant as well, with the S&P 500 up +3.09% on the day to its highest level since mid-September. The advance was incredibly broad-based, but was led by the more cyclical sectors, with the NASDAQ (+4.41%) and the FANG+ Index (+7.33%) seeing even larger gains.

Ahead of Powell’s speech, the latest US data releases painted a mixed picture on the state of the economy. First, the number of job openings in October fell to 10.334m (vs. 10.25m expected), a sign that labour demand was continuing to decline. That meant that the number of job openings per unemployment fell to 1.71 in October, which is the lowest since November 2021. Furthermore, the quits rate of those voluntarily leaving their job (which is correlated with wage growth) fell back to 2.6% in October, and that’s the lowest it’s been since May 2021. From the Fed’s perspective it’s a positive sign in that inflationary pressures from the labour market might be abating, but this is still a very tight labour market compared to the pre-pandemic world of 2019.

Earlier in the day, we also had some more negative data on the growth side, since the MNI Chicago PMI for November fell back to just 37.2 (vs. 47.0 expected). Apart from the pandemic months of April and May 2020, that’s the worst reading for that measure since early 2009, back when the economy was just beginning to emerge from the global financial crisis. In addition, we got the ADP’s report of private payrolls ahead of tomorrow’s jobs report, which showed the slowest monthly growth since January 2021, at just +127k in November (vs. +200k expected). So that echoes the more negative readings we’ve already had from the flash PMIs for November last week. One small piece of good news came from the more backward-looking data for Q3, with the second estimate of GDP revised upwards to show growth at an annualised +2.9% (vs. 2.6% previous estimate).

Over in Europe, we had some better news on the data side, since the flash estimate for Euro Area CPI fell to +10.0% in November, which was beneath the +10.4% reading expected, and down from a record +10.6% in October. It was also the first time in over a year that Euro Area inflation had slowed relative to the previous months, and the downside surprise will offer some support to the more dovish voices at the ECB ahead of their meeting in just a couple of weeks’ time. Nevertheless, our European economists still expect inflation to remain elevated through next year, and their forecasts show it remaining at more than double the ECB’s 2% target throughout 2023, only falling to 4.8% by December 2023. Some of the details from yesterday’s release were also a bit less promising than the headline, with core CPI holding steady at a record +5.0%.

Investor expectations for the ECB were little changed in response to the release, having already reacted to the downside surprises in the country-specific releases on Tuesday. In fact sovereign bond yields actually moved higher across the continent, as they had in the US prior to Fed Chair Powell’s speech, and yields on 10yr bunds (+0.9bps), OATs (+1.3bps) and BTPs (+5.3bps) all moved higher on the day. Equities also put in a pretty strong performance, although they closed ahead of the subsequent bounce in the US, leaving the STOXX up +0.63%.

Overnight in Asia, the optimism from the US has continued and equity markets are rallying across the region. Chinese equities are leading the outperformance, with the Hang Seng (+1.36%), the CSI 300 (+1.31%) and the Shanghai Composite (+0.66%) all seeing solid gains. Those moves have also been supported by comments from China’s Vice Premier Sun Chunlan, who said that “As the omicron variant becomes less pathogenic, more people get vaccinated and our experience in Covid prevention accumulates, our fight against the pandemic is at a new stage and it comes with new tasks”. That was seen by investors as another signal that China could be inching away from the zero Covid strategy. Elsewhere in the region, equities are also trading in positive territory, with the Nikkei (+1.13%) and the KOSPI (+0.28) advancing. In addition, US and European equity futures are pointing to further gains ahead, with those on the S&P 500 up +0.20% this morning.

In terms of yesterday’s other data, German unemployment rose by +17k in November (vs. +13.5k expected), which took the unemployment rate up to 5.6%. Over in the US, the latest data on pending home sales showed a 5th consecutive monthly decline in October, which takes them to their lowest level in over a decade if you exclude the pandemic month of April 2020.

To the day ahead now, and data releases include the global manufacturing PMIs for November, German retail sales for October, the Euro Area unemployment rate for October, the US weekly initial jobless claims, personal income and personal spending for October, and the ISM manufacturing for November. Otherwise, central bank speakers include the Fed’s Logan, Bowman and Barr, as well as the ECB’s Lane.