International

Raising corporate tax rates will hurt us all

Raising corporate taxes would hurt firms’ profitability and funds to grow their businesses. Employment growth and wages would suffer The finance ministers of more than 130 nations and territories have arrived at a tentative agreement to create a tax…

Raising corporate taxes would hurt firms’ profitability and funds to grow their businesses. Employment growth and wages would suffer

The finance ministers of more than 130 nations and territories have arrived at a tentative agreement to create a tax floor – a minimum corporate tax rate of a proposed 15 per cent. Its proponents, sadly including Canada, claim it will create a “level playing field” and stop a “race to the bottom.”

Some nations face a harsh choice: lower corporate taxes to retain and attract domestic and foreign investors, or lose revenue, which will have to be made up by raising personal income taxes and other taxes.

This tentative agreement has other features, including more precise and narrow definitions of intellectual property, digital commerce, transfer pricing and allocation or attribution of revenues, costs, profit or other flows by region or other criteria.

There are also the usual bleats of “fair share.”

Several points undermine the case of these eager governmental money-grabbers.

The first is the arbitrariness of 15 per cent. Why 15 per cent and not 10 or 20 per cent? Presumably, the former number would be too low to satisfy some and the latter too high based on what they currently levy. Ultimately, it was a negotiated compromise and not demonstrably based on optimization studies.

The next issue is that it would disadvantage some nations that have low corporate tax rates. A key part of Ireland’s success – after a financial near-death in 2008-10 – is its 12.5 per cent corporate tax rate. This is lower than most other nations, especially advanced rich ones. Ireland’s per capita gross domestic product is now higher than that of the United Kingdom, the United States, the Scandinavian nations and Qatar. Only Luxembourg has a higher GDP, and it’s also a low-tax locale.

Raising corporate income tax rates would hurt firms’ profitability, their operating cash flow, and their available funds to reinvest and grow their businesses.

Employment growth and wages would suffer from reduced economic growth. Economic growth that’s lower than forecasted will hurt government tax revenues from personal income taxes, excise taxes, property taxes, sales taxes and value-added taxes (VAT).

Governments would be tempted or compelled to reduce services or raise other taxes to make up the shortfall in corporate and other growth-sensitive taxes, which would almost certainly fall on working citizens, reducing their standard of living.

The third issue is the belief that corporate income tax revenue is a big and vital part of overall government receipts. It’s not. Using Organization for Economic Co-operation and Development (OECD) data, the Tax Foundation found that corporate income tax revenue, on average, is just 9.6 per cent of total national income.

So if Ireland had this OECD average share from firms and had to raise it by 20 per cent – from 12.5 to 15 per cent – it would gain a little less than two per cent from the exercise, at the expense of damaging its economy and people.

Yet Ireland derives 14.4 per cent of its total tax take from corporate income taxes, nearly five per cent more than the OECD average. By keeping its rate low, it has actually increased its total revenue.

Sovereignty is one of the most important concerns. By agreeing to such a tax treaty, Canada and other nations would be bound by its terms and be unable to lower taxes, except perhaps at the provincial, territorial or local level.

If Canada were in a recession, low-growth stagnation, a war or similar emergency, it might want to suspend, drastically cut or eliminate corporate income taxes.

Subnational regions such as provinces or states could also lower their taxes or make them negative to attract business, as sometimes happens now.

There are ways to game the system. The draft treaty could prohibit or limit this, but there could be other ways around it. National governments could transfer large sums to provinces or states, allowing them to keep their business taxes low. Corporate income taxes could also be rejigged to have much more generous capital cost allowances, investment tax, research and development or hiring and training credits.

There are other reasons not to believe the sincerity of the motives of the major proponents of this idea. The new United States administration wants to raise corporate and personal income taxes, to pare its enormous deficit. This will make the U.S. far less attractive to investors and companies who may want to enter or expand in the U.S. market.

It will also be less attractive to high-income or highly-skilled professionals, entrepreneurs, financiers, inventors, and technical or scientifically trained people.

Progressives always like raising taxes and are always less than hospitable toward business and free markets.

This also gives cover to governments that are far too lazy, cautious or scared to become more efficient, eliminate bad programs, sell off unneeded assets, lower their costs and constrain spending.

The excuse of the pandemic is wearing thin. The economic recovery is well underway. Gradual lowering of taxes could well bring more benefits and higher revenues than raising them on corporations.

Corporate income taxes are only one thing businesses and investors look at before committing money. They are also looking for:

- the strong rule of law;

- firm property and commercial rights;

- abundant, affordable and accessible sources of energy;

- high-quality infrastructure;

- smooth, quick import and export, regardless of tariff levels, including extensive and widespread trade agreements;

- high-quality, educated labour forces and technical services;

- stable, understandable and reasonable regulatory regime;

- safety and security;

- relatively stable politics;

- receptive and business-friendly government and society;

- easy, quick and relatively inexpensive permitting and project approval processes.

Governments have enough problems meeting all of those requirements. Raising taxes on companies and high-income achievers will only make things worse.

Governments need to make better choices and be forthright about what is and isn’t affordable. Raising corporate income taxes may look good to a few loud people but it will harm everyone.

By Ian Madsen

Senior policy analyst

Frontier Centre for Public Policy

Ian Madsen is a senior policy analyst with the Frontier Centre for Public Policy.

Courtesy of Troy Media

recession pandemic economic recovery economic growth gross domestic product gdp recovery canadaSpread & Containment

GSK to part ways with ‘most’ Bellus Health employees a year after $2B buy

Many of the employees behind GSK’s late-stage investigational drug for chronic cough will be let go at the end of March.

Roberto Bellini

“After having…

Many of the employees behind GSK’s late-stage investigational drug for chronic cough will be let go at the end of March.

“After having completed the transition activities linked to the GSK acquisition, most Bellus Health employees will be wrapping up their involvement with the company on March 31,” Roberto Bellini, the longtime CEO of Bellus, wrote Thursday on LinkedIn.

A year ago, GSK bought the Canadian biotech for $2 billion for Bellus’ Phase 3 chronic cough candidate, which was expected to compete with Merck’s P2X3 antagonist. That drug was rejected by the FDA for a second time in December.

In his LinkedIn post, Bellini said it was the “end of an era.” He’s now a managing partner at life sciences investor BSquared Capital.

“We’re excited to see GSK complete the last legs of the journey and fulfill our mission of getting this important product to the chronic cough patient community,” Bellini wrote.

GSK, which completed the deal in June, did not disclose the number of roles impacted. In his LinkedIn post, Bellini tagged about 40 people whose profiles list them as Bellus employees.

“During the GSK-Bellus acquisition, we retained employees to a predetermined date to ensure the successful integration of the business,” a GSK spokesperson told Endpoints News. “As often is the case during this process, redundancies may occur.”

GSK is currently running two Phase 3 trials for its lead drug from Bellus, a P2X3 antagonist known as camlipixant or BLU-5937. Data are expected next year, the drugmaker has said.

“We look forward to continuing to drive the CALM Phase 3 clinical development program forward to address the unmet needs of patients living with refractory chronic cough,” the spokesperson wrote.

GSK has described camlipixant as one of its top clinical prospects, and chief commercial officer Luke Miels has said the company projects peak sales in the “single billion dollar” range.

Chronic cough can interrupt daily activities, impair people’s ability to work and disrupt social experiences as some say the condition has been stigmatized due to the Covid-19 pandemic. The pharma has estimated about 10 million people in the US and EU experience refractory chronic cough for more than a year.

Merck has said it’s going through feedback from the FDA’s latest no-go for gefapixant, its chronic cough candidate. The treatment is approved in the EU, Switzerland and Japan.

Other companies in the category include startup Nocion Therapeutics, which this month reeled in $62 million for a Phase 2b this year testing whether its alternative approach to treatment can work. Aldeyra Therapeutics, meanwhile, “deprioritized” its mid-stage treatment candidate in January.

treatment testing fda pandemic covid-19 japan euGovernment

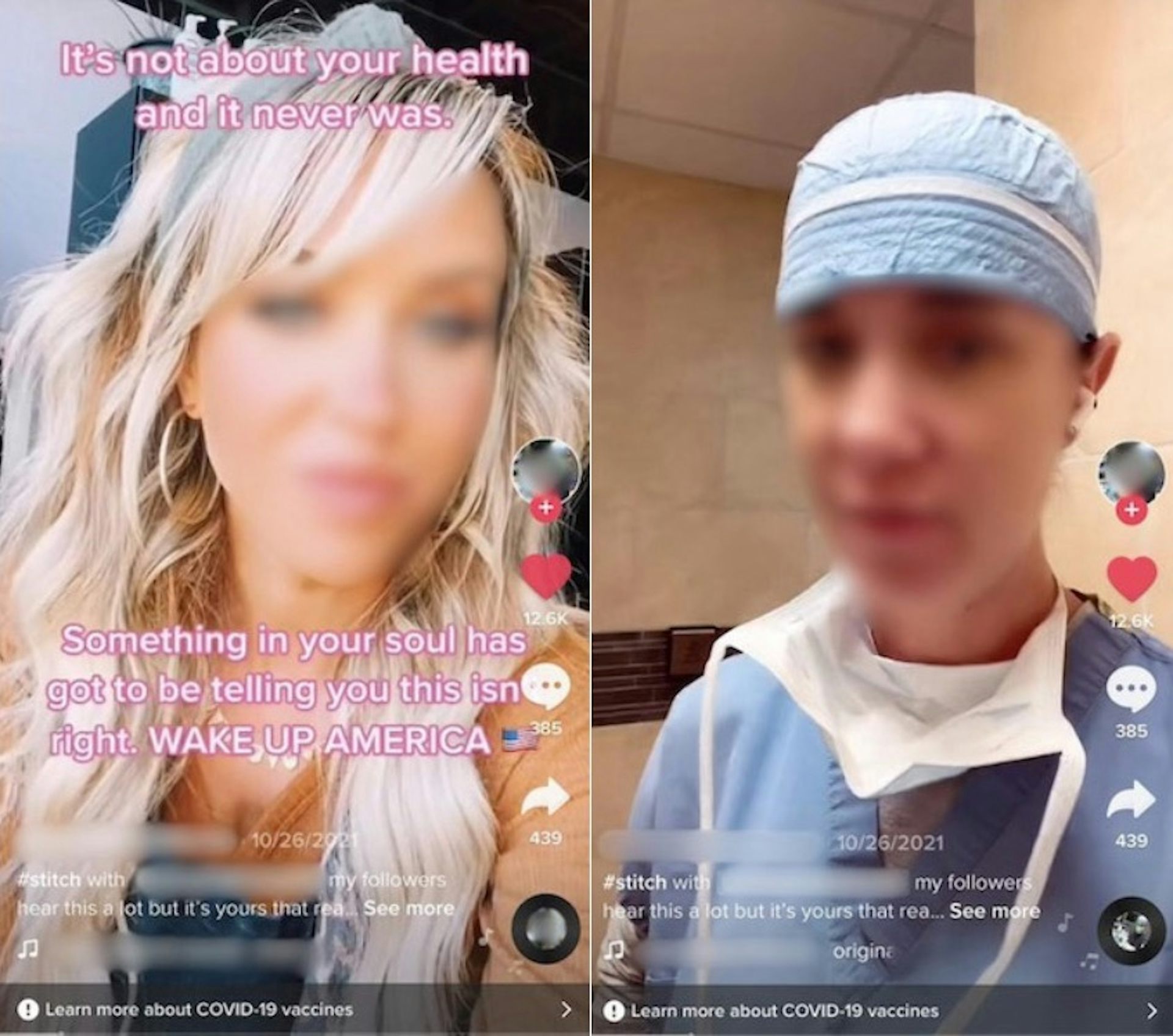

TikTok’s duet, green screen and stitch turn political point-scoring into an art form

TikTok’s features for combining different users’ videos have sparked a wave of creativity. They’ve also formed an arena for political arguments and…

Since its astronomical rise in popularity during the 2020 COVID-19 lockdowns, TikTok has played an increasing role in all aspects of American life, including politics, from the White House briefing key TikTok creators on the war in Ukraine to Joe Biden’s presidential campaign launching a TikTok account.

The U.S. House of Representatives passed legislation on March 13, 2024, seeking to force TikTok’s China-based parent company to sell the app or face a ban in the U.S. Even if this legislation passes the Senate and Biden signs it into law, it’s unlikely TikTok will go away before the 2024 U.S. presidential election. Any law banning TikTok is likely to be challenged in court, and the app won’t simply disappear from people’s phones overnight.

Given that TikTok is almost certain to play a role in the 2024 election, it’s important to examine how TikTok helps shape political expression and discussion. With communications scholar Mackenzie Quick, I recently published a journal article exploring how American TikTok users use the app’s stitch, duet and green screen features to stoke partisan conflict.

Getting together

TikTok says its mission is to “inspire creativity and bring joy.” In 2019, it introduced several features to help bolster that mission: duet, green screen and stitch. Duet allows you to post your video side by side with a video from another TikTok user. Green screen allows you to superimpose your video on a video from another TikTok user. Stitch allows you to append your video to the end of a short clip from a video from another TikTok user.

TikTok describes these features as giving users “the most creative tools available” and providing a way for users “to engage with the world of content that’s made … by the ever-creative TikTok community.” Given these descriptions, it appears that these tools were designed to increase creativity, interaction and connections.

They can be used in playful ways or used by subject matter experts to convey information. For example, some veterinarians use TikTok to convey pet health information.

However, a platform’s statements about how it intends its features to be used and how people actually use them can be quite different. While these features are often used in TikTok’s preferred ways, our research found that in political tiktoks, people often used the tools to double down on their political positions and attack those who don’t agree with them. In a time of volatile political divisiveness, these features can function as outlets for people to express their strongly held political views.

Scoring points

Reinforcement and insults were recurring themes in our study. For instance, the green screen feature was often used to incorporate “evidence” in the background to support the creator’s claims. With this feature, “evidence” was often presented in the form of news articles or posts from other social media platforms.

One post from a conservative-leaning creator features a screenshot of the Apple iTunes music store charts to show the popularity of a song called “Let’s Go Brandon,” a conservative rallying cry and coded insult against Biden. This creator presents the song’s position at No. 1 in the music store as proof that the conservative viewpoint is popular. “Evidence” is a loose term and could be anything that supported the creator’s viewpoint.

We found the duet feature was often used to communicate nonverbally, often to poke fun at someone with opposing political views. Eye rolling, smirking and head shaking were common gestures. In one video, a conservative creator starts a chain – an extended succession of duets – of women who support former President Donald Trump. A liberal-leaning creator uses the duet feature to join the chain with video of themselves holding a clothes iron out to the side to make it appear as though the iron is burning the original creator’s hand.

Stitches functioned similarly to duets, but people tended to use the feature as a chance to verbally respond and refute the previous creator’s point. These uses show that on political TikTok, personal feelings and proving others wrong matter more than constructive debate.

The who and why of political TikTok

While regulation of the app is a political issue, understanding how political conversations occur across TikTok remains important for understanding an increasingly polarized American electorate. When considering political discussions on TikTok, however, it’s important to remember that the app’s features don’t force users to do anything. Users actively shape their experiences in digital spaces.

Also, as political communication scholars Daniel Kreiss and Shannon McGregor note, it’s important to proceed with caution when discussing the effects of technology on polarization because not all groups experience polarization the same way. For instance, the Black Lives Matter movement may be seen as polarizing for disrupting existing power structures, but its goal is to fight for equality, and it’s important to consider that context when looking at the group’s use of technology.

The lesson is to consider who is engaging in polarizing content and why they are doing so. While some users expressing themselves via these TikTok features aim to simply prove others wrong, akin to petty arguments, others may be critiquing and challenging the powerful.

Jessica Maddox does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

white house senate house of representatives trump covid-19 ukraine chinaInternational

Global Population Set To Fall For First Time In 700 Years

Global Population Set To Fall For First Time In 700 Years

Authored by Steve Watson via Modernity.news,

A major study published in scientific…

Authored by Steve Watson via Modernity.news,

A major study published in scientific journal The Lancet has found that the global population will start to fall within decades due to vastly reduced fertility rates and may never recover.

The study, funded by the Bill & Melinda Gates Foundation, found that by the year 2050, 155 of 204 countries are on course to have birth rates lower than required to sustain the population level.

It notes that as of 2021, the “total fertility rate” worldwide was 2.23, hovering only just above the 2.1 children per woman needed to maintain population growth.

That figure has fallen from 4.84 in 1950, with researchers predicting it will decrease to 1.83 in 2050 and go as low as 1.59 by 2100.

Dramatic declines in global fertility rates set to transform global population patterns by 2100, new GBD Capstone study suggests.

— The Lancet (@TheLancet) March 20, 2024

Explore the data ➡️ https://t.co/Mvc1PyR4F4 pic.twitter.com/xdpSjVLrQJ

The study notes that by that time only 26 countries will have birth rates that outpace the number of people dying, with “most of the world transitioning into natural population decline”.

A fall in population would mark the first time in seven centuries such an occurrence has taken place.

The last time it happened was after the Black Death bubonic plague pandemic killed as many as 50 million people in the mid-1300s, reducing the global population from 400 million to 350 million.

Commenting on the study, it’s co-author Dr Natalia Bhattacharjee said declining fertility rates “will completely reconfigure the global economy and the international balance of power and will necessitate reorganising societies”.

Bhattacharjee, lead research scientist at the Institute for Health Metrics and Evaluation (IHME) at the University of Washington, also noted that a major consequence will be increased immigration from countries where there is still a “baby boom,” such as sub-Saharan Africa, in order to make up workforce shortages in nations with aging populations.

Professor Stein Emil Vollset, senior author from IHME, also noted that the world is “facing staggering social change through the 21st century” due to population decline.

The findings are exactly what the likes of Elon Musk have been warning of for years, describing population decline as a ‘civilisational threat’ and urging that humanity is literally going to disappear if something is not done to reverse the trend.

While Eco loons rage about ‘moral issues’ with having children, the potential causes of fertility decline, such as plastics and chemical shrinking penises and sperm counts, are relatively ignored.

The stark reality is that birth rates globally are collapsing and almost every country is on course to have shrinking populations by the end of the century.

In countries like South Korea and Japan, there are twice as many people are dying as there are being born. You don’t have to be a mathematic genius to do the calculations on what’s going to happen very soon.

These countries are already considering embracing mass migration, with South Korea’s Justice Minister recently declaring the country faces a “demographic catastrophe” and potential extinction otherwise.

Fertility rates globally are collapsing and almost every country is on course to have shrinking populations by the end of the century. This is why @elonmusk and others are sounding the alarm. Report here: https://t.co/I3vfVi3M3Q pic.twitter.com/0enKUksxk2

— m o d e r n i t y (@ModernityNews) January 30, 2024

Despite this horrifying reality, it is now commonplace in modern culture for young people to genuinely believe they need to abandon their human instincts to reproduce, all for the greater good:

* * *

Your support is crucial in helping us defeat mass censorship. Please consider donating via Locals or check out our unique merch. Follow us on X @ModernityNews.

-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges