International

Qualivian Investment Partners Q2 2020 Investment Letter

Qualivian Investment Partners Q2 2020 Investment Letter

Qualivian Investment Partners commentary for the second quarter ended July 2020, discussing the O’Reilly Automotive Inc (NASDAQ:ORLY) stock.

Q2 2020 hedge fund letters, conferences and more

“Short-term investors will accept a 20% gain because they didn’t spend the time to develop the conviction and foresight to see the next 500%.” – Ian Cassell

Executive Summary

Readers of investment letters fall into several categories:

- Those who read the entire letter in detail,

- Those who skim, and

- Those who are only interested in the twitter version. For this category here is the tweet:

“Our performance in Q2 was ahead of the S&P 500 by 9.6% and 9.5% on a gross and net basis. Since inception through Q2 2020, we have outperformed by 27.3% and 25.0% on a gross and net basis. The COVID crisis does not change our strategy. We made two trades in Q2.”

Now for those who would like more detail…

Overview

About Us

The Qualivian Focus Fund is an investment partnership focused on long-only public equities. We own a concentrated portfolio (15 -25) of understandable companies with wide moats, long reinvestment runways, and outstanding capital allocation. We expect them to compound capital at a mid-teens rate and hold them for an extended period. We have a private equity approach to public equities. We are seeking investors that are aligned with our long-term horizon. We do not short securities. We do not use leverage. We do not use derivatives. We are not macro investors. We believe that only a relatively small number of exceptional companies are worth investing in over the long term. Our investment process seeks to find and hold those companies. The fund primarily focuses on US companies of all sizes but can have 20% of its portfolio outside the US.

We buy carefully. We sell infrequently. We believe the stock market is a mechanism to transfer wealth from the impatient to the patient. High quality businesses with durable and growing cash flows are rare in a world awash in low and negative interest rates. When they are run by able management teams with excellent capital allocation, they are scarcer still. We are quite comfortable sitting back, holding on, and watching the power of compounding work. The big money is made in the waiting, not in scratching the itch to “do something”. We do not mind watching trees grow.

Our formula: Long-Term Orientation+ Long-Term Investors + Focused Portfolio + Quality Compounders = Maximizing Chance for Outperformance.

Our investors should understand how we invest so they make the right decision (both for them and us). We are not right for all investors. We would encourage investors aligned with our long-term horizon and philosophy to contact Aamer Khan (aamer.khan@qualivian.com) at 617-970-9583 or Cyril Malak (cyril.malak@qualivian.com) at 617-977-6101.

This letter discusses our Q2 2020 performance, recaps our core beliefs and thinking, and discusses a portfolio holding which has been in the fund since inception.

Performance of the Fund in Q2 2020

In Q2 2020, we were up 30.2% and 30.0% on a gross and net basis versus the S&P’s 20.5% increase, outperforming by 9.6% and 9.5%. In 2019 we finished up 40.2% and 39.4% on a gross and net basis respectively, versus the S&P 500’s performance of 31.5%, or an outperformance of 8.7% and 7.9% respectively.

Since the inception of our fund in December 2017 through June 30, 2020, we have returned 49.8% and 47.4% on a gross and net basis versus the S&P 500’s 22.4% return in the same period, outperforming by 27.3% and 25.0% respectively. Appendix 1 contains a detailed quarter by quarter performance table.

As a long-only strategy that does not short (or employ leverage or options or other derivatives), we were not immune from the record-setting drop in the markets in the back half of February and throughout March resulting from the COVID virus. However, the returns from our high-quality companies with high gross and operating margins, strong balance sheets and cash flow generation translated into a more muted pull back for our portfolio in Q1 2020 and a superior bounce back in Q2 2020.

Our top three contributors in Q2 2020 were PayPal (PYPL), Amazon (AMZN), and O’Reilly Automotive (ORLY). Our bottom three contributors were TJX Companies (TJX), Brookfield Asset Management (BAM), and Adobe Inc. (ADBE).

PayPal: PYPL benefited from strong tailwinds due to COVID and more payments moving online in an accelerated fashion. Fiscal Q3 2020 results were substantially ahead of already high expectations. Total payment volume growth and net new user growth were the strongest since PYPL listed. PYPL is clearly benefiting from the faster digitization of payments and commerce. PYPL gained users who had not previously shopped online and saw new spend categories which were previously offline move to online post crisis. Omni-channel convergence (online ordering and instore pickup) has massively increased their total addressable market. PYPL is prioritizing the in-store opportunity and focusing on other forms of engagement like rewards, bill pay and Honey. It has strong growth optionality in eCommerce.

Amazon: AMZN shares, along with many other eCommerce participants, have been on a strong run this year, outperforming the S&P 500 materially since February. COVID is pulling forward years of eCommerce migration and AMZN is the big winner with a commanding share of key US and European markets – potentially even gaining share from an already dominant market position. Alongside this, cloud migration should continue to accelerate as the cost-benefit of outsourcing to the cloud dominates in-hosting. Operating cash flow increased 42% last quarter to $51.2 billion for the trailing twelve months ended June 30, 2020. Amazon Web Services grew revenue at 29% last quarter and operating income grew by 58%. The internet infrastructure is effectively an oligopoly with AMZN as the biggest player. AMZN is currently trading at a price to operating cash flow ratio of 30X. This multiple does not incorporate the optionality that AMZN has as a dominant online and infrastructure platform. AMZN has multiple growth options going forward, some resulting from its enormous and hard to replicate advantage of free user data, together with the increasing application of artificial intelligence to that data. AMZNs competitive advantage is getting stronger. The key risks are regulatory and political.

O’Reilly Automotive: ORLY’s Q2 2020 results were above even the most bullish expectations. While it began the quarter slowly, it reported same-store sales growth of 16.2%. This was significantly more than the consensus estimate of -2.3%. ORLY’s Do-It-Yourself business was extremely strong in Q2 and outpaced the Do-It-For-Me segment. This performance was impressive even though a key driver of industry demand (miles driven) has been under pressure. The offset was a shift away from public transit, air travel, and ridesharing. O’Reilly Automotive resumed share repurchases in May, highlighting confidence in its liquidity position and outlook.

TJX: TJX’s Q1 2020 (ending April 30) was in the middle of the COVID related shutdown. The stock sold off with much of the retail sector. It reported EPS well below consensus driven largely by far worse than expected gross margins. Most of the gross margin erosion came from weaker merchandise margins on lost sales and a $500 million inventory write-down on seasonal merchandise, with the balance coming from store shutdowns. Management has taken steps to maximize liquidity since the beginning of the pandemic, such as drawing down $1B on their revolver and suspending share repurchases. Most notably, TJX suspended both their Q1/Q2 dividends (but remain committed to the practice over the long term), as well as meaningfully lowering their FY 2020 capex plan to $400-600M (from $1.4B) as they lowered their planned store openings to 50 (from 70).

Despite the COVID headwinds, TJX off price model remains one of the best in retail and a model that is still not fully understood by many investors. Some are skeptical that a business that sells surplus inventory can continually find supply. Wouldn’t manufacturers of retail goods get their supply chains in order and stop producing surplus inventory? The answer is no because the economics of surplus clothing are quite different from the economics of surplus industrial goods. When clothing goods are manufactured overseas with a six month or so lead time, and very low incremental cost of production, it is optimal to over produce, with the comfort factor that you can sell excess product to TJX (at a discount) rather than miss out on large profits that accrue when retailers re-order a bestselling product. Department and apparel stores do not disclose this policy, so investors are less familiar with it.

Brookfield Asset Management BAM is a premier investor in alternative assets, including real estate, infrastructure assets, fixed income, and private equity. The stock underperformed together with much of the credit sensitive financial sector as the uncertainty regarding the length and depth of the COVID slowdown increased in the quarter. Some of BAM’s subsidiary companies (BPY for instance) have substantial exposure to real estate and have higher than average levels of leverage. We reduced our holding in BAM, which is discussed below.

ADBE: Reported strong Q2 results in the Digital Media and Document Cloud segments. The third segment, Digital Experience, was negatively impacted by COVID which led to a decline in advertising and delays in booking and consulting services for enterprises. COVID also negatively impacted the small and medium size business segment. The business model and market position of Adobe remains strong and we have confidence in it as a long-term holding.

Changes to the portfolio in Q2 2020

We only made two changes to the portfolio during the quarter: (1) reducing our position in BAM, and (2) starting a new position in ADBE. In an environment of potentially high credit impairments and economic uncertainty, we were less confident in our ability to forecast BAM’s growth runway. We replaced it with ADBE, a dominant software leader that had been on our shopping list and which we had been tracking closely.

Our Portfolio and Disruption

The world of business is undergoing (at least) two disruptions: a shorter-term disruption due to COVID and a longer-term disruption via the digital revolution. Each of these disruptive events causes major value shifts, leading to winners and losers.

Our Portfolio and COVID

The COVID crisis has intensified existing trends, widening the gap between those at the top and bottom of the power curve of economic profit. “Bad companies are destroyed by crises, good companies survive them, and great companies are improved by them” said Andy Grove1. We benefitted since our portfolio firms are dominant in their industries, are capital light and cash generative, have secular growth and are not economically cyclical.

However, the COVID crisis does have a silver lining: what was previously an unknown unknown (COVID) has now become a known unknown, transforming genuine uncertainty into more tractable risk.

Disruption and Mean Reversion of Pricing

Let us make a key distinction here: we are referring here to mean reversion in equity pricing, not mean reversion in returns on capital. There is substantial evidence that mean reversion does not work for firms with higher returns on capital. But here we are discussing mean reversion of pricing.

Does mean reversion of pricing work in an era of disruption?

Many investors reflexively assume that mean reversion works for equity pricing i.e. a stock which has underperformed, may subsequently outperform going forward. The underperformance may have been due to short-term behavioral biases and liquidity considerations. Mean reversion in pricing is a widely used heuristic, both for active and quantitative management.

The underlying assumptions behind mean reversion are:

- Market prices of firms diverge from their “intrinsic value” due to behavioral biases and other factors.

- Over time market prices approximate intrinsic value.

- Intrinsic value is less volatile than the market price.

- Alpha is created by arbitraging the market price and intrinsic value.

There is a major assumption underlying mean reversion: that firms will continue to have a stable business model that will generate a predictable level of cash going forward, making intrinsic value a stable and calculable parameter. However, in an era of disruption, the continuity of a firm’s business and predictability of its cash flows are far more uncertain. In these conditions, firms behave more like an option: a firm either survives disruption or it does not, and equity value goes to zero. This is akin to an option finishing in the money or out of the money. Mean reversion is less applicable. This effect is exacerbated when a firm’s debt level is high, which increases chances of an equity wipeout. Quality compounders, because of their wider moats, are less susceptible to disruption and have less debt, so mean reversion in pricing is more applicable to them. However, applying it to average firms can lead to value traps.

Can Passive Investing Outperform Active Investing regarding Quality Compounders?

The focus on Quality companies often is a key discussion point with prospective investors. Some have asked whether our Quality Compounder strategy could be replicated by a quantitative approach via a passive fund or ETF.

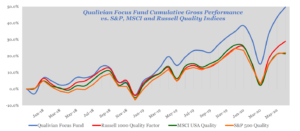

To test this, we compared the performance of our portfolio with that of three listed “quality indices” in the graph below. The three ETFs we used in the analysis below track the S&P 500 Quality Index, the MSCI USA Quality Index, and the Russell 1000 Quality Factor Index2.

The Qualivian Focus Fund outperformed the three passive “quality” ETF’s by a wide margin. This performance differential highlights the difference between quantitatively derived quality factors and our approach to identifying quality compounders and the value-added that active management delivers to investors.

Specifically, quality compounders capture characteristics that are missed by factor-based approaches that attempt at capturing quality characteristics of a company, like:

- Our assessment of a management team’s pro-shareholder capital allocation, both in the past and extending into the future,

- Our evaluation of a company’s growth prospects and the duration of that runway and the ability of the management team to reinvest in the company,

- The optionality embedded in a business model which cannot be captured by any quantitative-based approach, and

- The potential for disruption arising from competition, changes in the macro backdrop, new innovations that spell inflection points for companies and the trajectories they have been on.

All four of these characteristics are hard to capture by using a quantitative-only approach. Furthermore, we are strong proponents of concentration as a key element of an investment strategy’s ability to outperform the broader markets, which these passive ETF products that track broader market indices cannot deliver.

Are the Big Five Valued Properly?

Some of our holdings are amongst the largest S&P 500 stocks (“the Big Five”), which have had strong performance over the past year. Are these stocks irrationally valued? We present some relevant data3.

The combined market capitalization of the top five – Alphabet, Amazon.com, Apple, Facebook, and Microsoft in July 2020 is 22% of the S&P 500. At the market peak in March 2000, the five largest companies by market cap were 18% of the S&P 500. These companies were Microsoft, Cisco, General Electric, Intel, and Exxon Mobil.

In the last year, the top 5 stocks are up 49% while the remaining stocks in the S&P 500 are approximately flat. Does this mean that the top 5 are irrationally valued? Since earnings drive stock prices, about three quarters of the outperformance can be explained by superior earnings growth. The top five today have a greater share of the S&P 500’s earnings (13.9% ) than the top 5 did in 2000 (9.3%) and trade at a lower multiple (34.4X in 2020 vs 46.9X in 2000).

In March 2000, the top five stocks in the S&P 500 posted earnings and sales growth of 18.0% and 16.8%, respectively, over the preceding 12 months. That compared with 15.4% and 12.1%, respectively, for the other 495 S&P 500 companies. The big five S&P 500 stocks of 2000 had only slightly better fundamentals than the other 495 stocks.

Today, Alphabet, Amazon.com, Apple, Facebook, and Microsoft are sitting on 3.1% positive earnings growth over the past four reported quarters, while the remainder of the S&P 500 have seen negative earnings growth of 9.2%. The revenue gap is also significant: 11.2% growth for the top five and just 0.8% for the remainder. On a fundamental basis the top five S&P 500 stocks have far better fundamentals than the bottom 495 by a wide margin. This is a key difference between 2000 and 2020.

And that is not all. In an environment of high economy-wide stress, the top five have large net cash positions and wide profit margins, enabling them to withstand shocks much better. This should give them a lower risk premium, also justifying a higher valuation.

In conclusion, the top five have much stronger fundamentals: sales growth, earnings growth, profit margins, leverage, and risk premia. To assert they are overvalued vs. the rest of the market requires making a case that the gap in fundamentals will change. There is no sign of that yet, but we remain vigilant.

The Competitive Advantage of Investors

“The good news for the long-term investor is that the market of active stock pickers is hired, fired and compensated based on short-term performance.” – Seth Klarman

There is a large literature on the competitive advantage of firms. An influential study by Professor Hendrik Bessembinder found that the best-performing 4 per cent of listed US companies were responsible for the net gain made by the entire stock market between 1926 and 20164.

What about the competitive advantage of investors? Why do so few investors outperform the market? Let us start by inverting the question and say what a competitive advantage for investors is not.

We feel the following are not advantages:

- IQ

- Experience

- Sell side access

- Squadrons of analysts

In our opinion, real advantages reside in:

- High active share of conviction positions.

- Stomach to withstand drawdowns.

- Passion for investing rather than a focus on compensation.

- Ability to do nothing for extended periods.

And the biggest advantages?

- A long-term orientation. In an environment where performance comparisons are relentlessly made annually, quarterly, monthly, and daily, it is crucial to have a long view.

- Matching a long-term investment strategy with clients with a long-term horizon.

A long term orientation becomes more important in a volatile market like we experienced in the first half of 2020 since the gyrations would cause low conviction investors to panic and sell as the market was declining and miss out as the market recovered.

We now discuss O’Reilly Automotive (ORLY), a stock we have owned since the inception of the portfolio.

O’Reilly Automotive (ORLY): A Founder-Led Automotive Parts Quality Compounder

O’Reilly Automotive (ORLY) is the leading auto parts retailer in the US and it focuses on meeting the needs of two distinct customer segments: the Do-It-Yourself (DIY) customer (57% of sales) and the Do-It-For-Me (DIFM) segment (43% of sales), which is comprised of auto repair shops, service stations and dealers.

The auto parts market (total size of $300 billion with ORLY’s TAM of $100 billion) is still highly fragmented but has been consolidating over the past decade, forming an oligopolistic structure with the top 3 companies representing over 43% of the store counts and the top 5 companies representing 50%. We anticipate that concentration will continue to increase as scale gives the larger players an advantage in terms of distribution, technology, purchasing, and branding.

ORLY: A Mid-Teens EPS Compounder:

In the past ten years, O’Reilly Automotive has grown revenue at 7.7%, operating profit at 13.5%, and EPS at 23% compounded annually. Are these still reasonable expectations for the next five years on a normalized, post COVID basis? Let us look at the components:

We believe O’Reilly Automotive can continue to consistently compound earnings growth at a mid-teens plus level for the foreseeable future, leveraging 7%-8% topline growth into low-to mid-teens growth in after-tax earnings, and using their share repurchase program to ultimately deliver mid-teens plus EPS growth over our investment horizon.

Valuation

- ORLY is currently trading at 21.5X NTM5 P/E and 1.0X NTM relative P/E to the market, somewhat richer compared to its historical ranges in absolute terms and quite a bit cheaper on relative terms.

- O’Reilly Automotive has historically traded at a premium to the S&P 500 given its superior growth and return profile:

- 10-Year average for NTM P/E: 19.8X (with a range of 16.8X to 22.7X at +/- 1SD around the mean).

- 10-year average for NTM P/E relative to the S&P500: 1.3X (with a range of 1.1X to 1.5X at +/- 1SD around the mean).

ORLY meets our requirements of being a quality compounder: (1) it has sustainable competitive advantage, (2) has good reinvestment opportunities, and (3) has demonstrated excellent capital allocation. More specifically:

Competitive Advantages:

- Founder-Led Culture: the founder’s grandson, David O’Reilly Automotive, has been with the company since 1972 where he rotated through all the company’s major business operations, eventually becoming its President and CEO in 1993, before becoming Chairman in 2005, when he gave up day-to-day oversight of the company. Management today carry on the founder’s mantra of putting the customer first above all else and manage the business on that basis.

- Better Distribution System: O’Reilly Automotive pioneered and leads the auto parts industry in building its hub and spoke distribution center, hub and retail store network, giving them an advantage in being able to quickly supply auto parts at industry leading levels of service and product availability.

- This is key in all retail businesses but especially important in the Professional/DIFM segment, where mechanics need parts within a few hours so that they can reduce their wait times and turnaround their jobs more quickly and improve revenue productivity.

- Higher Customer Satisfaction via Greater Investments in IT:

- Furthermore, O’Reilly Automotive has been leading the auto parts sector in investing in its Omni Channel capability to expand order fulfillment options for its DIY and DIFM customers via instore, call-in or online ordering channels.

- COVID has accelerated the investments the company has made in its “Buy Online and Pickup in Store” process which is becoming a key differentiator across the retail space.

Good Reinvestment Opportunities

- Stable End-Market Drivers: Spending on auto repairs and maintenance is relatively stable and predictable and is a function of miles driven, light vehicle population, and fleet age.

- Store Growth: Furthermore, O’Reilly Automotive is underrepresented in key Northeast markets and has been growing store counts organically at a rate of 150-200 stores per year for the last 15 years, which represent roughly 3% to its topline organic growth.

Excellent Capital Allocation

- Opportunistic Acquirer: Typically, O’Reilly Automotive has supplemented its organic store growth via smaller opportunistic acquisitions, however in 2008 it acquired CSK which doubled its store count and gave it the scale to get an order of magnitude improvement in its purchasing leverage from vendors. Given the size and conservativism of its balance sheet, ORLY has the capacity to entertain another sizeable acquisition at the right price to further consolidate the market and improve its positioning within it.

- Share Repurchases: Management returns excess cash flow to shareholders via share repurchases and since the inception of the program in 2011 has bought back a little over 70 million shares, or approximately $13.0bn cumulatively, shrinking the share count by 46%.

A Final Thought: “Everything that Counts Cannot Always be Counted”

As a long-term investor with a focus on the less visible and tangible qualities that make great investments, we find the Zen saying relevant:

“Anyone can count the seeds in an apple. What is much harder is counting the number of apples in a seed.”

This article first appeared on ValueWalk Premium.

The post Qualivian Investment Partners Q2 2020 Investment Letter appeared first on ValueWalk.

Government

Looking Back At COVID’s Authoritarian Regimes

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked,…

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked, in March 2020, when President Trump and most US governors imposed heavy restrictions on people’s freedom. The purpose, said Trump and his COVID-19 advisers, was to “flatten the curve”: shut down people’s mobility for two weeks so that hospitals could catch up with the expected demand from COVID patients. In her book Silent Invasion, Dr. Deborah Birx, the coordinator of the White House Coronavirus Task Force, admitted that she was scrambling during those two weeks to come up with a reason to extend the lockdowns for much longer. As she put it, “I didn’t have the numbers in front of me yet to make the case for extending it longer, but I had two weeks to get them.” In short, she chose the goal and then tried to find the data to justify the goal. This, by the way, was from someone who, along with her task force colleague Dr. Anthony Fauci, kept talking about the importance of the scientific method. By the end of April 2020, the term “flatten the curve” had all but disappeared from public discussion.

Now that we are four years past that awful time, it makes sense to look back and see whether those heavy restrictions on the lives of people of all ages made sense. I’ll save you the suspense. They didn’t. The damage to the economy was huge. Remember that “the economy” is not a term used to describe a big machine; it’s a shorthand for the trillions of interactions among hundreds of millions of people. The lockdowns and the subsequent federal spending ballooned the budget deficit and consequent federal debt. The effect on children’s learning, not just in school but outside of school, was huge. These effects will be with us for a long time. It’s not as if there wasn’t another way to go. The people who came up with the idea of lockdowns did so on the basis of abstract models that had not been tested. They ignored a model of human behavior, which I’ll call Hayekian, that is tested every day.

These are the opening two paragraphs of my latest Defining Ideas article, “Looking Back at COVID’s Authoritarian Regimes,” Defining Ideas, March 14, 2024.

Another excerpt:

That wasn’t the only uncertainty. My daughter Karen lived in San Francisco and made her living teaching Pilates. San Francisco mayor London Breed shut down all the gyms, and so there went my daughter’s business. (The good news was that she quickly got online and shifted many of her clients to virtual Pilates. But that’s another story.) We tried to see her every six weeks or so, whether that meant our driving up to San Fran or her driving down to Monterey. But were we allowed to drive to see her? In that first month and a half, we simply didn’t know.

Read the whole thing, which is longer than usual.

(0 COMMENTS) budget deficit coronavirus covid-19 white house fauci trump canadaInternational

Problems After COVID-19 Vaccination More Prevalent Among Naturally Immune: Study

Problems After COVID-19 Vaccination More Prevalent Among Naturally Immune: Study

Authored by Zachary Stieber via The Epoch Times (emphasis…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

People who recovered from COVID-19 and received a COVID-19 shot were more likely to suffer adverse reactions, researchers in Europe are reporting.

Participants in the study were more likely to experience an adverse reaction after vaccination regardless of the type of shot, with one exception, the researchers found.

Across all vaccine brands, people with prior COVID-19 were 2.6 times as likely after dose one to suffer an adverse reaction, according to the new study. Such people are commonly known as having a type of protection known as natural immunity after recovery.

People with previous COVID-19 were also 1.25 times as likely after dose 2 to experience an adverse reaction.

The findings held true across all vaccine types following dose one.

Of the female participants who received the Pfizer-BioNTech vaccine, for instance, 82 percent who had COVID-19 previously experienced an adverse reaction after their first dose, compared to 59 percent of females who did not have prior COVID-19.

The only exception to the trend was among males who received a second AstraZeneca dose. The percentage of males who suffered an adverse reaction was higher, 33 percent to 24 percent, among those without a COVID-19 history.

“Participants who had a prior SARS-CoV-2 infection (confirmed with a positive test) experienced at least one adverse reaction more often after the 1st dose compared to participants who did not have prior COVID-19. This pattern was observed in both men and women and across vaccine brands,” Florence van Hunsel, an epidemiologist with the Netherlands Pharmacovigilance Centre Lareb, and her co-authors wrote.

There were only slightly higher odds of the naturally immune suffering an adverse reaction following receipt of a Pfizer or Moderna booster, the researchers also found.

The researchers performed what’s known as a cohort event monitoring study, following 29,387 participants as they received at least one dose of a COVID-19 vaccine. The participants live in a European country such as Belgium, France, or Slovakia.

Overall, three-quarters of the participants reported at least one adverse reaction, although some were minor such as injection site pain.

Adverse reactions described as serious were reported by 0.24 percent of people who received a first or second dose and 0.26 percent for people who received a booster. Different examples of serious reactions were not listed in the study.

Participants were only specifically asked to record a range of minor adverse reactions (ADRs). They could provide details of other reactions in free text form.

“The unsolicited events were manually assessed and coded, and the seriousness was classified based on international criteria,” researchers said.

The free text answers were not provided by researchers in the paper.

“The authors note, ‘In this manuscript, the focus was not on serious ADRs and adverse events of special interest.’” Yet, in their highlights section they state, “The percentage of serious ADRs in the study is low for 1st and 2nd vaccination and booster.”

Dr. Joel Wallskog, co-chair of the group React19, which advocates for people who were injured by vaccines, told The Epoch Times: “It is intellectually dishonest to set out to study minor adverse events after COVID-19 vaccination then make conclusions about the frequency of serious adverse events. They also fail to provide the free text data.” He added that the paper showed “yet another study that is in my opinion, deficient by design.”

Ms. Hunsel did not respond to a request for comment.

She and other researchers listed limitations in the paper, including how they did not provide data broken down by country.

The paper was published by the journal Vaccine on March 6.

The study was funded by the European Medicines Agency and the Dutch government.

No authors declared conflicts of interest.

Some previous papers have also found that people with prior COVID-19 infection had more adverse events following COVID-19 vaccination, including a 2021 paper from French researchers. A U.S. study identified prior COVID-19 as a predictor of the severity of side effects.

Some other studies have determined COVID-19 vaccines confer little or no benefit to people with a history of infection, including those who had received a primary series.

The U.S. Centers for Disease Control and Prevention still recommends people who recovered from COVID-19 receive a COVID-19 vaccine, although a number of other health authorities have stopped recommending the shot for people who have prior COVID-19.

Another New Study

In another new paper, South Korean researchers outlined how they found people were more likely to report certain adverse reactions after COVID-19 vaccination than after receipt of another vaccine.

The reporting of myocarditis, a form of heart inflammation, or pericarditis, a related condition, was nearly 20 times as high among children as the reporting odds following receipt of all other vaccines, the researchers found.

The reporting odds were also much higher for multisystem inflammatory syndrome or Kawasaki disease among adolescent COVID-19 recipients.

Researchers analyzed reports made to VigiBase, which is run by the World Health Organization.

“Based on our results, close monitoring for these rare but serious inflammatory reactions after COVID-19 vaccination among adolescents until definitive causal relationship can be established,” the researchers wrote.

The study was published by the Journal of Korean Medical Science in its March edition.

Limitations include VigiBase receiving reports of problems, with some reports going unconfirmed.

Funding came from the South Korean government. One author reported receiving grants from pharmaceutical companies, including Pfizer.

International

‘Excess Mortality Skyrocketed’: Tucker Carlson and Dr. Pierre Kory Unpack ‘Criminal’ COVID Response

‘Excess Mortality Skyrocketed’: Tucker Carlson and Dr. Pierre Kory Unpack ‘Criminal’ COVID Response

As the global pandemic unfolded, government-funded…

As the global pandemic unfolded, government-funded experimental vaccines were hastily developed for a virus which primarily killed the old and fat (and those with other obvious comorbidities), and an aggressive, global campaign to coerce billions into injecting them ensued.

Then there were the lockdowns - with some countries (New Zealand, for example) building internment camps for those who tested positive for Covid-19, and others such as China welding entire apartment buildings shut to trap people inside.

It was an egregious and unnecessary response to a virus that, while highly virulent, was survivable by the vast majority of the general population.

Oh, and the vaccines, which governments are still pushing, didn't work as advertised to the point where health officials changed the definition of "vaccine" multiple times.

Tucker Carlson recently sat down with Dr. Pierre Kory, a critical care specialist and vocal critic of vaccines. The two had a wide-ranging discussion, which included vaccine safety and efficacy, excess mortality, demographic impacts of the virus, big pharma, and the professional price Kory has paid for speaking out.

Keep reading below, or if you have roughly 50 minutes, watch it in its entirety for free on X:

Ep. 81 They’re still claiming the Covid vax is safe and effective. Yet somehow Dr. Pierre Kory treats hundreds of patients who’ve been badly injured by it. Why is no one in the public health establishment paying attention? pic.twitter.com/IekW4Brhoy

— Tucker Carlson (@TuckerCarlson) March 13, 2024

"Do we have any real sense of what the cost, the physical cost to the country and world has been of those vaccines?" Carlson asked, kicking off the interview.

"I do think we have some understanding of the cost. I mean, I think, you know, you're aware of the work of of Ed Dowd, who's put together a team and looked, analytically at a lot of the epidemiologic data," Kory replied. "I mean, time with that vaccination rollout is when all of the numbers started going sideways, the excess mortality started to skyrocket."

When asked "what kind of death toll are we looking at?", Kory responded "...in 2023 alone, in the first nine months, we had what's called an excess mortality of 158,000 Americans," adding "But this is in 2023. I mean, we've had Omicron now for two years, which is a mild variant. Not that many go to the hospital."

'Safe and Effective'

Tucker also asked Kory why the people who claimed the vaccine were "safe and effective" aren't being held criminally liable for abetting the "killing of all these Americans," to which Kory replied: "It’s my kind of belief, looking back, that [safe and effective] was a predetermined conclusion. There was no data to support that, but it was agreed upon that it would be presented as safe and effective."

Tucker Carlson Asks the Forbidden Question

— The Vigilant Fox ???? (@VigilantFox) March 14, 2024

He wants to know why the people who made the claim “safe and effective” aren’t being held to criminal liability for abetting the “killing of all these Americans.”

DR. PIERRE KORY: “It’s my kind of belief, looking back, that [safe and… pic.twitter.com/Icnge18Rtz

Carlson and Kory then discussed the different segments of the population that experienced vaccine side effects, with Kory noting an "explosion in dying in the youngest and healthiest sectors of society," adding "And why did the employed fare far worse than those that weren't? And this particularly white collar, white collar, more than gray collar, more than blue collar."

Kory also said that Big Pharma is 'terrified' of Vitamin D because it "threatens the disease model." As journalist The Vigilant Fox notes on X, "Vitamin D showed about a 60% effectiveness against the incidence of COVID-19 in randomized control trials," and "showed about 40-50% effectiveness in reducing the incidence of COVID-19 in observational studies."

Dr. Pierre Kory: Big Pharma is ‘TERRIFIED’ of Vitamin D

— The Vigilant Fox ???? (@VigilantFox) March 14, 2024

Why?

Because “It threatens the DISEASE MODEL.”

A new meta-analysis out of Italy, published in the journal, Nutrients, has unearthed some shocking data about Vitamin D.

Looking at data from 16 different studies and 1.26… pic.twitter.com/q5CsMqgVju

Professional costs

Kory - while risking professional suicide by speaking out, has undoubtedly helped save countless lives by advocating for alternate treatments such as Ivermectin.

Kory shared his own experiences of job loss and censorship, highlighting the challenges of advocating for a more nuanced understanding of vaccine safety in an environment often resistant to dissenting voices.

"I wrote a book called The War on Ivermectin and the the genesis of that book," he said, adding "Not only is my expertise on Ivermectin and my vast clinical experience, but and I tell the story before, but I got an email, during this journey from a guy named William B Grant, who's a professor out in California, and he wrote to me this email just one day, my life was going totally sideways because our protocols focused on Ivermectin. I was using a lot in my practice, as were tens of thousands of doctors around the world, to really good benefits. And I was getting attacked, hit jobs in the media, and he wrote me this email on and he said, Dear Dr. Kory, what they're doing to Ivermectin, they've been doing to vitamin D for decades..."

"And it's got five tactics. And these are the five tactics that all industries employ when science emerges, that's inconvenient to their interests. And so I'm just going to give you an example. Ivermectin science was extremely inconvenient to the interests of the pharmaceutical industrial complex. I mean, it threatened the vaccine campaign. It threatened vaccine hesitancy, which was public enemy number one. We know that, that everything, all the propaganda censorship was literally going after something called vaccine hesitancy."

Money makes the world go 'round

Carlson then hit on perhaps the most devious aspect of the relationship between drug companies and the medical establishment, and how special interests completely taint science to the point where public distrust of institutions has spiked in recent years.

"I think all of it starts at the level the medical journals," said Kory. "Because once you have something established in the medical journals as a, let's say, a proven fact or a generally accepted consensus, consensus comes out of the journals."

"I have dozens of rejection letters from investigators around the world who did good trials on ivermectin, tried to publish it. No thank you, no thank you, no thank you. And then the ones that do get in all purportedly prove that ivermectin didn't work," Kory continued.

"So and then when you look at the ones that actually got in and this is where like probably my biggest estrangement and why I don't recognize science and don't trust it anymore, is the trials that flew to publication in the top journals in the world were so brazenly manipulated and corrupted in the design and conduct in, many of us wrote about it. But they flew to publication, and then every time they were published, you saw these huge PR campaigns in the media. New York Times, Boston Globe, L.A. times, ivermectin doesn't work. Latest high quality, rigorous study says. I'm sitting here in my office watching these lies just ripple throughout the media sphere based on fraudulent studies published in the top journals. And that's that's that has changed. Now that's why I say I'm estranged and I don't know what to trust anymore."

Vaccine Injuries

Carlson asked Kory about his clinical experience with vaccine injuries.

"So how this is how I divide, this is just kind of my perception of vaccine injury is that when I use the term vaccine injury, I'm usually referring to what I call a single organ problem, like pericarditis, myocarditis, stroke, something like that. An autoimmune disease," he replied.

"What I specialize in my practice, is I treat patients with what we call a long Covid long vaxx. It's the same disease, just different triggers, right? One is triggered by Covid, the other one is triggered by the spike protein from the vaccine. Much more common is long vax. The only real differences between the two conditions is that the vaccinated are, on average, sicker and more disabled than the long Covids, with some pretty prominent exceptions to that."

Watch the entire interview above, and you can support Tucker Carlson's endeavors by joining the Tucker Carlson Network here...

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A