Pulling Forward Growth No Longer An Option

Pulling Forward Growth No Longer An Option

Authored by Lance Roberts via RealInvestmentAdvice.com,

Pulling forward growth over the last decade…

Authored by Lance Roberts via RealInvestmentAdvice.com,

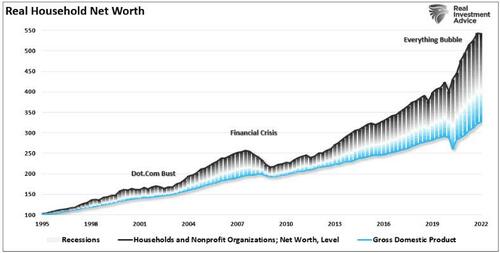

Pulling forward growth over the last decade remains the Federal Reserve’s primary tool for keeping financial markets stable while economic growth rates and inflation remained weak. From repeated rounds of monetary and fiscal interventions, asset markets surged, increasing investor wealth and confidence, which, as Ben Bernanke stated in 2010, would support economic growth. To wit:

“This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending.”

That certainly seemed to be the case as each time the economy stumbled; Federal Reserve interventions kept the financial markets and economy stable. However, there is sufficient evidence that “monetary policy” leads to other problems, most notably a surge in wealth inequality without a corresponding increase in economic growth.

As noted in the previous articles, current monetary policy has its roots in Keynesian economic theory. To wit:

“A general glut would occur when aggregate demand for goods was insufficient, leading to an economic downturn resulting in losses of potential output due to unnecessarily high unemployment, which results from the defensive (or reactive) decisions of the producers.”

In such a situation, Keynesian economics states that fiscal policies could increase aggregate demand, thus expanding economic activity and reducing unemployment.

The only problem is that it didn’t work as planned because “monetary policy” is NOT expansionary.

“Since 2008, the total cumulative growth of the economy is just $4.05 trillion. In other words, for each dollar of economic growth since 2008, it required nearly $11 of monetary stimulus. Such sounds okay until you realize it came solely from debt issuance.“

The question is whether pulling forward growth through monetary policy is sustainable.

The Unsustainability Of Monetary Policy

We have previously noted an inherent problem with ongoing monetary interventions. Notably, the fiscal policies implemented post the pandemic-driven economic shutdown created a surge in demand that created an unprecedented surge in corporate earnings.

Here is the problem. As shown below, the surge in the M2 money supply is now over. Without further stimulus, earnings must eventually revert to economically sustainable levels.

While the media often states that “stocks are not the economy,” economic activity creates corporate revenues and earnings. As such, stocks can not indefinitely grow faster than the economy over long periods.

When stocks deviate from the underlying economy, the eventual resolution is lower stock prices. Over time, there is a close relationship between the economy, earnings, and asset prices. For example, the chart below compares the three from 1947 through 2021.

Since 1947, earnings per share have grown at 7.72%, while the economy has expanded by 6.35% annually. That close relationship in growth rates is logical given the significant role that consumer spending has in the GDP equation.

The slight differentials are due to periods where earnings can grow faster than the economy. Such a period occurs when the economy is emerging from a recession. However, while nominal stock prices have averaged 9.35% (including dividends), reversions to actual economic growth eventually occur. Such is because corporate earnings are a function of consumptive spending, corporate investments, imports, and exports.

The market disconnect from underlying economic activity is apparent in the chart below. Since the peak in 2007, successive rounds of monetary interventions led to a cumulative increase of 219% for the stock market. However, real economic growth grew only 28% as corporate revenue rose by just 67%. In other words, stock prices rose nearly 8x more than the economy and 3.2x corporate revenue.

There is a problem in pulling forward economic activity.

The Fed Is Investors Biggest Problem

For investors, the most significant risk remains the Fed. Many hope the Fed will “pivot” from its battle against surging inflation to support stocks. However, such is unlikely in the near term, with inflation running at the highest level in 40 years.

However, even if the Fed does give up its fight against inflation in terms of hiking interest rates, it is unlikely they will immediately return to successive rounds of monetary policy without financial instability. So far, in 2022, markets are down, but not violently so. As we discussed previously, the Fed views markets very differently from investors. To wit:

“While the market has declined this year, the market remains higher than in 2020. To reduce excess market speculations, the Fed doesn’t mind some ‘disinflation’ in asset prices. Furthermore, the market decline also contributes to its tightening monetary policy to mitigate inflationary pressures.”

Absent a disorderly meltdown; the Fed will remain focused on stocks being still above their pre-crisis peak. As BofA notes:

“Since in a typical consumption model, households react to sustained changes in prices over a period of three years or so, the Fed is convinced the wealth effect is still positive.”

As noted above, the deviation from long-term growth trends is unsustainable. Repeated financial interventions were the cause. Therefore, unless the Federal Reverse is committed to a never-ending program of zero interest rates and quantitative easing, the eventual reversion of returns to their long-term means is inevitable.

Such will solely result in profit margins and earnings returning to levels that align with actual economic activity. As Jeremy Grantham once noted:

“Profit margins are probably the most mean-reverting series in finance. And if profit margins do not mean-revert, then something has gone badly wrong with capitalism. If high profits do not attract competition, there is something wrong with the system, and it is not functioning properly.” – Jeremy Grantham

Government

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary of State Mike Pompeo said in a new interview that he’s not ruling out accepting a White House position if former President Donald Trump is reelected in November.

“If I get a chance to serve and think that I can make a difference ... I’m almost certainly going to say yes to that opportunity to try and deliver on behalf of the American people,” he told Fox News, when asked during a interview if he would work for President Trump again.

“I’m confident President Trump will be looking for people who will faithfully execute what it is he asked them to do,” Mr. Pompeo said during the interview, which aired on March 8. “I think as a president, you should always want that from everyone.”

He said that as a former secretary of state, “I certainly wanted my team to do what I was asking them to do and was enormously frustrated when I found that I couldn’t get them to do that.”

Mr. Pompeo, a former U.S. representative from Kansas, served as Central Intelligence Agency (CIA) director in the Trump administration from 2017 to 2018 before he was secretary of state from 2018 to 2021. After he left office, there was speculation that he could mount a Republican presidential bid in 2024, but announced that he wouldn’t be running.

President Trump hasn’t publicly commented about Mr. Pompeo’s remarks.

In 2023, amid speculation that he would make a run for the White House, Mr. Pompeo took a swipe at his former boss, telling Fox News at the time that “the Trump administration spent $6 trillion more than it took in, adding to the deficit.”

“That’s never the right direction for the country,” he said.

In a public appearance last year, Mr. Pompeo also appeared to take a shot at the 45th president by criticizing “celebrity leaders” when urging GOP voters to choose ahead of the 2024 election.

2024 Race

Mr. Pompeo’s interview comes as the former president was named the “presumptive nominee” by the Republican National Committee (RNC) last week after his last major Republican challenger, former South Carolina Gov. Nikki Haley, dropped out of the 2024 race after failing to secure enough delegates. President Trump won 14 out of 15 states on Super Tuesday, with only Vermont—which notably has an open primary—going for Ms. Haley, who served as President Trump’s U.S. ambassador to the United Nations.

On March 8, the RNC held a meeting in Houston during which committee members voted in favor of President Trump’s nomination.

“Congratulations to President Donald J. Trump on his huge primary victory!” the organization said in a statement last week. “I’d also like to congratulate Nikki Haley for running a hard-fought campaign and becoming the first woman to win a Republican presidential contest.”

Earlier this year, the former president criticized the idea of being named the presumptive nominee after reports suggested that the RNC would do so before the Super Tuesday contests and while Ms. Haley was still in the race.

Also on March 8, the RNC voted to name Trump-endorsed officials to head the organization. Michael Whatley, a North Carolina Republican, was elected the party’s new national chairman in a vote in Houston, and Lara Trump, the former president’s daughter-in-law, was voted in as co-chair.

“The RNC is going to be the vanguard of a movement that will work tirelessly every single day to elect our nominee, Donald J. Trump, as the 47th President of the United States,” Mr. Whatley told RNC members in a speech after being elected, replacing former chair Ronna McDaniel. Ms. Trump is expected to focus largely on fundraising and media appearances.

President Trump hasn’t signaled whom he would appoint to various federal agencies if he’s reelected in November. He also hasn’t said who his pick for a running mate would be, but has offered several suggestions in recent interviews.

In various interviews, the former president has mentioned Sen. Tim Scott (R-S.C.), Texas Gov. Greg Abbott, Rep. Elise Stefanik (R-N.Y.), Vivek Ramaswamy, Florida Gov. Ron DeSantis, and South Dakota Gov. Kristi Noem, among others.

International

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Is there a light forming when it comes to the long, dark and…

Is there a light forming when it comes to the long, dark and bewildering tunnel of social justice cultism? Global events have been so frenetic that many people might not remember, but only a couple years ago Big Tech companies and numerous governments were openly aligned in favor of mass censorship. Not just to prevent the public from investigating the facts surrounding the pandemic farce, but to silence anyone questioning the validity of woke concepts like trans ideology.

From 2020-2022 was the closest the west has come in a long time to a complete erasure of freedom of speech. Even today there are still countries and Europe and places like Canada or Australia that are charging forward with draconian speech laws. The phrase "radical speech" is starting to circulate within pro-censorship circles in reference to any platform where people are allowed to talk critically. What is radical speech? Basically, it's any discussion that runs contrary to the beliefs of the political left.

Open hatred of moderate or conservative ideals is perfectly acceptable, but don't ever shine a negative light on woke activism, or you might be a terrorist.

Riley Gaines has experienced this double standard first hand. She was even assaulted and taken hostage at an event in 2023 at San Francisco State University when leftists protester tried to trap her in a room and demanded she "pay them to let her go." Campus police allegedly witnessed the incident but charges were never filed and surveillance footage from the college was never released.

It's probably the last thing a champion female swimmer ever expects, but her head-on collision with the trans movement and the institutional conspiracy to push it on the public forced her to become a counter-culture voice of reason rather than just an athlete.

For years the independent media argued that no matter how much we expose the insanity of men posing as women to compete and dominate women's sports, nothing will really change until the real female athletes speak up and fight back. Riley Gaines and those like her represent that necessary rebellion and a desperately needed return to common sense and reason.

In a recent interview on the Joe Rogan Podcast, Gaines related some interesting information on the inner workings of the NCAA and the subversive schemes surrounding trans athletes. Not only were women participants essentially strong-armed by colleges and officials into quietly going along with the program, there was also a concerted propaganda effort. Competition ceremonies were rigged as vehicles for promoting trans athletes over everyone else.

The bottom line? The competitions didn't matter. The real women and their achievements didn't matter. The only thing that mattered to officials were the photo ops; dudes pretending to be chicks posing with awards for the gushing corporate media. The agenda took precedence.

Lia Thomas, formerly known as William Thomas, was more than an activist invading female sports, he was also apparently a science project fostered and protected by the athletic establishment. It's important to understand that the political left does not care about female athletes. They do not care about women's sports. They don't care about the integrity of the environments they co-opt. Their only goal is to identify viable platforms with social impact and take control of them. Women's sports are seen as a vehicle for public indoctrination, nothing more.

The reasons why they covet women's sports are varied, but a primary motive is the desire to assert the fallacy that men and women are "the same" psychologically as well as physically. They want the deconstruction of biological sex and identity as nothing more than "social constructs" subject to personal preference. If they can destroy what it means to be a man or a woman, they can destroy the very foundations of relationships, families and even procreation.

For now it seems as though the trans agenda is hitting a wall with much of the public aware of it and less afraid to criticize it. Social media companies might be able to silence some people, but they can't silence everyone. However, there is still a significant threat as the movement continues to target children through the public education system and women's sports are not out of the woods yet.

The ultimate solution is for women athletes around the world to organize and widely refuse to participate in any competitions in which biological men are allowed. The only way to save women's sports is for women to be willing to end them, at least until institutions that put doctrine ahead of logic are made irrelevant.

Uncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

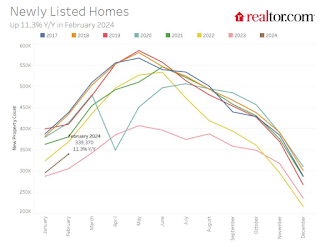

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges