PHILADELPHIA – The public’s knowledge about monkeypox has increased rapidly in recent weeks though misconceptions and uncertainty persist, and over a quarter of Americans say they are not likely to get vaccinated against monkeypox if they’re exposed to it, according to a new Annenberg Public Policy Center (APPC) survey.

The national panel survey conducted in August finds that 1 in 5 Americans (21%) are somewhat or very worried about contracting monkeypox in the next three months, statistically the same as in our July survey (19%).

The findings come as officials in California and Texas report the deaths of two individuals who had contracted monkeypox, which was declared a public health emergency on Aug. 4 by U.S. health officials. As of Sept. 12, there were 21,985 confirmed U.S. cases, according to the Centers for Disease Control and Prevention (CDC). In late August, however, the rate of increase in new cases had slowed in parts of the United States, leading CDC Director Rochelle Walensky to say she was “cautiously optimistic.”

The survey found increases in knowledge over a month since APPC’s last survey:

- Over half (61%) know that a vaccine against monkeypox exists, up from 34% in July.

- The vast majority (84%) know monkeypox usually spreads by close contact with an infected person, compared with 69% in July.

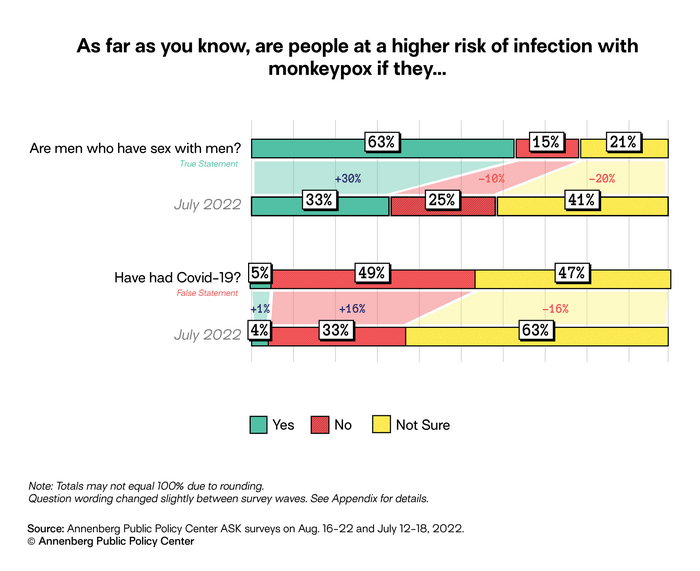

- Nearly two-thirds (63%) know that men who have sex with men are at a higher risk of infection with monkeypox – up from one-third (33%) in July.

- If exposed to the monkeypox virus, most Americans (73%) say they would be likely to get vaccinated – though over a quarter (27%) say they are “not too likely” or “not at all likely” to get the vaccine.

“At a time when people are questioning the capacity of public health authorities to effectively convey important information about consequential health risks, it is a credit to their efforts and those of the news media that the public has so quickly picked up critical knowledge about the new health threat posed by monkeypox,” said Annenberg Public Policy Center Director Kathleen Hall Jamieson.

The nationally representative panel of 1,621 U.S. adults surveyed by SSRS for the Annenberg Public Policy Center of the University of Pennsylvania from August 16-22, 2022, was the eighth wave of an Annenberg Science Knowledge (ASK) survey whose respondents were first empaneled in April 2021. The margin of sampling error (MOE) is ± 3.3 percentage points at the 95% confidence level. See the appendix and methodology for additional information.

This is a follow-up to the seventh wave of the ASK survey, conducted July 12-18, 2022, of 1,580 U.S. adults, which also had a margin of error of ± 3.3 percentage points.

Monkeypox concerns

Monkeypox, a rare disease caused by an orthopoxvirus, is a less deadly member of the same family of viruses as smallpox, according to the CDC. The disease, discovered in 1958, is typically characterized by rashes and transmitted person-to-person by direct contact with the infectious rash, scabs, or body fluids of an infected person; respiratory secretions; by touching items that touched infectious body fluid; by a pregnant person to a fetus through the placenta; or to and from infected animals. On Sept. 7, the CDC said, “Monkeypox is often transmitted through close, sustained physical contact, almost exclusively associated with sexual contact in the current outbreak.” (For more about monkeypox, see APPC’s FactCheck.org’s Q&A.)

Among the findings:

- Familiarity with monkeypox: Although the vast majority of people (80%) said in our July survey that they had “seen, read, or heard” something about monkeypox over the past month, in August just over a third (35%) considered themselves somewhat or very familiar with the disease, while 65% were not at all or not too familiar with it.

- Worries about monkeypox: 1 in 5 Americans (21%) worry about getting monkeypox over the next three months, about the same as in July (19%). (The July survey also found that 30% worry about getting Covid over the next three months.)

- Though the overwhelming majority of cases are among men who have sex with men, women continue to be more worried about getting it: 26% of women say they are worried about contracting monkeypox vs. 17% of men.

- Few know someone with monkeypox: 96% say they do not personally know anyone who has contracted monkeypox, while 2% say they do and 2% are not sure.

Monkeypox knowledge

The survey finds that:

- Knowing how monkeypox spreads: 84% know that monkeypox usually spreads by close contact with an infected person, up from 69% in July.

- Isolate if infected: 77% know that people with monkeypox should isolate at home until the rash is gone, which the CDC advises.

- Most do not know monkeypox is less contagious than Covid: Only 41% know that monkeypox is less contagious than Covid-19, a statistically significant change from July (36%). The other 59% of survey respondents think, incorrectly, that monkeypox is either as contagious (17%) or more contagious (5%) than Covid-19 or say they are not sure (37%). The CDC says monkeypox “is not known to linger in the air and is not transmitted during short periods of shared airspace” but through direct contact with an infected individual or materials that have touched body fluids or sores or through respiratory secretions during “close, face-to-face contact.” An infectious disease expert, Anne Rimoin, told Vox monkeypox is “not as highly transmissible as something like smallpox, or measles, or certainly not Covid.”

Who is at higher risk of getting monkeypox?

The survey finds that people are knowledgeable about some risks of contracting monkeypox:

- Are people who have had Covid-19 at higher risk? Almost half of those surveyed (49%) know that having had Covid-19 does not put someone at higher risk of infection with monkeypox, up from 33% in July. But a similar number (47%) are not sure whether or not this is true.

- Higher risk for men who have sex with men? Nearly 2 in 3 people (63%) know there is a higher risk of infection with monkeypox for men who have sex with men, a substantial increase from 1 in 3 (33%) in July. However, 21% of those surveyed are not sure if this is true. In a Washington Post interview, Walensky, the CDC director, said men who have sex with men are “the community most at risk.” An August CDC report said that among U.S. monkeypox cases with available data, 99% occurred in men, 94% of whom reported “recent male-to-male sexual or close intimate contact.”

- Higher risk if sharing bedding? Over two-thirds (68%) know that people are at higher risk of infection with monkeypox if they share bedding, clothing, or towels being used by someone has monkeypox. A quarter (26%) are not sure if this is correct.

- Higher risk with face-to-face contact? Two-thirds (67%) know that people are a higher risk of infection with monkeypox if they have close face-to-face contact with someone who is infected with monkeypox – but a quarter (24%) are not sure if this is correct.

- Monkeypox and the Covid-19 vaccine: A majority (71%) think it is false to say that getting the Covid-19 vaccine increases your chances of getting monkeypox – statistically about the same as 67% in July. There is no evidence of this.

More awareness of a monkeypox vaccine

Compared with July, in August there was much greater awareness of a vaccine to prevent monkeypox infection: 61% know that a vaccine for monkeypox exists, up from 34% in July. However, the latest survey still finds that a total of 4 in 10 people (39%) are unsure whether a vaccine exists or do not think it does, decreased from 66% in July. The Food and Drug Administration has licensed a vaccine for preventing monkeypox disease, and in addition, a vaccine licensed for smallpox is available to help prevent the disease, according to the CDC.

People can be vaccinated with the Jynneos monkeypox vaccine even after a known or presumed exposure to someone with monkeypox, ideally within four days after exposure, the CDC says.

When survey respondents were asked how likely they would be to take the monkeypox vaccine if exposed to monkeypox, less than half say they are “very likely”:

- 48% said they were very likely to get vaccinated

- 24% somewhat likely to get vaccinated

- 15% not too likely to get vaccinated

- 12% not at all likely to get vaccinated

Monkeypox misinformation and conspiracy theories

As in July’s survey, a majority of Americans do not believe conspiracy theories that monkeypox was bioengineered in a lab or intentionally released – though some remain uncertain about what is true or false. The levels of belief did not change significantly from July to August.

- Bioengineered in a lab: 57% say the idea that monkeypox was bioengineered in a lab is false (statistically the same as 54% in July). However, 15% say it is true (statistically the same as 12% in July) and over a quarter (28%) are not sure. There is no evidence of this.

- Intentional release (asked of a half-sample, MOE = ± 4.7 percentage points): Over half (60%) responded that it was false to say monkeypox was intentionally released, though a quarter (24%) are not sure and 16% think this is true. There is no evidence of this.

- Released to help Biden (asked of a half-sample, MOE = ± 4.7 percentage points): 70% reject as false the statement that monkeypox was intentionally released by scientists to deflect attention from the failures of the Biden administration. However, 18% were not sure whether this is true or false and 12% said it was true. There is no evidence of this.

- Caused by exposure to 5G: A large majority (82%) said it is false to assert that monkeypox is caused by exposure to a 5G signal, though 17% remain unsure. There is no evidence of this.

See the appendix and methodology for additional information. Read about prior Annenberg Science Knowledge surveys.

The Annenberg Public Policy Center was established in 1993 to educate the public and policy makers about communication’s role in advancing public understanding of political, science, and health issues at the local, state, and federal levels. APPC is the home of FactCheck.org and its SciCheck program, whose Covid-19/Vaccination Project seeks to debunk misinformation about Covid-19 and vaccines, and increase exposure to accurate information.

Method of Research

Survey